SALES PIPELINE PREDICTION

Predicting a Pipeline using Time Series and Dummy Variable Regression Models

Bindu Narayan, Deepak Ravindran, Picton Sue and Jayant Das Pattnaik

Hewlett Packard, Global e-Business Operations, CV Raman Nagar, Bangalore, India

Keywords: Sales Pipeline, Predictive model, Time Series, Seasonality.

Abstract: Sales pipeline metaphorically is a pipe through which the opportunities pass on the way to becoming a sale.

As the opportunity progresses through the pipe the likelihood of becoming a sale increases. Predicting the

sales pipeline is very critical. Accurately predicting the sales pipeline is essential in planning future costs

and capacity requirements. Since the sales pipeline is in itself a subjective prediction made by sales reps,

predicting the pipeline essentially becomes a problem of predicting a prediction. Most managers do this by

solely depending on their sales representatives perception on which business will close. A prediction model

was developed using time series modeling to predict the next quarter sales pipeline. The uniqueness of the

model is that, it captures two different types of co-existing seasonlaities. A predictive model was created

which is refreshed weekly with actual pipeline numbers and is successfully deployed within business.

1 INTRODUCTION

Sales pipeline is a reporting system which provides

visibility into potential future revenue realization. It

is a futuristic view created by the sales

representatives giving visibility into the revenues

they will be able to generate. Each sales

representative fills in details of deals they are

pursuing in the pipeline management tool. The

aggregated figures from the tool form the sales

pipeline. The figures featuring in the pipeline are not

actual sales figures, but are numbers estimated by

sales representatives. This estimation is a

judgemental one, based on the conviction each sales

person has on their ability of converting a deal to a

sale. They are allowed to edit the projections at any

point in time.

Sales pipeline is metaphorically speaking, a pipe

through which the opportunities pass on the way to

becoming a sale. As the opportunity progresses

through the pipe the likelihood of becoming a sale

increases (Lewis, 2006).

The sales pipeline is divided into sales stages as

shown in Figure 1.

Some opportunities make it through all stages

before it closes to become won. Some opportunities

do not make it through all sales stages and may close

as Lost or Cancelled during any stage in the pipe.

Figure 1: Sales Pipeline Funnel.

Accurately predicting the sales pipeline is

essential in planning future costs and capacity

requirements. Future pipeline gives a direct

indication to the management on the likely revenue

business can generate. Reliable pipeline prediction

by region and sub regions can provide early warning

signals to run business and they in turn can take

corrective measures to counter adversities.

Most sales managers rely on the perceptions of

sales people about which deals will close, and when.

Unfortunately, this leaves the manager exposed to

the vagaries of subjectivity as each salesperson

either hedges or exaggerates. “The only way I come

close is by making my own gut-feel alterations to the

lies my sales people tell me. There has to be a better

way of generating numbers” (Tom Snyder, 2006).

Won

Negotiate

Propose

Qualify

ValidateLead

Identify Lead

Early Sales

Stages

Qualified

Stages

Won

Opportunities

114

Narayan B., Ravindran D., Sue P. and Das Pattnaik J..

SALES PIPELINE PREDICTION - Predicting a Pipeline using Time Series and Dummy Variable Regression Models.

DOI: 10.5220/0003716201140119

In Proceedings of the 1st International Conference on Operations Research and Enterprise Systems (ICORES-2012), pages 114-119

ISBN: 978-989-8425-97-3

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

Since the sales pipeline is in itself a subjective

prediction made by sales reps, predicting the

pipeline essentially becomes a problem of predicting

a prediction.

This paper discusses how a statistical model was

developed using time series and dummy variable

regression models to predict the sales pipeline.

2 PROBLEM DEFINITION

2.1 Pipeline Conversion

Pipeline conversion is essential as it results in

revenue realization. Pipeline conversion rate is

calculated after the quarter close & is measured as

the actual revenue realized for the quarter divided by

sum of opportunities in the qualified stage at the

beginning of the quarter.

