INTELLIGENT SYSTEMS FOR RETAIL

BANKING OPTIMIZATION

Optimization and Management of ATM Network System

Darius Dilijonas, Virgilijus Sakalauskas, Dalia Kriksciuniene and Rimvydas Simutis

Vilnius University, Muitines St. 8, LT-44280 Kaunas, Lithuania

Keywords: Retail banking, Automatic Teller Machines, Intelligent Cash Management, Neural Networks, Retail

Banking, Agent Technologies, Multi-agents, Agent Oriented Systems.

Abstract: The article analyzes the problems of optimization and management of ATM (Automated Teller Machine)

network system, related to minimization of operating expenses, such as cash replenishment, costs of funds,

logistics and back office processes. The suggested solution is based on merging up two different artificial

intelligence methodologies – neural networks and multi-agent technologies. The practical implementation of

this approach enabled to achieve better effectiveness of the researched ATMs network. During the first

stage, the system performs analysis, based on the artificial neural networks (ANN). The second stage is

aimed to produce the alternatives for the ATM cash management decisions. The performed simulation and

experimental tests of method in the distributed ATM networks reveal good forecasting capacities of ANN.

1 INTRODUCTION

Banks have been employing electronic service

delivery technologies aggressively for the past 20

years. This part of banking business is called retail

banking. One of the main driving forces of retail

banking is cost reduction using self-service

technologies. Intelligent systems technologies

(neural networks, agent systems and ect.) in retail

banking are beginning to show value in fields of

cash management, branch optimization, self-service

network efficiency, and other core banking business

processes.

The main research object of the article concerns

contemporary methods of ATM networks

optimization, as one of the most urgent topics of

managing retail banking self-service infrastructure.

The cost of cash in the ATMs network operating

environment of Central and Eastern Europe (also in

Asia) is the largest category of costs, which make

from 20% to 50% of all operating costs.

The ATM cash management and optimization

tasks are solved by the efforts of cash management

experts and the computerized tools. The software

market provides several different solutions for ATM

cash management tasks (Wincor Nixdorf PCA;

Carreker OptiCash and ect.), but their forecasting

capability still can’t outperform the experts. The

systems architectures are very complex and not

adjusted for performance in the distributed

environments with huge amounts of data, which are

the characteristic features of the ATM networks

optimization tasks. Most advanced results for

solving these tasks are expected of using hybrid

artificial intelligence methods, and in this article we

consider the combination of neural networks and

multi-agent technologies. The extensive scientific

research materials present theoretical frameworks,

based on the statistical and economical analysis

perspectives (Adam R. Brentnall, et al., 2008;

Bezdek J.C., 1992; Heli Snellman and Matti Viren,

2006; McAndrews J. and Rob R., 1996;

Sakalauskas V. and Kriksciuniene D., 2008).

The biggest drawback of the present research is

lack of description, how to implement different

mathematical models into the distributed ATMs

network structure. The innovative approach of the

elaborated model of intelligent system is based on

using two different artificial intelligence

methodologies – neural networks and multi-agent

technologies. The merging up of these technologies

enables to effectively solve ATMs network

management problems both from the theoretical

perspective and from the practical implementation

aspect. The chapters 2 of the article describe the

321

Dilijonas D., Sakalauskas V., Kriksciuniene D. and Simutis R. (2009).

INTELLIGENT SYSTEMS FOR RETAIL BANKING OPTIMIZATION - Optimization and Management of ATM Network System.

In Proceedings of the 11th International Conference on Enterprise Information Systems - Artificial Intelligence and Decision Support Systems, pages

321-324

DOI: 10.5220/0001975003210324

Copyright

c

SciTePress

problem related to ATMs network management and

research achievements in field of ATM networks

optimization. The chapter 3 presents the suggested

ATM cash optimization system. The overview of the

architecture of the ATMs network cash management

system is described in the 4

th

chapter.

2 RELEVANCE OF THE CASH

MANAGEMENT PROBLEM

Operating a network of ATMs involves plenty of

different functions: purchasing and installing of

ATMs, processing transactions, clearing paper jams,

repairing broken parts, picking up and processing

deposits, and also replenishing cash (D’Ambrosio, et

al., 2006). Expenses and operational efficiency is

determined by ability of deplorers to manage these

functions. Operating expenses can be divided into

two main categories: Cash-Related and Non-Cash-

Related. Cash-Related expenses, such as cash

replenishment, costs of fund, and back office

operating account cover almost one third of the total

expenses in USA, 59 % in Baltic States, 60 % in

Asia. The ATM owners are more aware of the

impact that the cost of funds make on their daily

operations because of recent tendency of rising

interest rates. Creating cash optimization system of

ATM networks could help to significantly reduce the

ATMs total operating costs.

