STOCK MARKET FORECASTING BASED ON WAVELET AND

LEAST SQUARES SUPPORT VECTOR MACHINE

Xia Liang, Haoran Zhu and Xun Liang

School of Information, Renmin University of China, Beijing, China

Keywords: Wavelet transforms, Least squares support vector machine, Stock price prediction, Noisy signal, Machine

learning.

Abstract: In this paper, we propose a novel method using wavelet transform to denoise the input of least squares support

vector machine for classification of closing price of stocks. The proposed method classifies closing price as

either down or up. We have tested the proposed approach using passed three-year data of 10 stocks randomly

selected from sample stock of hs300 index and compared the proposed method with other machine learning

methods. Good classification percentage of almost 99% was achieved by WT-SVM model. We observed that

the performance of stock price prediction can be significantly enhanced by using hybrized WT in comparison

with a single model.

1 INTRODUCTION

Stock price prediction is an important financial

subject that has attracted lots of attentions from

researchers for many years(Liang et al,2009a). In the

past years, conventional statistical methods were

employed to forecast stock price. However, stock

price series are generally quite noisy and

non-stationary. To solve this problem, numerous

machine learning methods are adopted.

Tay and Cao(2001)used back-propagation neural

network and SVR and proved that SVR forecasts

better than BP neural network. Kim(2003)also used

BP and SVRs and in terms of movement direction it

proved that SVR outperformed back-propagation

neural network. Huang et al.

(2005) compared SVR

with linear discriminate analysis ,quadratic

discriminate analysis and Elman BPN and observed

that SVR forecasts better than other techniques in

terms of movement direction. Pai and Lin(2005)

proposed a hybrid model of ARIMA and SVM and

proved that the hybrid model forecasts better than

SVR and ARIMA.

Although SVM is useful in predicting the stock

price, lots of studies ignored the non-stationary of the

financial serials which are caused by political events,

economic conditions, traders’ expectations and other

environmental factors, are an important characteristic

of price serials(Abu&Atiya,1996). This variability

makes it difficult for any single machine learning

technique to capture the non-stationary property of

the data.

In our study, a prediction method using wavelet

transform to denoise the input of LS-SVM is

proposed. The performance between WT hybrid

model and single model are compared. All the models

are tested by past three-year financial serials of 10

stocks randomly selected from sample stocks of

hs300 index. The remainder of this paper are

organized as follows. In section 2, we introduce the

basic theory of WT and LS-SVM briefly. Section 3

gives the experiment scheme. The experiment results

are shown in Section 4. Finally conclusions are drawn

in Section 5.

2 THEORY OF WAVELET

TRANSFORM AND LS-SVM

2.1 Wavelet Transform

Wavelet is a kind of special waveform with limited

length and zero average (Chen&Guo,2005). Suppose

ψ

(t) is a quadratically integrable function, that is

ψ

(t) ∈ L

2

(R), if its Fourier transform satisfies the

following condition:

46

Liang X., Zhu H. and Liang X..

STOCK MARKET FORECASTING BASED ON WAVELET AND LEAST SQUARES SUPPORT VECTOR MACHINE.

DOI: 10.5220/0003436500460053

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 46-53

ISBN: 978-989-8425-54-6

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

=

|

(

)|

|

|

<+∞

(1)

Then

ψ

(t) is a basic wavelet or mother wavelet.

Equation (1) is the sufficient condition of mother

wavelet. By expanding and translating the wavelet

function, we can get

,

(

t

)

=

1

√

ψ

−

,>0,∈

(2)

a is called scale parameter and b is translation

parameter.

ψ

a,b

(t) is a wavelet function dependent on

parameter a and b. If a and b are continuous

parameters, then

ψ

a,b

(t) is a continuous wavelet

function. However, when using computer to deal with

signal, we usually use discrete wavelet function

instead and its reverse transform. Discrete wavelet

transform is as follows:

(

)

(

,

)

=

/

()Ψ

−

d (3)

is conjugate function of Ψ

.

The reverse of discrete wavelet:

(

)

=

〈

,

,

〉

∙

,

,

(

)

=

1

(

,

)

∙

,

,

(

)

(4)

In practice, useful signal is low frequency signal

or stationary signal while noise signal is high

frequency signal(Yin&Zheng,2004). To denoise the

signal, first we can use mother wavelet function to

decompose the signal and get the noise which is in the

high frequency component. Then we use threshold to

deal with the high frequency coefficients and we can

achieve the end by reconstructing all the components.

