FINDING E-BUSINESS SOLUTIONS WITH THE HELP OF A

SELF-MANAGED ONLINE TOOL

Falk Scheiding, Melanie Stiller, Jan Finzen and Claudia Dukino

Fraunhofer IAO, Nobelstr. 12, 70569 Stuttgart, Germany

Keywords: SME, Web-based online tool, e-Business competence, Intelligent search, Software selection, e-Business

solutions, European commission.

Abstract: In recent years, providers of e-business software have started tailoring their solutions to the needs of SMEs,

e.g. smaller sized ERP and CRM systems. However, for many SMEs, e-business systems are still too

expensive or require a lot of effort on the SME’s side. As SMEs often do not employ IT-specialists who

possess the necessary skills and knowledge to evaluate and select an appropriate e-business software system

that fits the company’s needs, the need for external support becomes evident. The eBSN eBusiness

Solutions Guide is an online tool that especially helps SMEs in finding suitable e-business solutions. It is

equipped with different search algorithms and offers an e-business competence calculator. The paper

introduces the tool and thereby focuses on the methods and concepts to match the offers of e-business

suppliers and SME needs.

1 INTRODUCTION

Information and communication technology (ICT)

and e-business models have a deep impact on a

company’s innovativeness and competitiveness

which is expected to keep growing in the future. As

the variety of offered solutions grows, it becomes

more difficult for companies to chose the product or

service that fits their needs best. This holds true

especially for small and medium-sized enterprises

(SMEs). SMEs can only invest a limited effort into

exploitation of ICT and often do not possess the

necessary knowhow to do so. Since SMEs are highly

important in the European economy it is one of the

European Commission’s priorities to support them

(cf. European Commission, 2005).

Fraunhofer IAO on behalf of the European

Commission has realised an interactive web-based

online tool (the eBSN eBusiness Solutions Guide) to

support SMEs in finding suitable ICT solutions. The

ICT market for SMEs is very heterogeneous and

many software systems require much adaption effort

on the customer’s side. The eBusiness Solutions

Guide was created to minimize the effort of

choosing a suitable solution for SMEs by taking care

of SME specific characteristics. It includes a

growing database on e-business solutions and

services currently available (cf. Renner, Vetter et al.,

2008). Since its publication in March 2009 on the

European Commission’s web server

1

the tool has

achieved growing popularity. This paper introduces

the tool’s main concepts and discusses its current

status and acceptance.

The remainder of this paper is structured as follows:

In chapter 2 we depict the rising importance of e-

business awareness for SMEs and discuss the

benefits and problems that go with it. We deduce the

need for an easy-to-use online tool that helps SMEs

finding the right software products and services

within the unclear diversity of different offers. In

chapter 3 we describe our proposed solution in detail

by showing how providers can enter their solutions

in the portal and how SMEs can apply different

search strategies to find the solution that fits their

specific needs best. In chapter 4 we discuss the

reception of the eBSN eBusiness Solutions Guide

based on the current content and usage statistics and

describe the forthcoming development.

1

http://ec.europa.eu/enterprise/e-bsn/ebusiness-solutions-guide

340

Scheiding F., Stiller M., Finzen J. and Dukino C.

FINDING E-BUSINESS SOLUTIONS WITH THE HELP OF A SELF-MANAGED ONLINE TOOL.

DOI: 10.5220/0002805803400346

In Proceedings of the 6th International Conference on Web Information Systems and Technology (WEBIST 2010), page

ISBN: 978-989-674-025-2

Copyright

c

2010 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 MOTIVATION

The Sectorial eBusiness Watch – an annual journal

published by the European Commission – describes

the adoption, implications and impact of electronic

business practices in different sectors of the

economy. According to them, small firms benefit

from e-business solutions especially by gaining

access to international markets and expanding their

business networks, e.g., through online collaboration

tools (Selhofer, Lilischkis et al., 2008). Moreover,

two trends for the benefit of SMEs are noticed:

Large ICT vendors have started developing

affordable solutions targeted to the needs of

SMEs (e.g. smaller-sized ERP and CRM

software).

