AN AUTOMATED NEGOTIATION SYSTEM FOR PRICE

COMPARISON BASED ON AGENT TECHNOLOGY

Xiuzhen Feng and Gaofeng Wu

Economics & Management School, Beijing University of Technology, P. R. China

Keywords: Agent Technology, Automatic Negotiation Model, Price comparative System.

Abstract: In order to promote the efficiency of online negotiation, Distribute Artificial Intelligence is adopted in

designing an automated negotiation system to improve negotiation process. This system can be used to deal

with multilateral price comparison and automated negotiation. The results from simulation are meaningful

and useful, which also verified the efficiency and effectiveness from both price comparison and automated

negotiation.

1 INTRODUCTION

The negotiation and price comparison can be critical

issues in business world. In e-business field,

negotiation based on Internet technology has been

getting popular after buyers found the proper goods

and prices of these goods. If a buyer would pay less

to buy the prefered goods, it is neccerssory to

compare the price with other sellers via internet first,

and then to bargain with one of sellers. There are

two kinds of nigotiations either online or offline

between buyers and sellers directively. Obviously,

both negotiations can be time-consuming and very

low effectiveness. To save time and cost of

negotiations for both buyers and sellers, it is useful

and meaningful to design a price comparison system

with automated negotiation fuctionality.

Based on literature study, related research

effors in e-commerce and e-business have been

concentred on application of agent technology, such

as intelligent recommendation systems, auction

systems and so on. Current research contributions

are limitted on price comparing among sellers. In

this paper, agent technology will be employed in

negotiation process to deal with multilateral price

comparison as well as automated negotiation. The

aim of our efforts is to design a price comparison

system with automated negotiation based on

agreement and strategy.

2 RELATED WORKS

Negotiation Support System (NSS) is one of group

decision support systems, which has been adopted to

promote trading and coordinate conflicts of trading

in both e-commerce and e-business. NSS can be

traced back in 1980s; it has been a special field to

deal confliction and negotiation with advanced

information technology and decision theory. Many

scholars engaged in NSS research from different

perspectives, and developed some corresponding

NSS software, such as CAP, DECISIONMAKER,

NEGO, DECISION CONFERENCING, MEDIAT -

-OR, RUNE, PERSUADER, INSPIRE, and etc

(Wang, 2008).

With the application of agent technology in

negotiation system, negotiation efficiency has been

greatly improved because agent-based negotiation

support technology can promote negotiation process

effectively. The agent technology could reduce

human-computer interaction time, decrease the

complexity of system operation (Bartolini, et al.

2004), expand the application of negotiation, and

avoid being emotional human disturbance.

According to literature study, the agent technology

has been continuing as the hot topic in negotiation

study, such as obtaining the rival’s preferences like

attribute weight and constrain, being the negotiation

expert with domain knowledge including market

condition and inventory information, gaming with

each other’s preferences etc, which can be much

better than artificial negotiation to complete complex

negotiation process (Chari and Manish, 2009). For

275

Wu G. and Feng X.

AN AUTOMATED NEGOTIATION SYSTEM FOR PRICE COMPARISON BASED ON AGENT TECHNOLOGY.

DOI: 10.5220/0003267302750281

In Proceedings of the Twelfth International Conference on Informatics and Semiotics in Organisations (ICISO 2010), page

ISBN: 978-989-8425-26-3

Copyright

c

2010 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

example, some systems were developed for e-

commerce training or experiment, such as the

Kasbah (Raymond, 2007) and the Tete-a-Tete (Maes,

et al. 1999) in MIT. The former system took

advantage of price to present different bargaining

attitude. In fact it could only carry on single-attribute

negotiation because it wasn’t involved in artificial

intelligence and machine learning technique. The

latter one applied to retail model of electronic

trading system. Its purpose is to solve the multi-

attribute negotiation problem based on multi-

attribute utility theory. However, the system could

not deal with the monotonic issues during the period

of negotiation. AuctionBot

(Wurman, et al. 1998) is

an auction agent system that was developed by

Michigan University, which was a single attribute

online auction server. It didn’t process multi-

attribute between the agents of buyers and sellers.

