“THE RIGHT TIME” - SOCIAL TIME PERSPECTIVE FOR

DEVELOPING RETAIL BANKING SERVICES ONLINE

Johanna Ahola and Helena Ahola

University of Oulu, Department of Anthropology and Art Studies, Cultural Anthropology

Pentti Kaiteran katu 1, Oulu, Finland

Oulu University of Applied Sciences, School of Business and Information Management

Teuvo Pakkalan katu 19, Oulu, Finlan

Keywords: Case study, Internet marketing, Retail banking service, Time, Value creation.

Abstract: The anytime, ubiquitous, and interactive Internet creates customer value, and makes market offerings as

services. Service is a logic or a perspective to co-produce and co-create value with the customers. But if the

Internet promise is “anytime”, what is “the right time” for the customer and the service provider? Time is

usually understood as clock time, although it could be understood also from social and other perspectives. In

that way even more customer value and better service quality and productivity could be achieved. To

explore the idea of looking at time from other than only from resource perspective in service co-production

and value co-creation, an illustrative case study is provided within retail banking contexts. For banks the

Internet is one of the major marketing channels of their services. We propose that developing the retail

banking service concept from service logic and social time perspectives could add marketing effectiveness,

and provide a value-adding solution also to the “timing” problem.

1 INTRODUCTION

The aim of this paper is to provide a social time

perspective to services marketing on the Internet.

Creating customer value is a complex issue because

of customers’ participation and co-production of

value, and their expectations on ubiquitous services

and the service providers’ pressure of service

productivity.

The Internet is not anymore seen as technology

but as an environment consisting of people and as a

hub for various marketing operations. The

ubiquitous Internet with its functional, social,

emotional and epistemic dimensions of value have

impact on customers’ intention to use the medium

for shopping purposes (Ming-Sung Cheng, Wang

Ying-Chao Lin & Vivek, 2009). The Internet as a

marketing channel integrates marketing

communication with commercial transactions and

service delivery (Rowley, 2004).

When products (goods and services) are

marketed via the Internet, they are, in fact, services.

Service and value creation in services is a very

complicated thing. Gummesson (1991) concludes,

that “the marketing specialists of the marketing

department are seldom in the right place at the right

time with the right customer contacts.” Should this

be possible at the Internet time?

The Internet adds the availability of services.

Customers have an important role in value creation

and innovation of services. Customer involvement

aims to facilitate the generation and dissemination of

market intelligence and the organization-wide

responsiveness to it. Interaction is also the essence

of customer involvement. (Matthing, Sanden &

Edvardsson, 2004) Menor, Tatikonda and Sampson

(2002) explore the impact of the Internet on the

design and development of services, and suggest that

technology is changing the way services are both

delivered and designed, and that the role of

technology in developing new services is critical

requiring further exploration.

What is the” right time” when the Internet allows

anytime access to services? There are industries

which are time-dependent or which are, in fact;

based on time, such as banking. Time is, however,

usually understood as clock-time. Anthropologists

and sociologists emphasize that the essentially

Western chronological construct of time is but one

of the wide range of constructs of time (Jenkins,

209

Ahola J. and Ahola H. (2009).

“THE RIGHT TIME” - SOCIAL TIME PERSPECTIVE FOR DEVELOPING RETAIL BANKING SERVICES ONLINE.

In Proceedings of the International Conference on e-Business, pages 209-214

DOI: 10.5220/0002190402090214

Copyright

c

SciTePress

2002). Particularly the purchase of financial services

suffers from a lack of temporal attention and

perspective (Gibbs (1998, 997). Furthermore,

Turnbull (2004) points out that in organization

studies there is a gap in time-related research.

2 RESEARCH QUESTIONS

The financial sector (banking) is one of the business

areas that has been most affected by the internet,

and, for example, the way in which financial

institutions interrelate with their customers

(Flavia´n, Guinalı´u & Torres, 2006). Durkin,

Jennings, Mulholland & Worthington (2008) also

emphasize the increasing role of the Internet in retail

banking, because it can “serve to reduce costs and

often improve service reliability and increase

marketing effectiveness.” Still no research has been

done on social or other than clock-time perspective

in value creation of banking services. We look for an

answer to the main research question: How can

value be created in marketing retail banking services

by understanding time also from other than clock-

time perspective?

