BALANCED GOALCARDS

Combining Goal Analysis and Balanced Scorecards

Alberto Siena

Center for Scientific and Technological Research FBK-Irst, via Sommarive 18, Trento, Italy

Alessio Bonetti, Paolo Giorgini

University of Trento, via Sommarive 14, Trento, Italy

Keywords:

Software Engineering, Requirements Engineering, Business Strategy, Goal Analysis.

Abstract:

Today’s Information Systems are complex systems that have to deal with a variety of different and potentially

conflicting needs. Capturing their strategic requirements is a critical activity, as it must answer at the same

time to software and corporate goals. In this paper, we introduce the economic foundations of strategic re-

quirements. We propose a novel conceptual framework for requirements modeling and validation, based on

economic and business strategy theory. The soundness of the framework is also evaluated, by presenting the

result of its application to a real case study.

1 INTRODUCTION

Understanding and analysing the purpose of a soft-

ware system before defining its desired functional-

ities, results crucial and more and more mandatory

in the development of modern information systems

(Fuxman et al., 2001). Early requirements analysis

(Giorgini et al., 2003; Alencar et al., 2000) is cur-

rently gaining popularity in the requirements engi-

neering community as an effective way to understand

the reasons of a new system with respect to the organ-

isational setting in which it will operate. In this con-

text, goal-oriented techniques have been proposed in

the last decade (Rolland, 2003; Giorgini et al., 2005;

Delor et al., 2003) to answer why questions, besides

what and how, regarding system functionality. An-

swers to why questions ultimately link system func-

tionality to stakeholder needs, preferences and objec-

tives.

Goal analysis techniques (Dardenne et al., 1993)

are useful to understand the structure and the corre-

lations among goals, their decomposition into more

fine-grained sub-goals, and their relation with opera-

tional plans. Moreover, reasoning techniques applied

to goal models (Giorgini et al., 2002) can be very use-

ful to verify properties of the model and possibly to

support the analyst in the conflict resolution process.

Although these techniques result very useful to rea-

son about single goal models, they are inadequate to

support strategic decisions of an organisation. This is

mainly due to the fact that they assume the perspec-

tive of the designer of the system and do not consider

other dimensions like the business or financial needs

that are crucial in decision process of an organisation.

In this paper, we revise the Tropos methodology

(Bresciani et al., 2004) extending its goal reasoning

framework (Giorgini et al., 2005) with a more enter-

prise and business oriented approach, the balanced

scorecards. The adoption of balanced scorecards al-

lows the analyst to have a more comprehensive vi-

sion of the enterprise and consequently to adopt so-

lutions that can be related to its strategic decisional

process. The purpose of this paper is twofold. On

the one hand, it introduces the conceptual framework

and the methodology for guiding the analyst in the re-

quirements analysis process, by assuming and comb-

ing multiple perspectives of analysis (i.e., financial

perspective, internal processes perspective, customer

perspective, learning and growth perspective). On the

other hand, it evaluates such a framework with respect

to its actual contribution to the software engineering

process, by means of a real world example.

The paper is structured as follows. Section 2

presents our experience with a requirements analysis

case and the problems it rises. Section 3 introduces

the underlying concepts of goal analysis techniques

107

Siena A., Bonetti A. and Giorgini P. (2008).

BALANCED GOALCARDS - Combining Goal Analysis and Balanced Scorecards.

In Proceedings of the Third International Conference on Evaluation of Novel Approaches to Software Engineering, pages 107-114

DOI: 10.5220/0001763801070114

Copyright

c

SciTePress

and the Balanced Scorecards business modelling ap-

proach. Section 4 presents the new Balanced Goal-

cards framework. Section 5 discusses the results that

emerge from the application of the framework to our

case. Section 6 concludes the paper.

2 AN IS FOR LOGISTICS

Frioli S.n.C. is a small Italian transport company lo-

cated in the Trentino region, interested in developing

a new information system to support its business. The

company was founded in the sixties as a family com-

pany, and today it has five associates and four full-

time employees. It owns five trucks and four trailers,

and it transports both construction material (mainly

cement) and undifferentiated goods. The transport ac-

tivity is 80% in northern Italy, 10% in the rest of Italy,

and 10% among Austria, Germany and France. Its

costs are mainly related to fuel, insurance and road

tolls. First need of the company is to optimise travels,

and a new information system seems to be a necessary

step in this direction. Our purpose is to gather the re-

quirements for such an information system, ensuring

them to be aligned with the actual business culture of

the company.

Requirements have been initially collected after a

number of meetings with people in the company. The

main objective of these meetings was to understand

the company’s strategy and related activities. Unfor-

tunately, after that it was not possible to have further

meetings with the company (mainly for reasonable

business constraints). This methodological constraint

is the major motivation for our work. In a perfect

world, with full information and unlimited resources,

we could elicitate the requirements perfectly with ef-

fectiveness and efficiency. But in the real world, the

challenge of software development is to overcome any

kind of limitations - time constraints, budget con-

straints, communication obstacles, domain-specific

skills, implicit information, and so on - to deliver the

right solution at the right time and for the right mar-

ket (Ebert, 2005).

Our experience with the company has confirmed

such a problem. A modelling session followed the

interviews, with the purpose to model and formally

analyse the models. Already during the modelling

phase, we have encountered suspicious inconsisten-

cies. For instance, managers declared interest in re-

ducing costs but they were not interested to reduce

phone customer support and off-line marketing tech-

niques in favour of on-line services. The reason of this

can be shortly explained as follows: the company has

currently a positioning in the market and in the local

community and doesn’t want to lose it. Its position-

ing is built on top of the company’s philosophy that is

implicit and depends on many factors, such as qual-

ity of directors and employees, local market charac-

teristics, history and structure of the company, results

obtained, etc. In this scenario, on-line marketing can

produce a very negative impact and change heavily

the customers’ perception of the company. So, even

if the company wants to reduce costs, choosing the

lower-cost solution is not the right solution.

