PROBABILISTIC NEURAL NETWORKS FOR CREDIT RATING

MODELLING

Petr Hájek

Institute of System Engineering and Informatics, Faculty of Economics and Administration, University of Pardubice

Studenstká 84, Pardubice, Czech Republic

Keywords: Credit rating, Probabilistic neural networks.

Abstract: This paper presents the modelling possibilities of probabilistic neural networks to a complex real-world

problem, i.e. credit rating modelling. First, current approaches in credit rating modelling are introduced.

Then, probabilistic neural networks are designed to classify US companies and municipalities into rating

classes. The input variables are extracted from financial statements and statistical reports in line with

previous studies. These variables represent the inputs of probabilistic neural networks, while the rating

classes from Standard&Poor’s and Moody’s rating agencies stand for the outputs. Classification accuracies,

misclassification costs, and the contributions of input variables are studied for probabilistic neural networks

compared to other neural networks models. The results show that the rating classes assigned to bond issuers

can be classified accurately with probabilistic neural networks using a limited subset of input variables.

1 INTRODUCTION

Credit rating can be defined as an independent

evaluation in which the aim is to determine the

capability and willingness of an object to meet its

payable obligations. This is based specifically on

complex analysis of all the known risk factors of the

assessed object. The assessment is realized by a

rating agency. Credit rating is a result of a credit

rating process. It is represented by the j-th rating

class ω

j

Ω, Ω={AAA,AA, ... ,D}, where Ω is a

rating scale. The rating class ω

j

Ω is assigned to

assessed objects. Credit ratings are used by bond

investors, debt issuers, and governmental officers as

a measure of the risk of an object. Bankers and

companies considering providing credit rely on

credit ratings to make important investment

decisions. Credit ratings are costly to obtain due to

the large amount of time and human resources

invested by rating agencies to perform the credit

rating process. There is a great deal of effort made to

simulate the credit rating process of rating agencies

through statistical (Hwang and Cheng, 2008), and

artificial intelligence (AI) methods (e.g. Brennan

and Brabazon, 2004; Huang, Chen, Hsu, Chen and

Wu, 2004). The difficulty in designing such models

lies in the subjectivity of the credit rating process.

Such a complex process makes it difficult to classify

rating classes through statistical methods. However,

AI methods can be applied for the modelling of such

complex relations.

Probabilistic neural networks (PNNs) defined by

Specht (1990) are neural networks (NNs) for

classification which combines the computational

power and flexibility of NNs, while managing to

retain simplicity and transparency. So far PNNs

have been applied in only a few studies in finance

such as liquidity modelling (Li, Shue and Shiue,

2000) or audit reports qualifications (Gaganis,

Pasiouras and Doumpos, 2007). In this paper I will

demonstrate that they represent a suitable

architecture for credit rating modelling.

The paper is structured as follows. First, related

literature on corporate and municipal credit rating

modelling will be reviewed. Then, the basic notions

of PNNs will be presented. The models of PNNs

will be used for the modelling of corporate and

municipal credit rating. The input variables for the

modelling are designed based on all the aspects of

economic and financial performance of companies

and municipalities. Most input variables used in this

study have also been applied in previous works. In

this paper, however, financial market indicators have

been applied for the first time. An optimum set of

input variables will be obtained by using a

289

Hájek P..

PROBABILISTIC NEURAL NETWORKS FOR CREDIT RATING MODELLING.

DOI: 10.5220/0003062002890294

In Proceedings of the International Conference on Fuzzy Computation and 2nd International Conference on Neural Computation (ICNC-2010), pages

289-294

ISBN: 978-989-8425-32-4

Copyright

c

2010 SCITEPRESS (Science and Technology Publications, Lda.)

combination of correlation based approach (Hall,

1998) and genetic algorithms (GAs). The

contribution of input variables will be studied using

sensitivity analysis. Finally, the gained results will

be compared across selected models of NNs.

2 LITERATURE REVIEW

Recently, AI methods such as NNs (Brennan and

Brabazon, 2004; Moody and Utans, 1995), support

vector machines (SVMs) (Huang et al., 2004; Lee,

2007), artificial immune systems (Delahunty and

O’Callaghan, 2004), evolutionary algorithms

(Brabazon and O’Neill, 2006), and case based

reasoning (Lee, 2007) have been used for corporate

credit rating modelling. Usually, AI methods are

compared to statistical methods such as multiple

discriminant analysis (MDA) or linear regression

(LR).

