AN ONTOLOGY DRIVEN MULTI-AGENT SYSTEM FOR

CLIENT ASSIGNMENT IN A BANK QUEUE

María de Lourdes Martínez-Villaseñor

1,3

, David González-Marrón

2,3

, Miguel González-Mendoza

3

and Neil Hernández Gress

3

1

Universidad Panamericana Campus México, Augusto Rodin 498, Col. Insurgentes Mixcoac, México, D. F., México

2

Instituto Tecnológico de Pachuca, Carretera México-Pachuca Km 81.5, Pachuca, Hidalgo, México

3

Instituto Tecnológico y de Estudios Superiores de Monterrey, Carretera Lago de Guadalupe Km 2.5

Atizapán de Zaragoza, Edo. de México, México

Keywords: Multi-agent, Ontology, Bank queue, Client profiling.

Abstract: This paper presents an ontology driven multi-agent system that uses a negotiation process for decision-

support in a Bank Queue. The system assists queue client assignment based on the client profile and the

cashiers’ workload in order to guarantee a minimum time response in client attention. The multi-agent

system has a direct positive impact in the quality of service. Simulations of service providers’ management

are presented in order to optimize the use of the resources. Our ontological user profiling and multi-agent

system approach can be easily extended and adapted to other domains by adding client profile

characteristics and adapting agent behaviours. The ontology proved to be useful when sharing content

between agents and performing semantic checks.

1 INTRODUCTION

High quality customer service is one of the key

ingredients for success when marketing products and

services. Enterprises all over the world recognize

that offering a good service even attached to a

product sell is most likely to determine their

competitive advantage. For that matter, knowing the

customer better can help many service providers to

improve and customize their service delivery and

development. To model user preferences, interests,

and requirements is a very important research area

for several applications, like Web usage and content

mining and Web search personalization (Jin, 2000;

Sieg, 2007), Service Marketing (Chen, 2009),

Personalized Information Services (So, 2009) among

many others. Ontological user profiling and adaptive

multi-agent systems attempts have been made

providing decision-support in gathering and

presentation on information. Harvey & Decker

(2005), demonstrate that the influence of the user

models on content selection and presentation

improves system output, (Harvey, 2005).

The quality of service in a bank is determined in

a large proportion by the time customers have to

wait in a queue before he or she receives attention

and the way the service provider recognizes their

special needs. Time of response restrictions and user

requirements have to be taken into consideration in a

client assignment system in order to guarantee a fair

quality of service.

In this paper, we present an ontology driven

multi-agent system that uses a Contract Negotiation

Process between a manager agent and several

cashier agents (service providers) for a Bank Queue

management. The system supports the decision on

the assignment of a new client to a cashier based on

the cashiers’ workload and the user profile to

guarantee a 20 minutes time response. The system

simulates the service providers’ management with

the purpose of optimizing the number of cashiers

opened considering the number of clients, the arrival

and service rates, and the clients’ profile.

In Section 2, the multi-agent system architecture

and its approach in client assignment are introduced.

In the Section 3 the client profiling and the ontology

development for user profiling as well as the

evaluation function derived from user characteristics

are presented. Agents bid summiting and negotiation

process is presented in Section 4. In Section 5 the

implementation is described, and in Section 6 the

241

Martínez-Villaseñor M., González-Marrón D., González-Mendoza M. and Hernández-Gress N..

AN ONTOLOGY DRIVEN MULTI-AGENT SYSTEM FOR CLIENT ASSIGNMENT IN A BANK QUEUE.

DOI: 10.5220/0003089602410250

In Proceedings of the International Conference on Knowledge Engineering and Ontology Development (KEOD-2010), pages 241-250

ISBN: 978-989-8425-29-4

Copyright

c

2010 SCITEPRESS (Science and Technology Publications, Lda.)

experiments and results of the simulation are

explained. Finally, in the last section main

conclusions and suggestions for future work are

presented.

2 MULTI-AGENT SYSTEM

CLIENT ASSIGNMENT IN A

BANK QUEUE

In ordinary bank branches clients arrive in the day

when just a few cashiers are necessary, however, at

the busiest times, the bank has to open every cashier

they have. Bank personal must foresee the changes

in the frequency of client arrivals in order to

optimize resources, in this case, the number of open

cashiers.

Some banking institutions establish policies and

rules on attention time of response. For example, in

Bolivia and Argentina a client must not wait in line

more than 30 minutes before he or she receives

attention,(Central,2010)(

NoticiasOnline.org,2010).

Based on banking policies, for the purpose of this

system, we considered a policy of 20 minutes

attention time of response. A new cashier should

open if some client is near to that time limit in order

to fulfil this policy. Additionally, for our purposes,

we consider six cashiers available in view of an

average bank branch.

To simulate the process we develop a multi-

agent system. In this system, agents provide us with

autonomy and decision-making capacity as well as

social ability for cooperation and negotiation needed

to provide a solution to this problem.

2.1 Multi-agent System Architecture

Our multi-agent system has three types of agents

with two distinctive roles. These agents are

described in the following paragraphs:

A. The cashier agents are responsible for providing

banking services for the customers assigned to

their queue. They should always be in contact

with the manager agent to receive future clients

and to constantly verify if some client waiting

time is near to 20 minutes. If so, the client must

be reassigned for immediate attention.

