A METHOD FOR PORTFOLIO MANAGEMENT

AND PRIORITIZATION

An Incremental Funding Method Approach

Gustavo Taveira, Antonio Juarez Alencar and Eber Assis Schmitz

Informatics Graduate Program, Institute of Mathematics and Electronic Computing Center

Federal University of Rio de Janeiro, Rio de Janeiro, Brazil

Keywords:

Portfolio management, Incremental funding method, Minimum marketable features, Principles of choice, De-

cision theory.

Abstract:

In today’s very competitive business environment, making the best possible use of limited resources is crucial

to achieve success and gain competitive advantage. To accomplish such a goal organizations have to maxi-

mize the return provided by their portfolio of future investments, choosing very carefully the IT projects they

undertake and the risks they are willing to accept, otherwise they are bound to waste time and money, and

still be likely to fail. This article introduces a method that enables managers to better evaluate the investment

to be made in a portfolio of IT projects. The method favors the identification of common parts, avoiding the

duplication of work efforts, and the selection of the implementation order that yields the highest payoff con-

sidering a given risk exposure policy. Moreover, it extends Denne and Cleland-Huang’s ideas on minimum

marketable feature modules and uses both Decision Theory and the Principles of Choice to guide the decisions

made under uncertainty.

1 INTRODUCTION

In today’s dynamic business environment where most

organizations strive to gain competitive advantage

over a myriad of competitors, the use of information

technology (IT) is seen as a crucial tool to achieve

such a goal. With its growing strategic importance,

the expenditure on IT keeps on increasing rapidly and

has become a dominant part of the capital budget of

organizations in many markets (Chen et al., 2007).

Although businesses have invested enormous

sums in IT, these investments have often proved to

be unsuccessful, exceeded budget, and even harmed

companies (Bingi et al., 1999; Chen, 2001; Somers

and Nelson, 2003). Because of that, while IT projects

are becoming more complex, due to the uncertainty

about their economic impact, technological complex-

ity, rapid obsolescence, implementation challenges,

and so forth, the pressure imposed on managers to

keep the balance between risk and payoff on their

decision making is getting even bigger (Chen et al.,

2007; S. Dewan, 2007).

To make information technology investment deci-

sions easier McFarlan suggests that portfolio theory

should be used to analyze and manage the money to

be spent on IT (McFarlan, 1981).

An important lesson that comes from portfolio

theory is the understanding that the values of invest-

ments or assets within a portfolio are often highly

correlated. In other words, investment decisions are

seldom taken in isolation (Markowitz, 1952; Sil-

vius, 2008). Hence, project portfolio management

(PPM) has been receiving increasing attention from

both practitioners and researchers, as PPM practices

advocate that the entire portfolio of projects have to

be considered before a decision is reached on which

projects should be given priority on implementation

and which ones should be added or removed from

the portfolio (Jeffery and Leliveld, 2004; Reyck et al.,

2005).

This article introduces a method that enables

decision makers to better evaluate the investments

to be made in a portfolio of IT projects. Based on

an organization risk taking or risk averse culture the

method identifies the implementation order that yields

the highest payoff and avoid the duplication of work.

The method extends Denne and Cleland-Huang’s

Incremental Funding Method (IFM) and their

modularization ideas of minimum marketable

features. Also, it uses both the Decision Theory

23

Taveira G., Juarez Alencar A. and Assis Schmitz E. (2010).

A METHOD FOR PORTFOLIO MANAGEMENT AND PRIORITIZATION - An Incremental Funding Method Approach.

In Proceedings of the 12th International Conference on Enterprise Information Systems - Information Systems Analysis and Specification, pages 23-33

DOI: 10.5220/0002873400230033

Copyright

c

SciTePress

and the Principles of Choice to support the decision

making process under uncertainty.

The reminder of this article is organized as

follows. Section 2 presents the conceptual framework

the paper is based upon. Section 3 introduces the

Incremental Funding Portfolio Management Method

(IFPMM) with the help of a real world inspired exam-

ple. Section 4 presents a discussion on the impact of

the IFPMM on IT portfolio management and business

strategy. Finally, section 5 presents the conclusion.

2 CONCEPTUAL FRAMEWORK

2.1 The Incremental Funding Method

The Incremental Funding Method (IFM) is a finan-

cially informed approach to software development

that uses the Functional Class Decomposition con-

cept (Chang et al., 2001) to decompose the system

to be constructed into small self-contained software

units that can be delivered quickly and whose fea-

tures have value to business. This kind of units are

called minimum marketable features, or MMF for

short (Denne and Cleland-Huang, 2003; Denne and

Cleland-Huang, 2004).

Besides MMFs, projects usually have an archi-

tectural infrastructure they may rely upon. As

claimed by the IFM, this infrastructure can also be

decomposed into self-contained deliverable units,

which are meant to be constructed and delivered on

demand (Denne and Cleland-Huang, 2003; Denne

and Cleland-Huang, 2004). Such units are called

architectural elements (AEs).

By decomposing a project into units that can

be managed as “miniprojects”, the IFM increases

the likelihood of success for large-scale development

efforts (Denne and Cleland-Huang, 2004). The

benefits of this approach to software development

projects are numerous:

• Large and complex systems can be developed

from a relatively smaller investment,

• Bring financial discipline into software develop-

ment practice,

• Return on investment is maximized,

• Demand for shorter investment periods and

payback time are addressed,

• Favor faster time-to-market of projects that

depends upon software development, and

• Position the software development process as a

value creation activity in which business analysis

is an integral part of it.

In the IFM, once the MMFs and AEs are identi-

fied, a window of opportunity is established in which

these units are developed and provide value to busi-

ness. When the window closes the software units are

replaced by a more valuable alternative or discarded

altogether.

Although MMFs and AEs are self-contained units,

it is often the case that they can only be developed

after other MMFs or AEs have been completed. This

creates a dependency relation among such units,

constraining the order in which they can be

developed, thus limiting project sequencing

options (Denne and Cleland-Huang, 2005).

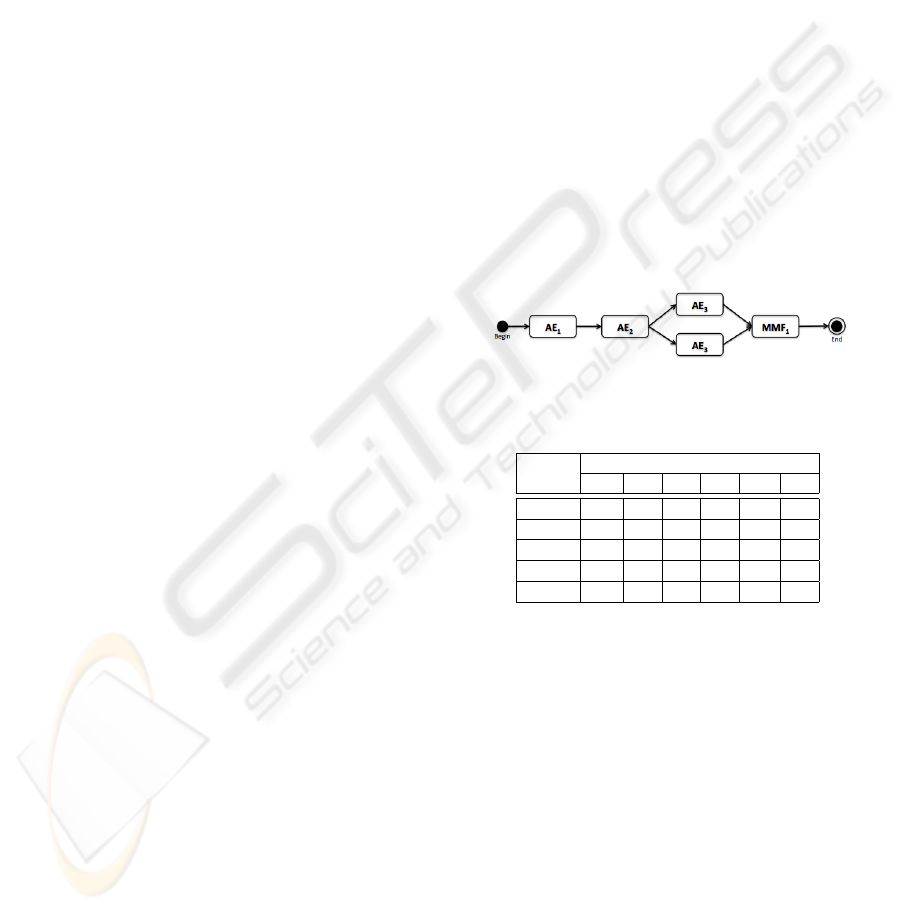

For example, consider the set of MMFs and AEs

whose development schedule is constrained by the

precedence graph introduced in Figure 1. In that

figure an arrow going from one unit to another, e.g.

