Strategic Planning in Highly Dinamic Competitive Contexts

A Study of Italian Mobile Network Operators

Antonio Ghezzi

1

, Marcelo Nogueira Cortimiglia

2

, Alejandro Germán Frank

2

and Raffaello Balocco

1

1

Department of Management, Economics and Industrial Engineering, Politecnico di Milano, Milan, Italy

2

Department of Industrial Engineering, Federal University of Rio Grande do Sul, Porto Alegre, Brazil

Keywords: Strategic Management, Technology Management, Mobile Telephony.

Abstract: Strategic management formulation and implementation in highly dynamic competitive scenarios is a

challenging task. This is the case of the Mobile Telephony segment of the Information and Communication

Technology (ICT) industry. In this competitive setting, potentially disruptive changes in both marketing and

technological dimensions are the norm, as attested by the recent decrease in voice-related revenues by

Mobile Network Operators (MNO) and the consequent rise in mobile data traffic. In this context, this paper

aims to contribute to the literature on Strategic Technology Management by proposing an interpretative

framework to support strategic decision making in dynamic, competitive contexts characterized by

disruptive changes in both technology and business dimensions. The proposed framework is based on

empirical research conducted at the four MNOs operating in Italy and allows identifying drivers of

potentially disruptive change and their implications on a firm’s business model. The framework use is

illustrated through the analysis of the Italian Mobile Telephony industry. Finally, the research also

highlighted the main strategic routes MNOs have at their disposal to face the turbulent competitive times

ahead. These include specific strategic actions to cope with the issues of mobile bandwidth scarcity and

decreasing voice-related revenues. A summary of MNOs future strategic positioning options is also

provided.

1 INTRODUCTION

Given the ubiquity of mobile phones, Mobile

Telephony is clearly a cornerstone of the current

Information and Communication Technology (ICT)

industry. The relevance of Mobile Telephony was

initially established during the 1990s, when

substantial investments by Mobile Network

Operators (MNOs) cemented a vast customer base

all over the world. During the following decade and a

half, the Mobile Telephony market was characterized

by constant growth in terms of users and revenues,

most of which associated with voice transmission.

In recent years, however, this context has changed

considerably, with MNOs’ focus increasingly shifting

towards data transmission and its related value-

added services (Peppard and Rylander, 2006). First

of all, mobile subscriber growth is stagnating in

most countries and, particularly in mature markets

such as Western Europe, MNOs face a situation

where subscriber saturation and tight cost

competition lead to voice-related revenues becoming

increasingly less profitable.

Technology innovation is also a factor. On the

one hand, the rise of mobile devices tailored to

Internet use (i.e., smartphones and tablets) and the

diffusion of data-hungry content such as video

streaming drive the consumption of data in mobility.

On the other hand, innovation and investment in

network infrastructure technology increase the

availability of data provision, while lower mobile

data tariffs make it more accessible. In this complex

competitive context, elements such as the regulatory

backdrop, changing customer needs, and the

positioning of competitors and partners alike are

some of the additional variables that must be

addressed by MNOs when devising their strategies.

Furthermore, MNOs must also contend with a

business convergence trend in act in the ICT

industry that mirrors the technological convergence

of telecommunications, software, Internet and

electronic devices. This has caused a paradigmatic

shift in traditional Mobile Telephony value

networks, as exemplified by the successful foray of

155

Ghezzi A., Nogueira Cortimiglia M., Germán Frank A. and Balocco R..

Strategic Planning in Highly Dinamic Competitive Contexts - A Study of Italian Mobile Network Operators.

DOI: 10.5220/0004077501550162

In Proceedings of the International Conference on Data Communication Networking, e-Business and Optical Communication Systems (ICE-B-2012),

pages 155-162

ISBN: 978-989-8565-23-5

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

Apple in this market, that profoundly affects the

strategy of all players involved, particularly MNOs.

It seems clear, then, that the task of setting

strategic guidelines in this technology-oriented,

multifaceted context is particularly daunting. New

business models, pricing mechanisms and value

network relationships must be designed and

implemented in order to cope with the dynamic

conditions and continuous technological change.