Conversion Rate = Actual revenue realized

for the quarter ÷ Qualified pipe at the

beginning of the quarter

(1)

During the first two weeks of any quarter the

sales reps concentrate on closing the deals for the

previous quarter and updating them in the pipeline

management tool. Accurate sales updation for the

previous quarter has a direct impact on the sales reps

quota achievement and variable payout calculations.

Due to this fluctuation qualified opportunities

updated as of week three is considered as the most

convincing figure available that can be converted to

sales for the quarter. Therefore, if the qualified

opportunities in the pipe as of week three every

quarter can be predicted, the likely revenue end

point can be derived using the average historical

conversion rate.

2.2 Prediction for Wk3 of Next

Quarter

The business needs to predict the qualified

opportunities as of third week of every subsequent

quarter. E.g., In Q3W1 (Quarter 3, Week 1)

managers would like to know how much qualified

opportunities the pipe will have as of Q4W3.

The prediction of next quarter pipleine build is

being currently done in a very subjective maner, the

prediction error being approximately +20%. The

sales opportunities in the pipeline is run past the

account managers from each region. The individual

opportunities are validated and marked as likely to

close for the quarter. These marked deals are rolled

up at a country/region/worlwide level to arrive at the

prediction for the quarter. The resulting prediction is

based on the perception of the account managers and

the sales representatives and hence subjective. To

provide business with better planning there is a need

to develop a statistical model that can predict the

next quarter sales pipeline.

3 ANALYTICAL APPROACH

The sales pipeline data of a Fortune 50 company has

been used for analysis and model development. The

data pertains to a specific Business Unit of the

company.

The analysis was done in two phases.

Sales Pipeline Analysis – To understand how

exactly the pipeline gets built and to

understand what drives the pipleine build

Developing the Prediction Model – To

develop a statistical model that can predict the

next quarter pipeline

3.1 Sales Pipeline Analysis

Sales pipeline analysis was carried out more as an

exploratory data analysis to understand what drives

the sales pipeline build. There were two specific

objectives for this phase:

Identify the right sales stages to be included in

the prediction model

Identify the factors effecting the week on

week pipeline build

3.1.1 Identifying the Sales Stages to be

Included

The time it takes for an opportunity from inception

into the pipe to closure is called average velocity of

the sale. On tracking historic sales pipeline it was

observed that opportunities in the early sales stages

are very unlikely to close within the same quarter.

Since opportunities in the qualified stage have a high

probability of closing within the quarter, only those

were included in the prediction model.

3.1.2 Analysing Factors Effecting Pipeline

Build

The pipeline build is influenced by many factors,

some of them having a positive effect (inflates the

pipeline build) and some having a negative effect

(deflates the pipeline build). List of factors affecting

the pipe build were identified as:

SALES PIPELINE PREDICTION - Predicting a Pipeline using Time Series and Dummy Variable Regression Models

