BARRIERS TO MOBILE BANKING ADOPTION

A Cross-national Study

Tommi Laukkanen

Department of Business and Management, University of Kuopio, Kuopio, Finland

Pedro Cruz

Instituto Superior de Gestao, Lisbon, Portugal

Keywords: Innovation resistance, Adoption, Mobile phone, Banking.

Abstract: The objective of this study is to explore barriers to mobile banking adoption in two distinct European

countries namely Finland and Portugal. Even successful innovation may face various types of resistance that

may paralyse customers' desire to adopt or use the innovation. We investigated the country effect to five

adoption barriers namely usage, value, risk, tradition and image, derived from the earlier literature. An

Internet questionnaire was developed and 3.597 usable responses were collected. A confirmatory factor

analysis was implemented with SEM to build the constructs’ latent score levels. Using non-parametric

difference tests we concluded that the resistance is significantly lower among the Portuguese online bank

customers in terms of four out of the five barriers. The results can be used for a better understanding and

enhancement of adoption of this specific case of m-commerce.

1 INTRODUCTION

The wide penetration and rapid diffusion of mobile

phones has opened opportunities for new

innovations in the services sector. One such

innovation is mobile banking representing one of the

most promising, while still marginally adopted, m-

service. Previous studies have shown that mobile

banking increases efficiency and convenience in bill

paying, for example, as the service can be used

wherever wanted enabling time savings and

immediate reactions to unexpected service need

(Laukkanen and Lauronen, 2005; Laukkanen,

2007a).

Finland has long been seen as the most

successful European country in terms of the

adoption and use of mobile services (Bouwman et

al., 2007). However, even though already around

two thirds of the Finns pay their bills over the

Internet, mobile banking has not yet received the

attention of the masses. In general, Finland is

referred as one of the leading European countries in

terms of Internet banking adoption, while, for

example, Portugal is lacking far behind (Eurostat,

2007). In this study we investigated what inhibits

mobile banking adoption in these two European

countries and how the countries differ in terms of

barriers to the service adoption.

First we describe the Internet and mobile

communications market both in Finland and

Portugal. Thereafter, we summarise the relevant

literature on innovation resistance and banking

technologies. Finally, the findings are presented and

concluding remarks drawn.

2 INTERNET AND MOBILE

COMMUNICATIONS MARKET:

FINLAND VS. PORTUGAL

During the last decade the penetration of mobile

phones has been dramatic. In addition, the diffusion

of Internet-connected computers has been

remarkable in the 21

st

century. These advances in

communication technologies have reshaped the

service development and revolutionised the service

consumption. In Finland the amount of Internet-

connected computers per 100 persons have grown

from roughly 20 in 2002 to nearly 50 in 2006

300

Laukkanen T. and Cruz P. (2008).

BARRIERS TO MOBILE BANKING ADOPTION - A Cross-national Study.