AE

4

→ MMF

1

, indicates that the development of

the former (AE

4

) must precede the development of

the latter (MMF

1

). Table 1 shows the cash flow

elements of these software units within their window

of opportunity.

Figure 1: The project precedence graph.

Table 1: AEs and MMFs cash flow elements (US$1,000).

Period

Unit 1 2 3 4 · · · 30

AE

1

-27 0 0 0 · · · 0

AE

2

-70 0 0 0 · · · 0

AE

3

-40 0 0 0 · · · 0

AE

4

-14 0 0 0 · · · 0

MMF

1

-12 25 28 35 · · · 80

Note that while the AEs require some

initial investment to be developed, they do not

generate any revenue during the project lifecycle. For

instance, AE

1

can be developed in just one period,

requires US$ 27 thousand to be completed, and yield

no revenue until the window of opportunity closes 29

periods later.

Although MMFs also requires some initial

investment to be developed, once deployed

they provide revenue to business over a certain

number of periods. For instance, MMF

1

can also be

developed in just one period, requires US$ 12 thou-

sand to be completed, and generates US$ 25 thousand

in the second period, US$ 28 thousand in the third,

and so on and so forth. The revenue returned by an

MMF is often the result of cost savings, competitive

differentiation, brand-name projection, and enhanced

customer loyalty (Denne and Cleland-Huang, 2003;

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

24

Denne and Cleland-Huang, 2004).

Counterpointing to the IFM objective, looking

at just one single project at a time and optimiz-

ing its Net Present Value (NPV) is not quite the

main goal of most organizations, which usually have

limited resources, several investment options and

prefer to benefit from the analysis of portfolios of IT

projects instead (Jeffery and Leliveld, 2004; Reyck

et al., 2005).

Moreover, the way the cash-flow elements of

MMF and AEs are calculated by Denne and Cleland-

Huang (op. cit.) prevent them from adequately

reflecting real world circumstances, where it is often

the case that the investment required to develop a

software unit and the revenue it generates cannot be

precisely determined in advance.

To deal with real world situations, one has to

consider the inherent uncertainty associated to

future values of cash-flow elements. Besides, the

literature has repeatedly indicated software develop-

ment as a complex and risky activity (Westerman

and Hunter, 2007). Hence, as results obtained under

uncertainty can be quite different, the valuation of

software projects should always take uncertainties

into account (Abdellaoui and Hey, 2008; Barbosa

et al., 2008; Schmitz et al., 2008).

In many circumstances, a triangular probability

density function (TPDF) is used to represent the

uncertainty described in cash flow elements. This

TPDF is obtained by estimating a lower bound (Min),

an upper bound (Max) and the most likely value (ML )

for each period, as presented in Table 2. According

to Hubbard (Hubbard, 2007), the lower bound,

most likely and upper bound values are more easily

obtained considering the worst, most likely and best

case among all reasonable scenarios.

Table 2: Cash flow streams under uncertainty (US$ 1,000).

Period

Unit 1 2 · · · 30

(Min,ML,Max) (Min,ML,Max) (Min,ML,Max)

AE

1

(-35,-24,-20) (0, 0, 0) · · · (0, 0, 0)

AE

2

(-80,-75,-60) (0, 0, 0) · · · (0, 0, 0)

AE

3

(-50,-35,-30) (0, 0, 0) · · · (0, 0, 0)

AE

4

(-18,-12,-10) (0, 0, 0) · · · (0, 0, 0)

MMF

1

(-15,-12,-10) (20,23,30) · · · (70, 85, 90)

2.2 Decision Making under Uncertainty

When all the possible alternatives have known out-

comes and their consequences can be described using

a single measure, then making a choice among them

is an easy task. Otherwise, whenever any sort of

uncertainty is present, the choice becomes more

difficult.

As presented by Holloway (Holloway, 1979),

there are four characteristics that can increase the

difficulty of making choices, turning decision

problems into complex decision problems, namely:

• a large number of factors – which is often the

case for financial problems, such as investments

decision making;

• more than one decision maker – a common situa-

tion to most of the existing business;

• multiple attributes – whenever more than one

aspect is needed to describe the outcome of a

decision and one has to balance between them,

such as profit and risk; and

• uncertainty – which is inherent to any kind of

IT project and to the dynamic environment that

surrounds software development.

When handling portfolios of IT projects and

analyzing the resulting investment options, an orga-

nization usually faces all these difficulties. As the

variables of interest incorporate uncertainty, they

become random variables and, consequently, may

be represented as Probability Density Functions

(PDF) (Kotz and van Dorp, 2004).

Therefore, a method to analyze these PDFs and

make investment decisions under uncertainty is a

“must have” for every single IT decision maker. The

methods of direct choice under uncertainty are clas-

sified in three groups (Holloway, 1979): probabilistic

dominance, summary measures and aspiration-level.

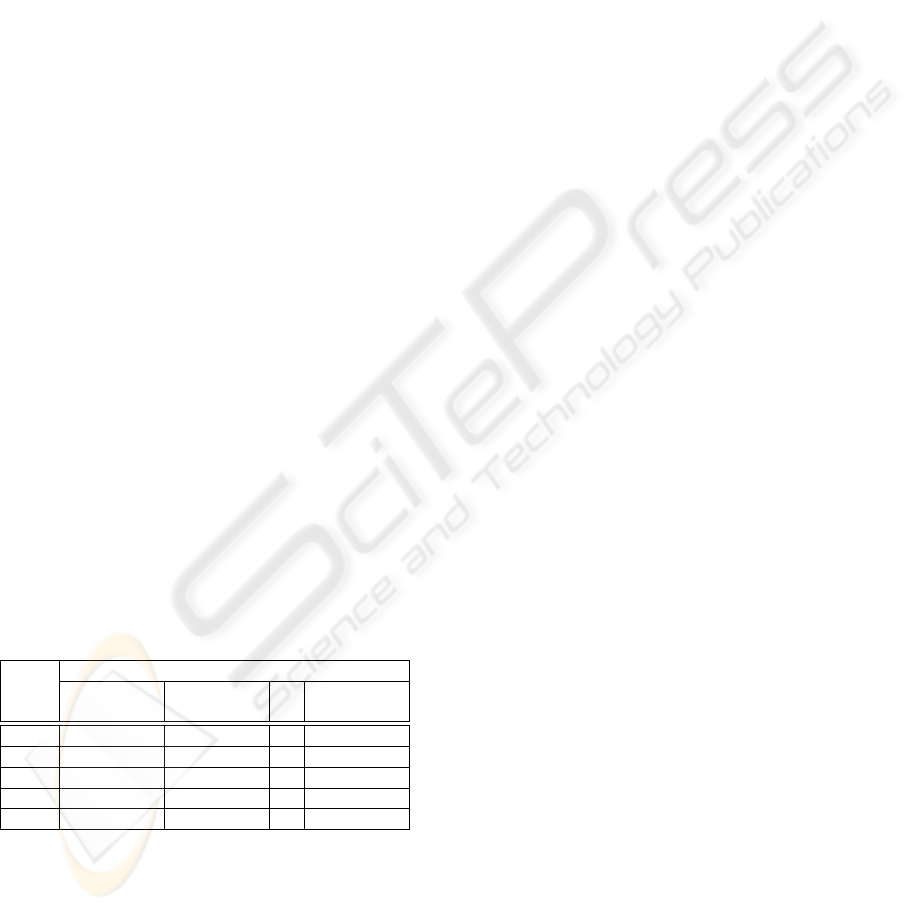

As stated by the probabilistic dominance crite-

rion, in circumstances where the probability of one

of the alternatives achieving any value is greater than

or equal to the probability of any other alternative

achieving that value, then this alternative probabilisti-

cally dominates all the others.