B. The executive agents are responsible of

providing banking services as well. The

differences in the services provided by the

cashiers are not relevant for this work because

the 20 minutes policy on attention time of

response also applies in spite of these

differences. The agent role is considered the

same.

C. The manager agent, only one, is responsible of

opening and closing cashiers i.e. creating and

destroying cashier agents when needed. He or

she is also responsible for assigning every

incoming client to the most convenient cashier

agent in order to provide attention to the

customer as fast as possible. The Manager

Agent receives the client´s profile information,

evaluates these characteristics and negotiates

with the active cashier agents, and assigns the

client to a cashier queue.

For statistical purposes, the manager agent registers

the client profile and arrival time in a blackboard

and the corresponding cashier agent updates this

record when the client leaves. Both types of agents

can read these records.

With some interval the cashier agents verify from

the records, how long has each client really been

waiting.

3 CLIENT PROFILE

There are many client characteristics worthy of

consideration to provide a personalized service and

speed up the client attention. In order to classify the

clients that arrive to a bank branch, we considered

the following characteristics:

1) The type of service required which determine

if the client needs to be attended by a cashier

or an executive.

2) Type of client: VIP or regular customer

3) Physical condition: handicapped, pregnant

women, elderly.

4) Number of intended transactions.

The type of service required determines the first

client categorization: Temporary client if the client

is going to be attended by a cashier or repeat client

if he or she is going to be attended by an executive.

Each section queue is separated. In this paper we

only describe the cashiers queue but the process of

managing the executives queue is similar and the

implementation is straightforward. The manager

cooperates with the executive agents in the same

manner as it works with the cashiers.

Depending of the type of client, physical

condition and number of intended transactions, an

expected time of attention (

) is calculated. This

variable (1) describes how long it takes a cashier to

serve a particular client. If we calculate an expected

KEOD 2010 - International Conference on Knowledge Engineering and Ontology Development

242

time of attention for each client, it is possible to

estimate how long each client must wait in line.

1

Where

= client expected time of attention

=Number of transactions and

|0 4

(1)

= Handicapped and 0,1

= Pregnant and 0,1

= Elderly and 0,1

Tc=Type of client (vip or regular) and

0,1

|0

2 i=1,2,3

Each

represents a weight that can be

considered for each physical condition attribute with

the intention of doing a more accurate estimation.

The value of the attribute itself is 1 when the

characteristic is present in a client or 0 if it is not.

We suppose that certain client attributes add

delay to the normal time spend in making one

operation and when clients are VIPs clerks make an

extra effort to speed up the execution of their

transactions.

Each cashier or executive agent has a queue and

the manager agent has to decide taking the current

state of the system and the client profile, which

agent is the best choice for assigning each arriving

client, in order to minimize the expected time of

response. The equation 1 applies to the cashier

agents, but equation for executive agents is similar.

∑

1

Where

= client expected time of attention

(2)

i

=Number of transactions of service

i

required and

|0 2

= minutes taken to perform service

i

required

= Handicapped and 0,1

= Elderly and 0,1

Tc=Type of client (vip or regular) and

0,1

|0

2 i=1,2

Transactions in the cashier equation are

considered to last one minute each plus the client’s

profile increase. This is not likely to be true for

executive transactions due to the nature of the

service required. To calculate the expected time of

attention of a client served by an executive agent, we

considered the type of service the client requires and

the minutes taken to perform each service (k

i

).

The k constants should be determined by a bank

expert and are intended to be system parameters.

