USING WEBQUAL 4.0 IN THE EVALUATION OF

THE RUSSIAN B2C COSMETIC WEB SITES

Valeria A. Durova and Nadia Amin

Harrow Business School, University of Westminster, Harrow, U.K.

Keywords: e-Business, B2C, Russia, On-line shopping, Web site quality evaluation, Cosmetic Web site.

Abstract: The rapid development of Russian e-commerce has involved the emergence of different Web sites. The

latest tendencies showed that there is an upward trend in online purchases in the country. This paper

examines the results of a quality survey of three different types of cosmetic Web sites in Russia. This

industry sector is of particular interest because of its rapid growth and a wide range of organizations

involved in this business. The Web sites are examined in terms of design, usability, and information quality.

The findings show strengths and weaknesses of the sites and demonstrate user impressions over the

interaction with the Web sites.

1 INTRODUCTION

The Russian economy has boomed averaging 7.3%

annual real GDP growth between 2003 and 2007

(Euromonitor, 2008). Since late 1990s a substantial

number of Russian companies decided to go online.

This was the start of the new era of e-business in

Russia.

According to Barnes and Vidgen (2002), a key

challenge for e-commerce companies is to

understand customer requirements and to develop

their web presence and back-office operations

accordingly. In cases when organisations’ Web sites

are poorly designed and users find them difficult to

use and interact with, a poor image will be projected

on the internet, thus weakening the organization’s

position. Therefore, it becomes imperative that a

company is able to make an assessment of the

quality of its e-commerce offering. Each time they

do this, the companies can improve their

performance over time and benchmark against

competitors and best practice in any industry.

According to information provided by the

research agency Romir Monitoring (2008) there are

still no results regards the frequency of online shops

visits in the country, but there is information that

60% of respondents have done shopping in internet

shops this year and 75% of respondents have

experience of online shopping in general. However,

25% of respondents find internet shopping too

difficult.

2 e-COMMERCE IN RUSSIA

There was virtually no e-commerce in Russia prior

to 1998. In 2002 Hawk stated that B2C and B2B e-

commerce are both in their early phases in Russia

(Hawk 2002). Today almost 28 million Russians use

internet every day, of which 9.5 million are in the

central regions (CIA Factbook, 2008).

According to Fey, Koning and Delios (2006),

there is another difference from the world within the

e-commerce field: in many developed countries,

online purchases by individual consumers are made

using credit cards. However, few Russians even

those with a credit card will try to use it to make

online transactions.

Generally, all international companies which

come to the Russian market launch their Web sites,

and those from domestic market have just started to

pick up the idea, but the functionality of these Web

sites is still limited. Market research shows that 12%

of the respondents say that they buy cosmetics

online (Romir Monitoring, 2007). This number is

increasing by 1-1,5 % every season (once in 3

month) as buying things online became the latest

trend in Russia. However, up till now, commercial e-

business sectors such as cosmetics experience little

competition, as e-business competition has yet to

mature in this industry in Russia.

585

Durova V. and Amin N.

USING WEBQUAL 4.0 IN THE EVALUATION OF THE RUSSIAN B2C COSMETIC WEB SITES.

DOI: 10.5220/0001843205850588

In Proceedings of the Fifth International Conference on Web Information Systems and Technologies (WEBIST 2009), page

ISBN: 978-989-8111-81-4

Copyright

c

2009 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2.1 Cosmetic Web Sites in Russia

The culture of cosmetics consumption is strong in

Russia. The tendency to “look beautiful anytime

anywhere” has resulted in boom of the cosmetics

market in Russia, reports Nielsen Russia. The

market for upscale cosmetics and other personal care

products is developing at a rapid pace (Grishenko,

2006). The Russian market for cosmetics and beauty

products was growing by almost 20% a year in the

early 2000s (15% in 2004 compared with 2003

according to Staraya Krepost, a Russian cosmetics

market research group, and has already become one

of the fifth largest in Europe. Cosmetic industry in

Russia is the second fastest growing FMCG (Fast

Moving Consumer Goods) sector and appears to be

of great interest for the largest research agencies.