Hence, probabilistic dominance is a compelling

reason for choosing one alternative over another.

Figure 2 presents an example where alternative 1

probabilistically dominates alternative 2.

However, it is not often the case that probabilistic

dominance can be applied. In circumstances where

dominance does not exist, each alternative must be

analyzed regarding its risks and payoffs. During this

analysis, it is very important to consider whether

one is dealing with a risk-taken or risk-averse orga-

nization. Figure 3 presents the cumulative density

function of three alternatives, namely A, B and C,

where none of them probabilistically dominates the

others.

Despite trying to assimilate the entire probability

distributions, the analysis and further comparisons of

alternatives can be done through the use of Summary

A METHOD FOR PORTFOLIO MANAGEMENT AND PRIORITIZATION - An Incremental Funding Method Approach

25

Figure 2: CDF with probabilistic dominance.

Figure 3: CDF without probabilistic dominance.

Measure Criterion, which consider values such as

mean, minimum, and maximum, among others (Hol-

loway, 1979). According to the decision theory (Lang

and Merino, 1993; White, 2006), the following prin-

ciples are used to take decisions under uncertainty

based on summary measures:

• Maximin or Minimax Principle – this principle

always considers the worst case scenario in the

decision making process, choosing the alterna-

tive that has the highest minimum revenue or the

lowest maximum cost, depending on the criterion

one is using. To analyze the example introduced

in Figure 3, the organization would compare the

minimum values presented in Table 3, choosing

alternative B as the best investment option, which

yields at least a US$ 90,000.00 profit.

Table 3: Return of each investment option (US$ 1,000).

Alternative Minimum Mean Maximum H

CV

A 80 150 200 164

B 90 132 180 153

C 65 142 230 179

• Maximax or Minimin Principle - In contrast to

the previous principle, the Maximax and Min-

imin principle always consider the best case sce-

nario in the decision making process, choosing the

alternative that has the highest maximum revenue

or the lowest minimum cost. Using the Max-

imax principle within the example of Figure 3,

the organization would consider the maximum

values presented in Table 3, selecting C as the best

investment option, which can yield a revenue as

high as US$ 230,000.00.

• Equal Likelihood (Laplace) Principle – this

principle assumes that all possible outcomes are

equally likely to occur. Based on this assump-

tion, it considers the mean value of all the possible

alternatives and selects the highest one. Table 3

also presents the mean values from the alterna-

tives within the Figure 3 example. By using the

Laplace principle, the organization would choose

the alternative A as the best investment option.

• Hurwicz Principle – instead of making decisions

based on just one summary measure such as

the previous principles, Hurwicz combines both

minimum and maximum values, creating a

balance between them. Such a balance is achieved

by using an index of optimism (α), which is

estimated by specialists and vary from

organization to organization. Once α is defined,

the Hurwicz criterion value (H

CV

) is given by

Equation 1.

H

CV

= α ∗ Max(Profit) + (1 − α) ∗ Min(Profit)

(1)

Table 3 presents the H

CV

of each alternative

within the example, considering α equal to

70%. In this scenario, an organization using the

Hurwicz principle would prefer alternative C to

any other investment option.

• Minimax Regret (Savage) Principle - analogous

to the Hurwicz principle, it also considers both

minimum and maximum values to analyze each

one of the alternatives, but in a completely

different manner. The objective is to compare

these two values and compute the maximum

regret of each alternative, which is calculated

considering the difference between the best and

the worst outcome that it can achieve. The

maximum regret table from the Figure 3 example

is presented in Table 4. Once the maximum regret

is computed, this principle chooses the alternative

that minimizes it. In this case, the decision maker

would choose alternative B as the best investment

option.

Another useful criterion to be applied is to base

the comparison on some aimed output value that is

very important to the organization. The Aspiration-

Level Criterion maximizes the probability of achiev-

ing such a value. To illustrate, assume that in the

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

26

Table 4: Maximum regret per alternative.

Alternative Maximum Regret

A US$ 120,000.00

B US$ 90,000.00

C US$ 165,000.00

Figure 3 example the decision maker defines that it is

extremely important to have at least a US$ 120,000.00

profit. Table 5 presents the probability of achieving

a profit equal to or greater than US$ 120,000.00 for

each alternative. Using the aspiration-level criterion,

alternative A would be chosen.

Table 5: Probability of achieving the aspiration level.

Alternative Prob. of US$ 120,000.00 or more

A 85%

B 70%

C 72%

As aforementioned, it is up to organizations to

define which is the most suitable criterion to be used

in their decision making process under uncertainty.

This criterion of choice may vary from organization

to organization, depending on their objectives and

predefined risk-exposure policy.

3 THE METHOD

For better understanding, the method proposed in

this paper is introduced and explained step-by-step

throughout this section with the help of a real-world

inspired example

1

.

Step 0: Context Information. Consider a large mo-

bile telecommunication carrier such as AT&T, Ver-

izon, Sprint, T-Mobile, Vodafone, Telef

´

onica and

many others, which have millions of subscribers and

provide different kinds of services for voice, data, and

broadband. For the purpose of this paper this organi-

zation is called World Mobile Telecom Corporation,

or WMTC for short.

Technology advances in telecommunications have

brought significant changes in the services provided

by mobile carriers around the world. As a result,

WMTC’s competitors are struggling for strategic

advantages that would enable them to gain market

share and even surpass WMTC.

1

The data used to obtain the results presented in this pa-

per is closely related to real data provided by one of the

Latin America’s largest mobile network operator. Because

the data reflects the current portfolio of on-going IT projects

of this organization and, as a result, part of its business strat-

egy, the authors have been kindly requested not to disclose

its name.

Furthermore, a growing number of customers con-

scious of their bargaining power are demanding for

better products and services for reduced prices, so the

need for innovation and differentiation is increasing

rapidly. Therefore, as WMTC wants to advance its

position as a major player in the mobile telecommu-

nication business, it must undertake the right tactical

and strategic projects, making the best possible use of

its limited human and financial resources.

Considering that there is not enough resources to

run all projects that are necessary to increase its mar-

ket share, WMTC Board of Directors became firmly

convinced that the company has to adopt decision

theory and principles of choice to get the most out

of its investment in IT.

However, due to shortage of funds caused by the

world financial crises, WMTC was forced to reduce

drastically its number of employees. Counting on just

one development team, they need to ensure that the

company concentrates their efforts on maximizing the

benefits of their diversified portfolio of IT projects.