For the most popular denoising method, the signal is

firstly Fourier transformed and then using low-pass

filter among the frequency domain. As Fourier

transform cannot deal with time-frequency analysis,

it will smooth the mutations of the signal while

wavelet transform will keep mutations of the original

signal(Chen et al.,2001). So in order to denoise the

financial time serials, wavelet transform is a better

choice than Fourier transform. We can use wavelet

transform to denoise the signal by the below three

steps.

z Step 1 wavelet decomposition: choose the

wavelet and the decomposition level j and

then decompose the given signal. For

example if the decomposition level is three

the high frequency components will be

cD1-cD3 and low frequency will be cA3.

z Step 2 use threshold to denoise high

frequency coefficients: choose different

threshold value to modify the detail

coefficients for 1 to j-1 level.

z Steps 3 reconstruct the signal: based on the

low frequency coefficients and the modified

high frequency coefficients, reconstruct the

signal.

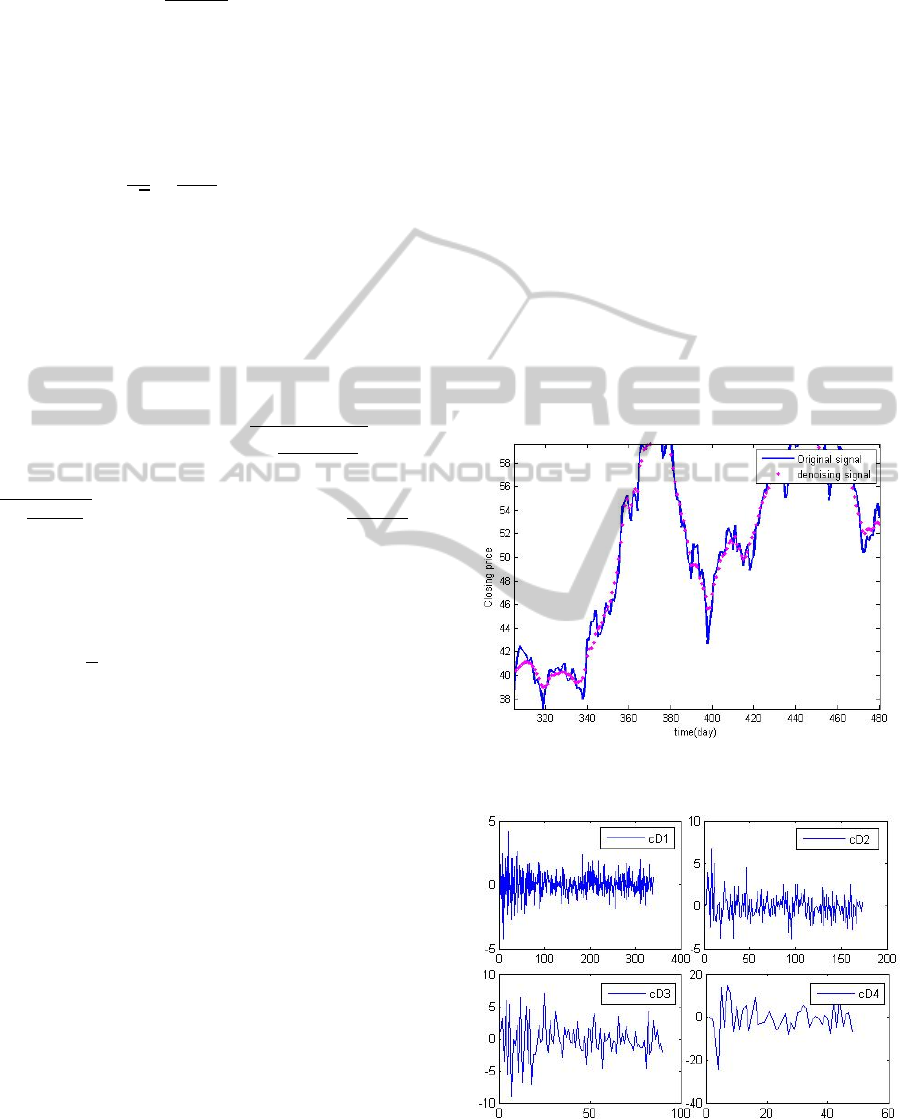

In Figure 1 the solid blue curve is the original

financial signal and the dashed red one is

reconstructed with WT. We can see that the denoised

signal is much smoother and less fluctuate than the

original one. Figure 2 shows its four components in

details, cD1-cD4, obtained after the application of the

WT. These details correspond to the highest

frequency components of the signal using different

sizes of time windows for each scales(Mallat,1999).