However, these efforts require systematic research

that considers both the business and technological

issues at hand. In this way, important theoretical

implications for the Strategic Technology

Management discipline can be derived during

turbulent times, as demonstrated by classic works

such as Henderson and Clark (1990), Anderson and

Tushman (1990), Christensen and Rosenbloom

(1995) and Pepperd and Rylander (2006).

By studying the actions and decisions of firms

profoundly affected by contexts of turbulent

technologic and market change, insights on strategy

formation mechanisms can be formed. In particular,

it is possible to study the relationship between the

sources of disruptive change and their potential

strategic implications, as well as the business model

dimensions impacted. Thus, the aim of this paper is

to propose an interpretative framework to support

strategic decision making in dynamic, competitive

contexts characterized by disruptive changes in both

technology and business dimensions.

2 LITERATURE REVIEW

The issue of strategic planning in highly mutable

competitive contexts is well established in academic

literature. The field of Strategic Technology

Management is perhaps the most prominent

example. Most of the contributions in this regard can

be traced back to two main approaches to strategy:

the traditional positioning approach and the

emergent (or incrementalist) approach. Moreover,

the impact of ICT in business, particularly with the

Internet diffusion of the early 90s, brought to light a

new theme in strategic management: the concept of

business model. These two topics are briefly

addressed in this section in order to contextualize the

empirical research.

2.1 Strategic Technology Management

Since the early 80s, technology has been

incorporated into strategic thinking. This means,

basically, to understand how technology relates to

the overall business strategy and incorporate this

understanding into strategic planning and action.

The fact that technological change is highly dynamic

and frequently out of the firm’s reach brings

additional difficulties to this task.

2.1.1 The Positioning Approach

A first approach to strategic management of

technology incorporates a set of theories whose

basic assumptions imply that competition is the

battle for the most favourable position in a

competitive environment, and strategy is how a firm

can identify and achieve such position (Porter, 1980,

1985). Well known authors that adhere to this line of

thought include, for instance, Foster (1985), Shapiro

(1989), Hax and Majluf (1991) and Barat (2008).

Strategic decisions, thus, involve the selection of

business areas within a market structure for a firm to

explore and the internal leverage of a firm’s

resources to position itself in the industry. Thus, to

build sustainable competitive advantage, a firm must

analyse both endogenous and exogenous factors

affecting the industry and its position within it.

Technology, according to this approach, is at the

same time one of the variables that can be used to

implement a firm’s strategic choices and a

determinant of industry characteristics.

It is evident that this approach assumes that the

competitive environment is rather static. This was, in

fact, the overall condition when the basic theories

that underlie this approach were elaborated.

However, in the light of the growing pace of change

in technological, economic, social and political

scenarios that characterizes the current competitive

environment, this is no longer the case.

2.1.2 The Emergent Approach

This approach to strategic management assumes not

only a highly dynamic competitive environment, but

also that changes in this environment are inherently

difficult to foresee. Notwithstanding, strategic

efforts to induce and, if possible, control change and

its effects must be made. Contrarily to the

positioning approach, the emergent approach to

strategic technology management considers that a

firm’s competencies and resources are the main

source of competitive advantage, since they change

at a much slower pace than technologies or market

conditions. This approach builds upon the Resource-

Based View theory (Wernerfelt, 1984, Barney,

1986) and has as main exponents authors like

Prahalad and Hamel (1990), Teece et al. (1997) and

Collis and Montgomery (1995), as well as more

ICE-B 2012 - International Conference on e-Business

156

recent conceptual deployments such as the Blue

Ocean strategy (Kim and Mauborgne, 2004) and

Open Innovation (Chesbrough, 2003).

In particular, in the emergent approach to

strategic technology management considers

technology as a variable that induce change either

externally, through uncontrolled innovation by

competitors or players in other industries, or

internally, through planned innovation.

