INTELLECTUAL CAPITAL IN TURKISH PRIVATE BANKS

Fethi Calisir, Cigdem Altin Gumussoy

Industrial Engineering Department, Management Faculty, Istanbul Technica University, Macka, Besiktas, Istanbul, Turkey

Faruk Cirit, Emrah Yorulmaz, A. Elvan Bayraktaroglu

Industrial Engineering Department, Management Faculty, Istanbul Technica University, Macka, Besiktas, Istanbul, Turkey

Keywords: VAIC

TM

, Banking Sector, Private Banks.

Abstract: In order to keep up in today’s competitive banking sector, banks need to offer more value added and more

diversified services. Service quality of banks highly depends on intellectual capital. In this study, VAIC

TM

(Value Added Intellectual Coefficient) has been used, developed by Pulic in 1998, to compare the private

banks in Turkey in terms of intellectual capital performance for the years 2002-2006. For all years except

2002, Akbank T.A.S. has the highest VAIC

TM

values. It also tops the list with the highest HCE and SCE

scores from 2002 to 2006. Adabank A.S. has the worst scores in HCE, SCE, and VAIC

TM

for almost all

years, while it occupies the highest places in CEE listing.

1 INTRODUCTION

Traditional accounting systems do not fully reflect

the success of a company. Each company’s unique

knowledge, skills, values, and solutions can be

transformed into value in the market, which may in

turn affect the competitive advantage, and increase

the productivity and market value (Pulic, 2002a).

These intangible assets define intellectual capital

(Yalama and Coskun, 2007). Intellectual capital is

an ‘intellectual material, knowledge, information,

intellectual property, and experience that can be put

to create wealth’ (Stewart, 1997).

Several successful companies realize the

importance of investing in intellectual capital for

their business, to create high value products and

services (Chang, 2007) from the company’s physical

assets (Wang, 2006). However, establishing an

evaluation system, which also focuses on value

creation and not only on cost, is a challenge for

many companies (Pulic, 2000). Several methods

have been developed to measure intellectual capital,

such as, market capitalization approach, direct

intellectual capital measurement approach, scorecard

approach, economic-value added approach, and

VAIC

TM

(Chan, 2009a). In this study, the authors

have used VAIC

TM

, developed by Pulic in 1998, to

calculate the intellectual capital performance of

private banks in Turkey. This method provides a

standardized and consistent measure that can be used

to compare banks (Shiu, 2006).

2 INTELLECTUAL CAPITAL

IN BANKING SECTOR

Financial sources are essential for all sectors in a

country’s economy, so banking sector is

indispensable for a sustainable economical growth.

In order to keep up in today’s competitive banking

sector, banks need to offer more value added and

more diversified services (Goh, 2005). As the

service quality of banks highly depends on

intellectual capital, banking sector provides a great

research opportunity for intellectual capital studies.

In addition to that, regularly declared financial

reports of banks supply reliable data for these

studies. (Goh, 2005; Kamath, 2007).

There is a growing body of research, which uses

VAIC

TM

as a performance measure for the

comparison of companies and as a predictor for

company performance (Chan, 2009a; Chan, 2009b;

Ghosh and Mondal, 2009; Kamath, 2008; Kamath,

2007; Appuhami, 2007; Tan et al., 2007; Ozturk and

Demirgunes, 2007; Shiu, 2006; Yalama and Coskun,

189

Calisir F., Altin Gumussoy C., Cirit F., Yorulmaz E. and Elvan Bayraktaroglu A..

INTELLECTUAL CAPITAL IN TURKISH PRIVATE BANKS.

DOI: 10.5220/0003088201890194

In Proceedings of the International Conference on Knowledge Management and Information Sharing (KMIS-2010), pages 189-194

ISBN: 978-989-8425-30-0

Copyright

c

2010 SCITEPRESS (Science and Technology Publications, Lda.)

2007; Goh, 2005; Chen et al., 2005; Mavridis, 2004;

Firer and Williams, 2003).