115

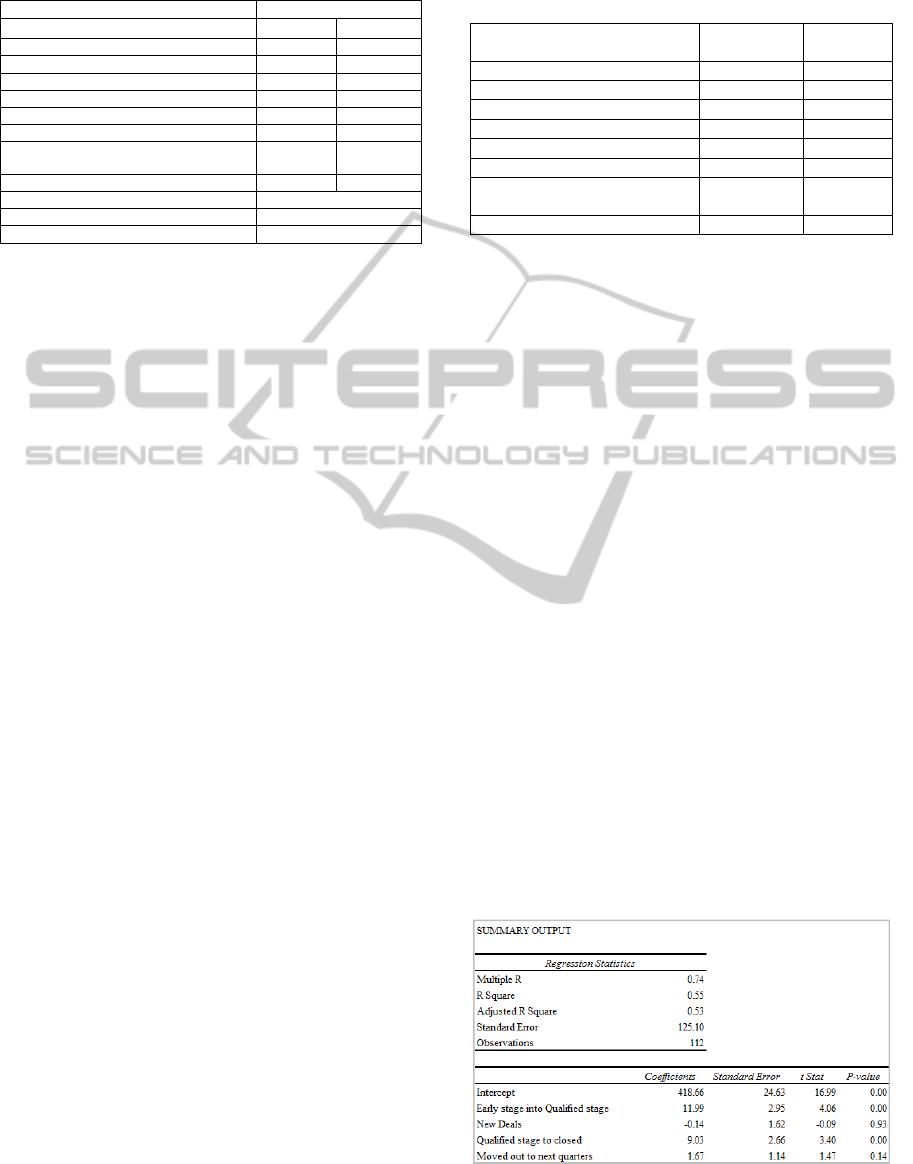

Table 1: Factors affecting pipeline build week on week

(Illustrative).

Prior Week Qualified Value 1500

Variables $ Delta % Delta

Rolled over from Prior Quarters 56 3.8%

Early stage into Qualified stage 8 0.5%

Rolled ahead from Next Quarters 2 0.1%

New Deals 24 1.6%

$ value change in qualified stage -6 -0.4%

Moved back to prior quarters -6 -0.4%

Qualified stage to closed

(Won/Lost/Cancelled)

-19 -1.3%

Moved out to next quarters -32 -2.1%

Current Week qualified value 1526

Week over week delta (%) 2%

Week over week delta ($M) 26

Opportunities that were anticipated to close

within the quarter might move ahead into previous

quarters or out to subsequent quarters based on the

discussions reps have with customers. Some of the

reasons that contribute to this movement are:

Prolonged discussion with the customer in

providing the exact solution needed

Change in buying budget for the quarter

All the opportunities that are rolling into the

qualified stage of the quarter inflate the pipeline, the

variables positively contributing to increasing the

last weeks pipe are:

Rolled over from Prior Quarters

Rolled from early stage into qualified stage

Rolled ahead from Next Quarters

New Deals

All the opportunities that are moving out from

the qualified stage of the quarter deflates the

pipeline, the variables negatively impacting last

week’s pipe are:

$ Value change in qualified stage

Moved back to prior quarters

Qualified stage to close

Moved out to next quarters

As shown in Table 2, the overall increase in

pipeline value of $26M week on week is a net effect

of the positive and negative factors affecting the last

week’s pipe value of $1500M. The effect can be

quantified as:

Current Weeks Pipe = Last Week’s Pipe +

(+ve) Factors – (-ve) Factors

(2)

4 MODEL DEVELOPMENT

4.1 Correlation Analysis

A correlation analysis was done to find out the

drivers which correlate the most with the current

week pipeline qualified value

Table 2: Result of correlation analysis.