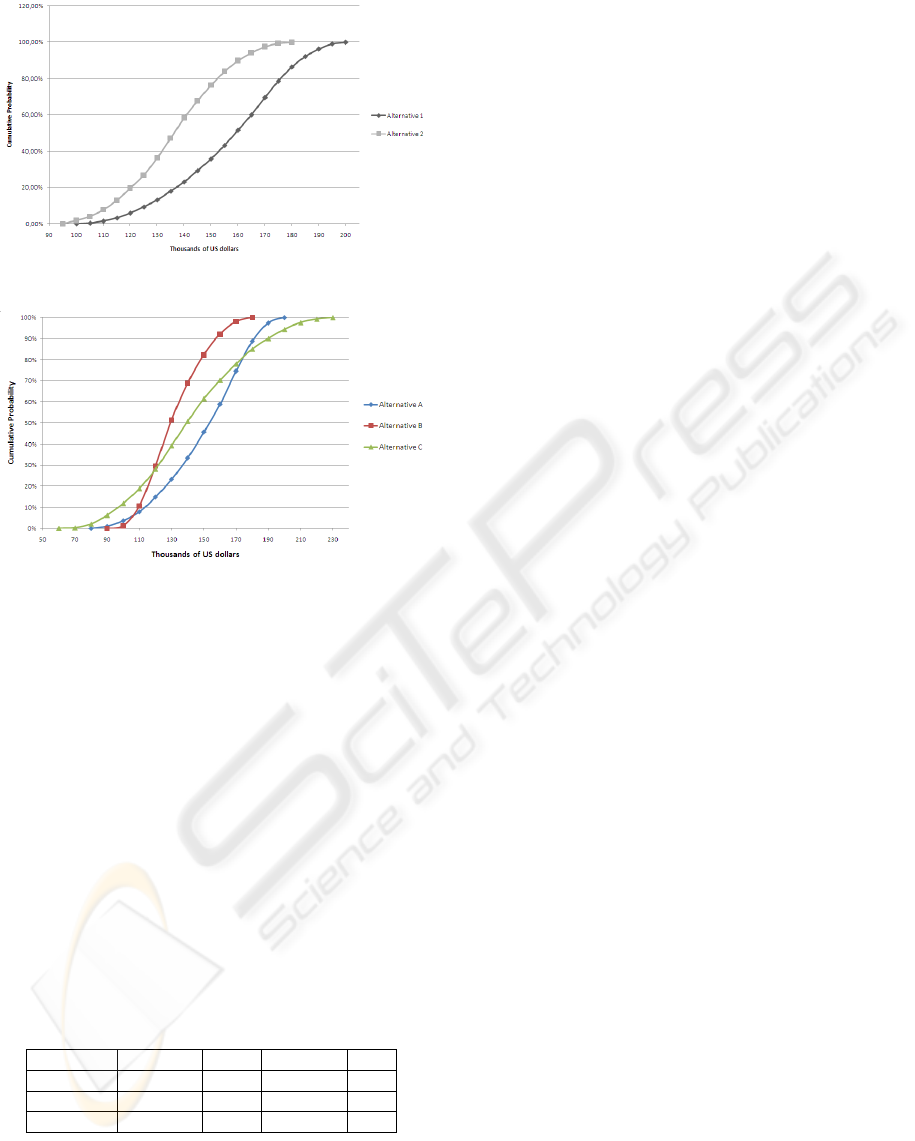

Table 6 presents the projects comprising WMTC’s

portfolio, which are meant to support a strategic move

against growing competition in its market.

Table 6: WMTC’s portfolio of strategic IT projects.

Id Project Description

GSP GOODS AND

SERVICES

PURCHASE

Allows subscribers can go shopping with

nothing else but their mobile phones, us-

ing it as a credit card to pay for goods

and services in associated stores.

EP MOBILE

ENTERTAINMENT

PASS

Lets subscribers to search for movies,

plays and shows, browse their synopsis

and buy tickets directly from their mo-

bile phones. Subsequently to purchasing

a ticket, subscribers receive an SMS with

a queue avoiding electronic ticket.

M

+

MESSAGE+ Enables subscribers to have an e-mail

browser experience when handling SMS

(short message service) and MMS (mul-

timedia message service). Users can

store, search, send, forward, redirect,

auto reply, copy, and also maintain an e-

address book of their contacts.

VM VIDEOMAIL Make it possible for subscribers to re-

ceive, store and retrieve messages when-

ever they can not answer an incoming

video call.

VoIP VOIP SERVICE Delivers voice over internet protocol to

subscribers who already have an unlim-

ited data plan.

Step 1: Identifying the MMFs and AEs within

WMTC’s Portfolio of IT Projects. If one is will-

ing to take advantage of Denne and Cleland-Huang’s

ideas on minimum marketable features (op. cit.), the

A METHOD FOR PORTFOLIO MANAGEMENT AND PRIORITIZATION - An Incremental Funding Method Approach

27

projects in the WMTC portfolio have to be decom-

posed into AEs and MMFs, so that they can be in-

crementally delivered to customers as “miniprojects”.

Tables 7, 8, 9, 10 and 11 introduce the AEs and MMFs

identified by the WMTC’s Project Management Of-

fice (PMO).

Table 7: Goods and services purchase MMFs.

Id Type Name Description

GSP

1

AE Service

subscription

Allows customers to subscribe to

and unsubscribe from the service

GSP

2

AE Credit

analysis

Figures the likelihood of a customer

paying a debt according to pre-

established dates and values

GSP

3

AE M-Payment Lets customers pay for goods and

services they want to buy in associ-

ated stores

GSP

4

AE Refund Allows customers to be refunded

when returning goods and services

they bought in associated stores

GSP

5

MMF Shopping Entitles customers to shop for goods

and services in associates stores.

This includes paying and on occa-

sion being refunded for the goods

and services they have bought

Table 8: Mobile entertainment pass MMFs.

Id Type Name Description

EP

1

AE Service

subscription

Allows customers to subscribe to and

unsubscribe from the service

EP

2

AE Credit

analysis

Figures the likelihood of a customer

paying a debt according to pre-

established dates and values

EP

3

MMF Search

movie

Allows customers to search for

movies, plays and shows based on

multiple criteria such as: title, cast,

district, theater and genre

EP

4

MMF Browse

synopsis

Make it possible for customer to

browse among movie, play and show

synopses

EP

5

AE Captures

customer

location

Gathers information about the cur-

rent customer location (GPS or tower

based)

EP

6

MMF Buy

ticket

Allows customers to choose which

specific theater or showroom seat they

would like to purchase, charges the

ticket value to the customer’s account

and provides a queue avoiding elec-

tronic ticket

EP

7

MMF Browse

nearby

places

Provides information on all theaters

and showrooms in the vicinity of the

current customer location

Step 2: Establishing the Precedence between

identified Software Units. One of the main ben-

efits of organizing MMFs and AEs in a port-

folio is the possibility of more easily identify-

Table 9: Message+ MMFs.

Id Type Name Description

M

+

1

AE Service

subscription

Allows customers to subscribe to and

unsubscribe from the service

M

+

2

AE Credit

analysis

Figures the likelihood of a customer

paying a debt according to pre-

established dates and values

M

+

3

AE Store

messages

Stores SMS and MMS messages re-

ceived by customers

M

+

4

AE Organize

inbox

Allows customers to order messages

by different parameters, delete mes-

sages and search for specific messages

M

+

5

AE Reply Allows customers to edit a text and use

it to reply to a message

M

+

6

AE Send &

Forward

Sends a new and an existing message

to a given address (email or phone

number) or a set of addresses

M

+

7

MMF Manage

inbox

Allows customers to organize their

message boxes, send, reply to and for-

ward messages

M

+

8

MMF Auto

reply &

redirect

While “on” automatically replies to

any received message or redirects all

received messages to a given address

(email or phone number)

M

+

9

MMF Use

contacts

info

Lets customers to use informations

from their contact lists when sending

or forwarding messages, such as con-

tact name, phone number and email

address

Table 10: VideoMail MMFs.

Id Type Name Description

VM

1

AE Service

subscription

Allows customers to subscribe to and

unsubscribe from the service

VM

2

AE Credit

analysis

Figures the likelihood of a customer

paying a debt according to pre-

established dates and values

VM

3

AE Recorder Lets callers to record a video message

when their incoming video calls are

not answered

VM

4

AE Password

input

Authenticates subscribers, granting

access to their VIDEOMAIL accounts

VM

5

MMF Listen to

video mails

Allows customers to retrieve a

recorded video message from their

mail boxes

VM

6

MMF Manage

video mails

Allows subscribers to store or delete a

video message, change their VIDEO-

MAIL welcome message and also re-

trieve the caller’s id

ing common software units. By factoring out

such units one may reduce the portfolio’s time-to-

market and cost, at the same time that increases

quality (Pressman, 2009).

When analyzing the portfolio of strategic IT

projects, the WMTC PMO identified two software

units that are common to two or more projects, i.e.

