A STRATEGIC ANALYTICS METHODOLOGY

Marcel van Rooyen

1

and Simeon J. Simoff

2

1

University of Technology, Sydney, Australia

2

School of Computing and Mathematics, University of Western Sydney, Australia

Keywords: Business intelligence, data-mining project methodology, data-mining, Knowledge Discovery in Databases

(KDD), knowledge management, concept drift, Telco retention-management, technology enablement.

Abstract: Businesses are experiencing difficulties with integrating data-mining analytics with decision-making and

action. At present, two data-mining methodologies play a central role in enabling data-mining as a process.

However, the results of reflecting on the application of these methodologies in real-world business cases

against specific criteria indicate that both methodologies provide limited integration with business decision-

making and action. In this paper we demonstrate the impact of these limitations on a Telco customer

retention management project for a global mobile phone company. We also introduce a data-mining and

analytics project methodology with improved business integration – the Strategic Analytics Methodology

(SAM). The advantage of the methodology is demonstrated through its application in the same project, and

comparison of the results.

1 INTRODUCTION

The use of advanced data-mining to add quantitative

rigour and break-through to business decision-

making, is becoming the ‘industry standard’ for

companies that aim at strategic advantage (Hirji

2003). Business decision-making is a hypothesis-

driven business process consisting of an iterative,

intertwined sequence of qualitative and quantitative

activities that produce business action (Pyle 2004,

pp.35ff, 54ff, 165, 662.) (Hastie, Tibshirani et al.

2001, p.99) (Schön 1995) (Pearce and Robinson

2004) (Liu 2003, p.429). (Van Rooyen 2004, p.85)

(Van Rooyen 2005). In order for data-mining to

best support business decision-making, its must be

methodologically integrated with this business

process.

Data-mining project methodologies have been

developed to facilitate this integration (Pyle 1999,

p.10) (Van Rooyen 2004, p.86) (SAS Institute 2000,

p.xi) (Chapman, Clinton et al. 1999-2000, p.3). At

present, the two most common data-mining project

methodologies are Data-mining Projects

Methodology (SDMPM) (SAS Institute 2000), and

Cross-Industry Standard Process for Data Mining

(Chapman, Clinton et al. 1999-2000). Hirji (Hirji

2003) has also outlined the phases of a methodology,

which at the time of the publication was at a

conceptual level and had not been tested completely.

Despite the existence and use of these

methodologies, organisations are still experiencing

difficulty in integrating data-mining and analytics

with the business. Van Rooyen showed that one of

the main reasons for this is that data-mining project

methodologies were data-centric. (Van Rooyen

2005). The reports of several panel discussions at the

ACM SIGKDD annual forums on data-mining and

knowledge discovery also pointed out the need for

better alignment of the output of the data-mining

process and business knowledge development

activities (Ankerst 2002) (Fayyad, Shapiro et al.

2003). Hirji (Hirji 2003, p.89) describes the problem

as relating to strategy, process and technology

variables. Kolyshkina and Simoff (Kolyshkina and

Simoff 2007) stressed that the potential value of

Analytics has not been fully realised or utilised in

business settings due to lack of congruency between

business issues and analytics targets, and lack of

analytics project management. They demonstrated a

stage model of the analytics project that provides

capabilities for improving business analytics projects

(Kolyshkina and Simoff 2007).

The first author considered improving the

integration of data-mining with the business through

embedding the data-mining process into the business

20

van Rooyen M. and J. Simoff S. (2008).

A STRATEGIC ANALYTICS METHODOLOGY.

In Proceedings of the Third International Conference on Software and Data Technologies - ISDM/ABF, pages 20-28

DOI: 10.5220/0001873300200028

Copyright

c

SciTePress

decision-making process. Conceptually the business

decision process acts as a “shell” for the data-mining

process, feeding input requirements and data, and

utilising the output of the data-mining. Hence central

to such approach is the structure of the business

decision-making process. The Strategic Planning

Cycle (SPC) (Pearce and Robinson 2004) is a

generic business decision-making process, which is

widely used by business, the military, etc. In this

paper, we assume the reader has a basic degree of

familiarity with the methodology and terminology of

SPC in its commercial application.