2.2 Business Models

Although initially criticized for their apparent

murkiness (Porter, 2001), the concept of business

model has been already fully incorporated in

Strategic Management theory (Teece, 2010). It is

now recognized as a valuable tool bridging the gap

between strategy formulation and implementation in

the form of business processes (Osterwalder, 2004;

Shafer et al., 2005). Particularly in the context of

Strategic Technology Management, a business

model is a “coherent framework that takes

technological characteristics and potentials as inputs,

and converts them through customers and markets

into economic outputs” (Chesbrough and

Rosenbloom, 2002, p. 532).

Due to its potentially ample field of application,

many authors have proposed different interpretations

for the fundamental elements that characterize a

business model. For the purposes of this research, a

summarized conceptual model addressing business

model elements elicited by Chesbrough and

Rosenbloom, (2002); Osterwalder and Pigneur,

(2002); Osterwalder, (2004); Shafer et al., (2005);

Ballon, (2007) and Teece, (2010) is used. This

conceptual model consists of the following

dimensions: (i) value proposition; (ii) value creation;

(iii) value delivery; and (iv) value appropriation.

The value proposition dimension relates to the

effective offering in the form of products and/or

services that create value for the user, but also

includes target customer selection and segmentation

as well as customer acquisition strategies. The value

creation dimension reflects the internal

organizational variables and characteristics that

determine a unique strategic approach to the market

and includes the key firm resources, assets,

processes, activities, and capabilities necessary to

create the value proposition. The value delivery

dimension refers to how the business is articulated in

order to reach its consumers and partners and relates

to elements of value network positioning, key

partnerships and relationships, delivery and

distribution channels, and customer relationship

strategies. Finally, the value appropriation

dimension, relative to how the business captures

value and generates profit, includes the parameters

of revenue model, revenue sharing, investment

model, and financing and cost structure.

3 RESEARCH METHODOLOGY

The present research is based on a comprehensive

literature analysis on the topics of Strategic

Technology Management, particularly regarding

deliberate and emergent strategy formation

mechanisms, Business Models and Value Networks.

The strong empirical- and business-oriented nature

of the research problem at hand, as well as its high

complexity, calls for an exploratory research

approach.

Thus, four explorative multiple case studies were

employed as research method for the empirical study

(Yin, 1994). The unit of analysis for the case studies

was the firm. All four MNOs operating in the Italian

Mobile Telephony market were studied: Telecom

Italia Mobile, Vodafone, Wind, and Tre. Data

collection was conducted through seven face-to-face

semi-structured interviews with top and middle

managers responsible for the following

organizational units: Operations (Value-Added

Services), Operations (Broadband Content), Market

Innovation and Research, Planning and Control

(Technology and Operations), Operations (Mobile

Broadband), New Project Development, and

Technology Strategy. Secondary sources such as

internal company documents, news published in

specialized publications, reports and white papers

were also used.

Data analysis for the four case studies was

conducted in parallel, with combined cross-case

analysis of case study write-ups. Data analysis

procedures included coding analysis of the interview

transcripts and secondary data (Auerbach and

Silverstein, 2003; Ritchie and Lewis, 2003). The

empirical study began in October 2011 and was

concluded in January 2012.

4 RESULTS

From the insights obtained in the empirical research

it was possible to draw a tentative framework to

incorporate disruptive change into strategy and

business model formation in turbulent competitive

scenarios. This framework includes two main

Strategic Planning in Highly Dinamic Competitive Contexts - A Study of Italian Mobile Network Operators

157

elements: a classification schema for disruptive

change and guidelines to identify disruptions and

incorporate them in the strategic planning process

and, consequently, in business model design and

implementation.

4.1 Disruptive Change Factors

The first element of the proposed framework is a

classification schema for disruptive change factors

that classifies disruptions as environment- or

enterprise-driven. Environment-driven changes are

exogenous to the company and can be further

distinguished as: (i) external innovation; (ii)

regulatory change; (iii) customer change; and (iv)

competitor strategy change.

In line with Garcia and Calantone (2002),

external innovation refers to marketing and/or

technological discontinuities at the macro level, that

is, on a world, market or industry level. This

includes, for instance, the introduction of the App

Store distribution model by Apple (a market macro-

level discontinuity coupled with a significant

technology discontinuity at micro/firm level) or the

emergence of tablets and smartphones as main

computing platforms (a technology discontinuity at

macro level causing significant discontinuity at both

marketing and technology micro/firm levels).