Variables Correlation

Coefficient

p-value

Rolled over from prior quarters 0.14 0.47

Early stage into Qualified stage 0.62 0.00

Rolled ahead from next quarters 0.35 0.02

New Deals 0.55 0.82

$value change in qualified stage -0.12 0.51

Moved back to prior quarters -0.01 0.34

Qualified stage to closed

(Won/Lost/Cancelled)

0.66 0.00

Moved out to next quarters 0.64 0.01

The variables which showed significant, high

correlations are:

Rolling in from early sales into qualified

stage

New deals inducted into the pipeline

Movement from qualified stage to closed

Deals moving out to next quarters

4.2 Regression Analysis

A regression model was developed using the drivers

which had the maximum correlation with the current

pipeline. The model with the below variables came

out as the most significant

Rolling in from early sales into qualified

stage

Movement from qualified stage to closed

(Won/Lost/Cancelled)

The R-square being only 0.55 was an indication

that the model was not robust enough to explain the

phenomenon. Even if a robust model could be

developed, it may not be practically usable. This is

because the independent variables themselves are

guesstimates. Hence, separate models will have to be

developed to predict future values of independent

variables. This would add on to the error of

prediction. Therefore, it was decided not to use the

regression models for predicting.

Figure 2: Results of Regression.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

116

4.3 Time Series Model

It was observed that the sales pipeline build is a

typical time series data. It had trend and seasonality

components which are the basic building blocks for

any time series. Hence, it was decided to build a

time series model. Cyclicality could not be observed

since only one and a half years of data was available.