Large companies take stock in a connection

with their smaller partners to benefit from the

advantages of e-business.

The need for SMEs to invest into an appropriate

e-business strategy rises in the business-to-business

as well as in the business-to-customer sector:

cooperation with large industrial consumers requires

electronic process integration, while end-users

nowadays expect a modern online offer.

Nevertheless, SMEs often do not have the possibility

to develop a coherent ICT investment strategy or

employ ICT practitioners due to their limited

resources (Selhofer, Lilischkis et al., 2008). This is

also stated by Harindranath, Dyerson et al., who

conducted a survey among 378 SMEs located in the

southeast of England. They notice a rather low

investment into ICT and trace it back to SME’s

limited strategic flexibility. According to their

findings, the main barriers that prevent SMEs from

ICT adoption are (cf. Harindranath, Dyerson et al.,

2008):

the fear of technology obsolesce and requiring

of frequent updates

the dependence from external consultants or

vendors

SME owners or managers do not believe in

ICT as long term solutions to business

sustainability because of the complexity in

quantifying the business benefits that might

arise from such investments.

The German network of e-commerce on behalf of

the German Federal Ministry of Research and

Technology was responsible for a comparative

survey among SMEs in Germany between 2005 and

2008. Their research emphasised the SMEs need of

information and advice. Among other things the

1930 attendees where asked to rate their usage

intensity of internet applications (on a scale from

one = low to five = high). In 2008 the main usage

was the e-mail communication (4.4 points in

average) and the information search (4.29 points). E-

business relevant use cases like online procurement

were in fifth place (3.17 points) and online selling at

eight (2.14 points). The biggest increases from the

year 2005 to 2008 were found in online procurement

(+ 0.41) and data exchange with external partners (+

0.29). This trend is expected to further increase in

the future (cf. Hudetz, Eckstein, 2008). Therefore,

the need for reasonable and specialised solutions and

advices is expected to grow also.

In summary, one can detect an expanding range of

available products and a growing need for such

products on the SMEs side. The challenge now is to

help the SMEs in finding and assorting appropriate

products and services. Several commercial websites

aim at bringing seekers and solvers of ICT solutions

together (e.g., Europages

2

, ECeurope

3

,

webtradecenter

4

, commercial place

5

). The eBusiness

Solutions Guide however differs from those offers

with regard to some important aspects regarding

specific requirements of European SMEs.

Products and services are classified not only

with regard to their business focus but also

regarding their adequacy for different

company sizes.

SMEs can evaluate their “e-business

readiness” based on the “eBusiness

Competence Index”.

Users can give feedback and thereby

recommend or disadvise the use of products

and services.

As the eBusiness Solutions Guide is offered and

run by the European Commission, the webpage is

neutral, evident and free of advertisement. Of course

suppliers of solutions have the opportunity to

promote their offerings (this is one of the main goals

of the tool) but they only can do this by using the

specified number of words and without images or

different fonts or colours. So the user will not be

“overwhelmed” by the offerings or be stressed e.g.

by pop-ups on the webpage.

2

http://www.europages.co.uk

3

http://www.eceurope.com

4

http://dci.wai.de/wai.asp

5

http://www.commercialplace.com

FINDING E-BUSINESS SOLUTIONS WITH THE HELP OF A SELF-MANAGED ONLINE TOOL

341

3 SOLUTION DESCRIPTION

In the following, we describe the e-Business

solutions Guide’s main features in detail:

Adding new information on providers,

products, and services;

Finding appropriate products and services;

Evaluating an SME’s company’s e-business

competence.

We close the section by giving some information

on the technical implementation.

