RISK MANAGEMENT IN SUPPLY NETWORKS

FOR HYBRID VALUE BUNDLES

A Risk Assessment Framework

Holger Schr¨odl, Matthias Geier, Laura Latsch and Klaus Turowski

University of Augsburg, Universitaetsstrasse 16, 86159 Augsburg, Germany

Keywords:

Supply chain management, Risk management, Hybrid value bundles, Product service systems.

Abstract:

In the market for tangible goods there is increasingly a trend from the production of single individual products

towards individualized mass customization. In contrast to this, so-called hybrid value bundles are getting more

and more importance in achieving market share und make a differentation to the competitors. Hybrid value

bundles are integrated solutions combined of tangible and intangible goods. For these complex solutions, sub-

parts are often delivered from different suppliers and have to be bundled by a focal supplier. These bundles will

be delivered in form of a single solution to the customer. The large number of heterogeneous suppliers within

the supplier network needs a complex supplier relationship management. Classic supply chain management

techniques fail because of the specific requirements of hybrid value bundles. One major issue in the supplier

management is risk management. For this, the focal supplier has to evaluate its suppliers according to risk

characteristics and then choose to take those who have the lowest risk. In this paper a risk management

model is presented, which takes care of the specific requirements of hybrid value bundles and complex supply

networks. This risk management model may serve as a risk assessment framework for a focal supplier to

identify optimal supply chains for a specific offering.

1 MOTIVATION

Hybrid value bundles are a special type of product

bundle, which consists of well-coordinated, highly-

integrated products and services with the goal to

solve a specific customer problem (Hirschheim et al.,

1995). This tight integration increases the customer

value of hybrid value bundles which exceeds the sum

of the values of the individual sub-services (Johans-

son, J. E. et al., 2003). With these integrated solu-

tions in their product portfolio, companies are able to

differentate from their market competitors to gener-

ate higher margins and promote the development of

long-term, intense customer loyalty (Burr, 2002). In

addition, the product efficiency can be increased by

the individual adaptation to customer needs (Becker

et al., 2008) and higher added value is generated for

both the producer and the customer (Galbraith, 2002).

The development and provisioning of a hybrid

value bundle usually not only involves a single com-

pany as a vendorcompany, but often an entire network

of autonomous companies that make a contribution to

the hybrid value bundle. Reiss and Pr¨auer showed

study that the most suitable form for the develop-

ment and provisioning of value bundles are strate-

gic value-add partnerships, networks and cross-

company project-oriented cooperations (Reiss and

Pr¨auer, 2001).

Regardless of the origin of the network usually a

large number of suppliers and subcontractors are in-

volved. Each of these participants would engender

a risk to the network, and it changes the risk assess-

ment of individual supply chains. The larger and more

branched the network is, the more complex is the as-

sociated risk. Classical risk management methods for

supply chains are not suitable for the specific require-

ments of value bundles. The research question of this

paper is: how can risk be assessed in order to ensure

the customer a maximum safety during product deliv-

ery?

The paper is organized as follows: In Chapter 2

the foundations of hybrid value creation and risk are

explaind. Chapter 3 deals with the methods of sup-

plier evaluation and the positioning of a decision cat-

alog. In Chapter 4, the modeling of risk assessment is

157

Schrödl H., Geier M., Latsch L. and Turowski K..

RISK MANAGEMENT IN SUPPLY NETWORKS FOR HYBRID VALUE BUNDLES - A Risk Assessment Framework.

DOI: 10.5220/0003430501570162

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 157-162

ISBN: 978-989-8425-53-9

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

explained and an exemplary application is conducted.

Chapter 5 includes notes to the software program and

the underlying data model. Chapter 6 summarizes the

work and identifies additional research needs.

2 VALUE BUNDLES AND RISK IN

SUPPLY NETWORKS

Basis of the model to be developed for risk assess-

ment are specific requirements for hybrid value bun-

dles in procurement processes, on the other hand ex-

isting approaches to risk assessment in procurement

in general.

