OLAP FOR FINANCIAL ANALYSIS AND PLANNING

A Proof of Concept

Eitel J. M. Lauría

Marist College, Poughkeepsie, 12601, New York, U.S.A.

Carlos A. Greco

Universidad del Salvador, Buenos Aires, Argentina

Keywords: OLAP, Financial analysis, Planning, Management control, KPIs.

Abstract: We describe the design of an in-memory OLAP model for financial planning, analysis and reporting at a

medium sized manufacturing company in South America. The architecture and data model design are

explained within the context of the company’s requirements and constraints.

1 INTRODUCTION

Financial analysis is a critical task that all managers

should be able to carry out. Regardless of the nature

of the business or the size of the organization,

managers are required to diagnose the financial well

being of the organization by analyzing profit and

loss, key performance indexes, liquidity and returns,

anticipating consequences of operational decisions

and taking remedial action.

Accounting is the scorecard of business

(Higgins, 2001): financial statements are a window

into a company's financial performance,

summarizing the company’s activities into an

objective set of numerical information that can be

used by creditors, investors, stakeholders, regulators

and, more importantly, for internal decision making.

Unfortunately, the manner in which financial

statements are typically structured and presented

does not help to convey the information required for

sound financial analysis and planning. Business

management based on performance indicators does

not arise directly from accounting records, which are

mainly concerned with preserving evidence of

business transactions rather than the analysis and

interpretation of the underlying data.

Online analytical processing (OLAP) has had a

significant growth in the last decade with numerous

products and applications developed in different

business areas. The spreadsheet-like nature of OLAP

is well aligned with the mental models that business

users have of data.

In this paper we set out to describe a financial

planning and analysis model based on OLAP

technology. The work is focused on a medium sized

company headquartered in Argentina, with

operations throughout South America (hereafter

referred to as the Corporation). The paper covers the

initiation, analysis and design of the OLAP project.

The application will help the Corporation

improve the planning process and the overall

monitoring of the financial performance of the

organization across its geographically distributed

business units. The paper can be used as a teaching

case in information systems aimed at introducing

OLAP technologies and its application as a

management tool in a real-world scenario. The next

section describes the Corporation’s background: its

organizational setting and a description of the

financial reporting processes used by the

Corporation in the past. The paper follows with an

overview of OLAP architectures, and describes the

architecture adopted by the Corporation. Next the

paper provides an overview of OLAP modeling and

describes the design of the OLAP model for the

financial analysis and planning application. OLAP

concepts as well as definitions of accounting terms

and financial statements concepts have been

included in each section for pedagogical reasons.

The paper ends with a summary and raises some

points that could be used for class-based discussion.

347

Lauría E. and Greco C. (2010).

OLAP FOR FINANCIAL ANALYSIS AND PLANNING - A Proof of Concept.

In Proceedings of the 5th International Conference on Software and Data Technologies, pages 347-355

DOI: 10.5220/0003042603470355

Copyright

c

SciTePress

2 BACKGROUND

The Corporation is a mid-sized manufacturer and

supplier of products for the food industry, mostly

centered on seed crops with high content of Omega-

3. Omega-3 is the common name given to a family

of unsaturated fatty acids that has been shown to

reduce risks of heart disease and have potential

positive effects on other diseases (e.g. high

cholesterol). Omega-3 is not produced by the human

body and must be incorporated in the diet. The

Corporation processes flax and chia seeds, to

produce cold press oils and partially defatted flours.

Cold press oils with high contents of Omega-3 can

be consumed as part of a regular diet or used as

additives in sunflower or olive oils. Partially

defatted flours are included as additives in bakery

and other products (bread, cookies, cereal and

energy bars). Both flax and chia seeds have high

contents of Omega-3. The Corporation has been

especially successful at targeting whole food stores,

supermarkets and the bakery industry. The combined

annual production capacity of oil and flour extracted

from chia and flax seeds has made the Corporation a

major player of Omega-3 additives for the food

industry in South America. The Corporation has

recently added other seed crops to its list of

products, including quinoa (sold as flour and whole

grain) and safflower (processed to produce cooking

oil, margarine and cosmetics). The Corporation has

production and distribution capabilities in several

countries in South America. It has its headquarters in

Buenos Aires, Argentina, and affiliates in Uruguay,

Brazil, Chile, Peru and Colombia. The Corporation’s

production plants are located in Argentina, Peru and

Brazil. Chia and flax products are manufactured in

Argentina, whereas quinoa products are processed in

Peru. The Brazil affiliate is setting up a processing

plant for safflower.

The Corporation has a matrix organizational

structure, with management in each country and

traditional functional areas (production, sales and

marketing, finance). The finance division in each

country reports to a country manager and to the

Chief Financial Officer (CFO) with headquarters in

Buenos Aires. The information technology (IT)

function is small: an IT division headquartered in

Buenos Aires led by an IT director that reports to the

CFO’s office. Each country holds a reduced IT

support group that reports to the IT Director (in

some cases no more than one or two people

depending on the size of the branch).

The continued growth and expansion of the

Corporation from a small family business into a

multinational organization has created the need for a

regional strategic planning process and information

infrastructure. Each country is treated as a separate

business unit, and has its own financial regulations,

tax code, currency, interest rates and labor

considerations. Consolidated corporate financial data

is reported in dollars but is handled in each country

using local currency.