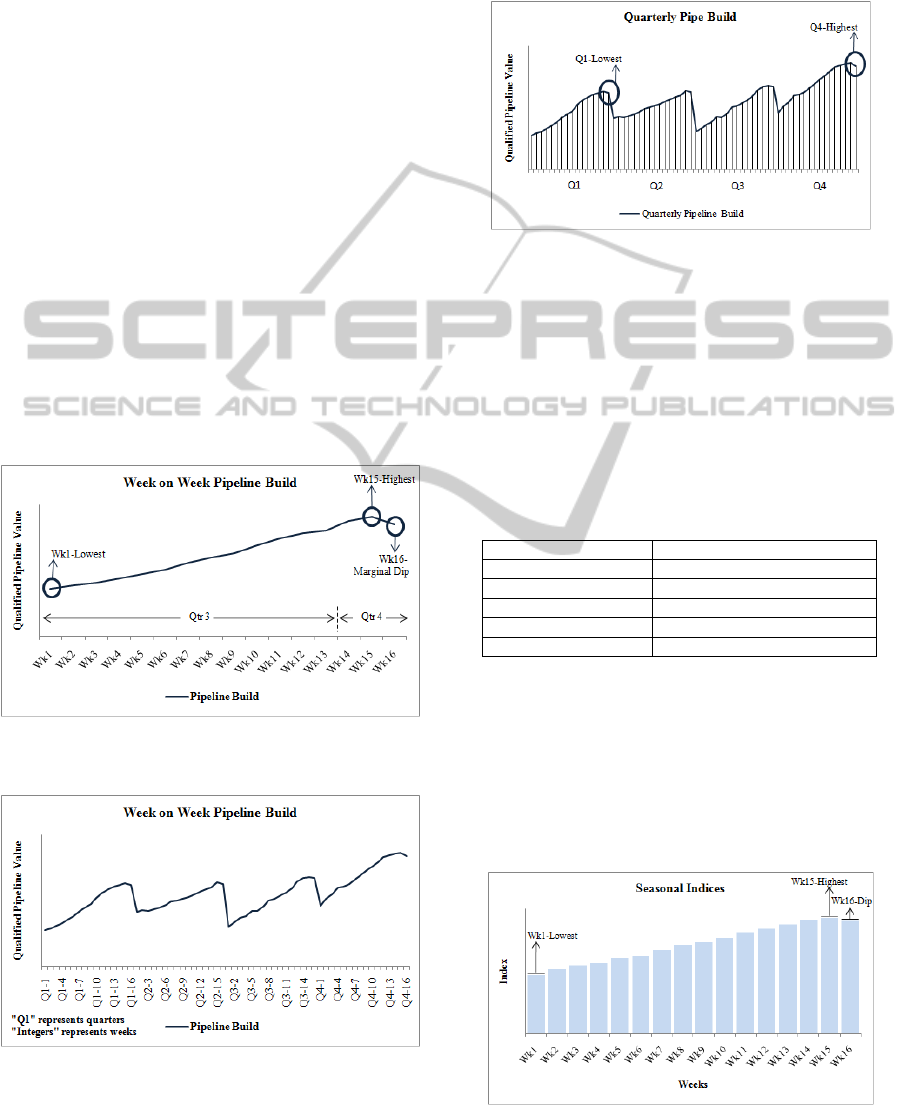

A unique feature of this time series data,

however, is that it has two types of seasonality. The

first type of seasonality is what is observed within

every quarter. The seasonality is across weeks, with

week1 always having the least pipe build, week15

the highest with a marginal dip in week16. It is

during the first two weeks of any quarter (wk14 &

15) that the sales reps concentrate on closing the

deals for the previous quarter and updating them in

the pipeline management tool. For eg: the cleanest

form of pipe available for Q4 is during the third

week of Q4 which is wk16 of the prior quarter. As

shown in figure 2 Weeks 1 to 13 is Q3 and 14 to 16

is the first three weeks of Q4. Post wk16 the

opportunities start closing or moving as it progresses

through the different stages in the sales cycle.

Figure 3: Week on Week pipe build (Illustrative: qualified

pipe values are masked to maintain data privacy).

Figure 4: Pattern observed across one year (Illustrative:

qualified pipe values are masked to maintain data

privacy).

The second type of seasonality is what is observed

across quarters, with Q1 having the least and Q4 the

highest pipe build. This is a pattern that is rampantly

observed in any industry.

Figure 5: Quarterly Seasonality (Illustrative: qualified pipe

values are masked to maintain data privacy).

4.3.1 Data Preparation

Weekly data for 96 weeks was available (08/2009 to

01/2011) for modeling. The data was divided into

development and validation sample. Data for 80

weeks was used to develop the model and data for

16 weeks was used as validation set. The general

statistics of the dataset is as given below:

Table 3: General Statistics of the Sample.

No: of obsevations 96

Mean $623

Standard Deviation $176

Minimum $238

Maximum $1035

Median $625

4.3.2 Deseasonalizing the Data

It was decided to deseasonalize the data with respect

to the weekly seasonality, as the weekly seasonality

was more prominent than the quarterly seasonality.

The quarterly seasonality was to be treated

separately. Seasonality indices were computed using

a 16-point moving average.

Figure 6: Weekly Seasonality (Illustrative: Seasonal

indices are masked to maintain data privacy).

SALES PIPELINE PREDICTION - Predicting a Pipeline using Time Series and Dummy Variable Regression Models

117

The computed seasonal indices showed the weekly

seasonality with week1 being the lowest, week 15

the highest and a marginal dip in week16.

