SAFE REVERSE AUCTIONS PROTOCOL

Adding Treatment Against Collusive Shill Bidding and Sniping Attacks

Ribeiro Leonardo and Guerra Ruy

Computer Center, Federal University, Recife, Pernambuco, Brazil

Keywords:

Safe Reverse Auction Protocol, DSA Digital Certificate, Hash Chain, Keys Exchange, Signature Verification,

Collusive Shill Bidding, Sniping.

Abstract:

Many secure auction protocols were created. BJK (Byoungcheon Lee, Kwangjo Kim e Joongsoo Ma 2001)

defined an efficient protocol for English auctions that can be used also for Reverse auctions. Chung (Yu Fang

Chung 2008) created an improvement of BJK, however there are still some security faults that can be explored

by attackers in these two protocols. In this article, we define a protocol based on BJK that is an improvement

of it with the addition of security’s treatment to attacks of Collusive Shill Bidding e Sniping.

1 INTRODUCTION

Internet auction is today a very popular and profitable

industry. Many enterprises like Ebay, Arremate, etc;

have invested in non-presence auctions. The fact

that the auctions participants are not committed to

be in same place brought many benefits however also

many ways to cheat. There are a lot of mechanisms

of cheating and many safe auctions protocols were

created to solve them. These protocols were based

on many cryptographic concepts like: Group Signa-

ture, Threshold Cryptography, Schnorr Signature, etc.

Each solution was created to fulfill characteristics for

each type of auction (English, Reverse, Sealed, etc).

In this article we will present a protocol for reverse

auctions. The presented protocol is based in the one

proposed by BJK(Byoungcheon Lee, Kwangjo Kim

e Joongsoo Ma 2001) that works very well for En-

glish and Reverse auctions. Our protocol comes to

improve protocol with the use of digital certificates

and a module to avoid frauds techniques known as

Collusive Shill Biddings and Sniping (Trevathan, Jar-

rod and Read, Wayne 2006) that are not considered

in any actual secure auction protocol (This protocol

is being proposed to brazilian government that uses

reverse auctions to buy services).

2 EXISTING PROTOCOL

The BJK protocol is one of the best already created

but it still has some problems:

1. K

i

keys exchange are done using Diffie-Hellman

without authentication which enables ”Man in the

Middle” attack.

2. It uses Schnorr signature for authentication of bid-

der that is not very used in commercial certifi-

cates(RSA and DSA are the most used).

3. It does not consider attacks like Shill Bidding and

Sniping.

We propose a protocol wich is an improvement of

BJK where:

1. All auction’s bidders will use DSA digital certifi-

cates for authentication.

2. The keys exchange using Diffie-Hellman will be

done using DSA certificates for authentication

with bidder doing this exchange with Auctionner

through Register Manager(RM).

3. A fraud module(FM) will implement Shill Bid-

ding detection.

4. Anti Sniping policies will be implemented by

RM.

2.1 Our Protocol

2.1.1 Phases

1. Registration

(a) B

i

has a private key x

i

and a public key y

i

de-

fined in his DSA digital certificate.

239

Ruy G. and Leonardo R. (2009).

SAFE REVERSE AUCTIONS PROTOCOL - Adding Treatment Against Collusive Shill Bidding and Sniping Attacks.

In Proceedings of the International Conference on Security and Cryptography, pages 239-244