These and other considerations showed clearly the

need to:

i) support the analyst in capturing during the inter-

views both technical requirements and business

strategy needs;

ii) provide a formalism to represent business entities

in the software development process.

3 BACKGROUND

3.1 Tropos and Goal Analysis

Tropos (Bresciani et al., 2004) is an agent-oriented

software development methodology, tailored to de-

scribe the system-to be in terms of its requirements.

It is intended to capture both functional and non-

functional requirements, and, as such, a special role

is given to the capability to model and understand

the stakeholders’ goals. The methodology analyses

the requirements of the system-to-be in terms of goal

models. Goals basically represent the functional re-

quirements, while the softgoals represent the non-

functional requirements of the system. Goal models

are represented by means of goal graphs composed

of goal nodes and goal relations. Goal relations can

be AND and OR decomposition relations; or, they can

be contribution relations, partial - the “+” and “−”

relations - and full - “++” and “−−” relations. In

practice, a goal graph can be seen as a set of and/or

trees whose nodes are connected by contribution rela-

tions arcs. Root goals are roots of and/or trees, whilst

leaf goals are either leaves or nodes which are not part

of the trees.

For each goal of a goal graph, we consider three

values representing the current evidence of satisfia-

bility and deniability of goal: F (full), P (partial), N

(none). We admit also conflicting situations in which

we have both evidence for satisfaction and denial of

a goal. So for instance, we may have that for goal G

we have fully (F) evidence for the satisfaction and at

the same time partial (P) evidence for denial. Such

an evidence is either known a priori or is the desired

ENASE 2008 - International Conference on Evaluation of Novel Approaches to Software Engineering

108

one. In both cases, the conflicts arise by reasoning on

the graphs with the techniques explained below.

On goal graphs, it is possible to analyse it with

both forward reasoning and backward reasoning.

Forward Reasoning. Given an initial values assign-

ment to some goals, input goals from now on (typ-

ically leaf goals), forward reasoning focuses on the

forward propagation of these initial values to all other

goals of the graph according to the rules described in

(Giorgini et al., 2005). Initial values represent the ev-

idence available about the satisfaction and the denial

of a specific goal, namely evidence about the state of

the goal. After the forward propagation of the initial

values, the user can look the final values of the goals

of interest, target goals from now on (typically root

goals), and reveal possible conflicts. In other words,

the user observes the effects of the initial values over

the goals of interests.

Backward Reasoning. Backward reasoning focuses

on the backward search of the possible input values

leading to some desired final value, under desired

constraints. We set the desired final values of the tar-

get goals, and we want to find possible initial assign-

ments to the input goals which would cause the de-

sired final values of the target goals by forward prop-

agation. We may also add some desired constraints,

and decide to avoid strong/medium/weak conflicts.

The present work is based on the consideration

that this kind of systematic analysis of the stake-

holders’ goals is necessarily general-purpose and per-

formed from the perspective of the requirements engi-

neer. As such, it provides little help in understanding

the business specific requirements of the organisation.

To overcome these difficulties, we refer to the “Bal-

anced Scorecard” approach.

3.2 Balanced Scorecards

The Balanced Scorecards (BSC) framework was

introduced by Kaplan and Norton in the early

nineties (Norton and Kaplan, 1992) as a new strat-

egy management approach, able to overcome the

limitations they found in the then existing manage-

ment methodologies. Essentially, pre-existing finan-

cial analysis techniques used to focus on monetary in-

dicators, without taking into account non-measurable

capitals of a company, such as knowledge or cus-

tomers loyalty. As opposite, the BSC approach re-

lies on three basic ideas (Kaplan and Norton, 2001):

i) both the material and immaterial objectives are

important for the company; ii) the objectives, mate-

rial and immaterial, can be numerically measured via

properly chosen metrics; iii) the strategy is the resul-

tant of the balancing of different kinds of metrics. In

a broad sense, the strategy consists in the set goals,

which will determine the success of the organisation

in the market (Porter, 1996). The strategy is the ac-

tual realisation of the mission, values and vision: the

Mission statement describes the reason of being of

the organisation and its overall purpose; the Busi-

ness Values represent the organisation’s culture, and

turn out in the priorities that drive the organisation’s

choices; the Vision describes the goals to be pursued

in the medium and long term, and how the organisa-

tion wants to be perceived from the market. In the

BSC approach, the strategy is bounded with a con-

ceptual tool, the Strategic Map (Kaplan and Norton,

1996). It is commonly represented as a diagram, con-

taining goals and their inter-connections. The connec-

tions are cause-effect relationships, meaning that the

achievement of a goal brings to the achievement of its

consequent. The strategic map is comprised by four

different perspectives, i.e., the the financial perspec-

tive, the internal processes perspective, the customer

perspective and the growth perspective.

The Economic-Financial Perspective. This per-

spective looks at the company from the point of view

of the profitability, as well as solvency, liquidity, sta-

bility and so on. It expresses how well are the com-

panys finances managed to achieve the mission. The

metrics associated with this perspective are monetary

and economic such as ROI, ROE, and more low-level

values.

The Customer Perspective. Customers are the key

stakeholders for the success of a company, so it is im-

portant to identify the target customer and define the

properties that meet his needs. The ultimate purpose

is to make products attractive for the customers.

The Internal Processes Perspective. The goals as-

sociated with this perspective are those that can have

an impact on the internal effectiveness and efficiency

of the company. Also, the goals that attain human and

organisational resources are relevant, and can be mea-

sured by metrics such as are time, turnaround time,

internal communications rating and so on. For in-

stance, the choice to use e-mails instead of the tele-

phone could improve the processes.

The Learning and Growth Perspective. The fourth

perspective describes the long-term success factors.