In Proceedings of the International Conference on e-Business, pages 300-306

DOI: 10.5220/0001907003000306

Copyright

c

SciTePress

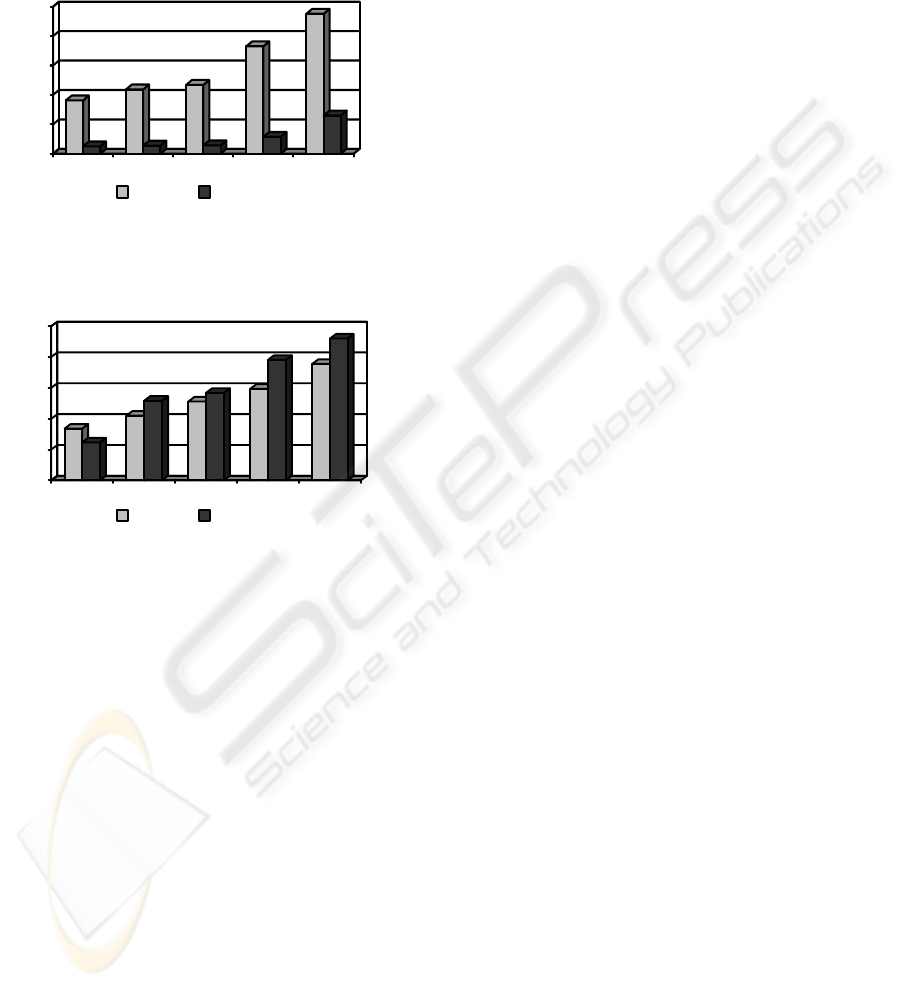

(Figure 1). Compared to Portugal, the relative

amount of these devices is over three times higher in

Finland. These figures may partly explain the higher

Internet banking adoption rates in Finland, even

though the growth rate of these devices in Portugal

has been dramatic during the last years.

0

10

20

30

40

50

2002 2003 2004 2005 2006

Finland Portugal

Figure 1: Internet-connected computers per 100 persons

(Statistics Finland, 2008).

0,7

0,8

0,9

1,0

1,1

1,2

2002 2003 2004 2005 2006

Finland Portugal

Figure 2: Mobile telephone subscription per capita

(Statistics Finland, 2008).

Although the distribution and penetration of

mobile handsets in Finland is argued to be among

the highest in the world, making the country an

interesting test-market for new mobile services

(Bouwman et al., 2007), the number of mobile

phone subscriptions is even higher in Portugal with

1,16 connections per capita compared to 1,08 in

Finland. The relatively low number of computers

connected to the Internet and a great number of

mobile phones make Portugal a highly potential

market for mobile services such as banking.

The future of mobile communications relies

heavily on services. However, the optimistic and

experimental mood that we witnessed in the

beginning of the century has been replaced by a

cautious atmosphere in which fewer risks are taken

in the development and marketing of new third

generation mobile services (Bouwman et al., 2007).

Therefore, insight into the reasons why consumers

are not adopting mobile services is needed. In this

paper we explore the adoption barriers to mobile

banking in the light of consumer resistance to

innovations.

3 LITERATURE

Albeit the pro-innovation bias (Sheth, 1981; Ram,

1987; Rogers, 2003) that majority of the diffusion

literature has, there may be product and service

categories or market segments where innovation

resistance is predominant (Gatignon and Robertson,

1991). The literature on innovation resistance aims

to explore the various reasons that inhibit innovation

adoption. Sheth (1981) suggests that the two key

factors explaining the phenomenon are habit or

satisfaction with an existing behaviour and

perceived risks associated with innovation adoption.

He states that the inclination toward an existing

behaviour is related to the typical human tendency to

strive for consistency and status quo rather than to

continuously search for new behaviours.

Consequently Ellen et al. (1991), note that

satisfaction with current performance increases

resistance to alternatives and reduces the likelihood

of adoption. They further highlight the role of

perceived self-efficacy which means the perceived

ability or skill to successfully perform a given task.

These lines of thought assume that consumers base

their decisions on two aspects: perceived benefits

over existing methods and perceived risks associated

with innovation adoption.

