CAUTIOUS AND SKEPTICAL SHOPPERS

Exploring Special Participant Behavior in China’s C2C Market

Yifan Li

Management School, Fudan University, 670 Guoshun Road, Shanghai, China

Ling Zhu

School of Business, East China University of Science and Technology, 130 Meilong Road, Shanghai, China

Yuning Zu

Anran Corporation, Chicago, IL U.S.A.

Keywords: Consumer-to-consumer, China, Consumer behavior, Market analysis, Localization strategy.

Abstract: Despite the growing body of literature on consumer behavior in electronic markets, previous research has

focused on western customers and cultures rather than upon China, the world’s largest netizen community.

In this paper we conduct structured in-depth interviews with 15 experienced buyers and sellers in China’s

consumer-to-consumer electronic market. Based on the interview results, we characterize the special

behavior of sellers and buyers in China, specifically focusing on the level of market maturity and economic

status. We further analyze the economic foundation of their behavior and use the eBay and Taobao case to

illustrate the importance of understanding the behavior.

1 INTRODUCTION

By the end of 2008, the number of Internet users in

China has reached 290 million and become the

biggest online population in the world. With more

than 130 percent growth rate, online retail sales in

China exceeded one hundred billion RMB in 2008

and accounted for one percent of total yearly sales

for retail and food services (iResearch, 2008). Eighty

million Internet users shop online and boost China’s

emerging consumer electronic market.

Attracted by the promising future, many

international companies such as Amazon and eBay

invested heavily on China’s e-business markets.

However, these dominant e-commerce market

makers in the United States face many challenges

when they try to replicate their success in China.

Previous research compared the differences

between international and local firms at the

This research is funded by the National Innovation Foundation of

Chinese Science and Technology Committee, and subject to the

project “Internet supervising system based on behavior analysis”

(No: 08DZ1191000).

corporate level (Lin and Li, 2005; Li, et. al. 2009).

However, few studies focus on the behavior of

participants in consumer-to-consumer (C2C)

markets, especial the consumer behavior in the big

emerging C2C markets in China.

In this research, we conduct structured in-depth

interviews with 15 persons who are experienced

buyers or sellers in online C2C markets. The results

characterize the different behavior of C2C

participants in China.

In following sections, we first review the general

business environment in China. Based on the

interview results, we characterize the sellers and

buyers’ behavior in China’s C2C market,

specifically focusing on the level of market maturity

and economic status. We further analyze the

economic foundation of their behavior and use the

eBay and Taobao case to illustrate the importance of

understanding the behavior.

151

Li Y., Zhu L. and Zu Y. (2009).

CAUTIOUS AND SKEPTICAL SHOPPERS - Exploring Special Participant Behavior in China’s C2C Market.

In Proceedings of the International Conference on e-Business, pages 151-158

DOI: 10.5220/0002191201510158

Copyright

c

SciTePress

2 STRINGENT BUSINESS

ENVIRONMENT IN CHINA

Since 1978, following the Reform and Open Policy,

China has been in the transition from the planning

economy to the free-market economy for thirty

years. Although China’s GDP has been growing at

the highest rate among all countries in recent years,

the business environment in China is still unfledged.

As to online business, it is an interesting but a quite

different story compared to developed countries. To

understand China’s C2C market, we first briefly

review China’s overall business environment from

both the business side and the consumer side.

2.1 Constraints on Small Businesses in

China

Although investment climate in China has been

improving dramatically in recent years, restricted

government regulation, heavy taxation, the shortage

of financial and professional services, and lack of

credit systems greatly Constraints the growth of

many brick and mortar small businesses.

China has one of the most complicated systems

of business registration. Many arising small

businesses have been stranded by strict registration

polices and tedious approving procedures. Business

registration and licensing are required for many

informal and flexible jobs such as shoe polishers,

handymen, and booth sales. In some cities, the labor

work and even scavengers need to be officially

registered; otherwise they will be treated as illegal.

As a comparison, in developed countries, self

employed individuals can work without registration,

as long as they follow the rules and pay taxes.

According to World Bank’s “Doing Business

2008” (World Bank, 2007), in China, registering a

company requires 13 administrative procedures,

taking an average of 35 days at a cost of 8.4% of

income per capita compared to 6 procedures, 6 days,

and 0.7% of income per capita in the United States.

Furthermore, the minimum capital of 190.2% of

income per capita becomes a high entry-barrier for

many entrepreneurs.