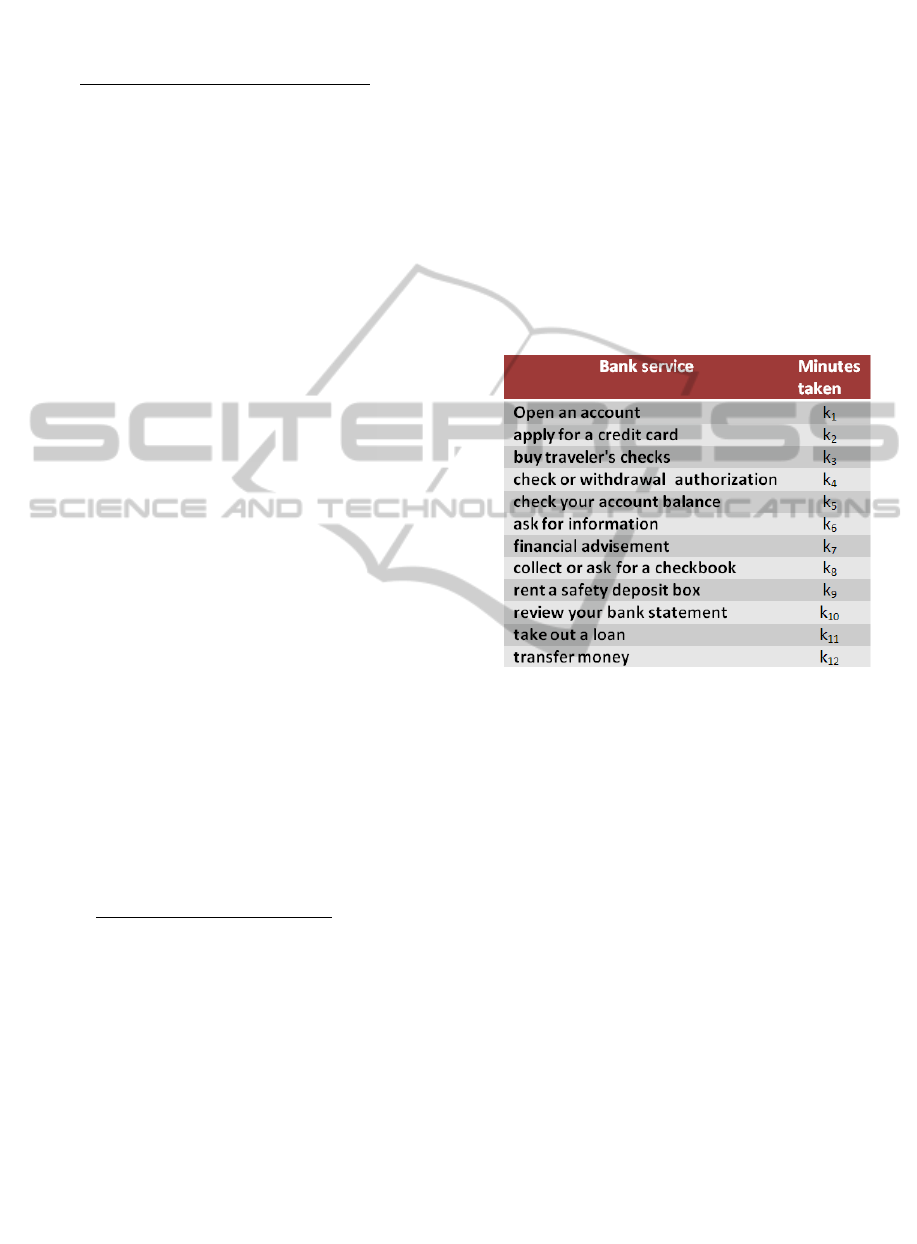

Examples of bank services performed in a bank

branch by bank tellers (executive agents) are shown

in figure 1.

Figure 1: Examples of bank services performed by the

executive agents.

3.1 Ontology Development for Client

Profiling

We develop the multi-agent system using JADE

(Java Agent Development Framework) to simplify

the implementation of the agents and their

communication through JADE’s tools that complies

with FIPA specifications (Bellifemine,1999).

Agents in our multi-agent system have to share

content with the purpose of cooperation in order to

reach the common goal of fulfilling the 20 minutes

policy on attention time of response. For that matter,

we designed the following ontology (Figure 2) so

JADE can perform the proper semantic checks on

given content expressions. Exploiting the JADE

content language and ontology support included in

the jade.content package includes developing proper

Java classes for concept, predicate and agent actions

(Bellifemine, 2001).

The type of service required at arrival time

determines what information is needed to considered

at the moment. This means that a client is classified

AN ONTOLOGY DRIVEN MULTI-AGENT SYSTEM FOR CLIENT ASSIGNMENT IN A BANK QUEUE

243

as a temporary client even though he has remained

several years as a client if he or she asks for a

cashier’s service. For a temporary client we consider

Figure 2: Ontology for client profiling.

just the type of client, physical condition and

number of intended transactions attributes. These

attributes are dynamic and vary for almost each time

a client arrives to a bank branch. For a repeated

client, a client that is looking for executive, more

long-term information is needed in addition to the

dynamic attributes described in equation 2. The

attributes in the long term scenario are age, gender,

salary, current investments, credit and general

historic records in the bank. These attributes can be

exploited also for other purposes.

Two concepts are designed with their

corresponding slots from the categories mentioned:

RepeatClient and TemporaryClient.

There are two agent actions used in manager

agent and cashier or executive agent negotiation:

AssignCashier and AssignExecutive. AssignCashier

action includes a slot with type TemporaryClien ,

and AssignExecutive includes a slot with type

RepeatClient with the purpose of sharing the

corresponding client information between manager

and the service agent (cashier or executive). One of

these two actions is sent in the manager agent´s

proposal.

Two relevant predicates were designed to enable

the service agents (cashier or executive) to respond

the manager agent´s proposal. An inCashierline

predicate is used in the manager agent and cashier

agent negotiation, and an inWaitingRoom predicate

is used if the service agent is an executive. With the

purpose of sending information relevant to the

proposal response, the predicates described include

the cashier or executive agent´s information, the

proposed client information and the expected

occupation time for the state of the service agent

queue.

4 CLIENT ASSIGNMENT

NEGOTIATION PROCESS

The presented multi-agent system gives decision-

support assistance in a Bank scenario based on

client’s profile and service provider agents’

workload. For that matter a negotiation process is

used. When a new client arrives the manager agent

receives his or her profile and calculates the

expected time of attention with equation 1. A

Contract Net Protocol is developed since the

manager agent wishes that the best suited cashier

agent assigns the client to its queue. The expected

time of attention among the client profile is sent in

the assign content of a FIPA cfp (call for proposal)

message to all active cashier agents. Each active

cashier agent receives the client profile and the

expected time of attention and evaluates the

expected occupation time given its current queue

status and the received information. The expected

occupation time (

) is the time the cashier agent

calculates a new client must wait in line before he or

she receives attention, if the current client prospect

is assigned to its queue. In other words, the cashier

agent calculates its workload if the proposed client

were to be assigned to its queue.

Where

expectedoccupationtime

expectedtimeofattentionofthe

proposedclient.

∑

= Sum of expected time of

attention of the n current clients

in the cashiers queue.