As a result, high classification accuracy has been

achieved by NNs (Brennan and Brabazon, 2004) and

SVMs (Lee, 2007). Neural networks make it

possible to model complex relations as they learn the

dependencies in training data. The learnt knowledge

can also be applied for unknown input data which

were not used in the training process. Prior studies in

modelling credit rating were aimed at quantifying

the effect of input variables for classification, i.e. to

find out which input variables are crucial for credit

rating process. Mostly, sensitivity analysis has been

employed for this purpose.

Input variables are mostly represented by

financial ratios. Given the results of the previous

studies, it appears that the level of information

available in financial data is bounded (Brennan and

Brabazon, 2004). Although NNs are capable of

detecting non-linear structures in input data, it does

not appear that this has noticeably improved the

results, as the classification power of NNs is only

slightly better than that recorded by traditional

statistical methods. This suggests that additional

inputs are required to obtain significantly better

results. This is in line with the claims of rating

agencies who emphasise the importance of

qualitative factors in their rating decisions.

The specific position of municipalities associated

with their financial management, requires the use of

different input variables than for companies. Further,

municipalities have rarely financial resources to pay

for the credit rating. As a result, there has been less

attention paid to municipal credit rating modelling in

the literature. Small data sets make it difficult to get

consistent results. Therefore, conventional statistical

methods have been mostly used so far in the

modelling (Loviscek and Crowley, 2003).

There have been several attempts made to

overcome the problem concerning small municipal

data sets in the literature. One of the possibilities

consists in the design of an expert system based on

the knowledge acquired from the rating agencies’

experts (Olej and Hajek, 2007). Further, it is

possible to extend the training and testing set using

unsupervised methods (Hajek and Olej, 2008). In

this case only low proportion of municipalities are

labelled with rating classes ω

j

Ω a priori. The other

municipalities can be then labelled with the rating

classes ω

j

Ω belonging to the most similar labelled

municipality. Then it is possible to apply supervised

methods like NNs on such pre-processed data sets

(Hajek and Olej, 2008), or to use semi-supervised

methods (Hajek and Olej, 2009).

Except for the municipalities, credit ratings of

sub-national entities were also analyzed in the

literature. Ordered probit method was applied by

Gaillard (2009) for the modelling of non-US sub-

national credit ratings. The model explained more

than 80% of Moody’s sub-sovereign credit ratings.

3 PROBABILISTIC NEURAL

NETWORKS

Probabilistic neural networks are based on Bayes

classifiers. They learn to approximate the probability

density function of the training objects (i.e.

underlying objects’ distribution). They are regarded

as a special type of RBF NNs (Wasserman, 1993).

The PNN consists of neurons allocated in four

layers, Figure 1.

There is one neuron in the input layer for each

input variable. The pattern layer has one neuron for

each object in the training data set. The neuron

stores the values of the input variables for the object

along with the target value. When presented with the

x

i

, i=1,2, ... ,m, vector of input values from the input

layer, a pattern neuron k, k=1,2, ... ,n, computes the

Euclidean distance of the object x

i

from the neuron’s

centre x

k

, and then applies the RBF kernel function

using the sigma value. There is one neuron for each

class ω

j

Ω in the summation layer. The actual target

class of each training object is stored with each

neuron. The neurons add the values for the class

they represent. For an input vector x

i

, the output

f

j

(x

i

) of the summation layer is calculated in this

way:

ICFC 2010 - International Conference on Fuzzy Computation

290

jk

ω

ki,

j

ij

o

n

1

)(f

x

x

,

(1)

where n

j

is the number of training objects belonging

to the j-th class ω

j

and o

i,k

is the output of the

exponential activation function. Assuming that all

data vectors are normalized to unit length, the

following equation holds:

2

T

ik

ω

j

ij

σ

1

exp

n

1

)(f

jk

xx

x

x

.

(2)

Figure 1: Structure of a probabilistic neural network.

The decision layer compares the weighted votes

for each target class and uses the largest vote to

predict the target class ω

j

Ω. The outputs of the

summation neurons can be transformed to posterior

class membership probabilities:

q

1j

ij

ij

i

)(

f

)(

f

) jP(ω

x

x

x

.

(3)

Based on these probabilities, the j-th class ω

j

Ω,

for which P(j|

x

i

) is maximum, is assigned to the i-th

input vector

x

i

in the decision layer.