Radical regulatory change is almost invariably

the result of marketing or technological innovations

that require new rules of conduct for companies or

individuals operating under the new assumptions.

Thus, it was deemed necessary to revamp the

regulatory backdrop regarding consumer privacy

following the refinement of tools that automatically

capture and analyse browsing habits online.

Changes in customer habits and preferences are

also considered exogenous disruptions as only a very

limited number of players may be actually capable

of generating such large-scale socio-economic

phenomena through marketing or technological

innovations. Finally, competitor strategy changes

include the usual relationships between different

firms competing in the same industry. A change in

the overall strategic focus or in business model

dimensions by one player normally affects its

competitors, even if the impact is only a change in

market share or profit levels.

On the other hand, enterprise-driven changes

refer to disruptions to the competitive status quo

generated by the firm itself. Basically, these can be

originated from: (i) research and development

efforts; and (ii) emerging resources and

competences. RandD efforts normally result in

innovations that may disrupt the market context at a

macro or micro level, from a technological or

marketing point of view (Garcia and Calantone,

2002). Similarly, emerging resources and

competences refers to change opportunities arising

from a firm’s unique processes and intangible

resources. While some of these opportunities may be

fully developed into marketing or technological

innovations, most of the time these changes will

result in improved internal processes, better

productivity or increases in intellectual capital that

may impact strategic planning and business model

deployment.

4.2 Impact of Disruptive Change

Factors

From the insights obtained in the empirical research

it was also observed that disruptive changes in a

market are normally associated with changes in

business model dimensions or value network

relationships. Normally, the direction of this effect is

from the outside to the inside, that is, a change in

market conditions can be deducted from a misfit

between the initial assumptions that drove the

business model design or value network positioning

and the current performance parameters observed.

Business model dimensions that may be

particularly subject to change following disruptions

in market conditions include: target segments;

customer value perception; value proposition

characteristics; internal value creation resources (for

example, specific processes or organizational

structures); position and role in the value chain;

value capture mechanisms (that is, the revenue

model); and cost structure. Similarly, changes in

value network structure derived from disruptive

environment changes may include: the arrival or

departure of players; changes in the value creation

activities of specific players; changes in the value

network governance structure; and changes in the

overall value network competitive strategy.

Thus, the main assumption of the proposed

model is that business model dimensions and value

network relationships can be used as signalling tools

for disruptive changes in the market context. It is

important to note that these elements must be

analysed and fed into the strategic planning process.

In a turbulent competitive context, strategic planning

must be continuous and particularly responsive. The

strategic guidelines thus generated must then be used

as input to the business model design and

implementation activities. The aim is to achieve, as

soon as possible, the best possible fit between the

ICE-B 2012 - International Conference on e-Business

158

overall strategy, its implementation in terms of

business models, and the characteristics of the

competitive environment.

5 FRAMEWORK APPLICATION

In order to illustrate how the proposed interpretative

framework can be used to support strategy and

business model formation, it was applied to the

analysis of the Italian Mobile Telephony industry.

5.1 Disruptive Change Factors

The first element of the proposed model is the

identification of disruptive change affecting the

industry. In the case of the Italian MNOs,

interviewees pointed out as the main change factors

the relatively recent explosion in mobile data traffic

coupled with the constant decrease in revenues from

voice traffic. The data traffic increase in mobile

networks has been explained by interviewees as a

direct result of a number sub-factors, such as the

diffusion of value-added service offering by over-

the-top operators, the growing popularity of

bandwidth consuming services such as video

streaming and peer-to-peer, the emergence of more

accessible data traffic plans, the popularity of social

networking services (some of which include rich-

media applications such as photo and video

uploading), the diffusion of easy-to-use Internet-

capable smartphones and decisive marketing efforts

by MNOs to prompt the use of value-added services

by mobile subscribers.

