FORECASTING DEMAND FOR CLOUD COMPUTING

RESOURCES

An Agent-based Simulation of a Two Tiered Approach

Owen Rogers and Dave Cliff

Department of Computer Science, University of Bristol, Merchant Venturers Building, Bristol, U.K.

Keywords: Utility computing, Market-orientated computing, Resource reservations, Cloud computing, Options

markets.

Abstract: As cloud computing grows in popularity and usage, providers of cloud services are facing challenges of

scale and complexity; how can they ensure they are most efficiently using their existing infrastructure, and

when should they invest in new infrastructure to meet demand? We propose a two-period model which

utilises a third party called the Coordinator, who interacts with a population of resource-buyers. The

Coordinator uses two mechanisms to aid the provider in future capacity planning. Firstly, the Coordinator

extracts probabilities from the buyers through an options market to determine their likely usage in the next

period, which can subsequently be used to schedule workloads. Secondly, the Coordinator uses previous

market demand to predict if cost can be reduced by investing in a reservation over a longer period. This

upfront investment contributes to the provider’s capital expenditure in new capability and implies that

Coordinator intends to further utilise such an investment. We implement the model in an agent-based

simulation using actual UK market data where a pool of users submit different probabilities based on

previous market demand. We show that the Coordinator can make a profit when faced with different market

conditions, and that profit can be maximised by considering the utilisation of previously purchased

reservations.

1 INTRODUCTION

Grid, cluster and, most recently, cloud computing

have all promised to transform computing resources

into a commodity, that can be delivered in a manner

similar to that of existing utilities, such as electricity,

gas, water and telephone services (Buyya et al.

2009). Cloud computing in particular is primed to

deliver a new level of freedom to the consumer,

allowing different levels of service and quality to be

delivered on an as-needed basis without the need for

capital investment

This utility model of provisioning gives users the

ability to purchase computing resources as if they

were any other commodity such as coal or steel. By

providing a suitable mechanism for buying and

selling, market oriented computing opens up a wide

range of trading possibilities - CPU cycles, storage

capacity, and memory allocations could be bought

and sold, for current or future use. This is already

happening to some extent in the marketplace, and a

wide range of economic and resource sharing

models for grids, clusters and clouds are public (Yeo

and Buyya 2006; Hilley 2009). To fully realise this

goal, however, providers must be able to

interoperate so that consumers can move between

providers easily and so that providers can utilise

each other’s capability when demand is high. This

federated cloud is the ultimate aim of cloud

computing (Buyya, Ranjan, and Calheiros 2010).

Currently, users purchase capability from the

utility-computing provider directly. Problems of

interoperability and lock-in are preventing

consumers from being able to easily change

supplier. Should standardisation be achieved, such a

federated cloud would enable the use of centralised

compute-resource “exchanges” and intermediary

aggregators and brokers. This is not yet widespread

but nevertheless seems likely to grow in significance

over coming years.

These centralised mechanisms would enable a

true Service Orientated Architecture where customer

needs are matched to the most suitable computing

106

Rogers O. and Cliff D..

FORECASTING DEMAND FOR CLOUD COMPUTING RESOURCES - An Agent-based Simulation of a Two Tiered Approach.

DOI: 10.5220/0003717201060112

In Proceedings of the 4th International Conference on Agents and Artificial Intelligence (ICAART-2012), pages 106-112

ISBN: 978-989-8425-96-6

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

resources using brokers or Coordinators. This would

be controlled through Service Level Agreements

(SLA) which would define the targets, for various

metrics, (e.g. uptime, latency) that must be achieved;

and would also define the compensation due to the

customer if the targets are not achieved.

To meet these SLA’s, the provider must ensure

they have enough resources to meet demand;

otherwise the provider will need to pay

compensation to those customers whose

performance criteria have not been met. Such a

prediction will ensure adequate investment in new

technology, and optimal utilisation of existing

capacity.

The provider could obtain information on likely

future requirements by letting users reserve

resources through a derivatives market involving

futures and/or options. A futures contract is a

contractual agreement to buy or sell an asset for a

certain price at a certain time in the future. An

options contract gives the contract holder the right to

buy, or sell, an asset by a certain date for a certain

price, without a binding obligation to do so (Hull

2005).

It has been proposed that swing options,

originally developed for trading electrical power,

can be used to price a future reservation of

computing resources (Clearwater and Bernando

Huberman 2005). As with electricity, computing

resources are non-storable and have volatile usage

patterns, so such a model would provide customers

with flexibility in terms of amount and duration of

resource requirement, and enable resource providers

to estimate demand.

