EVALUATING RISKS IN SOFTWARE NEGOTIATIONS

THROUGH FUZZY COGNITIVE MAPS

Sergio Assis Rodrigues

1

, Efi Papatheocharous

2

, Andreas S. Andreou

2

and Jano Moreira de Souza

1

1

COPPE/UFRJ – Computer Science Department, Federal University of Rio de Janeiro, Brazil

2

University of Cyprus, Dept. of Computer Science, 75 Kallipoleos str., CY1678 Nicosia, Cyprus

Keywords: Risk Management, Fuzzy Cognitive Map, Negotiation, Cost Estimation, Decision Making Process.

Abstract: Risks are inevitably and permanently present in software negotiations and they can directly influence the

success or failure of negotiations. Risks should be avoided when they represent a threat and encouraged

when they denote an opportunity. This work examines the influence of some negotiation elements in the

area of risk and cost estimation, which are both factors that directly influence software development

negotiation. In this work, risk quantification is proposed to translate its impact to measurable values that

may be taken into consideration during negotiations. The model proposed involves an assessment tool based

on basic negotiation elements – namely relationship, interests, cost and time – quantifying the influences

among each other, and makes use of Fuzzy Cognitive Maps (FCMs) for developing the associations around

basic risk elements on one hand and attaining an innovative risk quantification model for improved software

negotiations on the other. Indicative scenarios are presented to demonstrate the efficacy of the proposed

approach.

1 INTRODUCTION

This work approximates the issue of constructing

optimal goal-oriented risk and cost management

strategies to avoid risks during software

negotiations. In this phase, both the schedule and

cost approximations are highly affected by several

critical issues concerning the increasing rivalry of

competitors, the demand for shorter project life

cycles and cost reductions; however, they have no

compromise on the quality constraints. Appropriate

regulation of these constraints is decisive in order to

either gain or lose a contract, outrun schedules,

budget and misallocate project resources.

Especially in the initiation phase of a project, there

are many uncertainties and risks to be considered.

Negotiations and conflict resolution can be

responsible for influencing relationship maintenance

and leading the institution towards success or

failure, depending on the staff performance. In

general, the goal is to reach the planned agreements;

however, as in all decision-making processes,

negotiation is directly related to risk assessment.

Therefore, the correct management of risks allows

one to lead a negotiation in a structured and pro-

active way, introducing strategies that may prevent,

control and mitigate the risks that can lead to

negotiation failure.

Some particular elements are usually more

discussed in negotiations, such as scope, time, costs,

required changes, relationship, interests,

administrative issues, contract clauses and resources

(PMBOK, 2004). The perception of risk in some

negotiations is more significant, but, as (Bartlett,

2004) states, risk is an element found in all

negotiations, no matter their nature. Nevertheless,

the challenge is to know how to quantify risks in

order to prioritize them and, consequently, avoid

future problems.

This article attempts to show an approach to

quantify risks anchored in key negotiation elements.

An FCM model is utilized taking into consideration

these negotiation elements to improve the

negotiation process.

2 TECHNICAL BACKGROUND

In a decision-making environment, a systematic

method to manage risk may provide enough

information to negotiators and additionally, utilizing

negotiation elements to assist risk management may

380

Assis Rodrigues S., Papatheocharous E., S. Andreou A. and Moreira De Souza J. (2009).

EVALUATING RISKS IN SOFTWARE NEGOTIATIONS THROUGH FUZZY COGNITIVE MAPS.

In Proceedings of the 11th International Conference on Enterprise Information Systems - Artificial Intelligence and Decision Support Systems, pages

380-383

DOI: 10.5220/0002017603800383

Copyright

c

SciTePress

be an innovative aspect for any organization

entrepreneur. Moreover if the negotiator is aware of

the existing risks involved and realize that may be

considered either as threats or opportunities may

result in optimized agreements (Rodrigues, 2008).