2.1 Hybrid Value Creation

The term ”hybrid value bundle” represents an inte-

grated bundle of products and services with the goal

to solve a customer problem (B¨ohmann and Krcmar,

2007) (Sawhney et al., 2006). This can be, for exam-

ple service level agreements, availability guarantees,

the output of a machine, performance / full service

contracts, performance guarantees, finance, consult-

ing, licenses or rights include. The level of integration

of these different components may vary significantly

(Fettke and Loos, 2007). On the one hand there are

standarized physical products combined with services

directly related to the physical product (e.g. a mobile

phone with a corresponding telephone contract). On

the other hand there is the business case of perfor-

mance contracting where the offer of a value bundle

consists of several service agreements to the customer

with no tangible asset at all (e.g. the garanteed output

of a printing unit in printing pages per day) (Corsten

and G¨ossinger, 2008).

An example of a hybrid value bundle is the iPhone by

Apple Inc.. Usually not only the product in form of a

mobile phone will be sold, but also the contract, con-

sulting and service. But also criteria like brand, net-

work, and the software solutions offered by the manu-

facturer are part of the hybrid value bundle. However,

services, rights or service level agreements may be in-

volved in a hybrid value bundle.

2.2 Risk Management in Supply

Networks for Hybrid Value

Creation

The need for risk management in supply chains with

a large amount of participiants is highly accepted

(Braithwaite and Hall, 1999). For the concept of risk

in supply chain management, there are several defi-

nitions (March and Shapira, 1987) (Svensson, 2002).

For the following we adopt the definition of risk as

”risk of loss or damage [which] by the failure of ser-

vices that can be attributed to not be influenced or an-

ticipated events [arises]” (G¨otze et al., 2001). Risk

can be seen as the probability that a particular adverse

event occurs during a specified time or resulting from

a challenge out.

In the case of supply networks this includes a non-

limited number of risk factors relating to the supply-

ing company. To rate this variety of criteria, it re-

quires an appropriate method. In contrast to the above

general case of risk assessment, the evaluation of sup-

pliers and supply chains uses a number of criteria,

which include some quantitative risk metrics such as

delivery reliability, delivery quality or liquidity of the

supplier, but also qualitative criteria like the corporate

form or the location of the headquarters. The same

applies to the criteria for hybrid value bundles.

Moreover (Burianek et al., 2007) could identify

seven criteria which are characteristic for a hybrid

value bundle and have an essential effect on the com-

plexity of value provision: type of customer benefit,

scope of services, amount and heterogenity of partial

services, degree of technical integration, degree of in-

tegration into the value chain of the customer, degree

of individualization and temporal dynamics and vari-

ability of value provision. Which criteria in detail are

the best to serve as base for the calculation of risk is an

individual decision of the focal supplier and can not

be defined per se. Examples of such decision criteria

can be found in (Heyder et al., 2009). Coupled with

possible effects (M¨ussigmann, 2006), which can help

to assess the criteria change with respect to individual

suppliers, one can get a practical insight. Especially

for hybrid value bundles there is another example of

(Pousttchi et al., 2009). This is a classification of fea-

tures for hybrid value bundles, which distinguishes

the corresponding characteristics in three groups of

features: strategic classification, components compo-

sition and value creation.

For the assessment of suppliers, especially in hy-

brid value bundles, we recommend a list of criteria

with dimensions such as price, quality or reliabil-

ity, and including a simultaneous classification of the

product, which is to be the end product of the supply

chain, morphological inside the box. This allows fo-

cus on the product features and corresponding criteria

which can be selected and weighted.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

158

3 SUPPLIER RATING

3.1 Methods for Risk Assesment for

Suppliers

The risk assessment of suppliers for the physical

goods market have a long tradition and many estab-

lished methods. The method of scoring is a numerical

representation method, which gives expression to the

qualitative methods, (Beucker, 2005), is in the litera-

ture clearly dominant (Koppelmann, 2003) and also

for the case of risk assessment in supply networks

with hybrid value bundles the most appropriate. Scor-

ing procedures in the scientific literature is divided

again into 100-point rating method, percent assess-

ment procedures and scoring models. For the model

to be developed, the scoring model is used to achieve

an optimal weighting of the factors (Janker, 2008).

3.2 Exemplary Calculation Basis of

Decision Criteria

In order to assess the entire supply network, it is first

necessary to evaluate the single node (M¨ussigmann,

2006). A node in our model corresponds to a supplier,

subcontractor or the focal supplier itself.

3.2.1 Placing the Decision Catalogue

The focal supplier first provides a decision-catalog

basis of decision-relevant criteria. These criteria may

be, for example, delivery reliability, delivery quality,

quality of workers or the nature and formulation of

service contracts and agreements. This list of de-

cision criteria must now be assessed with a scoring

method. This means that each criterion is assigned

a weighting point value, for example in the range

of 1-20, which states how much the focal supplier’s

knowledge of this criterion from a vendor or supplier

would be worth. An example of this decision cata-

logue would be the first two columns in table 1.

