TEMPLATE FREE BIOMETRIC E-BANKING

AUTHENTICATION

More Trustworthy or False Trail?

Tim French, Marc Conrad

Department of Computer Science and Technology, University of Bedfordshire, Luton LU1 3JU, England

Raymond Brown

Keywords: Identity, user authentication, e-banking, template free biometrics.

Abstract: Identity management is an area that has proved challenging for many e-service providers such as e-banks.

The problem is how to authenticate on-line consumers at the initial point of registration and also how to re-

authenticate on-line customers each time they wish to access e-banking services. Hitherto, e-banks have

adopted several different technological approaches to user authentication. These include traditional user

passwords, as well as one-time passwords that necessitate the user operating a specialist device. In order to

more fully conceptualise the area it is proposed that e-banks should classify the available and emerging

using that we call a "Sign Based Identity Management" approach. One emergent solution is considered in

more detail: namely template free biometric authentication. Our contribution suggests that the hitherto

neglected area of biometric user authentication for e-banking may not only be more robust than existing

whilst also meeting many of the requirements (security, usability, strong trust model, less vulnerable to

replay attacks) of existing methods.

1 INTRODUCTION

E-banking providers have deployed a range of

techniques to handle on-line user authentication. The

use of user passwords being ubiquitous and chip-

and-pin cards (with passwords) is commonplace.

Biometric techniques have hitherto tended to have

been dismissed too often by the banking industry as

a whole as being inherently too vulnerable to replay

attacks or loss of identity templates leading to an

unacceptable risk of loss of identity (Venkatraman

and Delpachitra, 2008). There may also deeper

organisational cultural reasons for the lack of

adoption of biometrics within banking more

generally to due to a risk aversion culture and

technological conservatism (Constanzo 2006). For

example the guidance issued by relevant authorities

such as the Federal Finance Examinations Council

(http://www.ffiec.gov) tends to stress the importance of

risk management and the increasing dangers of

identity theft in relation to tried and tested methods,

rather than promoting the adoption of novel

methods. This has led to a culture of conservativism

in terms of adopting new technologies, despite the

rise in criminal abuse. For example, the FSA

(Financial Services Authority) recently identify a

worrying rise in online banking fraud losses totalling

some £21.4m during the six month to June 2008, a

185% rise compared to 2007 (Financial Crime

Newsletter, 2007). Similarly, a recent IBM report

(IBM Internet Security Systems X-Force®, 2008)

identifies USA and UK based e-banking fraud as

one of the fastest growing area of on-line crime.

Phishing attacks for example are targeted mainly at

USA and UK based e-banks (88%), with a further

8% targeted at financial payment sites. This is due to

the high economic return of investment for

criminals. Traditional well tried and trusted methods

of operating secure e-banking predominate.

However the rise of e-crime may force e-banking

providers to consider new approaches. Later, we

identify a novel variant template free (voice based)

biometric as offering an alternative for e-bank

authentication both at the initial customer e-banking

enrolment stage and also beyond enrolment for users

on a regular day-to-day basis. The main potential

111

French T., Brown R. and Conrad M.

TEMPLATE FREE BIOMETRIC E-BANKING AUTHENTICATION - More Trustworthy or False Trail?.

DOI: 10.5220/0003267801110116

In Proceedings of the Twelfth International Conference on Informatics and Semiotics in Organisations (ICISO 2010), page

ISBN: 978-989-8425-26-3

Copyright

c

2010 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

advantage is that (unlike traditional biometric

methods) there is no need to generate a client

template from a presented biometric. The method is

still emerging from the research literature and has

not been specifically tailored for e-banking use.

Rather, limited trials and test-beds have

demonstrated proof-of-concept results using voice

speech samples (Wisse, 2006). The semiotic

paradigm has offered little support for identity

management. Only Wisse (Athan and Howells,

2009) has offered a theoretical extension to Peirce's

triadic model of semiosis to take into account the

additional complexities of mapping a biological

identity to virtual identities. We go on to ground our

contribution within a semiotic analytic approach to

trusted authentication. This can be seen as a natural

extension to a generic semiotic account of an E-trust

framework most recently articulated within French

(French, 2009).