Use of such derivatives presents two problems.

Firstly, how can users accurately predict their future

resource requirement? Determining and hedging

their future demand for a resource is not an easy

task; the variable nature of IT usage means that

pricing the service so that competitiveness and

profitability are balanced has an element of risk

(Khajeh-Hosseini, Sommerville, and Sriram 2010)

Secondly, how can the user be trusted to submit

a true representation of their likely resource

requirements?

The first issue can be solved using a forecasting

tool, such as that proposed in Clearwater

(Clearwater and Bernando Huberman 2005) or by

analysing historical market data such as that

proposed by Sandholm et al. (Sandholm and Lai

2007). For the second issue, Wu et al. proposed a

reservation model which was shown to lead to a

truthful reservation on the user's part (Wu, Zhang,

and BA Huberman 2008).

Wu et al.’s model involves a number of users

who require the resource, plus a central authority

(‘the Coordinator’) responsible for receiving and

resolving resource requests. The Coordinator and

users take part in a two-period game.

In this paper, we extend the model so that the

Coordinator uses two mechanisms to predict future

usage, while remaining profitable.

We create a practical implementation of the

model, where market demand varies to typically

observed dynamics using data obtained from the UK

Government and where users have a degree of

intelligence when submitting future resource

requirements. Our objective is to determine if the

model can be developed into a commercial offering,

and be profitable in different market conditions.

2 BACKGROUND

2.1 Wu et al. Two Period Model

Wu et al. proposed a two-period model for resource

reservation in which in the first period the user

knows her probability of using the resource in the

second period, and purchases a reservation whose

price depends on that probability.

Consider N users who live for two discrete

periods. Each user can purchase a unit of resource

from a service provider to use in the second period,

either at a discounted rate of 1 in Period 1, or at

higher price C, where C > 1, in Period 2. In Period 1,

each user only knows the probability that they will

need the resource in Period 2 - it is not known for

certain until the next period.

A third agent, the Coordinator, is introduced who

makes a profit by aggregating the users’

probabilities and absorbing risk through a two period

game described below:

1. Period 1: Each user i submits to the Coordinator

a probability, q

i

, which does not have to be the

real probability, p

i

, that they will require a unit

of resource in Period 2.

2. Period 1: The Coordinator reserves q

i

n

i

units of

resource from the resource provider at the

discount price for use in Period 2, where n

i

is

the number of units of resource required by

each user. For simplicity in this simulation, n

i

=1 for all users.

3. Period 2: The Coordinator delivers the reserved

resources to users who claim them. If the

amount reserved by the Coordinator is not

enough to cover the demand, the Coordinator

purchases more from the resource provider at

FORECASTING DEMAND FOR CLOUD COMPUTING RESOURCES - An Agent-based Simulation of a Two Tiered

Approach

107

the higher unit price C.

4. Period 2: User i pays:

f(q

i

) if resource is required

g(q

i

) if resource is not required

The contract can be regarded as an option if g(q

i

)

is paid in Period 1 (i.e. as a premium), and f(q

i

) -

g(q

i

) is paid in Period 2 (i.e. as a price) should the

resource be required. In Period 1, the resource is

reserved, but the user is not under any obligation to

purchase.

Wu et al. showed that if the following conditions

could be met, the Coordinator would make a profit:

• Condition A: The Coordinator can make a profit by

providing the service.

• Condition B: Each user prefers to use the service

provided by the Coordinator, rather than to deal with

the resource provider.

The following truth-telling conditions are not

completely necessary, but are useful, for conditions

A and B to hold:

• Condition T1 (truth-telling): Each user submits his

true probability in Period 1 so that he expects to pay

the lowest amount later.

• Condition T2 (truth-telling): When a user does not

need a resource in Period 2, it is reported to the

Coordinator in the same period.

The following specific case was proved to meet

these conditions, where k, a constant chosen to alter

the price paid by the customer, is set to 1.5 and C is

set to 2:

2.2 Previous Simulations

In an earlier paper (Rogers and Cliff 2010a) we

simulated the reservation model proposed by Wu et

al., in a multiple-user, heterogeneous, variable-

demand market. Through a simulation model, we

showed that honesty benefits both the user and a

Coordinator when the market varies uniformly, and

that the user-base evolves to be more honest over

time.