However, only a small part of the studies have

analyzed the intellectual capital performance of the

banking sector. Pulic has assessed intellectual capital

performance of Austrian banks (1997) in a period of

1993-1995 and Croatian banks (2002b) in a period

of 1996-2000 using VAIC

TM

. Appuhami (2007) has

investigated the impact of intellectual capital

efficiency on the investors’ capital gains, by

collecting data from 33 banking, insurance, and

finance companies in Thailand for the year 2005.

Mavridis (2004) has analyzed the intellectual and

physical capital of the Japanese banking sector for

the financial period 1 April 2000 to 31 March 2001,

and has discussed their impact on the banks’ value-

based performance. Goh (2005) has measured the

intellectual capital performance of commercial

banks in Malaysia, for the period 2001 to 2003, by

using VAIC

TM

, and has compared domestic and

foreign banks in terms of intellectual capital

performances. Kamath (2007) has analyzed the

intellectual and physical capital performance of the

Indian banking sector by using VAIC

TM

for the five-

year period, and has then discussed the impact of

intellectual and physical capital performance on

value-based performance. Yalama and Coskun

(2007) have analyzed the intellectual capital

performance of the quoted banks on the Stock

Exchange Market in Turkey for the period 1994 to

2004 using VAIC

TM

.

Banking sector is one of the fastest growing

sectors in Turkey. Banking sector in Turkey consists

of three types of banks; deposit banks (mevduat

bankaları), development and investment banks

(kalkınma ve yatırım bankaları) and participation

banks (katılım bankaları). In terms of balance sheet

size, deposit banks constitute 94% of the sector by

September 2007. By the end of 2006 there were 33

deposit banks in Turkey, where 13 of them were

private banks.

The aim of this study is to analyze how well the

private banks in Turkey take advantage of their

intellectuall capital during the period 2002 to 2006.

3 METODOLOGY

In this study VAIC

TM

was used to calculate the

intellectual capital performances of the private banks

in Turkey.

VAIC

TM

measures the ‘efficiency of physical

capital and intellectual potential’ (Pulic, 1998), and

indicates ‘corporate value creation efficiency of

tangible and intangible assets within a company

during operations’ (Pulic 2000; Tan et al., 2007).

Ease of data acquisition and conducting data

analysis on other data sources are some of the

advantages of the Pulic’s method. Data needed to

derive the components of VAIC

TM

are standard

financial numbers derived from audited financial

reports of companies (Tan et al., 2007).

The Pulic’s method suggests that human capital

efficiency (HCE), structural capital efficiency

(SCE), and capital employed efficiency (CEE) are

the components of VAIC

TM

. Therefore, VAIC

TM

is

calculated by the sum of these components and

defined as (1):

VAIC

TM

= HCE

i

+ SCE

i

+ CEE

i

(1)

where, VAIC

TM

= the sum of value added for the

company i, HCE

i

= human capital efficiency of the

company i, SCE

i

= structural capital efficiency of the

company i , CEE

i

= capital employed efficiency of

the company i.

To calculate these components, first on has to

find out ‘how competent a company is to create

Value Added (VA)’. The aim is to ‘create as much

value added as possible with a given amount of

financial and intellectual capital’ (Pulic, 2000). The

calculation of VA

i

(the sum of value added for

company i) is defined as follows (Yalama and

Coskun, 2007) (2):

VA

i

= I

i

+ DP

i

+ D

i

+ T

i

+ M

i

+ R

i

+ WS

i

(2)

Where, I

i

= interest expenses for company i, DP

i

=

depreciation expenses for company i, D

i

= dividends

for company i, T

i

= corporate taxes for company i,

M

i

= equity of minority shareholders in net income

of subsidiaries for company i, R

i

= profits retained

for company i, WS

i

= the sum of wages and salaries

for company i.

In this formula, employees are not taken as costs,

but taken as an investment for companies (Pulic,

2002a).

CEE is the ratio of total VA divided by the total

amount of capital employed (CE). CEE is defined as

(3):

CEE

i

= VA

i

/ CE

i

(3)

where, CEE

i

= capital employed efficiency of the

company i, VA

i

= the sum of value added for the

company i, CE

i

= book value of net assets for the

firm i.