Ram and Sheth (1989) suggest a more

comprehensive view on innovation resistance by

explaining the phenomenon with five adoption

barriers namely usage, value, risk, tradition and

image.

3.1 Usage Barrier

Ram and Sheth (1989) suggest that the usage barrier

relates to the situation in which an innovation is not

compatible with existing workflows, practices or

habits. In the context of technological innovations,

however, this construct parallels with complexity

which, according to Rogers (2003), refers to the

degree to which an individual considers an

innovation to be relatively difficult to understand

and use.

The small size of mobile devices including small

screens and tiny multifunction keypads may be

troublesome to use and hamper the usability of

mobile services. Earlier studies on mobile banking

show that the smaller screens appear adequate in

BARRIERS TO MOBILE BANKING ADOPTION - A Cross-national Study

301

information-based mobile services, such as request

for account balance service, but those banking

services that involve transactions require a bigger

screen size (Laukkanen, 2007b). For example, some

bank customers consider bill payment via mobile

handheld device to be difficult and time consuming

as the device enables only a limited amount of

information processing and for this reason, the

whole bill is not visible on the display inhibiting the

progress in the service process (Laukkanen and

Lauronen, 2005; Laukkanen, 2007a). Moreover,

some studies highlight the importance of simple

authorization mechanisms in mobile banking

(Laukkanen and Lauronen, 2005) while some report

inconvenience due to changing PIN codes among

some bank customers as the codes need to be carried

along (Kuisma et al., 2007).

3.2 Value Barrier

The degree to which an individual believes that an

innovation is better than the idea it supersedes

determines the individual's decision to use the

innovation (Rogers, 2003). This is called relative

advantage which is a related concept with the value

barrier referring to the performance and monetary

value of an innovation in comparison to its

substitutes (Ram and Sheth, 1989).

In similar vein, the greater the perceived

advantage that mobile banking offers over other

ways of banking, the more likely it is to be adopted

(Brown et al., 2003). The earlier studies show that

the option to check the movements or transactions of

an account wherever wanted increases customers'

feeling of control over their financial affairs adding

value to service consumption (Laukkanen and

Lauronen, 2005).

However, if an innovation does not offer greater

performance to existing alternatives, it is not

worthwhile for consumers to change their behaviour

(Ram and Sheth, 1989). The extent to which an

individual believes that using mobile banking is

uneconomical, for instance, has a negative effect on

the intention to use mobile banking (Luarn and Lin,

2005).

3.3 Risk Barrier

The risk perceptions in technological innovations

usually arise due to the uncertainty to the

technology’s capability to deliver its expected

outcome (Im et al, 2008). Thus, the diffusion of

innovation is likely to take the longer the more risk

adverse the innovation is (Dunphy and Herbig,

1995).

As with many other technological innovations,

there appear to be security and privacy concerns to

mobile banking among some bank customers (Luarn

and Lin, 2005). Safety measures of personal details

and financial information by the bank are one of the

critical factors for the commercial success of mobile

banking (Brown et al., 2003). A portable list of PIN

codes may also pose security threats as it may be

lost by a customer and found by an untrustworthy

party (Kuisma et al., 2007).

Moreover, the extent to which a person believes

a new technology will perform a job consistently

and accurately (i.e. reliability) is highly important

risk-related factor in technology-based financial

service innovations (Lee et al., 2003). Mobile

phones, for instance, may be limited in

computational power, memory capacity and battery

life, limiting the use of mobile services (Siau and

Shen, 2003).

3.4 Tradition Barrier

The tradition barrier is related to the change an

innovation may cause in a consumer's daily routines.

Thus, if the consumer considers routines important

in his/her daily behaviour, the tradition barrier will

most likely be high. Moreover, the tradition barrier

may arise when an innovation is incompatible with

the consumer's existing values, norms and past

experience (Ram and Sheth, 1989). Thus, an

innovation needs to be well-suited with the existing

values and norms in order an individual to adopt the

innovation (Rogers, 2003).

Kuisma et al. (2007) showed that some

consumers resist Internet banking due to their habit

of paying bills via bill paying ATMs. Alternatively,

a customer may need social interaction and enjoy

talking to bank personnel as a strong desire to deal

with human tellers is found to discourage consumer

from adopting self-service technologies in banking

(Marr and Prendergast, 1993). Thus, it may be that

in mobile banking the tradition barrier arises if an

individual simply prefers to deal directly with the

bank clerk instead of using new banking

technologies.