In this case, the focal supplier’s knowledge in

assessing the delivery performance of the suppliers

would be very much worthy, knowing about the lo-

cation of the headquarters, however, relatively little.

3.2.2 Assessment by the Suppliers

Now, this list will be filled with the appropriate infor-

mation from suppliers, subcontractors and raw mate-

rial manufacturers. A possible result is as in the third

column of table 1 look like. However, the problem of

the result is that not all values correspond to a numer-

ical value (example: head office = Munich), but this

Table 1: Evaluation of decision criteria including coded and

uncoded suppliers data.

criterium weighting

points

supplier data

(uncoded)

supplier

data

(coded)

delivery

reliability

20 0,9 0,9

delivery quality 17 - -1

guarantee of

outcome and

availability

16 - -1

service contracts 14 3 contracts,

maintenance of

several plants

0,85

workers quality 13 - -1

solvency 13 0,8 0,8

number of

employees

8 10.000 0,7

type of financing 6 Leasing 0,3

head office 3 Munich,

Germany

0,9

is necessary for further calculations. Therefore, the

values must be encoded and represented as a number

between 0 and 1. 0 is considered here as the worst

value and 1 as the optimal one. This means that in-

formation such as company head office or number of

employees must be classified as far as Munich that

represents a value of 0.9, 10,000 people a value of

0.7 or servicing various machines to a value of 0.85.

The value 0.9 of the headquarters may be interpreted

to that way, that the focal supplier itself has its corpo-

rate headquarter in Munich and therefore the transport

distance is minimal, creating risk occuring during the

transport is minimized. Furthermore, the value -1 will

be taken as code for unspecified information.

3.2.3 Coding of the Table

Since the coding of the criteria strongly depends on

the particular criteria and the priorities of the affected

companies, there is no complete table shown here, but

we provide a recommendation of a possible coding

for a focal supplier. An exemplary coding of vendor

data is in the fourth column of table 1. Such a ta-

ble can contain hundreds of decision-making criteria

and therefore it is important to create a framework on

which criteria are to be specified by the supplier. One

possibility would be a minimum number of fixed sum

of weighting points for the criteria of the data to be

evaluated, which suppliers need to be delivered. The

focal supplier would determine this is to be done from

any eligible supplier, which in total have at least 60

weighting points for example. This has the advantage

that each supplier can provide either very much infor-

mation on criteria which do not add much value to the

focal supplier, but allow a total of a good assessment

RISK MANAGEMENT IN SUPPLY NETWORKS FOR HYBRID VALUE BUNDLES - A Risk Assessment Framework

159

of the supplier, or the supplier provides only little in-

formation, but information to criteria highly relevant

for the decision of the focal supplier. Now, if the focal

supplier, for example, specify that it requires data of

60 weighting points, so this would be satisfied in the

example above.

4 MODELING THE RISK

ASSESMENT IN SUPPLY

NETWORKS FOR HYBRID

VALUE CREATION

The values generated by the weights of each node

must now be calculated into a risk value, which repre-

sents the risk of a specific supply chain. In the follow-

ing, the value will be calculated by a dedicated supply

chain for the focal supplier.

4.1 Decision Criteria

The risk value of the supply chain will be denoted as

Ω

l

i

and ranges in the interval [0;1]. The best value is

1, the worst value is 0. Ω

l

i

is dependent on both the

above-mentionedweighting scores of the affected cri-

teria and the explicit expressions of the supply chain

to be considered relevant criteria.

4.2 Model Formulation

To calculate Ω

l

i

several variables and indices are

relevant. These will be defined in the following:

Variables

Ω

l

i

∈ [0 : 1]: value of the supply chain l

i

for the focal

supplier

l

i

= {m

k

|m

k

∈ K, Kconfiguration}: i-th supply chain

consisting of the knots which are able to fullfil a

specific customer demand

M = {m

1

, . . . , m

z

}: set of all suppliers in the supply

network

m

k,l

i

: supplier of the supply chain l

i

with ID k

C = {c

1

, . . . , c

y

}: set of all criteria in the supply

network

G = {g

1

, . . . , g

y

}: set of all weighting points of the

focal supplier

g

j

∈ {1, 2, . . . , o}: weighting point of a criterium c

j

a

j,l

i

: frequency of the criterium c

j

within the supply

chain l

i

w

k, j

∈ [0;1]: value of a criterium c

j

for the supplier m

k

Indices

y: amount of the criteria in the supply network

o: maximum sum of weighting points in the criteria

list

z: number of suppliers in the supply network

k: ID of a supplier in the supply network

i: ID of a possible supply chain for a specific cus-

tomer demand

j: ID of a criterium in the supply network

With this notation, there is the following formula

to calculate the value of a supply chain:

Ω

l

i

=

∑

m

z

k=1

∑

c

y

j=1

[ f(w

k, j

∗ g

j

)]

∑

c

y

j=1

[g

j

∗ f(a

j,l

i

)]

(1)

Calculation of the function f(w

k, j

):

f(w

k, j

) =

(

w

k, j

, for w

k, j

6= −1

0, else

(2)

Calculation of the function f(a

j,l

i

):

f(a

j,l

i

) =

(

a

j,l

i

, for w

k, j

6= −1

a

j,l

i

− 1, else

(3)

The value Ω

l

i

of a certain supply chain l

i

is com-

bined from the product of every single value of the

criteria w

k, j

and the corresponding weighting points

g

j

from every single supplier M in the supply chain

and all published criteria c.

This value will be divided by the product from the

weighting points g

j

and the corresponding frequency

of the criteria a

j,l

i

to derive an average value. In ad-

dition, the variable w

k, j

can be −1 in cause there are

no values stated for this variable in the table. In this

case, the function f(a

j,l

i

) decreases the denominator

by −1 and the function f(w

k, j

) sets the numerator for

this criterium to 0. Otherwise the result would be fal-

sified by the criteria not stated from the suppliers. The

calculated value for Ω

l

i

ranges betweeen 0 and 1, at

which 1 is considered to be the best value.

4.3 Exemplary Application of the Model

For illustration purposes a scenario is presented,

which is reduced in complexity, but covers all relevant

aspects of the issue of risk management for the pro-

curement of hybrid value bundles. Suppose the focal

supplier possessed only a single supplier that is rel-

evant for the considered hybrid product. This allows

the summation of all suppliers and it results in the fol-

lowing simplified formula for calculating the value of

a supply chain for the focal supplier:

Ω

l

i

=

∑

c

y

j=1

[ f(w

k, j

∗ g

j

)]

∑

c

y

j=1

[g

j

∗ f(a

j,l

i

)]

(4)

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

160

The calculation for f(w

k, j

) and f (a

j,l

i

) remain un-

changed.

The criteria for the example should have the fol-

lowing characteristics (see tabelle 2):

Table 2: Exemplary validation of decision criteria.

criterium weighting

points

supplier

data

delivery reliability 20 0,9

delivery quality 17 -1

guarantee of out-

come and availability

16 -1

service contracts 14 0,85

workers quality 13 -1

solvency 13 0,8

number of employees 8 0,7

type of financing 6 0,3

head office 3 0,9

The weighting points g

j

are stated in the second

column and the supplier data w

k, j

is stated in the third

column. From these data the calculation for the risk

value follows:

Ω

l

=

0,9∗20+0∗17+0∗16+0,85∗14+0∗13+0,8∗ 13+0,7∗8+0,3∗6+0,9∗3

20∗1+17∗1−1+16∗1−1+14∗1+13∗2−1+8∗1+6∗1+3∗1

=

50,4

107

= 0, 4710

If more than one supplier would be involved, the

weighting scores should be added in the numerator

and the sum of the weighted scores to share times the

number of incidents. The result would be the case in

a number between 0 and 1.

5 PROGRAM FOR THE

SIMULATION OF THE RISK

MODEL

To demonstrate the risk calculation of this model a

software program as a prototyp evaluation is imple-

mented. This program was implemented in a modular

3-tier architecture to allow maximum flexibility in the

illustration of different risk scenarios. To generate an

appropriate model for the representation of the hybrid

value bundle and to achive a efficient implementation,

the semantic data model of Schr¨odl (Schr¨odl et al.,

2010) is used accordingly. The presented Java pro-

gram offers both the functionality of the evaluation

and selection of suppliers and graphic elements for

managing the data on which the calculation is based.