Each cashier agent sends a proposal if the expected

occupation time is less than or equal to 20 minutes,

or rejects the proposal if the expected occupation

time is longer. The occupation time with the

cashier’s agent identification and the client profile is

sent in an inline predicate content to the manager

agent.

KEOD 2010 - International Conference on Knowledge Engineering and Ontology Development

244

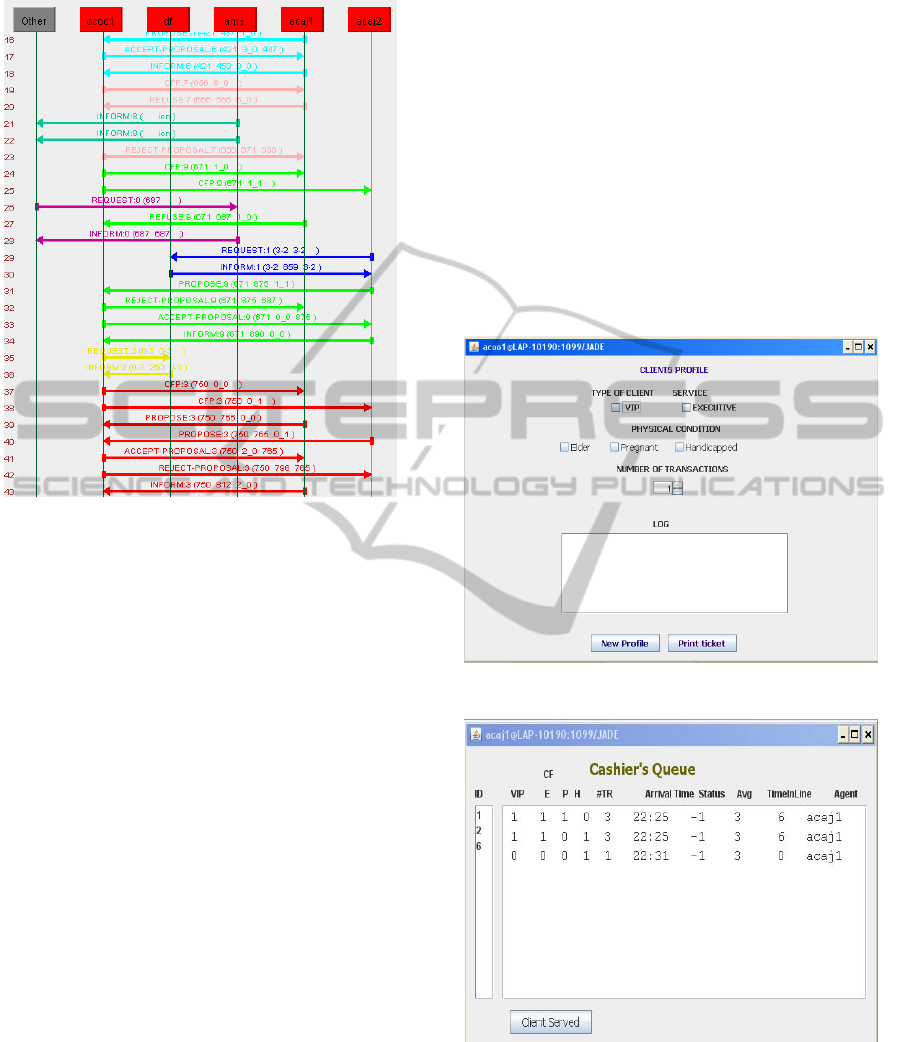

Figure 3: Partial view of agents’ negotiation.

The manager agent receives all the cashier agent

bids and evaluates which cashier agent has the

minimum occupation time for the given client

profile and accepts the best offer.

The main decision the manager agent can make

as a result of this negotiation, is which cashier agent

is the best suited to provide service to the incoming

client. However, other decisions can follow this

negotiation. If all cashiers reject the proposal, it

means that everybody is too busy and a new cashier

agent should be opened. On the contrary, if all bids

on the proposal are too low or even some of them

are zero, it means that at least one cashier agent

should be closed. The “low” threshold should be

determined by the bank based on an expert opinion

and is intended to be a system parameter.

5 IMPLEMENTATION

As we described earlier, the multi-agent system was

implemented using Jade (Java Agent Development

Framework). The ontology was first designed with

Protégé platform (http://protege.stanford.edu) and

afterwards, corresponding Java classes were

generated using the Ontology Bean Generator for

Jade (van Art, 2002). For preliminary

experimentation two swing-based Graphical User

Interfaces (GUI) were designed in Java. The first

interface of the manager agent (Figure 4) allows the

user to determine the arriving client attributes and

initiate its process simulating the bank branch device

that prints a turn number for the clients.

The second interface of the cashier agent (figure

5) allows the user to visualize how the clients are

been assigned to the agent´s queue and the client´s

attributes. The process of providing a service to the

client is implemented in the cashier agent GUI with

a button that simulates the event of finishing the

attention of a client and deleting its information

from the queue. In order to proof the multi-agent

system performance, two procedures were

implemented to simulate automatic entrance and exit

of clients.

Figure 4: Manager agent GUI.

Figure 5: Cashier agent GUI.

The arrival and service rates are simulated with

Java timers, and random client profiles are generated

for each input.

Interfaces can be used for a particular sequence

of client entrance and attention or the timer

AN ONTOLOGY DRIVEN MULTI-AGENT SYSTEM FOR CLIENT ASSIGNMENT IN A BANK QUEUE

245

procedures and random generated clients for a batch

simulation can be employed.