The most relevant analysis in the field of ATM

networks optimization mainly relates to topics of

optimal size of ATMs network (McAndrews, J. and

Rob, R., 1996; Heli Snellman and Matti Viren,

2006), demand for cash (Adam R. Brentnall, et al.,

2008; Amromin, E. and S. Chakravorti, 2007), and

cash demand forecasting and optimization for the

ATMs network, presented in Simutis et al (Simutis

R., et al., 2007; Simutis R., Dilijonas D., et al., 2007;

Simutis R., Dilijonas D., et al., 2008), formed the

background for the recent study and is more

extensively described in the following chapters.

Other researches related to financial optimization

using neural networks discus bankruptcy prediction

problem (P. Ravi Kumar, V. Ravi, 2007), credit risk

analysis (Lean Yu, et al., 2009), but does not address

the problems of system implementation in

distributed services networks.

We have compared flexible ANN model with

SVM (support vector machines) (Simutis R., et al.,

2008). Forecasting results for real ATMs were using

flexible ANN model MAPE (mean average

proportional error) varied between 15-28% and for

SVR models between 17-40%. The obtained

forecasting results are in some confrontation with

the today’s opinion about the possibilities of SVR

techniques. SVM/SVR (support vector regression) is

assumed to be “next generation” technique and some

of “panacea” for classification and forecasting tasks.

The analysis of the literature sources has shown

that there are no studies in this area (practical

implementation of cash demand prediction in ATM

networks using hybrid artificial intelligence

methods). The extensive scientific research materials

present only theoretical frameworks, based on the

statistical and economical analysis perspectives.

3 FORECASTING METHOD

BASED ON FLEXIBLE NEURAL

NETWORK

The system is created by using artificial neural

networks for prognosis and optimization. The

rational agent technologies are used for data

collection in the distributed ATMs networks.

Combining both technologies creates the advantage

of managing cash optimization dynamically in

complex systems, by considering different needs of

the participants.

For every ATM machine a separate three-layer

feed-forward neural network was designed. The

neural network was trained using Levenberg-

Marquardt optimization method and RMS (root

mean square) error between predicted and real value.

Regularization term was also included in the training

criterion (Haykin S., 1999). The input variables for

ANN were the coded values of weekday, day of the

month, month of the year, holiday effect value and

average daily cash demand for ATM in last week.

The output variable of ANN was cash demand for

the ATM for the next basic time interval. For the

simplification purpose the ANN structure was

chosen the same for all ATMs in the network (the

same inputs and the same 15 hyperbolic tangent

neurons of hidden units in ANN).

Therefore we proposed a special flexible neural

network design procedure for cash demand

prediction for every local ATM. The realization of

the proposed procedure and this execution steps are

presented in Simutis R., et al. (Simutis R., et al.,

2007; Simutis R., Dilijonas D., et al., 2008)