During the business operation, small firms face

very heavy taxes and fees including 33% corporate

income tax, 17% value added tax (VAT), 5.5%

business tax, and additional taxes (Kim, et. al. 2006).

The corporate income tax leads to double taxation

for many proprietors and business partners as their

incomes are subject to personal income taxes. In

addition to the taxes, some government agencies

collect miscellaneous fees from non-state owned

firms. For example, in a survey in a small city in

2005, 23 firms were charged a total of 12 million

RMB fees compared to 3.9 million taxes. Small

firms cannot maintain a profit margin for a

sustainable growth

In China, professional services such as financial,

accounting, and payment services are difficult to

find. Among those, the biggest problem is lack of

capital and investment. Although bank loan and

credit are the major form of new capitals for small

businesses, the shortage of co-signers and collaterals

makes it hard to get the loans. Moreover, due to the

limited operational power of local government

institutes, many start-up funds and project contracts

designed to support small businesses can hardly

reach the entrepreneurs in need. For example, one

government agent only approved ten

uncollateralized small loans for startups in five

years.

Currently the free-market economy in China is

still unfledged. Personal and corporate credit

systems have barely emerged but not been widely

adopted. On the other hand, the business morals

inherit from the long time planning economy such as

“cheat nobody, neither the old nor the young” and

“being honest and keeping promise” have been

much weakened because of the intense competition

and immature protection by the current laws. In

developed countries, either shoppers or buyers

cherish their credit so much that they would never

leave anything unpaid. There is no such trust and

punishment established in China yet. Therefore, the

majority of buyers and sellers would rather use cash,

even for online transactions.

2.2 Low-end Consumers

Base on the data published by National Bureau of

Statistic of China, the net annual income per capita

in 2008 is 15,781 RMB ($2,321) in urban area and

4,761 RMB ($700) in rural area. Despite of the high

growth rate of income per capita in China, its

absolute income level is still quite low compared to

that in developed countries.

Cheap labor costs in China have been well

explored in the past two decades. In the last few

years the government signed a series of labor laws to

protect worker’s right such as the minimum hourly

rate. But compared to developed countries, the

absolute labor cost in China is still low. For

example, the part time hourly rate in Beijing where

the labor rate is the highest among all other cities is

9.6 RMB ($1.41) per hour.

ICE-B 2009 - International Conference on E-business

152

Based on the statistics from China Consumer’s

Association, consumer’s time and money spent for

rights protection is much higher than the actual

compensation. The low compensation rate cannot

enforce the punishment to sellers who broke the

laws. According to officials in China Consumer’s

Association, even a consumer won a lawsuit, the

average compensation he or she can get is only 700

RMB ($103), which is extremely low. While in the

U.S., the average compensation per case is $350,000

in 2007, about 3,700 times more than it in China.

Series of the consumer rights protection laws need to

be revised to keep up with the market change.

Besides the low compensation in money, consumers

who sue a company usually are overwhelmed by the

tasks to get evidence, make a complaint following

proper procedures, and push through the process of

investigation, lawsuit and final settlement. The time

of the whole procedure is quite long. Even though a

consumer won a case, he or she actually lost more.

Practically, considering the time, money, and energy

spent in rights protection, consumers are better off to

do nothing.

3 EMERGING C2C ELECTRONIC

MARKET

Online electronic markets in China quickly boom in

the past few years. Compared to set up a brick and

mortar business in China’s stringent business

environment, it is much easier and efficient to set up

a business online. Invested by Alibaba, the largest

B2B company in China, Taobao.com was founded in

2003, focusing on the C2C market. In 2007, the total

revenue for online C2C transaction in China reached

5.18 billion RMB (740 million dollars), while

Taobao alone accounted for 84.9% of it (iResearch,

2008). Despite the large proportion of the C2C

market share, Taobao does not make attractive

profits itself. Even though, attracted by the potential

of this huge, emerging value added market, other

major players such as Baidu.com, TOM-eBay

China, and Paipai.com also launched their

marketplaces and intensified the competition in the

C2C market.