3.5 Image Barrier

The image barrier arises from unfavourable

associations to the identity of the innovation, such as

the country of origin, brand or the product category

to which the innovation belongs (Ram and Sheth,

ICE-B 2008 - International Conference on e-Business

302

1989). In the case of technological innovations, for

instance, image barrier may derive from a negative

image of new technology in general and of a product

class in particular.

In the late 90’s Fain and Roberts (1997) argued

that the image barrier in online banking derives from

a negative hard-to-use image of computers and the

Internet. We argue that this may well be the case in

mobile banking today as some consumers may

perceive the mobile technology to be too difficult to

use and therefore instantly form a negative image of

the service related to the mobile technology.

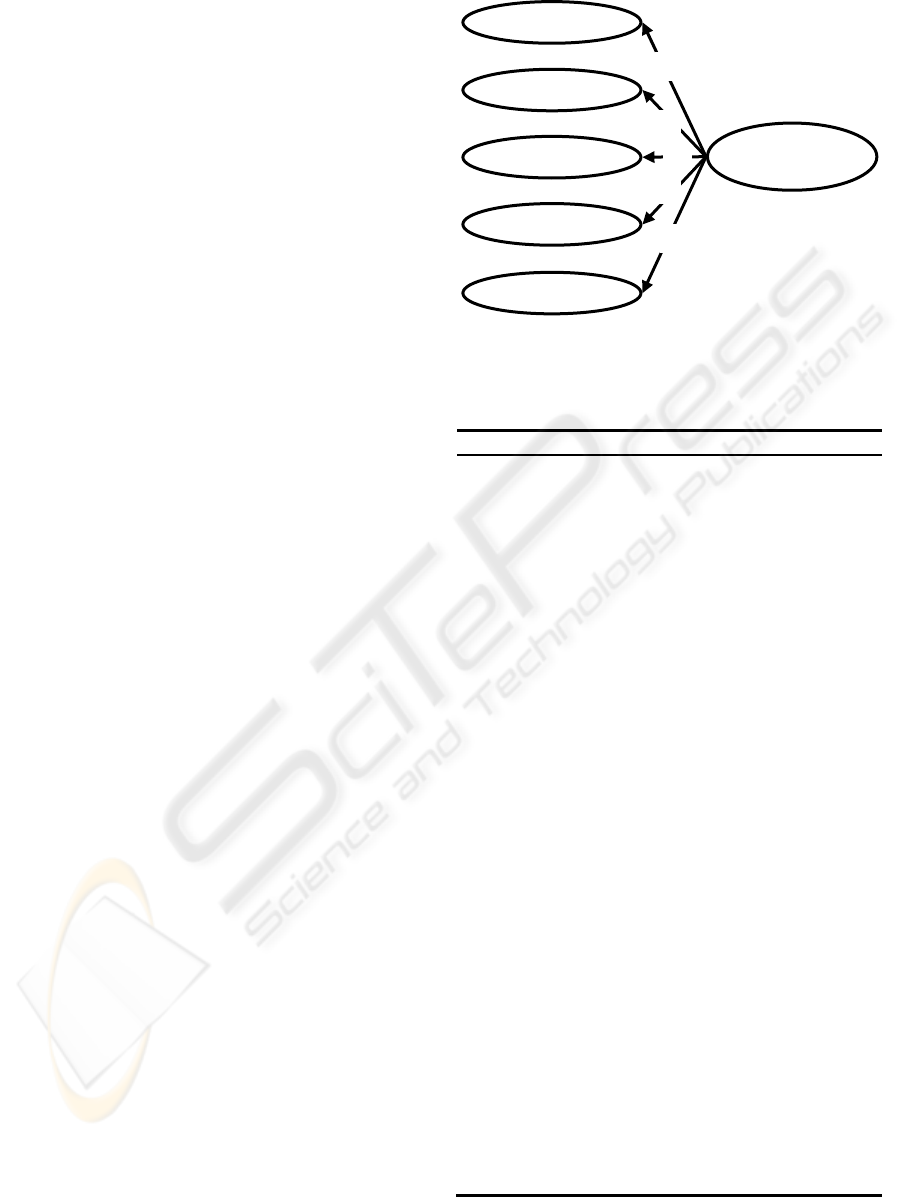

3.6 Hypotheses Development

Following the earlier literature on innovation

resistance a research model was designed (Figure 3).