The research sub-questions are:

1. What is service and how value is created

in services according to the recent service marketing

research?

2. What kind of time dimensions are

suggested besides clock time?

3. How can the time-critical points in retail

banking services be identified?

4. How to create time-sensitive service

concepts in retail banking taking into account the

Internet marketing environment?

The first two research questions will be answered

by utilizing service marketing and time theories, and

the last two by doing a case study of a service

concept in a retail bank.

3 RESEARCH STRATEGY AND

METHODOLOGY

An explorative single case study of developing

service concepts was done in a Finnish retail bank.

Based on the recent service and time theories

propositions are made for understanding time in

banking service contexts. The case study strategy

was chosen to illustrate the service concept and

potential critical time-dependent points in real-life

retail banking contexts. The case is a typical case of

a banking service concept. The analysis is based on

triangulated data. Multiple sources of evidence were

used, such as unobtrusive documents (public and

internal reports), archival records, direct observation

in seminars, participant observation during

development projects (notes and research diary), and

physical artefacts to corroborate the findings. The

authors have closely observed the development of

online retail banking with professional interest since

2000. Besides, the first author has worked within

banking business since 2001, and currently works at

the case bank as Development Manager in projects

related to customer service, customer relationship

management and “products”. Data particularly for

this case study has been obtained from the 1

st

of

September to the end of December, 2008. In

addition, the first author completed an academic

course on relationship marketing offered by Kataja

Organization of the universities in Finland. During

that course the service research was very thoroughly

studied.

The theory of service and the construct of service

concept, the social time construct and the timescape

framework guided the data collection process, and

served as the analytic strategy and the logic to link

the data to the research propositions, and to interpret

the findings. The units of analysis are the elements

of the banking service concept (in particular, the

service operation). Analysis of the case study

evidence was done according to the study questions.

The facts presented come from convergence of

multiple sources of the banking case evidence.

4 THE SERVICE CONCEPT AND

VALUE CREATION

Grönroos (2006) discusses services and service

logic, and the theory of value creation. Based on the

Nordic School view, services can be defined as

processes that consist of a set of activities which

take place in interactions between a customer and

people, goods and other physical resources, systems

and/or infrastructures representing the service

provider and possibly involving other customers,

which aim at solving customers’ problems. The

issue is how value is created through service.

Grönroos (2006) in his article provides a

fundamental theoretical knowledge base of service

logic for marketing. Following his idea of a service

logic and the value-in-use notion value creation

includes three phases (for services as well as for

goods): value facilitation, value co-creation and

ICE-B 2009 - International Conference on E-business

210

value creation. Also Edvardsson, Gustafsson and

Roos (2005, 118) conclude in their recent study that

‘Service is a perspective on value creation rather

than a category of market offerings’. In their

analysis, perspective seems to mean a way of

thinking, or a ‘logic’. Hence, services are value-

supporting processes. Thus service logic means that

the firm facilitates processes that support customers’

value creation. Due to the customers’ involvement in

these interactive processes, firms and customers are

co-producers of the service and co-creators of value.

Instead of including only the use of the marketed

product itself, consumption also encompasses all

elements, physical objects such as goods,

information, people-to-people encounters,

encounters with systems and infrastructures and

possible interactions with other customers that

together have an impact on customers’ value

creation. If consumption is viewed in this way, there

will be both theoretical and empirical challenges

ahead in marketing. The more content there is in the

customer interface, the more complicated it probably

is for the firm to manage the whole value-creating

process. Taking a value-in-use perspective, the

marketer has to try to carefully design and manage

as many elements of the interface as possible.