There are 1.05 million active online stores in

China’s online market. 850 thousand of them, eighty

percent of the online stores, are on Taobao. Among

1.17 million online sellers, 1.05 million are on

Taobao’s platform (iResearch, 2008). However, the

average monthly income of the sellers is not high

though, about 2,080 RMB ($300) per month. As

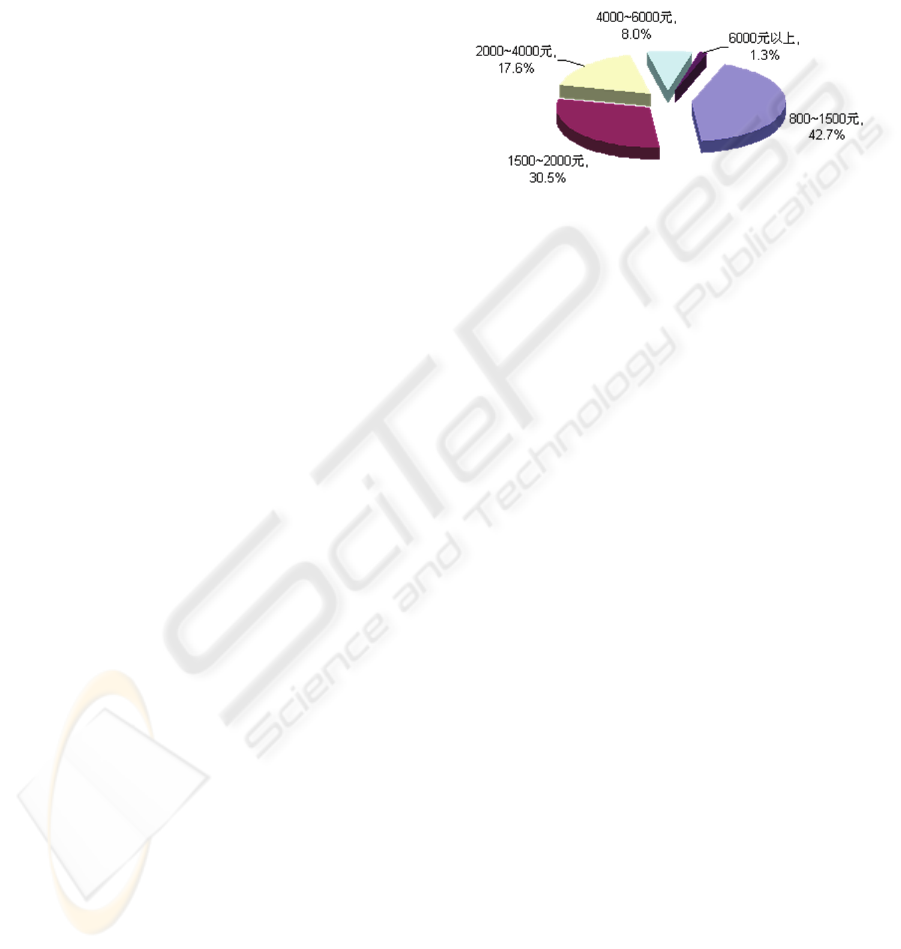

shown in Figure 1, 42.7% of the sellers have

monthly income between 800 to 1,500 RMB and

30.5% are between 1,500 to 2,000 RMB. Only top

1.3% earned more than 6,000 RMB per month.

Based on a sales survey, about 90% of the sellers are

small and they only contribute to 20% of total sales.

For example, more than two thirds of the sellers

have monthly sales lower than 2,000 RMB.

Figure 1: Monthly incomes of C2C sellers (in RMB).

The majority of buyers in the online C2C market

are white collar workers, middle class employees,

and college students between 18 to 35 years old.

Without high annual incomes, they have spare time

and energy to explore opportunities in online

markets. Female is the main body of online shoppers

in China’s C2C market. In large volume

transactions, such as apparel, cosmetic products, and

jewelry, the number of female buyers always surpass

the number of males. Other female dominated

product categories include nutrition supplements,

kitchen, home, body and bath products, toys, baby

and kids’ products, as well as pets and pet related

products. Most buyers live in urban and sub-urban

areas in big cities such as Beijing, Shanghai and

Guangzhou. People with higher education,

especially college students, contribute a great part to

C2C online transactions.

In this paper, we use orientated structured in-

depth interviews method to study the behavior of

buyers and sellers. We developed a survey online in

December 2008. Based on the survey results, we

selected fifteen individuals who are mostly qualified

for this research and made an in-depth interview

with each of them. Among the interviewees, there

are seven buyers, three common sellers, and five

professional sellers; six females and nine males;

eleven college or graduate students and four full

time workers. They are aged between 20 to 26 years

old. Ten of them do the online transactions on

Taobao only, and five have been using both Taobao

and eBay, but not other platforms. This distribution

reflects the market share of Taobao and eBay.