2 IDENTITY MANAGEMENT:

A SEMIOTIC ANALYSIS

Previously one of us has suggested that a novel trust

ladder a novel and tailored variant of Stamper's well

known semiotic ladder (Stamper, 1973) can prove to

be invaluable conceptual tool to clarify matters of

trust and security issues in the context of e-bank

web-site design as well as in the context of SSL/TLS

client-server exchanges (Bacharach and Gambetta,

1997).

Semiotic trust ladder

Social world, organisational trust:

Beliefs and reputation. Trust as expectations

Organisational trust, social capital

Pragmatics of trust:

Goals, intentions, trusted negotiations, trusted

communications

e-service consumption & provision

Semantics of trust:

Meanings, truth/falsehood, validity

e.g. deception and mimicry on a web-site home-

page

Syntactics of trust:

Formalisms, tangible security, trusted access to

data, files, software

e.g. PKI, X.509 certificates

Empiric trust:

Cryptographic ciphers, entropy, channel

capacity, e.g. RSA

Figure 1: A “Universal” e-service semiotic trust ladder.

For each of the layers of the semiotic trust ladder (a

close variant of Stamper’s famous ladder) an

exemplar security/trust aspect is indicated. Clearly

the development of a semiotics of security and trust

forms a much larger research agenda. This task lies

outside the scope of the present paper, though this

paper forms a minor contribution to this research

agenda. Indeed, that the ladder may prove to be

useful in the analysis and classification of e-banking

user authentication methods and hence establish a

kind of taxonomy of identity management that we

coin as Sign Based Identity Management (SBIM).

SBIM is intended to reveal the inherent

characteristics and vulnerabilities of well known

user authentication methods used by e-banks and

seek to map these to the various layers of the

semiotic trust ladder. The trust ladder is reproduced

as Figure 1 above.

We suggest that the ladder may prove to be useful in

the analysis and classification of e-banking user

authentication methods and hence establish a kind of

taxonomy of identity management. SBIM is

intended to reveal the inherent characteristics and

vulnerabilities of well known user authentication

methods used by e-banks and seek to map these to

the various layers of the semiotic trust ladder.