The systems above designed have been only

concentrated on negotiation agreement or strategy

modelling in previous study. Fewer research

contributions reported auto-negotiation systems in

simulation on trading behaviours that related to

multi-attribute with monotonic issues. Inspired by

previous research contribution, we would come up

with a comprehensive, practical, and flexible B2C e-

commerce auto-negotiation model in this paper,

which is expected to deal with the multilateral multi-

issue negotiation.

3 NSS SYSTEM THEORITY

In order to design a universal quantitative Agent

negotiation model, we assumed that the issues are

mutually independent. These issues could be merged

as one if interdependence existing. Meanwhile, we

assumed that each issue value is continuous.

Accordingly, the formalized description of bilateral

multi-issue negotiation model can be presented as

following:

max

,, , , , , ,NAIVWUPST=< > .

{| 1,2, ,}

i

A

ai I==L indicates the agent sets of

participators in the negotiation, and n represents

the agent number of participators in the

negotiation. Then, B (Buyer) is denoted as Seller

Agent, and S (Seller) is indicated as Buyer Agent.

{| 1,2, }

j

I

ij J==L presents the issue set of

negotiation. J represents the number of issues.

V is defined as the value range of the issues.

{}

12

,,,

n

VVV V= L .

j

i

values range corresponds

to

j

V , and [min , max ]

j

jj

V = .

W is weight set of the negotiation issues, which

can be denoted as

{| 1,2,,}

a

i

Wwj m==L .

a

i

w

represents the preference degree of Agents on

issue j,

1

1

n

a

i

i

w

=

=

∑

.

U is defined as the effectiveness evaluation

function of negotiation issues.

P is named as the set of negotiation protocol.

S represents the negotiation strategy.

max

T specifies the maximum times of

negotiation. Within the limited times of

negotiation, the negotiation must be ended before

approaching

max

T , whether the negotiation is

success or not.