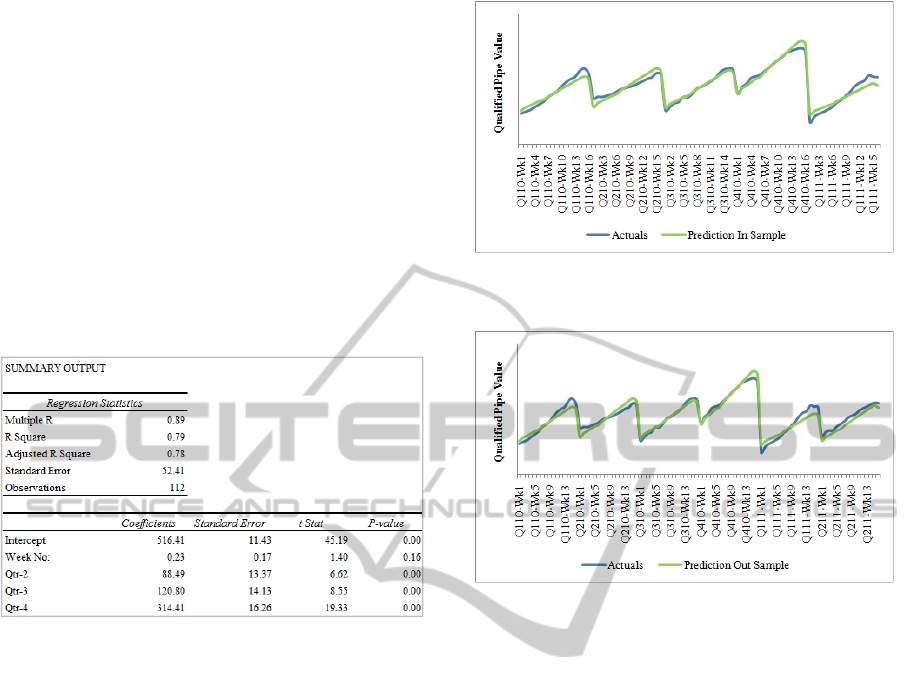

4.3.3 Developing the Trend Line With

Quarterly Seasonality

The deseasonalized values were regressed on the

Sales Pipeline to develop the trend line. Dummy

variables were included in the model to capture the

effect of the quarterly seasonality.

The model was found to be significant at α=

0.05. Adjusted R-square of the model is 0.78. Only

Q2, Q3 and Q4 came out as having significant effect

on the prediction.

Figure 7: Result of Regression.

The equation developed to predict sales pipeline

(SP) qualified value is:

(3)

The fourth quarter was found to have the highest

positive impact on the pipeline value

The final prediction with seasonality is derived

by multiplying the predicted pipeline value with the

corresponding seasonality index.

(4)

4.3.4 Model Validation

Sales pipeline value was predicted using the model

and then compared with the actual pipeline value.

Both in sample and out sample validation was done

and the MAPEs (Mean Absolute Percentage Error)

were found to be 6% and 8% respectively. But,

while examining the prediction plots, it was

observed that the model was effectively capturing

the seasonality components (Weekly & Quarterly) as

well as the trend, but it was failing to predict the

sales pipeline at the beginning of every 16-week

cycle accurately.

Figure 8: In Sample Validation (Qualified pipe values are

masked to maintain data privacy).

Figure 9: Out Sample Validation (Qualified pipe values

are masked to maintain data privacy).

It can be observed that if the starting point of every

quarter can be corrected, the trend and volumes

predicted thereafter would match with the actuals.

4.3.5 Triangulation

The fact that the model is not stable at the beginning

of every 16-week cycle can be attributed to the

fluctuations in the first three weeks which is caused

by rep behaviour. To accurately model the starting

point of every quarter extraneous factors such as

market conditions and sales rep motivations will

have to be introduced. Due to lack of data it was

decided not to pursue those efforts.

Instead, a triangulation method was adopted. One

of the best practices in sales pipeline prediction is to

triangulate between historical trends, market vectors

and sales pipeline (Lewis, 2009). The pipeline is

observed during the high flux period (Wk1 to Wk3)

and the prediction is adjusted against the Wk3

actual. By doing so, the MAPE improved to 1%.