The calculation as core of the program is displayed

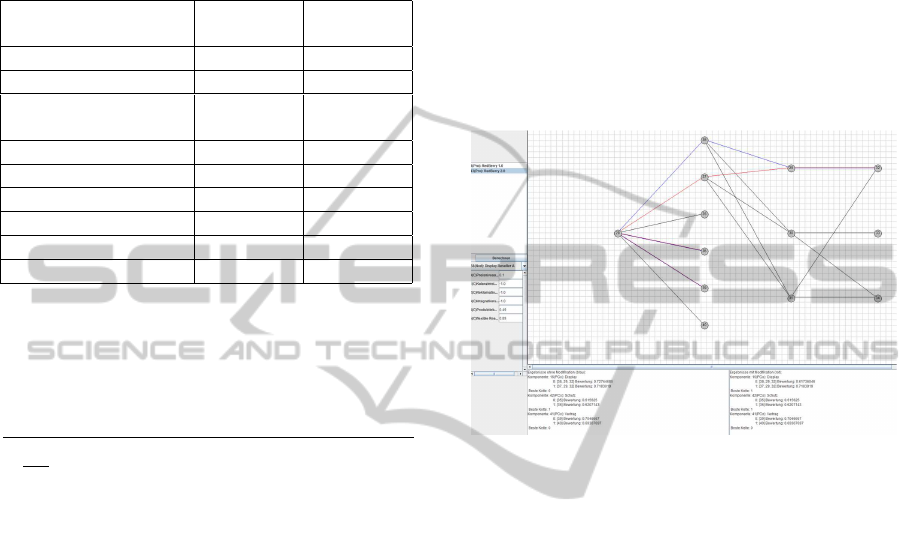

in the visualizer (see figure 1), which selects the first

node without outgoing edges, that is created normally

the focal supplier, and from that of the network of ac-

cessible nodes. Unreachable nodes are neglected by

the program. Results are shown in the graph in color.

Left of the window there is a range of products pro-

duced by the focal supplier, and can be run on one of

the calculation. Below the selection, the button is to

start the calculation and a way to adjust the criteria

forms for a particular node in the network. These ad-

justments will result in a rule also in a different calcu-

lation and presented in the graph in a different color.

Figure 1: Visualizer.

6 CONCLUSIONS AND

OUTLOOK

Aim of this paper was to develop a model for risk as-

sessment of suppliers for hybrid value bundles. For

this purpose, specific characteristics of hybrid value

bundles were identified and different methods of risk

assessment in supplier relationships were evaluated.

Based on these findings, a new mathematical model

for risk assessment of suppliers has been developed

for supply networks for hybrid value bundles. This

model is based on a scoring method with a decision

catalog in addition to a moving average method. Ad-

vantage of this model in contrast to existing risk man-

agement models is the possibility to deal with incon-

sistent information from single suppliers but never-

theless giving a complete risk assesment of the whole

supply chain for the focal supplier. To demonstrate

this model, a software program was developed that

demonstrates the different uses of the risk model.

It is shown that the model provides comprehen-

sible and well interpretable results that allow sellers

of hybrid value bundles to offer their solutions with

a minimized risk in the market. The model presented

is variable in the criteria and can therefore be used to

RISK MANAGEMENT IN SUPPLY NETWORKS FOR HYBRID VALUE BUNDLES - A Risk Assessment Framework

161

identify an optimal supplier strategy for certain hybrid

offerings. In addition, the model can be used to act in

the operational procurement as a basis for decision,

if one of the risks occurring in the procurement and

the question of an optimal alternative variant arises.

In summary, the presented model represents an opti-

mization of supplier relations for supply chain man-

agement for hybrid value bundles.

The proposed model is a first step towards a com-

prehensiverisk management as seen in the supply net-

works for hybrid value bundles. As further steps, sev-

eral aspects are possible. First, the inclusion of the

time factor and thus a widening in the direction of op-

erational procurement. Another factor is the fact that

may not all suppliers of the focal supplier deliver the

required information. In the lead set out in this work-

ing model, this would indeed be a quite acceptable

result in large variance values but could still compli-

cate the interpretation from the perspective of the fo-

cal supplier. Thus the question remains of how to deal

with incomplete information in such a model. The last

major point is the fact that the focal supplier may have

a different implementation of the criteria list than an-

other supplier in the network.

REFERENCES

Becker, J., Beverungen, D., and Knackstedt, R. (2008).

