CHARACTERIZATION OF e-BANKING TECHNOLOGICAL

SOLUTIONS IN PORTUGAL

Juliana Tavares, Ramiro Gonçalves

UTAD – Universidade de Trás-os-Montes e Alto Douro

Dep. Engenharias, Quinta de Prados, Apartado 1013, 5001-801 Vila Real, Portugal

Paulo Martins

GECAD – Grupo de Investigação em Engenharia do Conhecimento e Apoio à Decisão

Dep. Engenharias – UTAD, Quinta de Prados, Apartado 1013, 5001-801 Vila Real, Portugal

Keywords: Banking, Electronic Banking, Technological Solutions.

Abstract: Economic activities are part of everyday life since always. The banking sector has a large dimension that

exists for a long time, doing a major contribution to economic growth in Portugal. In this new millennium

the advent of Internet has had a significant impact on the banking service that is traditionally offered by

banks to customers. With help of the Internet, customers can access its banking services anytime, anywhere,

since Internet access is available. This service is called Electronic Banking (EB), being in explosive growth

in many countries, transforming the traditional banking practices. With this paper, we intend review,

evaluate and characterize the technological solutions of EB in Portugal.

1 INTRODUCTION

The banking sector has a large dimension that exists

for a long time, doing a major contribution to

economic growth in Portugal. In this new

millennium the advent of Internet has had a

significant impact on the banking service that is

traditionally offered by banks (Liao and Cheung,

2003). With help of the Internet, customers can do

their banking anytime, anywhere, since Internet

access is available. This service is called Electronic

Banking (EB), being in explosive growth in many

countries, transforming the traditional banking

practices (Liao and Cheung, 2003). By offering

services with EB, the financial institutions seek to

reduce operating costs, improve banking services,

retain consumers and expand customers share

(Lichtenstein and Williamson, 2006). This article

has the main purpose of review, evaluate and

characterize the technological solutions of EB in

Portugal.

This paper is organized as follows. Section 2

characterizes the concept of banking on the

Portuguese market. Section 3 presents the issues

related to the concept of EB. Section 4 is the main

contribution of this article, identifying a sample of

EB platforms, the parameters evaluated and assess

according to the defined criteria. Section 5

concludes the paper.

2 BANKING

Although the concept of banking is directed to the

financial area, involving the movement of capital, its

definition can lead to several subjectivities. Many

sociologists believe that the financial and banking

market is a system of social interactions, where

banks are the key intermediaries.

2.1 Portuguese Financial System

The Portuguese financial system has been subject to

major structural reforms, which contributed to the

increasing of its efficiency, with the privatization of

existing banks, the liberalization of markets, in

deregulation and alignment of existing regulations in

Portugal to other economies, and increasing

modernization of the institutions, mainly driven by

the adoption of new technologies.

577

Tavares J., GonÃ

˘

galves R. and Martins P.

CHARACTERIZATION OF e-BANKING TECHNOLOGICAL SOLUTIONS IN PORTUGAL.

DOI: 10.5220/0001842405770580

In Proceedings of the Fifth International Conference on Web Information Systems and Technologies (WEBIST 2009), page

ISBN: 978-989-8111-81-4

Copyright

c

2009 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Between 1985 and 2003, while the national GDP