Van Rooyen (Van Rooyen 2004) presented a

comparative study based on the evaluation of the

documentation of the CRISP-DM and SDMPM

methodologies against SPC. The study indicated that

neither of these flagship methodologies offered the

required integration with the SPC planning process.

These preliminary, theoretical findings justified the

need to investigate and reflect on the results of an

actual, business application of one of the

methodologies. CRISP-DM was chosen because of

its availability in the public domain and frequency of

use by business. We next present background on the

project.

1.1 Background

The test case study aimed at enabling the business

decision-making process in a Mobile

Telecommunications company which had an

unacceptably high customer churn rate of 2.5% per

month in their 2

nd

generation (2G) mobile consumer

business. This resulted in lost revenue of tens of

millions dollars per annum. Consequently, the Chief

Financial Officer (CFO) set the grand objective (in

SPC terminology) to reduce voluntary customer

churn to 1.5%. The 2G management team, including

the product managers and the 2G retention manager

developed a grand strategy of using predictive data-

mining in retention marketing, and put a three-week

delivery time on the project. Tasked with delivering

the project, the data analysts decided to use CRISP-

DM as project methodology.

As the first author played a key role in the

project, in this study we use the Participatory Action

Research Methodology (Denzin and Lincoln 2003),

also known as action science or expert reflection-in-

action (Schön 1995). During the reflection and

evaluation phase, the first author (Van Rooyen

2005) evaluated the project’s outcomes against the

grand objective, its pace of progress against

business imperatives, and the quality of its

marketing content against the marketing principles

of Segment, Target and Position (STP) (Kotler

2002). The outcome, progress, and quality gaps were

identified and defined in SPC terminology (Van

Rooyen 2005), and linked back to the previous

evaluation of CRISP-DM (Van Rooyen 2004).

During the second stage the first author subsequently

experimented with an iterative re-design of the data-

mining methodology, guided by SPC principles.

Eventually, the initial version of the business-

oriented data-mining methodology, evolved into a

new methodology, labeled Strategic Analytics

Methodology (SAM). This paper presents evaluation

outcomes of the pilot CRISP-DM project. The paper

then presents the SAM framework, and discusses the

utility of SAM in integrating data-mining with the

business. The paper also discusses the framework of

the SAM, and concludes with the future research

direction in the area.

2 OBSERVATIONS AND

EVALUATION: PROJECT

OUTCOMES USING CRISP-DM

In this section we present our observations and

evaluation of the test-case project. The detailed steps

of the reflection methodology can be found in (Van

Rooyen 2005). The headings in this section are a

refinement of Van Rooyen’s categories in (Van

Rooyen 2004).

2.1 Introducing Expert Business

Subject Matter

New retention-management subject matter was

introduced to target retention-marketing campaigns

at customers whose impending churn has been

predicted by data-mining.

However, no innovation was proposed in

segmenting the targeted customers on behavioural

proxies in the data for value, need, and loyalty

(Wedel and Kamakura 2000). The analysts decided

to retain the existing retention segmentation based

on socio-demographic data cubes despite the fact

that there were known problems with this approach,

and it was accepted that the segmentation was

negatively impacting on campaign response rates.

Also, no consideration was given to the use of

customer behavioural profiles in tailoring campaign

offers. The retention-anagement innovation was

therefore limited to the T (targeting) component of

the STP marketing principles, restricting the

potential improvements in campaign response rates

at the outset of the project.

A STRATEGIC ANALYTICS METHODOLOGY

21

2.2 Formulating Project Scope and

Objectives

The defining of the business rules about voluntary

churn - and therefore the project scope - was not

undertaken by the management team. Instead, the

data analysts were left on their own to scope the

project. This led the analysts to take an extra step in

extracting business rules from the business, which

added an extra four weeks to the first phase of the

work – an unacceptable delay in the current globally

competitive business climate.

The management team had decided at the outset

that the new retention campaigns must be delivered

within the predicted 3-month time window. This was

unrealistic given organisational circumstances we

discuss later, and in reality the campaigns took an

unacceptable six months to execute.

Also, despite a caution from the analysts about

potential lack of evidence, management expressed

their determination to continue addressing an

anecdotal driver of churn (handset type) in the

campaign offer.

