A Comparative Study of Intelligent Techniques for Modern Portfolio

Management

Konstantinos Metaxiotis and Konstantinos Liagkouras

Decision Support Systems Laboratory, Department of Informatics, University of Piraeus,

80, Karaoli & Dimitriou Str., 18534 Piraeus, Greece

Keywords: Portfolio Selection, Optimization Techniques, Evolutionary Algorithms.

Abstract: In this paper we present a wide range of intelligent technologies applied to the solution of the portfolio

selection problem. We also provide a classification of the available intelligent technologies, according to the

methodological framework followed. Finally, we provide a comparative study of the different intelligent

technologies applied for constructing efficient portfolios and we suggest potential paths for future work that

lie at the intersection of the presented techniques.

1 INTRODUCTION

Computer Science not only provided a fast and

reliable way of calculating computationally

demanding financial models but also revolutionized

the financial modeling research field itself by

developing innovative algorithmic approaches for

solving difficult financial problems that in many

cases cannot be solved using exact methods. The

computational approaches dealing with financial

modeling can be clustered into four different groups

depending on the applied methodology.

2 INTELLIGENT TECHNIQUES

FOR OPTIMAL PORTFOLIO

SELECTION

2.1 Evolutionary Algorithms

The first classification concerns the so called

Evolutionary algorithms (EAs). EAs are population

based stochastic optimization heuristics inspired by

Darwin’s Theory of Evolution. An EA searches

through a solution space in parallel by evaluating a

set of possible solutions. Genetic Algorithms (GAs)

which belong to the family of EAs have been proved

very effective for solving constrained portfolio

optimization problems (Shoef and Foster, 1996);

(Chang et al., 2009) that cannot be solved with exact

methods. Genetic and Evolutionary Programming

(EP) and Evolutionary Strategy (ES) belong as well

to EAs.

2.2 Swarm Intelligence

The second classification of algorithmic approaches

for the construction of efficient portfolios concerns

the Swarm Algorithms. Swarm Intelligence (SI) is

inspired from the biological examples provided by

social insects. SI is a decentralized, self-organized

system in which the agents through their collective

behavior find coherent solutions to the arisen

problems. Ant Colony Optimization (ACO) is an

optimization procedure inspired by ants’ ability to

identify optimal paths by depositing pheromone on

the ground.

Another popular SI technique is the Particle

Swarm Optimization (PSO). The particle exchanges

information with the neighboring members, in order

to adjust its trajectory towards the best attained

position. Both ACO and PSO techniques have been

applied to solve the constrained portfolio selection

problem (Deng and Lin, 2010); (Doerner et al.,

2004); (Armananzas and Lozano, 2005);

(Golmakani and Fazel, 2011); (Zhu et al., 2011).

2.3 Local Search Algorithms

The third classification of computational approaches

for the solution of the portfolio selection problem

concerns the Local Search Algorithms techniques.

268

Metaxiotis K. and Liagkouras K..

A Comparative Study of Intelligent Techniques for Modern Portfolio Management.

DOI: 10.5220/0004114102680272

In Proceedings of the 4th International Joint Conference on Computational Intelligence (ECTA-2012), pages 268-272

ISBN: 978-989-8565-33-4

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

These algorithms try to improve an initial solution

by applying iteration in order to create the

neighborhood of the current solution. Then the best

solution of the neighborhood is selected for the next

iteration. The process continues until a solution

considered optimum is found.

Simulated Annealing (SA) is a well known local

search technique developed to deal with highly

nonlinear problems. SA techniques have been

applied extensively for the solution of the portfolio

selection problem (Chang et al., 2000); (Crama and

Schyns, 2003); (Maringer and Kellerer, 2003);

(Ehrgott et al., 2004); (Armananzas and Lozano,

2005). Hill Climbing and Tabu Search (TS) are as

well known local search techniques applied to the

portfolio optimization problem.

2.4 Multiobjective Evolutionary

Algorithms

Finally the last classification of computational

approaches for the solution of the portfolio selection

problem concerns the Multiobjective Evolutionary

Algorithms (MOEAs). Multiobjective optimization

(MO) is the problem of maximizing / minimizing a

set of conflicting objective functions subject to a set

of constraints. In MO there is not a single solution

that maximizes / minimizes each objective to its

fullest. This happens because the various objective

functions in the problem are usually in conflict with

each other. Therefore, the objective in MO is to find

the Pareto front of efficient solutions that provide a

tradeoff between the various objectives. MOEAs can

be useful in the solution of complex problems for

which no efficient deterministic algorithm exists

(Metaxiotis and Liagkouras, 2012). In finance there

are several NP-hard problems for which the use of a

heuristic is clearly justified (Schlottmann and Seese,

2004). Portfolio Selection belongs to this category of

problems, because of the simultaneous optimization

of several conflicting objectives subject to a set of

constraints imposed to the problem.