According to the Eurostat’s (2007) statistics, Finland

is among the leading European countries in terms of

individuals’ Internet banking adoption with 63

percent adoption rate in 2006. Portugal, for example,

represents the opposite with only 10 percent

adoption rate. Based on these facts we hypothesise

that the resistance to electronic banking services,

including mobile banking, is significantly lower

among the Finns compared to Portuguese bank

customers. This leads us to the following

hypotheses:

H1: Usage barrier to mobile banking is significantly

lower among the Finns compared to Portuguese

H2: Value barrier to mobile banking is significantly

lower among the Finns compared to Portuguese

H3: Risk barrier to mobile banking is significantly

lower among the Finns compared to Portuguese

H4: Tradition barrier to mobile banking is

significantly lower among the Finns compared

to Portuguese

H5: Image barrier to mobile banking is significantly

lower among the Finns compared to Portuguese

H6: Overall resistance to mobile banking is

significantly lower among the Finns compared

to Portuguese

4 DATA AND METHODS

Based on the theory of innovation resistance and the

existing literature on banking technologies,

especially on mobile banking, a survey questionnaire

was designed. The five adoption barriers were

examined with 17 statements expressed in Table 1.

A seven-point Likert scale ranging from totally

disagree (1) to totally agree (7) was used.

Figure 3: Conceptual model.

Table1: Measure development of the barriers.

Statements measuring the barriers

Usage barrier

B1. In my opinion, mobile banking services are easy to use *

B2. In my opinion, the use of mobile banking services is

convenient *

B3. In my opinion, mobile banking services are fast to use *

B4. In my opinion, progress in mobile banking services is clear *

B5. The use of changing PIN codes in mobile banking services is

convenient *

Value barrier

B6. The use of mobile banking services is economical *

B7. In my opinion, mobile banking does not offer any advantage

compared to handling my financial matters in other ways

B8. In my opinion, the use of mobile banking services increases

my ability to control my financial matters by myself *

Risk barrier

B9. I fear that while I am paying a bill by mobile phone, I might

make mistakes since the correctness of the inputted information

is difficult to check from the screen

B10. I fear that while I am using mobile banking services, the

battery of the mobile phone will run out or the connection will

otherwise be lost

B11. I fear that while I am using a mobile banking service, I

might tap out the information of the bill wrongly

B12. I fear that the list of PIN codes may be lost and end up in

the wrong hands

B13. I trust that while I am using mobile banking services, third

parties are not able to use my account or see my account

information *

Tradition barrier

B14. Patronizing in the banking office and chatting with the

teller is a nice occasion on a weekday

B15. I find self-service alternatives more pleasant than personal

customer service *

Image barrier

B16. In my opinion, new technology is often too complicated to

be useful

B17. I have such an image that mobile banking services are

difficult to use

*Reversed scale

Mobile

banking

Usage barrier

H1

Value barrier

Risk barrier

Tradition barrier

Image barrier

H

H3

H

H5

BARRIERS TO MOBILE BANKING ADOPTION - A Cross-national Study

303

The questionnaire was first designed in Finnish

and thereafter translated to English. The English

questionnaire was then translated to Portuguese. The

questionnaires both in Finland and Portugal were

placed in a log-out page of large banks’ online

service. Due to a vast number of online banking

users in Finland the questionnaire was open much

longer in Portugal than in Finland. In Finland the

questionnaire was open for 72 hours between

November 6

th

and 9

th

2006, whereas in Portugal the

questionnaire was open for 2 weeks, between June

28

th

and July 13

th

2007. The surveys generated a

total random sample of 3597 usable responses

without missing values.

The Finnish sample is slightly male dominated

(53%) and relatively young with 36.7 percent of the

respondents being less than 35 years old. Finnish

sample consisted of a total number of 1.494 valid

responses of which 28 percent (419 cases)

represented mobile banking users. The Portuguese

sample is largely male dominated (61%) and even

younger than the Finnish sample with 59.3 percent

of the respondents being less than 35 years old. A

total number of 2.103 valid responses were obtained

from Portugal with 32.7 percent (688 valid cases) of

mobile banking users.