3.1 Adding New Information on

Providers, Products, and Services

The eBSN eBusiness Solutions Guide’s content is

self-managed, e.g., vendors can enter their company

and product information themselves. This grants the

suppliers the opportunity to promote their products

as best as they can. The approach also helps to keep

the content up-to-date and downsizes the operating

costs for the European Commission, as the

responsibility for updating information is distributed

among the providers. Additionally a staff member of

the European Commission will take care for the

quality and correctness of the data. If the acceptance

of the tool is growing the implementation of further

quality assurance mechanisms would be helpful (e.g.

activation of entries by an administrator).

3.1.1 Role Model

The Guide offers two distinct user roles to insert

supplier specific data:

Producer: The role “Producer” can enter product

data and facts about the own company into the

Guide. After the registration the producer has the

possibility to fill out several forms which specify the

producer’s offerings. This includes e.g. the

description of the company and the offering,

keywords, size of target firms and the possibility to

classify the products with the help of the

classification system that was developed for this

project. The Producer can only insert and manage

his own company’s data. Additionally he has all the

rights of an evaluator.

Sales Partner or Consultants: Members of this

group can add information about multiple producers

and their respective products and services. This is

intended for associations or distributors of solutions

from different providers.

3.1.2 Classification Systems

The eBSN eBusiness Solutions Guide uses its own

hierarchical product and services classification

system containing 170 categories.

It uses two main

classifications: An industry sector and a product

classification. Both classifications aim at demanders

who look for special tools and solutions for their

specific economic and industrial sectors. The

classifications base on an analysis of a variety of

internationally recognised classification standards

such as the classification of branches of trade by the

German Federal Statistical Office

6

, the Central

Product Classification (CPC)

7

and the International

Standard Industrial Classification (ISIC)

8

of the

United Nations Statistics Division. We found that

those classification systems were too complex for

our purposes. We therefore implemented a “best-of-

breed” approach in order to achieve both, a

carefully-designed and complete but still easily

manageable classification system. This provides a

structuring factor, both for the demand and supply

side.

3.2 Finding Appropriate Products and

Services

The eBusiness Solution Guide’s main module is the

assessment framework that proposes e-business

products and services that fit the needs of SMEs

seeking to improve their business processes.

Using this support the SME looking for a solution is

independent from external consultants or vendors.

The list of solutions is generated alphabetically by

the tool and organised according to the entered

needs of the SME.

3.2.1 Searching and Navigating

Depending on the user’s initial search situation,

different search strategies can be applied.

The simple keyword search enables the SME to

find a solution by typing in a keyword. A result list

of products and providers regarding the keyword

will be provided.

The detailed search offers distinct forms for

finding products, services, providers, or open source

products. In each case, the intended industry branch

and size of the searcher’s company can be specified.

Depending on the intended search object, the search

6

http://www.destatis.de

7

http://unstats.un.org/unsd/cr/registry/regcst.asp? Cl=25&Lg=1

8

http://unstats.un.org/unsd/cr/registry/isic-4.asp

WEBIST 2010 - 6th International Conference on Web Information Systems and Technologies

342

space can be further restricted with regard to product

or provider names, product or service categories,

price ranges, address information, etc.

The hierarchical search can be applied if the

detailed search is considered as too explicit and the

text search seems to be not restricting enough. The

user can browse the e-business and service

classifications, select one or several entries, and list

all products and services that fall into those

categories.

3.2.2 Result Presentation and Analysis

The results delivered by the assessment

framework are arranged in a structured list to

achieve intuitive illustration and comfortable

analysis possibilities.