It is important to understand the characteristics that

should equip the human, informative and organisa-

tional resources. So for instance, the choice to train

the employees to use IT resources could allow the

company to stay on the market also in the evolving

global economy.

The representation capabilities of a strategic map

may appear indeed limited. For instance, cause-

effect relationships are too restrictive and do not al-

BALANCED GOALCARDS - Combining Goal Analysis and Balanced Scorecards

109

low the analyst to represent all the possible relation-

ships among goals. Also, it is not possible to express

negative effects; it is not possible to specify partial

contributions among goals; and it is not possible to

express conflicts. Finally, relationships among goals

are not enough fine-grained: when multiple cause-

effect implications exist, it is unclear what can happen

if some goals cannot be satisfied. However, besides

these limitations the conceptual expressiveness of the

BSC approach seems promising, since it can capture a

business-centred entity, such as the strategy, in quite a

formal way. Thus, we aim at extending the represen-

tation capabilities of Tropos goal diagrams with the

conceptual expressiveness of the BSC.

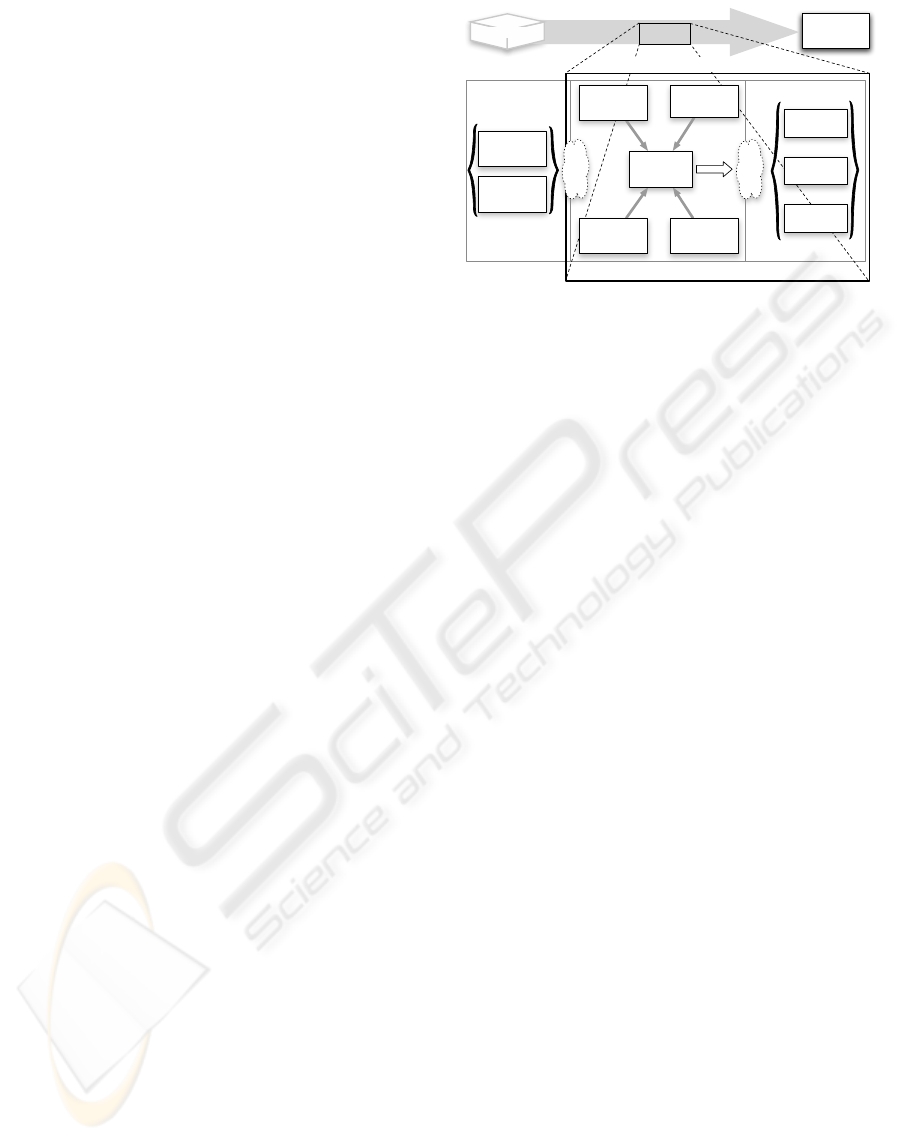

4 BALANCED GOALCARDS

With the term “Balanced Goalcards” we refer to a

novel approach for conceptual modelling that aims at

aligning the business-centred needs of an organisation

with IT-oriented requirements. The approach extends

the i*/Tropos methodology in both its modelling and

analysis capabilities, and turns out in the ability to

capture strategic requirements that are consistent with

economic principles. The methodological framework

of the approach is shown in Figure 1. Shortly, the

first step is the domain modelling and consists in the

definition of the basic organisational settings. The

actors are identified and their strategic dependencies

are modelled. This phase follows exactly the Tropos

methodology guidelines (see (Bresciani et al., 2004)

for more details). Then, in the strategy modelling,

the business context is modelled. Firstly, the mission

of the organisation should be made clear, and then

business values and vision. Using as leading parame-

ters these root entities, the four different perspectives

are modelled separately. The perspectives are then

joint in a goal diagram that represents the Strategic

Map. Finally, the map is validated along three dimen-

sions: conflicts detection and resolution, minimisa-

tion of costs, and evaluation of unpredictable events.

The result of the validation is the actual requirements

system.