In a second paper (Rogers and Cliff 2010b) we

extended our simulation, so that market demand did

not vary uniformly, but instead underwent a period

of high or low resource availability. It was found

that the Coordinator benefits more when resources

are in abundance, and less when resources are

scarce. However, it was also found that when

resources are abundant, the Coordinator does not

always benefit financially as the honesty of the user-

base increases. There is an optimum honesty that

occurs when there is no surplus or deficit of resource

purchased by the Coordinator.

3 RESELLING RESERVATIONS

Wu et al.’s model was found to be profitable

amongst a group of heterogeneous users, and was

found to promote honesty in the user-base.

However, the provider is only made aware of

future demand one period in advance which may not

be of any use for planning larger investments. If this

information is used to plan additional capacity in the

next period, the provider may have to make an

investment in technology without having any

guarantees regarding its longer-term utilisation.

To offset some of this risk taken by the

Coordinator we propose a new model. The

Coordinator now has the option of purchasing

resources from the service provider using one of the

following schemes:

In Period 1, the Coordinator can purchase a

reserved instance. A reserved instance gives the

Coordinator access to a resource for a fixed term

(36 months). The reserved instance costs a fixed

sum at the beginning of the term, but gives the

Coordinator access to the resource at a lower cost

per unit time

In Period 2, the Coordinator can purchase an on-

demand instance. An on-demand instance is

charged at a higher cost per unit time than a

reserved instance, but there is no one-off cost.

This primary benefit of this approach to the

provider is that they have a longer term view of

future demand through the purchase of reserved

instances by the Coordinator. In the short-term,

information on likely utilisation in the next period

could be used to efficiently schedule workloads on

servers in an off-line fashion so that servers are fully

utilised (Stage and Setzer 2009). Upfront payments

received for reserved instances demonstrate to the

provider that the Coordinator believes a resource

will be utilised in the future. In the longer term, the

provider can reinvest this upfront payment towards

new infrastructure with at least some evidence that it

will be paid back. Both sources of information could

be used to calculate spot market prices.

The Coordinator is now a wholesale reseller of

resource - the purchased reserved instances can be

provided to whichever users need to use the resource

in that period and wastage is reduced.

2

)(

2

i

i

kp

qg

22

1)(

2

i

ii

kp

kp

k

qf

ICAART 2012 - International Conference on Agents and Artificial Intelligence

108

For the user, their expenditure is reduced as

they can reserve a resource without having to pay

full price should they not need to use the resource

later. However, in our implementation of the

scheme, the user must anticipate that she will take

full advantage of the resource available to them

during the month.

3.1 Methodology

To investigate the performance of the model, a

computer simulation was constructed. The nature of

the new model allows its performance to be

evaluated using actual commercial cloud offerings

and actual market conditions.

Period 1

1. Each user i submits to the Coordinator a

probability, q

i

, which does not have to be the real

probability, p

i

, that they will require a unit of

resource in Period 2.

2.

The Coordinator must reserve

∑

units of

resource to be executed in the next month. For

simplicity in this simulation, n

i

=1 for all users.

a.

If the Coordinator has previously purchased

enough reserved instances for the predicted

demand, no further instances are purchased.

b.

If the Coordinator does not have enough

resources available to meet the anticipated

demand, it may need to purchase additional

reserved instances. It will consider the

performance of additional reserved instances

over the past 36 months:

A = array [Last 36 months monthly resource

demand]

B = array [Current resource capacity for next 36

months]

U = array [A – B]

Marginal Resource Utilisation (MRU) = (number

of items in

U > 0) / 36 months

The MRU is the fraction of the life of an

additional reserved instance that will be utilised

over the next three years based on past

performance.

The Threshold is a ratio determined by the

Coordinator to maximise profit.

c.

If MRU > Threshold, the Coordinator will

buy a new reserved instance for 36 months at

cost R

as it is likely it will be used enough to

make a return on the original investment

d.

If MRU < Threshold, it will be probably be

more profitable for the Coordinator to buy an

on-demand instance at cost D

h

in Period 2.

Period 2

3. The Coordinator delivers the reserved resources

to users who claim them. If the amount reserved

by the Coordinator is not enough to cover the

demand, the Coordinator purchases more from

the resource provider at the on-demand instance

cost D

h

. For the reserved instances, the reduced

cost of R

h

is paid.

4.

User i pays

f(q

i

) if resource is required

g(q

i

) if resource is not required

where f,g : [0,1]→R

+

3.2 Agent-based Simulation

A computer simulation was programmed in Python

and for each of the market segments shown in Table

1, a simulation was implemented with 1000 users.

