A REFERENCE MODEL FOR ANALYZING MOBILE

NETWORK OPERATORS’ STRATEGIC POSITIONING

Antonio Ghezzi and Andrea Rangone

Politecnico di Milano, Department of Management, Economics and Industrial Engineering

Piazza Leonardo Da Vinci 32, 20133 Milan, Italy

Keywords: Mobile Telecommunications, Mobile Network Operators, Strategy, Reference Model, Multiple Case

Studies.

Abstract: The revolutionary changes the Mobile Telecommunications Industries is going through are forcing the

Mobile Network Operators (MNOs) to radically reshape their strategies, according to the newly emerged

market’s value drivers. The purpose of this study is to provide an original reference model for supporting

the analysis of MNOs’ strategic positioning. Employing the multiple exploratory case studies research

methodology, the study identifies five dimensions or classification variables - Content creation &

innovation management, Mobile Advertising integration, Communities and Social Networking focus,

Charging & billing systems leverage and Network infrastructure management – through which describing

and assessing an MNO’s strategic positioning; consequently the model is applied to the four Italian

operators, so to obtain a validation as well as a picture of the adopted strategic positioning. The findings

show two alternative and quite contradictory “strategic extremes” the operators are swinging between seem

to be emerging: the Pure Carrier positioning, and the Media Company positioning. In between, the Smart

Pipe positioning sees the operator making the most out of its assets, gaining the role of the third parties’

offer enabler.

1 INTRODUCTION

After many years of unquestioned market leadership

in the Mobile Telecommunications industry, mainly

due to the possession of inimitable assets and to the

unique relationship established with the end

customer, the Mobile Network Operators (MNOs)

are currently finding themselves in the midst of a

period of turbulent market transition, where the

different interacting dimensions of uncertainty make

an accurate prediction of the environment’s

development virtually impossible (Courtney et al.,

1997).

The decline of voice services revenues (Muller-

Veerse, 1999; Arthur D. Little, 2001;), the refocus

on the Mobile Content segment, the crisis of the

traditional “walled garden” approach that drove to

an higher openness to off portal, the rise of third

parties with the need of developing appropriate

agreements and revenue sharing models (Maitland et

all., 2002; Olla, Patel, 2002; Kuo, You, 2006;

Peppard, Rylander, 2006), and the imminent

revolution determined by the clash with the Internet

industry are only some of the challenges the

operators are now forced to face.

Therefore, in the short run, the key issue for

MNOs will definitely be the structural rethink of

their strategies and business approaches.

When confronting this strategic priority,

however, MNOs appear to be lacking a clear

direction, and the strategies they are adopting are far

from being unambiguous.

Though initially all operators showed a strong

interested in shifting from the “must carry” to the

“must offer” paradigm – the first seeing the

availability of the network infrastructure as the core

asset and source of competitive advantage, while the

second recognizing the role of the multimedia

content and services portfolio provisioned as the true

market essential facility, recently this trend seems to

be inverted, and some players are starting to

consider the option of withdrawing from the

downstream activities of the chain to refocus on the

core business, that is, the activities related to

network provisioning.

Given this gradual departure from the initial

50

Ghezzi A. and Rangone A. (2009).

A REFERENCE MODEL FOR ANALYZING MOBILE NETWORK OPERATORS’ STRATEGIC POSITIONING.

In Proceedings of the International Conference on e-Business, pages 50-56

DOI: 10.5220/0002223600500056

Copyright

c

SciTePress

generalized approach, it becomes increasingly

important to identify which are the main strategic

positioning alternatives the MNOs can now adopt, as

well as which core assets they will have to leverage

on to succeed in the unsettled Mobile Value

Network.

Nevertheless, the undergoing radical internal and

external changes make it more and more difficult to

understand which drivers or classification variables

will allow to discriminate from one strategic

positioning to another.

In the light of the portrayed situation, the

purpose of this paper is to develop a model capable

of supporting the strategic positioning analysis of

Mobile Network Operators: through the definition of

a set of relevant “strategic dimensions”, whose

combination gives rise to a specific strategic

positioning, the model will allow to infer how the

operators are reshaping their business configuration,

and what solutions are currently adopting.