4.1 Strategy Modelling

The idea is that the Tropos early requirements phase is

led by the emergence of the strategic map. The strate-

gic map is represented as a Tropos goal diagram, so

that BSC’s cause-effect relations are replaced by Tro-

pos relations. AND-decompositions are used, when

multiple cause-effect relations exist, and there is the

evidence that the decomposed goal can’t be reached

Actors

modelling

Strategic

dependencies

modelling

Mission

Financial

Perspective

Customer

Perspective

Internal

Processes

Perspective

Learning and

Growth

Perspective

Strategic Map

Vision

Conflicts

detection

Costs

minimization

Analysis of

the events

Strategic

Requirements

Organization

Domain modelling

Strategy modelling Validation

Requirements Analysis Process

Balanced Goalcards Modeling Framework

Vision and Business Values

Vision and Business Values

Figure 1: The Balanced Goalcards methodological frame-

work.

if at least one of the sub-goals is not achieved. OR-

decompositions are used, when multiple cause-effect

relations exist, but achieving one of the sub-goal is

enough to consider achieved the parent goal. If there

is no clear evidence of a decomposition, a contribu-

tion link is used. Carefully evaluating the contribu-

tion metrics (“+”, “−”, “++” and “−−”, see section 3

for the guidelines) allows the designer to describe in

a more precise and realistic way the mutual influence

among goals.

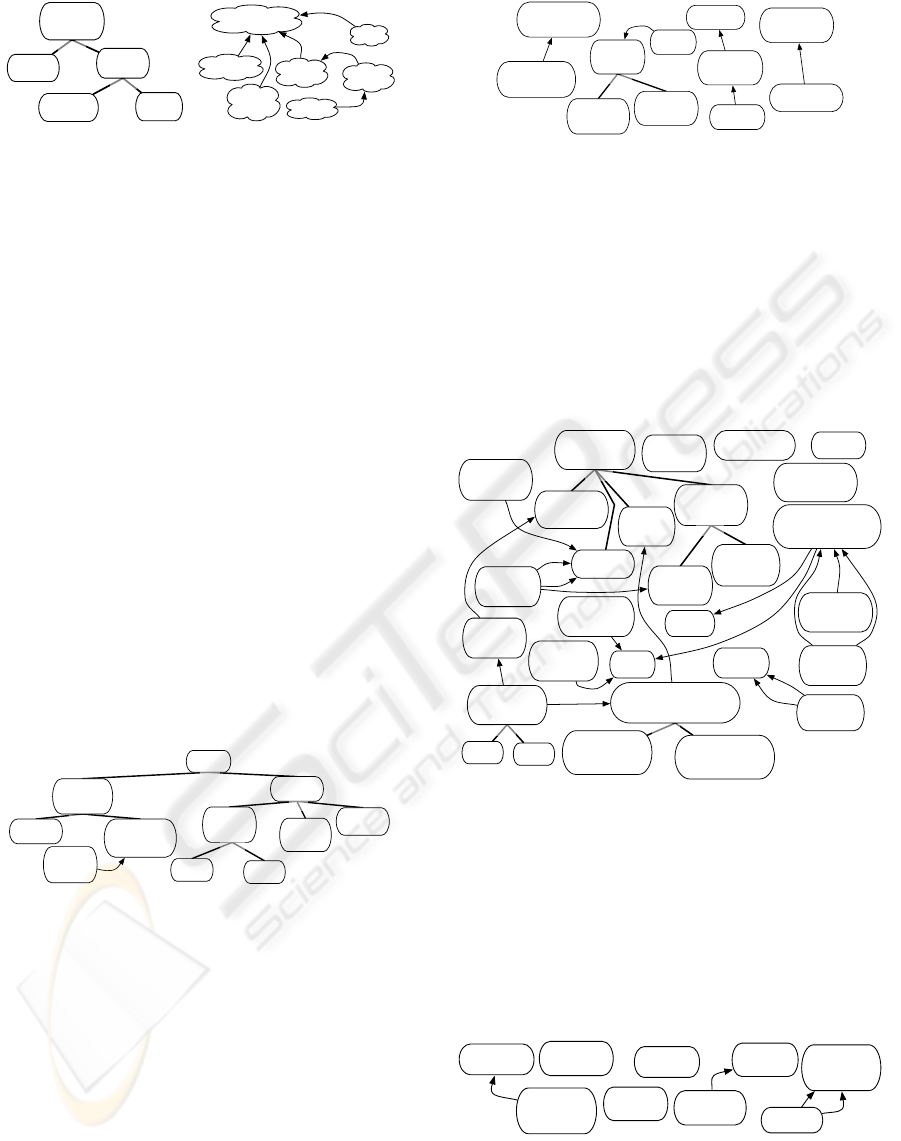

Mission. The concept of mission is mapped as the

root goal. Frioli is a transportation company, so we

have a root in the goal “Delivery service be fulfilled” as

in Figure 2(a). The root goal is further analysed by

a decomposition into more operational goals (“Orders

be received”, “Goods be delivered” and so on). There

could also be more that one root, if the company’s

business is wider.

Business Values. The business values are represented

as softgoals. They emerge from both, an explicit in-

dication of the organisation to be modelled, and the

perception of the analyst. For instance, “Customer

loyalty”, “Timeliness”, “Care corporate image”, and so

on (Figure 2(b)) are business values. They are linked

in weak cause-effect relations (represented as contri-

butions in the picture). The “Long-term value for the

associates” general-purpose goal is possibly reached

directly, via a “Growth” of the company; or indirectly,

via the “Customers loyalty” given by the “Quality of

service”. “Effectiveness” is related in particular with

the inner processes of the company, whereas “Care

corporate image” refers to how to company is per-

ceived by the customer.

Vision. The vision represents the link between what

the organisation is and what it wants to be. For the

Frioli company, no vision has been clearly identified.

This mainly because it is implicit in the managers’ ra-

tionales, and the challenge is to capture it and make it

explicit, so that we can elicit consistent requirements.