3.1 Negotiation Protocol

The Negotiation Protocol is a set of rules that Agents

must observe mutually. Bilateral agents should have

consistent rules, such as constraints, specified

negotiation status (start, end, etc) and variables,

which should be confirmed respectively during

negotiation. The negotiation protocol is presented in

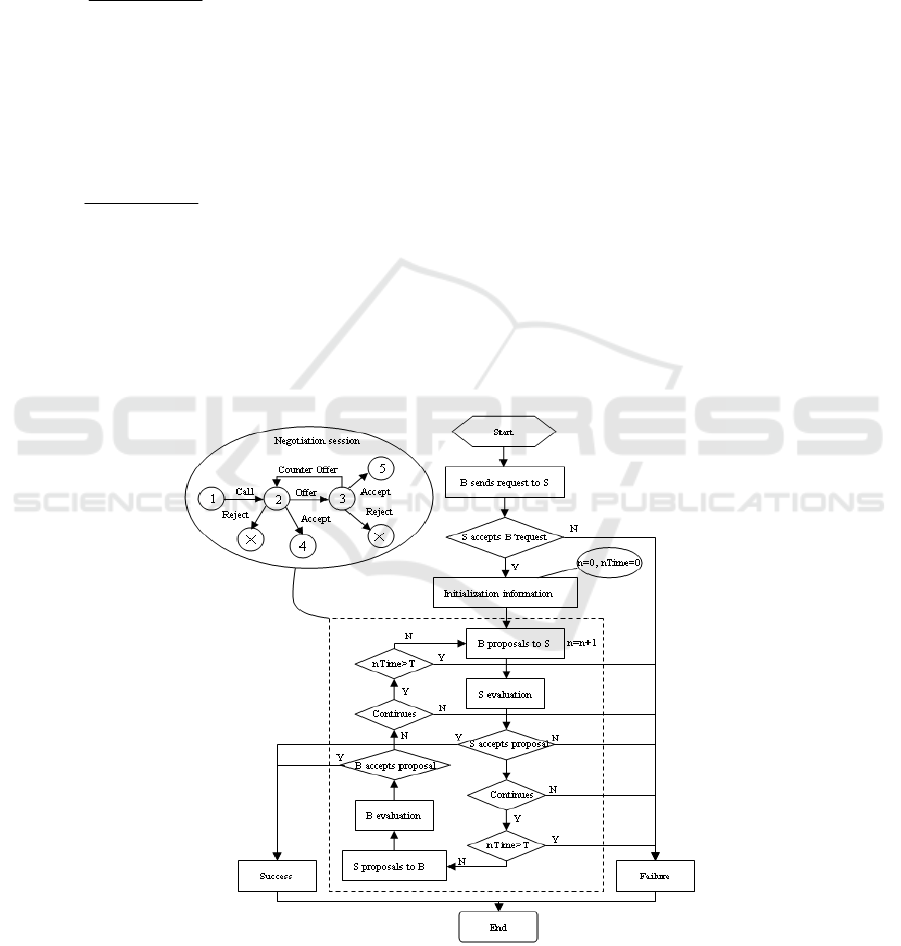

Figure 1.

The w can be changed at the end of the stage, and

then submit a new negotiation session to go further.

When the seller B sends a request to the buyer B

(state 1 to state 2), S in three ways:

(1) Agrees with the proposal, the negotiation will

succeed (state 2 to state 4);

(2) Rejects the proposal, the negotiation will get

failed (state 2 to state failure);

(3) Sent proposal, the negotiation stage is

Counter Offer (state 2 to state 3).

3.2 Negotiation Strategy

3.2.1 Utility evaluation

The negotiation decision function that was proposed

by Faratin (Faratin, et al. 2000) is adopted in this

paper to deal with the multi-attribute decision

making and the single-conflict negotiation. During

the negotiation, participants expected to have

maximum utility with the lowest price. Utility is

closely related with issues, which can be criterions to

evaluate the differences among different issues.

Different agents would have different criterions to

evaluate different issues. For example, for sellers,

the higher commodity price, the better utility is, and

then the price is ascending and goes up. However,

this is just the opposite to the buyer, the lower

commodity price, the better utility is, which is

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

276

descending and goes down. In this case, the

evaluation function can be divided into monotone

increasing and monotone decreasing function.

Take price issue as an example, B hopes

i

X

the smaller the better. It’s monotone decreasing

function, being standardized as follows:

(max )

max min 0

()

(max min )

1

ii

ii

a

ii

ii

x

vx

others

⎧

−

−≠

⎪

=

−

⎨

⎪

⎩

若

(1)

(): [0,1]

a

ii i

vx V→ 。

S hopes

i

X

the bigger the better. Its monotone

increasing function can be standardized as follows:

(min)

max min 0

()

(max min )

1

ii

ii

a

ii

ii

x

vx

⎧

−

−≠

⎪

=

−

⎨

⎪

⎩

若

ot her s

(2)

(): [0,1]

a

ii i

vx V→ 。

So,

i

a for the overall evaluation function, the

Offer is shown as following:

1

() ()

iii

j

jj

jn

Vx vx

ω

≤≤

=

∑

(3)

()

i

Vx is getting bigger when the degree of

satisfaction is higher, which can be seen whether it is

a standard negotiation. The discriminate function is

presented as following:

'

'

ma x

''

(, ) ( ) ( ),

s

st st st

bs bs sb

t

sb

reject if t t

I t x accept if V x V x t t

xotherwise

→→→

→

⎧

>

⎪

⎪

=

≥>

⎨

⎪

⎪

⎩

(4)

t

bs

x

→

will be judged by Agent S that proposed by

Agent B. If t+1 exceed the

max

T , the proposal will be

rejected, and the negotiation will be fail. Otherwise,

Agent S will evaluate the proposal and counter it. If

the counter is less, the Pareto optimal value can be

reached. In this case, Agent S will accept the

proposal and return a message of accepted B, and

then the negotiation will succeed. if it is more, Agent

S will send the counter to B, and the process will

continue.

Figure 1: Negotiation protocol.

AN AUTOMATED NEGOTIATION SYSTEM FOR PRICE COMPARISON BASED ON AGENT TECHNOLOGY

277

3.2.2 Counter-proposal Strategy

In this paper, we adopted the time-dependent

strategy proposed by Jennings (Sierra, et al. 1999).

We use the discount parameter β as the scope value

of the sides to insistence and compromise in

adjusting strategy based on time, resource and

opponent’s behaviours.

Generally speaking, if the negotiation time is

longer, the Agent will make the concession more

visible in proposal, which can be indicated as the

discount parameter

β ( 0

β

≤ ) and used in

convergence control. We define the discount

parameter β as follows: the negotiation conducts one

time for a given issue

i, and then Agent will be

considered bearing larger risk, so the effectiveness of

the evaluated value

i must have some discounts.

