DEVELOPING MULTIVARIATE MODELS TO PREDICT

ABNORMAL STOCK RETURNS

Using Cross-sectional Differences to Identify Stocks

with Above Average Return Expectations

Alwyn J. Hoffman

School of Electrical, Electronic and Computer Engineering, Northwest University, Potchefstroom, South Africa

Keywords: Multivariate models, Stock return prediction, Neural modelling.

Abstract: This paper describes the development of multivariate models used to identify stocks with above average

return expectations. While most other research involving the development of stock return models involves

time-series prediction of future returns, this paper focuses on the modelling of cross-sectional differences

between stocks. The primary measure used in this paper to evaluate potential predictors of future stock

returns is based on sorted category returns, an approach that was previously applied to NYSE listed stocks;

in this paper the same approach is applied to stocks listed on the JSE. This measure is used to identify a

number of fundamental and technical indicators that differentiates between high and low performing stock

categories. Linear and non-linear multivariate models are subsequently developed, utilising these indicators

to improve prediction performance. It is demonstrated that much of the useful stock return behaviour is

present in the extremes of the population, that significant differences exist between different size categories,

and that different aspects of stock behaviour is exposed using appropriate measures for portfolio returns.

Portfolio performance results achieved using individual indicators as well as multivariate models are

reported and compared with previously published results, and planned future work to improve on the results

is discussed.

1 INTRODUCTION

The identification of stocks that provide above

average return expectations has not only been the

focal point of interest for market analysts but has

also received much attention in academic literature

(Fama and French, 2008; Alcock et al, 2005). Two

broad schools of thought can be identified in this

domain: while many market participants favour a

technical approach to predict future stock behaviour,

academic research in general gives preference to an

approach based on fundamental analysis to identify

stocks that are over- or undervalued (Fama and

French, 2004).

Both technical and fundamental approaches to

stock analysis usually identify a set of indicators that

are believed to have predictive capabilities regarding

future stock returns. The predictive ability of an

indicator is typically based on some kind of

hypothesis regarding the way in which the market is

believed to behave within a specific set of

circumstances. A useful indicator can be viewed as a

behavioural trait that becomes apparent before the

price of the associated stock will display some form

of predictable behaviour (typically going up or down

over a defined period of time).

Several obvious questions present themselves,

resulting from the prior discussion: how can

potential indicators of future returns be assessed and

compared objectively, and in which way can several

indicators with proven predictive ability be

combined to generate an even more useful indicator?

The purpose of this paper is to investigate an

approach to stock selection that falls somewhere

between a passive buy-and-hold strategy and an

active trading strategy involving either time series

prediction or the daily monitoring of technical

indicators as part of portfolio management. The

objective is furthermore to determine whether a

more basic approach to stock selection can produce

returns that are comparable to returns claimed to

result from time series prediction. The strategy that

is considered will require the updating of the

composition of a portfolio only once a month, based

411

J. Hoffman A..

DEVELOPING MULTIVARIATE MODELS TO PREDICT ABNORMAL STOCK RETURNS - Using Cross-sectional Differences to Identify Stocks with

Above Average Return Expectations .

DOI: 10.5220/0003075704110419

In Proceedings of the International Conference on Fuzzy Computation and 2nd International Conference on Neural Computation (ICNC-2010), pages

411-419

ISBN: 978-989-8425-32-4

Copyright

c

2010 SCITEPRESS (Science and Technology Publications, Lda.)

on a number of indicators of which the values tend

to change relatively slowly over time.

An innovative approach to the statistical analysis

of stock return behaviour is used, borrowing ideas

from the work reported by Fama and French (Fama

and French, 2008) in their analysis of abnormal

stock returns. This work is further extended by the

use of multivariate modelling to combine different

indicators, some fundamental and some technical in

nature, to create more representative indicators of

the medium term return expectations for specific

categories of stocks.

The data set used for this study involves all of

the stocks listed in the Johannesburg Stock

Exchange over the period March 1985 to February

2010, covering a period of 25 years. The number of

stocks for which data were available over this time

period range from about 60 during the early years up

to more than 400 by the end of the period.

The outline of the paper is as follows: Section 2

provides and overview of relevant literature and a

description of the main techniques used in the rest of

the paper. Section 3 describes the definition of and

motivation for the set of indicators used in this

study, while section 4 explores the statistical

behaviour displayed by the stocks included in this

study, and explains why the selection of optimal

portfolios is not a trivial task. The sorted returns

technique to assess the predictive ability of

indicators is described in section 5. In section 6 the

multivariate techniques used to combine individual

indicators into more comprehensive models are

described, and the challenges to extract good models

are discussed. Section 7 covers the results that were

obtained using different stock selection approaches,

and compares these against results reported

elsewhere in literature. The paper is concluded with

section 8 which provides a summary and overview

of results, as well as references to future work.

2 LITERATURE REVIEW

There has been much fundamental debate in

literature about the predictability of financial time

series, and more specifically of stock returns (Blasco

et al, 1997; Kluppelberg et al, 2002). Initial views in

favour of the efficient market hypothesis stated that

stock prices already reflect all available knowledge

about that stock, making the prediction of stock

returns to earn abnormal returns on a portfolio

impossible in principle. Much has however been

published in recent years confounding those early

views, and today it is widely accepted that the strong

form of market efficiency does not hold up in

practice (Fama and French, 2004).