The financial planning process at the Corporation

includes two versions (scenarios) of the data (Actual

and Budget). All financial statement accounts are

recorded with a monthly granularity for each of the

scenarios. Sales and expenses data should have the

possibility of being sliced from multiple

perspectives (dimensions of analysis), including

countries, scenarios, products, and customers.

Products are grouped in product lines according to

the type of seed (chia, flax, quinoa, and safflower).

Customers across countries are grouped according to

the type of target industry (whole foods,

supermarkets, bakeries, and cosmetics).

The planning process and consolidation of

financial reports historically used by the Corporation

is labor intensive. Most of the budget analysis is

performed and kept in Excel spreadsheets whereas

the financial information is handled through

accounting applications running onsite at each

country, or outsourced to a local accounting firm,

according to the size of the branch. Accounting data

is readily available, but the lack of a common

analytical reporting framework paired with the

differences among countries’ accounting regulations

and the distributed nature of the reporting process in

terms of hardware / software platform and staff

makes it difficult to have consistent reporting of

analytical data with adequate levels of granularity

across the Corporation.

The Corporation would like to create a financial

planning and management reporting system that a)

helps compare actual results versus planned

scenarios and enables consolidation of financial data

across countries b) measures the financial health of

the organization through a number of key

performance indicators (KPIs) included in a

financial dashboard. Three types of KPIs are of

special interest to the Corporation: (1) Profitability

KPIs; (2) Solvency KPIs; (3) Cash Flow ratios.

The CFO’s office has decided to initiate a project

to develop a planning and financial analysis tool to

meet the Corporation’s immediate and future

reporting needs.

ICSOFT 2010 - 5th International Conference on Software and Data Technologies

348

3 OLAP TECHNOLOGY FOR

FINANCIAL ANALYSIS

AND PLANNING

The term OLAP, derived from Online Analytical

Processing defines a technology that is based on

multidimensional analysis of business data and

allows the user to have a faster, better and more

flexible access to such data. Originally introduced

by Codd et al (1993), OLAP technologies are

capable of capturing the structure of the real world

in the form of logical arrangements of numerical

data over multiple business dimensions, generally

referred to as data cubes. A ‘slice’ of an OLAP data

cube portrays business data in a spreadsheet-like

representation (a 2D row-by-column arrangement of

data), where each face of the data cube shows

business metrics (sales, revenue, costs, earnings, or

some other measure) for two or more dimensions

simultaneously (Koutsoukis et al, 1999). This data

driven decision making process, is made up of

numerous, speculative “what if” and “why” data

intensive simulations with the goal of studying the

behavior of complex business problems under

different conditions, called scenarios (Golfarelli,

2006). The virtue of OLAP is to allow business

users to operate within the confines of the well

known spreadsheet paradigm while at the same time

eliminating some of the major drawbacks of

spreadsheet applications: separation between data

and models is enforced, as data is kept in the OLAP

repository and is retrieved using spreadsheet type,

pivot-table operators: (a) pivot and slice

: users can

arrange a selected subset of dimension

configurations in a 2D cross-tab view of the data; (b)

drill-down and roll-up

: allows users to create data

aggregations at different levels of a dimension

hierarchy, or conversely, drill down to the most

detailed levels of the data. OLAP technology has a

very good fit with financial reporting and planning.

Financial statements are an important window on

the reality of an organization [1], providing a short-

term and long-term, structured view of its financial

condition. The three principal reports used in

standard accounting practice (Income statement,

Balance Sheet and Cash Flow Statement) play

distinctive roles but are tightly intertwined:

The balance sheet is a snapshot taken at a given

point in time of the company’s net worth: how

much it owns (assets) and how much it owes

(liabilities). Assets and liabilities that turn into

cash within one year are described as short-term

(or current), and all others are described as long

term. Examples of current assets are cash itself

and inventories (with the assumption that they

must be sold within one year). Current liabilities

include accounts payable and income taxes).

Long term assets include the property and

equipment essential for the company’s continued

operation, typically subject to depreciation.

Other long term assets include, intangible assets

(e.g. intellectual property), and long term

investments.

The profit and loss statement (P&L, or income

statement) does not look at net worth but instead

measures the ability of a company to generate

profit in a given time frame (how much money

can the company make in a given period). In

doing so, the income statement records the flow

of resources over time (Higgins, 2001), with

earnings reporting the difference between the

company revenue stream and the costs and

operating expenses that result from producing

such revenue.

The cash flow statement “follows” the cash (its

sources and uses over a period of time), along

three main activities: (i) cash flow from

operations, (ii) cash flow from investing

activities, (iii) cash flow from financing

activities.

The interconnection among these reports based

on well defined formulation, their time dependence

and the demand for various types of financial data

consolidation and analysis (temporal, geographic, or

over product lines, customer groups and multiple

planned scenarios) makes OLAP technology an ideal

delivery platform for carrying out complex

multidimensional analysis based on financial data.

This has been well understood by the project

management team at the Corporation who has set

out to identify OLAP platforms that meet the

requirements of the organization in terms of

flexibility, speed, and adherence to budgetary

constraints.

3.1 OLAP Architectures

and in-Memory OLAP

at the Corporation

OLAP structures are described in terms of logical

rather than physical arrangements, to stress the fact

that the underlying physical structure may vary,

depending on the type of OLAP implementation.

