COLLABORATION AMONG COMPETING FIRMS

An Application Model about Decision Making Strategy

Marco Remondino and Marco Pironti

e-business L@B, University of Turin, Torino, Italy

Keywords: Collaboration, Bias, Ego biased learning.

Abstract: To understand the adoption of collaborative systems, it is of great importance to know about economical

effects of collaboration itself. Decision makers should be able to evaluate potential drawbacks and

advantages of collaboration: strategies may be seen as a mixture of cost reduction, product differentiation

and improvement of decision making and/or planning. In this context information technology may help a

firm to create sustaining competitive advantages over competitors. It is less clear whether collaboration is of

any use in such an environment. According to the Economics literature, the most important factors affecting

benefits of collaboration are market structure, kind and degree of uncertainty faced by the firms, their risk

preferences and the collaboration propensity. The results depend on the way these factors are combined. We

present a microeconomic model and use techniques from game theory for the analysis. The way the model

is constructed will allow the derivation of closed-form solutions. Traditional learning models can't represent

individualities in a social system, or else they represented all of them in the same way – i.e.: as focused and

rational agents; they don’t represent individual inclinations and preferences. Results indicating whether

collaboration in various areas makes sense will be obtained. This makes it possible to judge the potential of

available collaborative technology. The basic presented model may be extended in various ways.

1 INTRODUCTION

Decision makers need to understand the economics

of collaboration in order to be able to evaluate the

potential of collaborative technology. Collaboration

among different actors may occur within a firm’s

boundary or across it. The economic effects of

collaboration between firms located along different

phases of the value chain (typically supplier-

purchaser-relationships) have been extensively

studied in the literature.

Usually, transaction cost theory is applied to

derive the “optimal” institutional structure

(Williamson, 1975). Basic institutional arrangements

are hierarchy, market and network cooperation

(Clemons et al., 1993). The use of collaborative

technology may be especially useful in case of

network cooperation. As Clemons et al. point out,

the use of IT triggers a move towards such

cooperation. As is well-known, strategies of firms

may be seen as a mixture of cost reduction, product

differentiation and improvement of decision making

and/or planning. Information technology may help a

firm to create sustaining competitive advantages

over competitors. Social models are not all and only

about coordination, like iterated games, and agents

could have a bias towards a particular behavior,

preferring it even if that’s not the best of the possible

ones. An example from the real world could be the

adoption of a technological innovation in a

company: even though it can be good for the

enterprise to adopt it, the managerial board could be

biased and could have a bad attitude towards

technology, perceiving a risk which is higher than

the real one. Thus, even by looking at the positive

figures coming from market studies and so on, they

could decide not to adopt it. This is something which

is not taken into consideration by traditional learning

methods, but that should be considered when

modeling social systems, where agents are often

supposed to mimic some human behavior. In order

to introduce these factors, a formal method is

presented in the paper: Ego Biased Learning (EBL).

A first result of the analysis shows that

maximization of expected utility may lead to

different optimal actions than maximization of

expected profits. While the latter in general is a

simple optimization problem, maximization of

expected utility requires knowledge of the utility

387

Remondino M. and Pironti M.

COLLABORATION AMONG COMPETING FIRMS - An Application Model about Decision Making Strategy.

DOI: 10.5220/0002796903870391

In Proceedings of the 6th International Conference on Web Information Systems and Technology (WEBIST 2010), page

ISBN: 978-989-674-025-2

Copyright

c

2010 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

function of the decision maker. Note, that this is a

more difficult and complex problem.

If costs of information sharing are sufficiently

low, information sharing generally is beneficial if

development know how is equally distributed. This

is an expected result since then development costs

may be reduced. This result, however, changes

significantly if know how for development is not

equally distributed between the competitors. In this

case, situations that are well-known from the

treatment of “prisoner-dilemma-situations” occur.

Results then strongly depend on the degree of risk

aversion and the market structure and nearly all

“prisoner-dilemma-situations” may be constructed

by suitably choosing the model parameters. First

mover and follower strategies are then optimal

choices depending on risk aversion of the decision

makers and market structure.

In some instances, the results obtained will be

surprising and contradict rational expectations.

It can be shown, e.g., that the use of information

to reduce uncertainty may be harmful for an

enterprise. Firms are paid for taking risks. If they try

to reduce such risks profits and expected utility may

decrease (even if risk is reduced at zero costs, see

e.g. Palfrey; 1982).

