ECONOMIC-PROBABILISTIC MODEL FOR RISK ANALYSIS

IN PROJECTS

Rogério Feroldi Miorando, José Luis Duarte Ribeiro, Maria A. C. Tinoco

and Carla Schwengber ten Caten

Federal University of Rio Grande do Sul, Porto Alegre, Brasil

Keywords: Risk analysis, Project management, Simulation.

Abstract: This paper presents an economic-probabilistic model to conduct risk analysis in projects. The model

integrates risk and economic project analysis by quantifying both value and probability of occurrence of

potential cash flow deviations, thus resulting in an economic-probabilistic analysis of the expected returns.

The model allows calculating risk-adjusted values for cash flow groups and projecting net present value

through stochastic simulation. As a result, the model provides both the risk-adjusted project economic return

with the associated probability distribution to its NPV and the variability that each risk factor generates in

the project return.

1 INTRODUCTION

Risk analysis is growing in importance in the current

economy, as most economic decisions are taken in

uncertainty-prone scenarios. Uncertainty sources are

multiple and extensive, encompassing risks

associated to markets, suppliers, weather,

technology, etc. (Chavas, 2004).

Among the risk analysis models for project

available in academic literature, few directly indicate

the actual risks. Moreover, among the models that

propose specific tools for risk analysis, most focus

only on the success probability for the overall

project itself, without considering their economic

dimension. There are also models, such as

Benaroch’s (2002, 2007), that use real options to

value IT projects given the assumed risks, but these

models only conduct economic analysis and do not

face the problem of identifying and quantifying the

risks involved.

The objective of this paper is to present the

application of an economic-probabilistic model for

analysing risks in project investments. The model

integrates risk and economic project analysis by

quantifying both value and probability of occurrence

of potential cash flow deviations, thus resulting in an

economic-probabilistic analysis of the expected

returns.

2 MODEL STRUCTURE

The model presented in this paper was based on the

models by Karolak (1996), Foo and Murugananthan

(2000) and Schimitz et al. (2006). The application of

the model is conducted according to four steps: cash

flow structure completion; risk assessment structure

completion; determination of cash flow group risk-

adjusted Net Present Value (NPV); and

determination of risk-adjusted Net Present Value for

the project.

In the step of cash flow structure completion, the

benefit and cost items are distributed among nine

cash flow groups. The groups are divided as follows:

(i) Benefits, (ii) Financial costs, (iii) Infrastructure,

(iv) Licensing and equipment, (v) Labor, (vi)

Training, (vii) Outsourced services, (viii)

Consumables and (ix) Other expenses.

The risk assessment structure completion is

carried out through a questionnaire that combines

the categories of risk with the project's cash flow.

Risk categories and associated risk factors were

identified through literature analysis coupled with

expert opinions. The questionnaire is composed of

six fields (Figure 1): (i) matching of cash flow

groups and risk categories; (ii) assessment of risk

factor impact; (iii) assessment of probability of

occurrences for the risk factors’ impact ranges; (iv)

indication of analysts’ knowledge level about each

risk factor assessment; (v) indication of reasoning

208

Feroldi Miorando R., Luis Duarte Ribeiro J., A. C. Tinoco M. and Schwengber ten Caten C..

ECONOMIC-PROBABILISTIC MODEL FOR RISK ANALYSIS IN PROJECTS.

DOI: 10.5220/0003737302080211

In Proceedings of the 1st International Conference on Operations Research and Enterprise Systems (ICORES-2012), pages 208-211

ISBN: 978-989-8425-97-3

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

Worst case

Best case

Worst case

Best case

High

Medium

Low

Cash Flow Group A (-) Impact ($) (+) (-) Probability (+) Knowledge Reasoning base

Risk Category I

Risk Factor 1

Risk Factor 2

...

Group A Value

$ ...

Figure 1: Risk Assessment Structure.

