STUDY ON THE INFORMATION SECURITY SYSTEM

FOR BANK IN CHINA

Xichen Jiang, Zhenji Zhang

Institute of Economics and Management, Beijing Jiaotong University, Jiaotong University East Street, Beijing, China

Feng Cao

Institute of Economics and Management, Beijing Jiaotong University, Jiaotong University East Street, Beijing, China

Keywords: Bank, Information security, Information technology, Security system, Management.

Abstract: During the wide use of the new network technology in finance, the electronic finance, commercial services

on the net, and the cash payment system bring convenience to us, at the same time, it also brings lot of

hidden dangerous and financial risk. Now this paper will construct a security system for the information

system in bank based on contemporaneous theory of information safety and using the combination of

information technology and the methods of management.

1 INTRODUCTION

The usage of information technology in council,

commerce and finance brings out big change of

people’s life style. We are enjoying the big

transform of network technology, however, at the

same time; we have to face the problems coming

from the data and information attack. The safety

threaten of the information system are becoming

more and more serious. Lots of system holes are

used for bad things. All of these can bring hard

burden to the information system. What is worse, it

will leak out the personal private information,

commerce secret and country secret. It will cause

break off of the bank operation system and cause

lots of dignify. Nowadays, the data are becoming

more and more concentrate, the problem of safety

are becoming more and more stand out.

With the high pace of social development, high-

tech is continuously applied to all aspects of our life,

particularly the financial sector such as processing

information transfer. For example, currently e-

commerce, online banking and electronic remittance

processing business are widely used in our banks. To

some extent, the bank's computer data takes place of

money as a general equivalent, the transfer of

information using computer network has taken place

of the physical exchange of notes. This will be the

future of the financial industry; will greatly change

the traditional social life, production patterns and

social structures. Computer network spread rapidly

in the banking industry, while providing

convenience. However, how to ensure the security of

bank computer network reliability is the problem.

While the bank's dependence on the information

technology staffs is becoming more and more, the

risk also becomes very prominent. This requires

banks to strengthen their own vulnerability

detection. However, weak awareness of security is

the universal problem in China’s banks. Therefore,

how to ensure the information network system for

banking services becomes particularly important.

2 PERTINENT KNOWLEDGE

2.1 The Concept of Information

Security

Information security is to protect the secrecy,

integrality, usability, controllable and undeniable of

information, apply service and information facility.

It consists of information environment, information

network, information application and so on.

As searching correlative literature, we can find

that the information development in our county’s

bank has been in the stage of operation system

190

Jiang X., Zhang Z. and Cao F..

STUDY ON THE INFORMATION SECURITY SYSTEM FOR BANK IN CHINA.

DOI: 10.5220/0003477201900195

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 190-195

ISBN: 978-989-8425-55-3

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

conformity, concentrate of data. During the

development of information technology, there are

more and more threaten for information security.

Their methods are changing all the time and now

information security has been staring us in the face.

2.2 Status of Bank Information

Security

Now the methods taken for information system

security in China include the following:

(1) In the security for storage of database, the

operation system encrypt the key field and come into

field storage in order to ensure the validity of the

data changing and keep from nonlicet data changing.

(2) Control accessing purview, foreground

application and operation system set different

purview for users in different levels when the users

are trying to connect the database.

(3) Use cryptographic check for all local

transactions; through the designed program to shield

the system.

(4) When the application process is running, use

the way of signing to identify the operator, and

according to the operator's permission to control the

operator’s right. However, current application lacks

safety design and support issues.

(5) Taking into network security issues, banks

gradually using router and firewall products, these

products have a relatively strong network security

technology. But the products focus on local problem

rather the whole safety problem.

(6) Operations department develop and

implement a series of management systems and

operating rules, many of which related to computer

security issues, standardize the behavior of staff at

all levels. However, the safety management tools

drops behind.

2.3 Security Problems of Information

Systems of China Banks

China's information technology is not mature, first

of all, from the national scale, the system facilities is

not perfect, whether it is the completeness of the

information system facilities, or the breadth of its

application, diversity, the banking system has big

gap with the developed countries; Second, it is the

lack of qualified personnel, especially lack of

maintenance talents for bank information security.

The core issue has the following points.

1. Network security technology exist biases.

Many people believe that information security is

network security or computer security, so we put

pressure on the network making the network

complex. We set various control cards on the

information superhighway; however the result is less

effective. The most important point to protect is

information, we should be careful in the data

collection, storage, operating and analyzing.