Figure 1: The original signal (blue solid curve) and

denoised signal obtained with WT (red dot).

Figure 2: Signal’s components of details cD1-cD4 obtained

with WT.

STOCK MARKET FORECASTING BASED ON WAVELET AND LEAST SQUARES SUPPORT VECTOR MACHINE

47

2.2 The Least Squares Support Vector

Machine (LS-SVM)

The standard SVM is solved by using quadratic

programming methods. However, these methods are

often time consuming and are difficult to implement

adaptively. Least squares support vector machines

(LS-SVM) is capable of solving both classification

and regression problems and is receiving more and

more attention, because it has some properties related

to the implementation and computational method

(Suykens&Vandewalle, 1999; Suykens et al., 2002).

For example, training requires solving a set of linear

equations instead of solving the quadratic

programming problem involved in the original SVM,

and consequently the global minizer is much easier to

obtain. The original SVM formulation of Vapnik

(1998) is modified by considering equality

constraints within a form of ridge regression rather

than considering inequality constraints. In LS-SVM,

the Vapnik’s standard SVM classifier was modified

into the following formulation(Zheng et al.,2004):

2

1

11

min ( (5)

22

n

T

k

k

J ω,b,ξ)= ωω+ γ e

=

∑

Subjected to

[ ( ) ] 1 1,....,

T

ii k

y ωτ

x

beandk n+=− =

The corresponding Lagrange for Equation (5) is

()()

()

[]

{}

1

,,, , ,

1,(6)

n

T

kk k k

k

Lbe J be

yxbe

ωα ω

αωτ

=

=

−+−+

∑

α

k

is the Lagrange multiplier shown in

Ref(

Cristianini&Shawe,2000).The optimality

condition leads to the following [(N+1)× [N+1]]

linear system:

1

0

0Y

(7)

1

Y

T

T

b

ZZ I

α

γ

−

⎛⎞

⎛⎞⎛⎞

=

⎜⎟

⎜⎟⎜⎟

+

⎝⎠⎝⎠

⎝⎠

Where

1

11

1

() ,...,()

[ ,..., ]; [ ,..., ] (8)

i

i

nn

T

y

T

Zxy x

Yy y and

ττ

αα α

⎡⎤

=

⎢⎥

⎣⎦

==

In this paper LS-SVR represents least squares

support machine regression and LS-SVC represents

support machine classification.

3 EXPERIMENT DESIGN

3.1 Data Collection

We obtain the recent three year data from the finance

section of Yahoo. The whole data set covers the

period from January 1, 2008 to Dec 31, 2010 of 10

stocks. Each daily observation includes 6 indicators:

opening price, highest price, lowest price, closing

price, volume, and turnover. We examined 10

random stocks whose code can be found in Table 5.

We believe that the time periods cover many

important economic events, which are sufficient for

testing the issue of non-stationary properties inherent

in financial data.

3.2 Model Inputs & Outputs Design

For machine learning techniques combining with

WT, Original closing price was first decomposed and

reconstructed using wavelet transform. Symbol data

2008_2010 represents the original data and XC is

obtained from the closing price processed by WT. We

tried to design the input variables. Input variables

include VolumeIndex, CloseIndex, MeanClose,

RangeIndex, MaxHigh, MinLow, TurnoverIndex. All

of them were transformed according to passed 10-day

data. This design may improve the predictive power

of artificial methods. The output variable is

L+1-close. The input variables are determined by

lagged data2008_2010 values based on L-day

periods. L is the time window which is set to 10.In our

study we predict the closing price of 11

th

day based

on the last 10-day information. The calculations for

all variables can be found in Table 1. All the values

were first scaled into the range of [-1, 1] to normalize

each feature component so that larger input attributes

do not overwhelm smaller inputs. 500 observations

were used for training and 100 for testing.

3.3 Performance Criteria

The prediction performance is evaluated using the

following statistical methods: mean absolute

percentage error (MAPE), directional symmetry (DS)

and weighted directional symmetry

(WDS)(Kim,2003). The definitions of these criteria

can be found in Table 2.MAPE is the measure of the

deviation between actual values and predicted values.

The smaller the values of MAPE, the closer are the

predicted time series values in relation to the actual

values. Although predicting the actual levels of price

changes is desirable, in many cases, the direction of

the

change is equally important. DS provides the

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

48

Table 1: Input and output variables.