It is opportune to note that interviewees see the

increase in data traffic not only as a driver of

business, but also as a technological threat. This is

so because mobile bandwidth is a scarce resource

that, according to some forecasts, can be saturated in

the near future if the pattern of traffic growth

intensifies. Moreover, the research suggests that as

much as MNOs are concerned, the value

appropriation dimension of current business models

in act is not capable of generating enough revenues

to repay investments to expand the network and

improve quality of service.

On the other hand, MNOs seem to bring the

decrease in voice-related revenues back to the

following factors: market saturation (which leads to

extreme cost competition in order to shift market

shares), emergence of voice-over-IP (VoIP) services,

and diffusion of social networking services. The

latter two factors are seen by the interviewees as

substitute products that circumvent the traditional

MNO value appropriation mechanism: the mobile

phone bill.

5.2 Impact of Disruptive Change

Factors

Other than identifying the factors of disruptive

change in act in the Italian Mobile Telephony

market from the MNOs’ point of view, the research

attempted to understand their impact in the

operationalization of MNOs’ strategies, i.e., their

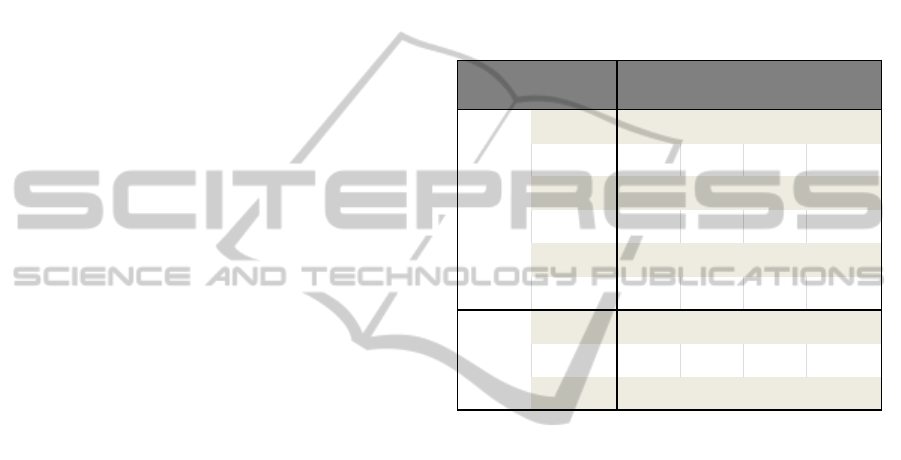

business models. Figure 1 summarizes the findings.

Figure 1: Impact of disruptive change factors in MNOs’

business model dimensions.

Moreover, the change factors have deeply

impacted the Mobile Telephony value network

configuration. This is particularly true in the case of

the Mobile Content and Internet market, and is

evident through a number of elements highlighted by

interviewees during the empirical research.

The first value network-related impact

mentioned is the arrival of new players. In the cases

at hand, this takes the form of Web-originated

companies expanding their value proposition to the

Mobile delivery channel, as well as a large number

of independent or semi-independent application

developers and mobile middleware technology

providers. Specific strategic relationships with each

type of new player have to be formulated and

implemented, with evident impact in coordination

resources. At the same time, a higher level of

strategic complexity is observed in these

relationships, with the introduction of co-opetition

dynamics with device manufacturers and web

companies, open innovation agreements and partial

role overlapping in some cases (for instance,

between device manufacturers and MNOs for direct

Value

Proposition

Value

Creation

Value

Delivery

Value

Appropriation

Diffusi on of VAS

(OTT)

Direct No Direct Indirect

Bandwidth

consuming services

Indirect Indirect Indirect Indirect

Accessibl e data

traffic plans

Direct No Indirect Direct

Soci al networki ng

services

Indirect Indirect Indirect Indirect

Smartphones Direct No No Direct

Marketing efforts Direct No Direct No

Market saturation Indirect Indirect No Direct

Emergence of VoIP Indi rect Indirect No No

Soci al networki ng

services

Direct Indirect Indirect Indirect

Increase in

data traffic

Decrease in

data revenues

Business Model Dimension

Change Factor

Source of change

Strategic Planning in Highly Dinamic Competitive Contexts - A Study of Italian Mobile Network Operators

159

customer ownership or billing).