No measurement link was established with

Return on Marketing Investment (ROMI) as a

measure of the project’s success.

2.3 Mapping Technique to

Data-mining Plan

The data-mining strategy selected for prediction (T

in STP) was a neural network model. However, the

computational models that it offered, and the

predicting effects that it generated, were too difficult

to interpret and to explain to management. Hence,

the strategy therefore failed to produce the needed

information and intelligence towards addressing

churn drivers in the campaigns.

Further, because no new business subject-matter

on segmentation (S) and promotion (P) was

introduced earlier, no data-mining objectives could

be formulated to re-visit the current segmentation

with another statistical technique that offers better

explanation, or to profile the segments for

campaign-relevant behavioural dimensions.

2.4 Evaluation of Interestingness,

Decision-making and Business

Action

We observed that the interestingness of knowing

each customer’s propensity to churn – and model lift

- was not sufficiently considered by the retention

manager. Instead of, say, halving the number of

customers targeted for retention, the manager

selected a similar 5% proportion of the 2G customer

base for retention management as before. Retention-

management costs were therefore not reduced,

which diluted the potential lift in ROMI associated

with model lift.

Further example of the lack of strategic flavour

observed in this analytics project is the mismatch in

the 2G customer-analytics retention campaign and

the introduction of the recently launched third

generation network (3G) acquisition campaign. The

campaign manager had incentives to perform in 3G

acquisition. The 2G manager did not consider the

impact of this on the 2G retention campaigns.

Because of this, the 2G retention campaigns were

not executed within their 3-month predicted time

window, resulting in some at-risk customers

receiving their retention offers after they had

actually cancelled their service. Also, the campaign

manager decided to target at random from the

selected 5%. This meant that the 2G retention

campaigns were not prioritised towards the most at-

risk customers, further diluting the benefits of model

lift.

The model produced by the neural network

proved difficult to interpret, and no interesting

insights were developed relating to how customer

value, loyalty, and the degree of product feature and

volume use, indicated churn. As a result, the existing

promotional content was retained; all 2G customers

with predictive handsets were offered 2G

replacement handsets, irrespective of their degree

and volume of use. There were two negative results

from this. First, the high cost-base relating to

handset promotion was perpetuated, and a potential

cost saving from the data-mining approach was

forfeited. Second, the existing 2G retention offer

(with replacement 2G handset) was maintained to

high-use 2G customers, despite the fact that they had

a disproportional low 2G campaign response rate.

There were no insights to stimulate thought about

perhaps targeting high-use customers with 3G

migration offers - since 3G is more suitable to high

use and is better featured – and to at least retain

revenue from these customers within the

organisation, albeit as 3G revenue.

Also, no new insights were developed regarding

the role of demographics in churn, and campaign

offer components continued to be mapped to

demographic descriptors, instead of being updated

potential for behavioural drivers as the literature

indicated.