On the other hand, there are several weaknesses in

the approach proposed which denotes that risk is a

simple multiplication between probability and

impact. In order to improve the approach, this work

additionally examines the use of Fuzzy Cognitive

Maps (FCM) (Papatheocharous, 2008) to illustrate a

negotiation result. The idea is to compare the use of

the basic simple formula of probability and impact,

with the results obtained through FCM simulations

and, consequently, propose an innovative improved

risk quantification model.

A Fuzzy Cognitive Map (FCM) is a diagram

consisting of nodes and arrows; the nodes represent

various qualitative concepts, while the arrows denote

the links between the concepts. Each concept is

characterized by a numeric activation value denoting

a qualitative measure of the concepts’ presence in

the conceptual domain. Thus, a high numerical value

indicates that the concept is strongly present while a

negative or zero value reveals that the concept is not

currently active or relevant to the conceptual

domain. When a strong positive correlation exists

between the current state of a concept and that of

another concept in a preceding time-period, we say

that the former positively influences the latter. This

relationship is indicated by a positively weighted

arrow directed from the causing to the influenced

concept. By contrast, when a strong negative

correlation exists, it reveals the existence of a

negative causal relationship indicated by an arrow

charged with a negative weight. Two conceptual

nodes without a direct link are, obviously,

independent.

The updating function of a CNFCM is the

following:

()

t

i

i

t

i

t

i

f

t

i

A

d

ASA

−=

+1

(1)

∑

≠

=

=

n

ij

j

ij

t

j

t

i

wAS

1

(2)

where A

i

is the activation level of concept C

i

at some

time (t+1) or (t), equation (2) is the sum of the

weighted influences that concept C

i

receives at time

step t from all other concepts, d

i

is a decay factor

(Tsadiras, 1998), and (3) is a modified version of the

function used for the aggregation of certainty factors

(Kosko, 1994).

⎪

⎪

⎪

⎪

⎪

⎩

⎪

⎪

⎪

⎪

⎪

⎨

⎧

−+

≤<<

−+=++

≥≥

−+=−+

=

otherwiseS

A

S

A

t

i

t

i

t

i

t

i

S

t

i

A

t

i

S

t

i

A

t

i

if

A

t

i

S

t

i

S

t

i

A

t

i

A

t

i

S

t

i

A

t

i

S

t

i

A

t

i

if

A

t

i

S

t

i

S

t

i

A

t

i

A

t

i

S

t

i

A

t

i

S

t

i

A

t

i

f

m

)),,min(1(

1|||,|,0,0

,)1(

0,0

,)1(

),(

(3)

3 RISK QUANTIFICATION

The importance of risk quantification is to provide,

numerically, the impact offered by a risk to a

negotiation, in the case that it occurs. Generally,

“risk value” is calculated through the Expected

Value analysis, obtained by the multiplication of

occurrence risk impact and probability (PMBOK,

2004). This work uses a mathematical method with

associated weights to the key negotiation’s elements:

namely cost, time, interests and relationship.

Time and Cost are measures that can be

expressed in numbers (e.g., 6 months, U$500, etc.)

and are primarily the key concepts affecting the

negotiation process and will have a profound impact

on the later stages of development. The proposed

tool allows negotiators to indicate the weights and

values of the best and worst cases for each

negotiation element respectively. These values will

then be used to normalize the risk impact for the

quantification step. Thereafter, the four negotiation

elements will have different weights and the value of

the adjusted impact will be between the range of 0

and 100. At the end, the normalized risk impact is

calculated by:

(4)

The above formula provides the expected value of

each risk, negative or positive. Index i represents the

element that varies from 1 to 4. Variables w

i

, b

i

and

p

i

represent the weight, the best case and the worst

case respectively for each element. Variable v

i

is

called the Affected Value, whose significance is

asserted by negotiators.