The following Web sites of the three major industry

players have been chosen by the author in order to

compare different types of internet sites:

leading Russian company, selling cosmetics

both online and offline in a number of own

shops thorough the country (L’etoile

www.letu.ru);

a solely online shop of selective cosmetics and

perfumery offering wide range of products at

competitive price and a number of additional

attractive offers (Aromat www.aromat.ru);

online non transaction site with a printed

catalogue available on subscription (La

Parfumerie www.laparfumerie.ru).

3 RESEARCH METHOD

The main objective of any B2C Web site is to

deliver information in such a way that a potential

customer will become a real customer. This can be

achieved through the qualitative and quantitative

instruments of customer analysis. A review of the

literature on the quality of web sites evaluation has

not revealed any utility mechanism or instrument

designed especially for cosmetic web sites.

Therefore the WebQual 4.0 was adopted.

The WebQual model was originally invented by

Stuart Barnes and Richard Vidgen and has seen

improvement over the number of years (Barnes and

Vigden, 2001, 2002, 2005). This research will be

based on the WebQual model which helps to

evaluate the Web site in terms of design, usability

and information quality from the “voice of the

customer” perspective. A questionnaire was

designed, then translated from English language into

Russian and distributed among mainly young

women. 176 questionnaires were collected. After

eliminating a number of non-answered and spoiled

questions 150 remained.

4 DATA ANALYSIS

The WebQual technique has been applied to the

questionnaire responses. Both quantitative and

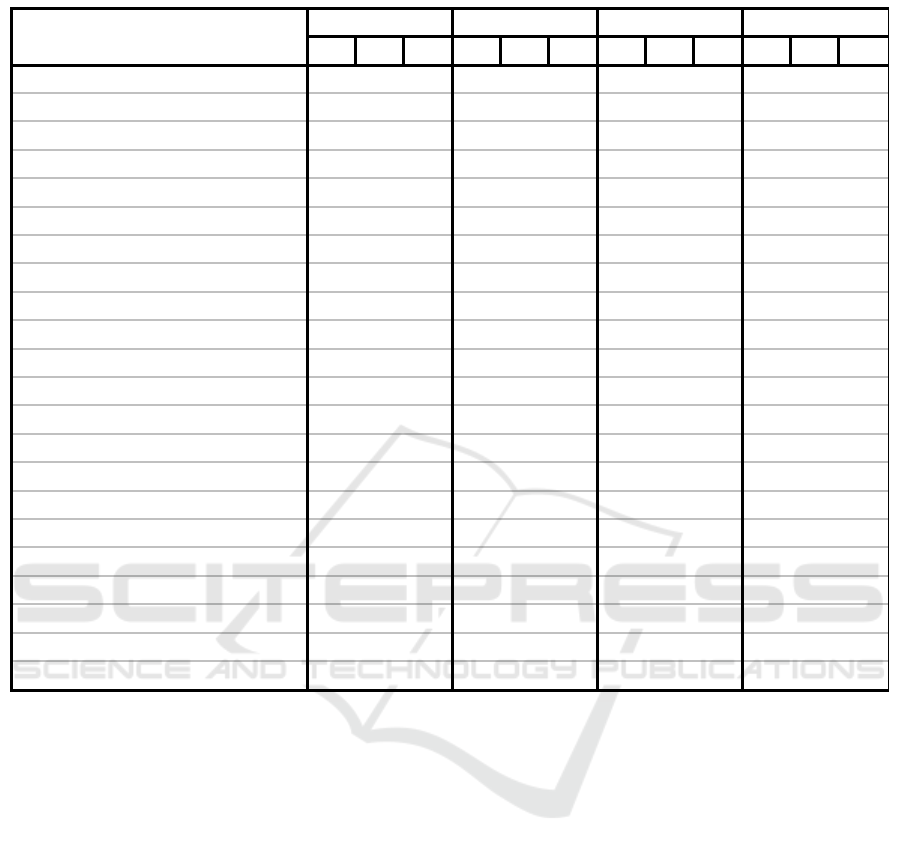

qualitative results were analysed. Table 1 shows a

number of items for discussion. It is based on 150

responses. Three cosmetic Web sites have been

assessed by the respondents and the importance

rating for each question and customer perception

ratings regarding each Web site has been reflected.