ICSOFT 2008 - International Conference on Software and Data Technologies

22

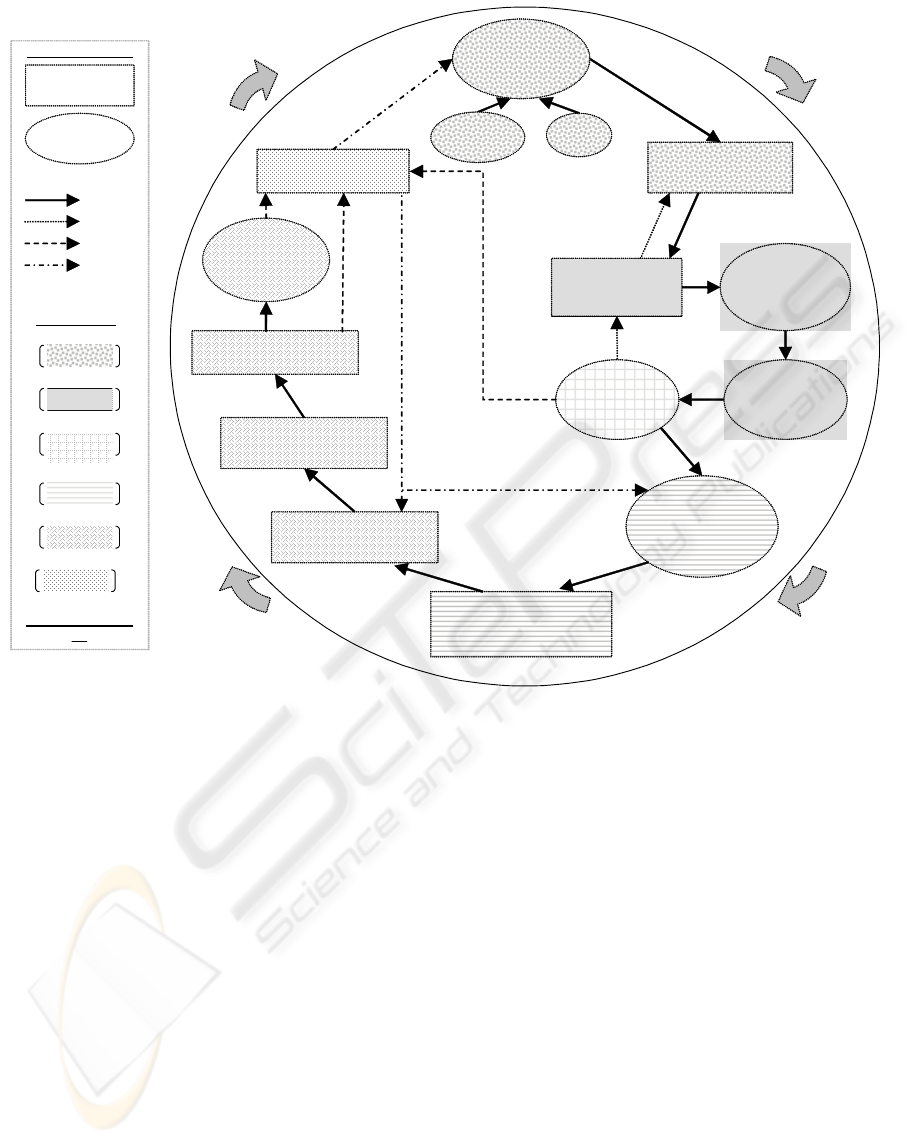

Data mining tasks

Business decision-

making & action

Project Dimensions

Project Phases

Preparation

Choice

Realisation

Monitor and control

Legend

Definition

Monitor and

control (9)

Develop data mining

application plan (6)

Deploy information

into business

(7)

Model, evaluate,

choose best model(s)

Develop new

business

solution(s)

(5)

Identify, assemble,

prepare data (2)

Data mining

discovery and

evaluation (3)

Execute new

business (8)

solution(s)

Strategic

choice (4)

Develop

circumstantial

knowledge

Strategic

analysis

Implement model(s)

Develop

project mission

(1)

R

e

de

v

e

l

o

p

Repeat these four

activities for each

BI goal

Control (recalibrate or adjust)

Analysis

Monitor strategic creep

Monitor concept

drift

Project Mile Stones

(n)

Business

problem

New

SME

Flow

Monitor

Control

Iterate

Figure 1: Strategic Analytics Methodology

Figure 1: Strategic Analytics Methodology.

2.5 Monitor and Control

The campaign manager continued to monitor

campaign response rates, and a 25% improvement

was recorded for the CRISP-DM project. The

retention manager monitored the percentage of

voluntary customer churn, and recorded a similar

improvement. However, both results fell short of an

expected 50% response rate increase resulting from

predictive lift.

There were no plans to monitor the drift of

concepts that should accompany the proactive,

predictive approach to retention management (Van

Rooyen 2004, p.94) i.e. monitoring changes in (1)

predictive effect scores (2) distance between

segments and changes in their behavioural profiles

(3) declining model accuracy against actual

churners, and (4) the overall predicted risk

associated with the churn problem. The business

remained locked into reactively responding to falling

campaign response rates; that is over time fewer and

fewer targeted customers responded positively to

save campaigns.

Further, since the calculation and tracking of

ROMI was not introduced, there was no return on

investment measure for quantifying the benefits that

data-mining had brought to retention management in

their company.