The study, focused on the MNOs operating in

the Italian Mobile Telecommunications market, is

structure as follows: at first, the research

methodology employed will be analyzed;

afterwards, the original MNOs’ strategic positioning

reference model developed will be presented, and

consequently applied to the four Italian MNOs; as a

conclusion, the study’s key implications will be

discussed, and some indications for future works

will be provided.

2 RESEARCH METHODOLOGY

The present research is based on case studies,

defined by Yin (2003) as “empirical inquiries that

investigates a contemporary phenomenon within its

real-life context, especially when the boundaries

between phenomenon and context are not clearly

evident; and in which multiple sources of evidence

are used”.

Qualitative research methodology was chosen as

particularly suitable for reaching the research

objectives, which aim at understanding the complex

phenomenon of strategic positioning within a given

industry – i.e. Mobile Telecommunications – and

with reference to a specific typology of players –

MNOs, and thus at building new theory – or

extending existing theories – on it.

To accomplish the previously identified research

propositions, from January to June, 2008, in-depth

exploratory case studies on the 4 companies

possessing a license for acting as a Mobile Network

Operator in Italy – TIM, Vodafone Italy, 3 Italy and

Wind – were performed. In addition to this, so to

obtain a better insight concerning MNOs’ strategies

and positioning, the 4 case studies, made of 16

interviews, were integrated by information collected

through a further set of 90 case studies on “third

party” firms involved in business activities with the

previously identified operators. These additional

case studies, performed in the same period of time,

were carried out within the wider 2008 Mobile

Content Observatory research (Bertelè et all., 2008).

As a whole, 138 interviews – both face-to-face and

phone interviews – were held with 110 persons

identified as key participants in the MNOs’ strategy

definition process at different levels, as well as

informants belonging to third party firms. The

population of informants included top and middle

managers – e.g. Presidents Chief Executive Officers,

Chief Information Officers, Chief Financial Officers,

Marketing & Sales Managers, Project Manager,

Software Engineers and Developers. The semi-

structured nature of the questionnaire made possible

to start from some key issues identified through the

literature, but also to let innovative issues emerge.

The choice of focusing the research on the

Italian Mobile Telecommunications context is

justified by its very characteristics: on the one hand,

the market is extremely mature (Informa Telecoms

& Media, 2008), but on the other it has always been

positioned at the forefront in industry innovation at a

global level (Bertelè et all., 2008).

Coherently to the research methodology

employed (Pettigrew, 1988), firms were not

randomly selected, but the theoretical sample was

made of firms that conformed to the main

requirement of the study, while representing both

similarities and differences considered relevant for

the data analysis.

A multiple case study approach reinforced the

generalizability of results (Meredith, 1998), and

allowed to perform a cross analysis on the variables

under scrutiny, to pinpoint differentials in terms of

strategic positioning – to see which variables

changed and which remained constant going from

one alternative to another, due to the presence of

extreme cases, polar types or niche situations within

the theoretical sample (Meredith, 1998).

Since the research needed to focus to different

subunits of analysis, the embedded (i.e. multiple unit

of analysis) case studies was adopted. The scheme of

analysis developed included the following main

units of analysis:

company profile;

business model components;

products and services performances;

A REFERENCE MODEL FOR ANALYZING MOBILE NETWORK OPERATORS' STRATEGIC POSITIONING

51

value network positioning;

strategy developed.

As the validity and reliability of case studies rest

heavily on the correctness of the information

provided by the interviewees and can be assured by

using multiple sources or “looking at data in

multiple ways” (Eisenhardt, 1989; Yin, 2003),

multiple sources of evidences or research methods

were employed: interviews – to be considered the

primary data source, analysis of internal documents,

study of secondary sources – research reports,

websites, newsletters, white papers, databases,

international conferences proceedings. This

combination of sources allowed to obtain “data

triangulation”, essential for assuring rigorous results

in qualitative research (Bonoma, 1985).

3 THE STRATEGIC

POSITIONING ANALYSIS

REFERENCE MODEL

The research carried out through the multiple case

studies allowed to shed light on the key dimensions

or classification variables that make it possible to

discriminate from different strategic positioning

alternatives, thus making inferences on the main

configurations the Italian MNOs are adopting.