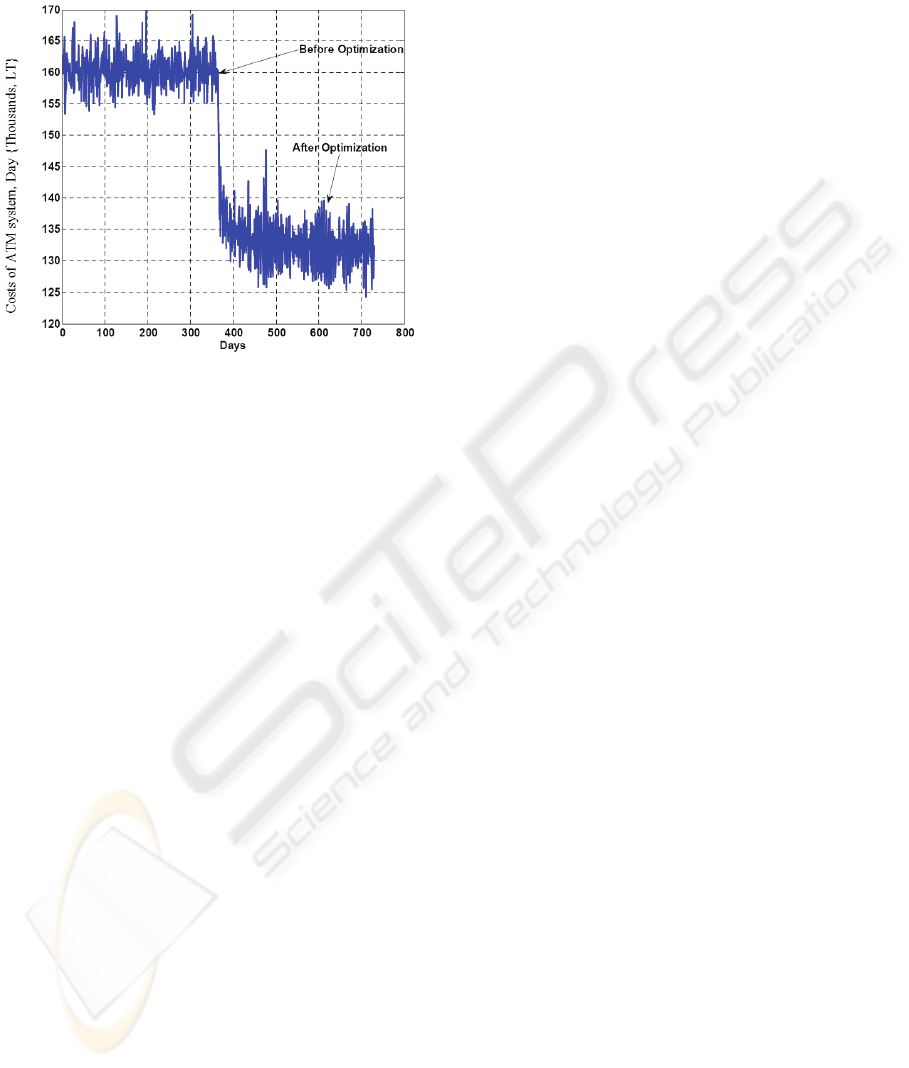

Fig. 1 shows the efficiency of the cash upload

optimization procedure. Simulation parameters:

Number of ATMs=1225; Annual interest rate=6%;

Cost of cash uploading in ATM=1 million LT

ICEIS 2009 - International Conference on Enterprise Information Systems

322

(currency course in Euros 3.45 LT=1 EUR),

Average daily cash demand=200000 LT/ATM;

Constant maintenance costs=30 LT/ATM;

Figure 1: Simulation results for cash optimization system,

daily maintenance costs for ATM network before and after

optimization.

Optimization procedure allowed decreasing daily

costs for ATM network maintenance approximately

18%. The simulation results, presented in Fig.1

reveal that the optimization results depend strongly

on the costs of money (annual interest rate) and cash

uploading. Maintenance costs decreased only by 2

%, then the simulation was run under annual interest

rate 3.5% and the increased cost of cash uploading

to 300 LT/ATM. Better results were achieved for

simulations, where higher interest rates and lower

costs of cash uploading were applied.