OLAP models can be built on top of relational

databases, specialized multidimensional databases,

or even memory-based data structures (more on this

later on). But at a logical level, the OLAP concept

OLAP FOR FINANCIAL ANALYSIS AND PLANNING - A Proof of Concept

349

remains identical or very similar across different

OLAP products, technologies and physical data

storage implementations.

Several OLAP architectures have been

developed over the years, the most prominent being

multidimensional OLAP (MOLAP) and relational

OLAP (ROLAP). The differences between these

technologies concern data storage and processing

capability (Hasan & Hyland, 2001). MOLAP

architectures implement the multidimensional view

by storing cube data in sparse (usually proprietary)

multidimensional array data structures (MDDS).

Data is periodically uploaded from an organization’s

relational databases into an MDDS. The array model

provides natural indexing, and as data is usually pre-

aggregated in the MDDS, this improves flexibility

and performance. MOLAP architectures are compact

and efficient but don’t scale well when handling

large dimensions or cubes with large numbers of

dimensions. ROLAP architectures used relational

database base systems to store cube data, usually

organized as star or snowflake schemas in the

relational data warehouse. Using the source data

directly allows users to drill down to lower data

levels, typically at the expense of higher processing

power requirements and slower performance. Some

products have implemented hybrid models (also

known and HOLAP, or hybrid OLAP). In such

architectures, MOLAP cubes are deployed to handle

aggregate data, with drill-down operations that

enable users to pull detailed data from the relational

data store.

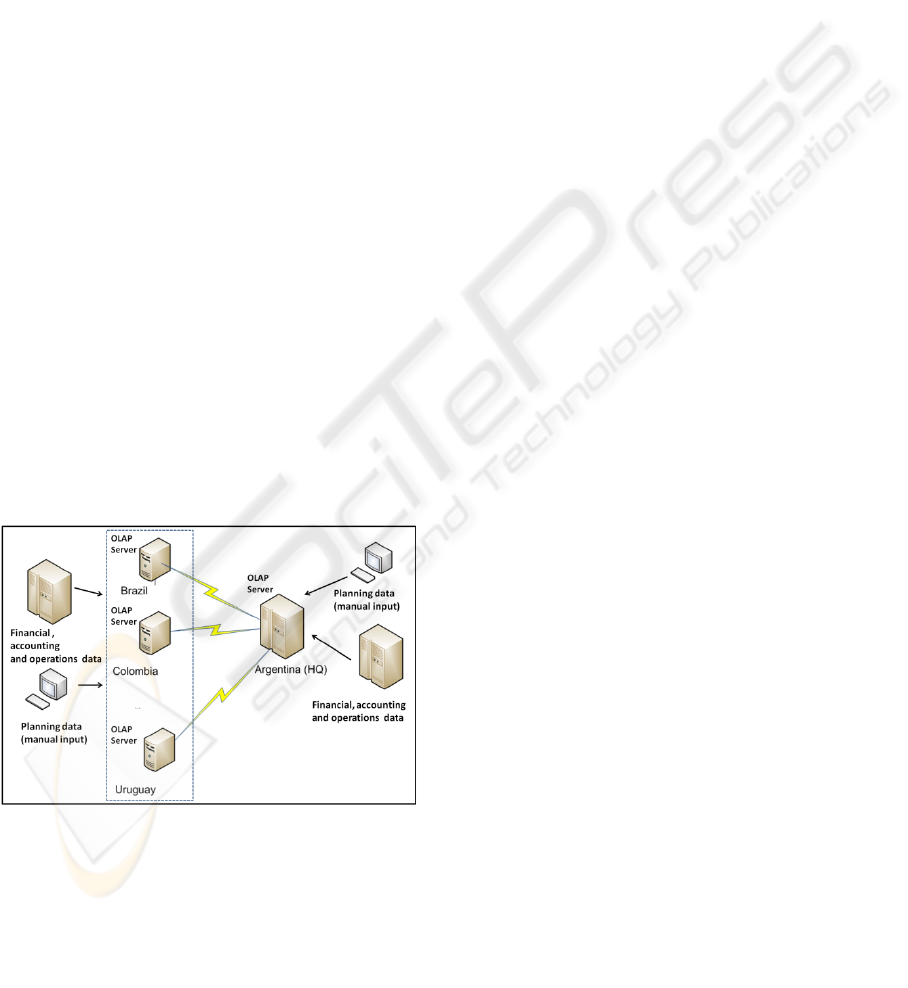

Figure 1: OLAP Architecture at the Corporation.

In-memory OLAP is a special case of OLAP

(typically MOLAP) architecture that has become

increasingly popular in the last years, and constitutes

a shift in paradigm in terms of performance and

scalability. The reason is simple: users can query

OLAP models residing in RAM memory, which is at

least several orders of magnitude faster than

accessing data from disk storage. In in-memory

OLAP, data is loaded into memory for real-time

querying, including calculations and aggregations

that can be swiftly generated on the fly. This

technology has been around for a number of years,

but only recently has the promise of RAM-based,

high-speed analytical processing become a reality

thanks to the introduction of 64-bit architectures

with large memory address spaces. With 64-bit

addressable memory space, RAM-based OLAP

servers can easily handle 100 gigabyte cubes,

something unthinkable not long ago.