The findings are synthesized in the “MNO

strategic positioning reference model” below

provided, which identifies five macro-dimensions:

1. Content creation & innovation management: it

expresses the operator’s presidium of the

upstream activities related to content creation,

aggregation and publishing, as well as the

overall process of content & services portfolio

innovation, typically performed by third parties

– Content Providers (CP) or Mobile Content &

Service Providers (MCSP). A high level of

involvement in the control and management of

third parties’ offers published “on deck”, i.e. on

the operator’s mobile portal, indicates that

concentrating in the Mobile Content segment

represent a strategic priority for the MNO.

2. Mobile Advertising integration: it refers to the

integration of Mobile Advertising within the

operator’s overall business model. An high

diffusion of Advertising-based models

promoted by the operator expresses its vocation

to act as a “Media Agency”, consequently

extending its core business towards neighboring

and complementary areas.

3. Communities and Social Networking focus: it

expresses the operator’s approach towards

Social Networking and Community value added

services. Such services clearly represent the

new differentiation driver of the Mobile Content

offer, the only element capable of increasing the

end customer’s “stickiness”. Thanks to the

concept of interaction Social Networking relies

on, which constitutes the true value of mobile

communications, this service category shall

become the package all other services like

Infotainment, Mobile Games, Music and Video,

are bundled in: by placing the content in the

middle of users interactions, the operator can

exploit all the offer portfolio synergies at his

hand, thus creating a unique user experience.

Therefore, the choices related to the role the

MNO decides to take on regarding Social

Networking – also with reference to the

possibility of integration with the Web Instant

Messaging communities – will strongly affects

its positioning, reflecting its resolution of either

actively covering the downstream activities of

the Mobile Content value network, or to

relegate itself to data traffic transferring. In fact,

should the operator give up the control of Social

Networking, and grant its customer base an

access to the Internet Instant Messaging

communities, it would attract a large number of

potentially new users, benefiting from revenues

from data traffic; on the other side of the coin,

however, it would risk to cannibalize its

traditional messaging services – like Sms and

Mms, losing the related sources of revenues.

4. Charging & billing systems leverage: it

concerns the exploitation of the operator’s

charging and billing proprietary systems and the

provision of such core asset to third parties, to

enable the mobile transactions between them

and the end users. Being the operator the only

actor within the Value Network qualified to

charge and consequently bill the content and

services cost to the end users’ credit, third

parties’ offer shall inescapably pass through the

establishment of an agreement with the MNO to

rely on its unique systems. The higher the

leverage on this asset, and the wider the number

of partners with a granted access to these

system, the more open the operator towards

third parties: in such scenario, the MNO is

configured as a facilitator and enabler of other

player’s business.

5. Network infrastructure management: it indicates

the extent to which an operator focuses on the

ICE-B 2009 - International Conference on E-business

52

provisioning of network infrastructure

functionalities to third parties, like

interconnection, connectivity, data transfer and

network operations management. An high rank

on the network infrastructure management

dimension shows the MNO’s willingness to

concentrate on the role of “bit pipe” provider.

While variables 4 and 5 are mentioned in

literature – for instance, see Kuo, Yu (2006) and

Peppard, Rylander (2006), the other three are

originally identified through the case studies, thus

representing an extension to existing theory.