HCE is the ratio of total VA divided by the total

salary and wages spent by the firm on its employees.

KMIS 2010 - International Conference on Knowledge Management and Information Sharing

190

HCE shows how much VA created by a unit of

money is spent on employees (Tan et al., 2007).

HCE is defined as (4):

HCE

i

= VA

i

/ HC

i

(4)

where, HCE

i

= human capital efficiency of the

company i, VA

i

= the sum of value added for the

company i, HC

i

= total salary and wage expenditure

of the company i.

SCE is the ratio of structural capital (SC) divided

by total VA. The structural capital includes

proprietary software systems, distribution networks,

supply chains, brand, organization management

process, and customer loyalty (Tan et al., 2008; Goh,

2005). The structural capital is the difference

between a company’s total value added and its

human capital. The calculation of SC

i

and SCE

i

can

be defined as follows (5-6):

SC

i

= VA

i

- HC

i

(5)

SCE

i

= SC

i

/ VA

i

(6)

where, SC

i

= structural capital of the company i, HC

i

= the total salary and wage expenditure of the

company i, SCE

i

= structural capital efficiency of the

company i, VA

i

= the sum of value added for

company i. The abbreviations for the formulas can

be seen in Table 1.

Table 1: Abbreviations and their description.

Abbreviation Description

HCE

i

Human capital efficiency for

company i

SCE

i

Structural capital efficiency for

company i

CEE

i

Capital employed efficiency

for company i

VA

i

The sum of value added for

company i

I

i

Interest expenses for company

i

DP

i

Depreciation expenses for

company i

D

i

Dividends for company i

T

i

Corporate taxes for company i

M

i

Equity of minority

shareholders in net income of

subsidiaries for company i

R

i

Profits retained for company i

WS

i

The sum of wages and salaries

for company i

CE

i

Book value of net assets for

firm i

HC

i

Total salary and wage

expenditure for company i

SC

i

Structural capital for

company i

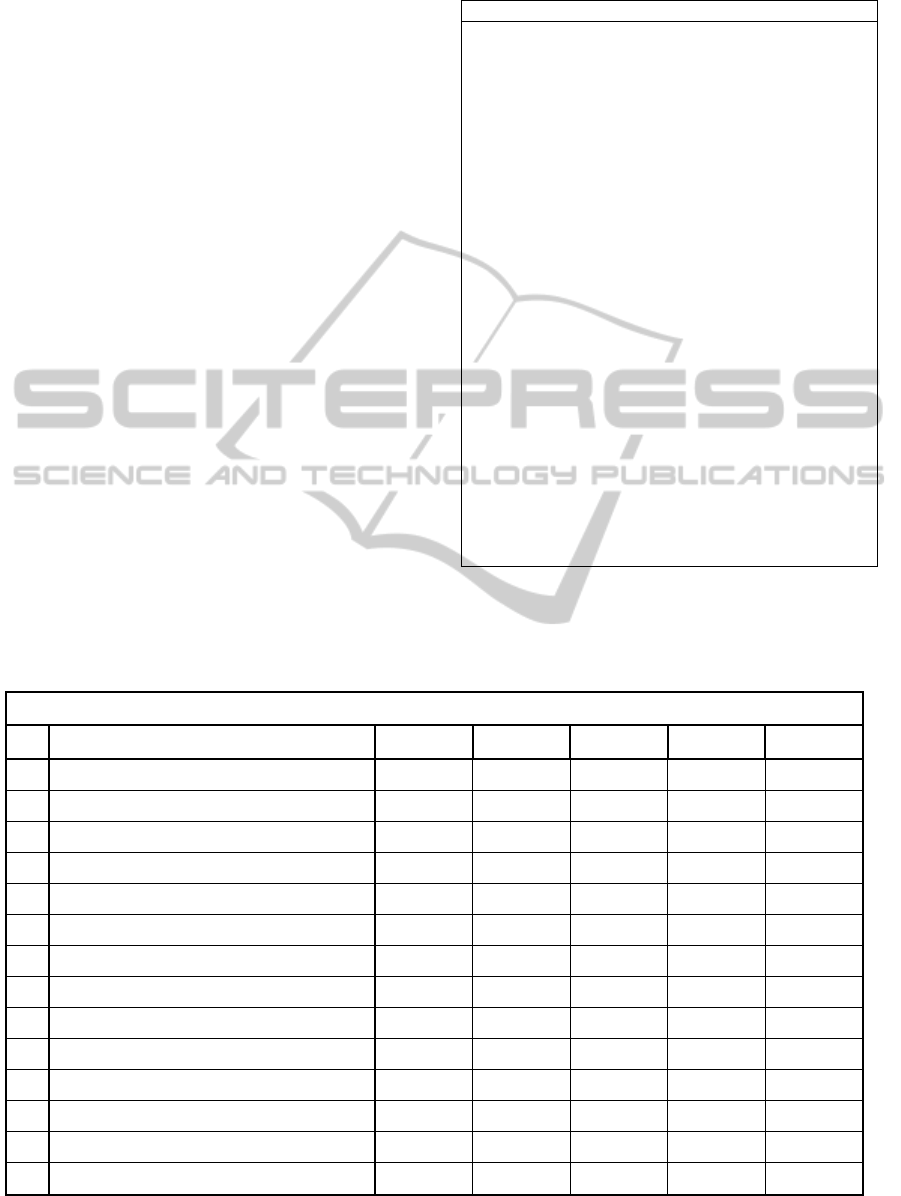

Table 2: VAIC

TM

values of the Turkish private banks.