“Service subscription” (CSU

1

) and “Credit analysis”

(CSU

2

).

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

28

Table 11: VoIP service MMFs.

Id Type Name Description

VoIP

1

AE Service

subscription

Allows customers to subscribe to

and unsubscribe from the service

VoIP

2

AE Credit

analysis

Figures the likelihood of a customer

paying a debt according to pre-

established dates and values

VoIP

3

AE Manage

buddies

Allow subscribers to search, add

and delete buddies from their buddy

list

VoIP

4

MMF Call buddy Call a buddy directly from the

buddy list using voice over internet

protocol (VoIP)

VoIP

5

AE Link buddy

and contact

Link a VoIP buddy to an existing

contact in the subscriber contact list

VoIP

6

MMF Call contact Call a buddy directly from the con-

tact list, using the link between the

contact and the VoIP buddy

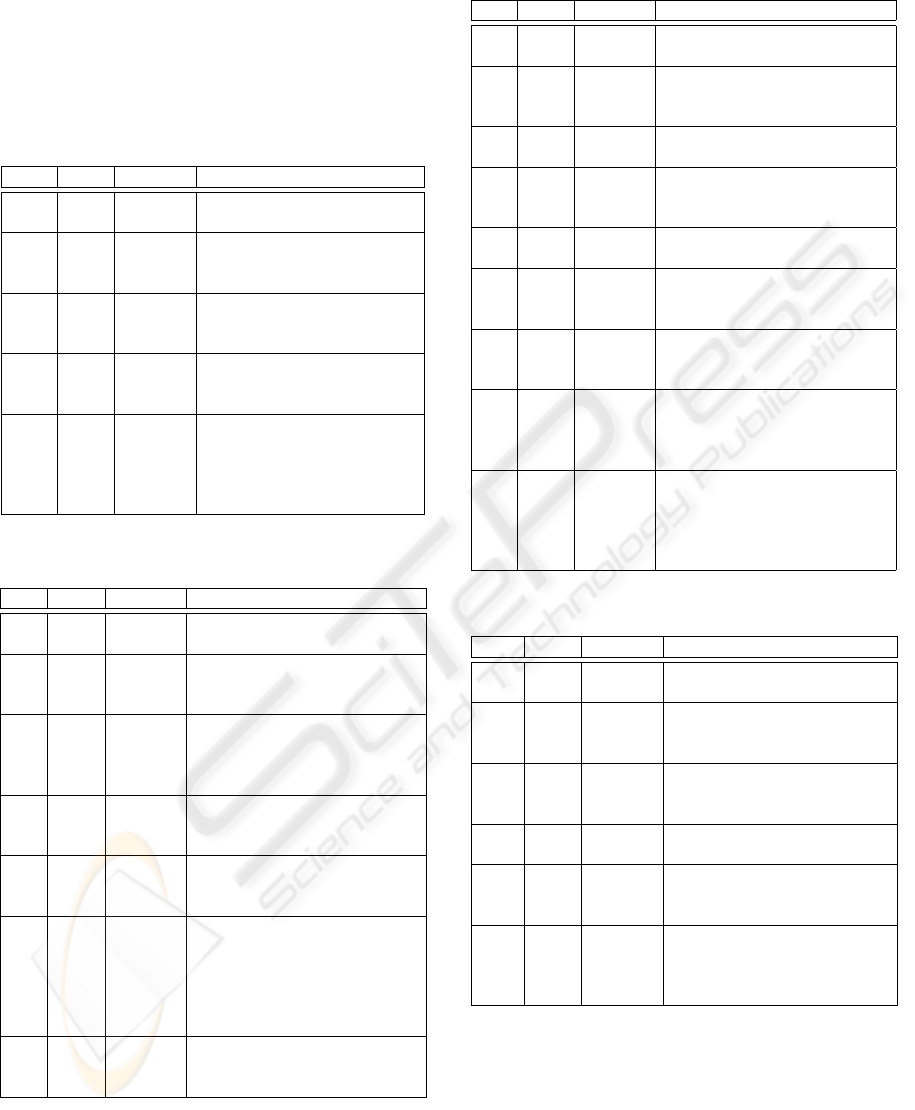

Figure 4, together with Figures 5, 6, 7, 8 and 9,

introduce the precedence graph of all software units

in the WMTC’s portfolio of strategic IT projects.

Figure 4: WMTC’s portfolio precedence graph.

Figure 5: Goods and service purchase precedence graph.

Figure 6: Mobile entertainment pass precedence graph.

Figure 7: Message+ precedence graph.

Step 3: Forecasting the Inflows and Outflows

of Software Units within the WMTC Portfolio.

Once the AEs and MMFs have been identified and

arranged into a precedence graph, their estimated

Figure 8: VideoMail precedence graph.

Figure 9: VoIP service precedence graph.

costs and revenues should be calculated and, subse-

quently, analyzed over the window of opportunity that

defines the portfolio lifecycle. See (Hubbard, 2007)

for guidelines on how IT project cost and revenue may

be properly calculated.

To take uncertainty into account WMTC decided

to consider the worst (Min), the best (Max), and the

most likely (ML) scenario for the value of each MMF

and AE cash flow element. Then, these elements were

modeled as triangular probability density functions.

Table 12 presents these values.

Table 12: WMTC’s AEs and MMFs cash flow (US$ 1,000).

Period

Unit 1 2 · · · 30

(Min,ML,Max) (Min,ML,Max) (Min,ML,Max)

CSU

1

(-35,-24,-20) (0, 0, 0) · · · (0, 0, 0)

CSU

2

(-80,-75,-60) (0, 0, 0) · · · (0, 0, 0)

GSP

3

(-50,-35,-30) (0, 0, 0) · · · (0, 0, 0)

GSP

4

(-18,-12,-10) (0, 0, 0) · · · (0, 0, 0)

GSP

5

(-15,-12,-10) (20,23,30) · · · (70, 85, 90)

EP

3

(-34,-29,-25) (15,17,25) · · · (45, 58, 60)

.

.

.

.

.

.

.

.

. · · ·

.

.

.

VoIP

6

(-20,-16,-10) (10,13,20) · · · (0, 0, 0)

Step 4: Generating Scenarios and selecting

the Best Sequencing Options. Once the port-

folio’s precedence graph is built and their

unit’s cash flows are estimated, the PMO must

identify the most attractive sequencing option,

together with its net present value (NPV).

Considering that their cash flow elements are

statistically correlated and that this correlation exists

both between elements of the same cash flow stream

(CFS) and elements of different CFSs within the

portfolio, the NPV can not be approximated by

Laplace’s Central Limit Theorem (CLT), which is

only suitable to a sum of n independent random vari-

ables. However, good computational approximations

can be obtained using sampling procedures like the

Monte Carlo method (Robert and Casella, 2005).

Using a Monte Carlo simulation tool, the WMTC

A METHOD FOR PORTFOLIO MANAGEMENT AND PRIORITIZATION - An Incremental Funding Method Approach

29

PMO decided to sample values for each cash flow

element based on its triangular distribution to gener-

ate one possible scenario and then use these values,

together with the branch and bound algorithm,

to obtain the optimal portfolio sequencing option,

which is the one that yields the maximum NPV.

See (Alencar et al., 2008) for guidelines on how to

use the the branch & bound algorithm to compute the

optimal implementation order in IT projects.

Posterior to the generation of 10,000 scenarios,

there was a total of ten sequencing options that were

chosen as optimal in one or more scenarios. Table 13

presents these sequences.

Table 13: Selected sequencing options.

Id Sequence

Seq

1

CSU

1

, CSU

2

, EP

3

, EP

4

, EP

6

, VoIP

3

, VoIP

4

, EP

5

, EP

7

, GSP

3

,

GSP

4

, GSP

5

, VM

3

, VM

4

, VM

5

, VoIP

5

, VoIP

6

, VM

6

, M

+

3

,

M

+

4

, M

+

5

, M

+

6

, M

+

8

, M

+

7

, M

+

9

Seq

2

CSU

1

, CSU

2

, EP

3

, EP

4

, EP

6

, EP

5

, EP

7

, VoIP

3

, VoIP

4

, GSP

3

,

GSP

4

, GSP

5

, VM

3

, VM

4

, VM

5

, VoIP

5

, VoIP

6

, VM

6

, M

+

3

,

M

+

4

, M

+

5

, M

+

6

, M

+

8

, M

+

7

, M

+

9

.