DOI: 10.5220/0002228902390244

Copyright

c

SciTePress

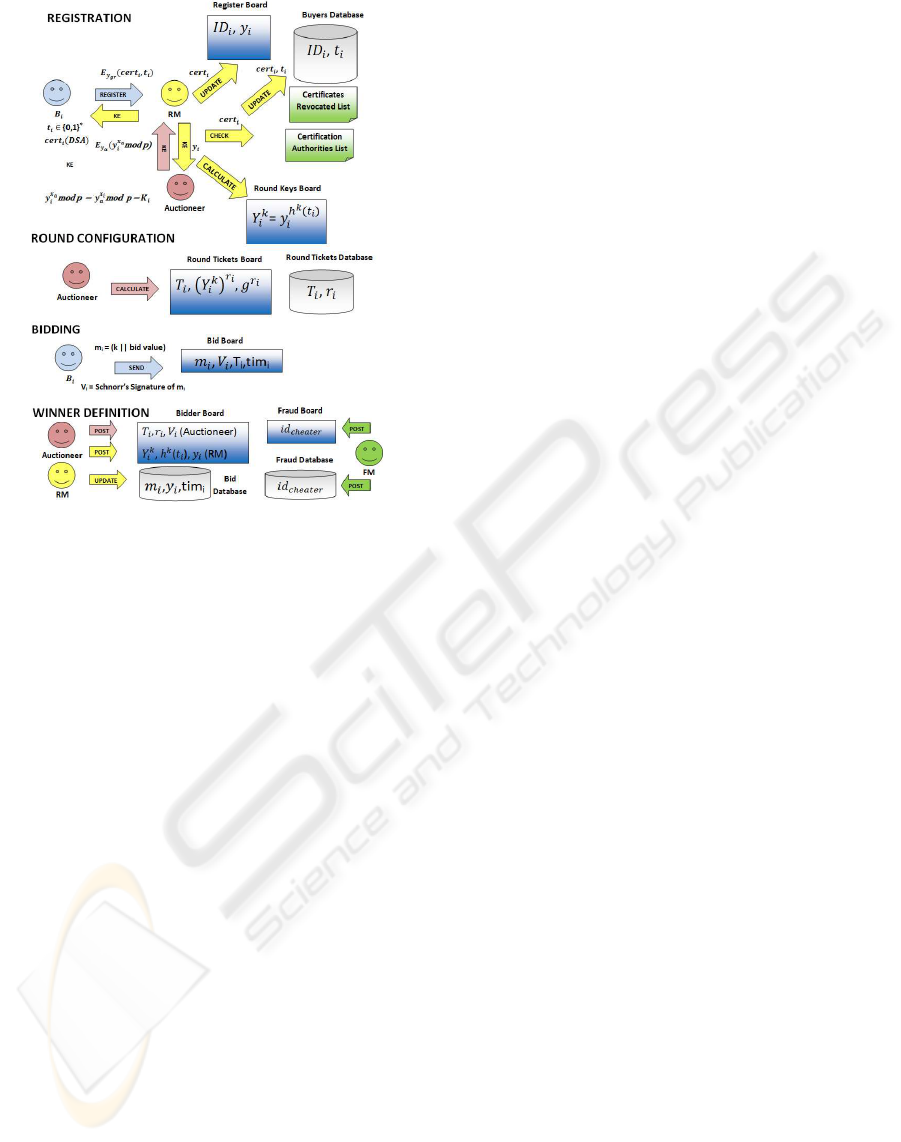

Figure 1: Protocol Phases Representation.

(b) B

i

registers in auction connecting to RM using

his certificate to create a SSL conection with

mutual authentication. The certificate is veri-

fied against CAs database. It’s verified the val-

idation of certificate’s expiration date and if it’s

in list of revocated certificates of the cerficate’s

CAs. I’t also verified if bidder id and/or public

key are in the list of mean bidders.

(c) After B

i

is authenticated, he/she chooses a ran-

dom string t

i

∈ {0,1}

∗

, keeping it safely by en-

cripting it whith his private key defined in his

digital certificate.

(d) B

i

sends t

i

and his certificate cert

i

to RM en-

cripting them with RM’s public key.

(e) RM decripts data and publish (ID

i

,y

i

) in ”Reg-

istration” board where ID

i

comes from digi-

tal certificate(Seee picture above). RM keeps

(ID

i

,t

i

) secretly in bidders database.

(f) RM calculates round key as: Y

k

i

= y

h

k

(t

i

)

i

for all

n valid bidders.

(g) RM publishes them in ”Round Keys” board.