3 REFRAMING: THE SAM

FRAMEWORK

In this section we present the framework of Strategic

Analytics Methodology (SAM), and discuss the role

of each framework element in the project. The full

details are presented in (Van Rooyen 2005, Chapter

5). The framework is shown in Figure 1. The

sequence of steps in the framework follows clock-

wise, starting at the 12 o’clock position. We follow

the six project phases shown in the legend, and

A STRATEGIC ANALYTICS METHODOLOGY

23

highlight the project milestones. The intermediate

steps within a project phase are referred in italics.

3.1 Preparation

In the preparation phase, we develop hypotheses

about the nature and extent of the business problem

or opportunity, its root causes, how data-mining and

analytics can enable its solution, and about the

actions the business could take. In Business problem

we define the status quo. The infusion of New SME

represents domain-specific, new subject matter

based on research that challenge the existing

boundaries of interestingness, poising the

organisation for break-through. In Develop project

mission the owner of the business problem and the

analysts together apply a technique that challenges

the current thinking about the business’s status quo.

The analysts and business agree on what will

constitute interestingness, on what the project must

deliver for the business action, and on how the

analytics will support the project. They then use a

guide to convert these hypotheses and agreements

into a project mission, the first milestone. The

project mission’s components include the project

scope, its specific business deliverables,

interestingness measurement criteria, and the time

frames, responsibilities etc. of the project. In

Identify, assemble, prepare data we identify and

source the interesting data, discover information

about the data quality and interesting signals, and

chart how we want to use the data on the project.

This constitutes the second milestone.

3.2 Analysis

In the analysis phase, we develop a technical

analysis charter and discover interesting information

from the data and evaluate it against the

interestingness criteria in the project mission. The

milestone is interesting information, which supports

the project mission. This information is interpreted

into circumstantial business insights and knowledge

(Develop circumstantial knowledge). In Strategic

analysis we test and redevelop our hypotheses in

light of the new insights, and formulate a range of

high-level business action options.

3.3 Choice

In this phase, we evaluate the range of action options

against organisational and environmental

circumstances using a SWOT analysis tool, and

reject those options that are not realistically

actionable. The choices made here are the 4

th

milestone, since they funnel the project through to

the definition of business action.

3.4 Definition

In this phase we develop the functional business

actions (Develop new business solution(s)) as

functional objectives and strategies (e.g. in

marketing, operations etc.) for all business enablers

(structure, systems, management etc.). We also

develop: (i) the key business performance metrics

that we will use in monitoring the success of the

business action; (ii) the data-mining application plan

that will support the business actions (Develop data

application mining plan). Further, we identify the

technical concepts that we model and monitor for

drift. Together these constitute the 5

th

and 6

th

milestones.

3.5 Realisation

In Model, evaluate choose best model(s) we refine or

modify the models from Data mining discovery and

evaluation, and format their informational output for

interfacing with other IT applications.

Before the business can Execute new business

solution(s), two application layers need enablement.

In Implement model(s) we build the extract,

transform and load (ETL) and analytics layers, and

in Deploy information into business we enable the

business and IT application layers e.g. the customer-

relationship management (CRM) application. As the

enabling of the business applications, this constitutes

the 7

th

milestone. In Execute new business solutions,

we execute the business actions through structure,

management, IT applications, channels, operating

strategies etc. This is the completion of business

action and therefore the 8

th

milestone.

3.6 Monitor and Control

In this last phase of the project we assure the

ongoing relevance of the business actions and of

their supporting applications (including the

operational models) through (i) a process of

monitoring the business KPI’s and the technical

concepts (ii) recalibrating actions and enablers

where required; (iii) and monitoring strategic creep.

Monitor and control is an ongoing activity but we

have made it the project’s 9

th

milestone. SAM draws

on the principles and practice of concept drift and

statistical process control for the technical

components, and on the monitor and control

ICSOFT 2008 - International Conference on Software and Data Technologies

24

activities of SPC for the business solution. When

either the business actions or the supporting enablers

become out of control, the project needs to be

reformulated, or a new project of higher return is

formulated.

4 MOVE TESTING: AN

INDUSTRIAL APPLICATION

OF SAM

In this section we demonstrate the application of

SAM on the same project, and describe the business

and technical benefits from this application. The

benefits are compared to the CRISP-DM application

where relevant.