2. Pay attention to the tools investment rather

than management investment. Investment in network

security is not entirely safe products investment and

tools investment, it should also include policies,

operating procedures and emergency handling

mechanism and other aspects of investment. The use

of security products and tools should have

appropriate environment of supporting process

management.

3. Application software in bank is very weak.

Bank's application software is the carrier of

information. Safety and quality of software is very

important including software development life cycle

and project management system. Nowadays more

and more holes in safety including technical and

management come from the quality of the

production of software.

4. Bank’s information and data management

contains safety holes. Most of the applications of

large banks are in the host application, the operating

system is relatively closed, and the information

storage is relatively safe. But the data and

information have risk in management, these data

include a variety of core business reports, customer

relationship data, office functions, risk control

information, etc., the information on the system

transfer through an open IP network transmission,

because the system's security holes, it is easily

penetrated by virus, loss of management information

is sometimes more dangerous than the loss of

business data.

5. Disaster prevention is a priority. With the

centralization of data, security risks are also

concentrated, often a data controls more than one

financial information processing, directly related to

the network's normal business, whether it is

software, host or network, it will have a huge

negative impact on society. In addition a variety of

disaster may lead to the data center does not work,

or even the loss of financial information. How to

design information security from the angle of

disaster, how to balance the investment and

information security is a problem that we must face.

Previous research shows that the current

researches in this area are from two aspects:

management and information technology. This is a

further research of previous research done by these

two aspects in order to get a secure system solution.

STUDY ON THE INFORMATION SECURITY SYSTEM FOR BANK IN CHINA

191

3 THE BANKING INFORMATION

SECURITY ARCHITECTURE

3.1 Security Risks of Banking Business

Security risks faced by banks, include the physical

layer, network and system layer, application layer,

and security management.

(1) Physical layer security risk. It includes

natural disasters, damage to the equipment room

because of accidents; power outages, disruption in

line system; the room and line electromagnetic

leakage, resulting in leaks and other system

information.

(2) Network and system level security risk. Risks

are caused by unauthorized access, malicious

attacks, viruses, invade, wiretapping and other

security ; operating system and database security

vulnerabilities, improperly security settings, and low

security level; lack of file system protection and

control of operations, applications exist back door.

Virus threat to security of information systems is an

important factor; the virus may cause information

leakage, data destruction or loss, network

congestion, and many other serious consequences.

(3) Application layer security risk. Key business

is facing the risk of impersonation and unauthorized

access; data may be stolen or unauthorized access,

modify and delete processing while transmission,

storage process. The information exchange and

sharing between different banks or between banks

and other sectors bring potential information

security risks.

(4) Management of security risks. Security

management is the most important part of security.

When the security products are becoming more and

more, the safety management of the product itself

becomes more complex. Also, because of security

management organizations, institutions and norms is

not perfect, there is a potential risk management.

Poor management brings more threaten to the

information system.

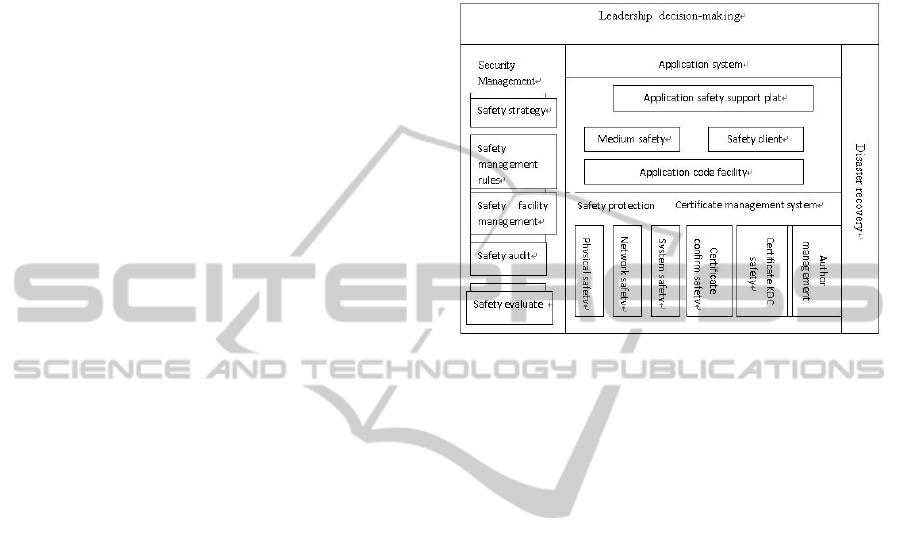

3.2 Design of Safety System

According to the characteristics of banking and

security requirements, in accordance with the

"network isolation, Fenwick protection; identity

authentication, authorization management ; layers of

protection, security management, "the security

policy should cover physical security, network

security, system security protection, application

security, security management, building a complete,

integrated information security system. Security

architecture of the logical structure is shown in

Figure 1 below.