Many studies have demonstrated the ability of

both linear and non-linear time series prediction

models to predict future stock behaviour, contrary to

earlier beliefs that the market behaviour should be

described as a random walk model (Lorek et al,

1983; Altay and Satman, 2005; Bekiros, 2007; Jasic

and Wood, 2004; Huang et al, 2007). An obvious

issue to be addressed is the most appropriate

benchmark against which to measure the

performance of such prediction models.

3 DEFINING THE PREDICTORS

The analyses in this paper are based on monthly

data, and returns are calculated relative to the market

index as calculated from the set of available stocks.

Returns were calculated using the change in the

baseline value of each stock, with the baseline value

being the value referred to the initial date when the

stock was first listed. The formula used to calculate

relative returns was as follows:

,

,

,

,

with RR

i,j

indicating the relative return of stock i

over period j and RelShBL

i,j

the relative share

baseline value of stock i for month j.

As will be explained in subsequent sections, this

paper will use sorted stock returns per category as

measure for the quality of a candidate predictor, a

technique that was first reported by Fama and

French (2008). For purpose of comparison the same

set of stock return predictors as defined by Fama and

French (mostly fundamental indicators) is used in

this paper, complemented by a number of additional

parameters that broadly fall in the class of ‘technical

indicators’. This paper therefore also serves the

purpose of comparing the predictive ability of

fundamental versus technical indicators, in the

process making a contribution towards the long

standing debate regarding the respective merits of

these two approaches to stock analysis.

The following list of parameters was

incorporated in the study as potential predictors of

future stock returns:

• Market capitalization (MC), defined as the

natural logarithm of the stock price multiplied

by the current number of issued shares;

• Momentum, defined as the relative return of

the stock over the period from 12 months to 1

months prior to the current date (relative return

ICFC 2010 - International Conference on Fuzzy Computation

412

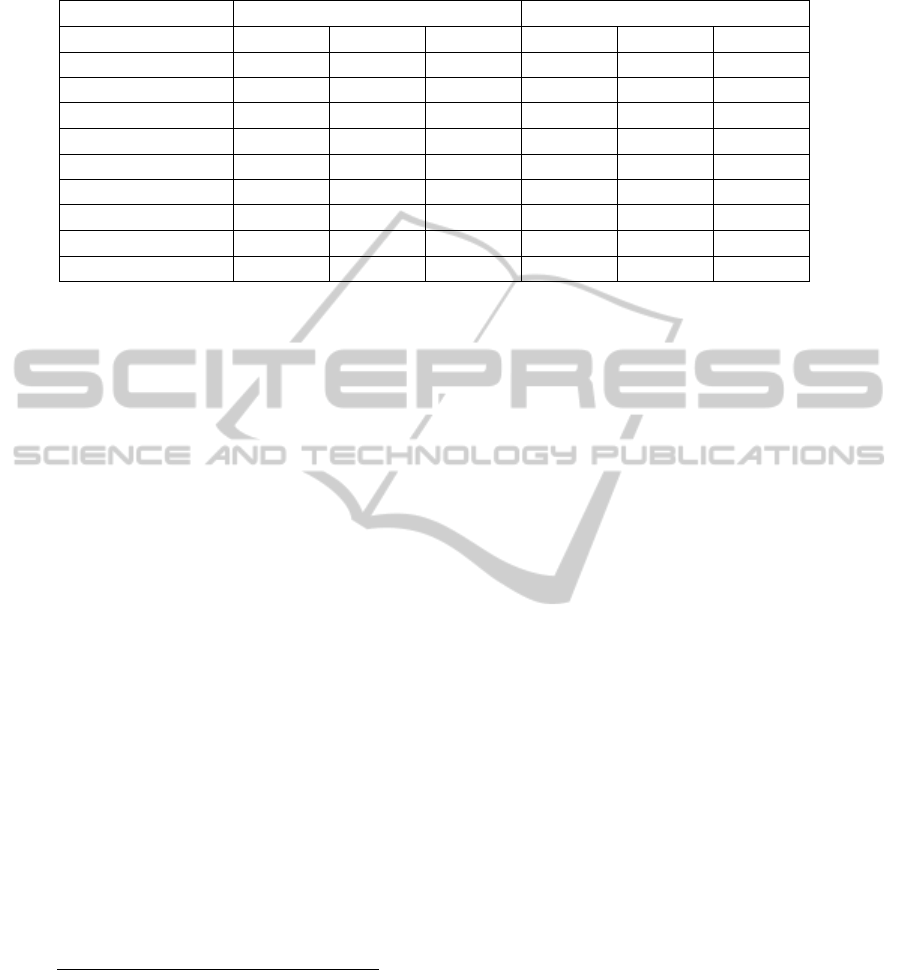

Table 1: Correlation between candidate predictors and future stock returns: a comparison between time-based and cross-

sectional correlations.