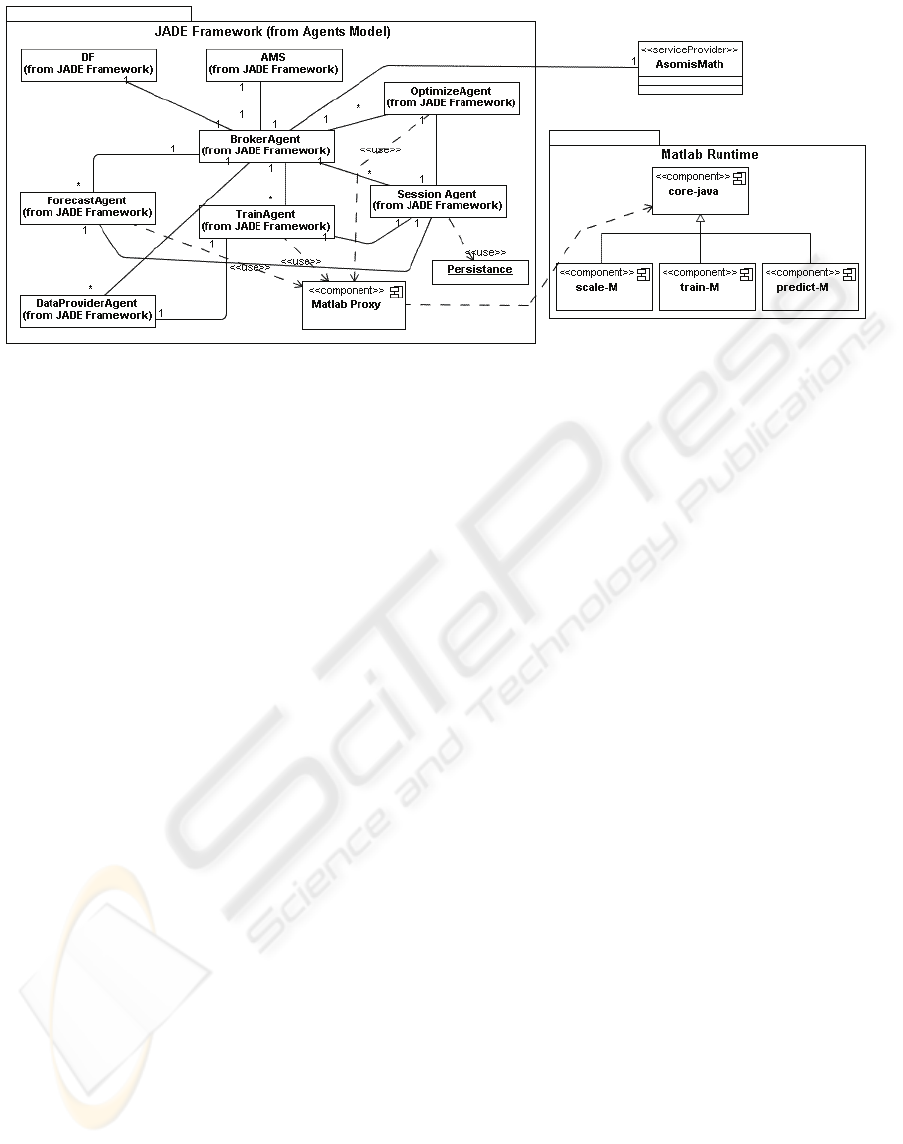

4 THE AGENT SYSTEM

ARCHITECTURE FOR RETAIL

BANKING OPTIMIZATION

This section gives a global design specification,

includes agent model specification of the system and

provides description for each component of the

design package. Figure 2 presents architecture of

retail banking optimization systems. The system is

based on JADE Framework (Bellifemine, F., et al.,

2005) where agents are responsible for use cases

realization in Math Processor Business. Agent

simulation is performed by using MatLab Runtime.

The external interface to the system is provided by

ASOMIS Math Web Service. Main components of

the system are assigned different tasks.

Directory Facilitator (DF) agent acts as specified

by FIPA. The Agent Management System (AMS) is

the agent who exerts supervisory control over access

to and use of the Agent Platform. Broker agent (BA)

is the agent responsible for service agents, such as

life-cycle management (create-kill, resume-suspend)

and dispatching the service request to a proper

service agent. Train Agent (TA) is the realization of

Train and Adapt Neural Network use cases. Forecast

Agent (FA) is the realization of Replenishment

Forecast use case and provides cash amount forecast

service, based on the trained neural network. Each

device is represented by its own FA. Optimize Agent

(OA) is the realization of Replenishment

Optimization use case, which provides service for

replenishment optimization, based on the forecast

results. Session Agent (SA) is responsible for

holding current neural network parameters per

device. Data Provider Agent (DPA) is the agent

responsible for collecting historical data from the

external source, such as database or file system, and

providing it to service agents. MatLab proxy is a

wrapper for MatLab Runtime and responsible for

wrapping atomic MatLab runtime operations in use

cases realizations of ASOMIS Math Processor

service level operation (Dilijonas D., Zavrid D.,

2008). The realized platform is created by using Java

2 Platform, Enterprise Edition (J2EE). This

technological solution meets the essential

requirements for the system including application of

numerous tools, clear programming model, and

work on different a platform, which is very

important for the distributed systems (Dilijonas D.,

Bastina L., 2007).