Once again, such surprising results show the

importance of understanding the economic effects of

collaboration before deciding on investments in

collaboration technologies. But it is very important

to consider collaboration expectation as a

predominant behavior of other firms.

2 COLLABORATIVE CULTURE

Generally, collaboration among competing firms

may occur in many ways. Some examples are joint

use of complex technological or marketing

processes, bundling products or setting standards.

Collaboration typically requires sharing information

and know how, as well as resources.

In the literature collaboration problems are

usually studied with the help of methods from

microeconomics and game theory. It turns out that

the most important factors affecting the usefulness

of collaboration are the following ones:

- Market Structure. If perfect competition

prevails collaboration is of limited use. No single

firm or proper subsets of firms may influence

market prices and/or quantities. In a monopolistic

environment there obviously is no room for

collaboration. Consequently, the interesting market

structure is an oligopoly. Depending on the kind of

products offered and the way an equilibrium is

obtained, price or quantity setting oligopolies may

be distinguished.

- Product Relationship. Products offered may be

substitutes or complements. In general, we would

expect that products of competing firms are

substitutes. Product differentiation, however,

allows to vary the degree of possible substitution.

- Distribution of Knowledge and Ability. The

distribution of knowledge and ability is closely

related to the possibility of generating sustaining

competitive advantages (Choudhury, Sampler;

1997). If a firm has specific knowledge or specific

abilities that competitors do not have it may use

these skills to outperform competing firms.

- Kind and Degree of Uncertainty Faced by

Competing Firms. Basically we may distinguish

uncertainty with respect to common or private

variables. As an example consider demand

parameters. They are called common or public

variables since they directly affect profits but are

not firm specific. On the other hand variable costs

are an example of private variables (Jin; 1994, p.

323). They are firm specific. Of course, knowledge

of rival’s variable costs may affect a firms own

decisions since it may predict rival’s behavior

more precisely.

- Risk Preferences of Competing Firms. It is

assumed that decision makers are risk averse.

Hence they will not maximize expected profits as

if they were risk neutral but expected utility of

profits.

The results obtained depend on the assumptions

made about the factors identified above. They

partially differ or even contradict each other.

The analysis presented in this paper is carried on

with the help of a microeconomic model based on

game theory. The basic assumption is that

collaboration occurs through knowledge and

information sharing, common information collection

and/or interpretation. In order to share information,

knowledge and know-how, collaborative technology

is usually applied. Joint application development and

joint use of resulting information systems, as well as

inter-organizational information systems in general

are typically covered by such an analysis. Joint

application development bundles development

capabilities in an effort to reduce development costs.

Typically specific know how and information is

shared between the cooperating development

partners. Hence, in case of competing developers, it

is necessary to compare the benefits associated with

reduced costs to possible disadvantages faced by

disclosing information and know how. In this paper

we will assume that information is shared via

temporary joint. Note, that in our context

WEBIST 2010 - 6th International Conference on Web Information Systems and Technologies

388

collaboration may be characterized as being pre-

competitive. It should not be mixed up with

collusion which may be legally restricted or even

forbidden. A formal model will be developed in the

sequel. Techniques from game theory allow to solve

the corresponding optimization problems. The

model will be analyzed in a simple setting in order

to be able to derive closed-form solutions which

may be handled more conveniently. Hence, it seems

natural to assume that a rational company maximizes

its expected profits. The compensation of such

managers is very often tied to profits. This fact, as

well as possible opportunistic behavior and

asymmetric information, suggest that managers

behave more or less risk averse (Kao and Hughes,

1993). Consequently, expected utility of profits is

maximized instead of expected profits.

3 REINFORCEMENT LEARNING

Learning from reinforcements has received

substantial attention as a mechanism for robots and

other computer systems to learn tasks without

external supervision. The agent typically receives a

positive payoff from the environment after it

achieves a particular goal, or, even simpler, when a

performed action gives good results. In the same

way, it receives a negative (or null) payoff when the

action (or set of actions) performed brings to a

failure. By performing many actions overtime (trial

and error technique), the agents can compute the

expected values (EV) for each action. According to

Sutton and Barto (1998) this paradigm turns values

into behavioral patterns. Most RL algorithms are

about coordination in multi agents systems, defined

as the ability of two or more agents to jointly reach a

consensus over which actions to perform in an

environment. An algorithm derived from Q-

Learning (Watkins, 1989) can be used. The EV for

an action is updated every time an action is

performed, according to Kapetanakis et al (2004):

(1)

Where 01 is the learning rate and p is a

payoff received every time action a is performed.