Predictor Time‐basedcorrelation Cross‐sectionalcorrelation

Ave Std Ave/Std Ave Std Ave/Std

MC ‐0.0912543 0.0836058 ‐1.0914829 ‐0.1575078 0.1149865‐1.3697937

BtoM 0.1074284 0.055503 1.935544 0.0790633 0.1667667 0.4740954

Momentum 0.0043152 0.0412991 0.1044854 0.0179527 0.1187149 0.1512252

NS ‐0.0286184 0.0379534 ‐0.7540394 ‐0.0348528 0.0628141‐0.5548568

YtoB 0.0118392 0.0380539 0.3111155 0.0333755 0.1374055 0.2428976

deltaAssets ‐0.0127946 0.0171016 ‐0.7481523 0.0034774 0.0810011 0.0429297

Accr 0.0021115 0.0212071 0.0995646 0.0064688 0.0707932 0.0913755

DO 0.0122353 0.0295008 0.4147464 0.0340647 0.1442936 0.2360794

DO_RR 0.0008196 0.0385019 0.021286 0.044983 0.0964287 0.46649

being the return on the stock compared to

return on the market index);

• Book-to-market (BtoM), defined as the ratio of

the book value of equity per share to the

market value of a share;

• Net share issues (NS), defined as the logarithm

of the ratio between the current number of

shares issued by the company and the number

of shares issued 12 months ago;

• Yield-to-book (YtoB), defined as the earnings

yield per share divided by the book value per

share;

• Accruals, defined as the proportional increase

of operating assets over the past 12 months;

• Delta Assets (DAssets), defined as the

proportional increase in total assets over the

past 12 months;

• Detrended oscillator for relative share baseline

(DO_RelShBL), defined as the difference

between the short and long term moving

average of the relative share price, divided by

the maximum value of the share price over a

defined historic time period (relative share

price being the price of the stock relative to the

market index, with price at the start of the

period of evaluation serving as baseline):

_

_

_

• Detrended oscillator for relative return

(DO_RR), defined as the difference between

short and long term moving average in relative

stock returns (opposed to relative stock price

used in the calculation of DO_RelShBL):

_

_

• Historic 12 month moving average of relative

stock return over a period ending one or more

years before the current time (e.g. RR12m60 for

a 60 month delay);

• MAEY, defined as the 12 month moving

average of earnings yield on the stock (earnings

yield being the earnings per share divided by

stock price).

4 STATISTICAL BEHAVIOUR OF

THE PREDICTORS

As a first step to unravel those relationships that can

potentially form part of prediction models the linear

correlations between the identified candidate

predictors and 12 month future returns were

calculated. Two types of correlation were calculated:

firstly the correlation over time between a stock

return and an explanatory variable was determined,

repeating this calculation per stock. To obtain a

summary measure representative of the entire

population the average is taken of the time-based

correlations for all stocks. This calculation is

repeated after each period once new data has been

added to the training set. While this correlation

parameter measures the ability of an explanatory

variable to predict the future return per stock, it does

not directly measure the degree to which differences

in the indicator value between stocks is correlated

with differences in future returns for those stocks.

The alternative correlation measure, which is

generally called the cross-sectional correlation, is

calculated by correlating, for each time period, the

stock return differences between different stocks

with the differences in values of the explanatory

variable over the same set of stocks. This calculation

is also repeated after each period and the average of

all cross-sectional correlations is taken over the

entire period for which training data is available. As

DEVELOPING MULTIVARIATE MODELS TO PREDICT ABNORMAL STOCK RETURNS - Using Cross-sectional

Differences to Identify Stocks with Above Average Return Expectations

413

this correlation parameter directly measures the

ability to predict differential future returns of the

stocks, it could be expected that it would be a

superior indicator based on which to select stocks

that will on average outperform the market for the

prediction period.

As is the case with most statistical modelling

exercises, there is no guarantee that a relationship

that exists over a specific period of time will persist

during subsequent periods. For this reason the

standard deviation of correlation coefficients over

time is also calculated for both correlation measures,

to indicate how stable these measures are to detect

relationships that can be exploited over extended

time periods.

The averages and standard deviations for both

types of correlation are displayed in Table 1, for

each of the predictors as defined in the previous

section. To allow the comparative assessment of the

stability of the correlations a column is added to

display average correlation normalised with respect

to standard deviation of correlation over time.

Firstly it can be seen that the relationships

between the respective indicators and future returns

vary substantially over time: for all of the indicators,

with the exception of MC (for both correlation

types) and BtoM (for time-based correlations), the

normalised average correlations have absolute

values smaller than one. This indicates that MC

should be the most consistent indicator for above

average returns, which is in line with prior research

(Fama and French, 2008), while the other indicators

could be expected to posses less predictive power.

For some predictors, e.g. MC, the two different

correlation measures provide consistent indications

of the relationship between the predictor and future

returns. For others, e.g. DO_RR, the time-based

correlation provides no indication of predictive

capability, whereas the cross-sectional correlation,

while not being very consistent, does indicate some

predictive power for this indicator.

For most modelling exercises the order in which

predictors are added to the model is potentially of

importance. While the time-based correlations

indicate BtoM as the most significant predictor, this

role is awarded to MC when using cross-sectional

correlations.

A further question is what minimum level of

correlation, or normalised correlation, should be

sufficient to indicate consistent predictive capability,

either for the indicator in isolation or when

considering the addition of that indicator to a

existing model in combination with other indicators.

This question was addressed by using the technique

of sorted returns, which is the next topic of this

paper.