Worst case

Best case

Worst case

Best case

A

ssessment of Benefits (-) Impact (U$/1.000) (+) (-) Probability (+)

Risks associated to competitor actions

Impact on benefits due to under/overestimated

competitor response

-1.045 -627 -209 816 2.448 4.080 35% 40% 15% 7% 3%

Impact on benefits due to under/overestimated

introduction of substitute technologies

-1.700 -1.020 -340 0 0 0 20% 35% 45% 0% 0%

... ... ... ... ... ... ... ... ... ... ... ...

Benefits Value U$ 14.764 million

* Monetary values, in thousands

Figure 2: Risk Assessment Structure – Impact versus Probability.

base; and (iv) calculation of the cash flow group.

The completion of the questionnaire is carried

out in four parts. First, the economic impact of the

risk factor upon the cash flow group where it

belongs is estimated. Analysts estimate values for

the largest negative economic impact as well as the

largest positive economic impact that each risk

factor can produce upon the expected value for the

cash flow group. From these values, the model

generates four intermediate values, resulting in five

probable economic impact ranges.

Secondly, analysts indicate the probability of

occurrence for each range generated in the previous

step. Figure 2 shows an example of this assessment

for the risk category Risks associated to competitor

actions. In the third part, the analysts indicate your

knowledge level about each risk factor assessment.

This allows analysing the opinion of several

analysts, according to their knowledge levels.

Finally, the analysts indicate the reasoning base,

which ensures the traceability of the criteria used in

the analysis and serve as a source of information to

correct any discrepancies between the responses of

different analysts.

In the step of determination of cash flow group

risk-adjusted net present value, average values for

the probable economic impact ranges and their

respective probabilities of occurrence are used to

generate a probability distribution for the economic

impact that translates the risk associated to each

factor. This distribution probabilistically describes

the impact of the considered factor on the monetary

value for the cash flow group in question.

Risk-adjustment was carried out by summing up

the deterministic value for the group, indicated in the

cash flow, and the probability distribution of the risk

factor that impact the group at hand, through

stochastic simulation using the Monte Carlo

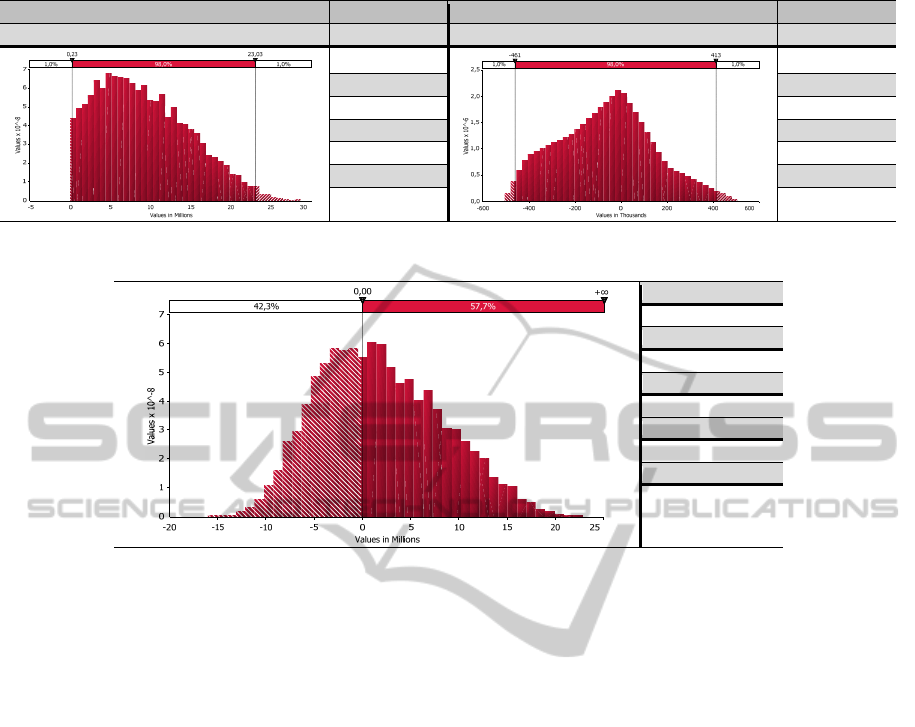

sampling technique. Figure 3 shows an example of

the probability distributions for the cash flow groups

Benefits and Financial costs and budgeting.