3 COMPARATIVE STUDY OF

INTELLIGENT TECHNIQUES

APPLIED FOR EFFICIENT

PORTFOLIO CONSTRUCTION

Below the table displays the most popular intelligent

techniques among the authors in the portfolio

selection research field. According to the table the

most popular artificial intelligence technique among

the authors in the field of portfolio selection is the

MOEAs with 33% of the total publications. EAs

come second with 29%. On the other hand, Local

Search Algorithms (LSAs) techniques are less

popular among the authors in the field as they count

for the 15% of all publications in the field.

Table 1: Artificial intelligence techniques for the solution

of the Portfolio Selection problem.

Multiobjective Evolutionary Algorithms 33%

Evolutionary Algorithms 29%

Local Search Algorithms 15%

Swarm Intelligence 23%

3.1 Theoretical Comparison of

Artificial Intelligence Techniques

Below we compare four well known intelligent

techniques that belong correspondently to the fields

of EAs, SI, LSAs and MOEAs.

Specifically the representatives of the four fields

are the following: GAs, PSO, SA and Non-

dominated Sorting Genetic Algorithms II (NSGA-

II). The four aforementioned techniques are

evaluated with regard to their ability to solve

efficiently portfolio selection problems. The Table

below highlights the main features of the examined

techniques.

Table 2: Comparison of artificial intelligence techniques.

Initial Population

Initial Solution

Evolve

in Genetics

Evolve in social

behavior

Evolve in

thermodynamics

GA PSO

SA

-Selection

-Evolve each

particle

-Evolve each atom

-Crossover

-Current position

-Initial temperature

-Search better

position

-Liquid metals cool

down process

-Mutation

-Velocity of

particle

As the graph above reveals the GAs and PSO

share more in common compared to SA. We notice

that GA has a population of alternative solutions

(chromosomes) while SA has only one individual

(the current solution). Additionally, there are

differences in terminology between the two

intelligent techniques that reflect the different

approaches for finding the optimal solution to the

problem. For instance in GA are used the terms:

chromosomes or individuals, fitness evaluation,

AComparativeStudyofIntelligentTechniquesforModernPortfolioManagement

269

selection, crossover and mutation. On the other hand

in SA the dominant terminology is: temperature,

costs, neighbourhood, and moves.

If we want to find common ground between the

two optimization techniques we would say that SA

can be considered a GA where the population size is

one. Since there is only one solution in the

population (the current solution) there is no

crossover but only mutation.

This is the key difference between GA and SA.

GA can create new solutions by combining existing

solutions (crossover), whereas SA creates a new

solution by modifying the current solution with a

local move. Which intelligent technique is better

able to find optimal solutions depends mainly on the

problem and representation used. Additionally, we

should highlight that both GA and SA techniques

share the assumption that good solutions are more

probable to be found near already known good

solutions rather than randomly selecting from the

whole selection space.

Table 3: Genetic algorithms vs simulated annealing.

Genetic Algorithms Simulated Annealing

chromosomes one individual - current solution

fitness evaluation calculate the energy of the system

Selection neighbourhood

Crossover modify current solution

mutation local move

Finally, it is clear that the performance of a GA

is seriously affected by the relative weights of

mutation and crossover respectively. For instance if

mutation defined to be the principal way for creating

new solutions then the GA tend to follow the way it

function a SA, as the solutions are being at large

independently improved.

Figure 1: Both GA and SA techniques share the

assumption that good solutions are more probable to be

found near already known good solutions.

3.1.1 Comparison of PSO with GAs

PSO and GAs on the other hand share many

similarities. First of all, both techniques start with a

population of random solutions and search for the

optimal solution by updating generations. However,

a striking difference between the two techniques is

that PSO does not have evolution processes such as

mutation and crossover. Instead in PSO the potential

solutions (particle) moves through the search space

by following the current best particles.

Table 4: GA vs PSO.

GA PSO

chromosomes population of solutions - particles

fitness evaluation evaluate fitness of each particle

Selection

update particle’s velocity and position

based on the best objective value found so

far by the particle and the entire population

Crossover

Mutation

Analytically, in PSO the particles are randomly

initialised and freely move through the search space.

During movement each particle updates its own

velocity and position based on the best objective

value found so far by the particle and the entire

population respectively. The updating policy drives

the particle to move towards the region of the higher

objective function. Finally, all particle gather around

the position with the highest objective function.