In the negotiation process, both agents have to go

through several rounds between proposals and

counter proposals before they obtained a satisfied

and consistent outcome. If there is no consensus,

both agents need to update the value of their

proposals, and send counter-proposals. Therefore,

we need to adjust the reservation value according to

different weights.

For issue

i, the proposal value of a function can

be expressed as:

min ( )(max min )

()

min (1 ( ))(max min )

SS S S

t

ii i i i

SB

SS SS

ii iii

tx

xi

tx

→

⎧

+Φ −

⎪

=

⎨

+−Φ −

⎪

⎩

is increasing

is decreasing

(5)

Let

t

SB

x

→

is the proposal value of S to B in time t.

Let

()

s

j

tΦ is the effectiveness of the reservation

value which Agent S plans to reach it in this round.

Here, time is a valuable resource for both sides.

Meanwhile, both sides have their own deadline. As

time goes by, the utility will continue to reduce. We

employed the interaction frequency dependence

(Faratin, et al. 1998) to determine the reservation

effectiveness of each round.

1

max

() (1 )( )

SS S

ii i

t

tk k

T

β

Φ=+−

(6)

Let

s

j

k

is a constant, which represents the initial

value effectiveness of Agent S for j. we assumed that

0

j

x

is the initial value for j, then:

0

0

( min )/ (max min )

(max ) / (max min )

SSS

S

ii iii

i

SSS

ii i i i

xx

k

xx

⎧

−−

⎪

=

⎨

−−

⎪

⎩

is increasing

is decreasing

(7)

The value of

β decides the attitude of insistence and

compromise. When

1

β

> , the initial value will get

close to its reservation value very quickly, which

means that the convergence rate is very fast. The

β is

bigger, the faster the convergence rate is. When

1

β

<

, the agent will try to maintain the initial value

at the beginning of negotiation, which would not

convergence until it is close to the deadline. When

1

β

=

, ()

s

j

tΦ is linear variation, and each round of

concession rate is the same. Suppose that k = 0.1, for

different β, when T assigns,

φ

(x)with β relations as

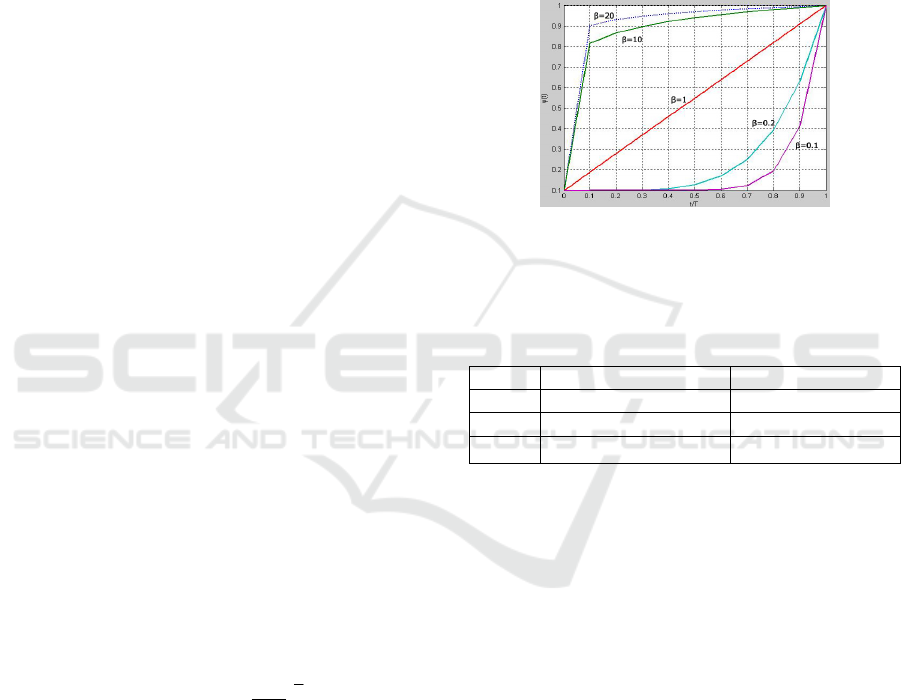

shown in Figure 2.