ENASE 2008 - International Conference on Evaluation of Novel Approaches to Software Engineering

110

Orders be

received

Vehicles be

available

Route be

planned

Goods be

delivered

AND

Delivery

service be

fulfilled

AND

(a)

Long-tern value

for the associates

Growth

Effectiveness

Quality of

service

Care

corporate

image

Customers

loyalty

Timeliness

+

+

+

+

+

+

(b)

Figure 2: (a) The mission of the company. (b) The business

values. Ovals represent goals, and clouds represent soft-

goals.

Strategy. We want to make the strategy to emerge

during the goal modelling, through the building and

evaluation of the strategic map. We want to capture

the business needs, and this means we need also to

model the business profile of the company. In order to

do this, we adopt here the classical BSC-based mod-

elling approach. In detail, we build our goal model

by taking into account the four perspective mentioned

above: the economic-financial perspective, the cus-

tomer perspective, the internal processes perspective

and the learning and growth perspective.

Economic-financial Perspective. From the economic

perspective, we observe an important effort of the

Frioli company to contain costs (see Figure 3). There

are two kinds of costs: management costs and sup-

ply costs. Supply costs are intrinsic to the transport

activity, such as fuel and tolls. On the other hand,

management costs are related to the administration of

the business; TLC are an important part, but also the

extra payments the arise from unforeseens.

+

Reduce

expenses

for tolls

Minimize

in-vain trips

Reduce

TLC costs

Reduce

costs

Sign

insurance

contracts

Reduce

management

costs

OR

Reduce

costs

OR

Reduce costs

for unforeseens

and casualties

Reduce

supply costs

OR

Reduce

expenses

for fuel

AND

Reduce

waste

Figure 3: The Economic-financial Perspective.

Customer Perspective. From this perspective, it is

important to understand in which way a company

can be attractive for the customer (Figure 4). The

overall image of the company (“Care corporate

image”) is important, as well as the details, such

as the look of the personnel and of the documents.

The communications with the customer (“Care the

communications with customers”) are important for

the customers to be loyal to the company. Also, an

important goal is to be able to offer an international

transportation service. Even if not frequent, the lack

of this service could affect the perception of the

customer in the company’s capabilities.

+

Care

the look of the

employee

Care

the look of the

documents

Behaviour

code

Be friendly in

communications

Consultancy

Be available

at communicating

with customers

Care

corporate

image

AND

International

freight

Capability

to satisfy short-term

commitments

Capability to

administrate

shipments

Care the

communication

with customers

++

++

++

++

Figure 4: The Customer Perspective.

Internal Processes Perspective. Economic-financial

goals and customer’s strategy have to be translated

into internal processes. Notice that we don’t want to

actually model the sequences of activities that form

the company’s business processes. What we want to

capture here is the why of the processes. The pro-

cesses shall allow the company to achieve its goals,

so we model only the low-level goals that the internal

activities are expected to fulfil (Figure 5).

++D

++S

+D

+

++S

+

+D

+S

++

++S

+

+S

++D

+S

++S

+

+S

Reduce

route errors

Reduce

communication

errors

Reduce

delivery

errors

Equip

vehicles

with GPS

Modify

corporate

structurre

Buy more safe

and efficient

vehicles

Optimize

routes

Detailed

daily info

on routes

Updated

news on

viability

E-mail

VoIP

Verify place and

modality of delivery

with sender

Verify place and

modality of delivery

with recipient

Verify

route and

delivery time

Verify

availability of

the vehicles

Increase quality

and frequency of

maintenance actions

Norm-compliant

vehicles

Integration

with the

customers IS

Select

high quality

components

Minimize

crashes

Minimize

injuries

Continuous

monitoring of

work tools

Buy

injury-protection

clothes

Vehicles

availability

Errands for

the requests

Improve

customer-carrier-recipient

communication

AND

Verify the

feasibility of

the order

AND

New

communication

media

OR

Reduce

malfunctionings

and errors

AND

Figure 5: The Internal Processes Perspective.

Learning and Growth Perspective. From this per-

spective, the company has a little margin of techni-

cal improvement. For instance, it could acquire new

tools (for self-made reparations) or train the person-

nel (Figure 6). Some other goals are related to the ac-

quisition of new customers. More ambitious growth

plans, such as investments in new market segments,

are not present in the company.

++

+

++S

+D

Safe-drive

courses

Acquire

new tools

Professional

staff

Acquire

proficiency

New

customers

acquisition

Gain

proficiency

Knowledge

of foreign

languages

Acquire new

knowledge

Marketing

Figure 6: The Learning and Growth Perspective.