VAIC

NO BANK 2002 2003 2004 2005 2006

1 ADABANK A.S. 6.57608 8.17608 1.98888 1.55635

2 AKBANK T.A.S. 14.36063 13.33390 11.86615 10.64885 12.04226

3 ALTERNATIFBANK A.S. 15.78902 11.94690 9.77288 5.56341 6.22177

4 ANADOLUBANK A.S. 10.80064 8.86060 7.66239 7.88099 6.52726

5 MNG BANK A.S. 12.85155 12.57087 4.89853 5.55873 6.86297

6 OYAK BANK A.S. 10.76219 7.65612 7.78786 7.52085 7.64483

7 SEKERBANK T.A.S. 9.89656 6.63093 5.47541 4.98635 4.97277

8 T. GARANTI BANKASI A.S. 11.76125 8.88014 7.48040 6.38952 9.12381

9 T. IS BANKASI A.S. 7.55180 7.70525 7.34699 7.78852 9.53076

10 TEKFEN BANK A.S. 8.25140 6.76674 4.87986 4.68063 6.25141

11 TEKSTIL BANKASI A.S. 10.58796 7.28017 5.48923 5.02603 5.86201

12 TURKISH BANK A.S. 10.77600 7.69831 6.67624 4.73161 6.14035

13 TURK EKONOMI BANKASI A.S. 7.19309 6.14880 6.20658 5.75834 6.71005

14 YAPI VE KREDI BANKASI A.S. 11.75939 9.77727 6.69509 6.89167 7.20736

INTELLECTUAL CAPITAL IN TURKISH PRIVATE BANKS

191

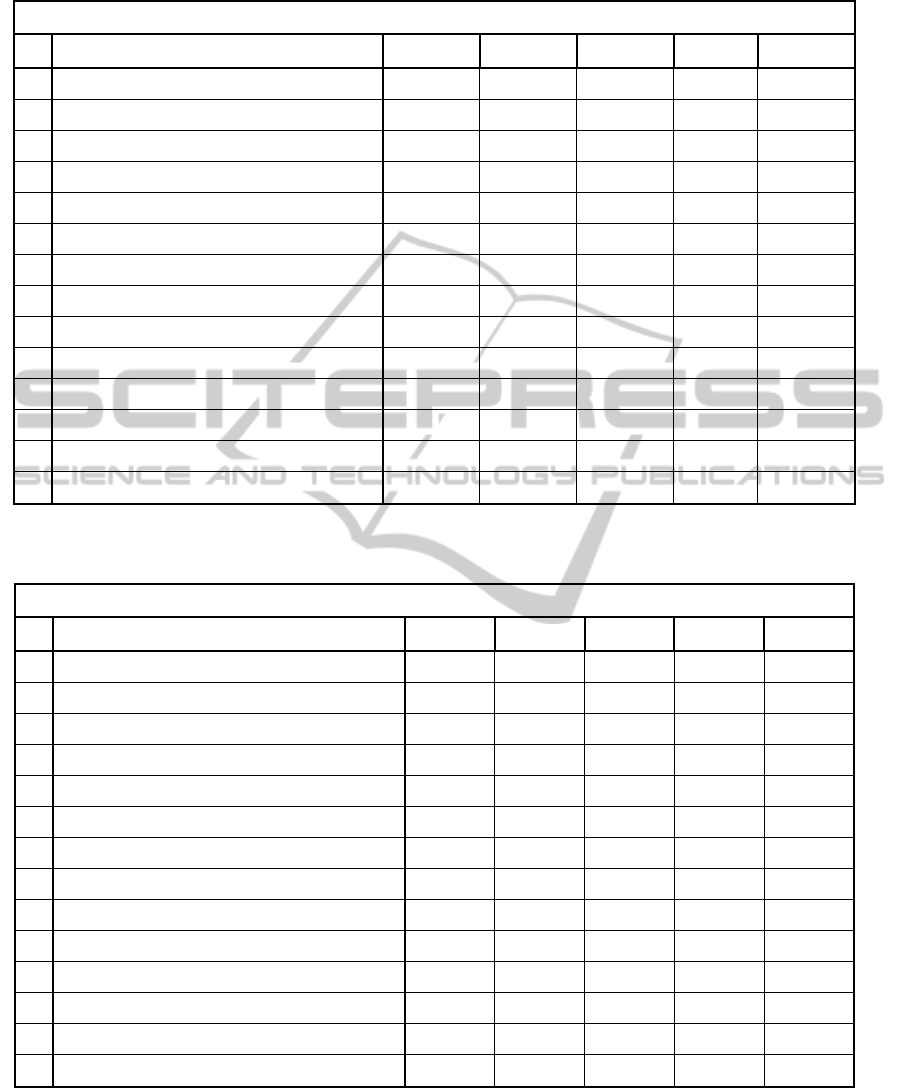