Figure 2:

φ

(x) with β relations.

As the explanation above, the bilateral negotiation

strategies associated with

β can be shown in table 1.

Table 1: Negotiation Strategy.

β

Agent S Agent B

β

<1 Strong-arm strategy Conservative

β

=1 Linear strategy Uniform linear

β

>1 Concessive strategy Compromissary

Participants will yield to the proposal value step by

step and gradually close to the agreement during

negotiation. The time functions in different forms

will have different concession scope. During strategy

determination and choice,

β can be selected with

multiple factors, such as resource, opponent

behaviours, time, and etc.

4 ANALYSES AND DESIGN ON

AUTOMATED NEGOTIATION

SYSTEM FOR PRICE

COMPARISON

The automated negotiation system for price

comparison is designed to deal with the e-commerce

trading process, which combined with B2C features

and addressed the multilateral multi-issue

negotiations. If the system can conduct the

fundamental process of e-commerce trading, the

designed features should be included as following:

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

278

customer login management, commodity query and

search function, price comparison decision-making

and so on. The system structure of automated

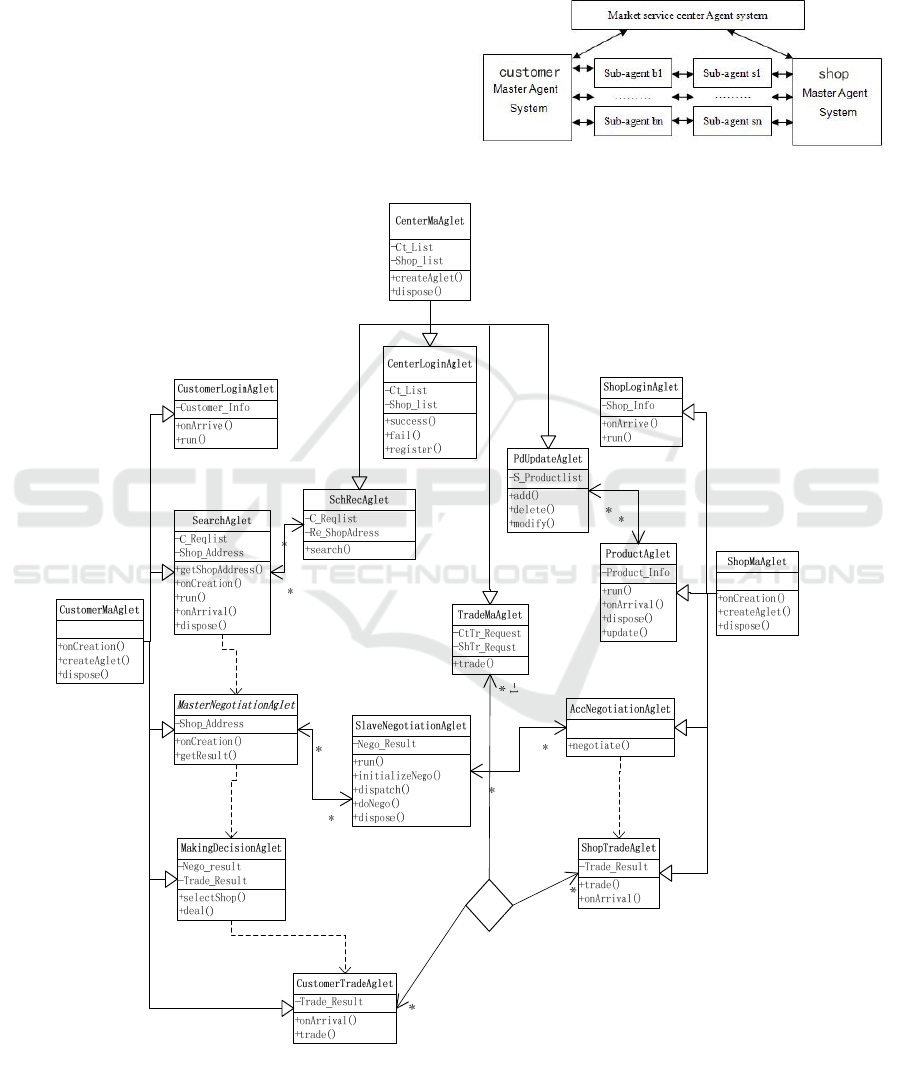

negotiation system for price comparison can be

depicted in Figure 3.