Feature Calculation

Input variable

VolumeIndex data2008_2010 (L+i-1,6)/mean(data2008_2010 (i:L-1+i,6))

CloseIndex data2008_2010 (L+i-1,5)/mean(data2008_2010 (i:L-1+i,5))

MeanClose Noise:Mean(data2008_2010 (i:L-1+i,5)) Denoise:Mean(XC(i:L-1+i,5))

RangeIndex max(data2008_2010(i:L-1+i,3))-min(data2008_2010(i:L-1+i,4))

MaxHigh max(data2008_2010(i:L-1+i,3))

MinLow min(data2008_2010(i:L-1+i,4))

TurnoverIndex mean(data2008_2010(i:L-1+i,7))

Output variable

L+1-Close Noise:data2008_2010(L+i,5)

1

,signfdata2008_2010(L+i,5)-data2008_2010(L+i-1,5))

2

;Denoise:

XC(L+i,1)

1

, signf(XC(L+i,1)-XC(L+i-1,1))

2

Notes:1 –while using LS-SVR;2-while using LS-SVC;signf

(

x

)

=

−1, x<0

1, x≥0

Table 2: Performance criteria and their calculation.

Metric Calculation

MAPE MAPE=(1/n)*∑

i=1

n

|a

i

-p

i

|

DS DS=1/n*∑

i=1

n

d

i

d

=

1

(

a

−p

)(

p

−p

)

0

WDS WDS=∑

i=1

n

d

i

*|a

i

-p

i

|/∑

i=1

n

d

i

’*|a

i

-p

i

|

d

=

0

(

a

−p

)(

p

−p

)

1

d

=

1

(

a

−p

)(

p

−p

)

0

correctness of the predicted direction of closing price

in terms of percentage; the larger values of DS

suggest a better predictor. WDS measures the

magnitude of the prediction error as well as the

direction. It penalizes error related to incorrectly

predicted directions and rewards those associated

with correctly predicted directions. The smaller the

value of WDS, the better is the forecasting

performance in terms of both magnitude and

direction.

3.4 Wavelet Denoising Implementation

There are two metrics to evaluate the performance of

WT denoisng. One is PERFL2 (Accardo&Mumolo,

1998).It is a percentage, representing how much

energy and mutations are reserved from the original

signal. The larger PERFL2 , the better wavelet

denoising will be. The other is norm of the difference

between original signal and reconstructed signal. The

smaller the norm, the more approximate the

reconstructed signal will be to the original signal.

For the process of WT denoising implementation,

there are two significant things-determining the

wavelet function and the threshold function. As the

wavelet function is not unique, different wavelet

functions may lead to absolutely different results.

Thus, it is a key point to choose an appropriate

wavelet function. Below we used the same threshold

which is automatically got by the ‘minimaxi’

function(FeiSi,2005) and compared three main

wavelet functions’ denoising effect. From Table 3 we

can see that wavelet function ‘sym6’ gives the best

STOCK MARKET FORECASTING BASED ON WAVELET AND LEAST SQUARES SUPPORT VECTOR MACHINE

49

denoising effect. The PERFL2 of ‘sym6’ is the

largest which means it removes the noise and keeps

the mutations of the original signal best. The Norm of

‘sym6’ is the smallest, that is to say, the reconstructed

signal is most appropriate to the original signal. Table

4 demonstrates that the threshold function ‘minmaxi’

is the best choice whose PERFL2 is the largest and

the Norm is the smallest.

Table 3: Denoising effect of different wavelet.

Wavelet function PERFL2 Norm

sym6 99.9366 25.7364

db4 99.9305 26.4097

Haar 99.9305 26.4097

Table 4: Denoisng effect of different threshold.

threshold rules PERFL2 Norm

Minmaxi 99.9366 25.7364

Rigrsure 99.9143 35.1875

Heursure 99.9291 26.6613

3.5 LS-SVM Prediction

Implementation

The typical kernel functions are the polynomial

kernel k(x,y)=(x*y+1)

d

and the RBF kernel

k(x,y)=exp(-(x-y)

2

/σ

2

), where d is the degree of the

polynomial kernel and σ

2

is the bandwidth of the RBF

kernel(

Goudarzi&Goodarzi,2008). In our

experiment, we chose the RBF kernel as our kernel

function because it tends to achieve better

performance (Liang&Wang, 2009b). The specific

steps are as follows:

z Step 1: Define N as the size of training data and

M as the size of testing data. Choose N+M

random unrepeated data from the normalized

data set. The former N will be used to training

the SVM model and the latter M will be used to

test the model performance. In our experiment

we set N=500, M=100.

z Step2: Train the SVR and SVC model by

choosing the LS-SVM type as ‘function

estimation’ and ‘classification’ respectively.

z Step3: Compute the metrics.

z Step4: Repeat all the steps for 10 selected

stocks.