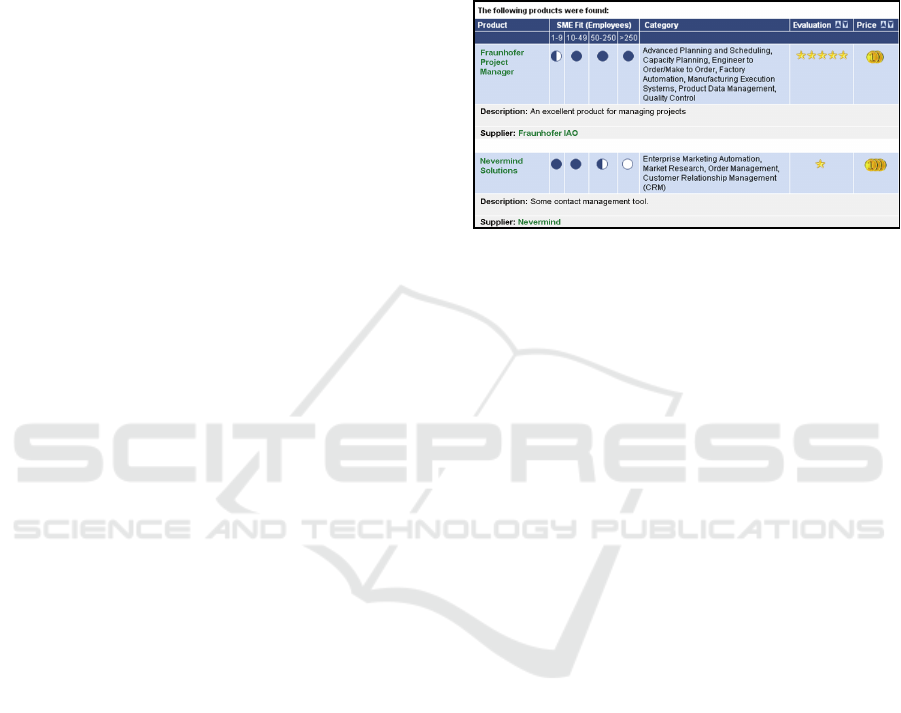

Figure 1 shows an example of a result list containing

two products. The list provides information about

the product itself and can be ordered by price or

evaluation. It contains:

Product name, description and provider: the

product name, a short description of the product and

the provider name are displayed. Clicking on the

product name leads to a detailed product

information.

The supplier link leads to the supplier details

view providing all information concerning the

supplier.

SME Fit: The SME Fit describes the suitability

of a product including e.g. transactions, availability

and capacity for different sizes of companies (1-9,

10-49, 50-250, >250 employees) and can be either

“not suitable”, “well suitable”, or “very well

suitable”, respectively. Users can find appropriate e-

business solutions for their company’s size by

analysing the SME fit value.

The categories help to specify the domain of the

product, service, open source project, or company.

Comments and rating: Additional to the

producer provided information a community rating

value is shown. By ordering all results by evaluation

the user can find best rated products on top of the

result list. Every registered user can rate a project.

To enter an evaluation for a product the user just has

to click on the product details page and then use the

“Evaluate Product” button. One can assign one (very

poor) to five (very good) stars. Users can also enter a

short text describing their own experience with the

product. The average rating value shows up in the

product search result list while the textual reviews

are listed in the product detail list. The comments

and ratings are an instrument to assure the quality of

the entries in the guide. Furthermore it gives the

managers of SMEs the possibility to learn more

about the business benefits that might arise from the

solution e.g. when the product has a high rating

value and good comments over a long time.

Price: The price range is symbolised with coins;

It starts with 0 to 299 € (one coin) and ends with

more than 5000 € (five coins).

Figure 1: Result list.

3.3 Evaluating a Company’s e-Business

Competence

The eBusiness Solution Guide offers means to

estimate a company’s eBusiness Competence Index

(EBCI). This index incorporates 16 questions

divided into four categories describing the overall IT

competences for companies. The EBCI follows the

specification of indicators developed by the

Sectorial eBusiness Watch in 2004 (cf. Selhofer,

2004). They are:

ICTBI: ICT Infrastructure and Basic

Connectivity Indicator (e.g. LAN use,

remote/wireless access to the company);

IBPAI: Internal Business Process Automation

Indicator (e.g. use of online technology, ERP

systems, intranet);

PSCI: Procurement and Supply Chain

Integration Indicator (e.g. integration of IT

system and electronic exchange with

providers);

MSPI: Marketing and Sales Processes

Indicator (e.g. use of CRM systems, online

selling rate).