6 EXPERIMENTATION AND

RESULTS

For our experimentation, we considered a dynamic

number of parallel service providers; the system will

open and close cashier agents as needed and will

serve with First-come, First-served (FCFS) service

discipline.

When a client arrives, the manager agent assigns

him/her to the agent cashier’s queue with minimum

workload. No client should be assigned to a queue

were the expected occupation time is more or equal

20 minutes consequently the queue capacity does not

depend on the number of clients but on the expected

occupation time calculated with equation 3. This is

related with each client’s profile and determines the

cashier´s workload. For the client expected time of

attention given w

=2, w

=1 and w

=2 we

implemented the following instance of equation 1.

With this weight values we suppose that a

handicapped or an elder client would cause a greater

delay than a pregnant women when been served.

When using the interfaces, client attributes are

captured or randomly generated using the batch

simulation process.

We verified the multi-agent system performance

in three basic scenarios that differ only in the

constant arrival and service rates. These rates are

measured in clients per minute. We simulated the

equivalent of eight hours of bank activity for each

scenario.

Given the expected time of attention of all

randomly generated profiles, the mean is 3.04

minutes with a standard deviation of 1.97.

6.1 First Scenario: Arrival Rate is

Slower than the Service Rate

In the first scenario we performed several

experiments in which the arrival rate is slower than

the service rate, simulating a very slow day.

First, we experimented with the following rates:

each 6 minutes a client arrives and each minute a

client can be served. In eight hours 80 clients

arrived. As expected, the system opened the first

cashier agent and began to serve clients. Even

though there was some delay in the service due to

the client’s profile, no other cashier agent was

needed. Most clients were served upon arrival.

When varying the service rate but keeping it

faster or equal than the arrival rate, the result

remains the same: just one cashier was needed and

no client had to wait more than 20 minutes.

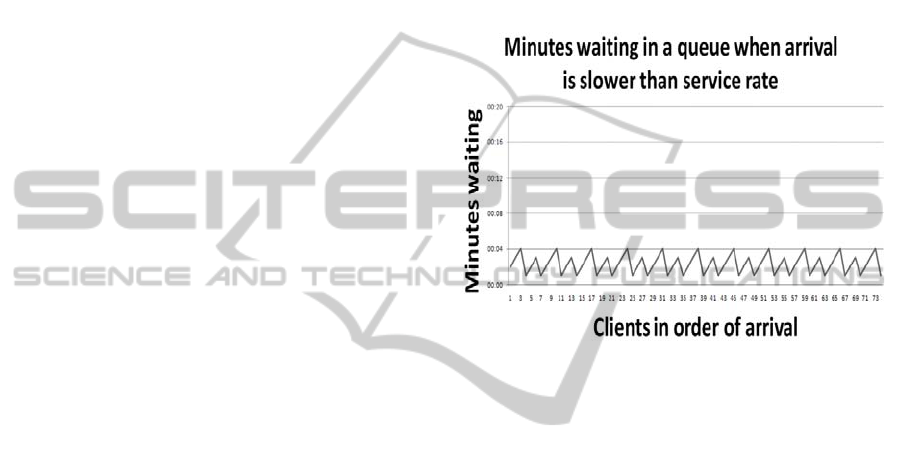

Figure 6 shows the time in minutes that clients

waited in a queue when the arrival rate was 6 clients

per minute and each 3.5 minutes a client can be

served, simulating the average service delay due to

the clients profile.

Figure 6: Minutes waiting in a queue in the first scenario.

6.2 Second Scenario: Arrival Rate is

Faster than the Service Rate

The arrival rate in this scenario was faster than the

service rate; this simulates very busy hours with

service for average clients.

In the first experiment of this scenario, the

arrival rate is 3.5 times faster than the service rate,

therefore each 3.5 minutes a client can be served and

one client arrives every minute. This service rate

was chosen to be a bit greater than the expected time

of attention mean, in order to simulate serving delay

depending on the client’s profile. In eight hours, 480

clients arrived and were served.

The system began with one cashier open and

because of the difference in the arrival and service

rates; more cashiers were almost immediately

needed. We observed that the system opened

cashiers one by one, and the clients waited a long

time until enough cashiers for the service rate given

were available. Five cashier agents opened in total,

to speed up the service.

Figure 7 shows how as waiting times increase,

new cashier agents start improving clients’ waiting

times momentarily until the fifth cashier opened and

KEOD 2010 - International Conference on Knowledge Engineering and Ontology Development

246

Figure 7: Minutes waiting in a queue in the second scenario.

stabilized the system. Notice that the small triangles

on the bottom show when a cashier agent start. Once

the required cashier agents provided the service,

every client was attended in less than ten minutes.

Analyzing the frequency of clients’ waiting

minutes in different intervals, we observe that the

grand majority of the clients waited up to five

minutes, however 3% of the clients waited more

than 20 minutes.(Figure 8).

Figure 8: Histogram of clients per minutes waiting in the

second scenario.