3.6 Other Machine Learning Methods

In order to prove the better performance of wavelet

transform denoisng and the high prediction of

LS-SVM, we chose two neural network methods to

predict the financial signal and compare their

performance(Gao,2007).

First, we established the BP neural network model

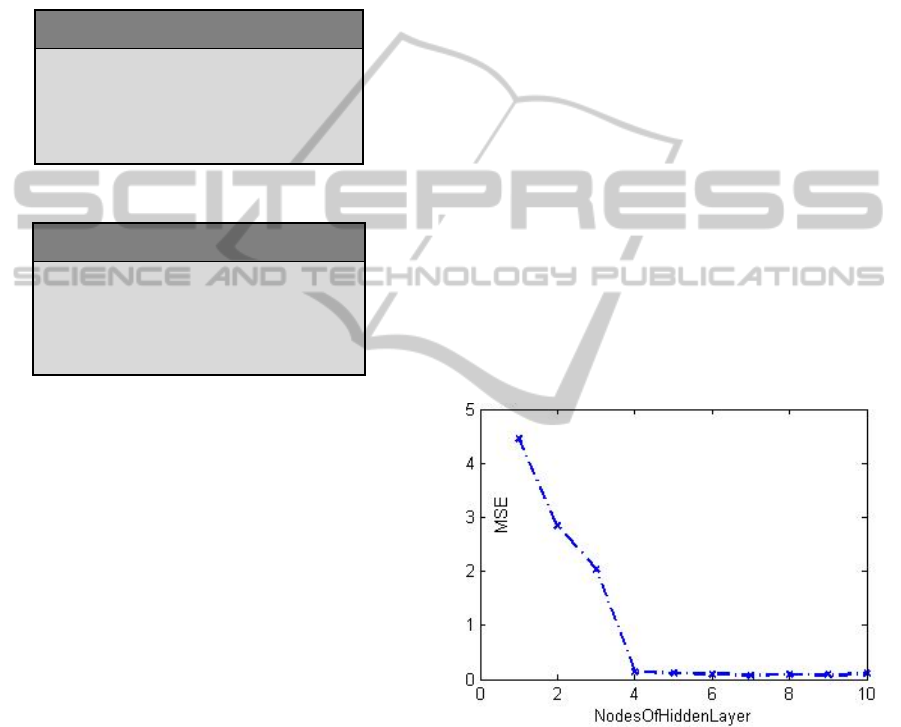

using the data defined by Table 1.The difficulty in

building the BP model is to find the best number of

nodes of the hidden layer (which we define as m).

According to formulation m = sqrt (n+l) +a (n is the

number of the nodes of input Layer and l is number of

nodes of output Layer), we get Figure 3 which prove

that when m equals eight, the model will perform

very well.

Second, we used the same time serials to build a

RBF (radius bias function) neural network

model.RBF neural network is a kind of efficient

feed-forward neural network, having best

approximation property and global optimal

performance which other networks do not have. Its

structure is very simple and the model training is very

fast. Meanwhile, the RBF neural network is also

widely used in pattern recognition, nonlinear pattern

recognition and the field of nonlinear neural network

modelling.

Figure 3: Nodes of hidden layer of BPN.