According to Specht (1990), the most obvious

advantage of the PNN is that training is trivial and

instantaneous. It can be used in real time because as

soon as one pattern representing each class has been

observed, the PNN can begin to generalize to new

patterns. As additional patterns are observed and

stored into the network, the generalization will

improve and the decision boundary can get more

complex. One of the disadvantages of the PNN

compared to the FFNNs is that PNN models are

large due to the fact that there is one neuron for each

pattern. This causes the model to run slower than

FFNNs when using it to predict classes for new

objects. Therefore, unnecessary neurons will be

removed from the model after the model is

constructed in this study. As a result, the size of the

stored model will be reduced, the time required to

apply the model for new patterns will be reduced,

and the classification accuracy of the model will be

improved.

4 DATASETS

Data for US companies and municipalities are used

for credit rating modelling. Datasets cover input

variables for 852 companies in the year 2007, and

for 169 municipalities in 2003-2007 (766 objects).

The companies are labelled with Standard&Poor’s

rating classes, while the municipalities are labelled

with Moody’s rating classes.

Rating agencies do not give publicity to their

credit rating factors. In the literature (Brennan and

Brabazon, 2004; Singleton and Surkan, 1995) the

main factors considered in assigning a rating class

ω

j

Ω to companies are company size, its character,

industry risk, and financial indicators. However,

some factors have either not been monitored yet

(industry, reputation), or so far only little attention

have been paid to them (asset management, market

value ratios). As there are plenty of corporate credit

rating input variables referred in the literature, the

design of the variables used in this paper contained

originally a set of 52 input variables drawn from the

Value Line Database and Standard&Poor’s database.

The original set of input variables was optimized

using correlation based approach and GAs so that

only significant input variables remained in the

datasets. For more information see Hall (1998). The

GA optimizes the set of input variables so that it

evaluates the worth of a subset of variables by

considering the individual predictive ability of each

variable along with the degree of redundancy

between them. The parameters of the GA are set as

follows: crossover probability=0.6, mutation

probability=0.03, population size=20, maximum

number of generations=20.

The obtained results show that the size of

companies is characterized by size class (SC) and

market capitalization (MC). Corporate reputation is

represented by the number of shares held by mutual

funds (IH). Profitability ratios are represented only

indirectly by ETR. Moreover, liquidity ratios are not

presented at all. The structure of assets (fixed

assets/total assets (FA/TA) and intangible

assets/total assets (IA/TA)) is related to industry

(sector). The input variable market debt/total capital

PROBABILISTIC NEURAL NETWORKS FOR CREDIT RATING MODELLING

291

(MD/TC) stands for leverage ratios. The rest of input

variables are associated with financial markets. Beta

coefficient and correlation of stock returns with

market index (Cor) show the relation between

corporate and market risk. The risk of stocks is

further represented by high/low stock price (HiLo),

while the dividend yield (Div/P) shows the return of

shareholders. The mean values for the input

variables show that the higher is the size of company

the better is the credit rating. On contrary, higher

debt and financial risk indicate worse credit rating.

The effect of other input variables is ambiguous.

Companies from manufacturing, services, and

transportation industries prevail in the dataset.

Frequencies of companies (f

comp

) and municipalities

(f

munic

) in rating classes are presented in Table 1.

Table 1: Frequencies of companies and municipalities in

rating classes.

ω

j

AAA AA A BBB BB B CCC CC D

f

com

p

7 26 129 261 233 164 18 2 4

ω

j

Aaa Aa A Baa

f

munic

60 241 436 29

Municipal credit rating is based on the analysis

of four categories of variables, namely: economic,

debt, financial, and administrative (Loviscek and

Crowley, 2003). Economic variables include socio-

economic conditions such as population,

unemployment, and local economy concentration.

Debt variables include the size and structure of the

debt. Financial variables inform about the scope of

budget implementation. Administrative factors

comprise of qualitative variables concerning

qualification of employees, municipal strategy, etc.

The original set of input variables included 14

variables. Again, this set was optimized by the GA

in order to obtain the final set of 3 significant input

variables, i.e. population (PO), median of family

income (FI), and the share of tax revenue on total

revenue (TAXR/TR). The values of the proposed

input variables were obtained for 169 US

municipalities (State of Connecticut) in years 2003-

2007. What becomes apparent from the mean values

of input variables is that municipalities with Aaa

rating class tend to be larger and in general in better

position either in terms of average family income

(FI) or fiscal autonomy (TAXR/TR).