In the empirical business context of value

creation a service concept is needed. Edvardsson and

Olsson (1996) have defined service concept as

“detailed description of what is to be done for the

customer (what needs and wishes are to be satisfied)

and how this is achieved”. These definitions refer to

both the customer and the service provider points of

view. Goldstein et al. (2002) exemplifies the service

concept as “service in the mind” which is the

customer’s and the service provider’s expectation of

what service should be. It is a foundation for

developing marketing content (“what”) and

operational content (“how”) of a service. Service

concept helps to mediate between customer needs

and the organization’s strategic intent, and includes

the following elements (Clark et al., 2000 and

Johnston and Clark, 2001): 1) Service operation: the

way in which service is delivered 2) service

experience: the customer’s direct experience of the

service 3) service outcome: the benefits and results

of the service for the customer 4) value of the

service: the benefits the customer perceives as

inherent in the service weighted against the costs of

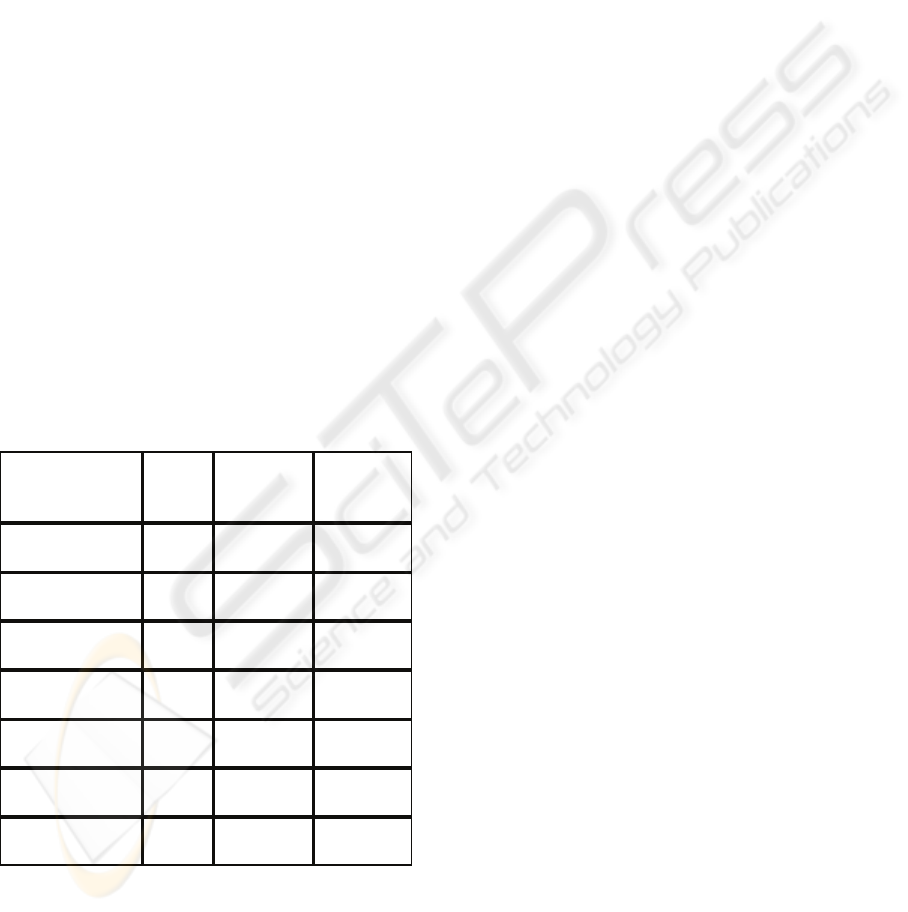

the service. (Figure 1).

The elements of

the service concept

the processes of

the service concept

Service operation the process of service

operation

Service experience the process of value co-

creation

Service outcome the process of co-

production

Value of the service the process of value

assessment

Figure 1: The elements of the service concept.

Proposition 1. According to the recent service

marketing theories service is a logic or perspective, a

process and value is created in co-production of

services. The definition of service refers to time as

the focus is on process and interaction; service is

thus “time dependent”. The processes consist of

actions and things that follow each other and vary in

their duration. Interactions that occur between

parties can be real-time or delayed. To

operationalize service the construct of service

concept is needed. Because the customer and the

service provider co-create value, time is not only

added value for the customer, but the “right timing”

is critical for the whole service concept, and the

time-critical points in the process should be

identified.

5 THEORIES OF TIME

Anthropologists and sociologists emphasize that the

essentially Western chronological construct of time

is but one of the wide range of constructs of time.

Time in general, in philosophy, represents two basic

ideas that are “duration” and “succession”

(Khatchadourian, 1961). Succession is the concept

that one event can be perceived to follow another.