4 EXPERIMENT RESULTS

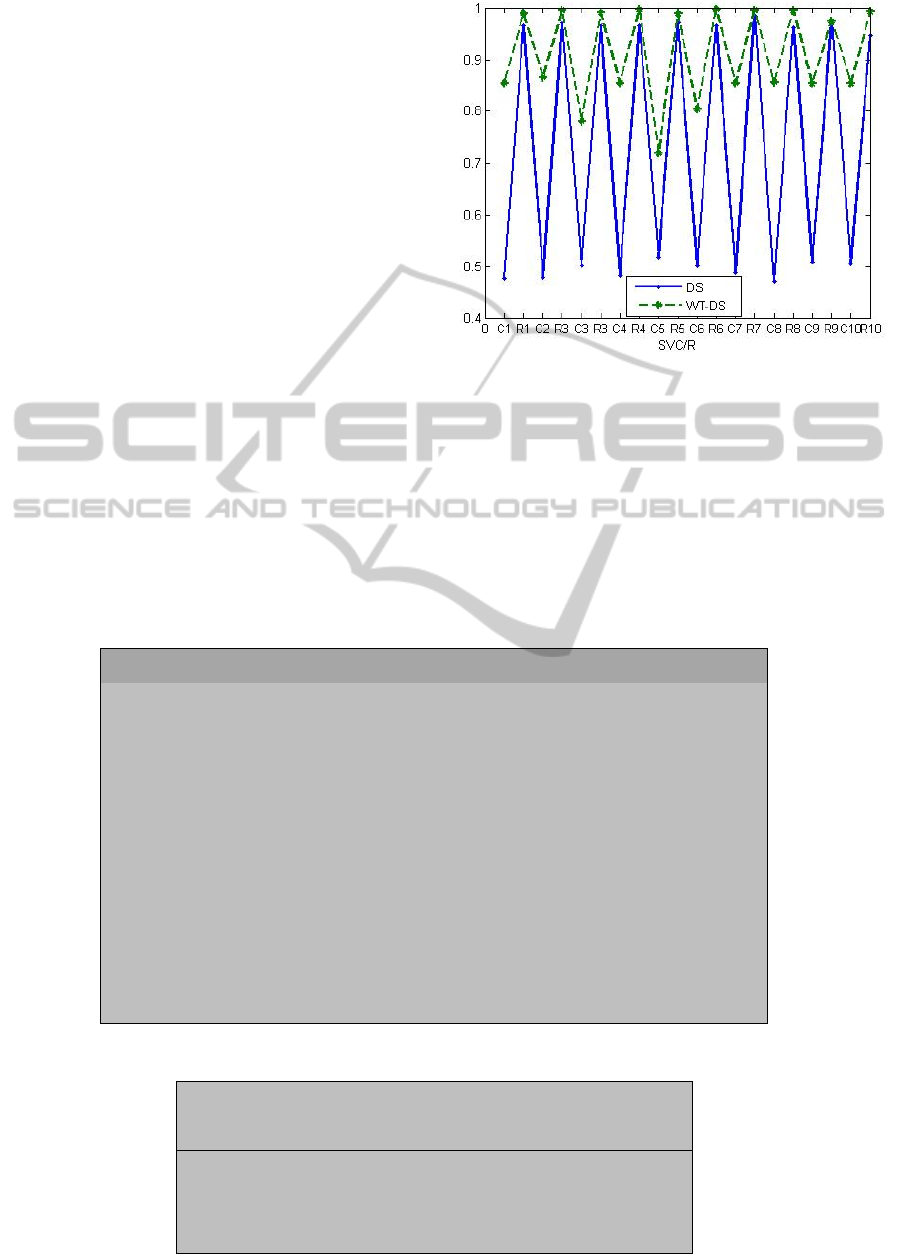

The results of single LS-SVM and WT-LS-SVM

model are shown in Table 5. The values of DS are

larger in the SVRs than in the SVCs and larger in the

WT model than the single model. This suggests that

in terms of correctness of the predicted direction of

closing price, the SVRs and WT model offers better

prediction and WT-SVRs give the best prediction.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

50

The results are tested and consistent in all 10 stock

data sets. Figure 4 shows that the WT hybrid model

outperforms the single SVM model.

In Figure 4, for the x axis, the Ci(i=1,2,…,10)

points are the values of SVCs and the Ri(i=1,2,…,10)

points are the results of SVRs. Table 5 and Figure 4

demonstrate that when the data is denoised by

wavelet transformation the prediction result is more

accurate and the deviation between the actual value

and prediction value is smaller. Specifically,

(1) SVRs has a accuracy rate more than 90% in

both single SVM and WT-SVM model. That means

SVR has a good ability to deal with outliers.

(2) The performance of SVCs is improved greatly

from less 50% to more than 80% after hybrid with

WT.