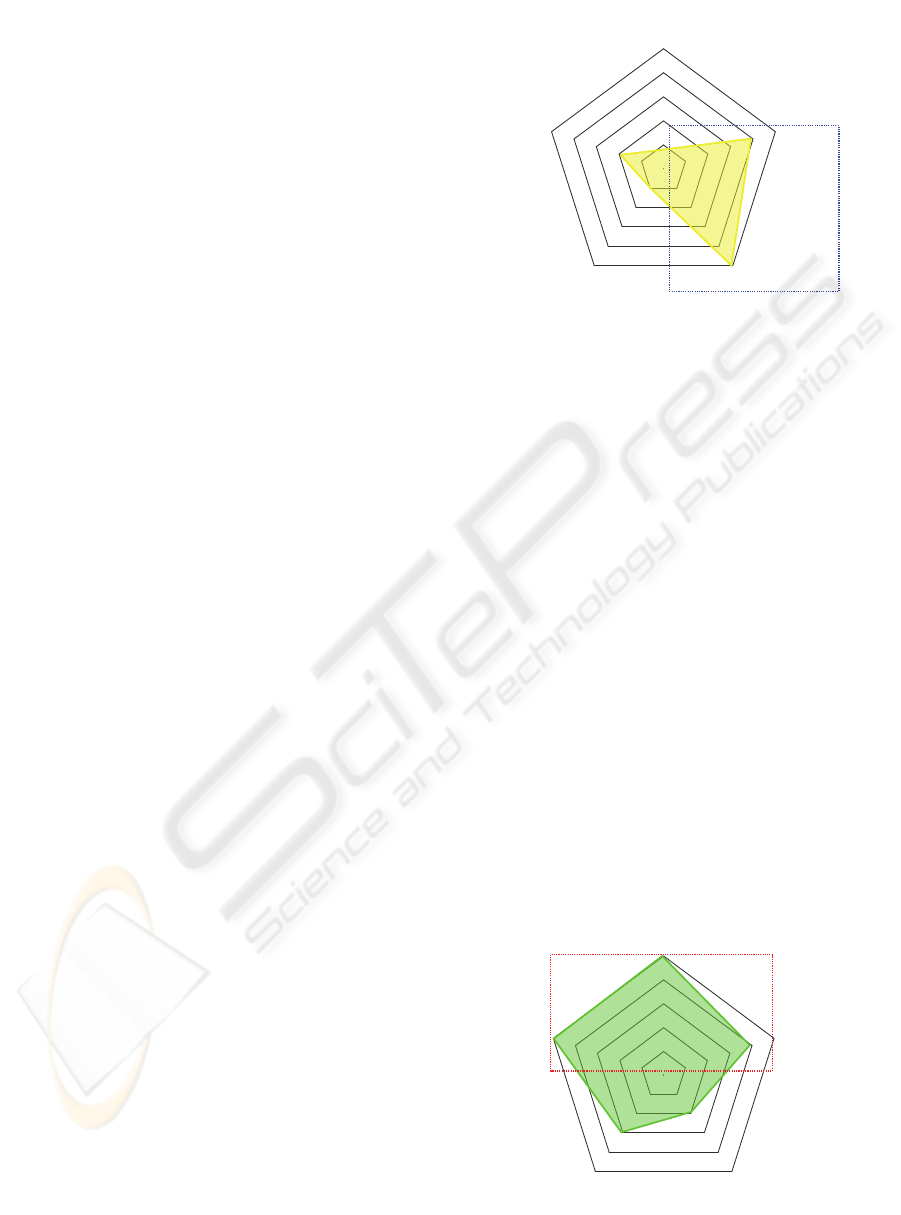

Content

Content

Creation

Creation

&

&

Innovation

Innovation

Management

Management

Network

Network

Infrastructure

Infrastructure

Management

Management

Charging

Charging

&

&

Billing

Billing

Systems

Systems

Leverage

Leverage

Mobile

Mobile

Advertising

Advertising

Integration

Integration

Communities

Communities

&

&

Social

Social

Networking

Networking

Focus

Focus

MEDIA

MEDIA

COMPANY

COMPANY

PURE

PURE

CARRIER

CARRIER

SMART

SMART

PIPE

PIPE

Figure 1: The MNO Strategic Positioning Pentagon

Model.

The original “MNO Strategic Positioning

Pentagon” model shows the combined coverage of

the five dimensions, drawing a perimeter that

delimitates the current MNO’s business scope.

Different combinations of the previously

identified dimensions can give rise to three main

strategic positioning an MNO could adopt:

1. the Media Company positioning;

2. the Pure Carrier positioning;

3. the Smart Pipe positioning

The Media Company positioning sees the MNO

strongly involved in the end-to-end activities related

to the creation, management and delivery of mobile

digital content. The operator exerts a strong control

on the content published on the mobile portal and on

the related revenues, typically establishing revenue

sharing models where limited margins are paid off to

third parties. At the same time, the MNO is

interested in acquiring a significant share of the

revenues related to Mobile Advertising, and tries to

operate as a Media Agency as well.

Therefore, an operator positioned as a Media

Company will be characterized by an unbalance

towards “Content creation and innovation

management” and “Mobile Advertising integration”

The Pure Carrier positioning, on the contrary, is

based on the refocus on the original core business,

that is, the activities related to the network

infrastructure and the provisioning of its

functionalities – e.g. interconnection, access,

connectivity, bandwidth. The logic underlying such

reorientation, similar to the trend that took place in

the Internet market involving the Internet Service

Providers, is that the MNO has gone too far in

extending its reach on the value network activities,

abandoning its core and entering new areas it does

not have the right resources and competences to

cover. Therefore, by giving up the direct control of

some downstream activities, by granting access to its

customer base to new entrants – like the Web

Companies – and by concentrating on data transfer,

the MNO would significantly increase the network’s

traffic, benefiting from higher revenues from

network provisioning. The risk related to this option

is to experience a depletion of the operator’s role:

after having undertaken heavy investment to install

the infrastructure and acquire 3G licenses, it would

not be able to retain an adequate share of the

revenues it is enabling.