Summing up the results, three items are shown in

this table for each question and subset: the mean,

standard error and standard deviation.

A pattern can be seen in the data shown in Table

1. The questions considered most important, with a

high rating from 6.52 to 6.95 were closely connected

with information accuracy, usability and issues of

trust. It should be noted that Russia has a history of a

country with low trust background, so trust turned

out to be one of the key aspects for the respondents.

Referring to the table, we can find the questions

in descending order of importance to the consumer:

22, 17, 16, 18, 9, 10, 19, 1 and 13. These questions

are heavily tied with the organization’s reliability in

relation to transaction performance, accuracy of the

information presented on the Web site and ease of

use and navigation. The most interesting item here is

a Web site reputation. It can be noted that only

L’etoile Web site was considered to have good

reputation in comparison to the other two. This

derives from the fact that it is a well-known

company which operates on the Russian cosmetic

market for a long time and has a good and stable

reputation with its offline customers. In spite of the

fact that its online shop has been just introduced to

the consumers it already has a leadership within the

market.

The table indicates that difference in usability

and navigation is relatively small, showing that a

certain level has been achieved by all three web

sites. So it won’t be a differentiating factor.

However it can be noticed that last three questions

have very low results, since respondents did not

transact with a website.

Questions rated lower than 4.52 were considered

less important. Here we can see quite a versatile

range of questions. The lowest score is 2.59 is

referred to the question about empathy, namely the

sense of community. Quite highly rated was a

perception of Web site design, where La Parfumerie

WEBIST 2009 - 5th International Conference on Web Information Systems and Technologies

586

Table 1: Mean and standard deviation for the questionnaire data (n=150).

Web site lags far behind others with its loud colors,

impossibility to perform transactions and

unattractive appearance. Other questions fall in

between these groups and the median is 5.88.

The results show that there are a number of

prioritized items for the cosmetic Web sites.

Customers are particularly concerned with the

information dealing with ‘trust’ and Web site

usability. These items have been noted to be

dependent on each other. These features are believed

to be critical for e-commerce cosmetic Web sites.

However the ‘soft’ qualities (Barnes and Vidgen,

2002) such as sense of community, communication

with the organization are quite low. It can be

identified that L’etoile is rated much higher than two

other scoring higher on each question. Aromat and

La Parfumerie varied in their scores, although the

latter appears to be a looser of the challenge between

these two.

The weighted scores and the Web Quality Index

were also calculated. It has been calculated that the

highest score again belongs to L’etoile. The only

way to do it is to index the total weighted score for a

site against the total possible score. The highest

possible score that a site can achieve is the mean

importance taken from Table 1 multiplied by 7, the

maximum rating for a question Aromat, for example,

achieves a score of 604.08 of a maximum possible

905.94, giving it a WebQual Index (WQI) of 0.68, or

68%. Overall, L’etoile is still benchmarked well

above the other two online cosmetic B2C Web sites,

with an overall WQI of 0.77. La Parfumerie follows

with a WQI of 0.75, which is close behind loosing

only 0.02 points, whilst Aromat is behind these two

loosing 0.07 points to the latter and coming up with

the result of 0.68.