5 EVALUATING PREDICTIVE

VALUE OF INDICATORS

One of the key focal points of this paper is to

compare the different correlation measures of the

previous section with sorted returns as basis for

selecting predictor variables to be incorporated into

a prediction model. Using the same approach as

described in Fama and French (2008), the ability of

each of these parameters to explain cross-sectional

differences in returns between different stocks is

investigated as follows:

• For each of the above parameters in

succession, all stocks are sorted based on the

value of the respective parameter for each

individual stock (e.g. the first sort is done

based on MC; next a sort is done based on

Momentum, etc.).

• Once a sort has been done, the stocks are

divided into five categories, each containing

the same number of stocks, from the lowest to

the highest values for the respective sorting

parameter.

• The aggregate return for all stocks within each

sorted category is calculated, both weighted

equally as well as weighted based on market

capitalization, using the following formulas:

_

1

_

∑

∑

where RelRet(n) is the relative return of the n-th

stock, MarketCap(n) is the market

capitilazation of the n-th stock, and N is the

total number of stocks in the portfolio under

consideration.

• This process is repeated after each month, in

every case only using information that was

already available before the start of the month.

• The average return of the sorted categories is

calculated over a period of time, and the

difference between returns of the lowest and

highest sorted categories is determined:

1

ICFC 2010 - International Conference on Fuzzy Computation

414

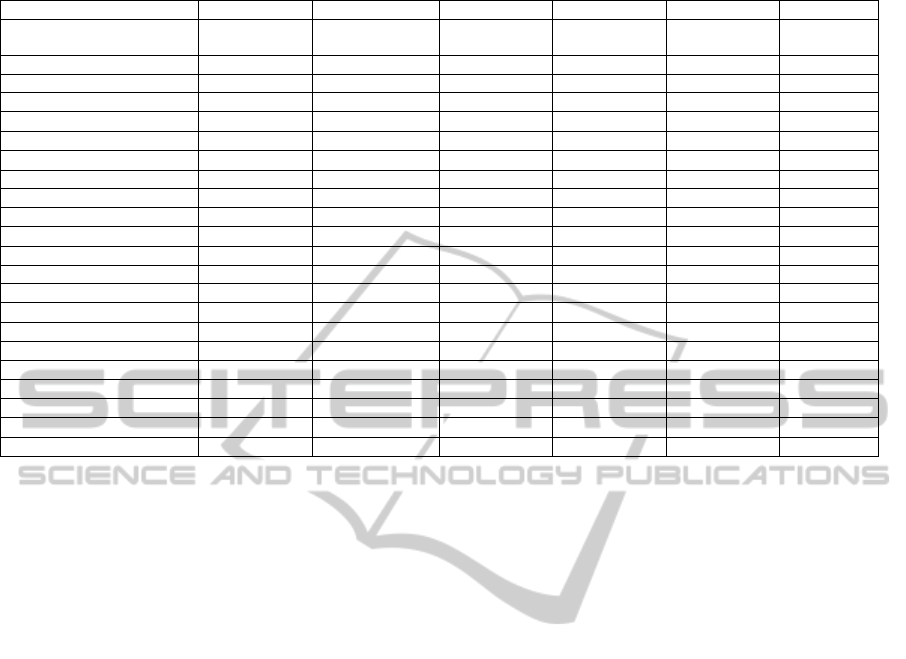

Table 2: Sorted returns and t-statistics for candidate cross-sectional stock return predictors.

MC RR_Momentum BtoM DO_RR DO_RelShB

L

NS

Average Corr Coeff with

Predicted Return

‐0.150 0.016 0.075 0.054 0.055‐0.028

Std of Average Corr Coeff

0.115 0.119 0.165 0.091 0.135 0.053

EqW High-low Returns

All

‐0.043 0.019 0.014 0.023 0.013‐0.016

Micro

‐0.050 0.014 0.003 0.027 0.017‐0.039

Small

‐0.003‐0.116 0.018 0.009 0.017‐0.006

Big

‐0.002‐0.004 0.018 0.011 0.019‐0.005

EqW High-low

t

-statistics

All

‐8.931 4.845 2.838 4.485 2.444‐3.298

Micro

‐9.143‐0.660 0.521 4.753 2.869‐7.246

Small

‐0.584 3.006 3.984 2.014 3.400‐1.429

Big

‐0.525‐0.660 4.604 2.741 4.314‐1.135

ValW High-low Returns

All

‐0.023 0.023 0.028 0.012 0.024‐0.003

Micro

‐0.016 0.020 0.007 0.020 0.031‐0.003

Small

‐0.002 0.017 0.018 0.005 0.017‐0.003

Big

‐0.005 0.019 0.019 0.007 0.021‐0.008

ValW High-low t-statistics

All

‐5.426 5.380 6.763 2.676 5.279‐0.736

Micro

‐3.344 4.192 1.505 3.961 6.062‐0.675

Small

‐0.423 3.912 4.085 1.212 3.613‐0.574

Big

‐1.108 4.517 4.493 1.565 4.417‐1.848

where M

i

is the number of months over which

the average return is calculated, i

cat

is the i-th

sorted category for which the return is

calculated, and RelRet(m

i

) is either the equal or

the value weighted average return of all stocks

falling into that category.