5 EXPERIMENTAL RESULTS

Probabilistic neural networks are compared to other

benchmark classifiers, i.e. NNs (FFNN, SVM, RBF,

group method of data handling polynomial NN

(GHMD) and cascade correlation NN (CCNN)), and

statistical methods (LR, MDA). For all the methods,

10-fold cross-validation is used for testing. Thus,

overfitting is avoided. The average accuracies and

standard deviations for the given datasets are

reported in bold text in Table 1. Where a runner-up

does not differ at the 5% confidence level (using a

paired t-test), it too is recorded in bold. The

experiments were realized for different settings of

NNs’ parameters. The resulting settings of NNs’

parameters are as follows: PNN (Gaussian kernel

function), FFNN (m-1 neurons in the hidden layer,

logistic activation functions, learning rate of 0.05),

RBF (100 neurons in the hidden layer), SVM (RBF

kernel function), GHMD (quadratic function with

two variables), and CCNN (2 Gaussian neurons in

the hidden layer, 1 output neuron).

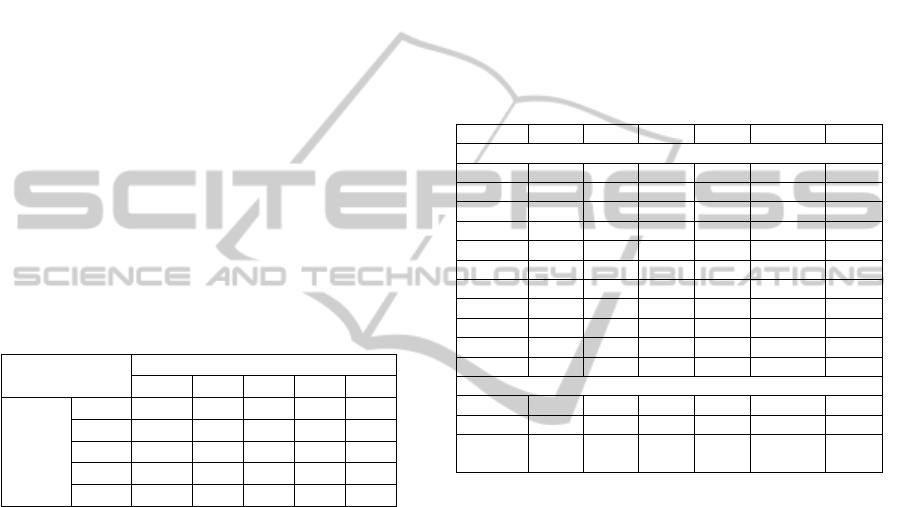

Table 2: Results of credit rating classification.

comp. munic.

Model

CA

test

±sd[%]

MC

test

±sd

CA

test

±sd[%]

MC

test

±sd

PNN

58.47±0.94 0.501±0.012 98.80±0.93 0.012±0.010

FFNN 51.71±2.24 0.525±0.023 86.30±1.68 0.144±0.021

RBF

58.28±3.08 0.489±0.025

92.80±1.88 0.072±0.019

SVM 55.63±1.52 0.551±0.012 96.00±2.16 0.045±0.021

GHMD 54.46±0.42 0.510±0.004 83.00±1.28 0.176±0.010

CCNN

57.69±2.16 0.503±0.018

91.10±1.76 0.092±0.019

MDA 55.83±1.32 0.554±0.009 78.60±3.35 0.226±0.031

LR 53.28±0.69 0.543±0.005 74.40±2.62 0.285±0.034

Legend: CA

test

is classification accuracy on testing data, MC

test

is

misclassification cost on testing data, sd is standard deviation.

For the corporate credit rating problem, PNN

shows best results concerning classification accuracy

(CA

test

=58.47%). Similar results are obtained also

for RBF and CCNN as classification accuracies of

higher than 57% were obtained. A considerably

worse classification was realized by the FFNN

model. The rating scale Ω with more than q=9 rating

classes was used only by Moody and Utans (1995)

with the classification accuracy of CA

test

=36.2% on

US data. Furthermore, in the case of six-class credit

rating problem, the classification accuracy of 66.7%

(Maher and Sen, 1997) was obtained.

For the municipal credit rating problem, the

highest classification accuracy CA

test

of 98.8% is

obtained using PNN. The comparison to prior

studies is possible to realize only with the MDA

method, as it was mostly used for municipal credit

rating modelling. For a three-class problem,

ICFC 2010 - International Conference on Fuzzy Computation

292

classification accuracy on testing data CA

test

was

66% (Serve, 2001) on European data, and 62% for a

four-class problem (Farnham and Cluff, 1982) on

US data. In this study the results obtained for the

four-class problem using statistical methods (78.6%

for MDA, 74.4% for LR) are slightly better than

previous results, while PNNs (98.8%) and SVMs

(96.0%) achieved significantly better classification

quality.