(h) RM sends y

i

to auctioneer and ask him to gen-

erate y

x

a

i

mod p.

(i) The auctioneer calculates y

x

a

i

mod p, encrypt

it with RM’s public key and send it back to RM.

(j) RM receives data and decrypts it, send y

x

a

i

mod p to B

i

encrypting it with his public key.

(k) B

i

receives y

x

a

i

mod p , decrypts it and stores

it localy encrypts it using El Gamal algorithm.

Remember that K

i

= y

x

a

i

= y

x

i

a

defined by Diffie-

Hellman key exchange algorithm.

Remarks:

The bidder B

i

can verify if his round key is in

”Round Keys” board.

No one except RM and B

i

know the correspon-

dence of y

i

and (Y

k

i

).

2. Round Configuration

(a) Auctioneer takes the list of round keys (Y

k

i

)

from ”Round Keys” board.

(b) Auctioneer generates n random numbers

r

1

,...., r

n

∈ Z

q

for each valid bidder where q

is retrieved from public key of Auctionner

certificate (Rembering that g, p and q are the

same for all certificates of entities participating

in auction).

(c) Auctioneer calculates ((Y

k

i

)

r

i

,g

r

i

i

) where k is

the number of round, g is retrieved from public

key of Auctionner certificate and r

i

is the ran-

dom number defined as above for each bidder

B

i

.

(d) Auctioneer calculates round ticket as T

i

=

h((Y

k

i

)

x

a

) where x

a

is auctioneer’s private key.

(e) Auctioneer publishes round ticket

(T

i

,(Y

k

i

)

r

i

,g

r

i

) on ”Round Tickets” board.

(f) Auctioneer stores (T

i

,r

i

) secretly in ”Round

Tickets” database.

Remarks:

The Auctioneer does not know the correspon-

dence of y

i

and (Y

k

i

) as RM does not know from

T

i

and r

i

.

See that a bidder can verify round ticket T

i

calcu-

lating:

Let K

i

= y

x

a

i

= y

x

i

a

like defined in registration phase

and (T

i

,(Y

k

i

)

r

i

,g

r

i

)

Then

T

i

= h((Y

k

i

)

x

a

) = h((y

h

k

(t

i

)

i

)

x

a

) = h((y

x

a

i

)

h

k

(t

i

)

) =

h((y

x

i

a

)

h

k

(t

i

)

) = h(K

h

k

(t

i

)

i

) and this value can be cal-

culated by B

i

because he/she has K

i

and t

i

and

he/she knows how to calculate h

k

(t

i

).

3. Bidding

The bidder B

i

that wants to participate in round

k of auction must follow the steps defined below

while the auction’s round has not expired:

(a) Calculates his round key Y

K

i

= y

h

k

(t

i

)

i

and ver-

ifies if it’s in ”Round Keys” board defined by

RM.

(b) Calculates T

i

= (h(y

h

k

(t

i

)

a

))

x

i

and takes his ticket

(T

i

,(Y

k

i

)

r

i

,g

r

i

) in ”Round Tickets” board.

SECRYPT 2009 - International Conference on Security and Cryptography

240

(c) Verifies the ticket through ((g

r

i

)

h

k

(t

i

)

)

x

i

=?

(Y

k

i

)

r

i

. If there’s a problem, tell Auctioneer.

(d) Prepares his bid (T

i

,m

i

,V

i

) as defined below:

i. m

i

= (auction’s round number || bid’s value)

ii. Signs m

i

with Schnorr’s Signature of Knowl-

edge to assure anonymity: V

i

= (c,s)

where c = h(m

i

||(Y

k

i

)

r

i

||g

r

i

||(g

r

i

)

k

i

), s = z

i

−

c.h

k

(t

i

)x

i

mod q and z

i

∈ Z

q

.

(e) B

i

updates ”Bids” board with (T

i

,V

i

,m

i

). It’s

stored the tuple (T

i

,V

i

,m

i

,tim

i

) where tim

i

is

the time of bidding.”Bids” board verifies if bid

value is lower than current for V

i

. No one ex-

cept the bidders can update ”Bids” board.