.

.

.

.

.

Seq

6

CSU

1

, CSU

2

, EP

3

, EP

4

, EP

6

, EP

5

, EP

7

, VoIP

3

, VoIP

4

, GSP

3

,

GSP

4

, GSP

5

, VoIP

5

, VoIP

6

, VM

3

, VM

4

, VM

5

, VM

6

, M

+

3

,

M

+

4

, M

+

5

, M

+

6

, M

+

7

, M

+

9

, M

+

8

.

.

.

.

.

.

Seq

10

CSU

1

, CSU

2

, EP

3

, EP

4

, EP

6

, EP

5

, EP

7

, VoIP

3

, VoIP

4

, VoIP

5

,

VoIP

6

, GSP

3

, GSP

4

, GSP

5

, M

+

3

, M

+

4

, M

+

5

, M

+

6

, M

+

7

, M

+

9

,

M

+

8

, VM

3

, VM

4

, VM

5

, VM

6

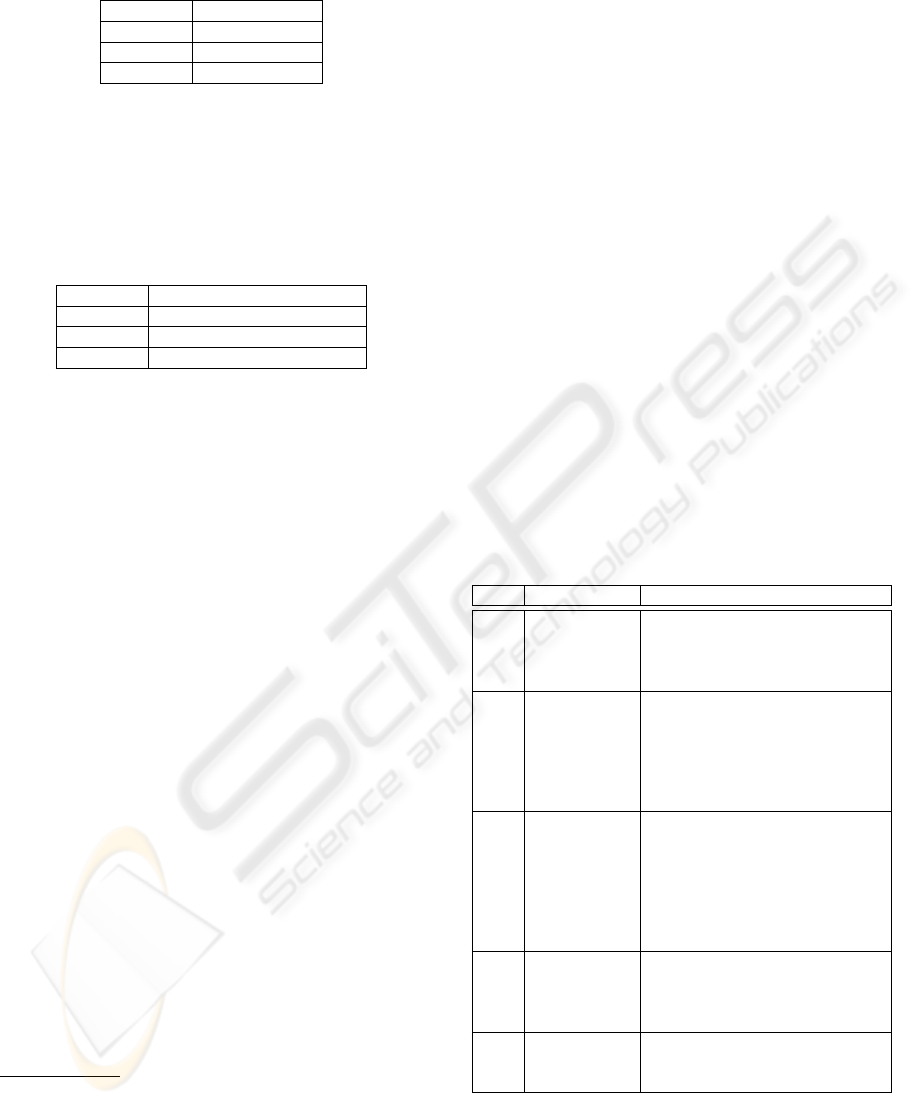

Step 5: Resampling the Selected Sequencing Op-

tions. As the number of sequencing options gener-

ated in Step 4 is quite small and some of them did not

have enough values to generate the cumulative density

function (CDF) of their NPV, all of them were taken

through a resampling, generating another 10,000 sce-

narios.

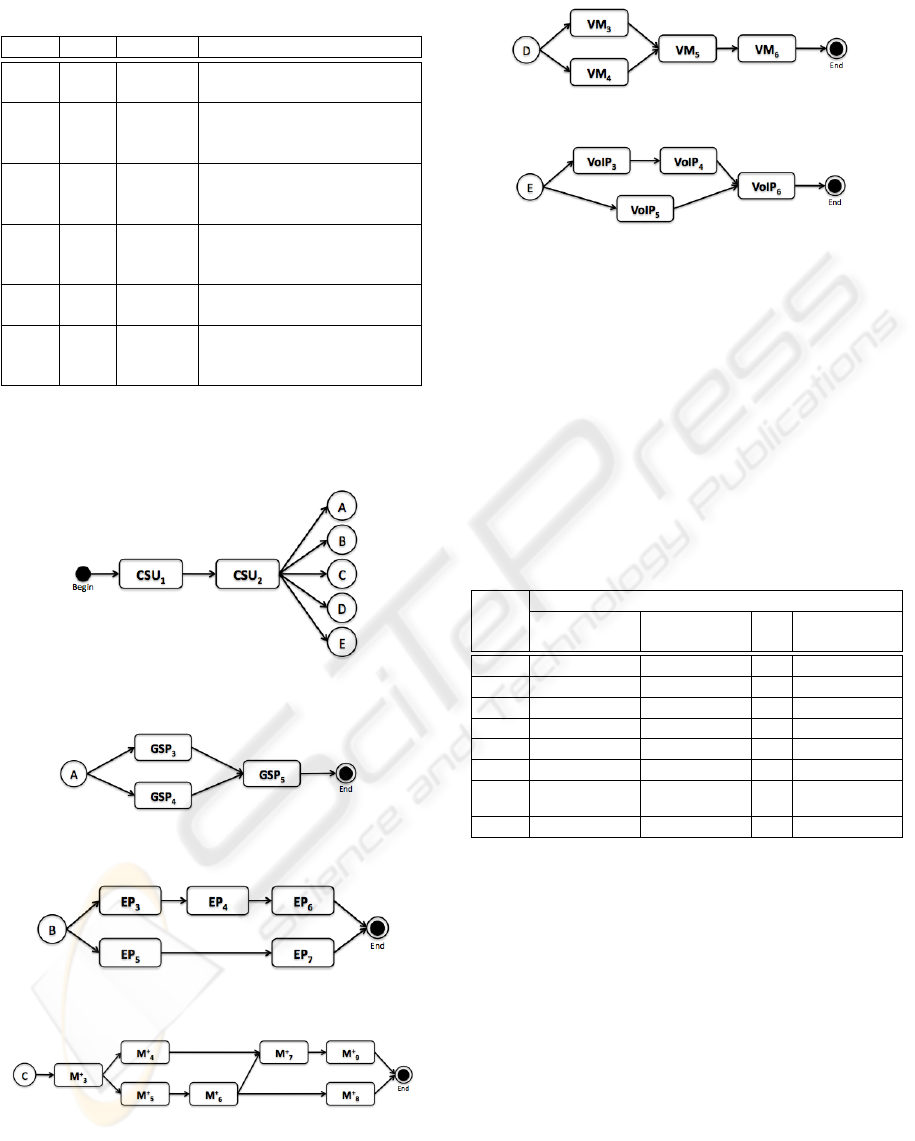

The data collected in these new scenarios was

used by WMTC to built the CDF of the NPV from se-

lected sequences and reach the required error margin,

within a predefined confidence interval. Figure 10

presents these results.