For each question of the indicators the possible

answers are:

The ICT solutions has already been

implemented (value: 3 points);

There is an implementation or deployment in

progress (value: 2 points);

The implementation is planned in the near

future (value: 1 point);

FINDING E-BUSINESS SOLUTIONS WITH THE HELP OF A SELF-MANAGED ONLINE TOOL

343

The implementation has neither been

considered nor planned (value: 0 points).

As to be seen in equation (1) the calculation of

one single indicator z contains values of answers a

j

(j=1…4). The given value for one answer a is

between 0 and 3. The sum of the four values is

averaged by the sum of maximum points (four

values with maximum 3 points each give a 12 points

maximum).

z

i

=

∑

=

4

1

12

1

j

ij

a

where z

i

…indicator i (i= 1…4)

a

ij

…value of answer j of indicator

number i (a

i

j

= 0…3)

(1)

By aggregating these indicators an overview of a

SME’s current e-business infrastructure is obtained.

The eBusiness Guide calculates the EBCI e as the

sum of the indicators z

i

(i= 1…4) averaged by the

number of indicators as to be seen in equation (2).

e =

∑

=

4

1

4

1

i

i

z

where e…value of EBCI

z

i

…value of indicator i (0 ≤ z

i

≤ 1)

(2)

The resulting EBCI has a value between 0 and 1.

The e-business maturity of the SME is defined as

follows:

Low e-business-competence firms (EBCI

from 0 to 0.333)

Medium e-business-competence firms (EBCI

from 0.334 to 0.666)

High e-business-competence firms (EBCI

from 0.667 to 1)