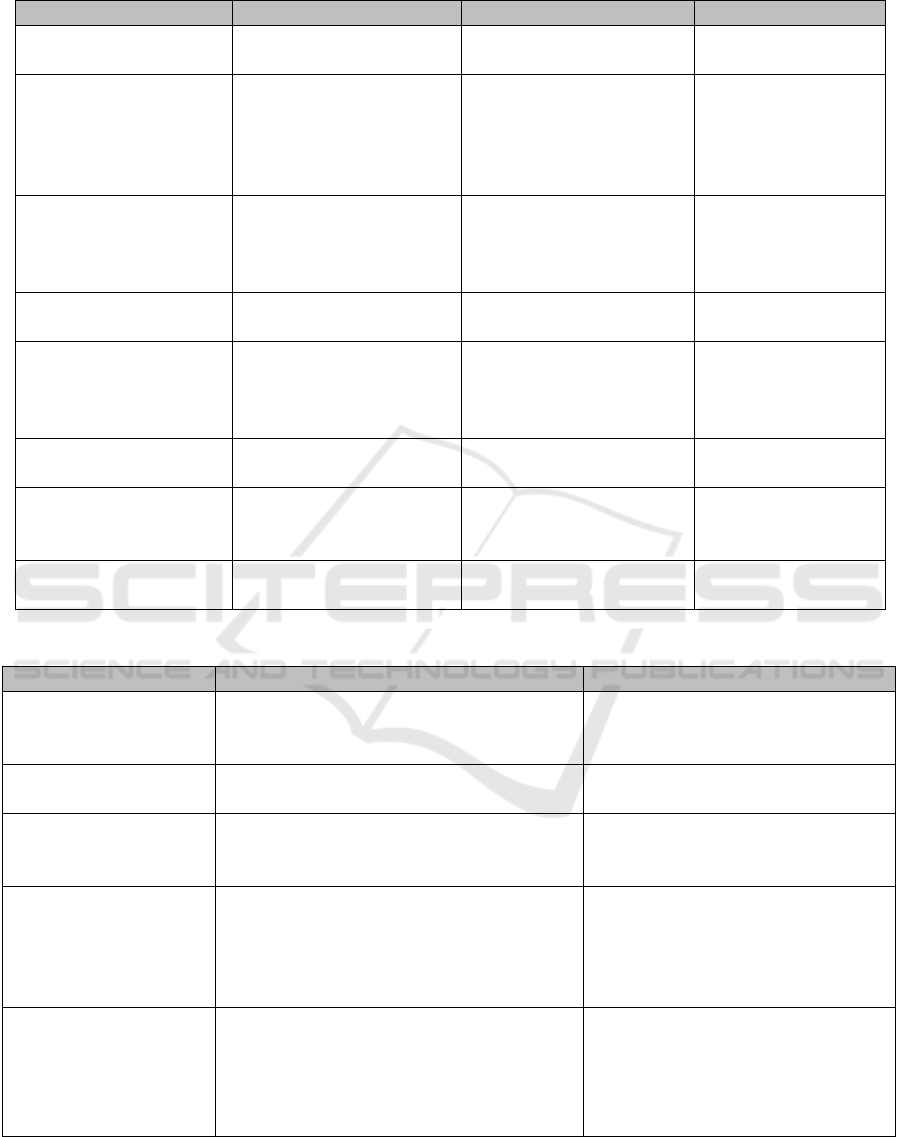

Tables 1 and 2 that follow present a tentative

mapping of key user authentication methods to signs

and signal exchanges and known vulnerabilities.

This mapping effectively re-factors authentication in

terms of the signs and signals being exchanged. It

can be seen in Table 1 below that traditional

methods suffer from well known weaknesses of

social engineering whilst the low adoption of one-

time passwords suggests user resistance to adoption.

Credentials such as smart cards and chip-and-pin

cards suffer from problems of 'cloning' and also

offer the possibility of a user presenting such

credentials under duress. It has recently been

suggested that the optimal (future) method of initial

registration identity verification in an EU context

may be the use of EU ID cards (Naumann, 2009).

Such credentials may be relatively easy to clone.

Table 1, contains an entry marked 'template free'

biometrics. We later seek to demonstrate

applicability to e-banking user registration and site

usage through the use of a use case based overview,

with supportive mathematical underpinning. SBIM's

"added value" is to seek to reveal clearly that every

method has known weaknesses and that these are

related to the nature of the signs being exchanged at

various levels of the trust ladder.

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

112

Table 1: User authentication methods compared.

Method Signs presented Vulnerabilities UK adoption by e-banks?

Passwords Alphanumeric strings

(PIN codes)

Shoulder surfing; social

engineering

Ubiquitous

Password generated token

devices:

(Key-fobs)

as part of 2 factor

authentication

User password (as above) +

Key fob generates unique

numeric codes every 30 secs.

Counteracts M-in-M attacks but

user adoption requires use of

specialist devices. Shelf-life

typically < 3 yrs

Barclays UK

Visual passwords

U

ser clicks on hot-spots within

images / or clicks on one or

more arrays of images

Shoulder surfing; poor

scalability for e-banking

None

Smart card Stored encrypted

public/private keys

Card cloning Commonplace

USB Token (as initial part of

two factor password based

authentication)

Stored user signed digital certs.

as part of PKI

Tamper resistant but needs

USB port; can be lost by user

leading to loss of service

availability

Used in USA but not

adopted in UK

EU ID Card As above plus potential for

stored biometrics

No ID card available yet across

EU. Loss of card. Card cloning.