(f) RM controls the round’s auction time. He ver-

ifies the rate of bids per minute in auction’s

round based on changes of ”Bids” board. If

there’s an anormal rise of bids in round’s last

2 minutes, time is extended more x minutes (x

is a parameter defined in auction’s round begin-

ning), avoiding this way Sniping attack.

Remarks:

Note that V

i

can be verified by anyone

that knows r

j

, h

k

(t

j

) and Y

k

j

accord-

ing to Schnorr’s signature of knowledge

c? = h(m

i

||(Y

k

i

)

r

i

||g

r

i

||(g

r

i

)

s

((Y

k

i

)

r

i

)

c

).

4. Winner Definition

(a) After auction’s round has finished, RM and

Auctionner take the lists of ”Bids”, ”Round

Keys” and ”Round Tickets” boards and find

bidders identities following the steps:

i. Auctionner takes (V

j

,m

j

,T

j

,time

j

) from

”Bids” board.

ii. Auctionner posts (T

j

,r

j

,Y

k

j

) on ”Bidders”

board that reveals the correspondence of Y

k

j

and (Y

k

j

)

r

j

. Bidder’s information becomes

(V

j

,T

j

,r

j

).

iii. RM posts (Y

k

j

,h

k

(t

j

),y

j

) on ”Bidders” board

that reveals the correspondence of Y

K

j

=

y

h

k

(t

j

)

j

and y

j

. Bidder’s information becomes

(V

j

,T

j

,r

j

,Y

k

j

,h

k

(t

j

),y

j

).

iv. RM updates ”Bids” database with m

i

, bidder’s

public key y

j

and tim

j

.

v. Anybody can verify the bidder’s signature V

j

using the announced public values r

j

, h

k

(t

j

)

and (Y

k

j

).

(b) Fraud module verifies the existence of ”Collu-

sive Shill Bidding”(See next section for more

explanations) based on ”Bids” database. If it’s

found a collusive shill bidding, the auction’s

round is invalidated and bidders found to be

cheating are included in ”Fraud” board and in

”Fraud” database.

(c) If no frauds were found, the bidder with lowest

bid value is announced as winner.

3 FRAUD MODULE

3.1 Shill Bidding

3.1.1 Introduction

Jarrod Trevathan and Wayne Read (Trevathan, Jar-

rod and Read, Wayne 2005) proposed an algorithm

for Shill Bidding Detection of only one shill. After,

the same authors proposed an improvement of this

algorithm for the case of a shill with more than one

bidder, also known as Collusive Shill Bidding (Tre-

vathan, Jarrod and Read, Wayne 2007). We are going

to use this last algorithm to propose a module that can

be used in our protocol for detecting collusive shill

bidding. This algorithm doesn’t run on real time but

after an auction is finished. The algorithm, based in

ratings, calculates what is called shill score. The score

informs if a specific bidder is working with others to

form a collusive shill bidding. Based on this score, an

auction can be invalidated and bidders are denied to

participate in more auction’s rounds. The detection of

a shill is based in calculation of these ratings:

1. α: Percentage of auction’s rounds a bidder i has

participated.

2. β: Percentage of bids that bidder i has submitted

throughout all the auction’s rounds he/she has par-

ticipated in.

3. γ: How many times the bidder has won over the

auction’s rounds he participated in.

4. δ: The average inter bid time of bidder in the auc-

tion’s rounds he participated in.

5. ε: The average inter bid increments in the auc-

tion’s rounds he participated in.

6. ζ: indicates how early in an auction’s round bid-

der i started bidding.

These ratings are defined in interval (0,1). The

higher values, more suspicious the bidder is. If zero

values, bidder has won the auction.