5 CONCLUSIONS

The research works in ATM networks optimization

sphere address main topics of optimal ATMs

network size, demand for cash and forecasting cash

withdrawal amounts in ATMs. The software

solutions, applied for cash management processes,

lack of sufficiently robust forecasting and

optimization tools, they are mostly based on simple

forecasting models, and are not capable to work

effectively in distributed environments. As the ATM

networks have features of the distributed systems,

the hybrid artificial intelligence methods should be

applied for optimization of such systems. The

practical model, proposed in this article, is based on

the combination of neural networks and multi-agent

technologies. The combined application of these

technologies gives the advantage of managing cash

INTELLIGENT SYSTEMS FOR RETAIL BANKING OPTIMIZATION - Optimization and Management of ATM

Network System

323

Figure 2: Agent model overview (Global design specification).

optimization dynamically in the complex systems.

Application of the proposed model resulted in cash

reduction by average 20 – 30%. The current stage of

design is accomplished by development of system,

based on agent technologies (JADE Framework).

The future researches are directed to the integration

of reasoning agent capabilities (Dilijonas D., Zavrid

D., 2008) into the designed ATM cash management

and service support system.

REFERENCES

Adam R. Brentnall, Martin J. Crowder, David J. Hand,

2008. Predicting the amount individuals withdraw at

cash machines, 23rd International Workshop on

Statistical Modelling.

Amromin, E. and S. Chakravorti, 2007. Debit card and

cash usage: A crosscountry analysis, Technical report,

Federal Reserve Bank of Chicago.

Bellifemine, F.; Bergenti, F.; Caire, G.; Poggi, A., 2005.

JADE – A Java Agent Development Framework:

Programming Multi-Agent Systems. Kluwer

Academic Publishers.

Bezdek J.C., 1992. On the relationship between neural

networks, pattern recognition and intelligence. Int. J.

Approximated Reasoning, 6: 85-102.

D’Ambrosio, C., Fox, M & Hayes, 2006. ATM Deployer

Study, Boston.

Dilijonas D., Bastina L., 2007. Retail Banking

Optimization System based on Multi-Agents

Technology, 6th WSEAS Int. Conference on

Computational Intelligence, Spain, pp. 203 - 208

Dilijonas D., Zavrid D., 2008. Retail banking e-services

management optimization research for real-time

decision support using BDI software agents,

EUROPT-2008, Lithuania, p. 119-124.

Dutta S., Shekhar S., 1988. Bond rating: A non-

conservative application of neural networks. Proc

IEEE Int. Conf. on Neural Networks, 2: II443-II450.

Haykin S., 1999. Neural networks: a comprehensive

foundation. Prentice-Hall, Inc.

Heli Snellman and Matti Viren, 2006. ATM Networks and

Cash Usage, FMG/Cass Business School Workshop

on "Financial Regulation and Payment Systems".

Lean Yu, Shouyang Wang, Kin Keung Lai, 2009. An

intelligent-agent-based fuzzy group decision making

model for financial multicriteria decision support: The

case of credit scoring, European Journal of

Operational Research 195, pp. 942–959.

McAndrews, J. and Rob, R., 1996. Shared ownership and

pricing in a network switch. International Journal of

Industrial Organization, 14, 727–745.

P. Ravi Kumar, V. Ravi, 2007. Bankruptcy prediction in

banks and firms via statistical and intelligent

techniques – A review, European Journal of

Operational Research 180, p. 1–28.

Sakalauskas V. and Kriksciuniene D., 2008. Neural

networks approach to the detection of weekly

seasonality in stock trading, Springer-Verlag 2008,

Lecture Notes in Computer Science 5326, p. 444–451.

Simutis R., Dilijonas D., Bastina L., Friman J., 2007. A

Flexible Neural Network for ATM Cash Demand

Forecasting, 6th WSEAS Int. Conference on

Computational Intelligence, Spain, p. 162-165;

Simutis R., Dilijonas D., Bastina L., 2008. Intelligent Cash

Management System for an ATM network. Int.

Computer Science and Technology Conference, USA.

Simutis R., Dilijonas D., Bastina L., Friman J., Drobinov

P., 2007. Optimization of Cash Management for ATM

Network. Information Technology and Control,

Lithuania, Vol. 36, No. 1A, 117 - 121.

Simutis R., Dilijonas D., Bastina L., 2008. Cash demand

forecasting for ATM using neural networks and

support vector regression algorithms, EUROPT-2008,

Lithuania, p. 416-421.

Wooldridge, M., 2001. An Introduction to Multi-agent

Systems, JOHN Wiley & Sons Ltd.

ICEIS 2009 - International Conference on Enterprise Information Systems

324