In the data analysis phase the scales of positively

formed statements were reversed so that the scales

of all statements were comparable. Thus, a higher

mean of a statement determines higher resistance of

the respondent. A Structural Equation Model (with

AMOS 7.0 software) was estimated and its fit and

constructs’ reliability was checked. Latent scores

were also computed at the constructs’ level. Using

non-parametric tests (Kolmogorov-Smirnov Z and

Mann-Whitney U), the differences between the

countries were assessed (variables and latent scores

did not follow normal distribution).

5 RESULTS

The constructs’ Cronbach’s Alphas indicated

satisfactory internal consistency reliability

(usage=0,92; value=0,60; risk=0,80; tradition=0,59;

image=0,65) and the estimated structural model

showed an acceptable fit (χ

2

=2896,10; d.f.=115;

p=0,00; CFI=0,90; RMSEA=0,08; GFI=0,91). All

coefficients revealed to be significant.

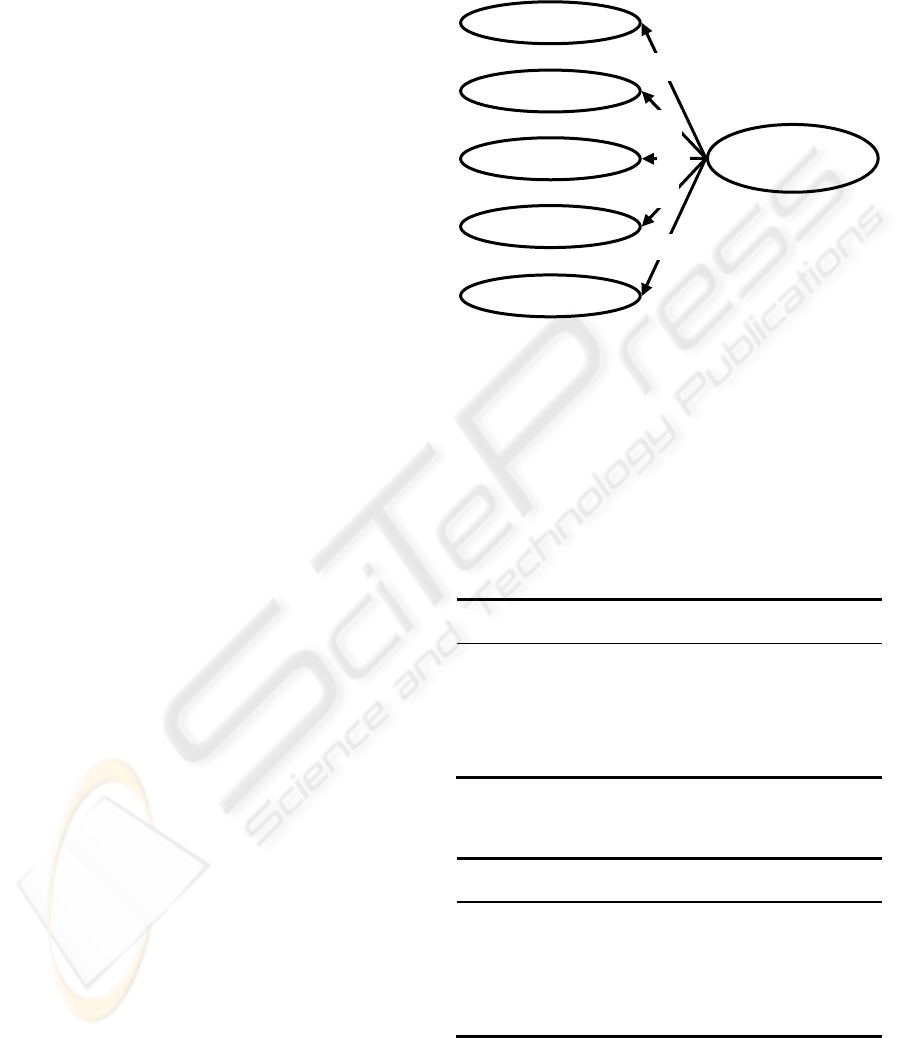

The second order structural model showed that

the resistance to the adoption of mobile services

mainly derives from usage (standardized structural

impact=0.93) and value (0.84) barriers. Image and

risk barriers also influenced the overall resistance,

the effects being 0.51 and 0.31 respectively. On the

other hand, tradition had a negative influence to the

overall resistance, with a standardized structural

coefficient of –0.15.