Based on these ratings, we can calculate a shill

score for one bidder as:

SS = ((θ

1

α+θ

2

β+θ

3

γ+θ

4

δ+θ

5

ε+θ

6

ζ)/(θ

1

+θ

2

+

θ

3

+ θ

4

+ θ

5

+ θ

6

)) × 10 where 1 ≤ θ

i

≤ 6

For the case of Collusive Shill Bidding, there are

more than one bidder working together and the calcu-

lation of these ratings and their scores doesn’t imply

SAFE REVERSE AUCTIONS PROTOCOL - Adding Treatment Against Collusive Shill Bidding and Sniping Attacks

241

that the bidders are in an agreement. Only using these

parameters to detect shills can include legitimate bid-

ders. Then, other techniques should be used. There

are three ways a collusive shill bidding act and we

can create mechanisms to detect them.

3.1.2 Forms of Collusive Shill Bidding

1. Alternating bids: Shills (a shill is a bidder that

participates in a collusive Shill Bidding) bid in

only one auction’s round to increase or decrease

the price.

2. Alternating rounds: Bidders take turns bidding as

a collusive shill in different auction’s rounds with

one shill per round.

3. Hybrid: Bidders take turns bidding as a collusive

shill in more than one auction’s round simultane-

ously.

3.1.3 Detection Mechanisms using Graphs

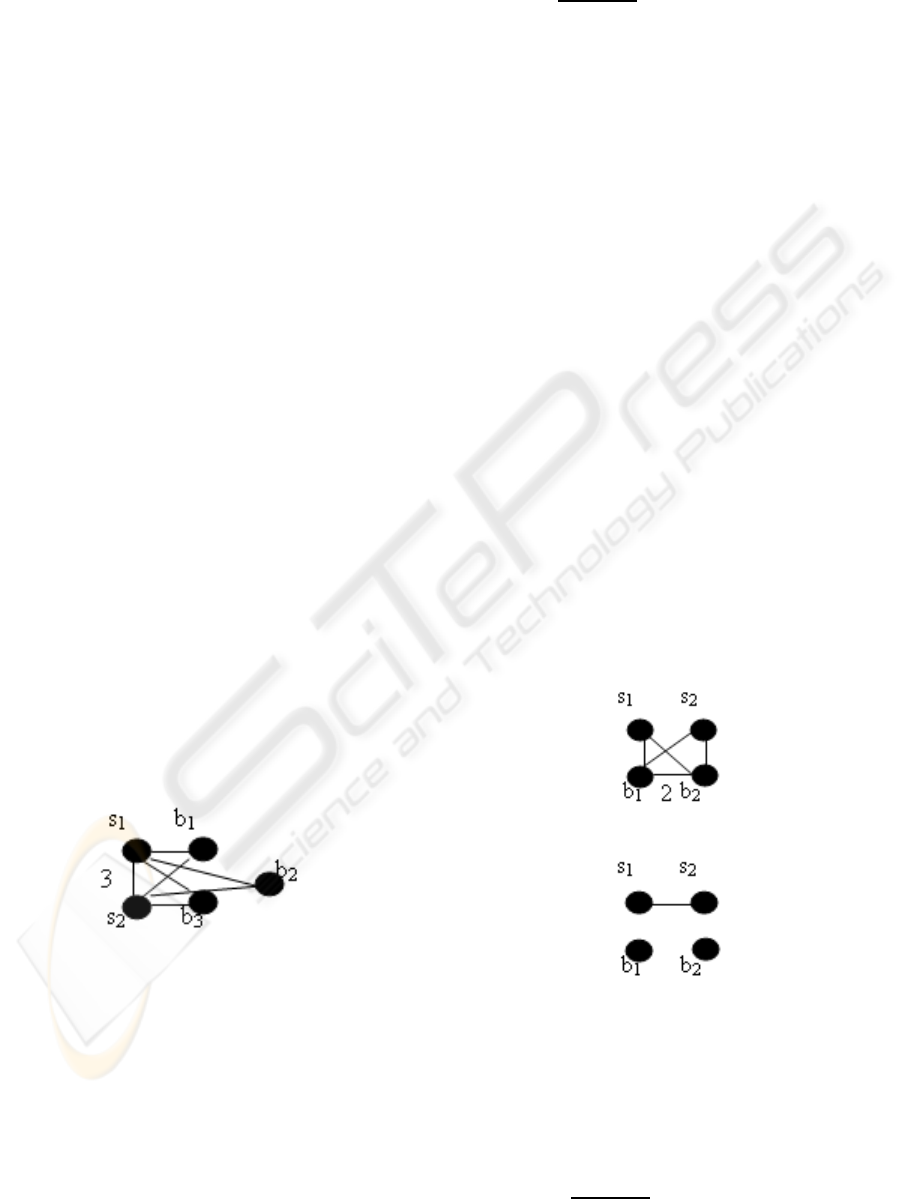

Collusion Graph

To detect the collusive shill biddings, it’s defined the

concept of Collusion Graphs. A collusion graph is

defined as G=(V,E) where V is the set of bidders and

E is the edges between them. Each edge e

i, j

exists

if they participated in a same auction’s round. Each

edge has a weight w

i

that defines the number of times

two bidders v

i

and v

j

participated in same auction’s

round. If the two bidders participated together in only

one auction’s round, w

i

= 0 and w

i

>= 1 otherwise.

Each edge has a weight w

i

, 1 <= i <= l, where l is

the number of bidders, that defines the number of

times two bidders v

i

and v

j

participated in more than

one auction’s round together.(See example on figure

2 below).

Figure 2: Collusiong Graph Normalization.

The graph above was generated for the se-

quence: (s

1

,b

1

,s

2

,b

1

,s

1

,b

1

) for first auction’s