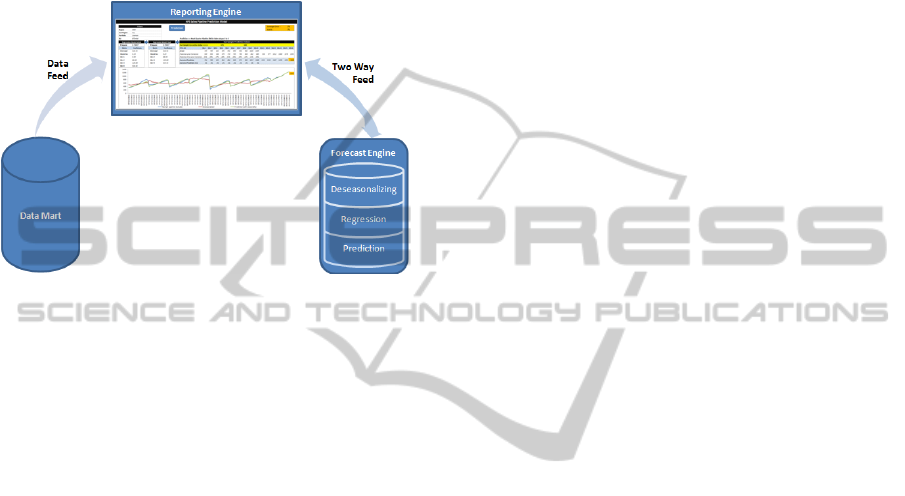

5 MODEL DEPLOYMENT

The model was deployed in business successfully.

= 516.4 + 0.23 ∗ + 88.5 ∗

2

+ 120.8 ∗

3

+ 314.4∗

4

(. )

,

=

∗ .

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

118

On testing the results over last two quarters the

pipeline build predicted was less than 0.5% from

actuals. The model was built to drill down to

specific regions and sub regions enabling business to

identify low growth regions in advance and take

corrective measures. Using the historic conversion

rate we are able to derive the likely revenue endpoint

with >98% accuracy.

Figure 10: Prediction Model reporting Schema.

Historical data for the past 92 weeks were

collated and structured into a master database which

acts as the back end to the model. Data cubes by

region/sub region and business units were created in

the data mart. On changing the filters corresponding

values are fed to the report engine and is send for

processing to the prediction engine. Seasonal indices

are recalculated for the new data and the

deseasonalized values are populated. The

deseasonalized values are regressed with the quarter

dummy variables to arrive at the final prediction for

the selected criteria. This data is fed back to the

report engine to provide the final output for the

selected criteria. The model is refreshed every week

with the actuals and irregularities are evened out by

triangulation to the model. The model is used as a

early warning system

6 CONCLUSIONS

The process most often used by sales managers and

companies today is taking a fixed percentage to last

year’s values and then increasing or decreasing the

figure based on the manager’s gut feel to derive the

prediction. Such a technique does not do justice to

the prediction process. While predicting, it is very

important to use a combination of historic data,

statistical modelling and also an in-depth knowledge

of the business.

In this paper, we have demonstrated a

methodology which combines a prediction technique

with business insights to arrive at prediction of sales

pipeline. The model has a prediction accuracy of

99.5%. It provides multiple views, at region, sub-

region and business unit levels, enabling business to

identify low growth areas ahead of time. Corrective

measures can be taken based on these insights.

However, the model is a pure time series model

and not a causal model. This does not take into

account actionable levers like the macroeconomic

factors or sales representative bias and is not capable

of suggesting levers to influence the sales pipeline. It

is restrictive in that respect. Any future research

should be concentrated on building such causal

models.

REFERENCES

Tom, Snyder. 2006. White Paper, Rational Forecasting.

Martin, Lewis. 2009. Webinar, Principal, 3g Selling.

Gilmore, Lewis. 2006. White Paper, How To Develop An

Effective Sales Forecast.

SALES PIPELINE PREDICTION - Predicting a Pipeline using Time Series and Dummy Variable Regression Models

119