has increased, in terms of market prices, more than 6

times, the assets of banks grew more than 12 times,

representing twice the growth. Although the

Portuguese economy has suffered some progress, not

all of its developments have been positive. Through

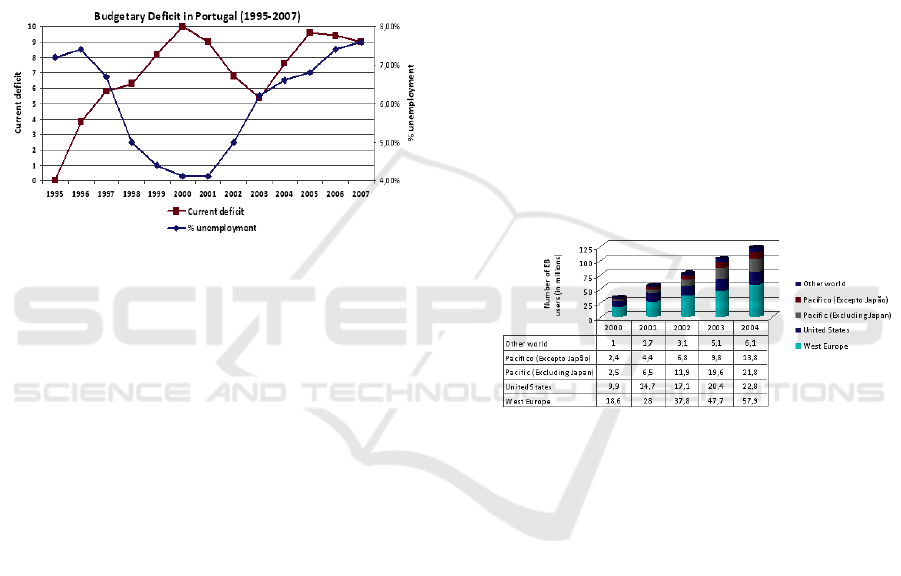

Figure 1 is possible to obtain an approach of

Portuguese economic situation in historical

perspective. Portugal has recently suffered a

slowdown in economic growth relative to richer

countries of the EU, leading the national banking

institutions development to constraints on their

growth (Blanchard, 2006).

Figure 1: Budgetary deficit between 1995 and 2007.

Adapted from: (Blanchard, 2006).

3 e-BANKING

For centuries, many financial transactions required

human presence. This peculiarity has been amended

with the emancipation of ICT. Currently, a customer

can make several financial activities without

entering a bank branch. This phenomenon is known

as EB (Beck, 2001), offering a range of services and

activities by digital means, usually provided through

a bank.

3.1 Appearance of EB

It is estimated that EB via Internet began in 1995,

indicating the use of Internet as a channel for

delivery to remote banking services (Gopalakrishnan

et al., 2003), however, some banks have had

informational Web sites before using phone as EB

channel. In Portugal a first step in EB was given by

BCP, with the release of several multimedia kiosks

providing the customer with bank information

(Beck, 2001).

3.2 Factors that Influenced the

Adoption of the EB

Several converging areas of reference and theories

suggest many influences on the adoption of EB,

including theories of costumer behavior in the

choice and use of the media, diffusion of innovation,

acceptance of the technology, service and

transaction costs, among other (Lichtenstein and

Williamson, 2006).

3.3 Adoption and Use of EB

Since EB’s appearance, there have been some

constraints in its usage and adoption. In Europe,

differences between countries appeared to be largely

explained by differences in the availability of

Internet access. Recently, EB users are relatively

satisfied with the quality of banking online (as can

be seen through Figure 2, where the number of users

of EB has increased on several countries over

several years).

Figure 2: Number of EB users. Adapted from: (Perumal

and Shanmugam, 2004).

In Portugal, according to data from the study

Netpanel and Marktest in May 2008, 1072 thousand

accesses were made on the banking websites,

representing a growth of 3.2% when compared to

April 2007, and 4.3% from the same month of 2007.

4 CHARACTERIZATION OF

TECHNOLOGY SOLUTIONS

FOR EB IN PORTUGAL

4.1 Survey of Financial Institutions

For a further analysis and characterization of

platforms and consequently the EB in Portugal a

survey of financial institutions currently operating in

Portugal was conducted, having been prepared in

accordance with the data of financial institutions

WEBIST 2009 - 5th International Conference on Web Information Systems and Technologies

578

entered the Bank of Portugal. The analysis

concluded that the number of financial institutions

with online presence is considerable big – most of

the financial institutions have a website. This

majority of EB platforms have a large percentage of

EB services.

4.2 Analysis and Presentation of

Parameters to Assess

To make the analysis and evaluation of a EB

platforms sample, it was necessary to conduct a

survey of different parameters to assess. Several

authors (Guru et al., 2003; Awamleh and Fernandes,

2005; Goi, 2006; Miranda et al., 2006; Al-

Mudimigh, 2007) consider essential the existence of

information, transactional and communicative

services, or relationship with the customer in the

platforms of EB. Based on the analysis of features to

be included in solutions of EB in the prospects of the

mentioned authors, were set the following

parameters for further evaluation:

• Quality of website;

o Accessibility

o Performance

o Navigability

o Content

• Informative functionalities;

• Transactional functionalities;

• Communicational functionalities.

4.3 Definition of Platforms Sample to

Evaluate

The sample defined of EB platforms consists of the

5 largest banks operating in Portugal in terms of

financial assets and market share – CGD, BCP, BES,

BPI and Banco Santander Totta (APB, 2007; BP,

2008) and the bank BEST, a bank exclusively

online.

4.4 Evaluation of the Sample

All EB platforms analyzed consist of two parts – a

public part, available to any user, with informative

content about the institution, its products and

services available, and a private side, available only

to customers with private credentials. To evaluate

the accessibility and performance of platforms, were

used some tools such as Total Validator, ATRC,

World Wide Web Consortium, among others. In

Figure 3 we can view the results of accessibility

evaluation made with resource to the mentioned

tools.