Table 3: HCE values of the Turkish private banks.

HCE

NO BANK 2002 2003 2004 2005 2006

1 ADABANK A.S. 5.64268 6.94791 1.48118 1.22447

2 AKBANK T.A.S. 13.32574 12.30015 10.84868 9.67121 11.02650

3 ALTERNATIFBANK A.S. 14.58338 10.84642 8.70406 4.68921 5.31548

4 ANADOLUBANK A.S. 9.73185 7.87536 6.69373 6.90216 5.59711

5 MNG BANK A.S. 11.46296 11.30450 4.04338 4.65471 5.91602

6 OYAK BANK A.S. 9.62871 6.64196 6.78765 6.54889 6.68259

7 SEKERBANK T.A.S. 8.78046 5.63843 4.54222 4.06942 4.07210

8 T. GARANTI BANKASI A.S. 10.72169 7.89981 6.53605 5.49830 8.15453

9 T. IS BANKASI A.S. 6.56157 6.71757 6.38119 6.84291 8.53947

10 TEKFEN BANK A.S. 7.15417 5.75020 3.99438 3.83630 5.33717

11 TEKSTIL BANKASI A.S. 9.49741 6.30716 4.60705 4.18854 4.97560

12 TURKISH BANK A.S. 9.68000 6.71656 5.73019 3.90239 5.23870

13 TURK EKONOMI BANKASI A.S. 6.25504 5.25085 5.29197 4.87850 5.78415

14 YAPI VE KREDI BANKASI A.S. 10.68079 8.74039 5.76511 5.95025 6.27535

Table 4: SCE values of the Turkish private banks.