Step 6: Choosing the Best Sequencing Option. Af-

terward, WMTC PMO compared all the simulation

results obtained in Step 5 to decide which is the best

implementation order, considering all the sequencing

options.

As the WMTC’s board of directors has defined

that the organization needs to generate at least a US$

4,000,000.00 revenue from the portfolio to advance

its position as a major player in the mobile telecom-

munication business and also to reach the Latin

Figure 10: Portfolio’s NPV for the selected sequences.

America’s leadership on the last key performance

indicator, which is the average revenue per user

(ARPU). Considering this aspiration, the PMO has

decided to maximize the probability of attaining such

a goal.

In the first step, making use of the Probabilistic

Dominance criterion, the PMO was able to restrict

even more the number of sequencing options which

should be compared. This was accomplished by

eliminating sequences 1, 4, 5, 7, 8, 9 and 10, which

were outperformed and probabilistically dominated

by sequences 2, 3 and 6.

Applying the Aspiration Level criterion on the

comparison of the remaining options, the PMO stated

that sequences 2, 3 and 6 have, respectively, 89%,

84% and 97% probability of achieving an actual

revenue equal to or higher than the targeted one. For

that reason, the PMO defined that Seq

6

was the best

implementation order for the WMTC’s portfolio.

These results were presented by the PMO to the

WMTC board of directors, who decided to undertake

the presented strategy as a guidance to manage their

portfolio and prioritize their projects.

In fact, it should be noted that Seq

2

, which

presents the best results under the mean value, is

outperformed by Seq

6

when taking uncertainties

into account and considering the Aspiration Level

criterion with the values previously defined by the

WMTC’s board of directors.

4 DISCUSSION

At the outset of this paper the authors presented

a method that provides a comprehensive way to

analyze investment options, balance their expected

return against their risk, and decide how to prioritize

the IT projects within one’s portfolio, enabling

organizations to maximize their payoffs. In this

section, some of the key questions regarding the

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

30

use and implications of the proposed method are

addressed.

A. Why have MMF and AE’s Cash Flow Elements

been Extended?

As presented in the IFM (Denne and Cleland-Huang,

2003), each one of the cash flow elements should

be estimated using the cost and revenues projections

made by the development team and the customer,

respectively.

The literature has stated that that IT projects are

provenly high-risk investments and have high rate of

failure (Whittaker, 1999; Biehl, 2007; Westerman and

Hunter, 2007). When the proposed method considers

the worst (Min), the most likely (ML) and the best

case (Max) scenarios to each cash flow element, it

automatically includes the inherent uncertainty from

real world circumstances, where there is an associated

risk to each cost and revenue projection.

Consequently, the method transforms each one of

the cash flow elements into random variables (Kotz

and van Dorp, 2004), which are presented as a

triangular probability density functions that are to

be used to balance between risks and benefits of a

given module’s cash flow stream (Hubbard, 2007;

Schniederjans et al., 2004).

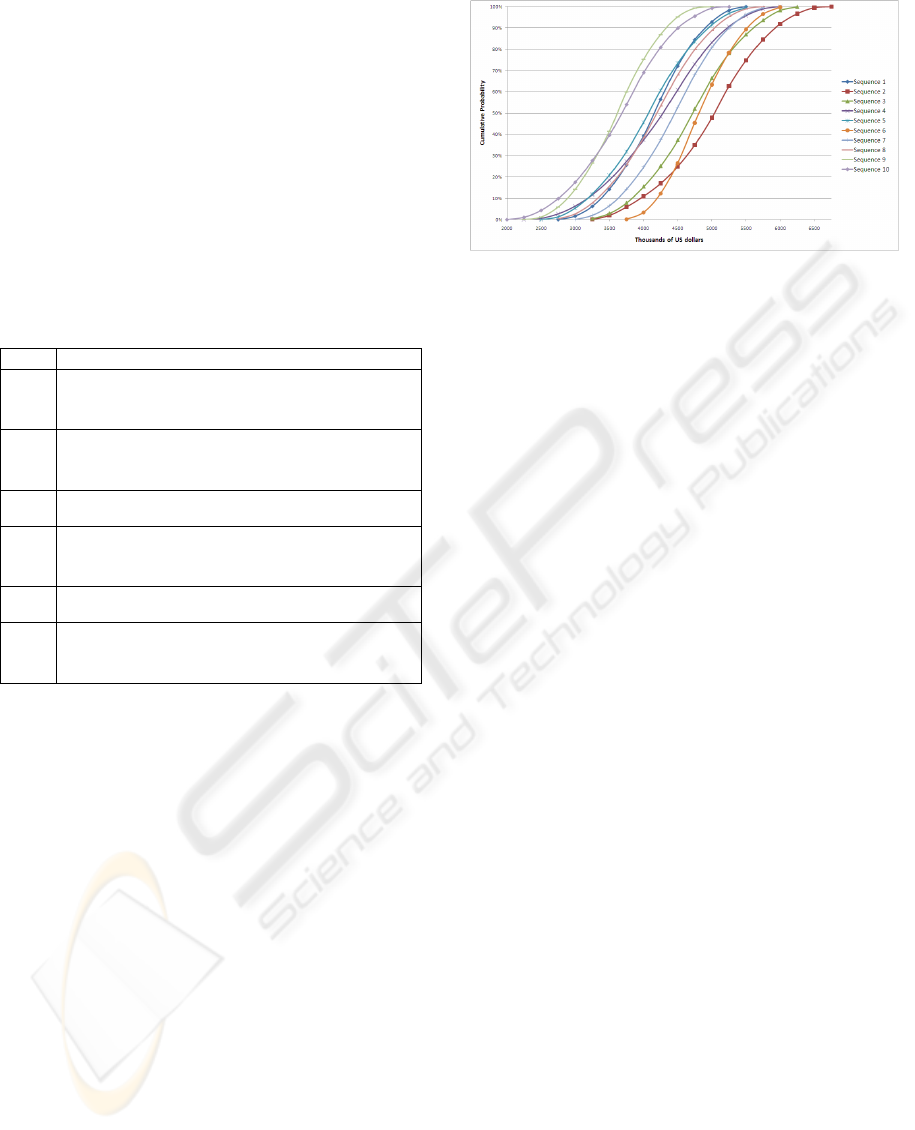

B. How to define the Most Suitable Decision making

Criterion?

After the resampling, there are some scenarios that are

possible to be presented. Depending on the organiza-

tion’s risk-tolerance policy, a different method is to be

used in their decision making process. These methods

and corresponding situations where they shall be

applied are presented below:

1. Probabilistic Dominance – it is a compelling

reason for choosing one sequencing option over

another, despite of being a risk-taken or risk-

averse organization.

2. Maximin Principle – comparing the worst case

of alternatives, this is a pessimistic decision

making and it is usually used by extremely conser-

vative organizations, which are willing to choose

the alternative that would have the lowest impact

in case of going wrong.

3. Maximax Principle – comparing just the best

outcomes, this method should be considered

by organizations that are risk-seeking, with the

objective of having the highest possible return on

investment.

4. Laplace Principle – whenever all the attainable

outcomes have the same probability to occur, the

comparison of alternatives using their mean is

a reasonable approach for risk-neutral decision

makers.

5. Hurwicz Principle – balancing between methods

that are either too optimistic or too pessimistic,

it should be considered by risk-neutral organiza-

tions that are able to define the index of optimism

in which this principle relies on.

6. Savage Principle – considered a risk-averse

method, its main objective is to minimize the risks

and choose the alternative that yields the lowest

variance, which is an alternative for the Maximin

principle for conservative decision makers.