Here the case is set out following a decision

made by the Corporation to use an in-memory

OLAP platform (IBM Cognos TM1) to develop the

financial analysis and planning application. Figure 1

displays the proposed OLAP architecture based on

TM1. An OLAP server is setup at each country,

providing multiuser access to planning and financial

analysis data. Budgets are prepared and entered at

each site, whereas financial data is extracted from

the local accounting systems (a set of files with

accounting data is received on a monthly basis from

the outsourcing service in those countries where the

accounting systems are not run in-house). OLAP

servers are interconnected in a star topology

centered at Buenos Aires’ headquarters that serves

as the aggregation hub where data originating in

each country is consolidated.

4 OLAP MODELING FOR

FINANCIAL ANALYSIS

AND PLANNING

The notion of a multidimensional data cube (also

known as hypercube, or simply “cube”) is central in

understanding OLAP modeling. OLAP hypercubes

play a similar role to tables in the relational database

model: they constitute the building blocks for data

storage, manipulation and retrieval. In a nutshell, a

hypercube is a logical multidimensional array where

each data value occupies a cell in the array, indexed

by a unique set of dimension members (Hasan &

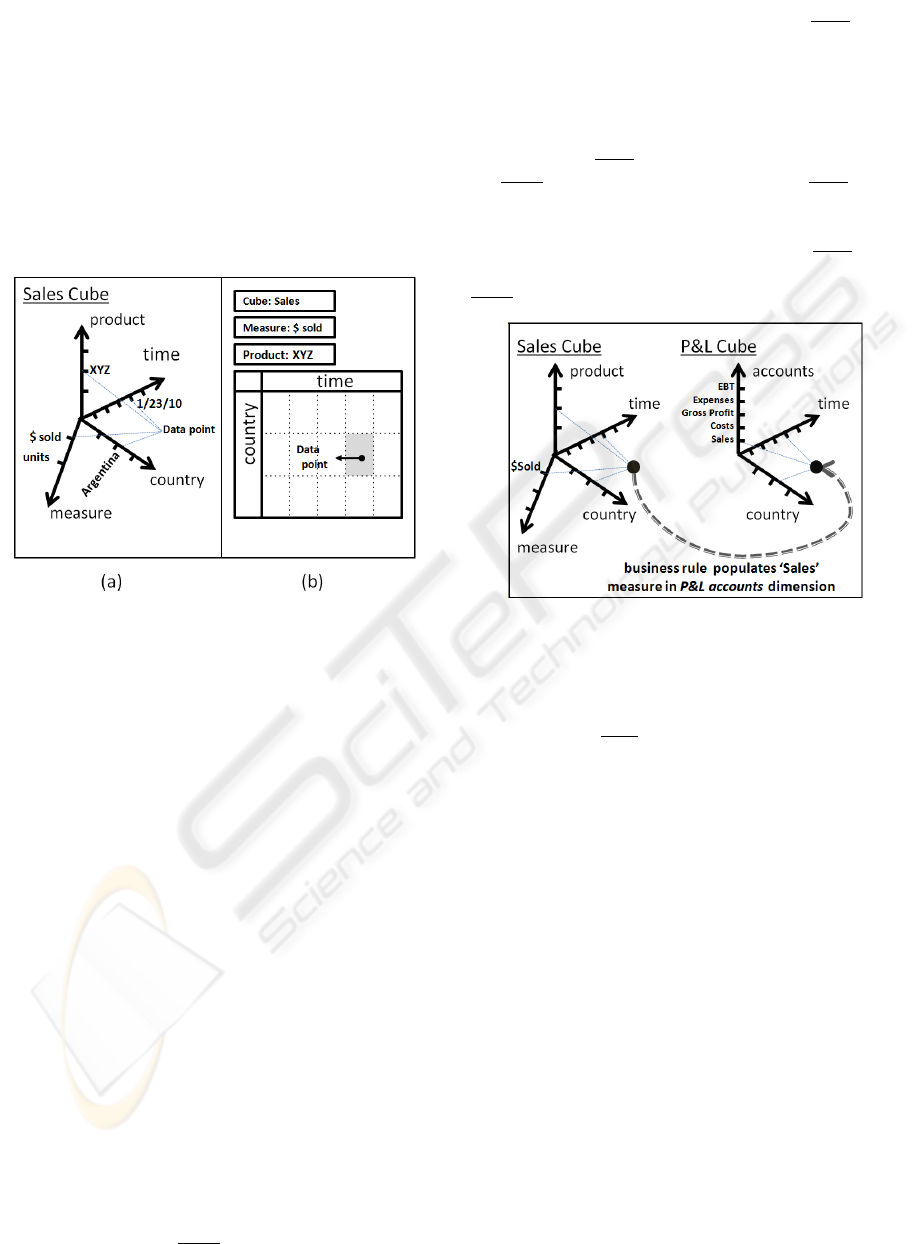

Hyland, 2001). The example in Figure 2.a shows a

Sales hypercube used to track the number of product

units and dollars sold across different countries. A

cell containing a data value in such hypercube is

uniquely identified using four parameters: measure

member (e.g. ‘dollars sold’), country member (e.g.

‘Argentina), time member (e.g. ‘January 23, 2010’),

and product member (‘XYZ’).

ICSOFT 2010 - 5th International Conference on Software and Data Technologies

350

Visual representation of multidimensional

business data requires mapping the n-dimensional

space into two dimensions. This is accomplished by

creating cross-tab representations of the hypercube

data by combining multiple logical dimensions

within the same display dimension over rows,

columns and at the header level of the cross-tab grid.

Figure 2.b shows a 2D, cross-tab representation of a

section of the hypercube data, where the sales in

dollars of product XYZ are displayed for each place

of a sale (in rows), and time of sale (in columns).