Afterwards, the Risk Expected Value is

calculated through the multiplication between risk

probability, acquired from historical experiences,

and impact, obtained from equation (4). Finally,

considering all identified risks, a negotiation’s

weighted average is estimated. This estimated value

will be used as the initial activation level of the

corresponding concept in the FCM.

EVALUATING RISKS IN SOFTWARE NEGOTIATIONS THROUGH FUZZY COGNITIVE MAPS

381

4 MODELLING THE

EXPERIMENT

Through the negotiation experiments executed we

were able to create associations to guide the

construction of an FCM model to assess (predict) the

outcome of the negotiation process in qualitative

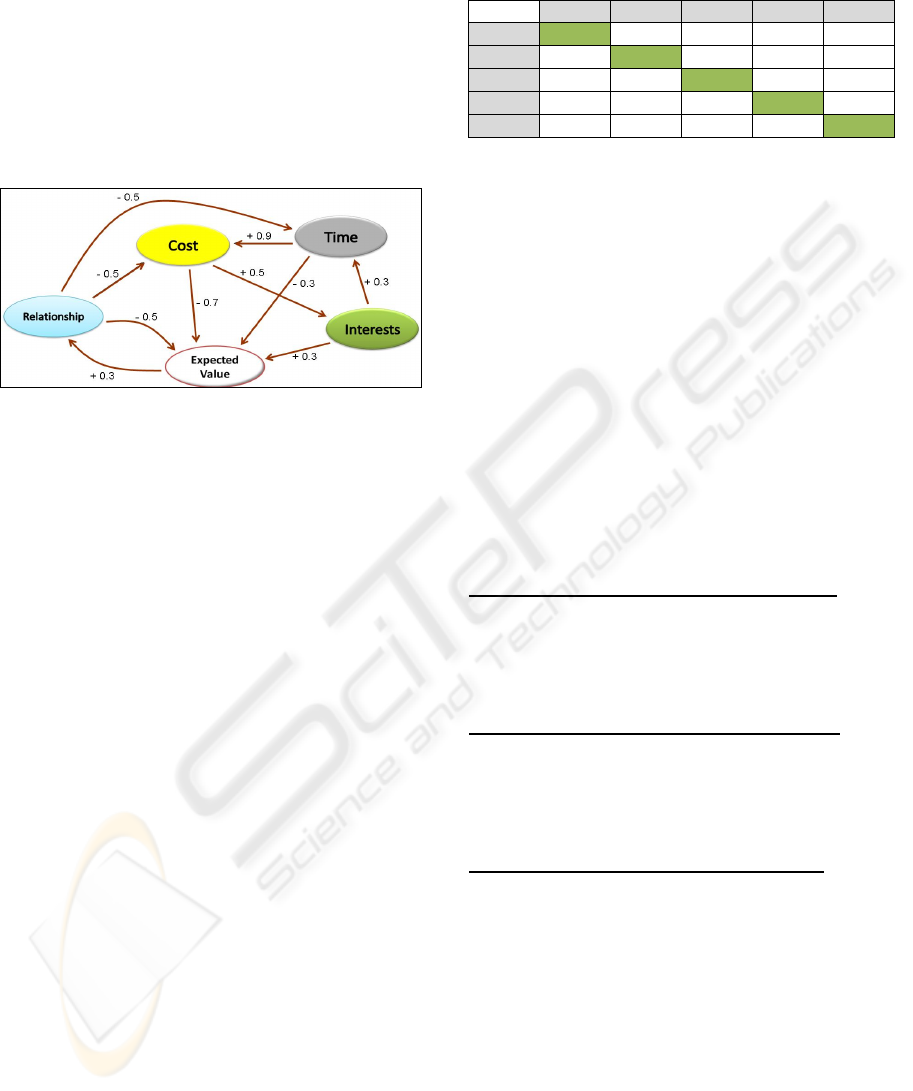

terms. Figure 1 shows the corresponding model

formed reflecting the negotiation scenery:

Figure 1: FCM modelling the outcome of the negotiation.