Figure 4: Standardized parameter estimates.

The latent scores were calculated using

Kolmogorov-Smirnov Z and Mann-Whitney U tests.

Both tests showed statistically significant differences

to the five constructs and overall resistance level

(Table 2). Apart from the tradition barrier, the

results indicated higher values for Finland in all the

barriers explored.

Table 2: Resistance levels across countries (latent scores).

Finland

n=1494

Portugal

n=2103

Sig.

Overall resistance

4,052 3,516 0,000

Value barrier

3,058 2,781 0,000

Image barrier

2,345 2,159 0,000

Tradition barrier

3,555 4,047 0,000

Risk barrier

3,879 3,594 0,000

Usage barrier

4,241 3,588 0,000

Table 3: Resistance levels across countries among non-

users (latent scores).

Finland

n=1075

Portugal

n=1415

Sig.

Overall resistance

4,516 3,907 0,000

Value barrier

3,420 3,083 0,000

Image barrier

2,583 2,287 0,000

Tradition barrier

3,514 3,828 0,000

Risk barrier

4,114 3,752 0,000

Usage barrier

4,727 4,011 0,000

In addition, differences between countries were

computed only for non-users of mobile banking

(Table 3). Out of the total number of 3597 responses

2490 respondents represented this group of

Mobile banking

resistance

Usage barrier

0.93

Value barrier

Risk barrier

Tradition barrier

Image barrier

0.84

0.31

0.51

– 0.15

ICE-B 2008 - International Conference on e-Business

304

customers with 1075 and 1415 observations in

Finland and Portugal respectively. The results of

these responses follow the research results of the

total sample. Therefore, the hypotheses H1, H2, H3,

H5 and H6 are rejected and only the hypothesis H4

is supported by the data in terms of both the total

sample and the sample of non-users.

6 CONCLUSIONS AND FUTURE

RESEARCH

The structural equation model showed that usage

and value barriers are the most intense determinants

of overall resistance to mobile-banking, followed by

image and risk barriers respectively. These results

suggest that functional usability and relative

advantage compared to other ways of banking are

currently the most powerful inhibitors of mobile

banking adoption. Interestingly, tradition appeared

to be a negative determinant of resistance.

Furthermore, Portuguese online bank customers

showed less resistance in terms of usage, value, risk

and image to adopting mobile banking services than

their Finnish counterparts. However, Portuguese

online bank customers showed greater preference for

personal service, indicating more traditional banking

behaviour compared to Finns. This idiosyncrasy of

the Portuguese could mean a high pre-disposition to

adopt new service channels alongside with more

traditional ones.

Compared to Finland, the relatively low

resistance scores to mobile banking among the

Portuguese may reflect the fact that Portugal has

simultaneously a low number of internet-connected

computers and a high mobile penetration, a situation

very auspicious for mobile services (Narinder,

2007). Another explanation for such surprising result

might be related to the sampling method as only

online banking users participated in the study.

Rogers (2003) argues that adopter categorisation is

based on innovativeness, i.e. the degree to which an

individual is relatively earlier in adopting new ideas

than other members of a social system. The fact that

only the Innovators and Early Adopters of the total

population in Portugal have so far adopted Internet

banking, and that in Finland the diffusion of the

innovation has already reached the Late Majority,

may have resulted that, in general, the Portuguese

sample consisted of more innovative individuals

than the Finnish sample.

In general, innovativeness is related to

demographics such as age. In our study the

Portuguese sample consisted of much younger

respondents compared to the Finnish sample. Future

research is needed related to the role of

innovativeness and demographic variables in mobile

banking adoption. Moreover, Finland and Portugal

represent very divergent countries in terms of

cultural dimensions (e.g. Hofstede, 1980), hence

providing good means to study the effect of culture

(Kivijärvi et al., 2007). Future research could

investigate the role of culture in consumer resistance

to technological innovations.