None

Biometrics Extract of salient features

e.g from voice (template)

Loss of template leads to loss

of identity! Specialist devices

needed at client end

None (methods are

relatively mature and

scale well)

Template free biometrics Salient features generate keys

from e.g. voice biometric

May not be scalable? None still emergent stage

Table 2: Mapping of password user authentication to the trust ladder.

Password Trust ladder layer Risk of compromise?

Password selection and

usage

Social level determines password strength /

social engineering leads to weaknesses /shoulder

surfing in internet café etc

High

Active attacks Pragmatic level

Brute force attack, DDNOS attacks

Medium

Phishing attacks

(fake web-site)

Semantic level

Consumers log on to fake site and re-enter

password due to lure of fake surface level signs.

High

IBM report

Key space Syntactic level

Can be re-issued

Medium

Reissuance involves manual interaction

with e-banking human agent to re-

establish security. Some possibility for

interception and/or abuse.

Ciphers/crypto Empiric level

Very low

Private key only. Mathematically secure

through use of hash functions

TEMPLATE FREE BIOMETRIC E-BANKING AUTHENTICATION - More Trustworthy or False Trail?

113

Table 3: Mapping of voice template free biometric user authentication to the trust ladder.

Voice template free

biometric

Trust ladder layer Risk of compromise?

Voice presented

by phone

Social level

Replay via social engineering

Low

Active Attacks Pragmatic

Goals of system re-directed by

inherent vulnerability exploits

Medium

Phishing

attacks

Semantic level

Biometric could be stolen

b

ut cannot be

matched to key pairs unless the secret

proprietary algorithm is compromised.

Low

IBM report

Key space Syntactic level

Cannot be reissued if compromised

Low

Template free mechanism guarantees that the

map from biometric feature to key space can

be adapted if necessary.

Ciphers/crypto Empiric level

Digital signal exchange and

verification

V. Low

Private / public keys generated dynamically and

not stored at client end. Unbreakable.

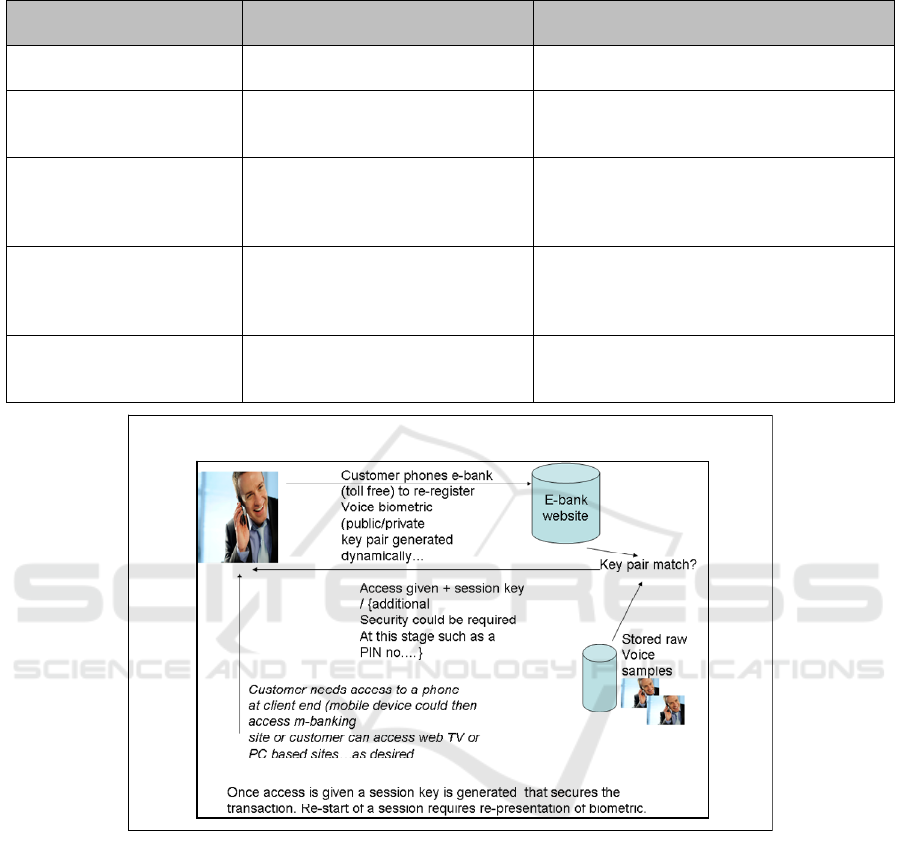

Figure2:Novelregistrationmethodaschematicdiagram

Figure 2: Novel registration method a schematic diagram.