This is particularly suitable for simulating multi

stage games (Fudenberg and Levine 1998), in which

agents must coordinate to get the highest possible

aggregate payoff. Given a scenario with two agents

(A and B), each of them endowed with two possible

actions

,

and

,

respectively, the agents will

get a payoff, based on a payoff matrix, according to

the combination of performed actions.

3.1 Ego Biased Learning

While discussing the cognitive link among

preferences and choices is definitely beyond the

purpose of this work, it’s important to notice that it’s

commonly accepted that the mentioned aspects are

strictly linked among them. The link is actually bi-

directional (Chen, 2008), meaning that human

preferences influence choices, but in turn the

performed actions (consequent to choices) can

change original preferences. As stated in Sharot et

al. (2009): “…past preferences and present choices

determine attitudes of preferring things and making

decisions in the future about such pleasurable things

as cars, expensive gifts, and vacation spots”.

Even if preferences can be modified according to

the outcome of past actions (and this is well

represented by the RL algorithms described before),

humans can keep an emotional part driving them to

prefer a certain action over another one, even when

the latter has proven better than the former. Some of

these can be simply wired into the DNA, or could

have formed in many years and thus being hardly

modifiable. A bias is defined as “a particular

tendency or inclination, esp. one that prevents

unprejudiced consideration of a question; prejudice”

(www.dictionary.com).

That’s the point behind learning: human aren’t

machines, able to analytically evaluate all the

aspects of a problem and, above all, the payoff

deriving from an action is filtered by their own

perception bias. There’s more than just a self-

updating function for evaluating actions and in the

following a formal reinforcement learning method is

presented which keeps into consideration a possible

bias towards a particular action, which, to some

extents, make it preferable to another one that has

analytically proven better through the trial and error

period. Ego Biased Learning allows to keep this

personal factor into consideration, when applying a

RL paradigm to agents.

In the presented formulation, a dualistic action

selection is considered, i.e.:

,

. In our

context, alternative actions represent two dyadic

collaborative behaviour: the whole of strategic and

tactic enterprise activities to establish a collaboration

or not

. In the last case

, enterprises

carry on other competitive strategies non based on

collaboration. By applying the formal reinforcement

learning technique described in equation (1) an agent

is able to have the expected value for the action it

performed. Each agent is endowed with the RL

technique. At this point, we can imagine two

different categories of agents (

,

: one biased

towards action

and the other one biased towards

COLLABORATION AMONG COMPETING FIRMS - An Application Model about Decision Making Strategy

389

action

. For each category, a constant is

introduced (0

,

1, defining the

expectation of each action, used to evaluate

and

which is the expected value of the

action, corrected by the bias. For the category of

agents biased towards action

we have that:

:

|

|

|

|

(2)

In this way,

represents the propensity for the

first category of agents towards action

and acts as

a percentage increasing the analytically computed

and decreasing

. At the same way,

represents the propensity for the second category

of agents towards action

and acts on the expected

value of the two possible actions as before. The

constant acts like a “friction” for the EV function;

after calculating the objective

it increments

it of a percentage, if

is the action for which the

agent has a positive bias, or decrements it, if

is

the action for which the agent has a negative bias. In

this way, the agent

will perform action

(instead of

) even if

, as long

as

is not less than

.

If

, by definition, the

performed action will be the favorite one, i.e.: the

one towards which the agent has a positive bias.