The final sentence of a caption must end with a

period.

Figure 1: Security Architecture.

1. Leadership decision-making is in the top-level

in the security system to guide the entire information

security system’s construction, implementation and

coordination. Leadership decision-making system’s

guidance comes true through the safety management

system. Safety management systems, security

systems, certificate management systems and

disaster recovery system not only have the level

relations, but also interrelated, organic integration,

showing safety from different angles. Application

security support platform built on the security

protection system and security infrastructure systems

on the use of security services for applications and

information system operation to provide security

support for the protection, also accept the unified

management of the safety management system.

2. Security Management

Banking network and information security

management must keep the principle of the

combination of management and technology.

Comprehensive prevention, improve information

systems security capabilities. Safety management

system achieves commercial bank information

network security management, security management

platform specific implementation of the completion.

3. Construction of the Application System

Platform

For the bank card systems, securities trading

system, international settlement system, cash

payment systems, treasury systems, debt

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

192

bookkeeping system, foreign exchange transactions,

open market operations and other financial products

applications, these systems which have been running

should be regulated, and as smooth as possible

transfer to a unified platform. What is more, new on-

line system should use unified platform. For the

back-office applications of online banking, call

centers, mobile banking channels and other services

should concentrate to improve resource use

efficiency, so that can form and maintenance the

unified customer information.

4. Disaster Recovery

Bank’s data centralization of data resources has

the benefit of effectively integrated management and

depth analysis to achieve communication between

different applications and integration, so that can

play the maximum value of the data. This can cause

great impact on the operations of bank.. Meanwhile,

the bank data centralization also brings new risks

and challenges. To prevent the natural, human or

technical reasons to cause the damage of system

resources and system led to termination of service,

we must establish the appropriate backup and fast

disaster recovery mechanism. The main content of

the disaster recovery plan covers the choice of the

disaster backup center, construction and design of

the recovery plan. We should further strengthen the

banking center and backup data center’s

infrastructure. When we make system planning,

design, feasibility studies, project implementation,

testing, production preparation, switching stages

before the data’s concentrate, we should give full

consideration to the safety of the system, and accept

the competent authorities.

4 THE ESTABLISHMENT OF

BANK INFORMATION

SECURITY SYSTEM

The construction of bank information security is a

combination of planning, management, technical, is

a continuous process of dynamic development,

which consists of safety management and safety

technology. The two aspects are interdependent and

mutually support each other; we cannot achieve the

safety of the banking information network without

either of them.

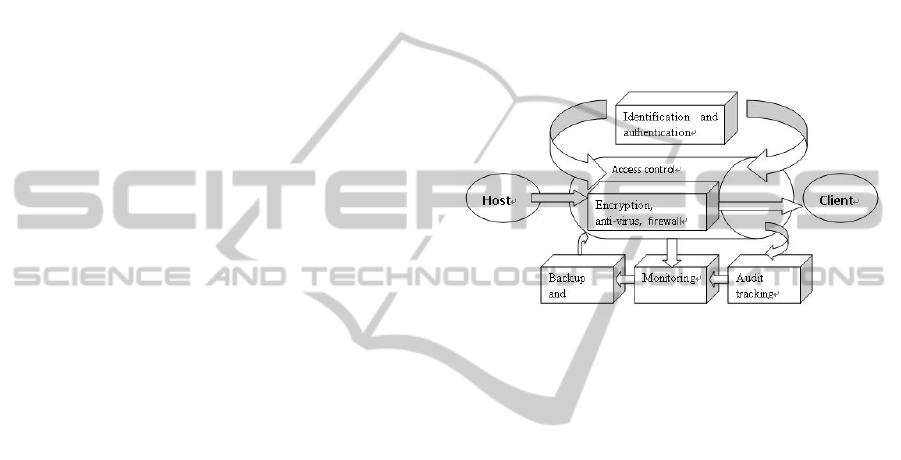

4.1 Establish Technology System

to Ensure Banking Information

Security

Computer network systems in the bank should use

advanced network security technologies. Its

technical means include access control, encryption

and data integrity protection, identification and

authentication, network anti-virus technology,

firewall, backup and recovery, monitoring, audit

tracking. The interaction between them in the order

is shown below.