Within the model, this positioning is expressed

by the prevalence of “Network Infrastructure

management” and, to some extent, of “Charging &

billing systems leverage” dimensions over the

others.

In between these two “strategic extremes”, a

continuum of alternative solutions are available. The

most significant that is worth mentioning is the

emerging Smart Pipe strategic positioning.

In such configuration, the MNO leverages on the

overall range of its core assets, i.e. the network

infrastructure, the 3G licenses, the charging &

billing systems, the proprietary distribution

channels, the strong brand awareness, the direct

access and deep knowledge of its customer base – in

terms of users profiles and behavior – to propose a

portfolio of enabling and facilitating business

services to the market’s third parties – e.g. MCSPs,

CPs, Advertisers. Therefore, the MNO takes on the

role of enabler and facilitator of its partners’ offer:

on the one hand, withdrawing from some

downstream activities more related to the market

making of content and services; but on the other,

enhancing its undercurrent position of foundation of

the whole value system.

The “Smart Pipe” concept stresses the fairly new

combination of a “bit pipe” role, where the MNO

mainly acts as a carrier, with a more far-seeing

thorough management of its assets. According to

this vision, the network, from being the operators’

A REFERENCE MODEL FOR ANALYZING MOBILE NETWORK OPERATORS' STRATEGIC POSITIONING

53

core business, becomes “core to their business”

(Nordmann, 2006).

The revenues streams the operator benefits from

are mainly related to data transfer, charging &

billing fees, advertising fees and a further fee for the

provision of data and information concerning the

end user – track history, profiles and preferences,

usage data etc.

A Smart Pipe positioning is characterized by a

focus on the Charging & billing systems leverage

and the integration of Mobile Advertising modes, as

well as by a heavy control over Social Networking,

seen as the “umbrella service” under which all

others are bundled.

After having described the original model’s

constitutive variables, in the next section it will be

applied to the four Italian MNOs, so to test the

framework validity and get a valuable insight on the

actual “state of the art” concerning the operators’

strategic positioning.

4 THE MODEL APPLICATION

TO THE ITALIAN MNO

The application of the model to the 4 Italian MNOs

allows to gain a significant insight on the main

strategic positioning alternatives these actors are

currently adopting, as well as to obtain a first model

validation.

According to the both qualitative and

quantitative information collected through the case

studies, an Interval or “Likert-like” scale was

employed to evaluate the coverage of each

dimension: a 0 to 5 ranking was then associated by

the authors to each classification variable for every

MNO. The rationale followed implies that the higher

the ranking on a given variable is, the more the

operator focuses on such dimension in shaping its

strategic positioning.

The operator Wind seems prone to adopt a Pure

Carrier positioning: its recent investments are

mainly directed towards the enhancement of the

network infrastructure management, as well as

towards the proper leverage on charging & billing.

The i-mode business model adopted – licensed

from the Japanese operator NTT DoCoMo – and the

related revenue sharing agreements, characterized by

high shares granted to content and service providers,

leave wide discretion to third parties, without a strict

control over their activity; the access to the

operator’s billing platforms is also granted with little

constraint to a plethora of partners.