BALANCED GOALCARDS - Combining Goal Analysis and Balanced Scorecards

111

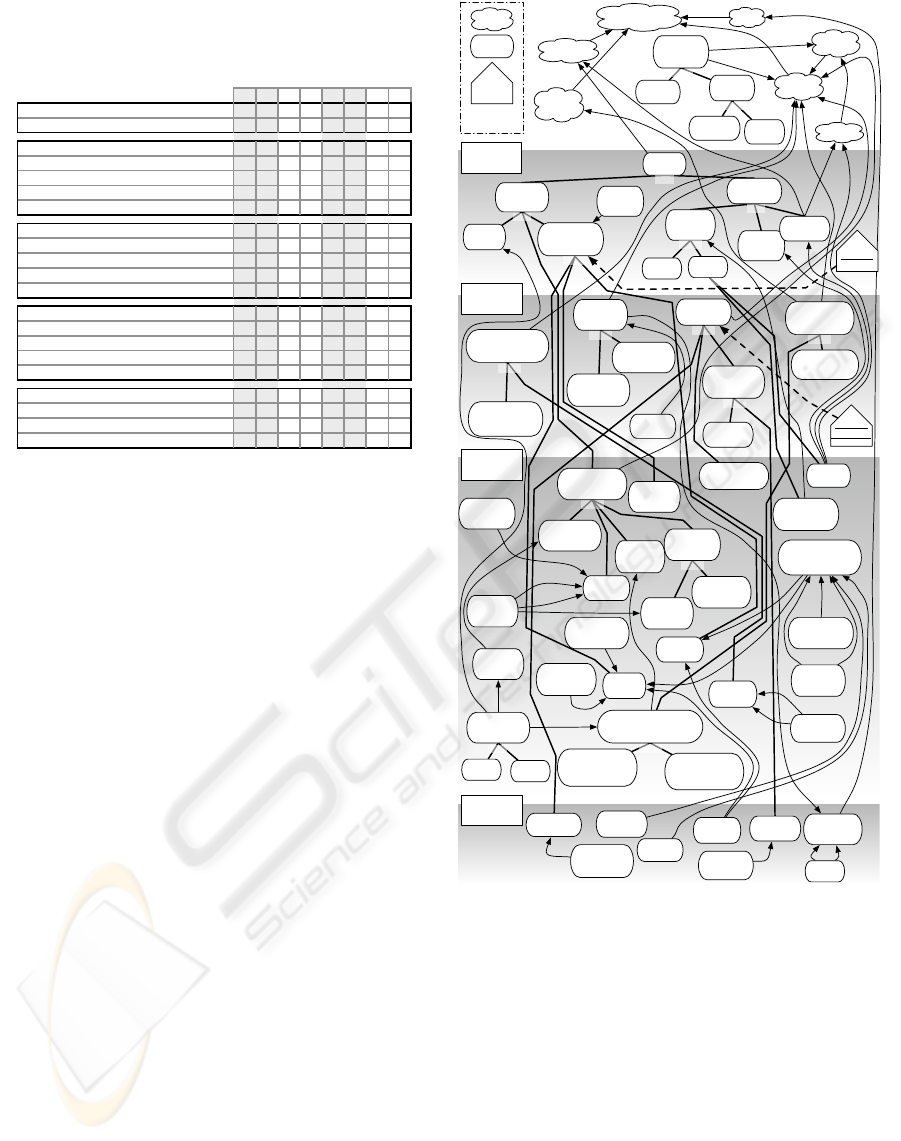

4.2 Validation of the Strategic Map

The last step consists in putting together the perspec-

tives and balance them into a consistent strategy. One

of the strength points of the original BSC framework

is its simplicity; using a goal diagram based approach

causes the level of complexity to grow up (see Fig-

ure 7), and this raises the need for formal analysis able

verify and validate the models. The first problem (ver-

ification) can be solved with goal analysis techniques.

The second problem (validation) is more complex,

since it requires to align the models with economic

principles. For this purpose, we have defined an anal-

ysis methodology comprised by three steps: conflicts

resolution, costs minimisation and risk prevention.

Conflicts Resolution. A conflict is a situation where

the satisfaction of some subgoals prevents (fully or

partially) the top goals from being fulfilled. Such kind

of situation is extremely dangerous, since an unseen

conflict can undermine the enforcement of the strat-

egy. But it results difficult to be detected, specially

when the strategic map becomes complex. The proce-

dure that we use for conflicts detection and resolution

is the following: i) we execute backward reasoning

in order to find a possible vales assignment for leaf

nodes that satisfy all the top goals; ii) if the solution

introduces a conflict for some of the top goal we start

again backward reasoning for each of the conflicting

goal; iii) the whole goal model is then modified ac-

cordingly to the partial results obtained in the previ-

ous step.

So for example, in Figure 7, the goal “Verify the fea-

sibility of the order”, introduced in order to “Reduce

malfunctioning and errors”, caused a conflict with the

goal “Reduce management costs”. Since the com-

pany privileges the financial perspective over the in-

ternal processes one, the first goal has been discarded.

Costs Minimisation. Due to OR-decompositions

and multiple contribution relations, different strate-

gies can be adopted; i.e., it is possible to find differ-

ent values assignments to the leaf goals that satisfy

the top goals without any critical conflict. To select

one of them we recall the BSC fundamentals, argu-

ing that each alternative has a different cost for the

organisation. So we assign to each goal a numerical

value, which represent its cost. If possible, we evalu-

ate its monetary cost; so for instance the actual cost of

the “Consultancy” can be accurately estimated. Other-

wise, we search for a suitable metrics; for instance,

for transport companies “timeliness” can be evaluated

and translated into a numerical value. Costs are then

associated to goals as meta tags, so that each possible

strategy will have by this way a corresponding weigh

in term of its resulting cost. The selection of the best

strategy will be based on the comparison of that costs.

For instance, in Figure 7, the goal of obtaining “Cus-

tomers loyalty” can be achieved either adopting a mar-

keting strategy (e.g., promotional campaigns) or in-

troducing a dedicated software able to reduce delivery

errors. However, a new software can be very expen-

sive and adopting marketing-based strategy could be

more convenient.

Risk Prevention. Risk is something that heavily af-

fects a company’s life. Risky events are outside the

control of an organisation and can prevent its strategy

to be accomplished. We take into account this prob-

lem by introducing in the diagrams a new entity - the

“Event”. Events are linked via −−

S

contribution rela-

tions to one or more goals. So, if an event occurs (i.e.,

its SAT value equals to P or F), then the affected goal

is inhibited. We have no control over the occurrence

of the event; however, by assigning the SAT value to

the event, we can perform bottom-up analysis and see

what is the potential effect of the event.

For example, in Figure 7 the event “Crashes” can

potentially compromise the whole long-term strategy

having a negative impact on the reduction of costs.