More accurate information on classification can

be presented using misclassification cost MC

test

which takes into account the fact that the rating

classes are ordered from the best one to the worst

one. The cost matrix for companies is designed in

Table 3. The greater the difference between actual

and predicted class is, the higher is the

misclassification cost. Accordingly, the cost matrix

is proposed also for municipalities. The results are

similar to those measured by classification

accuracies. For companies, RBF shows the least

misclassification cost (MC

test

=0.489), while PNN

outperforms other classification models in case of

municipalities.

Table 3: Misclassification cost matrix.

Rating class

Predicted

AAA AA A … D

Actual

AAA 0 1 2 … 8

AA 1 0 1 … 7

A 2 1 0 … 6

… … … … …

D 8 7 6 … 0

For a user, it is also important to get information

about the process of classification, i.e. how the NNs

obtain the results. The goal of the model’s

interpretation consists in the evaluation of input

variables’ effects on the results of classification. In

this study the calculation of variables’ importance is

performed using sensitivity analysis. The values of

each input variable are randomized and the effect on

the quality of the model (classification accuracy) is

measured. Finally the contributions of input

variables are standardized so that the contribution of

the most important input variable is 100%, and the

contributions of other input variables are related to

this variable. The resulting relative contributions of

input variables on corporate and municipal rating

classes are presented in Table 4.

For the nine-class corporate credit rating

problem, the size of the company is the most

important input variable (SC, MC). Further, the

input variables MD/TC and SIC play important

roles. As a result, I can declare that the size of

companies, their debt, and industry are the most

important factors in corporate credit rating process

realized by Standard&Poor’s rating agency.

However, there are several other factors including

asset management, shareholder structure,

profitability, and financial risks which serve for

improving credit rating evaluation process.

In the case of municipalities, the size of the

municipality represented by its population (PO), and

the wealth of its population (FI) show the highest

contribution. However, municipal financial

autonomy is also important in municipal credit

rating process.

Table 4: Relative contributions [%] of input variables.

PNN FFNN RBF SVM GMDH CCNN

comp.

SC 100.0 100.0 100.0 62.2 74.2 100.0

MC 23.4 48.8 23.0 100.0 100.0 51.7

FA/TA 10.0 55.1 10.8 19.6 3.1 13.9

IA/TA 1.5 35.0 10.8 25.2 1.0 5.3

IH 3.7 45.9 10.8 11.9 0.2 3.7

ETR 16.7 49.4 13.7 27.7 25.9 16.3

MD/TC 54.4 54.1 57.6 31.2 16.4 70.0

Beta 14.5 51.6 6.5 19.7 3.9 17.6

HiLo 10.1 59.8 21.6 17.1 11.1 27.6

Div/P 41.7 26.2 12.9 31 10.4 4.1

Cor 28.1 49.7 32.4 24.4 31.9 36.7

munic.

PO 10.0 100.0 100.0 100.0 100.0 100.0

FI 100.0 54.0 69.0 58.0 51.0 58.0

TAXR/

TR

5.0 51.0 33.0 70.0 49.0 70.0

6 CONCLUSIONS

The paper introduces the problem of municipal

credit rating process. The results of the prior studies

show that several crucial problems are involved with

credit rating modelling. First, data availability was a

critical point of concern in earlier studies. A

sufficient number of objects assessed by rating

agencies and, at the same time, the values of

important input variables must be available when

modelling credit rating. Without a large data set, the

use of these input variables is also limited. The next

point lies in the selection of input variables, as rating

agencies do not publish the details of their credit

rating process, which would emphasise the

subjectivity of the evaluation process. Further, the

appropriate method has to be applied in order to

model the complex relations among the input

variables.

In this paper PNNs are proposed in order to

realize the presented problems. Data were collected

PROBABILISTIC NEURAL NETWORKS FOR CREDIT RATING MODELLING

293

for US companies and municipalities. The assessed

objects were labelled by rating classes from rating

agencies. The selection of input variables was

realized as a two-step procedure. First, the original

sets of input variables were proposed based on

previous studies. Then correlation based approach

together with GA was employed with the aim of

reducing the original sets. The PNNs showed best

results for both the corporate and the municipal

credit rating problem. The results conform to prior

research results (Brennan and Brabazon, 2004;

Huang et al., 2004) indicating that the models of

NNs based on publicly available financial and

nonfinancial information could provide accurate

classifications of credit ratings. The sets of variables

identified in this study captured the most relevant

information for the credit rating decision.