The MNO focuses its Mobile Content offer on

Infotainment browsing rather than innovative and

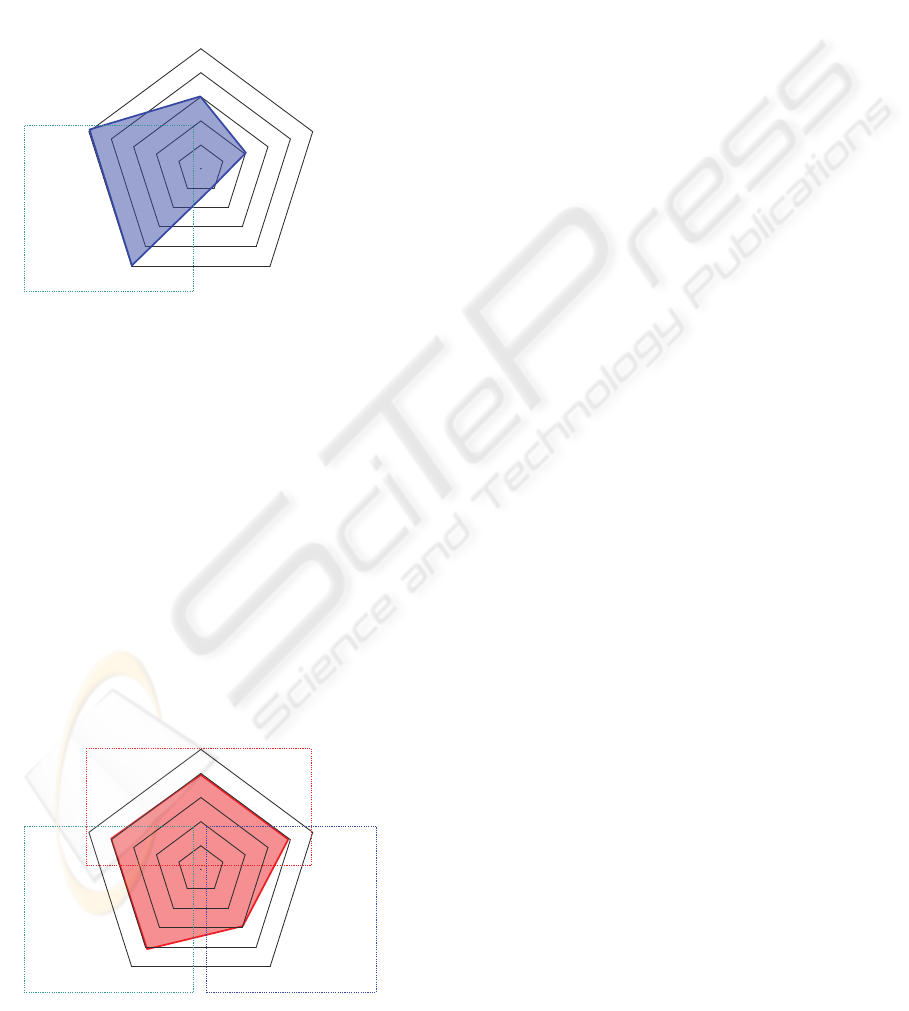

Content

Content

Creation

Creation

&

&

Innovation

Innovation

Management

Management

Network

Network

Infrastructure

Infrastructure

Management

Management

Charging

Charging

&

&

Billing

Billing

Systems

Systems

Leverage

Leverage

Mobile

Mobile

Advertising

Advertising

Integration

Integration

Communities

Communities

&

&

Social

Social

Networking

Networking

Focus

Focus

PURE

PURE

CARRIER

CARRIER

Figure 2: Wind Strategic Positioning.

multimedia services; moreover, the integration of

Mobile Advertising is only at an embryonic stage.

The operator Vodafone Italy appears to be

moving towards the renewal of its role, through a

significant trend of openness to third parties – a

survey performed within the research showed that

the number of content providers on “hybrid” or

“friendly off-net” mobile sites, i.e. partners’ external

sites with a link on the operator’s portal, was

characterized by an annual growth rate of 400%

from 2007 to 2008; at the same time, a new pricing

policy eliminating the navigation costs for the users

on hybrid sites was introduced, paralleled by a

strengthened control over the key assets of Social

Networking services – reflected by the acquisition of

the Web 2.0-oriented company Zyb, and the launch

of the mobile social network platform “Vodafone

Friends” – and of charging and billing systems. In

addition to this, a strong effort has been put on the

development of Mobile Advertising.

In the light of these consideration, it is possible

to claim that the MNO is currently positioned as a

Smart Pipe.

Content

Content

Creation

Creation

&

&

Innovation

Innovation

Management

Management

Network

Network

Infrastructure

Infrastructure

Management

Management

Charging

Charging

&

&

Billing

Billing

Systems

Systems

Leverage

Leverage

Mobile

Mobile

Advertising

Advertising

Integration

Integration

Communities

Communities

&

&

Social

Social

Networking

Networking

Focus

Focus

SMART

SMART

PIPE

PIPE

Figure 3: Vodafone Italy Strategic Positioning.