round, (s

2

,b

2

,s

1

,b

2

) for second auction’s round

and (s

2

,b

3

,s

1

,b

3

,s

2

,b

3

) for third auction’s round (s

i

means shill i and b

i

bidder i). Based in the Collusion

Graph, it’s calculated a collusion rating for each

bidder v

i

as:

n

′

i

=

∑

k

j

w

j

where k means the degree of bidder

i in graph and 1 <= j <= l where l is the number of

bidders.

Each bidder collusion rating is normalized as:

n

′

j

=

(n

′

i

−n

min

)

(n

max

−n

min

)

where n

min

is the lowest value

of all values n

′

i

and n

max

the highest.

According to n

′

j

normalized values, suspicious

bidders are separated as sets denoted by C

k

and

C = {C

1

,C

2

,C

3

,.,C

k

} is the set of bidders grouped by

n

′

j

. If two bidders, b

i

and b

j

, are suspicious and they

have similar collusion rate, i.e., n

′

j

= n

′

i

+ λ where λ

is an error factor, they will be in a same collusion

set. Bidders not suspicious will be in a set of one

element. See that 1 <= k <= l where l is the total

number of bidders. The n

′

j

values are then used to

join suspicious in a same set and preserve the correct

bidders.

The collusion graph is used in Alternating bids

form.

Dual Graph

It’s a graph used in Alternating rounds form. It’s

the opposite of Collusion graph. In this graph, two

nodes are connected if they didn’t participate in same

auction’s round. In this graph, we are not interested in

the quantity of how many auctions they participated

but in if they weren’t cooperating or not in same

round. So weight information has value one(1) if

there’s cooperation and zero(0) if not.In example

with auction’s round one sequence as (s

1

,b

1

,s

1

,b

2

)

and auction’s round sequence two as (s

2

,b

1

,s

2

,b

2

),

it can be defined a Collusion graph as figure 3 and a

Dual graph as figure 4.

Figure 3: Collusion Graph.

Figure 4: Correspondent Dual Graph.

Based in the Dual Graph, it’s calculated a collu-

sion rating for each bidder v

i

as:

θ

′

i

=

∑

k

j

w

j

where k means the degree of bidder

i in graph and 1 <= j <= l where l is the number of

bidders.