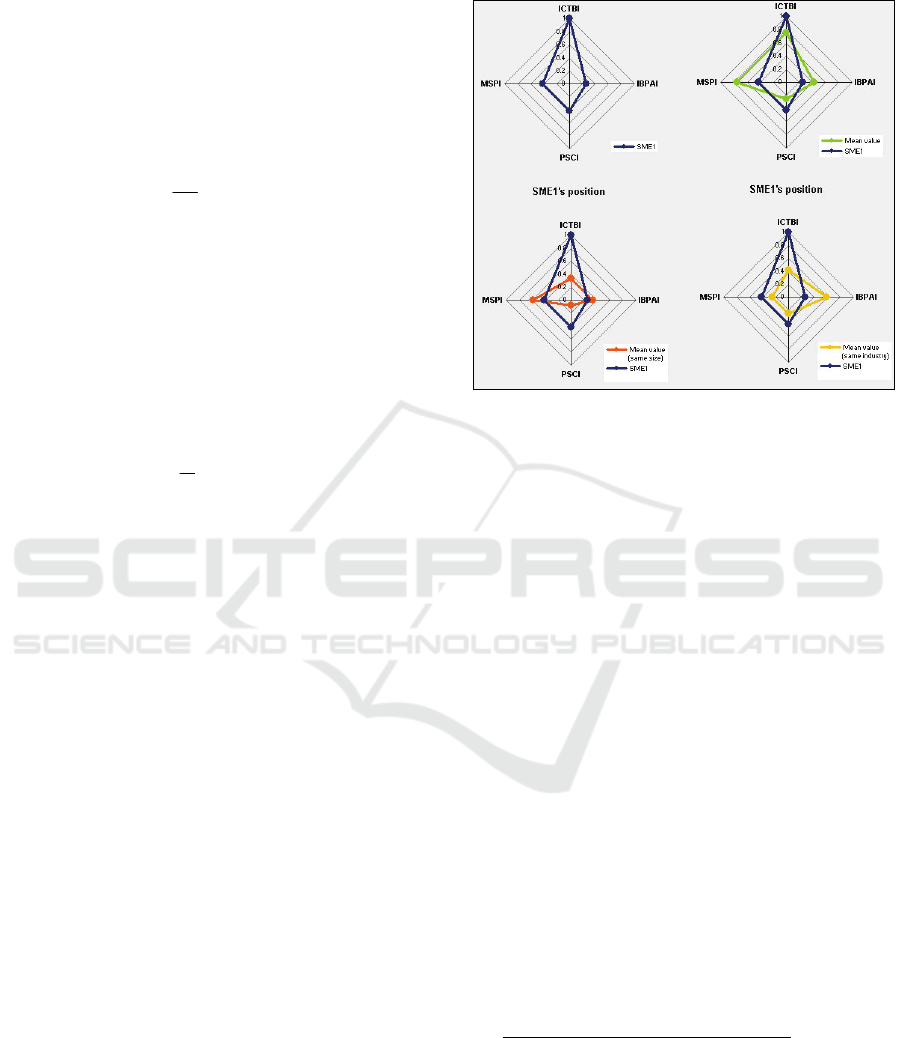

The EBCI as well as the single indicators and their

values appear at the summary. Additionally the

indicators are presented in the spider charts (see

Figure 2) which compare the indicators with the

average values of other companies’ entries. The

outcomes offer the SME useful advice regarding

which product categories would help to improve its

infrastructure. The advice is arranged according to

the four indicators including a direct connection to

the matching algorithm. Thus concrete solutions that

suit the related product categories are suggested. The

comparison of the different entries helps the

managers of the SMEs to be informed about the e-

business competence of the company without the

help of advisors. In corresponding cases it also helps

them in choosing newer and better products to get on

the same level as other competitors. When they see

that others also invest in ICT it gives the managers

more understanding for ICT as long-term solution.

Figure 2: e-Business Competence Indexes (EBCIs).

3.4 Implementation Notes

The eBSN eBusiness Solutions Guide is build on a

standard 5-layer-architecture (data management,

business entities, business logic, web layer, and user

interface).

It is implemented as a web application and has been

tested with the most common web browsers. The

server code runs inside a J2EE application server

(currently, BEA Weblogic is used

9

). The usage of

up-to-date software frameworks assures

maintainability and extensibility: Struts

10

(model-2

web framework), Tiles

11

(templates), Hibernate

12

(object relational mapping), and Spring

13

(inversion

of control and dependency injection) are applied.

Data is stored in a relational database (currently,

Oracle 9i

14

is used).

As the eBusiness Solutions Guide aims at SMEs

in Europe, the need for multi language support is

evident. While currently the user interface is only

implemented in English, French, and German,

support for further languages can be provided by

simply adding appropriate configuration files.

9

http://www.oracle.com/appserve

10

http://struts.apache.org

11

http://tiles.apache.org

12

https://www.hibernate.org

13

http://www.springsource.or

14

’http://www.oracle.com/technology/software/database

WEBIST 2010 - 6th International Conference on Web Information Systems and Technologies