SCE

NO BANK 2002 2003 2004 2005 2006

1 ADABANK A.S. 0.82278 0.85607 0.32486 0.18332

2 AKBANK T.A.S. 0.92496 0.91870 0.90782 0.89660 0.90931

3 ALTERNATIFBANK A.S. 0.93143 0.90780 0.88511 0.78674 0.81187

4 ANADOLUBANK A.S. 0.89724 0.87302 0.85061 0.85512 0.82134

5 MNG BANK A.S. 0.91276 0.91154 0.75268 0.78516 0.83097

6 OYAK BANK A.S. 0.89614 0.84944 0.85267 0.84730 0.85036

7 SEKERBANK T.A.S. 0.88611 0.82265 0.77984 0.75426 0.75443

8 T. GARANTI BANKASI A.S. 0.90673 0.87341 0.84700 0.81813 0.87737

9 T. IS BANKASI A.S. 0.84760 0.85114 0.84329 0.85386 0.88290

10 TEKFEN BANK A.S. 0.86022 0.82609 0.74965 0.73933 0.81263

11 TEKSTIL BANKASI A.S. 0.89471 0.84145 0.78294 0.76125 0.79902

12 TURKISH BANK A.S. 0.89669 0.85111 0.82549 0.74375 0.80911

13 TURK EKONOMI BANKASI A.S. 0.84013 0.80955 0.81103 0.79502 0.82711

14 YAPI VE KREDI BANKASI A.S. 0.90637 0.88559 0.82654 0.83194 0.84065

KMIS 2010 - International Conference on Knowledge Management and Information Sharing

192

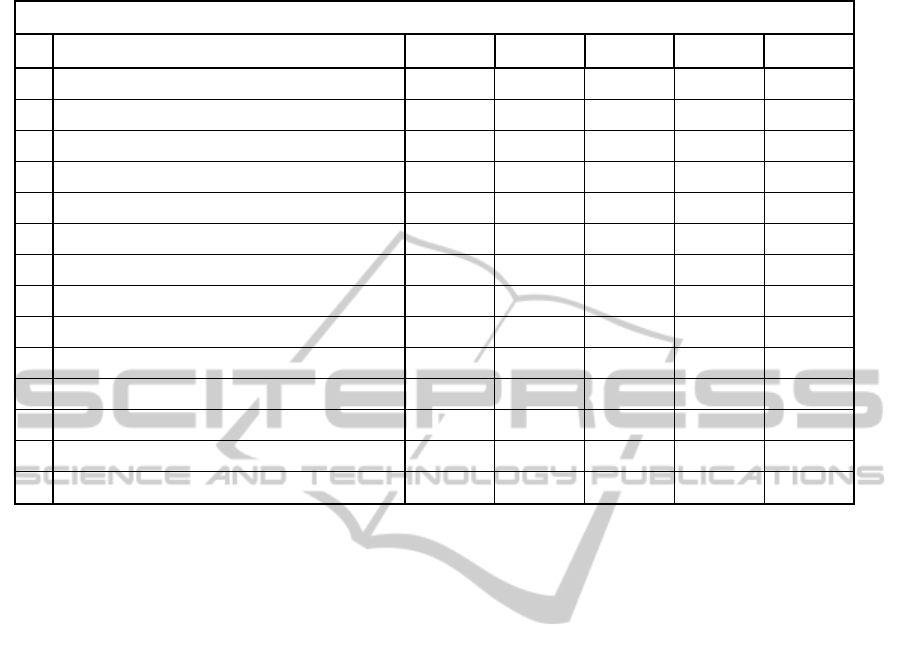

Table 5: CEE values of the Turkish private banks.