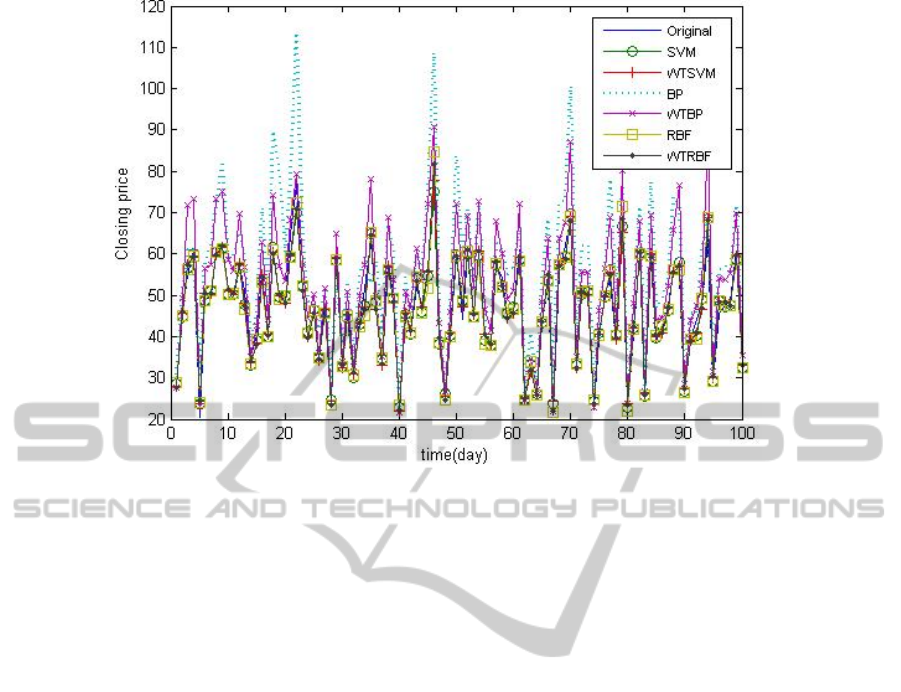

To better prove the effectiveness of wavelet

transform, we compared the performance of SVM

with that of BP and RBF neural network. The fitting

comparisons are shown in Figure 5 and the prediction

performance is shown in Table 6.

From Figure 5 we can see that the fitting values of

all the methods except BP are extremely approximate

to the original values. For BP, the hybrid model

outperforms greatly than the single BP.

Figure 4: DS of single SVM and WT-SVM.

The results of different machine learning methods

are shown in Table 6. In terms of MAPE, WDS,

we

observe that the WT hybrid model achieves

smaller values than the single model does on the

testing data set. This suggests that the WT model can

have smaller deviations between predicted values and

actual ones than the single model. The values of DS

are

larger in the WT model than single model. This

Table 5: Prediction performance of single SVM and WT model.

StockCode DS WT-DS StockCode DS WT-DS

601328 0.476(SVC) 0.855(SVC) 600102 0.501(SVC) 0.804(SVC)

0.966(SVR) 0.99(SVR) 0.965(SVR) 0.998(SVR)

600016 0.479(SVC) 0.866(SVC) 600282 0.488(SVC) 0.855(SVC)

0.971(SVR) 0.996(SVR) 0.986(SVR) 0.996(SVR)

601166 0.501(SVC) 0.781(SVC) 601003 0.472(SVC) 0.857(SVC)

0.966(SVR) 0.991(SVR) 0.962(SVR) 0.995(SVR)

600036 0.482(SVC) 0.855(SVC) 600376 0.509(SVC) 0.854(SVC)

0.965(SVR) 0.997(SVR) 0.975(SVR) 0.975(SVR)

601318 0.517(SVC) 0.719(SVC) 600350 0.505(SVC) 0.854(SVC)

0.971(SVR) 0.989(SVR) 0.948(SVR) 0.993(SVR)

Table 6: Prediction performance of different methods.

SVM

WT

SVM

BP

WT

BP

RBF

WT

RBF

MAPE 1.33 1.25 9.29 6.45 1.43 1.27

DS 0.97 0.99 0.87 0.91 0.96 0.97

WDS 0.03 0 0.16 0.1 0.05 0.03

STOCK MARKET FORECASTING BASED ON WAVELET AND LEAST SQUARES SUPPORT VECTOR MACHINE

51

Figure 5: Fitting values of different methods.

suggests that in terms of correctness of the predicted

direction of closing price, the WT model gives better

prediction. Comparing WT-RBF with SVM, we can

see that the values of their DS and WDS are the same

while the MAPE of WT-RBF is smaller than that of

single SVM.That means the WT-RBF model can

have smaller deviations between predicted values and

actual ones than the single SVM model. Thus, the

SVR model does not outperform the neural network

model which is not consistent with the conclusions of

most of recent studies like Huang et al. (2005).

5 CONCLUSIONS AND FUTURE

WORK

This study used LS-SVM to predict future direction

of stock price and the effect of the noise of time

serials in LS-SVM was considered. The experiment

results showed that the prediction performance was

increased by using wavelet transform hybrid model.

In addition, this study compared SVM model with

other machine learning methods. The experiment

results showed that single SVM may not have better

prediction performance than RBF neural network

model which is different from general studies. Hybrid

with wavelet transform, SVR model becomes

absolutely perfect as in terms of correctness of the

predicted direction of closing price. In this paper we

can see the WT-SVM model always gives above 90%

accuracy.