To sum up, there are five factors in the WebQual

4.0 instrument. The data has been summarized

around the five questionnaire subcategories, and the

WebQual Index as shown in Figure 1. The scale has

been restricted to values between 0.5 and 0.9 to

allow clearer comparison. The figure shows a clear

picture of the L’etoile Web site leadership in

Description

Im

p

ortance L'etoile La Perfumer

y

Aromat

Mean St.Er

r

StDev Mean St.Err. StDev Mean St.E

r

StDev Mean St.Er

r

S

t

Dev

I find the site easy to learn to operate

6,65 0,16 0,25 5,91 0,13 0,21 4,96 0,09 0,18 5,37 0,12 0,21

My interaction with the site is clear and

understandable

6,15 0,16 0,23 5,16 0,10 0,19 6,41 0,13 0,21 4,89 0,11 0,19

I find the site easy to navigate

6,18 0,09 0,18 5,56 0,17 0,23 5,63 0,12 0,20 5,38 0,14 0,21

I find the site easy to use

5,82 0,10 0,19 5,86 0,14 0,22 6,10 0,04 0,18 4,47 0,17 0,23

The site has an attractive appearance

6,43 0,12 0,23 5,56 0,09 0,17 2,98 0,07 0,16 5,97 0,05 0,18

The design is appropriate to the type of site

5,50 0,15 0,23 5,87 0,15 0,22 4,55 0,15 0,22 5,97 0,12 0,21

The site conveys a sense of competency

4,35 0,15 0,24 5,15 0,09 0,18 3,59 0,08 0,17 5,39 0,12 0,21

The site creates a positive experience for me

4,77 0,07 0,17 4,27 0,06 0,16 3,59 0,08 0,22 5,32 0,10 0,19

Provides accurate information

6,79 0,25 0,29 5,95 0,24 0,28 6,13 0,15 0,22 5,82 0,14 0,22

Provides believable information

6,78 0,24 0,28 5,73 0,09 0,18 6,15 0,10 0,19 5,19 0,05 0,15

Provides timely information

3,21 0,07 0,16 6,15 0,10 0,19 5,24 0,07 0,19 6,18 0,10 0,19

Provides relevant information

4,52 0,07 0,16 4,99 0,02 0,17 5,11 0,08 0,17 4,95 0,09 0,18

Provides easy to understand information

6,52 0,16 0,23 6,10 0,06 0,18 5,89 0,05 0,18 5,73 0,18 0,24

Provides information at the right level of

detail

6,41 0,13 0,21 5,77 0,06 0,16 6,13 0,04 0,18 5,40 0,08 0,17

Presents the information in an appropriate

format

5,93 0,09 0,18 6,21 0,07 0,18 6,38 0,11 0,20 6,39 0,11 0,20

Has a good reputation

6,91 0,29 0,32 5,91 0,11 0,20 1,99 0,08 0,17 2,80 0,08 0,17

It feels safe to complete transactions

6,91 0,29 0,32 2,93 0,10 0,19 3,18 0,15 0,22 2,99 0,10 0,20

My personal information feels secure

6,83 0,33 0,29 6,41 0,12 0,20 6,11 0,05 0,18 6,15 0,15 0,22

Creates a sense of personalization

6,74 0,23 0,27 6,03 0,10 0,20 6,09 0,14 0,22 5,22 0,07 0,16

Conveys a sense of community

2,59 0,16 0,23 4,57 0,13 0,22 2,34 0,16 0,23 1,84 0,04 0,23

Makes it easy to communicate with the

or

g

anization

6,48 0,14 0,23 2,11 0,18 0,24 1,04 0,25 0,29 1,42 0,22 0,27

I feel confident that goods/services will be

delivered as

p

romised

6,95 0,45 0,34 0,61 0,41 0,32 0,75 0,39 0,31 0,37 0,45 0,33

USING WEBQUAL 4.0 IN THE EVALUATION OF THE RUSSIAN B2C COSMETIC WEB SITES

587

comparison to the two other sites; however it does

not stand out in terms of results. Nevertheless the

Aromat Web site has been evaluated rather poorly in

comparison with the other two. The only item on

which it was behind La Parfumerie was ‘trust’.