Figure 2: Hypercubes: (a) multidimensional representa-

tion; (b) 2D crosstab display.

An OLAP model is made up of a collection of

cubes linked together through their common

dimensions. These common dimensions, when

identically structured, can be shared across cubes

and are usually referred to as conformed dimensions.

Kimball & Ross (2002) introduced the notion of

conformed dimensions to describe dimension tables

in a relational data mart that adhere to a common

structure and therefore allow queries to be executed

across data marts. Dimensions are not simple

enumerations of members; instead, they are

structured as multilevel hierarchies to allow for

aggregations of data.

Also, and depending on the underlying features

of the OLAP tool, cubes can be linked through

business rules and calculated dimension members to

enhance query performance and improve data

integration across cubes. This is especially true for

in-memory OLAP architectures, were calculated

dimension members can be computed on the fly

without lengthy waiting times. For a detailed

critique of some of the dominant, product-specific

approaches to the use of calculation rules in OLAP

models see (Thomsen, 2002). For example, as

shown in Figure 3, a Sales

cube can share the time,

product and country dimensions with a P&L

cube

(containing income statement data). Each data point

(cell) in the region delimited by the [‘$ sold’]

member in the measure dimension identifies sales in

dollars for each member of the time, product and

country dimensions. Through a business rule

attached to the P&L

cube, each of this data points in

the Sales cube can be “pushed” inside the P&L cube.

There is no data duplication: the [‘Sales’] member in

the accounts dimension is a calculated member

whose value for a given data point in the P&L

cube

is the result of an automated query operation on the

Sales

cube.

Figure 3: Calculated members and business rules.

We use the following notation to formulate the

business rule as described before:

[‘Sales’] = DB(Sales,’$ sold’, country, time, ‘Total

Products’)

(1)

DB(.) symbolizes the data extraction query rule.

The expression between brackets [.] refers to the

region in the cube (i.e. the collection of data points

in the cube) affected by the rule; and the reference to

a dimension indicates that the formula spans a whole

dimension. Note that two of the Sales cube

dimensions (measures and products) expressed in

the rule have fixed members denoting that the data

extraction rule proceeds on fixed sections of the

cube (‘$ sold’ and ‘Total Products’). The product

dimension has to be rolled up at its highest level as it

is not present in the P&L cube.

4.1 OLAP Model Specification

The following specification describes the data model

and business rule formulation for the OLAP

application to be implemented at the Corporation.

The specification is presented from the point of view

of users’ requirements. Design considerations tied to

the selected OLAP engine (IBM Cognos TM1) have

OLAP FOR FINANCIAL ANALYSIS AND PLANNING - A Proof of Concept

351

been added as needed. Functional requirements

should be addressed as much as possible through

native features of the OLAP engine in order to avoid

unnecessary programming.