Each bidder collusion rating is normalized as:

θ

j

′

=

(θ

′

i

−θ

min

)

(θ

max

−θ

min

)

where θ

min

is the lowest

SECRYPT 2009 - International Conference on Security and Cryptography

242

value of all values θ

′

i

and θ

max

the highest.

According to θ

′

j

values, bidders are separated as

sets denoted by C

θ

k

and C

θ

= {C

θ

1

,C

θ

2

,C

θ

3

,.,C

θ

k

} is the

set of bidders grouped by θ

′

j

. If two bidders, b

i

and

b

j

, are suspicious and they have similar collusion

rate, i.e., θ

′

i

= θ

′

j

+ λ where λ is an error factor,

they will be in a same collusion set. Bidders not

suspicious will be in a set of one element. See that

1 <= k <= l where l is the total number of bidders.

The dual graph is used in Alternating rounds form.

3.1.4 Alternating Bids

Bidders with similar collusion ratings defined by

collusion graph will have high probability to be in a

same shill. However this parameter isn’t enough to

define that a bidder belongs to a shill. It’s observed

that shill bidders in alternating bids have identical

β ratings. Based on that, a variable called bidding

factor is defined as:

φ

β

i, j

= 1 if β

i

= β

j

β

i

β

j

if β

i

< β

j

β

j

β

i

if β

i

≥ β

j

It defines how similar two bidders are for this

type of collusive shill.

The parameters n

′

i

, φ

β

i, j

, γ, δ and ε are then

combined together to define a new parameter called

Collusion Score.

CS

n

i

= (

(γ+δ+ε+n

′

j

+φ

β

σ

)

5

) × 10, where φ

β

σ

is

the average of all φ

β

i, j

.

For each set C

k

that is not singleton, it is

calculated bidder’s collusion score and bidders with

similar collusion score will be defined as bidders of a

same shill.

3.1.5 Alternating Rounds

In alternating rounds, as in alternating bids, we

can define collusive bidders based on parameter

Collusion Score. However to calculate it, we observe

a different characteristic. It’s observed that shill

bidders in alternating rounds have identical α ratings.

Based on that, the bidding factor is defined as:

φ

α

i, j

= 1 if α

i

= α

j

α

i

α

j

if α

i

< α

j

α

j

α

i

if α

i

≥ α

j

It defines how similar two bidders are for this type

of collusive shill.

These parameters θ

′

i

, φ

α

i, j

, ζ, δ and ε are then com-

bined together to define a new parameter called Col-

lusion Score.

CS

n

i

= (

(ζ+δ+ε+θ

′

j

+φ

α

σ

)

5

) × 10, where φ

α

σ

is the

average of all φ

α

i, j

.

For each set C

θ

k

that is not singleton, it is calcu-

lated bidder’s collusion score and bidders with simi-

lar collusion score will be defined as bidders of a same

shill.

3.1.6 Hybrid

The hybrid’s form combines the alternating bids and

alternating rounds form. It uses both graphs for de-

tection of shills. It uses the Collusion Score as:

CS

h

i

= (

(δ+ε+η+φ

β

σ

+φ

α

σ

)

5

)×10, where φ

β

σ

and φ

β

σ

are calculated for alternating bids and rounds forms

like already defined in the last sections.

3.2 Sniping

To avoid sniping in an auction, it should be followed

policies to avoid them. The most used technique to

avoid it is to extend auction time if there are bids sent

in the last minutes. In this paper, as defined in Bidding

phase of protocol, the auction is extended x minutes

if there are bids sent in the last 2 minutes (x is a pa-

rameter defined by auctineer). It avoids bids run in

the last minutes. Sniping is a very known technique

used by bidders in the most popular auctions of in-

ternet like Ebay, etc; but this behavior of bidders is

not accepted because it does not allows the real En-

glish(Reverse) auction process of price increasing(or

decreasing) in a period of time. Sniping transforms

English(Reverse) auction in a sealed auction because

almost all the bidders bid at the very end of auction’s

round time with each one sending a sealed letter at the

same time.