Tables 2 and 3 show how passwords present a

relatively high risk of compromise as compared to

template free biometrics, when examined in terms of

their vulnerabilities. This is because any adversary

would typically need to mimic genuine signs at

multiple layers of system and user abstraction,

making the task potentially harder. Passwords offer

more vulnerable layers (higher risk) than biometrics.

• In the context of e-banking the system dynamics

are: large scalability, high-volume, high accuracy

and reliability. The analysis presented earlier

suggests that e-banks should consider

supplementing their use of passwords and/or

smart cards with a template free biometric

approach. Organizations are using or actively

considering multi-factor authentication

techniques, despite increased management

overheads (Chiasson, 2008).

3 VOICE BASED TEMPLATE

FREE USER

AUTHENTICATION AND

E-BANKING

3.1 Overview

The traditional procedure for opening an on-line

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

114

bank account (enrolment) typically involves the

customer entering a high-street branch and

presenting evidence of ID, a copy of their signature

and evidence of domicile.

The bank often checks the credit score of the

customer, and after these checks are made the

customer is mapped to one or more accounts. Later,

the customer receives bank credentials (e.g. card,

passwords etc.) that enable transactions to be made

on-line. A variation of the above process involves

the initial capture of information from an on-line

customer, followed by verification of identity (off-

line) and issuance of credentials to the customer so

that the account can be activates and operated on-

line.

Atah and Howells (Athan and Howells, 2009)

claim to have developed a so called template free

authentication system. Here the encryption key is

devised directly from the measured features. It

should be noted that a simple hash algorithm would

not be appropriate in this situation as even a small

change in the recorded features would imply a

completely different hashed value. The algorithm

uses voice features, normalizes them and produces

data which is discretised. The use of voice based

template free biometric would typically involve an

initial visit to a branch followed by seamless on-line

usage. Thus the initial workload of enrolment would

be somewhat higher than the traditional method.

This (recording) would need to be accompanied by

manual ID document presentation as in the

traditional method for additional security reasons.

The e-banking customer presents a voice biometric,

by means of any voice enabled IP connected device.

To avoid replay attacks a daily 'passphrase' could be

embedded within their free voice text entry.

3.3 Empiric Level: A Novel Centred

Discretisation Approach

In an e-banking context it is always the case that an

e-bank needs to verify that the presented credential

matches the stored credential. The most vulnerable

situation is that of an e-bank storing the clear text

voice sample (as shown in Figure 2). In this case if

the sample is stolen a person's identity is also stolen.