Cost (C) directly positively influences the

client’s and developer’s interest. Increased

anticipated costs draw more attention on behalf of

the senior management whereas high costs hinder

the successful conclusion of a negotiation.

Time (T) represents the development time

needed to complete and deliver a software product.

Time influences positively Cost and negatively the

expected outcome of a negotiation.

Interests (I) represent the commitment level and

the interest of management (both in client and

developer organizations). Generally, several

interests imply overhead in time during development

as more time is consumed in communication.

Relationship (R) reflects the level of

communication, understanding and possibly trust

between client and developer. In general, this

element influences costs and time negatively and

positively the negotiation output (good

communication contributes to faster development,

with lower costs and improves successful deals).

Expected Value (EV) represents the outcome of

the negotiation. High activation means that

negotiation is successfully concluded and low

exactly the opposite. Hence it may be considered a

risk indicator of the course of negotiation.

In this case study, Copp, an Information

Technology research and software development

institution employing around 150 professionals

(managers, developers and research staff) was the

Service Supplier. The Client of this negotiation was

BraxPetrol institution, a global oil exploration and

production company, operating in Brazil.

Table 1: Influences between concepts in the FCM

negotiation model (column is the source).

C T I R EV

C

0.9 0 -0.5

0

T

0

0.3 -0.5

0

I

0.5 0

0

0

R

0 0 0

0.3

EV

-0.7 -0.3 0.3 0.5

The relationships of Figure 1 relate to a numerical

state indicating the influence exercised by the source

node to the destination node. These weights are

listed in Table 1. The underlying weights and the

values of the activation levels of the participating

concepts are illustrated on a five-scale scheme

equally spread in the range [-1, 1].

5 EXPERIMENTAL RESULTS

This section presents three negotiation scenarios

which were used to investigate the efficacy of the

model. The first and third represent the two extreme

cases of the worst and best circumstances in terms of

parameter values that hinder or promote successful

conclusion of the negotiation. The second case lies

somewhere in between:

Negotiation 1: The worst agreement setting

C Æ Very Bad : Interpreted as Very High (0.8)

T Æ Very Bad : Interpreted as Very High (0.8)

I Æ Regular : Interpreted as Low to Medium (0.2)

R Æ Bad : Interpreted as Low (-0.5)

EV Æ Bad : Interpreted as Low (-0.5)

Negotiation 2: A medium agreement setting

C Æ Good : Interpreted as Low (0.5)

T Æ Bad : Interpreted as High ( -0.5)

I Æ Good : Interpreted as High (0.5)

R Æ Good : Interpreted as High (0.5)

EV Æ Good : Interpreted as High (0.5)

Negotiation 3: The best agreement setting

C Æ Excellent : Interpreted as Very Low (-0.9)

T Excellent : Interpreted as Very Low (-0.9)

I Æ Good : Interpreted as High (0.5)

R Æ Good : Interpreted as High (0.5)

EV Æ Excellent : Interpreted as Very High (0.9)

Each negotiation case study involved executing the

map for 250 iterations when it reaches in a final

immutable situation characterized by equilibrium. In

each respective iteration the new activation level

value for each concept was calculated using

equations (1) to (3) as explained earlier. The final

values of the activation levels are listed in Table 2.

ICEIS 2009 - International Conference on Enterprise Information Systems

382

Table 2: Final activation levels of the concepts in the FCM

negotiation model.

C T I R EV

Negot.1

1.0 0.93 -0.83 0.91

-0.85

Negot.2

1.0 0.93 -0.83 0.91

-0.85

Negot.3

-1.0 -1.0 0.84 -0.91

0.86

Analyzing the results of Table 2 we observe that the

model behaves as it should have. More specifically,

in the worst and best scenario cases the value of the

negotiation concept stabilizes at -0.85 and 0.86

which suggests that the final outcome will

eventually be negative and positive respectively. The

rest of the concepts behave also as expected. In the

worst case negotiation both cost and time are driven

to even more negative values than originally started,

while it is interesting to note that Interest becomes

negative, which indicates that senior management

stops participating in “lost” cases and devotes their

time to other more beneficiary projects.