The in-depth interview is one to one in person

and lasts about 30 to 90 minutes. We developed two

CAUTIOUS AND SKEPTICAL SHOPPERS - Exploring Special Participant Behavior in China's C2C Market

153

survey questionnaires, one for professional sellers,

one for buyers and common sellers. The

questionnaire for professional sellers includes detail

questions such as personal information, online

shopping history, professional selling history, and

the choice of platforms; buyer’s questionnaire

includes personal information, online shopping

history and experience, and the choice of platforms.

The questionnaire for common sellers is the almost

same as buyer’s questionnaire except for additional

questions on selling experience.

Based on interviews, we find three most

important characteristics in the marketplaces: there

are many professional sellers, both sellers and

buyers are price sensitive, and lack of trust to sellers.

3.1 Professional Sellers

Professional sellers who take online sales as their

career are very active in China’s C2C market and for

many of them online stores are the only business

opportunities. In China, there are many people who

are not wealthy but have urge to make money. To

open an online store, what they need is just a

computer and the Internet. iResearch (2008) shows

that one quarter of C2C online sellers are consist of

unemployed workers, college students, or fresh

graduates. They have no or very low income,

relatively weak working skills, but plenty of time.

They could be frightened by the hurdles of setting up

brick and mortar stores in China’s stringent business

environment, or tired of endless registration

procedures and all kinds of fees. Online C2C

platforms have provided them a low threshold, low

risk, and a feasible starting point for a small

business.

The main source of income for the professional

sellers is from online transactions. They usually start

as common sellers and explore a new way of making

money online. Based on the interviews, some

college students who had no cash investment due to

their financial situation usually started as agent.

They set up an online store, post photos and product

details from other online stores with their

permission. They will pass all orders to the upstream

online stores and pay for the orders as soon as they

receive payments from their consumers. Or they

might even find upstream providers from the online

B2B market and order from there directly to make

more profit.

Not all common sellers became professional

sellers. Actually most of them just stayed as

common sellers being aware of how much time they

need to put in as professional sellers and the

intensity of competition among the online stores.

Many of these beginner sellers are opportunistic. For

them, to became a professional seller or not depends

on the profit and risk factor.

The nature of transactions made by professional

sellers and common sellers are different. Without

cash investment, common sellers sell second hand

products, coupons, or products from their upstream

channels. For professional sellers, their profit comes

from the price difference between wholesale and

retail. However, compared to offline retailers these

professional sellers do not need to register as a

company, rent an office physically, and pay

numerous taxes and fees. There is not much to lose

if they shut down the online stores. These characters

are very attractive for online retailers. The most

active online stores in the C2C marketplaces are

operated by these professional sellers. Although the

sellers operate the stores as their career, the

businesses are usually too small to be considered as

the real Business-to-Consumer scenario.

We are focusing on the professional seller

behavior in the following part through the analyses

on the characteristics of their operations.

Investment and Risk: Professional sellers need to

purchase stock from wholesalers. They have to use

push system rather than pull system to lower the cost

per product. In another word, they need to stock up.

This means risk. A professional seller who used to

be an agent said during the interview, “Compared to

the offline business, I don’t need an office for

operation. But I do need to stock up. This is risky.

But otherwise the benefit is marginal.” She is not

satisfied with her previous experience as an online

agent. “As an agent,” she said, “I cannot physically

access and examine the products I am selling and if

any problem arises, it’s hard to resolve. It’s also very

difficult to coordinate the shipping in time.” But the

key reason why she changed to be a professional

seller is that the price she got as an agent was pretty

high.

Time and energy: It is critical that sellers can be

reached at the time of a potential transaction in

China’s C2C market. Due to the culture difference

and lack of reliable credit systems, buyers usually

contact sellers online for verification before submit

any order. Like one Taobao seller mentioned, if a

seller cannot be reached at the time of sales, buyer

usually will not wait but just switch to another seller.

Therefore professional sellers need to be online most

of the time to answer buyers’ questions and avoid

any sales loss. Some professional sellers even hire

others for 24x7 online support.