• t-statistics of these high-min-low sorted returns

are calculated to determine if the returns of the

sorted stock categories differ significantly

from the return of the overall population of

stocks.

• Parameters of which the t-statistics of high-

min-low sorted returns falls outside of the

range ±1 are considered for inclusion as

predictors in the subsequent modelling

exercise.

Table 2 below displays the values of sorted returns

for the above set of candidate predictors, as well as

the t-statistics for high-min-low returns. The

predictors justifying inclusion into a stock selection

model, based on the above results, include MC,

Momentum, BtoM, NS, DO and DO_RR; three of

these can be regarded as fundamental indicators

(MC, BtoM and NS) while the other three fall into

the category of technical indicators.

The indication of predictive ability of the

respective indicators based on sorted returns differs

significantly compared to the outcome of the

analysis based on correlation coefficients. While

Momentum displayed relatively insignificant

correlation with future returns, this indicator proves

to be significant when assessed based on sorted

returns. The same is true for DO_RR, demonstrating

that there can be useful return behaviour associated

with the extreme behaviour of an indicator, even

though that indicator may not in general be well

correlated with future returns. It can furthermore be

seen that DO performs better than DO_RR for value

weighted portfolios, but that the opposite is true for

equally weighted portfolios. This indicates that DO

may be more strongly present amongst Big stocks,

with DO_RR more prominent amongst Micro

stocks. MC is clearly the most significant sorted

returns based indicator, confirming that cross-

sectional correlation is a more reliable measure

compared to time-based correlation.

6 EVALUATING THE

PREDICTORS USING A

TRADING SIMULATOR

The analysis of sorted returns as described above

does not take into account all of the practicalities

related to composing and maintaining an actual

stock portfolio. For this purpose a simulator was

developed to model the behaviour of a stock

portfolio over time, taking into account the

DEVELOPING MULTIVARIATE MODELS TO PREDICT ABNORMAL STOCK RETURNS - Using Cross-sectional

Differences to Identify Stocks with Above Average Return Expectations

415

following aspects that may impact upon the

consistence and performance of such portfolios:

• The number of stocks to be incorporated into

the portfolio (using a minimum number of

10);

• The size of the portfolio, against the

background of limited trading volumes in

some stocks, specifically micro cap stocks;

• Trading costs, setting this at 0.25%.

The simulator was used to simulate the expected

returns on portfolios using each of the candidate

predictors as criteria for stock selection. The results

are displayed in table 4 below for different initial

portfolio sizes and over different time periods when

the stock market potentially displayed different

types of behaviour.

It is clear that the simulated trading results

confirm the findings of the sorted returns analysis,

with MC providing the largest potential abnormal

stock returns. The other indicators tend to perform

differently over different time periods, each

experiencing periods of strong predictive power,

followed by periods where the relationship with

future returns tends to weaken or sometimes even

being reversed.

MC is the only predictor that retains its

predictive capabilities over the entire period of

evaluation. This performance is however only

sustained for portfolios that are small in size. What

is apparent from tables 1 and 2 is that abnormal

returns explained by MC is mostly confined to micro

caps: as soon as the portfolio size grows to a level

where most investments must be made into stocks

falling outside of the micro cap category, the

predictive capabilities of MC tend to weaken

substantially.

The above finding clearly indicates the need for

models that can combine all of the predictors into a

single measure that will be less dependent on

portfolio size and that will perform more

consistently over time. Both linear multivariate

regression and neural networks were used for this

purpose.

7 TRAINING MULTIVARIATE

MODELS

The models used in this work were limited to single

layer networks (to test the performance of linear

models combining several variables) as well as two-

layer network with one hidden layer (to determine if

non-linear models could better capture the true

cross-sectional relationships between predictors and

abnormal stock returns). In all cases the networks

were feed-forward, and used mean squared error

with Levenberg-Marquardt optimization used for

training 2 layer models. A general regression

network based on radial basis functions was also

trained to compare its performance with those of

multilayer perceptron networks.

In order to investigate the consistency of the

relationships between the predictor variables and

future returns the respective models were trained on

data sets covering different lengths of time. This will

provide an indication of how long the memory of the

market is and will indicate how often models should

be retrained. In this study models were trained with

training sets extending over periods varying from 24

months up to 120 months. Each trained model was

then applied to the next 12 months of data,

predicting returns over periods that were unseen

during the training period. This model extraction and

prediction process was repeated on a monthly basis

covering the entire period.

In each case the historic data was divided into a

training set (60% of samples), a validation set (20%)

and test set (20%). The number of input parameters

varied between 2 and 4, starting off with those

parameters that were expected to contribute the most

to predictive ability, based on the results of the

sorted returns analysis, and testing the ability of

additional variables to improve the modelled results.

The following criteria were used to assess the

performance of the respective models:

• Average correlation coefficient between target

and predicted variables over the unseen test

periods;

• Using predicted returns as sorting variable, and

then comparing the high-min-low sorted

returns;

• Finally by comparing the portfolio returns

obtained under different sets of circumstances,

using simulated portfolio returns as measure for

model performance.