The empirical research also generated an

understanding of the potential strategic directions

MNOs are evaluating given the change factors

identified and the potential impacts assessed. A first

set of strategic actions are aimed at solving the issue

of bandwidth scarcity. These include the revamping

of the value appropriation dimension of MNOs’

business models in order to align revenue

mechanisms with cost structures necessary to

expand network infrastructure. This may be

deployed through the limitation of flat data traffic

plans by a network cap or contract diversification

according to user choices such as peer-to-peer usage,

quality of service desired/required based on usage

profile, and time of day connections are established.

Another potential stream of strategic actions

aims at solving the bandwidth scarcity issue by

modifying the regulatory system. This can take the

form of net neutrality violations in the case of

network congestion, that is, blockage of high

bandwidth services identified through deep packet

inspection mechanisms. Conversely, MNOs can also

try to explore additional frequencies made available

through the digital dividend, that is, the switch-off

between analogic and digital transmissions taking

place in most Western countries. Finally, strategic

regulatory initiatives in this area may benefit of

ETICS (Economics and Technologies for Inter-

Carrier Services), a FP7 project promoted by the

European Community that aims at balancing the

revenue models of all players involved in the Fixed-

Mobile Internet value networks through revenue and

investment sharing mechanisms.

A third potential strategic solution to the

bandwidth scarcity issue lies, obviously, in increased

investments in network infrastructure, with

consequent expansion of capacity. If possible, this

solution would also benefit of the co-investment

strategies mentioned before.

The research also highlighted a second set of

strategic actions aimed at solving the issue of

decreasing voice-related revenues. The first option is

revamping the value appropriation dimension of

MNOs’ business models. This can be achieved, for

instance, by contract differentiation (with or without

VoIP access, for instance) or, as currently, price

reduction actions in order to improve market share

(a strategy successfully employed by Mobile Virtual

Network Operators all over Europe, for instance).

If these strategic actions are not enough to stop

the losses or create enough profits for future growth,

MNOs have also at their disposal the possibility of

exploring the disruptive changes at hand. This can

take the form of specific strategic investments in

innovative marketing opportunities. It is important,

however, to highlight the need for the adequate fit

between these innovative marketing opportunities

and firms’ competencies and distinctive value

creation assets. For instance, Telecom Italia Mobile

has decided to invest in areas such as Mobile

Payment, eBooks, OTT TV, target advertising,

Cloud Computing, and Application Stores. In this

particular case, the MNO was forced to face the

disruption caused by Apple’s marketing and

technological innovations, which have changed the

distribution paradigm for mobile digital content

from Mobile Portals to Application Stores. The

research suggests that MNOs willing to develop

their own Application Stores must be able to

guarantee a number of critical success factors

dictated by the market. These include a large user

base that can be easily reached (and this has to be

effectively communicated to potential application

developers), and a sustainable business model for

third parties and developers coupled with a proven

technical infrastructure for application development

(which also needs to be effectively distributed to

potential application developers). Interviewees also

highlighted the need for sharing marketing

information such as client segmentation and

application store usage with application developers

as well as implementing effective marketing tools

for them to promote their own content. All of this

must be grounded in an application store that, from

the user point of view, must be easy to use and at the

same time customizable and integrated to social

networking applications.

5.3 MNOs Future Strategic Scenarios

Finally, the research provided a summary of MNOs

future strategic positioning scenarios. In short,

MNOs must choose their own role in the Mobile

Internet convergence scenario. Three potential future

scenarios were evidenced through the empirical

research.