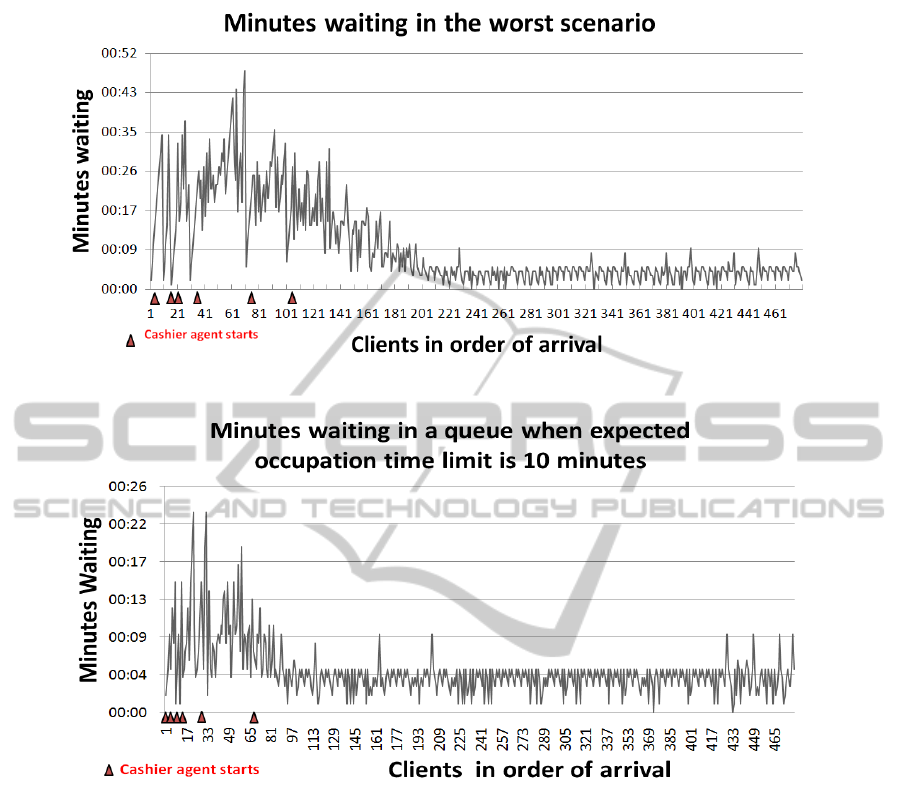

6.3 Worst Scenario: Clients with High

Expected Time of Attention in a

Very Busy Day

In this scenario we wanted to simulate what would

happen if, due to their profile and number of

transactions, all clients required a great deal of time

to be served and the number of clients was also

large.