Duration is the interval between successive events.

Social time consists of “collective

representations” that derive from and reflect the

groupings and varied “rhythms” in life. Calenderic

systems arise from social differentiation and a

widening area of social interaction (Munn, 1992).

Turnbull (2004) applies Jenkins’ (2002) theory of

social time in studies of time management in

working life of leaders. Researchers have identified

five key aspects of the time concept to study

marketing strategies in a global context (Harvey &

Novicevic, 2001; Harvey et al., 2008). These aspects

are: The nature of time (real or epiphenomenal,

experience of time (objective or subjective), clock vs

social time, time flow (novel, cyclical, or

"THE RIGHT TIME" - SOCIAL TIME PERSPECTIVE FOR DEVELOPING RETAIL BANKING SERVICES ONLINE

211

punctuated), time structure (discrete, continuous, or

epochal time, and temporal referent point (i.e. past,

present, or future).

Harvey & Novicevic (2001) developed a

construct of timescape based on social time.

Timescape is a strategic construct that can be

decomposed into seven elements useful in

visualization of time. These are time frame, tempo,

temporality, synchronization, sequence, pauses, and

the ubiquity of time. Timeframe means that people

prefer to engage in two or more tasks or events

simultaneously. Tempo is the perceived rhythm or

rate of time held by an observer. Temporality is the

concept of the limited durability of “things”.

Synchronization is the degree to which events are

coordinated relative to a concept of time. Sequence

is a structured pattern of events that are tied together

through time. Pauses mean the occurrence and

duration of time intervals between events. Ubiquity

of time is the ever present nature of time and the

resulting impact of time on marketing

events/strategies. (Harvey et al. 2008)

Proposition 2. Time is a complex phenomenon with

many dimensions. Some key aspects of the time

concept relate to social time, such as time frame,

tempo, temporality, synchronization, sequence,

pauses, and the ubiquity of time. The timescape

framework based on social time could be useful also

as a strategic construct in visualization of time in

banking. Understanding “time” from social time

perspective could add customer value, as the

ubiquitous Internet creates expectations of the

availability of services anytime.

6 CASE OF A SERVICE

CONCEPT AND TIME

The purpose of this case study is to identify the

time-critical points in a retail banking service

concept, and to illustrate how time-sensitive service

concepts could be created within retail banking, in

particular, in the ubiquitous Internet marketing

environment.

The bank in focus is a Finnish retail bank. The

bank group is comprised of independent member

cooperative banks and the group’s central institution.

The member banks throughout Finland offer full

range of banking services and promote the economic

welfare of the people and enterprises in their region.

The central bank offers technical solutions, builds

visions and solutions to support the local bank’s

business, and acts as a service center for its local

member banks, in particular, in terms of information

systems and customer relationship management

strategies.

The banking service concept consists of service

operation, experience, outcome, and value. The

focus is on the service operation with its different

elements. From the bank’s point of view criteria or

perspectives for the criticality of time are self-

service, customer service, and the service product

itself. These are selected as perspectives because

these can be understood as service, how it appears to

a customer. They include individual “concepts”

themselves but at the same time these are very much

dependent on each other.

The service operation of the retail banking

service concept developed above is analysed using

the construct of timescape. The seven elements of it

are time frame, tempo, temporality, synchronization,

sequence, pauses, and the ubiquity of time, and they

are analyzed from the bank’s time-critical

perspectives of self-service, customer service, and

the service product (Figure 2).

In the banking service operation, time frame is

critical from self-service, customer service and

service product viewpoints. In self-service,

customers can at the same time obtain information

from many sources or send applications to several

service providers. In customer service, a bank teller

may have tools that allow him to acquire

information from many sources via different devices

(e.g. using chat in order to consult colleagues).

Similarly, customers are usually provided with two

or more services at the same time, such as long-term

savings besides home loans.

Tempo refers to rhythm e.g. in the immediate

interaction within the customer service. Customers

can get bored if service is too slow; on the other

hand, if it is too fast, they might get confused. In

self-service customers may proceed in their own

rhythm. Also, in the service product, tempo is not

particularly critical, because there is no immediate

interaction going on.