8 RESULTS AND DISCUSSION

The results obtained with the different multivariate

models that were trained are displayed in table 3,

including the results for All Shares, Micro Shares,

Small Shares and Big Shares. In each case the table

displays average correlation coefficient between

actual and predicted returns, the EqW and ValW

High-min-Low sorted returns and the t-statistic for

ICFC 2010 - International Conference on Fuzzy Computation

416

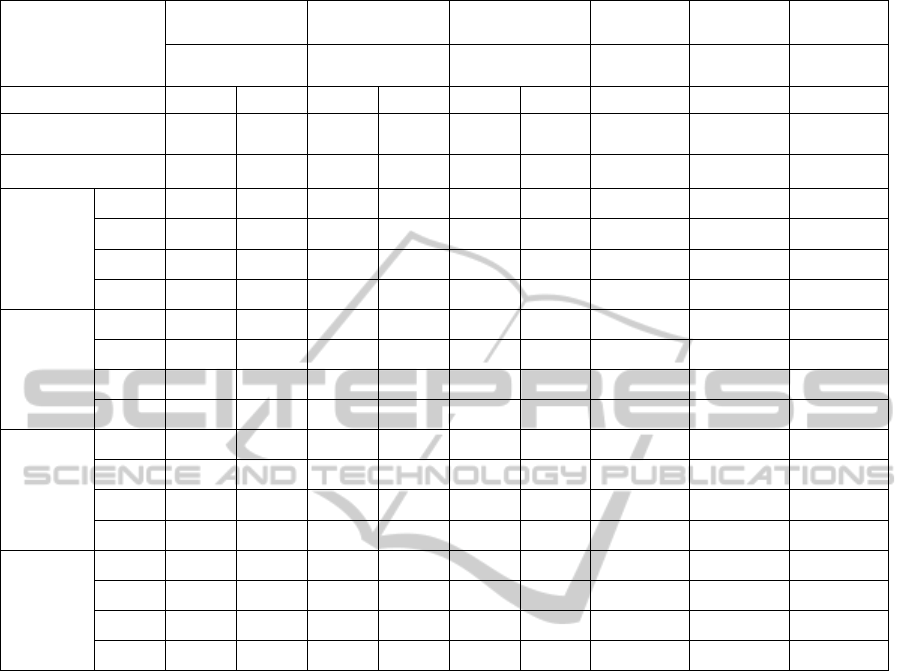

Table 3: Sorted returns and t-statistics obtained with multivariate models.

Predictorsused

LinRegr LinRegr LinRegr

FFNN

Num_Std0

FFNN

Num_Std2 RBFNN

MC,BtoM,DO_RR MC,BtoM NS,BtoM,DO_RR MC,BtoM MC,BtoM

MC,BtoM,

DO_RR

NumMonthsTrain 120 24 120 24 120 24 120 120 120

Average Corr Coeff

with Predicted Return

0.138 0.118 0.115 0.125 0.072 0.054 0.084 0.105 0.119

Std of Av Corr Coeff

0.134 0.140 0.148 0.137 0.117 0.147 0.110 0.085

EqW High-

low Returns

All

0.050 0.032 0.042 0.033 0.023 0.013 0.025 0.041 0.039

Micro

0.050 0.035 0.052 0.039 0.025 0.015 0.022 0.043

Small

0.010‐0.001 0.004 0.004 0.013 0.006 0.009 ‐0.005

Big

0.008 0.002‐0.003 0.003 0.012 ‐0.001 0.006 ‐0.001

EqW High-

low t-

statistics

All

9.610 6.128 8.702 6.887 4.455 2.591 4.728 8.135 7.009

Micro

8.431 5.938 9.560 7.202 4.179 2.515 3.672 7.593

Small

1.976‐0.143 0.874 0.806 2.733 1.334 1.917 ‐1.025

Big

1.958 0.476‐0.806 0.796 2.798 ‐0.248 1.421 ‐0.139

ValW High-

low Returns

All

0.030 0.017 0.019 0.022 0.018 0.003 0.023 0.025 0.030

Micro

0.020 0.013 0.026 0.021 0.019 0.010 0.013 0.017

Small

0.009 0.000 0.003 0.004 0.009 0.007 0.007 ‐0.006

Big

0.011 0.006‐0.006 0.003 0.011 0.003 0.006 0.001

ValW High-

low t-

statistics

All

6.444 3.690 4.592 5.277 3.877 0.551 4.957 5.787 6.008

Micro

3.904 2.468 5.509 4.380 3.596 1.978 2.453 3.372

Small

1.941 0.082 0.583 0.893 1.908 1.582 1.568 ‐1.261

Big

2.271 1.247‐1.390 0.737 2.269 0.615 1.391 0.308

that sorted return.

As could be expected, given the sorted returns of

the individual predictors, the best results were

obtained using sets of predictors that included MC.

The highest EqW relative monthly high-min-low

return is obtained with a linear model using MC,

BtoM and DO_RR as inputs, and just exceeds 5%

per month relative return, which implies an annual

return in excess of 80% over market return

(excluding trading costs). The relative return earned

by this model for Micro shares only is almost the

same, while much lower returns are generated with

portfolios selected from the Small and Big share

categories (0.96% and 0.84% per month

respectively, equating to annual excess returns of

12.1% and 10.5% respectively). The very high

relative returns generated by MC is therefore only

possible for portfolios that are small enough in size

to exploit the high returns of micro caps found in the

extreme sorted categories.