Each simulation was run 100 times with a different

threshold, between 0 and 1, in 0.01 increments.

The simulation was prepared with the following

characteristics:

3.2.1 Market Demand Data

Datasets were obtained from the UK National

Statistics Office on the Non-Seasonally Adjusted

Index of Sales at Current Prices from 1988 (earliest

available) to 2011 for four different market

segments, as shown in table 1. These segments were

chosen as they have a strong relationship to IT usage

and they vary differently over the period, therefore

allowing the model to be simulated across a wide

range of market conditions. These were normalised

between 0, where none of the N users submit a

resource request, and 1, where all N users submit a

resource request. The period of these statistics

represents a typical period of modern times where

demand has changed frequently, with both periods

of recession and growth. As such, it is a suitable

model of market variance.

3.2.2 User Agents

In the first period, the user will submit a probability

based on the market demand in the same month from

the previous year. The probability is chosen at

random from a uniform distribution between the

previous year’s market demand and 1. This approach

means that when a high market demand was

experienced during the same month in the previous

year, more users will submit a high probability to the

Coordinator, than when market demand was low.

FORECASTING DEMAND FOR CLOUD COMPUTING RESOURCES - An Agent-based Simulation of a Two Tiered

Approach

109

3.2.3 Service Provider Agent

The resource being purchased is an Amazon Web

Services EC2 Standard Small Instance (US East). At

the date of simulation (July 2011), these were being

advertised at a cost of D

h

= $0.085/hour for an on-

demand instance, and R = $350 plus R

h

= $0.03/hour

for a 36 month reserved instance.

3.2.4 Pricing Structure

Users are charged a price based on the values of f(q

i

)

and g(q

i

) suggested by Wu et al. However, as the

standard monthly on-demand cost charged by the

service provider is around $60, the Coordinator can

charge the user anything up to this value such that

condition B is met. To achieve peak profit while

ensuring the Condition B is met, the Coordinator

increases f(q

i

) and g(q

i

) by a factor of 60.