5 EVALUATION

In order to verify our approach, we have implemented

a CASE tool, the B-GRTool (Balanced-GoalCards

Tool). The tool has been implemented as an extension

of the GR-Tool (Giorgini et al., 2005) and maintains

all its functionalities, including reasoning techniques

like forward and backward reasoning. Besides the

standard GR-Tool scenarios, the B-GRTool supports

views on single scenarios that are used to build the

balanced perspectives. We used the tool to model the

strategy for Frioli S.n.C. according to the approach

shown in previous section. An almost complete goal

model is illustrated in Figure 7. It contains the mis-

sion and values of the company, together with the four

perspectives; notice that during the validation phase,

we have completed and refined the model by estab-

lishing further relations (contributions and decompo-

sitions). Table 1 shows the metrics that result from the

goalcards; due to lack of space, only a subset of the

goals can be shown. The four scenarios correspond

to alternative strategies, each of which gives different

priorities to different goals.

Scenario 1. The first scenario shows the current strat-

egy of the company and reflects its business values.

In this case, some goals result more important than

others. For instance, it is extremely important the

“Customer loyalty” obtained offering a reliable service.

This requires a particular attention to “Care corpo-

ENASE 2008 - International Conference on Evaluation of Novel Approaches to Software Engineering

112

Table 1: Perspective-based comparison of four possible

scenarios. The “S” columns contain Satisfiability values,

whereas the “D” columns contain Deniability values.

Scenario:

1 2 3 4

S D S D S D S D

Values

Long-term value for the associates P P P P

Customer loyalty P P P P

Sign insurance contracts P F

Reduce management costs P P F P

Reduce supply costs P P F P

Minimize in-vain trips F

P F F F

Capability to satisfy short-term commitments P

Care the communication with customers F P P

Care corporate image F P P P

International freight P P F P

Behavior code F F

Equip vehicles with GPS F

Reduce malfunctioning and errors P F P

New communication media P F P F

Improve customer-carrier-receiver comm. F P P P

Increase frequency of maintenance actions P P P P

New customers acquisition F F P P

Acquire new tools P P P F

Marketing F P P

Acquire new knowledge P F P

P = “Partial” T = “Total”

Economic

perspective

Reduce costs for unforeseens and casualties

Customer's

perspective

Internal

processes

perspective

Learning and

growth

perspective

rate image” and to “Care the communication with cus-

tomers”.

Scenario 2. The second scenario proposes a strat-

egy for a growth-oriented company. The focus of

the analysis is on goals such as “Acquire new tools”

or “New customers acquisition”. What we obtain is a

strategy that privileges the growth, but goals such as

“Reduce management costs” and “Reduce costs for

unforeseens and casualties” are denied. If a company

wants to grow, it is extremely difficult to reduce at the

same time the costs.

Scenario 3. The third scenario describes a strategy

for a company that wants to reduce costs. In this

case, the focus is on the economic and the internal

processes perspective, and particularly on goals such

as “Reduce management costs” or “Reduce expenses

for fuel”. The resulting strategy allows the company

to satisfy all goals, but suggests to abandon the inter-

national freight, and some non essential goals such as

“Care the communication with customers” and “Care

corporate image” are denied.

Scenario 4. The last scenario proposes to reach the

top goals by investing in innovation. In this case the

learning and growth perspective has again a relevant

influence on the strategy, but caring at the same time

the internal processes one. The resulting strategy is

similar to the one of scenario 2, but it is now possible

to contain costs.

Some interesting results come from the case study.

Despite their claim of the “Growth” as a business

value, the actual strategy does not reflect such a will.

It is possible to see in Figure 7 that the learning and

Long-tern value

for the associates

Growth

Effectiveness

Quality of

service

Care

corporate

image

Customers

loyalty

Timeliness

+

+

++D

+D

+

+

+

+

+

++

+

++S

+D

++D

+D

+

+

+

Crashes

No route

via Austria

Financial

Perspective

Customer

Perspective

Internal

Processes

Perspective

Learning and

Growth

Perspective

+

+

+

+

+

+

+

+

--S

+

+

-S

+

Event

SoftGoal

++S

--S

+

+

+

+

++S

+D

+

++S

+

+D

+S

++

++S

+

+S

++D

+S

++S

+

+S

Orders be

received

Vehicles be

available

Route be

planned

Reduce

expenses

for tolls

Minimize

in-vain trips

Reduce

TLC costs

Reduce

costs

Sign

insurance

contracts

Care

the look of the

employee

Care

the look of the

documents

Behaviour

code

Be friendly in

communications

Consultancy

Be available

at communicating

with customers

Reduce

route errors

Reduce

communication

errors

Reduce

delivery

errors

Equip

vehicles

with GPS

Modify

corporate

structurre

Buy more safe

and efficient

vehicles

Optimize

routes

Detailed

daily info

on routes

Updated

news on

viability

E-mail

VoIP

Verify place and

modality of delivery

with sender

Verify place and

modality of delivery

with recipient

Verify

route and

delivery time

Verify

availability of

the vehicles

Increase quality

and frequency of

maintenance actions

Norm-compliant

vehicles

Integration

with the

customers IS

Select

high quality

components

Minimize

crashes

Minimize

injuries

Continuous

monitoring of

work tools

Buy

injury-protection

clothes

Vehicles

availability

Errands for

the requests

Safe-drive

courses

Acquire

new tools

Professional

staff

Acquire

proficiency

New

customers

acquisition

Gain

proficiency

Knowledge

of foreign

languages

Acquire new

knowledge

Marketing

Goal

Reduce

management

costs

OR

Reduce

costs

OR

Reduce costs

for unforeseens

and casualties

AND

Reduce

supply costs

OR

Reduce

expenses

for fuel

AND

Reduce

waste

AND

Care

corporate

image

AND

International

reight

AND

Capability

to satisfy short-term

commitments

AND

Capability to

administrate

shipments

AND

Care the

communication

with customers

AND

Improve

customer-carrier-recipient

communication

AND

Verify the

feasibility of

the order

AND

New

communication

media

OR

Reduce

malfunctionings

and errors

AND

Goods be

delivered

AND

Delivery

service be

fulfilled

AND

Legend

Figure 7: An (almost) complete goal model for the Frioli

S.n.C. case study.