4.1 Problem Formulation

We used SAM’s utilities for defining the business

problem in Business problem with management

participation. Within two one-hour workshops, we

refined the business rule for voluntary churn to

exclude bad debtors. This later resulted in improving

the regression model’s predictive accuracy against

test cases from 75% to 80%.

4.2 Introducing Expert Business

Subject Matter

In New SME we introduced the concept of ROMI,

and assisted with developing a measure of ROMI

suitable for the business. We also linked for the

business the concept of predictive lift with the way it

could lead to a reduction in the number of customers

targeted (T). Further, we agreed with management

on: (i) selecting the concept of behavioural

segmentation (value, loyalty, needs); (ii) segmenting

the targeted customers into 5 statistically relevant

segments (to fit the existing segment numbers) by

these new measures (S); (iii) and tailoring campaign

offers based on behavioural profiles (P).

4.3 Formulating Project Mission

Given the previous re-defining of the churn business

rules, the project mission was reformulated to

exclude bad debtors. This better focused the analysts

on the problem at hand.

4.4 Formulating Technical Charter

Considering the business need for understanding the

drivers of churn, we used mapping techniques in

Data mining discovery and evaluation to lead the

project to a decision to build a predictive logistic

regression model, instead of using a neural network

model (T). This resulted in a model that was

interpretable, which in turn facilitated the

development of significant insights: (i) the degree

and volume of use actually were strong churn

drivers; (ii) there were use interactions with certain

handset-types; (ii) demographics were insignificant.

These insights supported the case for more

statistically valid behavioural segmentation. We

therefore decided to use clustering techniques to

segment the selected 2.5% customers by behavioural

criteria. We found that there were 5 distinct,

statistically valid segments (S), with distinct

behavioural profiles. One segment (segment 2)

consisted of 25% of the targeted customers, and had

a distinct handset-type high-use combination, which

was well-supported by the regression model.

4.5 Evaluating Interesting Information,

Decision-making and Business

Action

In the Analysis phase the retention manager now

considered a number of things:

(i) a new understanding of the benefits of lift;

(ii) the fact that predictive accuracy had increased

after the exclusion of bad debtors;

(iii) as the subject matter about behavior had

suggested, we had found strong, statistically valid

behavioural churn drivers and segments. The

combination of handset type and high-use behaviour

had featured, while no demographic factor was

driving churn as strong as the behavioural factors

drove;

(iv) limited campaign resources were available to 2G

retention;

(v) the retention and campaign managers now had

ROMI targets to attain. Therefore, during Strategic

choice they decided collaboratively to target (T)

only the most at-risk 2.5% of the 2G customer

database. We observed that this halving of targeted

customers resulted in the campaigns being executed

within their 3-month window to all the targeted

customers, eliminating the campaign execution

issues observed before.

During the Analysis phase of SAM, the retention

manager found segment 2 particularly interesting

(S). In Develop circumstantial knowledge and

A STRATEGIC ANALYTICS METHODOLOGY

25

Strategic analysis he considered the impact that the

recent launch of 3G had had on the first round of 2G

retention campaign execution, and in Strategic

choice he decided to hand segment 2 over to the 3G

acquisition manager for migration onto the 3G

network (T and P), to a technology that better

matched this behavioural profile. This further

contributed to attaining the ROMI target, because

they did not have to fund any 2G replacement

handsets for this segment, and this segment’s uptake

of 3G was very high.

In light of some evidence that demographics

were not driving churn, the retention manager

reformulated the retention offer content (P) for

segments 1, 3, 4 and 5. Previously, males in the 19 –

25 age group had received a promotional ticket

concession to Australian Football League (AFL)

matches, based on the assumption that most males in

this age group followed AFL. Now, the AFL

promotion was offered to all targeted individuals

who had a history of requesting sms results of AFL

games, irrespective of their demographic. Also,

where previously there had been replacement of all

2G handsets irrespective of use level, now 2G

handsets were promoted only to individuals with

medium-use patterns; individuals with low-use

patterns had to buy a replacement handset (recall

that high users were migrated to 3G).