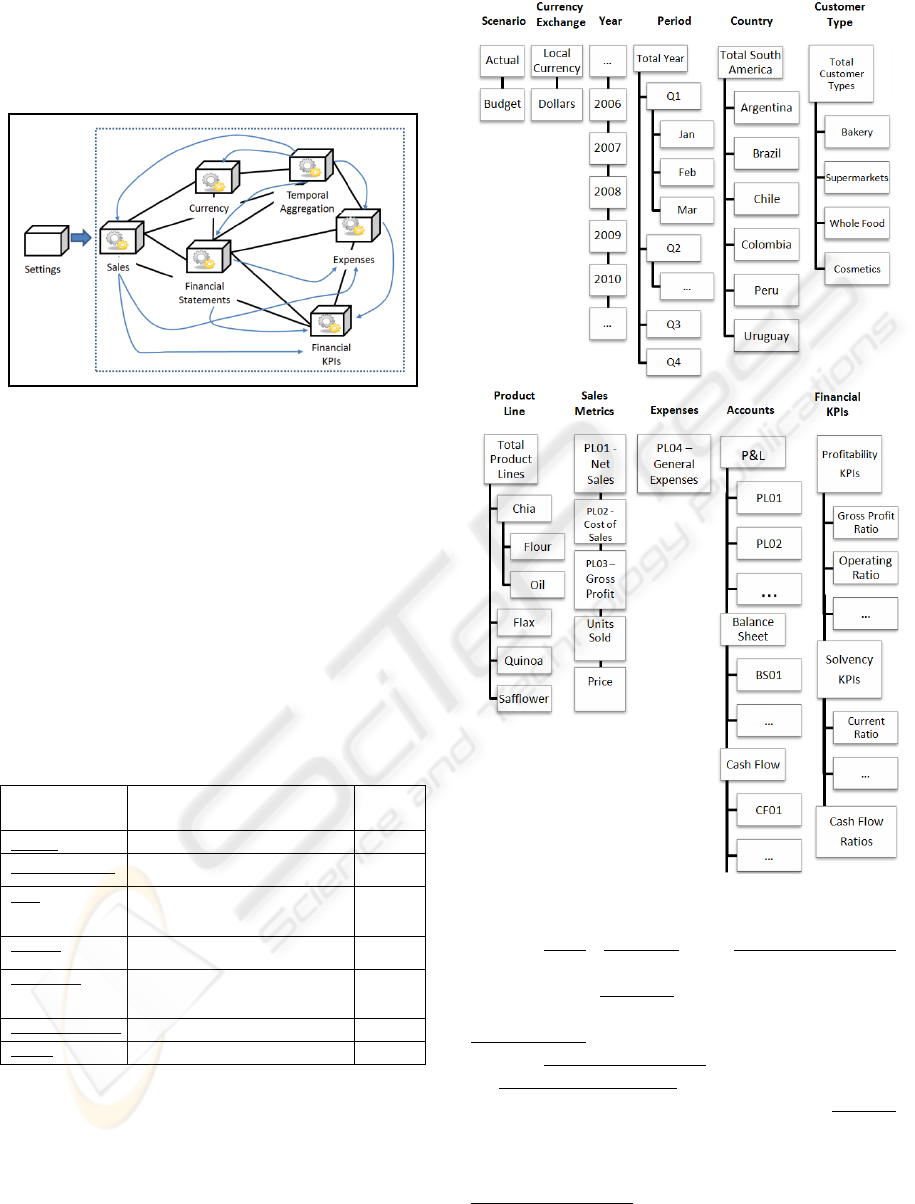

Figure 4: OLAP model for financial analysis and planning.

The OLAP model is composed of seven cubes

sharing common, conformed dimensions and linked

to each other through a set of business rules. Figure

4 depicts the data model, where straight lines linking

cubes signal shared dimensions, curved lines linking

cubes indicate the presence of data extraction query

rules, and the gear icons mark the presence of

intrinsic business rules calculations (calculated

members formulated through dimension members of

the same cube). For example, in the Sales cube:

[‘PL03-Gross Margin’] = [‘PL01-Net Sales’] -

[‘PL02-Cost of Sales’]

(2)

Table 1: OLAP model cubes and their dimensions.

CUBES DIMENSIONS BUSINESS

RULES

Currency year, period, country, currency_exchange

Y

FinancialStatements

country, scenario, currency_exchange,

accounts, year, period

Y

Sales country, scenario, currency_exchange,

customertype, productline, salesmetrics,

year, period

Y

Expenses country, scenario, currency_exchange,

productline, expenses, year, period

Y

FinancialKPIs country, scenario, currency_exchange,

productline, customertype,

financial_kpis, year, period

Y

TemporalAggregation period, consolidation_period

Y

Settings parameter, parameter_value

Table 1 displays the list of cubes that compose

the OLAP model together with their business rules.

Figure 5 shows the layout of dimension hierarchies

used by the OLAP model.

Figure 5: Layout of OLAP Model Dimensions.

The Sales, Expenses and FinancialStatements

cubes store the core financial and accouting

information. Currency

provides local currency

conversion for each of the countries into dollars.

FinancialKPIs

collects performance metrics derived

from the FinancialStatements cube.

TemporalAggegration provides support for

aggregating data over several (n) periods. Settings

contains general parameters used in business rules

by all the other cubes.