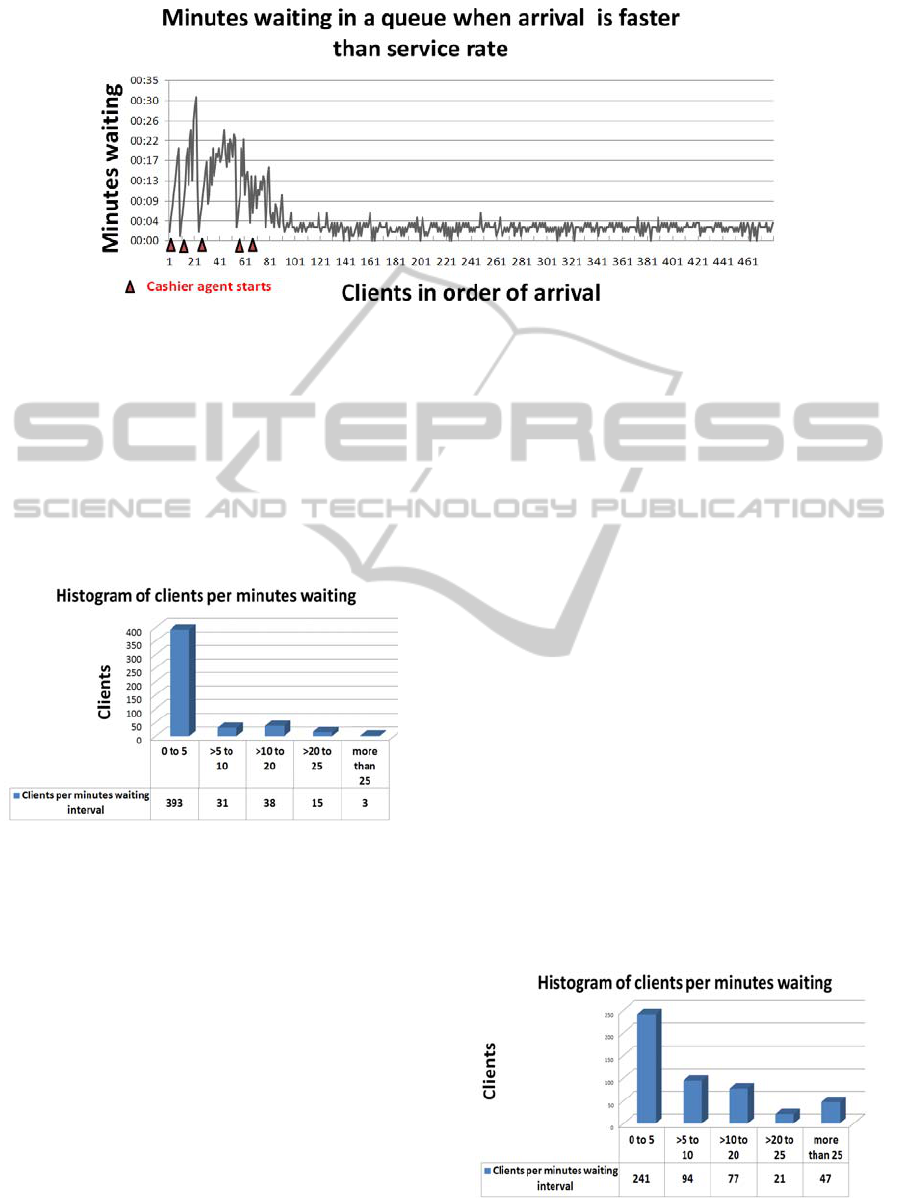

We programmed the arrival rate to be one client

per minute and service rate so that every five

minutes one client can be served. The service rate is

calculated considering that the expected time of

attention mean is 3.04 minutes with a standard

deviation of 1.97. We added the mean plus the

standard deviation in order to simulate that all

clients will take more than the average time to be

served, approximately 5 minutes.

As the difference between the arrival rate and the

service rate was much larger, the system took longer

to stabilize. Six cashier agents were open altogether.

In the mean time, 68 clients out of 480 had to wait

more than 20 minutes as a result of the lack of

enough cashiers for the arrival rate given (figure 9).

Specifically 14.166% of the clients waited more than

the allowed 20 minute policy. In the worst case, a

client waited up to 48 minutes.

If we compare the graphic of minutes waiting in

the second scenario (figure 7) with the same graphic

for the worst scenario (figure 10) we can see that as

the gap between the arrival and service rates grows,

the system needs more time to stabilize. The

importance of opening the right number of cashier

agents as fast as possible is evident.

In order to choose the right number of cashiers

required, three important factors have to be

considered: the arrival rate, the service rate, and the

cashier’s expected occupation time. Actually, the

next cashier agent opens if all the currently active

cashier agents reject a new proposal for assigning a

client.

Figure 9: Histogram of clients per minutes waiting in the

worst scenario.

AN ONTOLOGY DRIVEN MULTI-AGENT SYSTEM FOR CLIENT ASSIGNMENT IN A BANK QUEUE

247

Figure 10: Minutes waiting in a queue in the worst scenario.

Figure 11: Minutes waiting in a queue in the worst scenario with 10 minute limit in the expected occupation time.

As we described earlier, when the cashier agent’s

expected occupation time (equation 3) is more than

20 minutes, the agent rejects every new proposal

received. Therefore, if we want the system to open

new cashier agents more rapidly, this parameter can

be lowered.

6.4 Other Experiments

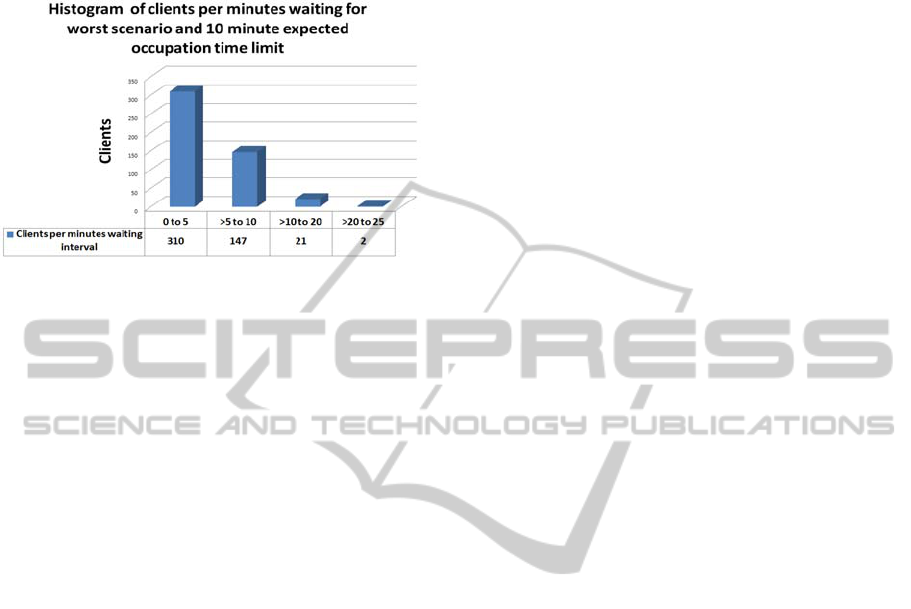

With the purpose of verifying the impact of a lower

expected occupation time, we conducted an

experiment with the same parameters for the worst

scenario but we changed the expected occupation

limit for the cashier agents to 10 minutes instead of

20. The results are presented in figure 11.

In this simulation, six cashier agents were

opened; the same number of cashier agents as the

simulation with 20 minutes expected occupation

time limit. Although the cashier agents started

earlier as we expected, due to the clients’ profile and

number of transactions, the system took more time

to stabilize.

We can assume from this experiment that the

resources i.e. cashier agents, needed for given arrival

and service rates are the same, for instance, six

cashier agents in this example. The expected

occupation time limit impacts the results starting the

cashier agents earlier therefore the occurrence of

clients waiting more than 20 minutes decreases.

Only two clients out of 480 waited more than 20

minutes, representing 0.417%. (Figure 12)

From this last experiment we observe that it is

likely to fulfill the goal with little percent of error

but resources, i.e. cashier personnel have to be

allocated, as soon as the arrival rate increases. In real

life situations, the cost of allocating resources to

KEOD 2010 - International Conference on Knowledge Engineering and Ontology Development

248

serve versus the institution commitment to the

quality of service wanting to provide must be

evaluated and balanced.