ICE-B 2009 - International Conference on E-business

154

Advertising and publicizing: Advertising and

publicity are the key to boost sales because

thousands of sellers are selling similar products on

the Internet. Most of the sellers just wait passively

for consumer’s visits which have a very low

possibility. Others advertise their produces through

paid publicity on Taobao.com or replying questions

in C2C discussion boards to get their names around.

One of the professional sellers from the interview

who sells both on Taobao and eBay said that the

Advertising especially pay-per-click on C2C

platforms is really rewarding.

Product variety: To increase the overall revenue

and to lower the cost, a professional seller usually

increases the variety of products sometimes through

multiple online stores.

3.2 Price, Price, Price

Sellers’ degree of sensitivity of the fees on opening

an online store and on transactions is highly related

to their profit levels. Professional sellers can take the

fees as their operational costs. During the interview,

when asked for the fees, one professional seller said

“if Taobao starts to charge fees, I will keep selling

and transfer the fees to buyers.” Common sellers

who do not live on the income from online sales

have less frequent transactions and they sale mainly

just for experience. Therefore, they are more

sensitive to the setup costs compared to professional

sellers (Li, et. al. 2009). For the same question about

the fees, a common seller said, “I just sell some

personal belongings and not for making money. If

Taobao charges fees, I will definite switch to another

free site... If all C2C sites charge fees, I will go back

to bulletin boards, a free place.”

Due to the low income level, buyers are very

sensitive to online prices and they are willing to

spend more time on searching and comparing to get

a better deal. Therefore, they have following special

shopping behaviors: use many price comparison

websites to find the lowest price; choose sellers in

the same geographical region to save shipping cost;

buy multiple items from one seller to reduce the

shipping fee per item; buy from the same sellers

again to get discounts; use instant messaging tools to

negotiate with sellers.

Bargaining as a traditional habit in offline

Chinese stores also appears in online markets. The

root cause of the bargaining phenomenon is the low

income level. With relative low value of time,

consumers are willing to spend more time to get

lower prices. To some people, the process of

bargaining and getting a good deal becomes a game

and a pleasant experience. For this reason, the “Buy

it now” is the most popular form of pricing

mechanisms in Chinese C2C websites and only a

few auction sites. The announced prices provide an

opportunity for offline negotiations: buyers often

shop around, compare prices, and contact sellers for

better prices. Most of consumers love the

achievement of getting a good discount and do not

like the uncertainty of raising prices in auctions. A

buyer in the interview said, “I only have one auction

experience in which the bids raised from 100 to 300

RMB. I didn’t feel comfortable with the final price.

Auctions could inflate the prices. I like ‘Buy it now’

more.”

The pricing transparency and buyers’ price

sensitivity greatly reduce sellers’ profit margin.

Therefore their only strategy is low price

competition. One seller said, “The key factor for an

online store is price because that is the reason most

of buyers shop online. Many buyers are very young

and have no stable income, they are pretty

demanding on price.” Another seller said, “Produces

in my store usually are 60 to 70 RMB cheaper

compared to offline stores. For the item with a 100

RMB price tag offline, you need to offer it at 30 to

40 RMB to attract people.” Some sellers may get

compensated from volume discounts on shipping.

One seller said, “Usually shipping companies will

approach me and offer discounts. I can earn one

RMB from five RMB standard shipping fee.”

3.3 Trust Crisis

Similar to the offline market, credit deficit, a lemon

market full of counterfeit and ersatz products, and

high costs of consumer right protection widely

create a chaotic online market. Buyers do not trust

sellers and rely more on word of mouth and

reputation systems when select online stores. Serious

sellers understand the importance of credibility and

start building their reputation. An informal credit

system is gradually developed to improve the

business environment in China.

Counterfeit and ersatz products are widespread in

the offline market and it is even worse in the online

market. Based on an investigation made by China

Association of Fragrance Flavor and Cosmetic

Industries in May 2008, 90% of cosmetic products

sold online are fake and low quality produces

swamp the whole market. Similar situations occur in

other product categories. For instance, smuggled cell

phones with new design and low prices attract many

consumers and bring sellers considerable short-term

profit. However, in long run, the lack of service

CAUTIOUS AND SKEPTICAL SHOPPERS - Exploring Special Participant Behavior in China's C2C Market

155

support and regulation damage the relation between

buyers and sellers.

Compared to offline stores, it is much easier to

sell illegal products and avoid being detected and

punished because of the difficulty of monitoring and

law enforcement for online transactions. The

technologies to identify anonymous sellers,

investigate online, obtain digital evidence, and

regulate online activities are ready to deploy.