The determination of risk-adjusted net present

value for the project is carried out by summing up

the probability distributions for the cash flow groups

through a new stochastic simulation. Figure 4

presents an example of the probability distribution

for the project NPV with an average NPV of U$

1,862,568.20.

ECONOMIC-PROBABILISTIC MODEL FOR RISK ANALYSIS IN PROJECTS

209

Cash Flow Group Values Cash Flow Group Values

Benefits Average Financial costs and budgeting Average

9.161.823

-63.890

SD SD

5.687.280 204.700

1% value 1% value

232.428 -461.450

99% value 99% value

23.025.189 412.544

Figure 3: Summary of the probabilistic cash flow.

Average

1.862.568,20

Standard Dev.

6.416.584,20

1% value

-10.431.215,30

99% value

17.053.084,40

P(VPL ≥ 0)

57,7%

Figure 4: Probabilistic risk-adjusted NPV.

Figure 4 also shows the NPV standard deviation, a

98% confidence interval for NPV and the probability

of a positive NPV. This information provides a

complete view of the economic risk involved in the

project in a language accessible to both analysts and

decision makers.

After completing the risk assessment structure

completion, it is also possible to rank the risk factors

according to their impact on the project. This allows

identifying which factors represent the greatest

threats and the best opportunities to the project,

enabling the analysis of new options.

This model fills a literature gap by integrating

risk and economic project analysis. It offers decision

support translating the different types of risks in

financial results providing a clearer view of the

project’s economic viability to decision makers.

3 CONCLUSIONS

The proposed model guides the elaboration of the

project cash flow, identifies the risks involved and

quantifies the risks by mapping the potential

economic impacts and their probabilities of

occurrence. As its final result, the model provides

the project risk-adjusted economic return in the form

of a probability distribution for its NPV.

The presentation of the economic-probabilistic

risk analysis as a project NPV probability

distribution facilitates the comprehension of the

subtitles involved in the risk analysis for the

decision makers. Moreover, the probabilistic NPV

allows decision makers without technical knowledge

to easily assess the project risk level and the impact

of alternative scenarios by themselves, whilst other

risk analysis solutions usually require the support of

specialists for this type of evaluation.

REFERENCES

Benaroch, M. 2002. Managing Information Technology

Investment Risk: A Real Options Perspective. Journal

of Management Information Systems, v. 19, n. 2, pp.

43-84.

Benaroch, M.; Jeffery, M.; Kauffman, R. J.; Shah, S.

2007. Option-Based Risk Management: A Field Study

of Sequential Information Technology Investment

Decisions. Journal of Management Information

Systems, v. 24 n. 2, p103-140.

Chavas, Jean-Paul. 2004. Risk analysis in theory and

practice. Elsevier Academic Press, San Diego, 247p.

Foo, S. W.; Muruganantham, A. 2000. Software Risk

Assessment Model. Proceedings of the International

Conference on Management of Innovation and

Technology, IEEE, v.2, n. 1, p. 536-544.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

210

Karolak, D. W. 1996. Software Engineering Risk

Management. IEEE Computer Society Press, Los

Alamitos.

Schmitz, E. A.; Alencar, A. J.; Villar, C. B. 2006. Modelos

Qualitativos de Análise de Risco para Projetos de

Tecnologia da Informação. Brasport: Rio de Janeiro.

ECONOMIC-PROBABILISTIC MODEL FOR RISK ANALYSIS IN PROJECTS

211