Figure 2: Bank information security techniques.

(1) Access Control: In the application systems

we create authorized operation or transaction

definition table by setting up multi-level permission,

provide different authority to operators in different

level. After the server’s verifying the identity of the

user, it will determine the user’s rights as his

authority control information. The operator at all

levels in the system can only be executed within the

scope of its responsibilities.

(2) Data encryption and integrity protection: in

the banking business in general. Use link layer

encryption and end to end encryption data

encryption strategy, the upper using an encryption

algorithm which is easy to implement, the

underlying hardware uses complex encryption

algorithm to protect data in transit security. While

for Internet banking, online transmission data

packets is based on transaction data structure and

Hash Algorithm message authentication code MAC

component, the receiver receives MAC verification,

and he can detect accidental or intentional data

transmission error modified to protect the

transmission of data integrity and confidentiality.

(3) Identification and validation: the data source

authentication is a means of identification of

information. Data source authentication is achieved

by digital signature technology. At the same time

STUDY ON THE INFORMATION SECURITY SYSTEM FOR BANK IN CHINA

193

using digital signature technology can also achieve

the purpose of anti-repudiation.

(4) Network anti-virus technology: including the

prevention of viruses, virus detection and removal

virus these three techniques. Through these

technologies we can prevent the virus goes into the

computer system to cause destruction. The latest

anti-virus technology should be all of these

technologies together to form a multi-layered

defense system that has the virus detection, but also

has client\server data protection.

(5) Firewall: A firewall is a kind of isolation

control technology; in the bank's network and other

networks it sets up obstacles to prevent the illegal

access to the information, but also can control the

banking network to transfer out illegal information.

(6) Monitoring detection. Refers to the process of

system access through a variety of technical means

to monitor and access behavior and detection, to

ensure that the theme of the subject access process’s

safety.

(7) Audit trails. It refers to the audit, tracking and

logging of system, user activity and application, in

order to improve the system auditability. System-

related activities for a system can have multiple

audit trails; records can be stored in the log file and

the associated database.

(8) Backup and recovery. It is the security

control measures taken by the appropriate technical

means, so that make the maximum reduction for the

accident on the business impact.

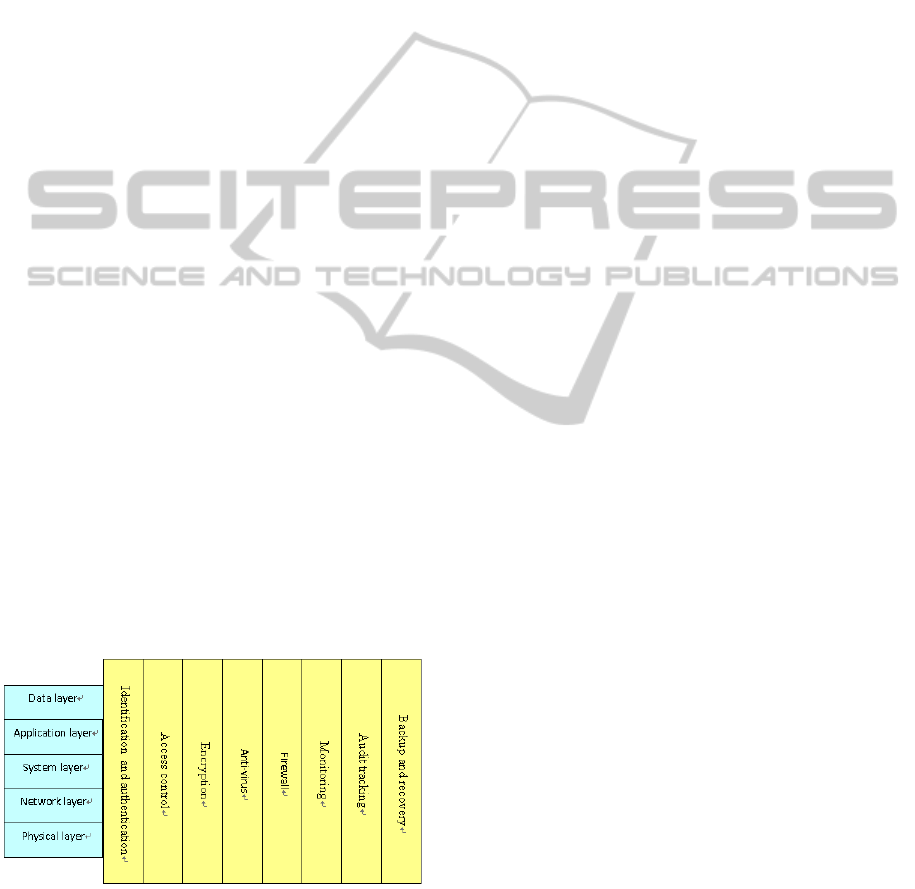

According to bank information security

techniques in the eight general protection measures,

combined with information security, object

hierarchy, the establishment of information security

technology system is shown below.