Figure 2: In PSO the updating policy drives the particles to

move towards the region of the higher objective function.

3.1.2 Comparison of TS with GAs

TS uses a local search procedure to move from a

current solution to a neighbor solution, until a

stopping criterion has been satisfied. The search

process starts with an initial solution and moves

from neighbor to neighbor as long as possible while

improving the objective function value.

Table 5: GA vs TS.

GA

Tabu Search

chromosomes current solution

fitness evaluation best known solution

Selection objective function value

Crossover neighbourhood of current solution

Mutation

Subset of the neighbourhood of current

solution - Allowed by the aspiration.

Tabu list

TS allows hill climbing to overcome local

optima. A key property of tabu search is to pursue

IJCCI2012-InternationalJointConferenceonComputationalIntelligence

270

the search whenever a local optimum is encountered

by allowing non improving moves. Additionally, the

use of memory (tabu list) prevents the cycling back

to previously visited positions.

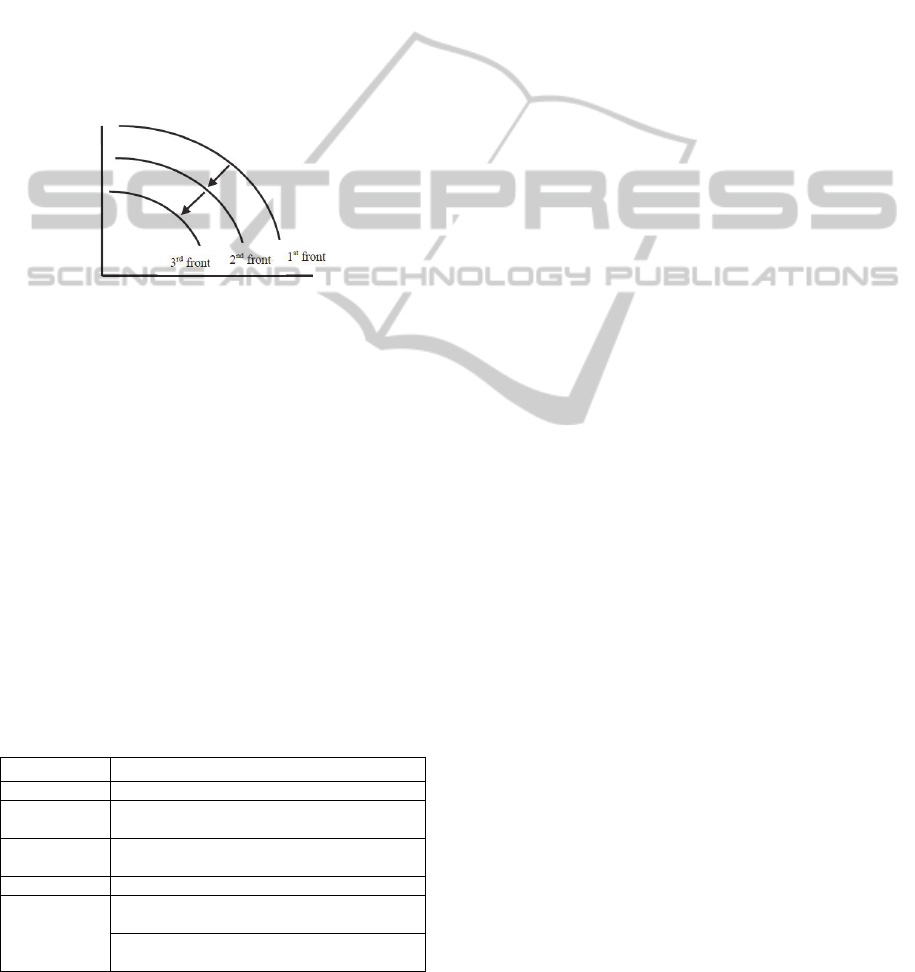

3.1.3 Comparison of NSGA-II with GAs

NSGA-II is a popular non-domination based genetic

algorithm for MO. The algorithm creates a

population of initial solutions. After the initialization

of the population, the population is sorted based on

non domination into each front. The first front

consisted by the non-dominated set in the current

population. The second front is only dominated by

individuals of the first front, and so on.

Figure 3: NSGA-II, population is sorted based on non

domination into each front.

Each individual in each front is assigned a rank

value based on the front in which it belongs to.

Thus, individuals in the first front are assigned

fitness value of 1, and individuals in the second front

are given a value of 2 and so on.

