BUSINESS MODEL APROACH FOR QOE OPTIMIZED

SERVICE DELIVERY

Jose I. Aznar, Eduardo Viruete, Julian Fernandez-Navajas, Jose Ruiz-Mas,

Jose Saldana and L. Casadesus

Communication Technologies Group (GTC), Aragon Institute of Engineering Research (I3A)

Dpt. IEC, Ada Byron Building, CPS, Univ. Zaragoza, 50018, Zaragoza, Spain

Keywords: QoE, B2B QoE model, End-user potential market.

Abstract: Current B2B (Business to Business) models are not capable to cover neither customer expectations in terms

of quality nor personalization. Network, service and equipment providers are tied to traditional business

models, missing the opportunity to increase their revenues derived from the integration of Quality of

Experience (QoE) models in their frameworks. In this work, we propose a B2B QoE model which

comprises the main guidelines to successfully integrate the QoE within the value chain and provide with

added-value services to potential subscribers. We also evaluate the potential QoE end-user market for six

European countries. Results indicate that there is a niche for QoE based models which rely on the joint

action of value chain actors and its agreement with the regulatory environment.

1 INTRODUCTION

New multimedia services have acquired

personalization and customization features which are

enclosed under the concept of Quality of Experience

(QoE). ITU-T has defined QoE as “the overall

acceptability of an application or service, as

perceived subjectively by the end-user, where the

overall acceptability may be influenced by user

expectations and context” (ITU-T, 2006).

The overall QoE demand entails a set of

requirements which must be accomplished from

technological and economical perspectives and in

the context of the regulation action. In terms of

technology, Equipment Providers (EPs), Service

Providers (SPs) and Network Providers (NPs) are

expected to handle much higher traffic levels,

offering improved quality. From an economical

perspective, the main difficulty hereby for providers

is that the potential subscribers remain reluctant to

pay more for QoE services. Also the uncertain

attitude of National Regulation Authorities (NRAs)

on QoE technologies might represent a showstopper

as far as regulation actions do not clarify the New

Regulation Framework (NRF).

From this situation, the question which arises is

whether or not it exits a niche for the QoE, or

alternatively, which are the key drivers that may lead

value chain actors to include QoE B2B (Business to

Business) models in their strategies to reach the

customer?

The main issue of this work aims to address this

question through the definition of a novel approach

for a QoE B2B model. This model clearly advocates

for driving innovation through alliances among

operators and providers while keeping competitive.

We also address the relation of the B2B model with

the end-user market: there have been identified the

key factors which may (positively or negatively)

impact users’ willingness to pay and QoE affinity.

The remainder of this paper is organized as

follows: In section 2 the B2B model is explained.

Section 3 presents the key factors which may impact

B2C (Business to Consumer) relationships. User’s

affinity and willingness to pay are also tested.

Section 4 concludes the paper.

2 QOE B2B MODEL APPROACH

2.1 QoE B2B Model

The QoE B2B model entails a shift on the side of

markets to adopt new business roles. There are

multiple individual markets which may be relevant

211

I. Aznar J., Virute E., Fernandez-Navajas J., Ruiz-Mas J., Saldana J. and Casadesus L..

BUSINESS MODEL APROACH FOR QOE OPTIMIZED SERVICE DELIVERY.

DOI: 10.5220/0003486502110214

In Proceedings of the International Conference on e-Business (ICE-B-2011), pages 211-214

ISBN: 978-989-8425-70-6

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

for the B2B model definition. Nevertheless, all these

markets can be combined to create a convergent

environment with three global markets and their

information flows located in two main levels:

application service and network service levels

(Figure 1). Market convergence increases the

possibilities for services and content-related

opportunities emerging for involved players.

Among the defined markets two possible options

may take place to determine if they become or not

strategic partners: “potential alliance” or “war”.

The most important requirement that markets

should achieve focuses on partnering strategies

leading for a new revenue distribution model.

2.2 Revenue Distribution Model

High competitive business environments and falling

prices in mature markets have favored the evolution

of the operator model from a “walled garden” model

to an “open garden” one.