A better case is when the e-bank stores only a

hashed value of a voice sample. In this case loss

would not result in a loss of identity due to the

difficulty of reversing such hash functions. The

difficulty of generating a unique hash value from

differing presented voice samples generated by the

customer remains problematic. Our solution is based

upon centred discretisation techniques. These

techniques retain the advantages of template free

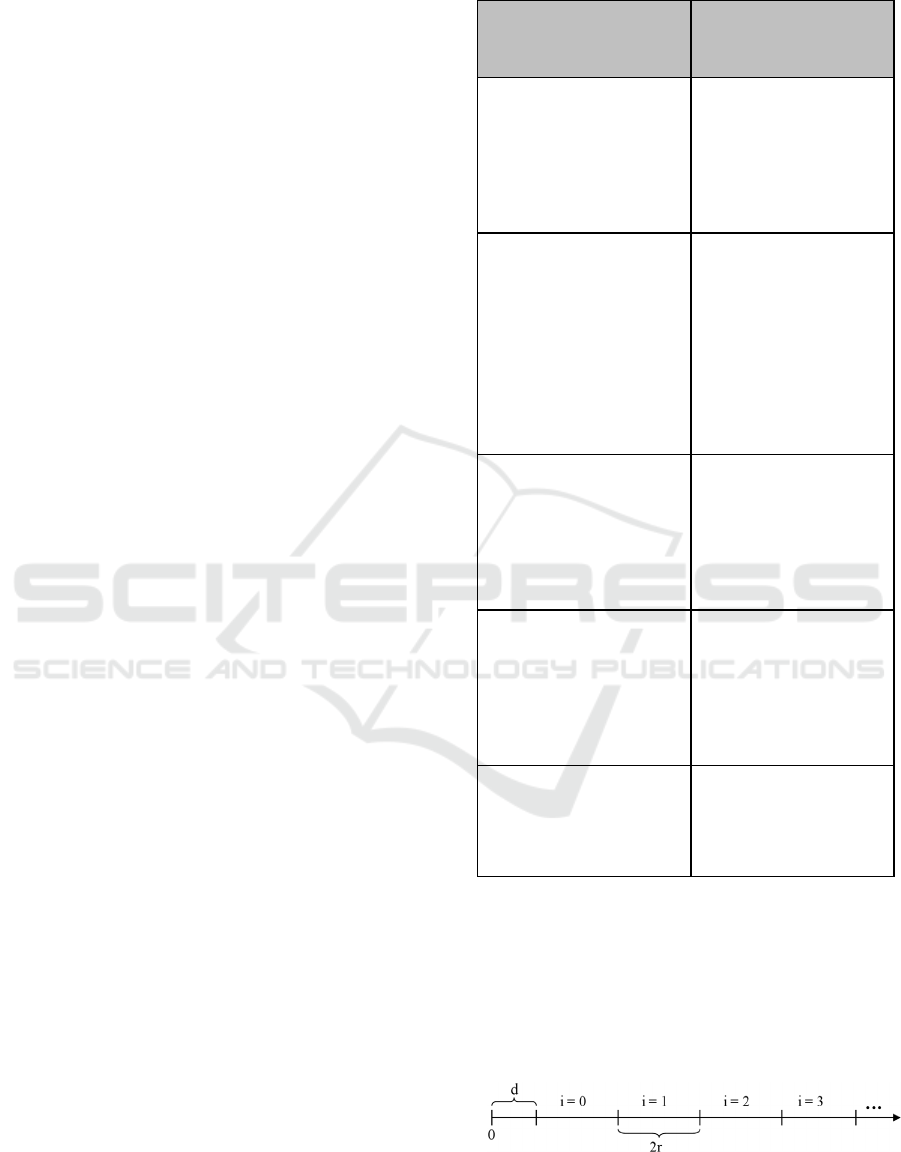

Table 4: a risk analysis of the template free method.

Semiotic trust ladder Vulnerabilities of

template free method

Social world,

organisational trust:

Beliefs and

reputation. Trust as

expectations

Organisational

trust, social capital

Adoption may be

limited by consumer

fears concerning

possible misuse of

presented voice

biometric

Pra

g

matics of

trust:

Goals, intentions,

trusted negotiations,

trusted communications

e-service

consumption &

provision

Customers are

adverse to adopting

biometric methods in

general for e-finance

in the UK. Past track

record of introduction

(for ATM's) failed

due to user (over

engineering)

reactions.

Semantics of trust:

Meanings,

truth/falsehood,

validity

e.g. deception and

mimicry on a web-site

Robust algorithms

needed to ensure

robustness to replay

attacks, user forced

under duress to

submit biometric by

adversary etc.

S

y

ntactics of trust:

Formalisms,

tangible security,

trusted access to data,

files, software

e.g. PKI, X.509

certificates

N

o trusted

standard (yet)

developed unlike

other systems that are

ANSI certified.