4.6 Monitor and Control

On the SAM-based project, the response rates

increased about 75% over the pre-data-mining basis.

This exceeded the business target of 50%, and the

25% improvement on the CRISP-DM-driven

project. Notably, there was a 90% uptake of the 3G

offer by segment 2 members. The CRISP-DM

project brought a 10% ROMI improvement over the

base (before CRISP-DM pilot) situation, while the

SAM project’s ROMI improved 30% over base. The

smaller ROMI improvement compared to the

campaign response improvements, are attributed to

fixed campaign costs remaining from the pre-data-

mining mining era; over time ROMI will improve as

the organization addresses these costs.

The value of a data-mining approach that

supports marketing STP was now well understood

by management and proved to the business. The

business responded with a request to monitor the

extent of the churn risk in the database and assist in

formulating responses. We monitored drift in the

sum of scored p_values within quintiles with every

quarterly database re-scoring, and relating these to

change in the campaign response rate. The project

iterated through the Analysis, Choice, and Definition

phases and we formulated various controls for this

phenomenon. For instance, if both sum of p_values

and campaign response are in decline (scenario 1),

the business solution is to address the drivers of the

problem. The first control response is to retrain the

model to maintain accuracy. If after a model retrain

the sum of p_values and campaign response still are

in decline, it indicates that the business solution is

also weeding out potential churners, and may be

approaching a situation of diminishing returns with

retention. The response is to fine-tune the campaign

offers (scenario 2). If with model retraining (and in

some cases after campaign refining) the sum of

p_values keep increasing while the campaign

response rates are in decline, then circumstances in

the business operating or marketing environments

are not represented in the data. The response is to

undertake qualitative research to identify these

circumstances, and to update the campaigns

(scenario 3).

We found that the three scenarios actually

manifested themselves in this order over scoring

cycles 2-4. In cycle 4, the 2G retention manager was

convinced that the point of diminishing returns had

been reached with 2G retention, with consensus in

the business, that most of the 2G churn risk had been

‘weeded’. This was the result of events that were not

reflected in the data, namely (1) the business had

stopped acquiring 2G customers with the launch of

3G in quarter 1, and (2) by the fourth quarter 3G was

cannibalising the mid- and high-user 2G business.

Since the revenue and margins in 3G were superior

to those in 2G, the business now had sufficient

evidence to abandon the 2G retention program.

The concept of interacting behavioural churn

drivers was now well understood and proved to the

business, and there was a necessity for monitoring

any drift in churn drivers, and their interactions, over

time. In the second SAM campaign cycle, we started

to rebuild the predictive model and the segmentation

on a monthly basis, and to monitor drift in effect

scores and segment parameters.

One noticeable drift in effects was the

diminishing impact of the high-use and handset type

combination. We attribute this to the fact that we

were gradually moving the high-use customers over

to 3G. What did emerge in its place was a

combination of over-3-years customer tenure, over-

18-month minimum contract plan types, and a 26-34

year-age demographic. It was now apparent, that our

own and emerging competitive 3G advertising, was

influencing the traditionally more conservative

customers in this age group to switch brand or

ICSOFT 2008 - International Conference on Software and Data Technologies

26

technology. This insight enabled the making of a

more proactive 3G migration offer to customers who

exhibited this behaviour. Their take-up was not 90%

as with segment 2 previously, because of the diluting

effect of competitive 3G activity.

There also was a noticeable reduction in the

importance of segment 2 in the segmentation

structure over time, since many customers with that

profile were migrating to 3G. Over time the

importance of customer tenure and plan duration

rose in the segmentation structure. When we

experimented with the number of segments, we

found that, compared to five segments, four

segments actually did not detract much from the

statistical significance of the clustering. The

business found this attractive, as it meant that they

could eliminate one of the five campaigns without a

significant impact on response rates. This

contributed a further 5 points to ROMI on the SAM

project, bringing SAM ROMI to 35% over base.

5 CONCLUSIONS AND FUTURE

WORK

We conclude that we have proved the hypothesis

that CRISP-DM requires extension in order to

integrate deeper analytics and the business decision-

making process. The improved results indicate it is

possible to improve data-mining methodologies to

better integrate with business decision-making and

action. We have also proved that the Strategic

Analytics Methodology (SAM), which follows a

deeper integration of data-mining and business

decision-making process, is sufficiently robust to

produce beneficial results in a dynamic business

environment.