4 ANALYSIS

4.1 Protocol

1. Anonym bidder: The RM cannot know the bid-

ders from (Ti, (Y

k

j

)

r

j

,g

r

i

) and (T

i

,m

i

,V

i

) because

SAFE REVERSE AUCTIONS PROTOCOL - Adding Treatment Against Collusive Shill Bidding and Sniping Attacks

243

know Y

k

j

and (Y

k

j

)

r

j

is a problem of calculation

discrete logarithm. Without K

i

, RM does not

know T

i

and find V

i

is also a discrete logarithm

problem. The auctioneer has no knowledge of Y

k

j

from (Y

k

j

)

r

j

and also does not know V

i

.

2. Publicly Verifiable: With RM and auctioneer data,

B

i

winner can be verified.

3. Bids not Forgeable: RM, the auctioneer and any-

one cannot forge the signature V

i

of bidder B

i

.

4. No repudiate: The B

i

winner cannot refuse his bid

because it’s signed with V

i

.

5. Efficiency:

(a) The bidder registration: takes one generation

of signature and a verification of signature

through SSL authentication(1SG + 1SV). One

encryption for sending certificate and t

i

val-

ues, two encryptions and decryptions for Diffie-

Hellman exchange with authentication(Bidder,

RM and Auctioneer communication).

(b) Round key generation takes a modular expo-

nentiation (1E).

(c) Auction ticket generation takes three modular

exponentiations (3E).

(d) The bid sending takes two modular exponenti-

ations and a signature generation (2E + 1SG).

(e) The winner’s definition takes two modular ex-

ponentiations and one signature verification

(2E + 1SV) for each bidder.

(f) Module fraud detection cost: Construction

of Collusive graph using adjacency lists to

build an adjacency matrix + scan adjacency

matrix(O(n)) + calculation of shill’s rates

(O(n)) + calculation of collusion rates (O(n)) +

construction of collusive rate sets(O(1)) + cal-

culation of collusive score (O(n)).

4.1.1 Sniping

There are not cost associated to this part of module

because the techniques to avoid Sniping are very sim-

ple according to section above.

5 CONCLUSIONS

It’s already known the efficiency of BJK protocol for

English auctions, but it does not consider none cryp-

tographic attacks. Our protocol intends to improve

BJK’s one adding techniques for treatment of Col-

lusive Shill Bidding and Sniping attacks.It also adds

authentication through DSA digital certificates. Our

protocol is built in a such form to protect reverse auc-

tions against these forms of attacks.

We are simulating all protocol to prove his effi-

ciency with real data. We are also trying to implement

improvements like the ones proposed by Chung.

ACKNOWLEDGEMENTS

To professor Ruy Guerra to all his help and advices.

Following always the idea to never give up.

REFERENCES

Trevathan, Jarrod and Read, Wayne (2006). Undesirable

And Fraudulent Behaviour In Online Auctions In Se-

curity and Cryptography Conference (SECRYPT), 450

458

Byoungcheon Lee, Kwangjo Kim e Joongsoo Ma (2001).

Efficient Public Auction with One-time Registration

and Public Verifiability. In Second International Con-

ference on Cryptology in India, Indocrypt’01, 162-

174, Springer-Verlag, LNCS 2247

Trevathan, Jarrod and Read, Wayne (2005). De-

tecting Shill Bidding in Online English Auc-

tions. Technical Report, 2005. Available at

http://auction.maths.jcu.edu.au/research/shill.pdf

Trevathan, Jarrod and Read, Wayne (2007). Detecting Col-

lusive Shill Bidding. In International Conference on

Information Technology – ITNG’07, page 799-808

Jame Cook University, North Queensland , Australia.

Yu Fang Chung 2008. Bidder-anonymous English Auction

Scheme with privacy and public verifiability. In Sci-

ence Direct, The Journal of Systems and Software 81,

2008, 113-119.

SECRYPT 2009 - International Conference on Security and Cryptography

244