ICE-B 2009 - International Conference on E-business

54

Concerning the operator 3 Italy, last entrant in

the market, the model confirms its effort in

positioning itself as a Media Company, because of

the high innovation of the services offered – also

confirmed by the significant investments in Mobile

Tv and on the DVB-H standard, and the heavy

reliance on Advertising-based models,

counterbalanced by some limitations and criticalities

in the network-related performances.

Content

Content

Creation

Creation

&

&

Innovation

Innovation

Management

Management

Network

Network

Infrastructure

Infrastructure

Management

Management

Charging

Charging

&

&

Billing

Billing

Systems

Systems

Leverage

Leverage

Mobile

Mobile

Advertising

Advertising

Integration

Integration

Communities

Communities

&

&

Social

Social

Networking

Networking

Focus

Focus

MEDIA

MEDIA

COMPANY

COMPANY

Figure 4: 3 Italy Strategic Positioning.

As regards to TIM, the market leader in terms of

customer base, what emerges from the model’s

application is a “fuzzy” positioning, laying between

the Media Company and the Smart Pipe solutions. In

fact, on the one hand the operator has a strong focus

on the network infrastructure and the charging &

billing platform assets – inherited by its mother

company, the ex-monopolist for fixed telephony

Telecom Italia; on the other, however, it shows a

remarkable interest in developing Social Networking

services – a vivid example of this approach is

represented by the “TIM Tribe”, as well as Mobile

Advertising models. The control of content

published on portal is also high.

Content

Content

Creation

Creation

&

&

Innovation

Innovation

Management

Management

Network

Network

Infrastructure

Infrastructure

Management

Management

Charging

Charging

&

&

Billing

Billing

Systems

Systems

Leverage

Leverage

Mobile

Mobile

Advertising

Advertising

Integration

Integration

Communities

Communities

&

&

Social

Social

Networking

Networking

Focus

Focus

MEDIA

MEDIA

COMPANY

COMPANY

PURE

PURE

CARRIER

CARRIER

SMART

SMART

PIPE

PIPE

Figure 5: TIM Strategic Positioning.

As a whole, it is possible to argue that the

strategic positioning alternatives emerging through

the model’s application are significantly diverse. To

tackle the “wind of change” blowing on the Mobile

Industry, the players seem to be taking different

directions, trying to exploit the current market’s

fluidity to reposition themselves and lay the

foundations for future sustainable competitive

advantages over the competitors, both incumbents

and new entrants.

It is hard to predict which model will prevail in

the medium-long run: however, as soon as the

market situation will consolidate, and as the

positioning adopted will crystallize, the choices

made today will strongly impact on the operators’

performances and chances of success.

5 CONCLUSIONS AND FUTURE

WORKS

The research provides an original reference model

for supporting the strategic positioning analysis of

Mobile Network Operators.

The findings show that the analysis of the

reshaped operators’ positioning goes through the

definition of new key strategic dimensions.

In fact, the model identifies an original set of 5

variables – Content creation & innovation

management, Mobile Advertising integration,

Communities and Social Networking focus,

Charging & billing systems leverage and Network

infrastructure management, where the first three are

newly defined and were inferred from the case

studies performed.

Concerning the variables combinations, two

alternative and quite contradictory “strategic

extremes” the operators are swinging between seem

to be emerging: the Pure Carrier positioning, and the

Media Company positioning. In between, the Smart

Pipe positioning sees the operator making the most

out of its assets, gaining the role of the third parties’

offer enabler.

The rigor of the qualitative research method

employed and the theoretical sample’s significance

grant, reliability and, to some extent, the

generalizabilty of the model’s results. The number

of case studies, and the fact that the model’s

variables are drawn from a wide sample of cases,

while the model is then applied only to a subset of

the analyzed firms – that is, the 4 MNOs, also

contribute in limiting the issue of tautological

validity the model may be burdened with.

A REFERENCE MODEL FOR ANALYZING MOBILE NETWORK OPERATORS' STRATEGIC POSITIONING

55

The paper’s value for researchers can be brought

back to the extension of Strategic Analysis theories

with reference to the Mobile Telecommunications

Industry, thanks to the creation of a model capable

of identifying newly emerged strategic dimensions

and positioning alternatives.