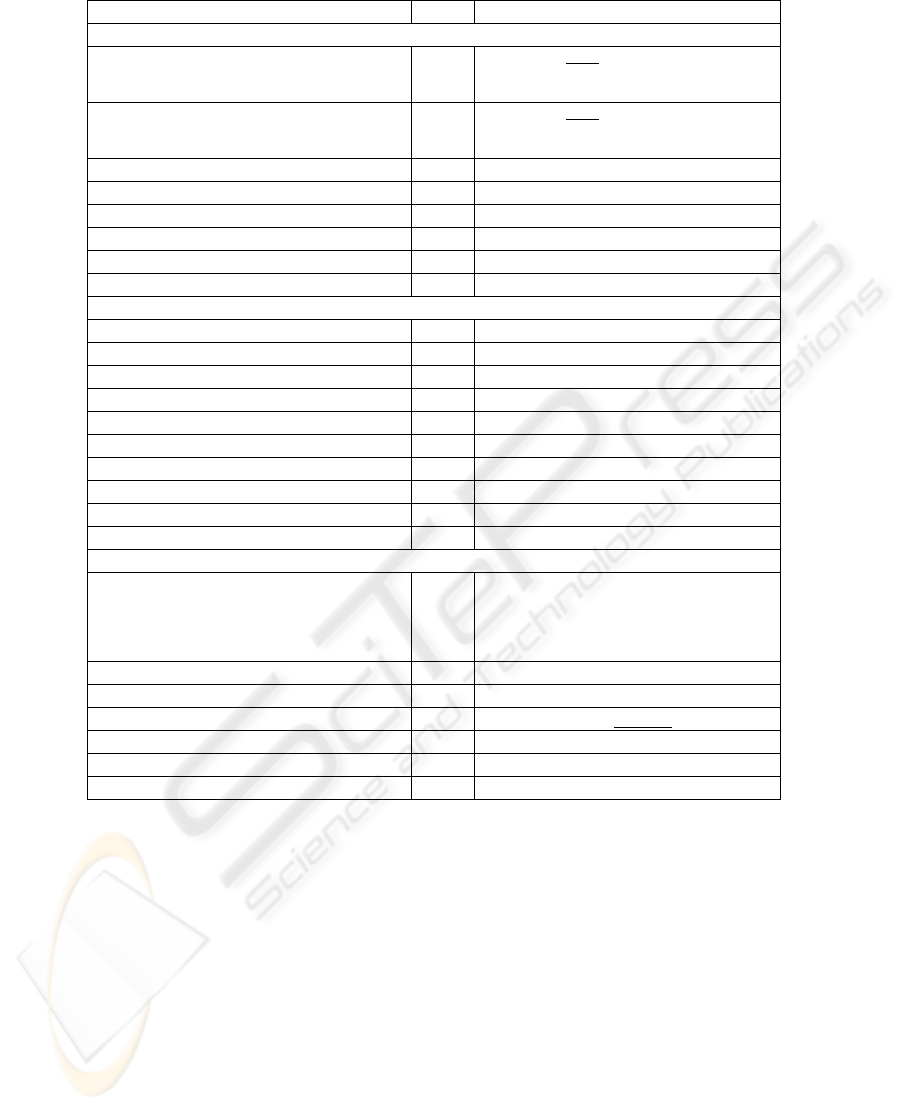

The accounts dimension in the

FinancialStatements

cube includes all of the

accounts corresponding to the three standard

financial statements: Balance Sheet, P&L Statement

ICSOFT 2010 - 5th International Conference on Software and Data Technologies

352

and Cash Flow Statement, listed as dimension

members. Some of them are input members, others

are calculated members, with values resulting from

the application of business rules. They are depicted

in Table 2, together with their interrelationship

and/or formulation. Data entered in the local

currency in each country is automatically converted

to dollars for comparison and consolidation purposes

using the Currency

cube that feeds the

corresponding exchange rate for each country and

time period.

Data for each financial statement is entered on a

monthly basis in two versions (‘Actual’ and

‘Budget’): ‘Actual’ data flows from the accounting

system, ‘Budget’ data is the result of the planning

process; Sales metrics (‘PL01’, ‘PL02’) are

extracted from the Sales

cube, where data is entered

by productline and customertype and aggregated in

the query process that feeds the Sales (PL01)

member.

General Expenses (‘PL04’) is a member of the

FinancialStatements

cube, and the Expenses cube.

The [‘PL04’]

metric in the Expenses cube is calculated

through an extraction rule that distributes expenses

according to productline sales, feeding data from the

Sales

cube and FinancialStatements cube. Its

formulation for the Expenses cube is shown below:

[PL04’, productline] = (DB(Sales, country,

scenario, currency, 'Total Customer Types',

productline, 'PL01', year, period) /

DB(Sales

, country, scenario, currency,

'Total Customer,Types', 'Total Products',

'PL01', year, period) *

DB(FinancialStatements

, country, scenario,

currency ,’PL04’, year, period)

(3)

As shown in Table 2, standard accounting rules

are implemented (or validated) through the use of

business rules and calculated members. For

example:

A company's assets are financed by either equity

or debt (liabilities)

[‘BS06’] = [‘BS09’] +[‘BS10’] (basic double-entry accounting

formula)

The sum of the cash flows in all three activities

(operating, investing, financing) equals the

change in the cash balances over the accounting

period

['CF07'] =[‘CF01’] +[‘CF02’]+ [‘CF03’] +[‘CF06’]

Following general accounting principles, when

financial statements are aggregated over a period of

n months over a calendar year starting at month i

and ending at month f, the following conditions must

be satisfied: a) all P&L (‘PLxx’) variables are

aggregated by adding the values corresponding to

each month; b) all balance statement variables take

the values corresponding to month f; c) ‘CF01’ takes

the value corresponding to month i; d) ‘CF07’ takes

the value corresponding to month f. The

TemporalAggegation

cube has been added to handle

the aggregation process over n months (n is an input

parameter to the aggregation process).

Financial Performance indicators are calculated

members resulting from business rules that extract

data from the input cubes (Financial Statements

,

Sales

, and Expenses) and are stored in the

FinancialKPIs cube and the Sales cube.

Profitability KPIs: these are measures of

operating efficiency. Metrics are grouped by

country, customertype, and productline, for any

given period.

Gross profit ratio = [‘PL03’] / [‘PL01’] *100

Operating Ratio = [‘PL02’] / [‘PL01’] *100

Expense ratio = [‘PL04’] / [‘PL01’] *100 (rolled up on

customertype )

Annualized ROE = [‘PL08’] *12 / ([‘BS10’, previous

month] + [‘BS10’, current month] /2)] (measures the

Corporation’s efficiency at generating profits from every

unit of shareholders' equity; rolled up on customertype

and productline)

Unit marginal profit (UMP) = DB(Sales, ‘Price’,…) – (DB

(Sales

, ‘Cost of Sales’, …) / DB(Sales, ‘Units Sold’, …)

Marginal Profit per customer type (MPC) = [‘UMP’] *

DB(Sales, ‘Units Sold’, customertype,…)

Unit marginal profit per product (UMPP) =

[‘MPC’,’Total Customer Types’, productline] / DB(Sales

,

‘Units Sold’, ’Total Customer Types’, productline,..)

(marginal profit metrics help determine the contribution

per product, and rank customer types based on average

prices and unit marginal profits. They can be used to

define price strategies)

Solvency KPIs: these metrics show how well the

Corporation can satisfy its short- and long-term

obligations; grouped by country for any given

period.

Current Ratio = [‘BS04’]/[‘BS07’] (measures short term

solvency)

Liquid ratio = [‘BS01’]/[‘BS07’] (measures immediate

solvency)

Cash Variation = [‘BS01’, previous month] - [‘BS01’,

current month] (measures variation of cash in one

period)

Debt to Equity ratio = [‘BS09’]/[‘BS10’] (measures long

term solvency)

Proprietary of equity ratio = [‘BS10’]/[‘BS06’] (measures

long term solvency)

OLAP FOR FINANCIAL ANALYSIS AND PLANNING - A Proof of Concept

353

Table 2: Financial Statements‘ accounts dimension.