CEE

NO BANK 2002 2003 2004 2005 2006

1 ADABANK A.S. 0.11062 0.37210 0.18284 0.14856

2 AKBANK T.A.S. 0.10993 0.11504 0.10965 0.08103 0.10646

3 ALTERNATIFBANK A.S. 0.27422 0.19267 0.18371 0.08746 0.09442

4 ANADOLUBANK A.S. 0.17155 0.11221 0.11806 0.12371 0.10881

5 MNG BANK A.S. 0.47582 0.35483 0.10247 0.11886 0.11598

6 OYAK BANK A.S. 0.23734 0.16471 0.14753 0.12466 0.11188

7 SEKERBANK T.A.S. 0.22999 0.16985 0.15334 0.16266 0.14625

8 T. GARANTI BANKASI A.S. 0.13283 0.10692 0.09734 0.07310 0.09191

9 T. IS BANKASI A.S. 0.14264 0.13654 0.12251 0.09175 0.10839

10 TEKFEN BANK A.S. 0.23701 0.19045 0.13583 0.10500 0.10160

11 TEKSTIL BANKASI A.S. 0.19585 0.13155 0.09924 0.07624 0.08739

12 TURKISH BANK A.S. 0.19931 0.13063 0.12056 0.08547 0.09253

13 TURK EKONOMI BANKASI A.S. 0.09791 0.08840 0.10358 0.08483 0.09878

14 YAPI VE KREDI BANKASI A.S. 0.17222 0.15129 0.10344 0.10948 0.09137

4 RESULTS

Table 2 shows the performances of companies in

terms of VAIC

TM

values. For the first bank on the

list, Adabank A.S., the VAIC

TM

value for the year

2006 was not calculated because this bank was a

private bank until 2005 and in 2005 it was

transferred to TMSF (Saving deposits insurance

fund). Also the HCE, SCE and CEE scores of this

bank for the year 2006 were not calculated for the

same reason.

For all years except 2002 Akbank T.A.S. has the

highest VAIC

TM

values. In contrast to that finding,

second place is occupied by different banks in every

year. In 2002 Alternatifbank A.S. is the first bank in

terms of VAIC

TM

values, while Akbank T.A.S. has

the second place. In terms of human capital

performance, all banks have relatively higher human

capital efficiency than structural capital and capital

employed efficiencies. Among the banks, Akbank

T.A.S. tops the list with the highest HCE scores

from 2003 to 2006 (Table 3). In 2002 it has the

second place following again Alternatifbank A.S..

The same situation repeats for structural capital

efficieny; although Alterbatifbank A.S. is the

number one bank in terms of SCE in 2002, Akbank

T.A.S. has the best performance for SCE in the last 4

years evaluated (Table 4). This approves that

Akbank T.A.S. emerged stronger from the

economical crises of 2001 which affected the

Turkish banking sector very gravely. In contrast to

this results, in terms of CEE scores, Akbank T.A.S.

occupies much lower places in the list for the years

evaluated, which means that Akbank T.A.S. creates

a high level of value added with its personnel, but

compared to its net assets, value added it has created

is relatively small.

Adabank A.S. has the worst scores almost for all

types of efficiencies and VAIC

TM

except CEE, for

almost all years except 2003. Especially in the last

two years (meaning 2004 and 2005) of its existence

as a private bank it has very low values for SCE,

HCE and VAIC

TM

, on the other hand it occupies one

of the top two places in the CEE score list. This

shows, in contrast to Akbank T.A.S., Adabank A.S.

creates a good amount of value added with its net

assets, but personel wages it has discharged are

relatively high for the value added it has created.

The results show that HCE and SCE scores,

which are related to personal wages and salaries that

banks discharge, have higher impacts than CEE on

VAIC

TM

values of the Turkish private banks. As a

result of that HCE, SCE and VAIC

TM

listings show

similar results, while CEE listing gives a totally

different order.

Generally it can be said that for most of the

private banks examined there is a decreasing trend

for all type of efficiencies and VAIC

TM

beginning

INTELLECTUAL CAPITAL IN TURKISH PRIVATE BANKS

193

mostly in 2002. This decreasing trend began to go

slightly upward again in years 2005 and 2006,

especially for HCE, SCE and VAIC

TM

. It can be

concluded that the Turkish private banks got over

the negative effects of the economical crises of 2001

and began to gather strength.

REFERENCES

Appuhami, B.A.R., 2007. The impact of intellectual

capital on investors’ capital gains on shares: An

empirical investigation of Thai banking, finance &

insurance sector. International Management Review,

Vol. 3 No. 2, pp. 14-25.

Chan, K.H., 2009a. Impact of intellectual capital on

organizational performance An empirical study of

companies in the Hang Seng Index (Part I). The

Learning Organization, Vol. 16 No. 1, pp. 4-21.