Figure 3: Bank information security technology system.

4.2 Establish Management System

to Ensure Banking Information

Security

Standardization of information security management

system shall be considered from a macro and micro

level, macro level mainly refers to the scientific

development of the security policies, it reduces the

risk areas through standardized information system.

Micro level is to make reasonable planning in the

system development stage, pre-reduced or

eliminated the vulnerability of the system using

advanced technology.

(1) Promote the bank information system’s

technical regulations and standardization, establish

and improve the implementation of appropriate

monitoring mechanisms, information systems

security issues because the ultimate solution to rely

on is legal protection. We should speed up banking

system’s construction indifferent levels, step by step.

Especially for online banking, electronic commerce,

mobile banking and other innovative products and

services, we should match the norms and standards,

and establish a scientific monitoring mechanism

through the system security, and strengthen technical

specifications and standards.

(2) Strengthen the information systems’

maintenance and management of daily operations,

and gradually establish and improve the

documentation of operational processes and make it

standardize to ensure the integrity and availability of

information.

(3) Establish a centralized monitoring center,

centralize and manage all information, so that

monitor the entire banking network, systems and

operating conditions at any time, to identify

problems and then control the problem through a

reasonable process.

(4) Comprehensive use various high-tech means

to make interconnection network intelligent.

Strengthen the resilience of risk prevention and

control capacity to combat financial crimes network

to ensure safe and smooth operation of the network

system.

(5) Strengthen the banking center and backup

data center infrastructure, and ensure the availability

of backup systems to reduce and avoid the data risks.

(6) Strengthen training and improve the

management and staff’s awareness of information

security. Particular put emphasis on training

operators for information security, making them

know the standard and the operate program.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

194

While in the implementation of these

management measures we should base on the

following three management principles:

(1) More than two persons are responsible: each

security-related activity, there must be two or more

persons present. For example, access control and

recovery with the release of documents, medium

release and recycling and disposal of confidential

information; hardware and software maintenance;

system software design, implementation and

revision; important programs and data deletion and

destruction.

(2) The principle of limited term: staff should be

working in circles from time to time, compulsory

leave system, and provides for rotation of staff

training so that the limited term of the system is

feasible.

(3) The principle of separation of duties: Staffs

who work in the information processing system

cannot ask others anything which is not concerned

with his work unless the leader has approved.

Considering security, computer operations and

computer programming, the reception and

transmission of confidential information; safety

management and systems management; application

and system preparation procedures, should be

worked separately.

5 CONCLUSIONS

Banking computer information system is an

important part of national financial information

system. It provides financial services to customers.

We should put security the chiefly position. The

computer network security in bank is a never

terminated work which we should keep

strengthening the technology and management all

the time. In management, security system must be

strictly enforced; in technology, network security

should be concerned on the emergence of new

problems and new technology, constantly block the

known security vulnerabilities, and continuously

enhanced network security by new technological

means.

REFERENCES

Huang Yong, 2008. Based on P2DR security model of

bank information security system and design,

Information Systems Management, Vol. 6, No. 4,

pp.115-118

Wood, Charles Gresson, 2005. Establishing Technical

Systems Security Standards at a Large Multinational

Bank. In Proceedings of the Third IFIP International

Conference. North-Holland

Sierra, José M., Hernández, Julio C., Ponce, Eva; Manera,

Jaime, 2005. Marketing on Internet communications

security for online bank transactions. In International

Conference on Computational Science and Its

Applications. IEEE

Kliem, R.L., 2000. Risk management for business process

reengineering project, Information Systems

Management, Vol. 17, No. 4, pp.71-3

Markus, M.L. and Tanis, C., 2000. The enterprise

systemexperience – from adoption to success”, in

Price, M.F. (Ed.), Framing the Domains of IT

Management: Projecting the Future through the Past,

PinnaflexEducational Resources, Cincinnati, OH, pp.

173-207

STUDY ON THE INFORMATION SECURITY SYSTEM FOR BANK IN CHINA

195