344

4 DISCUSSION AND

CONCLUSIONS

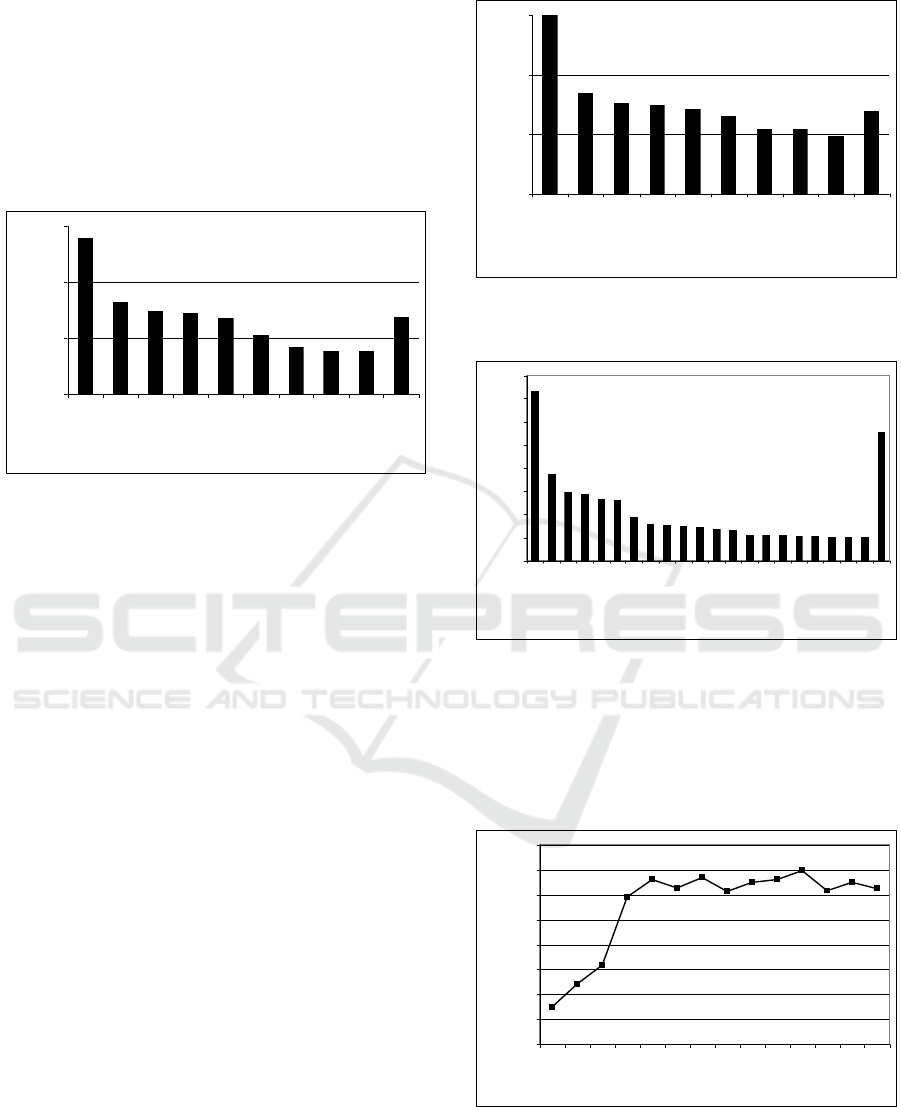

As of October, 2009, there are 1,392 active

registered users at the eBSN eBusiness Solutions

Guide. They have inserted information of 799

producers. Figure 3 shows the distribution of the

countries the entered producers are located in.

620

44

30

28

23

11

7

66

24

1

10

100

1000

Ge

rman

y

Au

stri

a

U

ni

ted King

d

om

Belgium

Italy

N

e

therland

s

Fra

nce

P

o

rtugal

R

o

mania

Ot

h

er

Producers

Figure 3: Distribution on entered producers among

different countries.

Most of the producers taking part so far stem from

Germany (78 %). This can be lead back to the fact

that the eBusiness Solutions Guide has so far been

mainly promoted in Germany (where it was

developed). Further entries are from Austria, the

United Kingdom, Belgium, Italy, and the

Netherlands, together accounting for 17 % of the

producers.

The distribution of the products’ localisation is

obviously related to the ones of the producers.

Figure 4 shows that so far, 993 of the 1,207 entered

products stem from Germany (82 %). Thus, there are

1.6 products registered per producer. The United

Kingdom has an equal rate but only provided 48

products, so far.

We measured the number of users on the

demand side by analysing the web server’s access

log file. As of October 2009 15,532 visitors attended

the platform. The introduction phase started in

September 2008. At that time, the tool was known

only to a small number of users. In December 2008,

a first stable version was promoted to a growing

number of associations and clients. The actual

production phase started in March 2009. As Figure 5

shows the number of visitors has levelled out to

approx. 1,300 visitors per month.