It can however be noted that this model also

provides a ValW relative monthly return of 2.95%,

i.e. an annual excess return of 41.5%, for value

weighted portfolios where Micro cap shares does not

play such a dominating role. The returns produced

by this model are also higher than the returns

generated by any of the individual predictors, both

for EqW and for ValW portfolios. It furthermore

compares favourably with returns reported

elsewhere based on time-series prediction techniques

(Lorek et al, 1983; Altay and Satman, 2005; Bekiros,

2007; Jasic and Wood, 2004; Huang et al, 2007).

Table 3 also displays results for different lengths

of the training set. It is clear that longer training

periods tend to lead to more accurate models, as in

all cases the best results are achieved when training

the models over 120 months, with training over only

24 months resulting in the worst performance. It

would therefore seem that the market has a relatively

long ‘memory’, indicating that at least some

elements of the relationships between predictors and

future returns tend to persist over periods of at least

up to 10 years. Conversely the conclusion can be

made that a period of only 2 years is too short to

train an accurate model, as this period of time does

not display all types of behaviour that may occur

DEVELOPING MULTIVARIATE MODELS TO PREDICT ABNORMAL STOCK RETURNS - Using Cross-sectional

Differences to Identify Stocks with Above Average Return Expectations

417

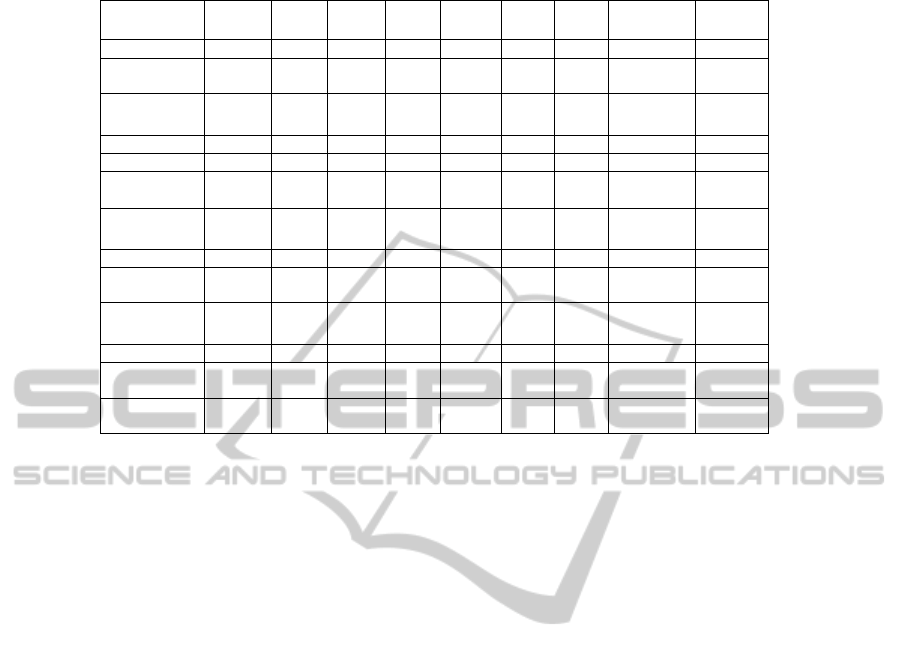

Table 4: Returns and fraction of good decisions produced by individual predictors and multivariate models.

Predictorsused Index MC Mom BtoM DO_RR DO NS

MC,BtoM,

DO_RR

MC,NS,

DO_RR

1985‐2010

FractionGood

Decisions

0.57 0.53 0.60 0.47 0.49 0.39 0.50 0.50

Annualised

Returns(%)

22.5 44.98 49.60 33.17 31.64 34.21 22.34 42.89 40.24

NormStdRet

3.96 2.97 2.35 2.51 2.84 2.82 3.85 3.08 3.10

1985‐1995

FractionGood

Decisions

0.67 0.53 0.77 0.51 0.56 0.28 0.47 0.53

Annualised

Returns(%)

27.75 95.31 59.46 69.40 51.07 46.84 13.17 57.34 71.59

1995‐2005

FractionGood

Decisions

0.60 0.54 0.53 0.44 0.47 0.38 0.61 0.51

Annualised

Returns(%)

20.93 36.74 54.73 33.72 24.75 36.22 29.61 44.43 43.29

2005‐2010

FractionGood

Decisions

0.46 0.52 0.57 0.51 0.48 0.47 0.43 0.46

Annualised

Returns(%)

21.83 28.65 33.13 9.29 31.29 21.45 16.13 26.96 9.73

over subsequent time periods when the model is

used for return prediction.

When comparing the different measures for

model quality, it is interesting to note that models or

predictors with a higher correlation coefficient

between actual and predicted share returns do not

always produce better results in terms of portfolio

returns. E.g. using MC as predictor produces a

correlation coefficient of 15.0%, an EqW relative

return of 4.3% and a ValW relative return of 2.3%.

The linear model using MC, BtoM and DO_RR has

a correlation coefficient of only 13.8% but produces

EqW and ValW relative returns of 5.0% and 3.0%,

respectively.