In future research, the sets of input variables can

be extended in order to involve also the qualitative

factors of credit rating process. So far, these

variables have been either ignored or replaced with

alternative quantitative input variables.

REFERENCES

Brabazon, A. and O’Neill, M. (2006). Credit Classification

using Grammatical Evolution. Informatica, 30, 325-

335.

Brennan, D. and Brabazon, A. (2004). Corporate Bond

Rating using Neural Networks, In Arabnia, H.R. (Ed.),

Proceedings of the Conference on Artificial

Intelligence (pp. 161-167).

Delahunty, A. and O’Callaghan, D. (2004). Artificial

Immune Systems for the Prediction of Corporate

Failure and Classification of Corporate Bond Ratings.

Dublin: University College Dublin.

Farnham, P. G. and Cluff, G. S. (1982). Municipal Bond

Ratings: New Directions, New Results. Public

Finance Quarterly, 26, 427-455.

Gaganis, Ch., Pasiouras, F. and Doumpos, M. (2007).

Probabilistic Neural Networks for the Identification of

Qualified Audit Opinions. Expert Systems with

Applications, 32, 114-124.

Gaillard, N. (2009). The Determinants of Moody’s Sub-

Sovereign Ratings. International Research Journal of

Finance and Economics, 31, 194-209.

Hajek, P. and Olej, V. (2008). Municipal Creditworthiness

Modelling by Kohonen’s Self-Organizing Feature

Maps and Fuzzy Logic Neural Networks. In Kurkova,

V. (Ed.), Lecture Notes in Artificial Intelligence (pp.

533-542).

Hajek, P. and Olej, V. (2009). Municipal Creditworthiness

Modelling by Kernel Based Approaches with

Supervised and Semi-Supervised Learning. In Palmer-

Brown, D., Draganova, Ch., Pimenidis, E. and

Mouratidis, H. (Eds.), Communications in Computer

and Information Science (pp. 35-44).

Hall, M. A. (1998). Correlation-Based Feature Subset

Selection for Machine Learning. Hamilton: University

of Waikato.

Huang, Z., Chen, H., Hsu, Ch. J., Chen, W. H. and Wu, S.

(2004). Credit Rating Analysis with Support Vector

Machines and Neural Networks: A Market

Comparative Study. Decision Support Systems, 37,

543-558.

Hwang, R. Ch. and Cheng, K. F. (2008). On Multiple-

Class Prediction of Issuer Credit Ratings. Applied

Stochastic Models in Business and Industry, 5, 535-

550.

Lee, Y. Ch. (2007). Application of Support Vector

Machines to Corporate Credit Rating Prediction.

Expert Systems with Applications, 33, 67-74.

Li, S. T., Shue, L. Y. and Shiue, W. (2000). The

Development of a Decision Model for Liquidity

Analysis. Expert Systems with Applications, 19, 271-

278.

Loviscek, L. A. and Crowley, F. D. (2003). Municipal

Bond Ratings and Municipal Debt Management. New

York: Marcel Dekker.

Maher, J. J. and Sen, T. K. (1997). Predicting Bond

Ratings using Neural Networks: A Comparison with

Logistic Regression. Intelligent Systems in

Accounting, Finance and Management, 6, 59-72.

Moody, J. and Utans, J. (1995). Architecture Selection

Strategies for Neural Networks Application to

Corporate Bond Rating. In Refenes, A.N. (Ed.),

Neural Networks in the Capital Markets (pp. 277-

300).

Olej, V. and Hajek

, P. (2007). Hierarchical Structure of

Fuzzy Inference Systems Design for Municipal

Creditworthiness Modelling. WSEAS Transactions on

Systems and Control, 2, 162-169.

Serve, S. (2001). Assessment of Local Financial Risk: The

Determinants of the Rating of European Local

Authorities. Lugano: EFMA.

Singleton, J. C. and Surkan, A. J. (1995). Bond Rating

with Neural Networks. In Refenes, A.N. (Ed.), Neural

Networks in the Capital Markets (pp. 301-307).

Specht, D. F. (1990). Probabilistic Neural Networks.

Neural Networks, 3, 109-118.

Wasserman, P. D. (1993). Advanced Methods in Neural

Computing. John Wiley & Sons: VNR Press.

ICFC 2010 - International Conference on Fuzzy Computation

294