993

48

33

30

26

20

12 12

9

24

1

10

100

1000

Germany

Un

i

t

ed

Ki

ngd

om

Aus

t

r

i

a

I

t

aly

Bel

g

i

um

Luxem

b

ourg

P

o

r

t

ug

al

Fr

an

ce

Ne

th

er

l

a

nds

O

t

he

r

Products

Figure 4: Distribution on entered e-business products

among different countries.

731

373

297

285

268

262

186

155

154

150

143

134

128

112 111

107

105 104

103 101

99

553

0

100

200

300

400

500

600

700

800

Germany

Belgium

France

United Kingdom

Spain

Italy

Austria

Romania

Greece

Ireland

Malta

Bulgaria

Netherlands

Finland

Portugal

Poland

Slovenia

Sweden

Denmark

Cyprus

Latv ia

Other

Visitors

Figure 5: Distribution of visitors in 2008 and 2009.

The log files also tell us which country-specific view

the user has selected – and thus give hints to where

the user stem from. Figure 6 shows that each of the

27 EU countries has been selected. Not surprisingly,

Germany was chosen most often.

0

200

400

600

800

1000

1200

1400

1600

Se

p

20

08

Oct

2

008

Nov 2008

De

c

20

0

8

Jan

200

9

Feb 2009

Mar 2009

Apr

20

0

9

May

200

9

Ju

n

2

009

Jul

2

009

Aug

200

9

S

e

p20

09

Oc

t

2

009

Visitors

Figure 6: Visitor's choice of country.

We expect the awareness level on the demand side

to grow with the amount of products and services

entered in the platform. As of today, the content for

FINDING E-BUSINESS SOLUTIONS WITH THE HELP OF A SELF-MANAGED ONLINE TOOL

345

the non-German market is still quite limited. But the

experiences so far indicate that the eBSN eBusiness

Solutions Guide is being well accepted among both,

e-business solution providers and e-business solution

seeking SMEs. However the current supply-side

usage statistics show a clear imbalance with regard

to the usage in different European countries. Thus,

forthcoming marketing campaigns should aim at

raising the tool’s awareness level in other European

countries.

REFERENCES

Bogaschewsky, R., 2009: Stimmungsbarometer

Elektronische Beschaffung 2009, available online at

http://www.bme.de/fileadmin/bilder/Stimmungsbarom

eter_2009.pdf

European Commission, 2005. The new SME definition:

User guide and model declaration, available online at

http://ec.europa.eu/enterprise/enterprise_policy/sme_d

efinition/sme_user_guide.pdf

Harindranath, G. Dyerson, R., Barnes, D., 2008. ICT

Adoption and Use in UK SMEs: a Failure of

Initiatives? In The Electronic Journal Information

Systems Evaluation, Volume 11, Issue 2, pp. 91 - 96,

available online at www.ejise.com

Hudetz, K., Eckstein, A., 2008. Elektronischer

Geschäftsverkehr in Mittelstand und Handwerk 2008,

available online at http://www2.ec-kom.de/ec-

net/Berichtsband_NEG-Erhebung_2008.pdf

Renner, T., Vetter, M., Scheiding, F. et al., 2008.

eBusiness Guide for SMEs: eBusiness Software and

Services in the European Market, European

Communities, Bruxelles

Selhofer, H., Lilischkis, S., Woerndl, M., et al. (ed.), 2008.

The European e-Business Report 2008: The impact of

ICT and e-business on firms, sectors and the economy,

European Communitites, Bruxelles

Selhofer, H. (ed.), 2004. The European e-Business Report

2004 edition: A portrait of e-Business in 10 sectors of

the EU economy, European Communities, Bruxelles

Schmidt, A.P., 2003. Strategische IT-Investments für

KMU. In KMU-Magazin No. 03, March 2003,

Switzerland

WEBIST 2010 - 6th International Conference on Web Information Systems and Technologies

346