If MNOs wish to maintain a focal role in the

future Mobile Internet value network, current

strategy makers understand that they must manage

three areas contemporaneously: (i) customer

relationship (the business model dimension related

to value delivery), where they can build sustainable

competitive advantage through economies of scope;

(ii) content commercialization and innovation,

focusing in innovative services and diminishing the

time-to-market of new content and services; and (iii)

infrastructure management, focusing in network

ICE-B 2012 - International Conference on e-Business

160

access services and mediation capability, where their

competitive differential also lies in economies of

scale. In other words, MNOs that wish to retain their

focal role must manage and control the value

network through the lens of the “Smart Pipe”

analogy, that is, exploring the opportunities brought

by the network functionalities and managing the

quality of service as source of competitive

advantage. An example of business model

implementation of the Smart Pipe concept was

provided by one of the interviewees: by managing

data traffic functionalities, it is possible to create

“preferred routes” for companies willing to pay for

superior network connection speed to costumers

accessing their sites or applications. In this business

model, MNOs can also create opportunities for

shared revenues with providers of technology

management services or third parties that

intermediate the value delivery for companies and

users alike. A second potential business model that

illustrates the Smart Pipe vision relies on the use of

core network functionalities by third parties in B2B

arrangements. Functionalities that can be explored in

these business models include location-based

technologies or the potential to billing the user

through the MNO’s Sim card. The MNO, thus,

would “rent” its technological assets and capabilities

to third parties able and willing to develop and

manage a profitable business model. Normally,

value appropriation in these cases can take the form

of revenue sharing.

Another strategic option suggested in this

research for MNOs in the near future goes beyond

the role of Smart Pipe. Depending on the

technological and marketing evolution of the

competitive environment, MNOs can play the role of

“Value Network Orchestrators”. According to the

evidence in this research, this implies in two main

strategic courses of action. The first one requires that

MNOs be able to achieve a state of equilibrium in

their relationships with other large players in the

value network, such as device manufacturers and

web companies. The other course of action is to

pursue the development of open technological

platforms compatible with as many different devices

as possible. Evidently, there is a delicate trade-off in

the actual strategic actions to be taken, as pursuing

open platforms may be contrary to the interests of

device manufacturers. The specific actions necessary

to achieve a role of “Value Network Orchestrator”

depend, evidently, of the future developments in the

Mobile Internet convergence scenario, but all Italian

MNOs are aware of this option.

Finally, a third analogy for the future strategic

role of MNOs was suggested in this research. That is

the role of “Innovation Coordinator” in the value

network. This requires the MNOs to relinquish the

operational activities related to content creation and

development of new products and services to

specialized third parties. Thus, MNOs become

coordinators of the development ecosystem and, if

the transition is managed correctly, will be able to

keep a main role in the value network without the

high costs related to development of innovative

products. MNOs, in this scenario, provide the

overall direction for the development efforts based

on their knowledge about the customers (obtained

through the usage monitoring and user profiling).

This is a similar role that is currently played by

Apple in the closed ecosystem it created with its

devices.

Obviously, these three scenarios are not mutually

exclusive. Instead, they are complementary – each

MNO will certainly look for a role adequate to its

strategic characteristics, competences, assets and

capabilities.

6 CONCLUSIONS

This paper presented an empirical research

conducted on the four Italian MNOs that resulted in

an interpretative framework to support strategic

decision making in highly turbulent competitive

scenarios. This is precisely the case of the Mobile

Telephony industry in recent years, as the

technological convergence between Internet and

Mobile has brought to light a number of business

consequences. By studying the strategic decision

making process of top and middle managers of firms

operating at the core of the affected industry, it was

possible to understand how strategy makers identify

the drivers of potentially disruptive change and,

more importantly, how they perceive the impact of

change factors in their business models. Finally, the

research also highlighted the main strategic routes

MNOs have at their disposal to face the turbulent

competitive times ahead. These include specific

strategic actions to cope with the issues of mobile

bandwidth scarcity and decreasing voice-related

revenues. A summary of MNOs future strategic

positioning options is also provided.

Given the exploratory nature of the research

reported, this paper represents a somewhat generic

contribution to the understanding of strategy

formation in dynamic contexts. However, its main

contribution lies in the detailed analysis of the

Mobile Telephony market in a context of technology

Strategic Planning in Highly Dinamic Competitive Contexts - A Study of Italian Mobile Network Operators

161

and business convergence. The richness of data

available made it possible to draw a clear picture of

the challenges and opportunities MNOs face.