Another interesting aspect is the degree to which

the same predictor or model retains predictive

capabilities over all three stock categories (Micro,

Small and Big). It is clear that models including MC

as predictor do not perform well for the Big and

Small categories, while models including BtoM and

DO or DO_RR perform much better for these

categories, indicating that these predictors capture a

larger portion of cross-sectional share differences in

the Big and Small categories.

Table 4 displays the results for simulated returns

over the trading period 1985-2010, using either

individual predictors or predicted returns generated

by multivariate models to select portfolios. Results

are shown for the entire period 1985-2010, as well

as for the three periods 1985-1995, 1995-2005 and

2005-2010. In addition to the returns generated over

the respective period, the table also displays the

fraction of good decisions resulting from each stock

selection criteria.

The highest returns over an specific time period

is produced using MC as criteria, producing a return

of 95.3% for the period 1985-1995. It must be noted

that the size of the portfolio was still small during

this period – as portfolio size grew over subsequent

periods, the returns generated by MC reduced

substantially.

The multivariate models based on several

predictor variables tend to perform more

consistently over the entire time period compared to

the individual predictors contained in these models,

and, except for small portfolios (where MC performs

the best on its own) outperforms the performance of

the individual predictors used to train these models.

9 SUMMARY AND

CONCLUSIONS

The primary contribution of this paper is to show

how robust statistical analysis can be used as basis

for evaluating the ability of indicators, as well as of

models based on such indicators, to identify stocks

with above average return expectations. The

simulated trading strategy demonstrates that

employing these indicators as basis for stock

selection can lead to risk-adjusted returns that far

exceed returns associated with the market index.

The paper furthermore practically demonstrates

that conventional statistical parameters like

ICFC 2010 - International Conference on Fuzzy Computation

418

correlation coefficient are not necessarily the most

appropriate to use for selecting stocks to produce

abnormal returns. The approach introduced by Fama

and French (2008) to compile sorted categories with

associated sorted returns seem to be more suitable to

select stocks that are associated with above average

probabilities of outperforming the market.

The third important observation is that the

relatively basic approach used in this work can

produce results that compare favourably with

strategies based on extracting time series prediction

models for each individual stock. It is important to

note that the indicators and models developed in this

work are common to all stocks, whereas most other

approaches require different models for individual

stocks.

A fourth observation is that stocks from an

exchange operating within a developing economy

(the JSE representing the South African economy)

behave in much the same way as stocks listed on the

NYSE with respect to a number of fundamental and

technical indicators. MC is confirmed to be the

strongest individual indicator of abnormal returns

(although this may be explained by the higher risk

associated with smaller stocks), with BtoM

providing the best indicator of abnormal returns for

non-micro cap stocks. Between them these two

parameters seem to be useful indicators to predict

excess returns for growth and value stocks

respectively.

The exercise to develop multivariate models

using these predictors as inputs shows that, while the

best performance of the multivariate models is not

much better than the best results with individual

predictors, the multivariate models tend to be more

consistent over different time periods and for

different size categories. These models seem to be

able to use the abilities of the different indicators in

such a way that the best predictive abilities of each

is used when the others tend to loose some of their

predictive capabilities (e.g. when moving from

Micro to Big portfolios).

ACKNOWLEDGEMENTS

The author would like to acknowledge the assistance

of the School of Business Mathematics and

Informatics, including mr Thys Cronjé, at Northwest

University for providing the stock data that was used

for this work.

REFERENCES

Fama, E. F., French, K. R., August 2008. Dissecting

Anomalies. In The Journal of Finance, LXIII(4).

Altay, E., Satman, M. K., Stock market forecasting:

artificial neural network and linear regression

comparison in an emerging market, 2005. In Journal

of Financial Management and Analysis, 18(2).

Lorek, K. S. et al, 1983. Further descriptive and predictive

evidence on alternative time-series models for

quarterly earnings. In Journal of Accounting Research,

21(1).

Bekiros, S. D., 2007. A neurofuzzy model for stock

market trading. In Applied Economics Letters, Vol. 14.

Jasic, T., Wood, D. 2004. The profitability of daily stock

market indices trades based on neural network

predictions. In Applied Financial Economics, 14.

Blasco, N., Del Rio, C., Santamaria, R., The random walk

hypothesis in the Spanish stock market: 1980-1992.

June 1997. In Journal of Business Finance and

Accounting, 24(5).

Kluppelberg, C. et al, 2002. Testing for reduction to

random walk in autoregressive conditional

heteroskedasticity models. In Econometrics Journal,

5, pp. 387-416.

Fama, E. F., French, K. R., 2004. The Capital Asset

Pricing Model: Theory and Evidence. In Journal of

Economic Perspectives, 18(3).

Alcock, J., Gray, P., June 2005. Forecasting stock returns

using model-selection criteria. In The Economic

Record, 81(253).

Huang, W. et al, 2007. Neural networks in finance and

economic forecasting. In International Journal of

Information Technology and Decision Making, 6(1).

Sharpe, William F., 1964, Capital asset prices: A theory of

market equilibrium under conditions of risk, Journal

of Finance 19, 425–442.

DEVELOPING MULTIVARIATE MODELS TO PREDICT ABNORMAL STOCK RETURNS - Using Cross-sectional

Differences to Identify Stocks with Above Average Return Expectations

419