Additionally a parameter called crowding

distance is calculated for each individual. Crowding

distance measures how close an individual is to its

neighbours. The greater the average crowding

distance the better, as indicates better population

diversity. Parents are selected from the population,

by using binary tournament selection based on the

rank and the crowding distance. The selected

population generates offsprings from crossover and

mutation operators.

Table 6: GA vs NSGA-II.

GA NSGA-II

chromosomes population of solutions

fitness

evaluation

population is sorted based on non domination

into fronts

Selection

crowding distance is calculated for each

individual

Crossover Parents are selected

Mutation

Offsprings generated from crossover and

mutation operators

Population sorted again based on non-

domination

The population including now the initial

population and the offsprings is sorted again based

on non-domination and only the N individuals are

selected. The selection is based as before on rank

and crowding distance on the last front. NSGA-II

technique has been applied extensively for the

solution of the constrained portfolio selection

problem (Deb et al., 2002); (Lin and Wang, 2002);

(Anagnostopoulos and Mamanis, 2009); (Deb et al.,

2011).

4 CONCLUSIONS

In it only since 1990s that artificial intelligence

techniques have been applied to the constrained

portfolio optimization problem. Yet in that short

space of time, they have had remarkable success in

this particular research field. Given the initial

success we can reasonably expect in the future a

growing number of powerful artificial intelligence

techniques applied to the solution of the constrained

portfolio optimization problem.

REFERENCES

Anagnostopoulos K. and Mamanis G., (2009)

Multiobjective evolutionary algorithms for complex

portfolio optimization problems, Springer – Verlag

2009

Chang, T. J., Meade, N., Beasley, J. E. and Sharaiha, Y.

M., (2000). “Heuristics for cardinality constrained

portfolio optimisation”, Computers and Operations

Research , 27, (2000), 1271-1302.

Chang, T. J., Yang S. C. & Chang K. J., (2009). Portfolio

optimization problems in different risk measures using

genetic algorithm, Expert Systems with applications,

36 (2009): 10529-10537.

Crama, Y. & Schyns, M., (2003). Simulated annealing for

complex portfolio selection problems, European

Journal of Operational Research 150: 546-571.

Deb K., Pratab A., Agarwal S., and Meyarivan T., (2002).

“A fast and elitist multiobjective genetic algorithm:

NSGA-II,” IEEE Trans. Evol. Comput., vol. 6, pp.

182–197, Apr. 2002.

Deb, K., Steuer, R.E., Tewari, R. & Tewari, R., (2011).

Bi-objective portfolio optimization using a customized

hybrid NSGA-II procedure, R. H. C. Tekahashi et al.

(Eds.): EMO 2011, LNCS 6576, pp. 358-373,

Springer-Verlag Berlin Heidelberg 2011.

Deng, G. F. & Lin W. T., (2010). Ant colony optimization

for Markowitz mean-variance portfolio model, B.K.

Panigrahi et al. (Eds): SEMCCO 2010, LNCS 6466,

pp.238-245, Springer – Verlag Berlin Heidelberg

2010.

Doerner K., Gutjahr W., Hartl R., Strauss C., Stummer C.,

AComparativeStudyofIntelligentTechniquesforModernPortfolioManagement

271

(2004). Pareto Ant Colony Optimization: A

Metaheuristic Approach to Multiobjective Portfolio

Selection, Annals of Operations Research 131, 79-99,

2004

Ehrgott M., Klamroth K., and Schwehm C., (2004). “An

MCDM approach to portfolio optimization,”

European Journal of Operational Research, vol. 155,

no. 3, pp. 752–770, June 2004.

Golmakani, H. R. & Fazel, M., (2011). Constrained

portfolio selection using particle swarm optimization,

Expert Systems with Applications 38 (2011): 8327-

8335.

Maringer, D. & Kellerer, H., (2003). Optimization of

cardinality constrained portfolios with a hybrid local

search algorithm. OR Spectrum (2003) 25: 481-495

Metaxiotis K. & Liagkouras K., (2012). Multiobjective

Evolutionary Algorithms for Portfolio Management: A

Comprehensive Literature Review, Expert Systems

with Applications, vol. 39, issue 14, pp. 11685-11698,

Oct. 2012

Schlottmann, F., & Seese, D., (2004). Financial

Applications of Multi-Objective Evolutionary

Algorithms: Recent Developments and Future

Research Directions. In C. A. Coello Coello & G. B.

Lamont (Eds.), Applications of multi-objective

evolutionary algorithms (pp. 627–652). Singapore:

World Scientific.

IJCCI2012-InternationalJointConferenceonComputationalIntelligence

272