Wertsch¨opfungsnetzwerke von produzenten und dien-

stleistern als option zur organisation der erstellung hy-

brider leistungsb¨undel. In Wersch¨opfungsnetzwerke,

pages 3–31. Physica-Verlag HD.

Beucker, S. (2005). Ein Verfahren zur Bewertung von

Lieferanten auf der Grundlage von Umweltwirkungen

unter Ber¨ucksichtigung von Prozesskosten. Disserta-

tion, Universit¨at Wiesbaden.

B¨ohmann, T. and Krcmar, H. (2007). Hybride pro-

dukte: Merkmale und herausforderungen. In

Wertsch¨opfungsprozesse bei Dienstleistungen Forum

Dienstleistungsmanagement, pages 239–255. Gabler

Verlag.

Braithwaite, A. and Hall, D. (1999). Risky business? crit-

ical decisions in supply chain management (part 1).

Supply Chain Practise, 1:40–57.

Burianek, F., Ihl, C., Bonnemeier, S., and Reichwald,

R. (2007). Typologisierung hybrider Produkte: Ein

Ansatz basierend auf der Komplexit¨at der Leistungser-

bringung, volume 2007,01. TUM Lehrstuhl f¨ur Be-

triebswirtschaftslehre - Information Organisation u.

Management, M¨unchen.

Burr, W. (2002). Service Engineering bei technischen Di-

enstleistungen: eine ¨okonomische Analyse der Modu-

larisierung, volume 286. DUV, Wiesbaden.

Corsten, H. and G¨ossinger, R. (2008). Einf¨uhrung in das

Supply Chain Management. Lehr- und Handb¨ucher

der Betriebswirtschaftslehre. Oldenbourg, M¨unchen.

Fettke, P. and Loos, P., editors (2007). Reference modeling

for business systems analysis. IGI Global and Idea

Group Publ., Hershey, Pa.

Galbraith, J. (2002). Organizing to deliver solutions. Orga-

nizational Dynamics, pages 194–207.

G¨otze, U., Henselmann, K., and Mikus, B. (2001). Risiko-

management. Physica-Verlag Heidelberg.

Heyder, M., Fahrtmann, K., and Theuvsen, L. (2009).

Lieferantenbewertung in der lebensmittelindustrie.

Jahrbuch der ¨osterreichischen Gesellschaft f¨ur

Agrar¨okonomie, pages 61–70.

Hirschheim, R., Klein, H. K., and Lyytinen, K. (1995). In-

formation systems development and data modeling:

Conceptual and philosophical foundations. Cam-

bridge Univ. Press, Cambridge.

Johansson, J. E. , Krishnamurthy, C., and Schlissberg, H. E.

(2003). Solving the solutions problem. McKinsey

Quarterly, (3):116–125.

Janker, C. (2008). Multivariate Lieferantenbewertung:

Empirisch gest¨utzte Konzeption eines anforderungs-

gerechten Bewertungssystems. Gabler Verlag.

Koppelmann, U. (2003). Beschaffungsmarketing. Springer-

Verlag GmbH.

March, J. and Shapira, Z. (1987). Managerial perspectives

on risk and risk taking. Management Sience, 11:1404–

1418.

M¨ussigmann, N. (2006). Evaluierung und Auswahl von

strategischen Liefernetzen unter Ber¨ucksichtigung kri-

tischer Knoten. PhD thesis, Universit¨at Augsburg,

Augsburg.

Pousttchi, K., Schr¨odl, H., and Turowski, K. (2009). Char-

acteristics of value bundles in rfid-enabled supply net-

works. The Ninth International Conference on Elec-

tronic Business (ICEB 2009), pages 886–893.

Reiss, M. and Pr¨auer, A. (2001). Solutions providing:

Was ist vision-was wirklichkeit? Absatzwirtschaft,

5(44):48–53.

Sawhney, M., Wolcott, R., and Arroniz, I. (2006). The 12

different ways for companies to innovate. MIT Sloan

Management Review, 47(3):75–81.

Schr¨odl, H., Gugel, P., and Turowski, K. (2010). Mod-

ellierung strategischer liefernetze f¨ur hybride leis-

tungsb¨undel. In Diskussionsbeitrag des 2. Workshops

Dienstleistungsmodellierung, Klagenfurt,

¨

Osterreich.

Svensson, G. (2002). A conceptual framework of vulnera-

bility in firms inbound and outbound logistics flows.

International Journal of Physical Distribution & Lo-

gistics Management, 32:110–134.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

162