Figure 3: Quality of platforms – accessibility.

By analyzing the Figure 3 it is possible to check

that the platform with the largest number of

accessibility issues is Banco Santander Totta (BST)

platform. To assess the navigability of platforms,

some operations were carried out in order to gain

sensitivity towards the various aspects while

browsing in them. Regarding the platform’s quality,

other parameters such as performance, navigability

and content were evaluated, as shown in Figure 4.

Figure 4: Quality of platforms – performance, navigability

and content.

To evaluate the response time, Total Validator

was executed five times. As shown in the chart, the

platform that presents a greater response time is the

BPI’s, being the BEST, BES and Banco Santander

Totta’s platforms those with a shorter response time,

followed by the BCP and CGD platforms.

In terms of navigability, it was attributed a quote

(from 1 to 20) for each platform to the problems or

constraints encountered along the navigation on the

platforms. Regarding the content, each platform has

its own layout, existing several similarities between

them in terms of designation of operations and

disposition of contents. After evaluating the quality

of the sample, their functionalities were evaluated.

Figure 5 reflects the results of these evaluations.

Most of the evaluated platforms dispose the

necessary functionalities for EB practices, respecting

the defined evaluation parameters of the present

study.

CHARACTERIZATION OF e-BANKING TECHNOLOGICAL SOLUTIONS IN PORTUGAL

579

Figure 5: Evaluation of informative, transactional and

communicative functionalities.

5 CONCLUSIONS

According to data presented during this article, we

may conclude that the usage of EB in Portugal is on

growth, following the international developments

and demystifying the adoption to these types of

services and platforms. It is clear the leadership of

EB services by CGD, with the largest number of

access. In terms of features and/or characteristics,

the majority of technological solutions studied have

the necessary features for the achievement of most

banking operations for this type of service. The final

evaluation of the various parameters is positive,

being Portugal and accomplishing the international

technological advances.

ACKNOWLEDGEMENTS

It is hoped that this work will serve as basis for the

financial institutions under study to make

improvements in their EB platforms, offering a

better service, fitting as most as possible the needs

of its customers. It can also serve as a resource for

customers who seek a robust reference of EB

platforms classification operating in Portugal, to

achieve a qualitative perspective, allowing them to

meet the major strengths and weaknesses of these

platforms, and demystify the uncertainty aspects of

EB services.

REFERENCES

Awamleh, R. and C. Fernandes (2005). "Internet Banking:

An empirical investigation into the extent of adoption

by banks and the determinants of customer satisfaction

in the United Arab Emirates." Journal of Internet

Banking and Commerce 9.

Al-Mudimigh, A. S. (2007). "E-Business Strategy in an

Online Banking Services A Case Study." Journal of

Internet Banking and Commerce 12: 1-8.

APB (2007). Dados sobre a Banca em Portugal,

Associação Portuguesa de Bancos: 183.

Blanchard, O. (2006). "Adjustment within the euro. The

difficult case of Portugal." Portuguese Economic

Journal: 1-21.

BP (2008). Indicadores de Conjuntura Banco de Portugal:

1-20.

Beck, H. (2001). "Banking is essential, banks are not. The

future of financial intermediation in the age of the

Internet." ACM - Digital Library 3: 16.

Gopalakrishnan, et al. (2003). "A multilevel analysis of

factors influencing the adoption of Internet Banking."

Engineering Management, IEEE Transactions 50.

Guru, B. K., B. Shanmugam, et al. (2003). "An Evaluation

Of Internet Banking Sites In Islamic Countries."

Journal of Internet Banking and Commerce.

Goi, C. L. (2006). "Factors Influence Development of E-

Banking in Malaysia." Journal of Internet Banking and

Commerce 11(2).

Liao, Z. and M. T. Cheung (2003). Challenges to Internet

e-banking Communications of the ACM archive.

Lichtenstein, S. and K. Williamson (2006).

"Understanding Consumer Adoption of Internet

Banking:An Interpretive Study in the Australian

Banking Context." Journal of Electronic Commerce

Research 7: 50-66.

Miranda, F. J., R. Cortés, et al. (2006). "Quantitative

Evaluation of e-Banking Web Sites: an Empirical

Study of Spanish Banks." The Electronic Journal

Information Systems Evaluation 9: 73 - 82.

Perumal, V. and B. Shanmugam (2004). "Internet

Banking: Boon or Bane ?" Journal of Internet Banking

and Commerce.

WEBIST 2009 - 5th International Conference on Web Information Systems and Technologies

580