The value for practitioners lies in the

provisioning of a tool for mapping existing and

future strategic positioning adopted by MNOs, thus

gaining a valuable insight on these player’s moves,

as well as on the market’s competitive configuration.

The paper represent a noteworthy attempt of

developing an ad hoc model for supporting strategic

analysis on the Mobile Industry. However, it does

not shed light on the different performances

acquirable through the adoption of a given

positioning. Future works will have to concentrate

on making the relation between positioning and

performances explicit, and on carrying out a

benchmarking analysis of the different alternatives

available.

In addition to this, concerning methodological

soundness, the model shall be applied to a different

sample of MNOs, in order to test its validity outside

the first sample which originated it, so to solve the

issue of tautological validity.

REFERENCES

Arthur D. Little, 2001. Key Success Factors for M-

Commerce. http://www.adlittle.com

Barney, J., 1991. Firm resources and sustained

competitive advantage. Journal of Management, 17

(1), 99-129.

Bertelè, U., Rangone, A. and Renga, F., 2008. Il Mobile

diventa Web. Il Web diventa Mobile. Rapporto 2008

Osservatorio Mobile Content.

Bonoma, T.V., 1985. Case research in marketing:

opportunities, problems, and a process. Journal of

Marketing Research, 22, 199–208.

Courtney H. G., Kirkland J., Viguerie S. P., 1997, Strategy

under uncertainty. Harvard Business Review.

Eisenhardt, K. M. and Graebner, M. E., 2007. Theory

building from cases: opportunities and challenges.

Academy of Management Journal, 50 (1), 25-32.

Eisenhardt, K. M., 1989. Building theories from case

study research. Academy of Management Review, 14

(4), 532-550.

Fjeldstad, Ø.D., Becerra M., Narayanan S., 2004. Strategic

action in network industries: an empirical analysis of

the European mobile phone industry. Scandinavian

Journal of Management, vol. 20, pp. 173-196.

Ghezzi, A., Renga, F. Cortimiglia, M., 2009. Value

Networks: scenarios on the Mobile Content market

configurations. Proceedings of the 8

th

International

Conference on Mobile Business (ICMB 2009), Dalian,

China.

Ghezzi, A., 2009. A strategic analysis reference model for

Mobile Middleware Technology Providers.

Proceedings of the 8

th

International Conference on

Mobile Business (ICMB 2009), Dalian, China.

Hamel, G. and Prahalad, C.K., 1994. Competing for the

future. Harvard Business School Press.

Informa Telecoms & Media, 2008. Mobile

Communications Europe, Research Report.

Kuo, Y. and Yu, C., 2006. 3G Telecommunication

operators’ challenges and roles: a perspective of

mobile commerce value chain. Technovation, 1347-

1356.

Li, F. and Whalley, J., 2002. Deconstruction of the

telecommunications industry: from value chain to

value network. Telecommunications Policy, 26, 451-

472.

Maitland C., Bauer J. M. and Westerveld R., 2002. The

European market for mobile data: evolving value

chains and industry structure. Telecommunications

Policy, 26, pp. 485-504.

Meredith, J., 1998. Building operations management

theory through case and field research. Journal of

Operations Management,16, 441-454.

Nordmann M., 2006. Squeezing the guy in the middle.

Ericsson Business Review, 24, pp.26-29.

Olla P. and Patel N. V., 2002. A value chain model for

mobile data service provider. Telecommunications

Policy, 26, pp. 551-771.

Peppard, J. and Rylander, A., 2006. From Value Chain to

Value Network: an Insight for Mobile Operators.

European Management Journal, 24 (2).

Pettigrew, A., 1988. The management of strategic change.

Blackwell, Oxford

Porter M. E., 1980. Competitive Strategy: Techniques for

Analyzing Industries and Competitors. New York,

Free Press.

Porter, M. E., 1985. Competitive advantage: Creating and

sustaining superior performance. New York, Free

Press.

Teece, D. J., Pisano, G. and Shuen, A., 1997. Dynamic

capabilities and strategic management. Strategic

Management Journal, 18 (7), 509-533.

Wirtz B. W., 2001. Reconfiguration of Value Chains in

Converging Media and Communications Markets.

Long Range Planning, 34, pp. 489-506.

Yin, R., 2003. Case study research: Design and methods.

Thousand Oaks, CA: Sage Publishing.

ICE-B 2009 - International Conference on E-business

56