growth perspective has a few number of goals. The

scenarios above also confirm this perception. So we

observe that, despite the fact that the company wants

to grow, its implicit values do actually privilege sta-

bility. This observation is reinforced by a look at the

customer perspective: it has an important impact on

the realisation of the business values. In particular,

we see that many goals exist in order to satisfy the

“Customer loyalty” soft-goal. Through the customer

loyalty, the general-purpose “Long-term value for the

associates” is intended to be reached. Thus, the com-

pany seems to have a well-established relation with

customers, and wants to keep it, without going fur-

BALANCED GOALCARDS - Combining Goal Analysis and Balanced Scorecards

113

ther into market risks. So the resulting requirements

system should privilege this status quo arrangement.

6 CONCLUSIONS

The importance of business criteria is explicitly

recognised in particular in the e-Commerce engineer-

ing, where value exchanges play a role in under-

standing and generating requirements for the sys-

tem (Gordijn and Akkermans, 2003). Also, in e-

Business, some approaches exist, which focus on

the need for the alignment of IT and business strat-

egy (Bleistein et al., 2004; Grembergen and Saull,

2001). In this paper we have presented a new method-

ological framework for modelling requirements and

validating them against a business strategy: goal

graphs are used to represent the strategic map, and

the economic metrics are associated to goals’ sat-

isfiability and deniability; this allows to reason on

the metrics and analyse the diagrams, building bal-

anced requirements systems. We have reported the

use of the framework in our experience with a trans-

port company, trying to evaluate the results by com-

paring different scenarios and estimating the effec-

tiveness gained in gathering requirements.

REFERENCES

Alencar, F., Castro, J., Cysneiros, L., and Mylopoulos, J.

(2000). From early requirements modeled by the i*

technique to later requirements modeled in precise

UML. In Anais do III Workshop em Engenharia de

Requisitos, pages pp. 92–109, Rio de Janeiro, Brazil.

Bleistein, S. J., Aurum, A., Cox, K., and Ray, P. K. (2004).

Strategy-oriented alignment in requirements engineer-

ing: Linking business strategy to requirements of

e-business systems using the soare approach. vol-

ume 36.

Bresciani, P., Giorgini, P., Giunchiglia, F., Mylopoulos, J.,

and Perini, A. (2004). Tropos: An agent-oriented

software development methodology. Journal of Au-

tonomous Agents and Multi-Agent Systems, 8(8):203

– 236.

Dardenne, A., van Lamsweerde, A., and Fickas, S. (1993).

Goal-directed requirements acquisition. Science of

Computer Programming, 20(1-2):3–50.

Delor, E., Darimont, R., and Rifaut, A. (2003). Software

quality starts with the modelling of goal-oriented re-

quirements. In 16th International Conference Soft-

ware & Systems Engineering and their Applications.

Ebert, C. (2005). Requirements before the requirements:

Understanding the upstream impact. In RE ’05: Pro-

ceedings of the 13th IEEE International Conference

on Requirements Engineering (RE’05), pages 117–

124, Washington, DC, USA. IEEE Computer Society.

Fuxman, A., Giorgini, P., Kolp, M., and Mylopoulos, J.

(2001). Information systems as social structures. In

Second International Conference on Formal Ontolo-

gies for Information Systems (FOIS-2001), Ogunquit,

USA.

Giorgini, P., Kolp, M., and Mylopoulos, J. (2003). Orga-

nizational patterns for early requirements analysis. In

the 15th Conference On Advanced Information Sys-

tems Engineering (CAiSE*03).

Giorgini, P., Mylopoulos, J., Nicchiarelli, E., and Sebas-

tiani, R. (2002). Reasoning with goal models. In the

21st International Conference on conceptual Model-

ing (ER2002), Tampere, Finland. Springer Verlag.

Giorgini, P., Mylopoulos, J., and Sebastiani, R. (2005).

Goal-oriented requirements analysis and reasoning in

the tropos methodology. Engineering Applications of

Artifcial Intelligence, 18/2.

Gordijn, J. and Akkermans, H. (2003). Value based require-

ments engineering: Exploring innovative e-commerce

idea. Requirements Engineering Journal, 8(2):114–

134.

Grembergen, W. and Saull, R. (2001). Aligning busi-

ness and information technology through the balanced

scorecard at a major canadian financial group: It’s sta-

tus measured with an it bsc maturity model. In HICSS

’01: Proceedings of the 34th Annual Hawaii Interna-

tional Conference on System Sciences ( HICSS-34)-

Volume 8, page 8061, Washington, DC, USA. IEEE

Computer Society.

Kaplan, R. and Norton, D. P. (1996). The Balanced

Scorecard: Translating Strategy into Action. Mas-

sachusetts: Harvard Business School Press.

Kaplan, R. S. and Norton, D. P. (2001). The strategy-

focused organization. how balanced scorecard compa-

nies thrive in the new business environment. Harvard

Business School Press.

Niehaves, B. and Stirna, J. (2006). Participative enterprise

modelling for balanced scorecard implementation. In

Ljunberg J, A. M. e., editor, the Fourteenth European

Conference on Information Systems, pages 286–298,

Goteborg.

Norton, D. and Kaplan, R. (1992). The balanced scorecard:

measures that drive performance. Harvard Business

Review, 70 (1).

Porter, M. E. (1996). What is strategy? Harvard Business

Review, 74(6):61–78.

Rolland, C. (2003). Reasoning with goals to engineer re-

quirements. In 5th International Conference on En-

terprise Information Systems, Angers, France, April

22-26.

ENASE 2008 - International Conference on Evaluation of Novel Approaches to Software Engineering

114