Chan, K.H., 2009b. Impact of intellectual capital on

organizational performance An empirical study of

companies in the Hang Seng Index (Part II). The

Learning Organization, Vol. 16 No. 1, pp. 22-39.

Chang, S., 2007. Valuing Intellectual Capital and Firms’

Performance: Modifiying Value Added Intellectual

Coefficient (VAIC) in Taiwan IT industry. Ageno

School of Business, Golden Gate University, August.

Chen, M., Cheng, S., Hwang, Y., 2005. An empirical

investigation of the relationship between intellectual

capital and firms’ market value and financial

performance. Journal of Intellectual Capital, Vol. 6

No. 2, pp. 159-176.

Firer, S., Williams, S.M., 2003. Intellectual capital and

traditional measures of corporate performance.

Journal of Intellectual Capital, Vol. 4 No. 3, pp. 348-

360.

Ghosh, S., Mondal, A., 2009. Indian software and

pharmaceutical sector IC and financial performance.

Journal of Intellectual Capital, Vol. 10 No. 3, pp. 369-

388.

Goh, P.C., 2005. Intellectual capital performance of

commercial banks in Malaysia. Journal of Intellectual

Capital, Vol. 6 No. 3, pp. 385-396.

Kamath, G.B., 2007. The intellectual capital performance

of Indian banking sector. Journal of Intellectual

Capital, Vol. 8 No. 1, pp. 96-123.

Kamath, G.B., 2008. Intellectual capital and corporate

performance in Indian pharmaceutical industry.

Journal of Intellectual Capital, Vol. 9 No. 4, pp. 684-

704.

Mavridis, D.G., 2004. The intellectual capital performance

of the Japanese banking sector. Journal of Intellectual

Capital, Vol. 5 No. 1, pp. 92-115.

Ozturk, M.B., Demirgunes, K., 2007. Determination of

effect of intellectual capital on firm value via value

added intellectual coefficient methodology: An

empirical study on ISE-listed manufacturing firms.

ISE Review, Vol. 10 No. 37, pp. 59-77.

Pulic, A., 1997. The physical and intellectual capital of

Austrian banks, available at: http://www.vaic-

on.net/start.htm (accessed 11 May, 2010).

Pulic, A., 1998. Measuring the performance of intellectual

potential in knowledge economy, available at:

Pulic, A., 2000. MVA and VAIC analysis of randomly

selected companies from FTSE 260, available at:

http://www.vaic-on.net/start.htm (accessed 9 July,

2009).

Pulic, A., 2002a. Do we know if we create or destroy

value?, available at: http://www.vaic-on.net/start.htm

(accessed 9 July, 2009).

Pulic, A., 2002b. Value creation efficiency analysis of

Croatian banks, available at: http://www.vaic-

on.net/start.htm (accessed 11 May, 2010).

Shiu, H., 2006. The application of the value added

intellectual coefficient to measure corporate

performance: Evidence from technological firm.

International Journal of Management, Vol. 23 No. 2,

pp. 356-365.

Stewart, T.A., 1997. Intellectual Capital: The new wealth

of organizations, Doubleday/Currency, New York,

NY.

Tan, H.P., Plowman, D., Hancock, P., 2007. Intellectual

capital and financial returns of companies. Journal of

Intellectual Capital, Vol. 8 No. 1, pp. 76-95.

Tan, H.P., Plowman, D., Hancock, P., 2008. The evolving

research of intellectual capital. Journal of Intellectual

Capital, Vol. 9 No. 4, pp. 585-608.

Wang, J., 2006. Utilizing Skandia navigator system and

Ohlson model to evaluate the intellectual capital

performance for Taiwan electronic corporations. The

Business Review, Vol. 6 No. 1, pp. 186-192.

Yalama, A., Coskun, M., 2007. Intellectual capital

performance of quoted banks on the Istanbul stock

exchange market. Journal of Intellectual Capital, Vol.

8 No. 2, pp. 256-271.

KMIS 2010 - International Conference on Knowledge Management and Information Sharing

194