4 RESULTS

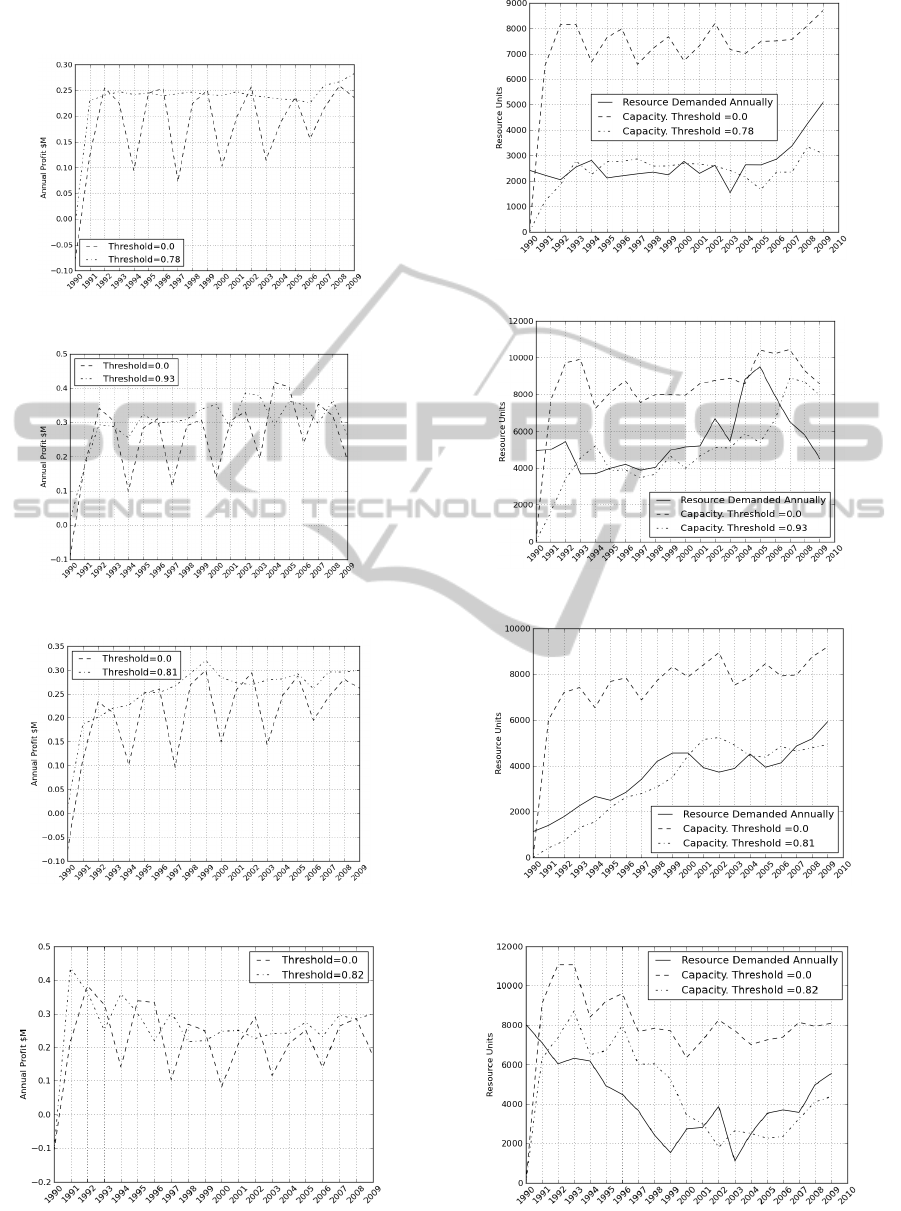

Plots of annual profit for each of the four segments

over time with no optimisation and maximum

optimisation are shown in figures 1 to 4 in the

Appendix. Plots of customer demand and capacity

reserved by the Coordinator for each of the four

segments over time with no optimisation and

maximum optimisation are shown in figures 5 to 8 in

the Appendix.

Table 1: Profit increases for market segments.

Profit £M - Period

No

Opt

Max

Opt

+/-

Opt

Thre

Non-store retail: All

businesses

3.62 4.63 28% 78%

Retail: IT

Equipment

5.02 5.92 18% 93%

Non-store retail:

Small businesses

4.26 5.15 21% 82%

Non-store retail:

Large businesses

4.10 5.05 23% 81%

Table 1 shows the profits achieved by the

Coordinator over the period when there is no

optimisation (threshold=0) and when there is

maximum optimisation (when threshold is set at that

which produced the maximum profit).

Table 1 shows that the Coordinator makes a

profit even when not optimising across the four

market profiles, which implies that the Coordinator

is likely to survive and prosper in a variety of

conditions. The total profit is related to the demand

of the market and the accuracy with which the

Coordinator predicts future usage.

Figure 8 most clearly shows the Coordinator

tracking changes in market demand, but a similar

pattern can be seen in figures 5 to 7.

When the Coordinator’s threshold is set to 0,

annual profit generally varies with market demand

as shown most clearly in figures 2 and 6, but cycles

every 3 years due to the need to buy additional

reserved instances whenever a deficit is anticipated.

However, the Coordinator regularly reserves

more resources than are required. This is due to

users submitting probabilities based on previous

performance as a way of guaranteeing access to a

resource in the event of high demand – this is shown

as the difference between the resources demanded

and the capacity available in figures 5 to 8.

From table 1, it can be seen that a significant

increase in profits can be made by considering past

performance before deciding to invest in a reserved

instance.

It is common sense that the Coordinator will

profit most when there is a large demand for

resources which has been fully anticipated by the

Coordinator. This means that all resources are

delivered to the users using the cheaper reserved

instance rate, and no new resources must be

purchased at the higher on-demand rate. It also

means that advance purchases of resources are being

wasted. The profit is therefore maximised when the

Coordinator is able to predict future demand most

accurately.

When the threshold is set to the optimum

threshold achieved during simulation, we see that

the profit stabilises and no longer cycles as in figures

1 to 4. The Coordinator now only buys reserved

instances when it believes it will be used enough

times to payback, and thereby reduces expenditure

and maximises profit.

5 CONCLUSIONS

This paper has shown how modification of a truth

telling reservation model for computing resources

described by Wu et al. can provide the basis for a

real-world implementation of an options market in a

federated cloud which is price-competitive for the

user, profitable for the coordinator and beneficial to

the service provider.

An extension of Wu et al.’s model was

implemented in an agent based simulation using

actual data on consumer demand over a typical

ICAART 2012 - International Conference on Agents and Artificial Intelligence

110

period in modern history, using costs of an Amazon

Web Service cloud instance, and where users submit

probabilities based on previous demand. It was

found that the coordinator profits in such a situation

in a number of market segments, thereby

demonstrating that a stable commercial

implementation is feasible.

It was also found that the Coordinator is better

off considering past performance when decided to

invest in another reserved instance, and this can

increase profits by up to 28%.