4 EXPERIMENTAL RESULTS

Some experiments were performed in order to test

the basic EBL equations introduced in paragraph

3.1. The agents involved in the simulation can

perform two possible actions,

and

. The agents

in the simulation randomly meet at each turn (one to

one) and perform an action according to their EV. A

payoff matrix is used, where p

is the payoff

originated when both agents perform a

(both of

enterprises don’t want establish a collaboration), p

is the payoff given to the agents when one of them

performs a

and the other one performs a

and so on

(only one of them want – and try without success –

establish a collaboration. Usually p

and p

are set

at the same value, for coherency. If corss-strategies

are the same and based on collaboration, pay off

p

is maximum. For each time-step in the

simulation, the number of agents performing a

and

a

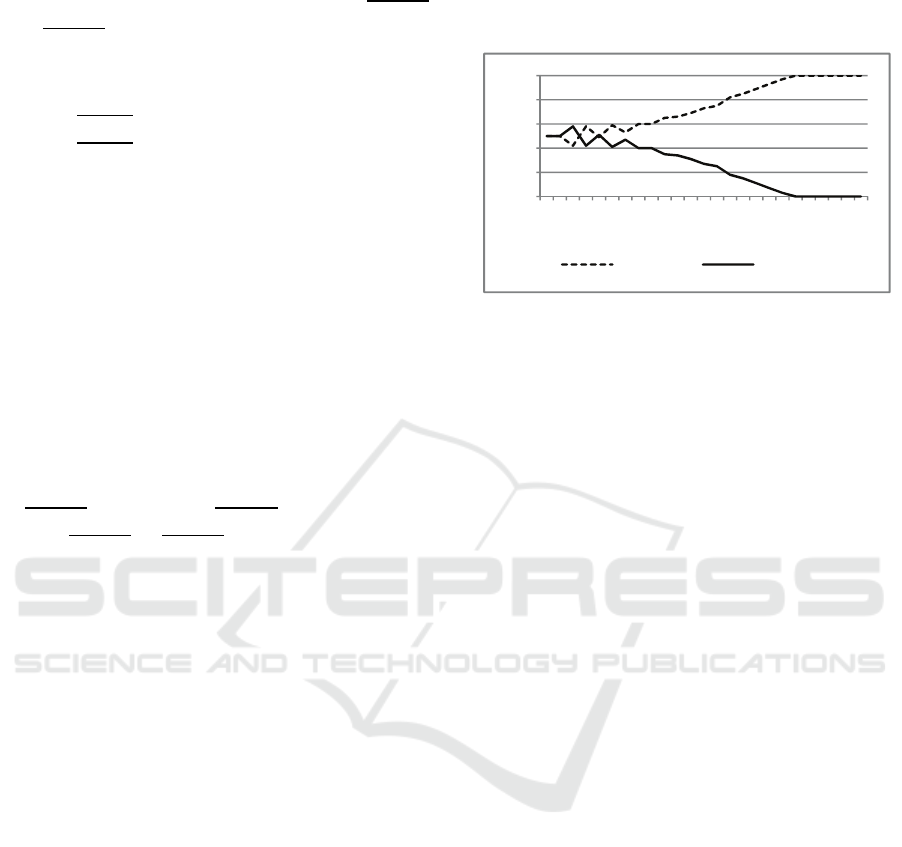

are sampled and represented on a graph.

In the first experiment, a small bias towards

action

is introduced for fifty

agents (

= 0.1).

Agents

do not have a bias, but all start playing

action

which is the most favourable one,

according to the payoff matrix; this will be different

in the following experiments, where unbiased agents

will start performing a random action. The results

are quite interesting, and depicted in figure 1.

Figure 1: Experiment 1: biased Vs unbiased agents.

In this example it has been chosen to have all the

rational agents (the straight line) starting from the

favoured action (

) so to show that, even so, it is

enough to have one half of the agents acting not

completely rationally to make the system go towards

the sub-optimal action (

). In fact, even if action

is clearly favored by the payoff matrix (payoff 2 vs

1), after taking an initial lead in agents’ preferences,

all the population moves towards action

. This is

due to the resilience of biased agents in changing

their mind; doing this way, the other 50 non-biased

agents find more and more partners performing

action

, and thus, if they perform

they get a

negative payoff. In this way, in order to gain

something, since they are not biased, they are forced

to move towards the sub-optimal action

, preferred

by the biased agents. In order to give a social

explanation of this, we can think to the fact that

often the wiser persons adapt themselves to the more

obstinate ones, when they necessarily have to deal

with them, even if the outcome is not the optimal

one, just not to lose more. This is particular evident

when the wiser persons are the minority, or, as in

our case, in an equal number.

Till now the advantage of performing join action

over

was evident (payoff 2 vs 1)

but not huge; in the next experiment, a new payoff

matrix is used, in the joint action

is

rewarded 3, instead of 2. The purpose is

investigating how much the previous threshold

would increase under these hypotheses. The

empirical finding is 25/75, and the convergence is

again extremely fast, and much similar to the

previous experiment. Even a bigger advantage for

the optimal action is soon nullified by the presence

of just 25% biased agents, when penalty for

miscoordination exists. This explains why

0

20

40

60

80

100

1 3 5 7 9 11 13 15 17 19 21 23 25

Actiona1 Actiona2

WEBIST 2010 - 6th International Conference on Web Information Systems and Technologies

390

sometimes suboptimal actions (or non-best products)

become the most common. In real world, marketing

could be able to bias a part of the population, and a

good distribution or other politics for the suboptimal

product/service could act as a penalty for unbiased

players when interacting with biased ones.