Temporality in the banking service concept is

most critical in customer service considering how

much is takes customers’ and the service provider’s

time. Temporality might not be so relevant in self-

service, rather it could be important in service

outcome (i.e. how long customer is committed to a

service product).

Synchronization is important in customer

service in two ways: first, service needs to be

available in synchronization with the customer

situation, secondly, asynchronization allows more

freedom to find out a solution to a customer’s

ICE-B 2009 - International Conference on E-business

212

situation. Both participants need not be present at the

same time. This is closely related to self-service, as

the customer is allowed to start service on his own

and wait for the response from the service provider.

In the service product case, consideration is needed

in recommending other services at the same time for

the customer.

Sequence emphasizes the process nature of

service as phases are following each other. Customer

service situation can be structured in a way that it is

understandable and interesting from the customer

point of view and leads to the expected outcome. In

self-service sequence is also critical, because the

customer has to proceed on his own. If service

product consists of modules, sequence could then be

relevant.

Pauses are relevant in customer service and self-

service. Pauses might be needed for many reasons

such as understanding the attributes of the service.

Pauses can also be irritating. Pauses need to be

planned.

Ubiquity of time is particularly relevant in self-

service, because customers prefer banking

independent on time and place. However, customer

service has a role in supporting customers and

responding to different customer situations needed

ubiquitously. In service product, ubiquity might be

relevant also in other service concept elements than

service operation.

Time-critical

points in service

operation

Self-

service

Customer

service

Product

Time frame

“polychronic”

H H H

Tempo

“rhythm”

M H -L

Temporality

“durability”

L H M

Synchronization

“coordination”

L H M

Sequence

“tied together”

H H M

Pauses “between

events”

H H L

Ubiquity of time

“ever present”

H M M

H= high importance, M= medium importance, L=

low importance

Figure 2: The service operation in the banking service

concept and the time-critical points.

Proposition 3. The time-critical points in retail

banking service operation have been identified from

the bank’s point of view. They are self-service,

customer service, and the service product itself. The

time dimensions of highest importance in the service

operation element of the service concept are in self-

service and customer service.

Proposition 4. Time-sensitive service concepts in

retail banking can be created by analyzing the

elements of the service concept and estimating the

importance of various time dimensions in each of

them. Using the developed timescape all the

elements of different service concepts could be

analysed, and social time sensitive banking services

could be created.

7 DISCUSSION

We have developed propositions for social time

sensitive retail banking services. A retail banking

service is a process and value is created in co-

production with the customers, and that service is

“time dependent”. To operationalize service the

construct of service concept is needed. In co-

creation of value, time is not only added value for

the customer, but the “right timing” is critical for the

whole service concept, and the time-critical points in

the process should be identified. Time is a complex

phenomenon with many dimensions, but the concept

of social time and timescape framework can be

applied as a strategic construct of time.

The time-critical points in retail banking service

operation have been identified. They are self-

service, customer service, and the service product

itself. Time-sensitive service concepts in retail

banking can be created by analyzing the elements of

the service concept and estimating the importance of

various time dimensions. In the analysis of the

service operation part of the service concept the

time-critical points were self-service and customer

service. Using the developed timescape all the

elements of different service concepts could be

analyzed, and social time sensitive banking services

could be created. The Internet will perhaps in the

future offer tools for banks to provide services in

real time, and multiple time perspectives of

customers can be taken into account efficiently also

from the bank’s point of view.

This study contributes to services marketing

theory by developing a model for marketing time-

critical banking services, and to social time theories

by offering a service marketing perspective applied

"THE RIGHT TIME" - SOCIAL TIME PERSPECTIVE FOR DEVELOPING RETAIL BANKING SERVICES ONLINE

213

in the banking business. Managers could use this

tool in planning service concepts from a more

multifaceted perspective rather than merely focus on

clock time. In fact, the time perspective should be

embedded in the service process. This requires

development of service attributes, the service

process and systems support.

Further research is suggested to study time in the

other elements of the service concept. These are the

service experience, outcome and value. Furthermore,

as this case study was based on expected customer

value and the bank’s point of view, the real

expectations of the customers should be empirically

studied. By inductive case studies the value-creating

process including value facilitation, co-creation and

value creation, or value-supporting process could be

described and understood. Then a new role for

marketers of services as instructors, coaches,

advisers on the ubiquitous Internet could be

identified and created.