The components of the system can divided into

three parts, such as market service centre agent

system, the customer master agent system and the

shop master agent system. The classes and methods

can be shown in figure 4.

In the system development process, XML format is

used for transmission or database storage of

negotiation strategy orders, shop negotiation strategy

orders, shopping information and etc. System

configuration files, as well as the files of state

agency using XML files will be stored on the server.

Therefore, Java XML coding is involved in system

development.

Figure 3: System Structure.

Figure 4: Agent class implements chart.

AN AUTOMATED NEGOTIATION SYSTEM FOR PRICE COMPARISON BASED ON AGENT TECHNOLOGY

279

5 IMPLEMENTATION OF THE

NEGOTIATION SYSTEM FOR

PRICES COMPARAISON

The Aglet development tool, which IBM Japan

Corporation developed, is used in this system

implementation because Aglet provided software

development toolbox (ASDK) and Aglet Workbench

platform are simple, scalable and reusable. This

system focuses on a certain brand of camera in

carrying on the automated negotiation. The issues

include commodity price (P), delivery time (DT) and

service Guarantee (SG, 1 expresses National joint

guarantee; 3 indicates 7 days unconditioned goods

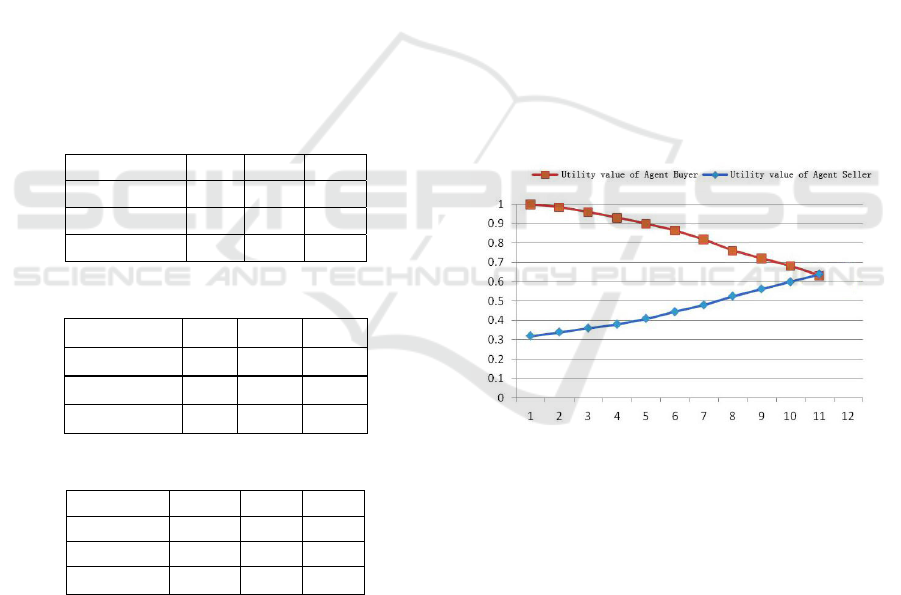

returned; 4 means No after-sales service.). Table 2,

tables 3 and Table 4 present the negotiation data of

participators, including the proposal value (P.V),

reservation values (R.V) and the weight (W) of each

issue in the process.

It should be noted that, in the real online

negotiation participators do not know the weight of

each issue on each other.

Table 2: Customer negotiation information.

Issue

P.V R.V W

P(¥) 3500 3950 0.7

DT(day) 2 12 0.1

SG(style) 1 3 0.2

Table 3: Negotiation information of seller 1.

Issue P.V R.V W

P(¥) 4200 3600 0.8

DT(day) 15 2 0.1

SG(style) 4 1 0.1

Table 4: Negotiation information of seller 2.

Issue P.V R.V W

P(¥) 4000 3500 0.7

DT(day) 12 2 0.1

SG(style) 4 1

0.2

The purpose of the multi-Agent system on camera

price comparison is to fulfil negotiation between the

buyer and multiple sellers within the limited time to

approach the most superior choice based on results

comparison. In order to evaluate the system, we took

the camera model of Canon’s G10 carrying on the

simulation experiment. Figure 5 demonstrates

variation on utility value between Agent B and

Agent S.