There are some other issues which may enhance

the prediction performance of SVM. For instance, the

sentiment analysis of financial news will be a very

interesting topic in the future. Whether the sentiment

value is a kind of noise needs to further study. The

feature vector based on wavelet transform mentioned

above has a good performance, but this vector might

not be the optimal choice. Therefore, the research on

the comparison of feature vector adding the sentiment

value is our following work.

ACKNOWLEDGEMENTS

This work was supported by the Fundamental

Research Funds for the Central Universities, and the

Research Funds of Renmin University of China plus

10XNI029 plus Research on Financial Web Data

Mining and Knowledge Management, the Natural

Science Foundation of China under grant 70871001,

and the 863 Project of China under grant

2007AA01Z437.

REFERENCES

Abu-Mostafa, Y. S., & Atiya, A. F., 1996. Introduction to

financial forecasting. Applied Intelligence, 6(3),

205-213.

Accardo, A. P., & Mumolo, E.,1998. An algorithm for the

automatic differentiation between the speech of

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

52

normals and patients with Friedreich’s ataxia based on

the short-time fractal dimension. Computers in Biology

and Medicine, 28(1), 75-89.

Available from http://www.mathworks.com.[Accessed on

20th Jan, 2011].

Chen, G. M., Zhang, M. Z., & Qi, Y. H., 2001. Application

of MATLAB language processing digital signals and

digital image. Beijing: Science Press, 125-127.

Chen, L. Z., & Guo, H, W., 2005. Discrete wavelet

transform theory and engineering practice. Beijing:

Tsinghua University Press, 9-15.

Cristianini, N., Shawe-Taylor, J., 2000. An Introduction to

Support Vector Machines and Other Kernel-based

Learning Methods. Cambridge:Cambridge University

Press.

FeiSi Technology R & D centre 2005. Wavelet analysis

theory and the implementation with MATLAB7. Beijing:

Electronic Industry Press, 328-330.

Gao, Q., 2007. The application of artificial nerve network

in the stock market forecast model. Microeclctronics&

Computer, 24(11), 147-151.

Goudarzi, N., & Goodarzi, M., 2008. Prediction of the

logarithmic of partition Nasser, etc. coefficients(log P)

of some organic compounds by least square-support

vector machine(LS-SVM). Molecular Physics,

106(21-23), 2525-2535.

Huang, W., Nakamori, Y., & Wang, S. Y., 2005.

Forecasting stock market movement direction with

support vector machine. Computers & Operations

Research, 32(10), 2513-2522.

Kim, K. J., 2003. Financial time series forecasting using

support vector machines. Neurocomputing, 55(1-2),

307-319.

Liang, X., Zhang, H. S., Xiao, J. G., & Chen, Y., 2009a.

Improving option price forecasts with neural networks

and support vector regressions. Neurocomputing,

72(13-15), 3055-3065.

Liang, X., & Wang, C., 2009b. Separating hypersurfaces of

SVMs in input spaces. Pattern Recognition Letters,

30(5), 469-476.

Mallat, S. G., 1999. A Wavelet Tour of Signal Processing.

San Diego: Academic Press.

Pai, P.-F., & Lin, C.-S. (2005). A hybrid ARIMA and

support vector machines model instock price

forecasting. Omega, 33, 497–505.

Strang, G., & Nguyen, T., 1997. Wavelets and Filter Banks.

Wellesley: Wellesley-Gambridge Academic Press.

Suykens, J. A. K., & Vandewalle, J., 1999. Least squares

support vector machine classifiers. Neural processing

letters, 9(3), 293-300.

Suykens, J. A. K., Gestel, T. V., Brabanter, J. D., Moor, B.

D., &Vandewalle, J., 2002. Least Squares Support

Vetor Machine Classifiers. Singapore: World Scientific

Publishing Co. Pte.Ltd.

Tay, F.E.H., &Cao, L.J., 2001. Application of support

vector machines in financial time series forecasting.

Omega, 29, 309-317

Vapnik, V. N., 1998. Statistical Learning Theory, Wiley,

New York.

Yin, G. W., & Zheng, P. E., 2004. Forecasting stock market

using wavelet theory. Systems engineering-theory

methodology applications, 13(6), 543-547.

Zheng, S., Liu, L., & Tian, J. W., 2004. A new efficient

SVM-based edge detection method. Pattern

Recognition Letters, 25(10), 1143-1154.

STOCK MARKET FORECASTING BASED ON WAVELET AND LEAST SQUARES SUPPORT VECTOR MACHINE

53