Although the specific issues were analysed in the

Italian context, it can be argued that it is reasonably

representative of most Western markets and, thus,

results and insights can be somewhat generalizable.

Evidently, explanatory and descriptive future

research will have to be conducted in order to

expand and validate the findings reported.

REFERENCES

Anderson, P., Tushman, M. L., 1990. Technological

discontinuities and dominant designs: a cyclical model

of technological change. Administrative Science

Quarterly, 35(4):604-633.

Auerbach, C. F., Silverstein, L. B., 2003. Qualitative Data

– An Introduction to Coding and Analysis, New York

University Press.

Ballon, P. 2007. Business modelling revisited: the

configuration of control and value, Info, 9(5): 6–19.

Barat, S., 2008. A new model for competitive warfare and

sustained advantage. Strategic Change, 17:269–280.

Chesbrough, H., 2003. Open Innovation – The New

Imperative for Creating and Profiting from

Technology, Harvard Business School Press.

Chesbrough, H.; Rosenbloom, R. S., 2002. The role of the

business model in capturing value from innovation:

evidence from Xerox Corporation's technology spin-

off companies. Industrial and Corporate Change, 22

(3):529-555.

Collis, D. J., Montgomery, C. A., 1995.“Competing on

Resources: Strategy in the 1990s, Harvard Business

Review, 73:118-128.

Foster, R. N., 1985. Timing technological transitions,

Technology in Society, 7:127-141.

Garcia, R., Calantone, R., 2002. A critical look at

technological innovation typology and innovativeness

terminology: a literature review, The Journal of

Product Innovation Management, 19:110-132.

Hax, A. C., Majluf, N. S., 1991. The Strategic Concept

and Process: A Pragmatic Approach, Prentice Hall.

Henderson, R. M., Clark, K. B., 1990. Architectural

innovation: the reconfiguration of existing product

technologies and the failure of established firms,

Administrative Science Quarterly, 35(1):9-30.

Kim, W. C., Mauborgne, R., 2007. Blue Ocean Strategy:

How to Create Uncontested Market Space and Make

the Competition Irrelevant”, Harvard Business School.

Osterwalder, A., Pigneur, Y., 2002. An E-Business Model

Ontology for Modelling E- business". In: Proceedings

of the 15

th

Bled eConference, Bled, Slovenia, June 17-

19, 2002.

Osterwalder, A., 2004. The Business Model Ontology: A

Proposition in a Design Science Approach. Doctoral

Thesis on Management Informatics, Lausanne: Ecole

des Hautes Etudes Commerciales, Universite de

Lausanne.

Peppard, J., Rylander, A., 2006. From Value Chain to

Value Network: an Insight for Mobile Operators.

European Management Journal, 24(2-3):128-141.

Porter, M. E., 1980. Competitive Strategy, Free Press.

New York.

Porter, M. E., 1985. Competitive Advantage, Free Press.

New York.

Porter, M. E., 2001. Strategy and the Internet. Harvard

Business Review, 79(3):62-78.

Prahalad, C. K., Hamel, G., 1990. The Core Competency

of the Corporation. Harvard Business Review, 68(3):

79-91.

Ritchie, J., Lewis, J., 2003. Qualitative Research Practice

– A Guide for Social Sciences Students and

Researchers, SAGE Publications.

Shafer, S. M., Smith, H. J., Linder, J. C., 2005, The power

of business models, Business Horizons, 48(3):199-207.

Shapiro, C., 1989. The theory of business strategy, Rand

Journal of Economics, 20:125-137.

Teece, D. J., Pisano, G., Shuen, A., 1997. Dynamic

capabilities and strategic management, Strategic

Management Journal, 18(7):509–533.

Teece, D. J., 2010. Business models, business strategy and

innovation. Long Range Planning, 43:172-194.

Wernerfelt, B., 1984. A resource-based view of the firm.

Strategic Management Journal, 5(2):170–180.

Yin, R. K., 1994. Case Study Research: Design and

Methods, Sage Publications. 2nd edition.

ICE-B 2012 - International Conference on e-Business

162