REFERENCES

Bouwman, H., Carlsson, C., Molina-Castillo, F.J.,

Walden, P., 2007. Barriers and drivers in the adoption

of current and future mobile services in Finland.

Telematics and Informatics, 24 (2), 145-160.

Brown, I., Cajee, Z., Davies, D., Stroebel, S., 2003. Cell

phone banking: predictors of adoption in South Africa

- an exploratory study. International Journal of

Information Management, 23 (5), 381–394.

Dunphy, S., Herbig, P.A., 1995. Acceptance of

innovations: The customer is the key! Journal of High

Technology Management Research, 6 (2), 193–209.

Eurostat, 2007. European business: Facts and figures,

Eurostat, Luxembourg.

Ellen, P.S., Bearden, W.O., Sharma, S., 1991. Resistance

to technological innovations: an examination of the

role of self-efficacy and performance satisfaction.

Journal of the Academy of Marketing Science, 19 (4),

297-307.

Fain, D., Roberts, M.L., 1997. Technology vs. consumer

behavior: the battle for the financial services customer.

Journal of Direct Marketing, 11 (1), 44-54.

Gatignon, H., Robertson, T.S., 1991. Innovative decision

processes. In Robertson, T.S., Kassarjian, H.H. (Eds),

Handbook of Consumer Behavior (pp. 316-48).

Prentice-Hall. Englewood Cliffs, NJ.

Hofstede, G., 1980. Culture’s Consequences, Sage

Publications, Thousand Oaks, CA.

Im, I., Kim, Y., Han, H.-J., 2008. The effects of perceived

risk and technology type on users’ acceptance of

technologies. Information & Management, 45, 1-9.

Kivijärvi, M., Laukkanen, T. and Cruz, P., 2007.

Consumer trust in electronic service consumption: a

cross cultural comparison between Finland and

Portugal. Journal of Euromarketing, 16 (3), 51-65.

Kuisma, T., Laukkanen, T., Hiltunen, M., 2007. Mapping

the reasons for resistance to Internet banking: a means-

end approach. International Journal of Information

Management, 27 (2), 75-85.

Laukkanen, T., 2007a. Internet vs. mobile banking:

comparing customer value perceptions. Business

Process Management Journal, 13 (6), 788-797.

Laukkanen, T., 2007b. Measuring mobile banking

customers’ channel attribute preferences in service

consumption. International Journal of Mobile

Communications, 5 (2), 123-138.

BARRIERS TO MOBILE BANKING ADOPTION - A Cross-national Study

305

Laukkanen, T., Lauronen, J., 2005. Consumer value

creation in mobile banking services. International

Journal of Mobile Communications, 3 (4), 325-338.

Lee, E-J., Lee, J., Eastwood, D., 2003. A two-step

estimation of consumer adoption of technology-based

service innovations. Journal of Consumer Affairs, 37

(2), 256-282.

Luarn, P., Lin, H-H., 2005. Toward an understanding of

the behavioral intention to use mobile banking.

Computers in Human Behavior, 21 (6), 873-891.

Marr, NE., Prendergast, GP., 1993. Consumer adoption of

self-service technologies in retail banking: is expert

opinion supported by consumer research. International

Journal of Bank Marketing, 11 (1), 3-10.

Narinder, C, 2007. Fast growth of Mobile

Communications in India: Lessons for emerging

markets. 6th Annual Global Mobility Roundtable, Los

Angeles, USA.

Ram, S. 1987. A model of innovation resistance. Advances

in Consumer Research, 14 (1), 208-212.

Ram, S., Sheth, JN., 1989. Consumer resistance to

innovations: the marketing problem and its solutions.

Journal of Consumer Marketing, 6 (2), 5-14.

Rogers, E., 2003. Diffusion of Innovations, Free Press.

New York, 5

th

edition.

Sheth, J.N., 1981. Psychology of innovation resistance: the

less developed concept (LDC) in diffusion research.

Research in Marketing, 4 (3), 273-82.

Siau, K., Shen, Z., 2003. Mobile communications and

mobile services. International Journal of Mobile

Communications, 1 (1/2), 3-14.

Statistics Finland, 2008. Information Society, Retrieved

April 13, 2008, from

http://www.stat.fi/tup/maanum/hakemisto_en.html

ICE-B 2008 - International Conference on e-Business

306