Additionally, Relationship becomes more positive

signifying that trust and good communication may

not be hampered in cases where the negotiation is

ended without consensus due to infeasible

development that results from unsatisfactory time

and cost projections.

The exactly opposite picture is observed for the

best case where a mirroring to the above set of

values again justifies the correctness of the model in

capturing properly the dynamics behind such

promising negotiation scenery. Finally, we should

comment a bit on the results of the medium state,

where we can discern that the outcome of the

negotiation is closer to the negative value. This is

also quite natural as it is clear from the behaviour of

the model that the two leading factors are cost and

time and once this suggest a negative development

expectation then negotiations are doomed to fail.

6 CONCLUSIONS

Negotiations are generally subject to many types of

risks. As previously discussed, a risk element can

influence negatively or positively the software

development and should be identified during

negotiation preparation because of the necessity of

having a real view of the context in which the

negotiation decision will take place. This work aims

at addressing a strategy to facilitate risk

identification and quantification, inferring to the

suggested expected value and based on critical

negotiation elements or concepts.

The work also examines the importance of

evaluating the risk assessment method through the

use of Fuzzy Cognitive Maps. The model proposed

obtains the appropriate associations among the

negotiation elements through real negotiation

experiments and evaluates the result. Three

hypothetical scenarios were executed taking into

consideration the key concepts of: contract’s cost

development, development time, counterparts’

interests, counterparts’ relationship and negotiation’s

expected value. The results showed that the method

is promising as the model reacts with the way it was

expected to.

Finally, we might suggest that the method of risk

quantification using proportionally weights and

impacts to evaluate risks in cost, time, relationship

and negotiation’s interests is capable to facilitate the

identification of preponderant threats and

opportunities and leads to better negotiations.

Conclusively, for future work the innovative tool

proposed may be further examined to involve other

supplementary elements to the software, which may

also be included in the assessment model of Fuzzy

Cognitive Maps (FCM), and make inferences in

different negotiation areas to examine the methods

generalization to other backgrounds.

REFERENCES

Bartlett, 2004, Bartlett, J. "Project Risk Analysis and

Management Guide", Second Edition ed., UK: Apm

Publishing Limited, 2004.

Kosko, 1994, Kosko, B., “Fuzzy Thinking. The New

Science of Fuzzy Logic”, London: Harper Collins.

Papatheocharous, 2008, Papatheocharous, E., Rossides, G.

and Andreou, A. S. "Qualitative Software Cost

Estimation Using Fuzzy Cognitive Maps", AISEW -

Artificial Intelligence Techniques in Software

Engineering Workshop at 18th European Conference

on Artificial Intelligence, Patras, Greece, 2008.

PMBOK, 2004, PMBOK. “Project Management Body of

Knowledge”, 2004 Edition. Project Management

Institute, http://www.pmi.org, 2004.

Rodrigues, 2008, Rodrigues, S. A.; Vaz, M. A.; Souza, J.

M. “A Software to Manage Risks in Project’s

Negotiations”. In: WORLDCOMP'08 The 2008 World

Congress in Computer Science, Computer

Engineering, and Applied Computing, Las Vegas.

Tsadiras, 1998, Tsadiras, A.K. and Margaritis, K.G. “The

MYCIN Certainly Factor Handling Function as

Uninorm Operator and its Use as Threshold Function

in Artificial Neurons”, Fuzzy Set and Systems, Vol.

93, 263-274, 1998.

EVALUATING RISKS IN SOFTWARE NEGOTIATIONS THROUGH FUZZY COGNITIVE MAPS

383