5 CONCLUSIONS

While individual preferences are very important as a

bias factor for learning and action selection, when

dealing with social systems, in which many entities

operate at the same time and are usually connected

over a network, other factors should be kept into

consideration, when dealing with learning. Ego

biased learning is formally presented in the most

simple case, in which only two categories of agents

are involved, and only two actions are possible

(collaboration or not). That’s to show the basic

equations and explore the results, when varying the

parameters.

Some simulations are run, and the results are

studied, showing how, even a small part of the

population, with a negligible bias towards a

particular action, can affect the convergence of the

whole population. In particular, if miscoordination is

punished (when cross-strategies are different), after

few steps all the agents converge on the suboptimal

action, which is the one preferred by the biased

agents. With no penalty for miscoordination things

are less radical, but once again many non-biased

agents (even if not all of them) converge to the

suboptimal action (non collaborative actions). This

shows how personal biases are important in social

systems, where agents must coordinate or interact.

If we look at things from a managerial/sociologic

point of view, we have the following explanation.

The presented experiments show that few players

potentially adverse to exchange information in a

system, are enough for all the players to stop

exchanging. This happens because the higher risk

aversion of these operators brings all the others to

the idea that carrying on collaborative strategies is a

potential dispersion of resources. In fact, whenever a

collaborative player crosses a non-collaborative one,

they both evaluate the possible business, but after

that the non-collaborative player denies it. From this,

the penalty for miscoordination. A collaborative

rational agent, after meeting some non-collaborative

ones, changes her mind as well, since each time she

loses some resources. Then, she becomes non-

collaborative as well, unless she finds many

collaborative players in a row. In other terms, to

avoid a refusal after trying to collaborate, which is

something that waste time and resources, also

potentially collaborative agents will start to

immediately refuse the possibility of a cooperation.

By doing this, they won't gain as much as they

would through collaboration, but they won't also risk

to lose resources. The whole system thus settles on

the sub-optimal equilibrium, in which no player

collaborates.

In future works, general cases will be faced

(more than two possible actions, different biases) in

order to analyze the psychological drivers behind

firms collaborations and additional experiments will

be run.

REFERENCES

Chen M. K., 2008. Rationalization and Cognitive Disso-

nance: do Choices Affect or Reflect Preferences?

Cowles Foundation Discussion Paper No. 1669

Clemons, E., Reddi, S. Row, 1993, M.: The Impact of

Information Technology on the Organization of

Economic Activity – The "Move to the Middle"

Hypothesis. Journal of Management Information

Systems 10, No. 2, pp. 9-35.

Fudenberg, D., and Levine, D. K. 1998. The Theory of

Learning in Games. Cambridge, MA: MIT Press

Jin, J.: 1994. Information Sharing Through Sales Report.

Journal of Industrial Economics 42, No. 3

Kao, J., Hughes, J. 1993. Note on Risk Aversion and

Sharing of Firm-Specific Information in Duopolies,

Journal of Industrial Economics 41, No. 1

Palfrey, T. R., 1982. Risk Advantages and Information

Acquisition. Bell Journal of Economics 13, No. 1, pp.

219-224.

Powers R. and Shoham Y., 2005. New criteria and a new

algorithm for learning in multi-agent systems. In Pro-

ceedings of NIPS.

Sharot T., De Martino B., Dolan R.J., 2009. How Choice

Reveals and Shapes Expected Hedonic Outcome. The

Journal of Neuroscience, 29(12):3760-3765

Sutton, R. S. and Barto A. G., 1998. Reinforcement Learn-

ing: An Introduction. MIT Press, Cambridge, MA. A

Bradford Book

Watkins, C. J. C. H., 1989. Learning from delayed

rewards. PhD thesis, Psychology Department, Univ. of

Cambridge.

Williamson, O., 1975. Markets and Hierarchies – Analysis

and Antitrust Implications. New York.

COLLABORATION AMONG COMPETING FIRMS - An Application Model about Decision Making Strategy

391