Due culture, social, and historical heritage, in

China, buyers generally take a skeptical attitude

towards sellers. Extensive counterfeit and ersatz

products and the difficulty of return and dispute

make buyers very cautious to shop online. Based on

a survey on 3119 individual online customers in

2007, 50.7% interviewees have no faith before they

could physically inspect the products and 49.5%

worry about after sales services. As previous

research revealed, lack of trust is the major hurdle in

China’s C2C online market (Peng, et. al. 2006;

Wang, et. al. 2006; Li, et. al. 2009). We illustrate the

detail representation of the lack of trust in the

following instances in China’s C2C market.

• Transactions made online are usually for cheap

products. For products with higher value,

customers usually buy offline to avoid the

uncertainty and risk. One buyer said during the

interview, “There is no guarantor or warranty

for online purchases. I would buy cheap

products online only for convenience.”

• People tend to buy from the same seller again if

they have previous satisfactory experiences,

which establish the trust on the seller.

• Buyers will intentionally investigate

questionable product categories and avoid

purchase in the market for lemons.

• Because of poor return policies, some buyers

prefer to investigate the same products in offline

stores before making online purchases.

• Reputation scores have a key impact on buyer’s

trust. Buyers use reputation scores to estimate

the quality of products and after sale services.

One buyer in the interview expressed that she

would not buy from a seller with more than two

negative feedbacks. One hundred percent

positive feedbacks make her feel comfortable to

make purchasing decisions.

• Buyers usually chat with sellers online to verify

the detail information on size, price, and quality

before submit an order. Taobao takes online

chat history as evidence to protect buyer’s right.

Customers tend to be influenced by word of

mouth from friends and family members. Buyers

trust the personal recommendations more than

advertising due to the poor credibility of some

businesses and the high cost of consumer’s right

protection. Many buyers in the online C2C market in

China made their first online purchase based on

friends’ reference.

Other than word of mouth, reputation scores are

another key factor to choose sellers. Reputation

scores capture the history of a seller’s transactions.

Bad reputation scores will discourage potential

customers. To get more positive feedbacks, online

sellers tried their best to satisfy buyers such as

providing better after sale services or even lower the

prices. Taobao encourages sellers to build good

reputation scores through series of evaluation rules.

The higher a seller’s reputation score is, the more

windows he or she can use to display produces on

Taobao.com.

4 CASE: TAOBAO VS. EBAY

On December 19, 2006 eBay, one of the most

successful e-commerce companies in the world,

announced a joint venture with TOM Online Inc.

and indicated the failure in the direct competition

with Taobao. In 2003, eBay owned over 70% market

shares and had a 10 times more advertisement

budget compared to Taobao. What were the reasons

leading to the overturn of market shares in three

years? Based on the analysis above, Taobao’s

business strategies on market targeting, service fees,

and online payment systems were better aligned with

the special participant behavior in Chinese C2C

market and therefore won the battle in short time.

4.1 Market Targeting

As illustrated above, eBay and Taobao, although

both serve the C2C market in China, have different

target markets. eBay committed to the second hand

market and friendly community; Taobao aims to

serve as an online trading platform for about 10

million owners of small and medium-sized

enterprises, which account for 95% of companies in

China and still mainly use traditional procurement

and distribution channels. It is hard for them to build

their own websites for online sales due to the lack of

technical support and financial investment (Peng, et.

al. 2008). Taobao provides an easy e-commerce

platform for these small businesses as well as start-

up companies and common sellers. Different market

targeting later leads to different focuses of service

pricing strategies.

ICE-B 2009 - International Conference on E-business

156

4.2 Service Fees

As a rule of thumb, price and fee sensitivity is

negatively correlated with income levels. The less

people earn, the more sensitive to the prices and fees

they are, and vice versa. For the low income level of

buyers and sellers, a small change in prices and fees

can bring tremendous changes in demand. Therefore

Taobao's free strategy not only makes fee-sensitive

storeowners switch from eBay, but also attracts the

majority of buyers.