7. Aspiration Level – it is often the case where an

organization defines a result that is very important

to obtain. To maximize the probability of having

an actual result equal to or higher than the desired

one, this method shall be used.

C. How do Organizations benefit from the Method?

As technology investments are inherently risky and

are becoming the dominant part of many organiza-

tions’ expenditures, IT projects are becoming even

more complex and difficult to undertake. Therefore,

the use of a comprehensive investment management

tool – to effectively allocate the resources and priori-

tize IT projects within a portfolio – is a “must have”.

By decomposing IT projects into self-contained

software units that can be managed as “miniprojects”,

analyzing their risk-return information, and provid-

ing insights into the existing sequencing options, the

proposed method unveils the power of combining

together the IFM (Denne and Cleland-Huang, 2003),

Decision Theory (Holloway, 1979) and Principles of

Choice (Lang and Merino, 1993; White, 2006) to

maximize the investments’ efficiency. The benefits of

this approach to PPM are numerous:

• Enable portfolios comprised of large and

complex IT projects to be managed with a

relatively smaller initial investment,

• Identify units that are common to different

projects, remove duplication and improve quality,

• Bring financial discipline into the IT portfolio

management,

• Identify risks and investment prioritization

options,

• Identify the most suitable investment option to

each organization,

• Maximize the efficiency of investments in portfo-

lios of IT projects,

• Demand for shorter investment periods and

payback time are addressed,

A METHOD FOR PORTFOLIO MANAGEMENT AND PRIORITIZATION - An Incremental Funding Method Approach

31

• Favor faster time-to-market of the portfolio, and

• Position the IT portfolio management as a value

creation activity in which business analysis is an

integral part of it.

5 CONCLUSIONS

To the best of our knowledge, this work is the first

to create a portfolio management method based upon

the Incremental Funding Method (IFM).

The Incremental Funding Portfolio Management

Method (IFPMM) extends the IFM to decom-

pose software projects into self-contained software

units, including the inherent uncertainty of software

development process into their cash flow streams

and considering the whole portfolio of IT projects,

rather than making investments decisions in isolation.

Besides, it uses decision theory together with

principles of choice to analyze each unit risk-

return information and prioritize their implementa-

tion, defining the best sequencing option considering

the organization’s risk tolerance.

The IFPMM provides crucial insights into the

business value of IT portfolios, facilitating the

decision making process and considering the

organization approach to business. Besides, it also

provides a technique to assure that investment

choices are always as efficient as possible, permit-

ting portfolios comprised of large and complex IT

projects to be managed with a relatively smaller

initial investment, demanding for shorter investment

periods, and also providing shorter payback times

and faster time-to-market.

REFERENCES

Abdellaoui, M. and Hey, J. D. (2008). Advances in Decision

Making Under Risk and Uncertainty. Springer, New

York, NY, USA.

Alencar, A. J., Schmitz, E. A., and de Abreu, E. P. (2008).

Maximizing the business value of software projects:

A branch & bound approach. In 10th International

Conference on Enterprise Information Systems, vol-

ume ISAS-2, pages 162–169, Barcelona, Spain. In-

stitute for Systems and Technologies of Information,

Control and Communication.

Barbosa, B. P., Schmitz, E. A., and Alencar, A. J. (2008).

The case for managerial flexibility in mmf-based

software development projects. In Workshop on

Business-driven IT Management, 2008. BDIM 2008.

3rd IEEE/IFIP International, pages 114–115, Sal-

vador, Bahia, Brazil. IEEE.

Biehl, M. (2007). Success factors for implementing global

information systems. Commun. ACM, 50(1):52–58.

Bingi, P., Sharma, M. K., and Godla, J. K. (1999). Critical

issues affecting an erp implementation. Information

System Management, 16(3):7–14.

Chang, C. K., Cleland-Haung, J., Hua, S., and Kuntzmann-

Combelles, A. (2001). Function-class decomposition:

A hybrid software engineering method. Computer,

34:87–93.

Chen, I. L. (2001). Planning for erp systems: analysis and

future trend. Business Process Management Journal,

7(5):374–386.

Chen, T., Zhang, J., Huang, W. W., and Zeng, Y. (2007).

Evaluating information technology investment under

multiple sources of risks. In the Proceedings of

the International Conference on Wireless Communi-

cations, Networking and Mobile Computing, pages

6111–6114, White Plains, NY, USA. IEEE Press.

Denne, M. and Cleland-Huang, J. (2003). Software by Num-

bers: Low-Risk, High-Return Development. Prentice

Hall.

Denne, M. and Cleland-Huang, J. (2004). The incremental

funding method: Data-driven software development.

IEEE Software, 21(3):39–47.

Denne, M. and Cleland-Huang, J. (2005). Financially in-

formed requirements prioritization. In Proceedings

of the 27th international conference on Software En-

gineering, pages 710–711, St Louis, Missouri, USA.

ACM New York, NY, USA.

Holloway, C. A. (1979). Decision Making Under Uncer-

tainty: Models and Choices. Prentice Hall, Engle-

wood Cliffs, NJ.

Hubbard, D. W. (2007). How to Measure Anything: Finding

the Value of ”Intangibles” in Business. John Willey &

Sons, Inc, Hoboken, NJ, USA.

Jeffery, M. and Leliveld, I. (2004). Best practices in it port-

folio management. MIT Sloan Management Review,

45(3):41–49.

Kotz, S. and van Dorp, J. R. (2004). Beyond Beta: Other

Continuous Families Of Distributions With Bounded

Support And Applications. World Scientific Publish-

ing Co., Hackensack, NJ.

Lang, H. J. and Merino, D. N. (1993). The selection process

for capital projects. Wiley-Interscience.

Markowitz, H. (1952). Portfolio slection. The Journal of

Finance, 7(1):77–91.

McFarlan, F. W. (1981). Portfolio approach to information

systems. Harvard Business Review, pages 142–151.

Pressman, R. S. (2009). Software Engineering: A Practi-

tioner’s Approach. MacGraw-Hill, 7th edition.

Reyck, B. D., Grushka-Cockayne, Y., Lockett, M.,

Calderini, S. R., Moura, M., and Sloper, A. (2005).

The impact of project portfolio management on infor-

mation technology projects. International Journal of

Project Management, 23(5):534–537.

Robert, C. P. and Casella, G. (2005). Monte Carlo Statisti-

cal Methods. Springer.

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

32

S. Dewan, C. Shi, V. G. (2007). Investigating the risk-

return relationship of information technology invest-

ment: Firm-level empirical analysis. Management

Science, 53(12):1829–1842.

Schmitz, E. A., Alencar, A. J., and de Azevedo, C. M.

(2008). A method for defining the implementation or-

der of software projects under uncertainty. In SAC ’08:

Proceedings of the 2008 ACM symposium on Applied

computing, pages 844–845, Fortaleza, Ceara, Brazil.

ACM.

Schniederjans, M. J., Hamaker, J. L., and Schniederjans,

A. M. (2004). Information Technology Investment:

Decision-Making Methodology, volume 1. World Sci-

entific Publishing Co., River Edge, NJ.

Silvius, A. J. G. (2008). The business value of it a concep-

tual model for selecting valuation method. Communi-

cations of the IIMA, 8(3):57–66.

Somers, T. M. and Nelson, K. G. (2003). The impact

of strategy and integration mechanisms on enterprise

system value: empirical evidence from manufactur-

ing firms. European Journal of Operational Research,

146(2):315–338.

Westerman, G. and Hunter, R. (2007). IT Risk: turning

business threats into competitive advantages. Harvard

Business School Press, Boston, MA, USA.

White, D. J. (2006). Decision Theory. Aldine Transaction.

Whittaker, B. (1999). What went wrong? unsuccessful in-

formation technology projects. Information Manage-

ment & Computer Security, 7(1):23–30.

A METHOD FOR PORTFOLIO MANAGEMENT AND PRIORITIZATION - An Incremental Funding Method Approach

33