Aromat is only 0.01 point ahead but still looses 0.03

points to the leader- L’etoile. It can easily be

identified that ‘trust’ is the only category where all

Web sites scored low. This WQI appeared to be the

lowest because of people’s low trust background in

which they were born. The remaining categories

contain almost equal scores for two Web sites -

L’etoile and La Parfumerie.

0,50

0,60

0,70

0,80

0,90

Usability

Design

Informatio nTrust

Empathy

L'etoile

La Perfumery

Aromat

Figure 1: Radar chart of WebQual 4.0 subcategories.

5 LIMITATIONS

Not denying the circumstance that all the research

and discussion were performed in accordance with

the well thought scheme, it should be noted that

there are still some limitations to this study, and

interpretation of the results needs to be undertaken

with caution. Firstly, it is a relatively small sample

size of cosmetic Web site users. It represents a

specific part of the population, whose opinion may

not represent the opinion of all users of the cosmetic

Web sites in Russia. Secondly, the research only

identifies the customers’ expectations and

perceptions about certain Web sites which represent

only a small part out of the whole cosmetics B2C

industry.

6 CONCLUSIONS

Russian cosmetic Web sites receive close attention

from customers and from the competing

organizations. WebQual 4.0 has been shown as a

proven method of assessing consumer perceptions

about particular Web sites. Five factors which

influence the overall rating index have been

identified. It can be concluded that potential Russian

customers evaluate the company’s reputation prior

to ordering. Word-of-mouth information is also

likely to be used in order to make the Web sites

recognizable. Building the reputation will help the

Web site in its future much more than anything else.

This has been stated by the authors of the WebQual

method and now has been proved by the authors of

this work considering the performed research.

The results shown have a significant level of

reliability. However the results are limited by a

relatively small sample size, and this should be

eliminated in further researches. Currently the model

provides valuable results that can show where the

potential problems lie. The findings regarding the

importance of the ‘trust’ component of the WebQual

4.0 point toward the need for systematic research

into differences between Russian and foreign

customers’ perceptions about the web site qualities.

Moreover, there is potential to future investigations

linked to this search involving the same Web sites in

order to analyze and reflect on changes over time.

REFERENCES

Barnes, S.J. and Vidgen, R., 2001. An Evaluation of

Cyber-Bookshops: The WebQual Method, Journal of

Electronic Commerce 6:1, pp.11-30.

Barnes, S., & Vidgen, R., 2002. An integrative approach

to the assessment of e-commerce quality. Journal of

Electronic Commerce Research. 3:3.

Barnes, S., and Vidgen, R., 2005. Data Triangulation in

action: using comment analysis to refine web quality

metrics. 13

th

European Conference on Information

Systems, Regensburg , Germany , May 26–28.

Doern, R.R. and Fey, C.F., 2006. E-commerce

developments and strategies for value creation: The

case of Russia. Journal of World Business 41:4,

pp.315-327.

Euromonitor, 2008. Cosmetics and Toiletries in Russia report.

Fey, C.F., De Koning, A. and Delios, A., 2006. How

similari is the world in the Internet era? A comparison

of E-Business in China, Russia, and Sweden.

Thunderbird International Business Review 48:5,

pp.727-747.

Grishenko, G., 2006. Russia’s cosmetics market growth is

driven by women’s optimism and rising prosperity ,

Skin Care Forum 40 (online). Available from

http://www.scf-online.com (accessed on 10/06/08).

Hawk, S., 2002. The development of Russian e-commerce:

the case of Ozon, Journal of Management Decision,

40;7 pp. 702-709.

ROMIR Monitoring, 2008. Available from

http://romir.ru/en/ (accessed on 24/08/08).

The World Factbook by CIA, 2008. Russia profile.

WEBIST 2009 - 5th International Conference on Web Information Systems and Technologies

588