REFERENCES

Clark, G., Johnston, R. and Shulver, M. 2000. Exploiting

the service concept for service design and

development, in Fitzsimmons, J., Fitzsimmons, M.

(Eds.), New Service Design. Sage, Thousand Oaks,

CA, pp. 71–91.

Durkin, M., Jennings, D., Mulholland, G., &Worthington,

S. 2008. Key influencers and inhibitors on adoption of

the Internet for banking Journal of Retailing and

Consumer Services 15 (2008) 348–357.

Edvardsson, B., Gustafsson, A. and Roos, I. 2005. Service

portraits in service research – a critical review.

International Journal of Service Industry

Management, Vol. 16, No. 1, pp. 107-121.

Edvardsson, B., Olsson, J. 1996. Key concepts for new

service development. The Service Industries Journal,

Vol. 16, pp. 140–164.

Flavián, C. and Miguel Guinalíu, M. & Torres, E. 2006.

How bricks-and-mortar attributes affect online

banking adoption. International Journal of Bank

Marketing Vol. 24 No. 6, 2006 pp. 406-423

Gibbs, P. T. 1998. Time, temporality and consumer

behaviour. A review of the literature and implications

for certain financial services. European Journal of

Marketing, Vol. 32, No. 11/12, pp. 993-1007.

Goldstein, S. M., Johnston, R., Duffy, J. and Rao J. 2002.

The service concept: the missing link in service design

research?. Journal of Operations Management, Vol.

20, No. 2, pp 121-134.

Grönroos, C. 2006. Adopting a service logic for

marketing. Marketing Theory, 6, pp. 317-333.

Gummesson, E. 1991. Marketing revisited: the crucial role

of the part-time marketers. European Journal of

Marketing, Vol. 25 No. 2, pp. 60-7.

Harvey, M. and Novicevic, M.M. 2001. The impact of

hypercompetitive “timescapes” on the development of

a global mindset. Management Decision, Vol. 39, No.

5/6, p. 448.

Harvey, M. G., Kiessling, T.S. and Richey, R.G. 2008.

Global social time perspectives in marketing: a

strategic reference point theory application.

International Marketing Review, Vol. 25, No. 2, pp.

146-165.

Jenkins, R. 2002. In the present tense: time, identification

and human nature. Anthropological Theory, Vol. 2 No.

3, pp. 267-280.

Johnston, R., and Clark, G. 2001. Service Operations

Management. Prentice-Hall, Harlow, UK.

Khatchadourian, H. 1961. “On time”, Philosophy and

phenomenological research, Vol. 21, No. 4, pp. 456-

466.

Matthing, J. Sanden, B & Edvardsson, B. 2004. New

service development: learning from and with

customers. International Journal of Service Industry

Management. ,Volume: 15 Issue: 5 Page: 479 - 498

Menor, L. , Tatikonda, M. V. and Sampson, S. E. 2002.

New service development: areas for exploitation and

exploration. Journal of Operations Management,

Volume 20, Issue 2, April 2002, Pages 135-157.

Munn, N. D. 1992. The cultural anthropology of time: a

critical essay. Annual Review of Anthropology, Vol.

21, pp. 93-123.

Rowley, J. 2002. Using Case Studies in Research.

Management Research News Volume 25 Number 1,

pp. 16-27

Rowley, J. 2004. Just another channel? Marketing

communications in e-business. Marketing Intelligence

& Planning Vol. 22 No. 1, pp. 24-41

available at: www.nova.edu/ssss/QR/QR3-

3/tellis2.html (accessed 15 December 2005).

Turnbull, S. 2004. Perceptions and experience of time-

space compression and acceleration, The shaping of

leaders’ identities. Journal of Managerial Psychology

Vol. 19 No. 8, 2004 pp. 809-824.

Ming-Sung Cheng, Shih-Tse Wang, E., Ying-Chao Lin,

J.& Vivek, S. D. 2009. Why do customers utilize the

internet as a retailing platform? A view from consumer

perceived value. Asia Pacific Journal of Marketing

and Logistics Vol. 21 No. 1, 2009 pp. 144-160.

ICE-B 2009 - International Conference on E-business

214