In the “walled garden” model, services are

directly retailed to end-users by operators and the

number of content and service providers is limited

by strict contractual agreements.

In contrast, in the “open garden” model, operators

adopt a different approach, which consists of

opening up their network capabilities (i.e. presence,

location, identification, billing) to third parties,

moving from a closed network model to a more

suitable one, in which service rollouts can be faster

to start obtaining revenues quickly.

All these factors may promote a greater

interaction among business actors. Figure 2 schemes

the different proposed relationships which enable to

build a revenue flow map among the markets of the

QoE value chain. Next section details the

characteristics of these partnering strategies.

Network

Device

Providers

PotentialAlliance

APPLICATION LEVEL NETWORK LEVEL

REGULATION

Figure 1: QoE business model based on market

convergence.

2.3 B2B Win-win Alliances

2.3.1 Operators and Equipment Providers

(EPs)

One possibility of revenue share can be identified

between Telecom operators and EPs. EPs may

deploy and manage QoE platforms, enabling

operators to reduce CapEx and OpEx, in return of a

percentage of the new revenue streams. The

integration of QoE in operators’ infrastructures

entails the acquisition of new equipment to deploy

QoE related enhancements. It is therefore necessary

to establish relationships among EPs, chip industry

and operators to provide QoE services.

2.3.2 Telecom operators and Service and

Content Providers (SPs/CPs)

SPs and CPs have been largely keeping a reciprocal

push and pull with operators based on an

accentuated mistrust between them. On one hand,

CPs and SPs are suspicious of enabling operators

manage the content that is provided through their

networks. On the other hand, operators still keep

reluctant to guarantee QoE access levels to

providers, without obtaining substantial profit from

this. Thus, CPs and SPs have the opportunity to

increase their revenues within the value chain if they

shift to an open-mind perspective in the QoE market.

Besides, thanks to operators’ network capabilities,

SPs and CPs will be able to reach a larger number of

customers, while ensuring high QoE.

2.3.3 Alliances among Telecom Operators

Competition in the Telecoms sector avoiding

dominant market positions is a key driver for lower

prices and substantially more attractive broadband

speeds. Europe’s digital deficit claims that the take-

up rate of superfast BB (BroadBand) could be

double in some European countries if networks were

opened to competition. Moreover, the NRF should

regulate BB service-packets fees across Europe.

2.3.4 Advertisers also Take Part

Users could remain reluctant to pay substantially

more for the QoE enhanced services, an already-

known player might be integrated in the value chain:

advertisers. Targeted advertisements could be

included inside service applications and be

optionally offered to users, subsidizing the service.

The QoE specific “personalization” feature is not

limited to users’ demanded contents, but can also be

extended to the advertising industry.

ICE-B 2011 - International Conference on e-Business

212

R

E

G

U

L

A

T

O

R

S

Service/

Content

Market

Telecom

Market

Network

Equipment

Market

Subscriber

Market

NetworkDevice

Telecom

Commercial

Broadcasters

Retailers Communities

Media

Convergence

Content

Delivery

Content

Pro v ider

Communication

CEVendor

A

D

V

E

R

T

I

S

I

N

G

Figure 2: Revenue flow map among incumbent potential

QoE markets.

2.3.5 Regulation and the Global Market

The telecom regulation action definitely impacts the

market, since the laws and actions carried out by

regulation authorities, set the basis for the B2B

ecosystem map. The NRF relies into two main

concepts: first, the need to ensure European

customers to have a greater choice of BB SPs with

prioritization, or differentiated products; and second,

a clear focus on net neutrality. The NRF seems to

match QoE expectances and guarantee the market

deployment and evolution in the mid-term.

However, both at the side of end-users and

wholesalers have appeared opposite points of view.

3 THE END-USER MARKET

3.1 Drivers/Showstoppers Factors

which may Impact the B2C Model

The success of the adoption of QoE to end-users

depends on several factors which may positively or

negatively impact their affinity and willingness to

pay. We have identified three key factors covering

the technological, social and legislatives fields.