Wu et al.’s model provides a suitable theoretical

model for an options-market in computing resource.

However, the service provider would have to

provide specific pricing to support the Coordinator,

and this might not always be profitable for the

service provider. Our extension to this model does

not require new pricing to be agreed, but contract

restrictions on reselling may be a barrier to

commercial implementation.

Our work shows that a probability-based options

market in computing capability is a viable

commercial proposition, and that all parties can

potentially benefit as a result of such a system. The

advantage of this approach is that a forecast of future

usage requirements is obtained, which can

subsequently used to plan future capacity

requirements and so that targets on performance as

detailed in a Service Level Agreement can be met.

These are currently issues for widespread federated

cloud adoption.

The simulation has shown that the reservation

model may be suitable for real-world application.

The model provides a platform for further risk

assessment work to be undertaken and, as discussed,

the simulator can be further extended to simulate a

variety of market conditions, or specific user

demands.

The optimum threshold is the value at which

market demand is fully anticipated by the

Coordinator, and which is fully provisioned through

reserved instances. Determining this threshold

mathematically is likely to be challenging due to

difficultly in determining market dynamics over a

very long period. However, an empirical simulation

using actual market data could produce such a

threshold for commercial implementation.

By taking the results from this paper and

extending them with future research into the

performance of the model under different conditions

and inherent honesties, in different segments, a

commercial offering that is profitable to the

coordinator, beneficial to the user, and with a

calculated level of risk looks likely to be achievable.

ACKNOWLEDGEMENTS

We thank the UK EPSRC for funding the Large-

Scale Complex IT Systems Initiative

(www.lscits.org) as well as HP Labs Adaptive

Infrastructure Lab for providing additional financial

support.

REFERENCES

Buyya, R., Ranjan, R., & Calheiros, R. N. (2010).

InterCloud : Utility-Oriented Federation of Cloud

Computing Environments for Scaling of. Network,

13-31.

Buyya, R., Yeo, C. S., Venugopal, S., Broberg, J., &

Brandic, I. (2009). Cloud computing and emerging IT

platforms: Vision, hype, and reality for delivering

computing as the 5th utility. Future Generation

Computer Systems, 25(6)

Clearwater, S. H., & Huberman, Bernando. (2005). Swing

Options : A Mechanism for Pricing IT Peak Demand.

Proceedings of 11th International Conference on

Computing in Economics.

Hilley, D. (2009). Cloud Computing : A Taxonomy of

Platform and Infrastructure-level Offerings Cloud

Computing : A Taxonomy of Platform and

Infrastructure-level Offerings. Technology, (April).

Hull, J. C. (2005). Fundamentals of Futures and Options

Markets.

Khajeh-Hosseini, A., Sommerville, I., & Sriram, I. (2010).

Research Challenges for Enterprise Cloud Computing.

Arxiv preprint

Rogers, O. and Cliff, D. (2010a), The Effects of

Truthfulness on a Computing Resource Options

Market, Proceedings of the Conference on Advances

in Distributed and Parallel Computing

Rogers, O. and Cliff, D. (2010b), The Effects of Market

Demand on Truthfulness in a Computing Resource

Options Market, Proceedings of the 3rd International

Conference on Agents and Artificial Intelligence.

Sandholm, T., & Lai, K (2007), A statistical approach to

risk mitigation in computational markets. Proceedings

of Conference on High Performance Parallel and

Distributed Computing

Stage, A., & Setzer, T. (2009). Network-aware migration

control and scheduling of differentiated virtual

machine workloads. 2009 ICSE Workshop on

Software Engineering Challenges of Cloud

Computing, 9-14.

Wu, F., Zhang, L., & Huberman, Ba. (2008). Truth-telling

reservations. Proceedings of 11th International

Conference on Computing in Economics.

Yeo, C. S., & Buyya, R. (2006). A taxonomy of market-

based resource management systems for utility-driven

cluster. Cluster Computing, (June), 1381-1419. doi:

10.1002

FORECASTING DEMAND FOR CLOUD COMPUTING RESOURCES - An Agent-based Simulation of a Two Tiered

Approach

111

APPENDIX

Figure 1: Non-store retail profit.

Figure 2: Computer equipment profit.

Figure 3: Non store, small business profit.

Figure 4: Non-store, large business profit.

Figure 5: Non-store retail units.

Figure 6: Computer equipment units.

Figure 7: Non-store, small business units.

Figure 8: Non-store, large business units.

ICAART 2012 - International Conference on Agents and Artificial Intelligence

112