4.3 Online Payment Systems

Before Alipay, Taobao’s online payment system,

buyers and sellers mainly use banking systems to

finish transactions. Once a buyer finds a product

online, the buyer and the seller will discuss the detail

of the transaction by telephone or instance

messaging. Then the seller will ship the product after

the buyer deposits the payment to seller’s bank

account electronically. Although the process is

simple, buyers make the advanced payment with the

risk of being cheated, e.g. receiving defective items

or no shipment at all. The uncertainty of transactions

and lack of trust on sellers precludes many potential

online shoppers.

eBay provides PayPal to facilitate payment and

resolve dispute. However PayPal’s transaction

framework does not fit into a financial environment

without established credit and trust. PayPal operates

purely based on its own authority as a moderator and

the protection of fully fledged credit card systems in

the developed countries. If a seller failed to fulfill

the agreement, the buyer can file a chargeback with

his or her card issuer or submit a claim to PayPal.

Cheating sellers will be punished by PayPal and

have bad records in the future. Personal credit

systems are essential to enforce the trust during

transactions. Therefore, with immature credit card

payment and personal credit systems in China, it is

difficult to replicate this mechanism (Li, et. al.

2009).

For this reason, Taobao designed Alipay as a

trusted middleman connected to existing banking

systems. A typical Alipay transation is: when a

buyer deposits the payment into his or her Alipay

account, Alipay will ask the seller to ship the order;

after the buyer receives the order and instructs

Alipay to finish the payment, Alipay will transfer the

money to seller’s Alipay account and the seller can

withdraw it through his or her bank. Banks rather

than online payment websites serve as the

fundamental payment infrastructure. In China, major

banks have very low default and bankruptcy rates

due to the support from the government.

Consequently, they are trusted and preferred by the

customers for the payment method.

Similar to the letter of credit in the international

trade, Alipay constructs the trusted relation between

buyers and sellers via banking systems. Although

buyers need to pay first, they can get refund if they

are not satisfied with the products. On the other

hand, sellers can get compensation for the shipping

for returned products.

Alipay changed the payment preference of online

consumers in China. According to our earlier

interviews in 2005, two years after Alipay was

introduced, most of online shoppers preferred

searching products online and finished the

transactions offline through cash-and-carry or cash-

on-delivery. However, during this study in 2008,

most of shoppers are comfortable with online

payment. Alipay has established the reputation and

facilitated the trust in the online market.

5 CONCLUSIONS

This paper analyzes China’s C2C market from the

perspective of participants’ behavior. Although the

Internet and globalization greatly reduce the national

barriers, the behavioral differences of consumers in

different countries are still tremendous. The

electronic markets in China form a unique type of

bazaars, not an auction based market. Both sellers

and buyers exhibit special behaviors for their social

and economic status. Recognizing these behavioral

characteristics is the first step for international

companies to understand Chinese online market and

consumers and design their localization strategies.

REFERENCES

iResearch (2008) 2007-2008 China Online Shopping

Research Report, Shanghai, P.R. China: iResearch

Consulting Group

Kim, W. G., Ma, X., & Kim, D. J. (2006) Determinants of

Chinese hotel customers’ e-satisfaction and purchase

intentions, Tourism Management 27, 890-900.

Lin, Z., & Li, J. (2005) The online auction market in

China: a comparative study between Taobao and

eBay. the 7th international conference on Electronic

commerce (pp. 123 - 129). Xi'an, China, ACM New

York, NY, USA.

Li, Y., Lu, X., Zhang, Y., and Zhu, L. (2009) Examining

Factors that Caused eBay's failure against Taobao in

China: A Case Study, International Conference on e-

CAUTIOUS AND SKEPTICAL SHOPPERS - Exploring Special Participant Behavior in China's C2C Market

157

Commerce, e-Administration, e-Society, and e-

Education, Singapore.

Peng, L., Chen, Z., and Li, Q. (2006) Model and Method

for Evaluating Creditability of C2C Electronic Trade,

the 6th international conference on Electronic

commerce, August 14–16, 2006, Fredericton, Canada

Peng, L., Chen, J., & Li, Q. (2008) The e-commerce

transaction statistics in developing countries, the 10th

international conference on Electronic commerce,

Innsbruck, Austria: ACM, New York, NY, USA

Wang, Z., Zhang, Z., and Zhang, Y. (2006) Towards

Enhancing Trust on Chinese E-Commerce, Frontiers

of WWW Research and Development - APWeb 2006,

LNCS 3841, pp. 331–342.

World Bank. (2007) Doing Business 2008, Washington,

DC.

ICE-B 2009 - International Conference on E-business

158