From a technological perspective the current

international broadband gap is the most important

issue to be solved: Eastern and Southeast Europe’s

gap with its Western neighbors in terms of access to

high-speed internet is widening and limiting the

access to potential QoE subscribers. Concerning

social trends, recent studies (Microsoft 2009), have

forecasted during the last decade that Internet

consumption would overtake TV during 2010.

Nowadays, this is a fact. Finally, national regulation

actions do not only consist of legislating on how net

neutrality must be established in the B2B model, but

also on setting the rules for subscribers’ access to

content. The main issue that CPs are currently

experiencing deals with the legal piracy vacuum

present in some countries, since it entails significant

lower business perspectives than in countries where

P2P sharing constitute an illegal activity.

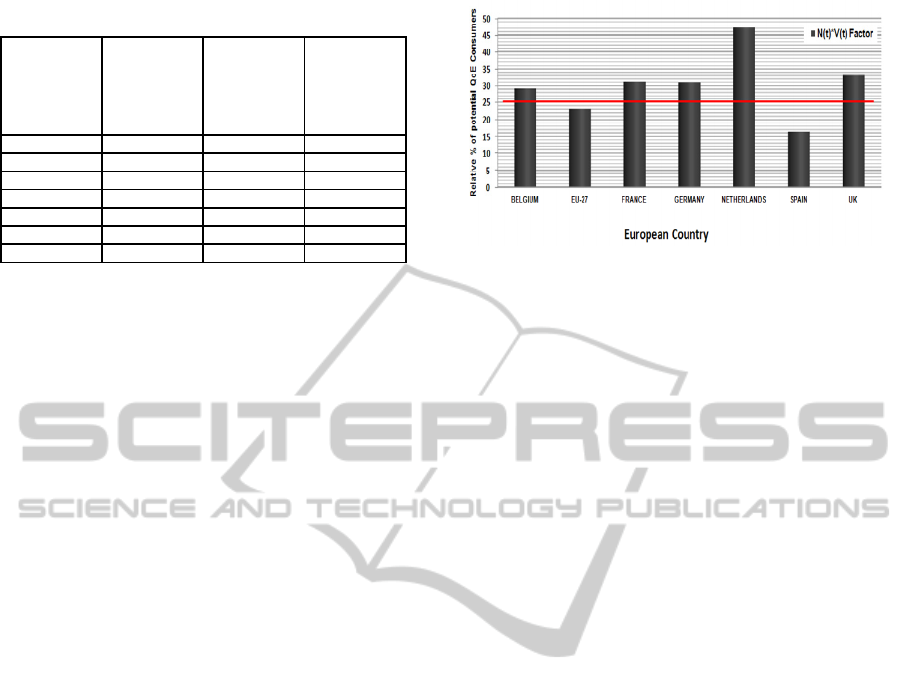

3.2 Study of End-user QoE Affinity

We conclude this work with a quantitative approach

of the end-user potential market. The approach

enables to forecast whether or not the there is a will

from the end-user side to acquire and pay for QoE

services. We have addressed the end-user affinity

analysis from a set of descriptors, for six European

countries and also for the overall EU-27 former

states.

The study has been conducted based on the

measurement of the end-user potential market

demand (EuPM) characterized by (1) taken and

adapted from the marketing management

environment (Kotler, 2006):

WP Q vN EuPM ×

×

×

=

(1)

Where the factor

vN

×

(2)

represents users’ potential affinity in the QoE

market. Q is the acquired product quantity by a

medium purchaser and WP represents the price

assigned to the product of interest, in this case, the

QoE. This study focuses on (2). Q and WP factors

determination are out of the scope of this work.

N represents the potential household BB fixed-

access penetration rate. N values have been

compiled from (TNS, 2010) and can be observed in

Table 1. v is the relevant percentage of BB

households that may consume QoE services. This

descriptor has been derived from two secondary

descriptors: The “National Education Attainment”

and the end-users’ “age rank” descriptors. The main

considerations for v descriptor have been also

categorized: assumptions related to the “age-rank”

descriptor: people below 25 do not represent QoE

potential consumers. People between 25 and 79

represent the most valuable group since they

perceive a salary and are closely related too. People

above 80 are neither technology nor QoE familiar.