SAM, in its current version met its research

objective as industry-driven, academic research by

late 2004. At present, a SAM-derived framework is

used effectively in process-enabled, industrial data

analytics.

Several directions are considered in terms of the

future development of SAM, aiming at:

1. further experimentation with better controls, in

order to quantify the incremental benefit that

SAM contributes to business data-mining

compared to existing methodologies;

2. specific development and refinement of SAM

to better accommodate the unique integration

criteria of not-for-profit and government

applications;

3. proving the hypothesis that the existence of a

more supportive project methodology like SAM

would enhance the uptake and adoption of data-

mining and analytics by business and

government.

ACKNOWLEDGEMENTS

This research was done under the e-Markets

Research Program, University of Technology

Sydney. We acknowledge the RTS Scholarship and

the support of SAS Institute Australia Pty. Ltd.

Thanks to a global mobile-phone company for

providing the real-world data and analytics

environment. Thanks Dr. Michael J. Yerbury for

your grammatical contribution.

REFERENCES

Ankerst, M. (2002). "Report on the SIGKDD-2002 panel -

The perfect data mining tool: interactive or

automated?" ACM SIGKDD Explorations 4(2): 110-

111.

Chapman, P., J. Clinton, et al. (1999-2000). CRISP-DM

1.0: Cross Industry Standard Process for Data Mining.

http://www.crisp-dm.org/CRISPWP-0800.pdf, CRISP-

DM Consortium. Accessed November 2003.

Denzin, N. K. and Y. S. Lincoln (2003). Strategies of

qualitative inquiry. Thousand Oaks, CA, Sage.

Fayyad, U., G. Shapiro, et al. (2003). "Summary from the

KDD-03 panel - Data mining: the next 10 years."

ACM SIGKDD Explorations 5(2): 191-196.

Hastie, T., R. Tibshirani, et al. (2001). The Elements of

Statistical Learning. New York, Heidelberg, Berlin,

Springer-Verlag.

Hirji, K. K. (2003). A Proposed Process for Performing

Data Mining Projects. Managing Data Mining

Technologies in Organizations: Techniques and

Applications. P. C. Pendharkar, Idea Group Inc.: 350.

Kolyshkina, I. and S. J. Simoff (2007). Customer analytics

projects: addressing existing problems with a process

that leads to success. Conferences in Research and

Practice in Information Technology, Data Mining and

Analytics 2007, Australian Computer Society Inc: pp.

13-20.

Kotler, P. (2002). Marketing Management: Analysis,

Planning, Implementation, and Control. International,

Prentice Hall.

Liu, X. (2003). Systems and Applications. Intelligent Data

Analysis. M. Berthold and D. J. Hand. Heidelberg,

Springer-Verlag: 429-442.

Pearce, I. J. A. and J. R. B. Robinson (2004). Strategic

Management: Formulation, Implementation, and

Control, McGraw-Hill.

A STRATEGIC ANALYTICS METHODOLOGY

27

Pyle, D. (1999). Data Preparation for Data Mining. San

Francisco, Morgan Kaufmann Publishers.

Pyle, D. (2004). Business Modelling and Data Mining.

London, Morgan Kaufmann.

SAS Institute (2000). SAS Data Mining Projects

Methodology. Cary, NC, SAS Institute Inc.

Schön, D. A. (1995). The Reflective Practitioner: How

Professionals Think in Action. London, Ashgate

Publishing Limited.

Van Rooyen, M. (2004). An evaluation of the utility of

two data mining project methodologies. Proceedings

of the 3rd Australasian Data Mining Conference,

Cairns, Australia, University of Technology Sydney:

85-97.

Van Rooyen, M. (2005). A Strategic Analytics

Methodology. Faculty of Information Technology.

Sydney, University of Technology: 350.

Wedel, M. and W. Kamakura (2000). Segmentation:

Conceptual and Methodological Foundations. Boston,

Kluwer Academic Publishers.

ICSOFT 2008 - International Conference on Software and Data Technologies

28