Figure 12: Histogram of clients per minutes waiting in the

worst scenario and 10 minutes expected occupation time

limit.

7 CONCLUSIONS AND FUTURE

WORK

In this paper we presented a Multi-agent system

based on an ontology that simulates the service

provider’s management and the assignment of

clients in a bank branch. Experiments and simulation

of cashier agents’ management were presented.

The results of our experiments show three

factors that are important to consider in fulfilling the

20 minute waiting time policy to guarantee the

quality of service: 1) the arrival rate, 2) the service

rate, and 3) the service provider workload

determined by the expected occupation time of each

cashier or executive. Regarding the arrival rate, it

can be predicted; however this is not in the scope of

this paper. The service rate depends on the client’s

profile and the number of transactions. We presented

a way to evaluate the expected time of attention for

each client in order to estimate the service rate,

assign the client to a queue, and simulate the clients

been served. The expected occupation time for each

cashier is calculated from the expected time of

attention of its clients, thus, each cashier agent

workload is estimated. The use of the resources, i.e.

starting and closing cashier agents, is determined by

the state of all cashier agent queues.

We develop a client profiling ontology with the

purpose of cooperation and negotiation between the

manager agent and service agents. It proved to be

useful when sharing content and performing

semantic checks. The client’s profile can be

modified adding new attributes relevant to this

domain.

Some upgrades to the initial version can be made

for a more realistic aid in decision-support on client

assignment. In order to establish the most significant

characteristics for each strategic bank service a

feature analysis of client attributes can be made.

This analysis would help to enhance and improve

client’s profile as well as construct service ontology

To conclude, a bank branch can fulfil a 20

minute waiting time policy better manage its

resources, and improve the quality of service by

estimating the expected attention time according to

the client’s profile and the number of transactions

Our experiments show that it is possible to fulfil the

20 minute waiting time policy if the institution

designates the resources needed as soon as the

arrival rate increases. The decision maker has to

confront the cost of the resources versus the quality

of service promised.

In the future we expect to develop new queue

models using improved client profiles, using just one

queue, or reassigning a client if the agent discovers

that one or more of its clients are close to 20 minutes

waiting.

The system is designed to admit serving the

clients with other priorities instead of always using

First-come, First-served (FCFS) service discipline.

This is possible using the interactive interface but

exhaustive experiments must be done.

In addition, a reinforcement learning model

where the manager agent learns based on cashier

agents’ performance could be implemented. Adding

criteria other than the queue workload to the

assignment decision

REFERENCES

Bellifemine, F., Poggi, A., Rimassa, G., 2001, Developing

multi-agent systems with a FIPA-compliant agent

framework, Software—Practice & Experience, v.31

n.2, p.77-97

Bellifemine,F., Poggi,A., Rimassa,G., 1999, “JADE - A

FIPA-compliant agent framework”, Proc In Fourth

International Conference on the Practical Application

of Intelligent Agent and Multi Agent Technology,

Pages: 97-108

Central de reclamos de autoridad de supervisión del

sistema financiero, February 2010, Recopilación de

Normas para Bancos y Entidades Financieras, Sección

2: Atención de Clientes y Usuarios en Cajas, Art. 4º.

Tiempo de espera máximo, Bolivia.

Chen,H., Sui, Y., June 2009, "Ontology driven multi-agent

system to support service marketing of the publishing

house," icsssm, pp.641-645, In 6th International

Conference on Service Systems and Service

Management

AN ONTOLOGY DRIVEN MULTI-AGENT SYSTEM FOR CLIENT ASSIGNMENT IN A BANK QUEUE

249

Harvey,T., Decker,K., and Carberry, S.,2005, ”Multi-

agent decision support via user-modeling”, In

Proceedings of the fourth international joint

conference on Autonomous agents and multiagent

systems, July 25-29, The Netherlands

Jin,X., Zhou,Y., Mobasher,B., September 2000,

”Integrating Web Usage and Content Mining for More

Effective Personalization”, In Proceedings of the

International Conference on E-Commerce and Web

Technologies (ECWeb2000), Greenwich, UK.

NoticiasOnline.org, Consulted:.May 18th, 2010, In El

Diario de Patagonia Online, San Martin de los Andes,

http://www.noticiasonline.org/index.php?option=com_

content&view=article&id=1463%3Acolas-no-mas-de-

30-minutos-en-

euquen&catid=22%3Aactualidad2&Itemid=7,

Protege, http://protege.stanford.edu, Consulted: May

18

th

,2010, Stanford Center for Biomedical Informatics

Research at the Stanford University School of

Medicine.

Sieg,A., Mobasher,B., Burke,R., 2007, ”Web search

personalization with ontological user profiles”, In

CIKM \'07: In CIKM '07: Proceedings of the sixteenth

ACM conference on Conference on information and

knowledge management, pp. 525-534.

So, C.F., Chapmann C.L. Lai, and Raymond Y.K. Lau,

2009, “Ontological User Profiling and Language

Modeling for Personalized Information Services”, In

Proceedings of the 2009 IEEE International

Conference on e-Business Engineering,Pages: 559-

564

van Aart, C.J.. Beangenerator, 2002,

http://protege.cim3.net/cgi-bin/wiki.pl?Ontology

BeanGenerator.

KEOD 2010 - International Conference on Knowledge Engineering and Ontology Development

250