The v descriptor values (shown in Table 1) have

been derived from public statistic data (UNESCO,

2010), (UNDP, 2009). The “National Education

Attainment” descriptor has been divided into three

levels: low, medium and high education attainment.

BUSINESS MODEL APROACH FOR QOE OPTIMIZED SERVICE DELIVERY

213

Table 1: N and v values for end-user QoE affinity analysis.

Country

Number of

households

(Thousand)

Household

BB

penetration

N (% of BB

households)

Share of

relevant

QoE

v (% of BB

households)

Belgium

4568 54% 53.97%

EU-27

202925.2 48% 38%

France

27392.9 59% 52.89%

Germany

39311.2 45% 41%

Netherlands

7269.8 79% 59.77%

Spain

17076.3 44% 37.10%

UK

26753.3 58% 57.07%

It has been assumed that low education attainment

people do not represent QoE relevant consumers.

Figure 3 shows the relevant share of QoE end-

user potential consumers (N * v product) for each

country. This represents an approach to determine

the percentage of country population which, having

access to QoE technology may be allied to the QoE

market. Country values have been normalized to

their corresponding total population.

The Netherlands and the UK present a major

affinity for QoE consumption, whereas EU-27 and

Spain values reflect a minor affinity. Results are

directly impacted by the national BB penetration and

the legal vacuum in terms of piracy (see section 3.1).

Two main affinity levels can be observed: On

one side, there can be found countries in which BB

deployment is over 50% (The Netherlands, Belgium,

France and UK), where piracy and P2P are

forbidden (Germany and France) or both. These

countries present an affinity degree over 25% of the

total population. On the other level we find the EU-

27 and Spain, were the lower level affinity is caused

by the lack of legislation in terms of P2P and the

lower BB household penetration, which is still far

from reaching top countries. Neither Spain nor the

EU-27 reaches a 25% of QoE affinity degree.

4 CONCLUSIONS

The QoE B2B market has been depicted as a

landscape of alliances and partnerships among three

main markets explained through the B2B QoE

model. The revenue distribution model and the

proposed alliances among SPs, EPs, CPs and

Telecom Operators may drive the QoE integration

and consist of a combination of personalized

services and customized applications which attract

end-users to the QoE market. Regulation authorities

may accomplish a homogenized regulation to permit

operators and providers low fares. The end-user

potential affinity shows that they are not yet aware

Figure 3: Relative country QoE affinity.

of the benefits that QoE based services provide.

There is a demand, but it must be encouraged.

Summing up, the QoE market is hanging by a

thread. There is a niche for the QoE market which

mostly depends not only on how the BB is carried

out, but also on the companies’ marketing strategies.

ACKNOWLEDGEMENTS

This work has been partially financed by CPUFLIPI

Project (MICINN TIN2010-17298) and the Catedra

Telefonica of University of Zaragoza.

REFERENCES

ECTA. (2010). Europe’s €25bln digital deficit. ECTA

press releases. Available at: < http://www.ectaportal.

com/en/PRESS/ECTA-Press-Releases/2010/Europe-s-

25bln-digital-deficit >.

ITU-T (2007) ITU-T Recommendation P.10/G.100,

Amendment1 (2007), Definition of QoE.

Kotler P., Keller K. (2006) Marketing Management.

Prentice-Hall, 12 edition.

Microsoft. (2009). Europe Logs on. Available at: <

http://www.scribd.com/doc/14065700/Europe-Logs-

On-Microsoft-Study >.

TNS. (2010). E-Communications on Household Survey.

Available at :< http://ec.europa.eu/information_society

/policy/ecomm/doc/library/ext_studies/household_10/r

eport_en.pdf >.

UNDP. (2009). United Nations Development Program

Human and Education report. Available at:

<http://hdrstats.undp.org/es/indicators/169.html>.

UNESCO. (2010). Global Education Digest 2010:

Education Statistics Across the World. Available at:

<http://www.ifap.ru/library/book482.pdf >

ICE-B 2011 - International Conference on e-Business

214