As shown in the initial round, Agent S utility is

higher, but it has a lower benefit compare to Agent

B. In the subsequent round, both sides carry on the

negotiation based on the action rules and discount

parameter β. As time goes on, the utility value has

been changed from time to time. The value of Agent

S has been enhancing in the view of Agent B, but its

own value is decreasing. In the 11th round, utility

value curve is crossed in the figure. The meaning of

intersected point is that the counter proposals utility

value of Agent B in the next round will be lower

than Agent S in the current round. Therefore, the

negotiation succeeds at this point.

When the curves appear intersection point, it

means that the negotiations is succeeded and should

be stopped there. In this case, each sub-agent

feedbacks the results to the host Agent, and the

market service canter Agent compares the price that

the score highlighted wins. From the experiment

results, we know that the utility value of seller 1 is

0.54, and the seller 2 is 0.63. Accordingly we chose

seller 2 as the trader. The price highlighted in final

round is 3680 Yuan; and delivery time is within 3

days complying with the national joint guaranteeing

program.

Figure 5: Utility values Curve of Offer and Counter.

From the results of system operation as well as the

analysis on experiment, it is very clear that the

system completely fulfilled the automated multi-

agent negotiation and achieved the purpose on

comparison price.

6 CONCLUSIONS

To deal with the inefficiency online negotiation and

time-consuming, in this paper, we provided an

automated negotiation system model that resolves

the multilateral multi-issue with comparison price.

The model includes many aspects, such as the

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

280

process, the evaluation function, and counter

proposal strategy. The system model included the

Agent technology of Distributed Artificial

Intelligence, which is used to define decision-

making agent system, buyer agent system and seller

agent system and to form a multi-agent system. We

also use the Aglet to develop an automated

negotiation system for price comparison, which can

be implemented to replace the human participating

for trading price selecting among numerous buyers.

The system model in this paper is a good experience

for further studying on automated negotiation in

general, and on dealing with multi-issues with

preference in particular. Of course, many research

efforts are still needed on studying the automated

negotiation on recourses comparison and selection in

e-business field.

REFERENCES

Bartolini, C., Preist, C., Jennings, R., 2004. A software

framework for automated negotiation. In SELMAS

2004. London, UK: Springer-Verlag, 213-235.

Faratin, P., Sierra, C., Jennings, R., 1998. Negotiation

decision functions for autonomous agents. Robotics

and Autonomous Systems, 159-183.

Faratin, P., Sierra, C., Jennings R., 2000. Using similarity

criteria to make negotiation trade-offs. In

Proceedings of the 4th International conference on

Multi-Agent Systems. Washington, DC, USA: IEEE

Computer Society, 119-126.

Maes, P., Guttman, R., Moukas, A., 1999. Agent that buy

and sell. Communication of the ACM. New York, NY,

USA: ACM, 81-93.

Manish, A., Chari, K., 2009. Negotiation Behaviours in

Agent-Based Negotiation Support Systems.

International Journal of Intelligent Information

Technologies.

Raymond, Y., 2007. Towards a web services and

intelligent agents-based negotiation system for B2B

eCommerce. Electronic Commerce Research and

Applications. Elsevier Science Publishers B. V., 260-

273.

Sierra, C., Faratin, P., Jennings, R., 1999. A service-

Oriented Negotiation Model between Autonomous

Agents. Human and artificial societies. London, UK:

Springer-Verlag, 201-219.

Wurman, R., Wellman, P., Walsh, E., 1998. The Michigan

Internet AuctionBot: A Configurable Auction Server

for Human and Software Agents. In Proceedings of

the Second International Conference on Autonomous

Agents. New York, NY, USA: ACM, 301-308.

Wang, H., 2008. Research on Representation of Preference

of negotiator in negotiation Support System. In 2008

International Symposium on Electronic Commerce

and Security. Washington, DC, USA: IEEE Computer

Society, 708-713.

AN AUTOMATED NEGOTIATION SYSTEM FOR PRICE COMPARISON BASED ON AGENT TECHNOLOGY

281