Dimension member Type Business Rule

Profit & Loss (P&L) Statement

PL01-Sales Calc

['PL01']

= DB(Sales, country, scenario, currency,

'Total Customer Types', 'Total Products', 'PL01',

year, period)

PL02-Cost of sales Calc

['PL02'] = DB(Sales

, country, scenario, currency,

'Total Customer Types', 'Total Products', 'PL02',

year, period)

PL03-Gross profit Calc ['PL03'] = [‘PL01’] – [‘PL02’]

PL04-General Expenses Input Distributed by product line

PL05-Other income (expense) Input

PL06-Earnings before taxes (EBT) Calc ['PL06'] = [‘PL03]–[‘PL04’] +[‘PL05’]

PL07- Provision for income taxes Input

PL08 – Net income Calc ['PL08'] = [‘PL06]–[‘PL07’]

Balance Sheet

BS01-Cash Input

BS02-Short term investments Input

BS03-Accounts receivable Input

BS04-Current assets Calc ['BS04'] = [‘BS01]+[‘BS02’] +[‘BS03’]

BS05-Long term assets Input

BS06-Total assets Calc ['BS06'] = [‘BS04’] +[‘BS05’]

BS07-Current liabilities Input

BS08-Long term liabilities Input

BS09- Total liabilities Calc ['BS09'] = [‘BS07’] +[‘BS08’]

BS10-Shareholders Equity Input Checks that BS06 = BS09 +BS10

Cash Flow Statement

CF01-Cash and cash equivalents, beginning of year Calc [‘CF01’] = [‘BS01’, previous month] +[‘BS02’,

previous month]

Fed through rule from within the same cube

Checks that CF01 =CF07 from previous month

CF02-Cash flows from (used in) operating activities Input

CF03-Cash flows from (used in) investing activities Input

CF04-Payments of capital and interest Input Feeds [‘CF04’] in the Expenses cube

CF05-Other financing activities Input

CF06-Cash flows from (used in) financing activities Calc ['CF06'] = [‘CF04’] +[‘CF05’]

CF07-Cash and cash equivalents, end of year Calc ['CF07'] =[‘CF01’] +[‘CF02’]+ [‘CF03’] +[‘CF06’]

Cash Flow ratios: these metrics show the

adequacy of cash at the Corporation to meet its

obligations; grouped by country for any given

period.

Capital Expenditure Coverage = [ ‘CF02’] /[‘CF04’]*100 -

100 (measures the ability of the company's operating

cash flow to meet its capital requirements)

Operating Cash Flow Ratio = [ ‘CF02’] /[‘BS07’]*100

(measures how well the company’s operations are able

to cover current liabilities )

Having both actual and planned data as part of

the OLAP financial model allows the Corporation to

define KPIs aligned with its strategic goals and

defined along multiple dimensions and varying

granularity. Planned and actual KPIs can then be

compared over time in order to measure and correct

deviations.

5 SUMMARY

This paper provides a proof of concept for OLAP-

based financial analysis and planning. It is also the

first step of a more long-term project aimed at

developing a full blown application based on an in-

memory OLAP platform, and a detailed teaching

case. We have described some of the salient features

of the design of the OLAP model using a real-world

scenario. OLAP technology helps create powerful

data-driven software applications to help decision

makers analyze financial data and make timely and

better informed decisions.

ICSOFT 2010 - 5th International Conference on Software and Data Technologies

354

6 POINTS FOR DISCUSSION

What are the advantages and disadvantages of an

in-memory OLAP approach?

The OLAP model was designed using a set of

dimensions described in Figure 5. What

alternative designs would you consider? Discuss

the way in which time dimensions have been

treated.

Using the business rules processed by the OLAP

engine allows for self-contained applications that

reduce the need for extra application

programming. Are there any disadvantages to

this approach?

REFERENCES

Codd E. F., Codd S. B., and Salley C. T., Providing On-

Line Analytical Processing to User–Analysts: An IT

Mandate. 1993, E.F. Codd and Associates.

Golfarelli, M., S. Rizzi, and A. Proli, Designing what-if

analysis: towards a methodology. In Proceedings of

the 9th ACM international workshop on Data

warehousing and OLAP. 2006, ACM: Arlington,

Virginia, USA.

Hasan, H. and P. Hyland, Using OLAP and

Multidimensional Data for Decision Making. IT

Professional, 2001. 3(5): p. 44-50.

Higgins, R. C., Analysis for financial management. 6th ed.

The Irwin/McGraw-Hill series in finance, insurance,

and real estate. 2001, Boston: Irwin/McGraw-Hill.

Kimball, R. and M. Ross, The data warehouse toolkit: the

complete guide to dimensional modeling. 2nd ed.

2002, New York: Wiley. xxiv, 436 p.

Koutsoukis, N.-S., G. Mitra, and C. Lucas, Adapting on-

line analytical processing for decision modelling: the

interaction of information and decision technologies.

Decision Support Systems, 1999. 26(1): p. 1-30.

Thomsen, E., OLAP Solutions: building multidimensional

information systems. 2nd ed. 2002, New York: Wiley

Computer Pub. xxiv, 661 p.r.

OLAP FOR FINANCIAL ANALYSIS AND PLANNING - A Proof of Concept

355