Empiric trust:

Cryptographic

ciphers, entropy,

channel capacity

Template free

discretisation of

continuous data may

constitute a problem

of matching stability.

biometric method (no potential loss of identity if the

discretised samples are stolen) whilst enhancing the

practicability of an e-bank correctly matching the

hashed values of the presented credential to the

stored credential. We suggest that centred

discretisation provides a potentially more stable

approach, as depicted schematically in Figure 3

below.

Figure 3: Continuous line (0..∞) divided into segments of

length 2r (adapted from (14).

TEMPLATE FREE BIOMETRIC E-BANKING AUTHENTICATION - More Trustworthy or False Trail?

115

The centred discretisation algorithm is discussed in

(Chiasson, 2008), in the context of graphical

passwords. We have adapted the method so as to

match the needs of e-banking voice verification.

4 CONCLUSIONS

The adoption of novel user authentication

technologies by e-banks is a complex affair. From a

semiotic analytic viewpoint barriers and

vulnerabilities exist at several layers of the trust

ladder not only at the tangible security layer. Whilst

the template free approach offers the future prospect

of a generally more robust solution to e-banking user

authentication, concerns remain, particularly as to

the reaction of on-line customers and with respect to

the ease with which unique bit strings can be

generated within a fault free context from presented

samples. Future work includes an e-banking

provider survey and initial exploratory partnerships

with one or more UK e-banks, so as to seek active

support for the adoption of voice based template free

biometrics. Before adoption, enhancements such as

the centred discretisation method will be needed and

scaled to meet the demands of security, trust and

user acceptance of such novel technologies. Existing

technologies are weak and liable to abuse by

criminals. To simply maintain the status quo may

not prove viable.

REFERENCES

Venkatraman, S. and Delpachitra, I. (2008) Biometrics in

banking security: a case study. Journal of Information

Management and Computer Security,6 (4), 415-430.

Costanzo, C. (2006). Suddenly, biometric ID doesn’t seem

like science fiction, American Banker,

Vol. 171 No. 107, pp. 6-11.

Financial Crime Newsletter (2007). Special edition from

the Financial Crime Sector Team

Issue No.8, August 2007 Authentication and Safeguarding

of Customer Identity, FSA Publications.

IBM Internet Security Systems X-Force® 2008 Trend &

Risk Report, Available as a PDF from: http://www-

935.ibm.com/services/us/iss/xforce/trendreports/xforce

-2008-annual-report.pdf

Wisse, P. (2006). Semiotics of Identity Management.

Prima Vera Working Paper Series,

University of Amsterdam, Working Paper 200602.

Atah, J., Howells, G. (2009). Mapping of Information in

Voice Features for use in an Efficient Template - Free

Biometric Security System, International Conference

on Information Security and Privacy (ISP-09),

Orlando, Florida, USA.

French, T. (2009). Towards an E-service Trust

Framework: Trust as a Semiotic Phenomenon, PhD

Thesis, School of Systems Engineering, Reading

University, UK.

Bacharach, M. & Gambetta, D. (1997). Trust in Signs. In:

Cook, K.S. (Ed.). Trust in Society. Russell Sage

Foundation. New York, 148–184, 1997.

Clayton. (2005) Who’d phish from the summit of

Kilimanjaro? Procs. 9th International Conference FC

2005, Roseau, The Commonwealth of Dominica,

February 28-March 3rd 2005, Vol. 3570 of LCNS,91-

92, Springer-Verlag.

Clayton. (2005). Insecure real-World Authentication

Protocols (or why Phishing is so Profitable).Procs.

13th International Workshop on Security Protocols,

Cambridge, UK.

Wu, M. (2006). Fighting Phishing at the User Interface.

PhD Thesis. MIT, August 2006.

Stamper, R. K. Information in Business and

Administrative systems. New York: Wiley, 1973.

Naumann, I. (2009) (Ed.) 'Privacy and Security Risks

when Authenticating on the Internet with European

eID Cards', ENISA Risk Assessment Report.

Chiasson, S., et al., (2008).Centered Discretization with

Application to Graphical Passwords, in USENIX

Usability, Psychology, and Security (UPSEC). 2008.

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

116