Improving Supply-Chain-Management based on Semantically

Enriched Risk Descriptions

Sandro Emmenegger

1

, Emanuele Laurenzi

2

and Barbara Thönssen

1,2

1

Institute for Information Systems, University of Applied Sciences and Arts Northwestern Switzerland FHNW,

Riggenbachstr. 16, Olten, Switzerland

2

Dipartmento di Matematica e Informatica, University of Camerino, Via Madonna delle Carceri 9, Camerino (MC), Italy

Kewords: Supply-Chain-Management, Risk-Management, Enterprise Ontology, Semantic Technology.

Abstract: To discover risk as early as possible is a major demand of today’s supply-chain- risk-management. This

includes analysis of internal resources (e.g. ERP and CRM data) but also of external sources (e.g. entries in

the Commercial Register and newspaper reports). It is not so much the problem of getting the information as

to analyze and evaluate it near-term, cross-linked and forward-looking. In the APPRIS project an Early-

Warning-System (EWS) is developed applying semantic technologies, namely an enterprise ontology and an

inference engine, for the assessment of procurement risks. The approach allows for integrating data from

various information sources, of various information types (structured and unstructured), and information

quality (assured facts, news); automatic identification, validation and quantification of risks and aggregation

of assessment results on several granularity levels. For representation the graphical user interface of a

project partner’s commercial supply-management-system is used. Motivating scenario is derived from three

business project partners’ real requirements for an EWS with special reference to the downstream side of

supply chain models, to suppliers’ company structures and single sourcing.

1 INTRODUCTION

Globalization of the economy, on-going change of

the market situation and ever-increasing cost

pressure cause new business models to take up the

challenges. In the manufacturing industry

networked, virtual or extended enterprises have

emerged (Park and Favrel, 1999) allowing for global

sourcing without the necessity of owning all the

players of the supply chain (Chung et al., 2004).

However, transnational, inter-organizational

collaborations of enterprises are not limited to the

manufacturing sector but also of growing

importance of the tertiary and quaternary economic

sector, providing (shared) services to businesses and

consumers. Whereas that strategy brings down the

costs it increases the effort on managing business

relations, particularly with respects to the supply

chain.

In parallel dynamism of the economic

environment increases and therefore, the risk factors

that affect the performance of the supply chain, too.

Studies of Volatier et al. (2009) show, that the risk

portfolio can change significantly within a period of

three months (factor 8 more critical suppliers), and

thus greatly increase the vulnerability of the own

enterprise. The Global Risks Barometer presents an

overview of 37 risks analysed in 18 workshops by

more than 500 leading experts and decision-makers

(Emmerson, 2011). The survey not alone identified

risks and assessed the likelihood to occur in the next

10 years but also show how risks are interconnected.

To look not only at direct suppliers but on the whole

supply chain is a trend identified in the latest annual

survey by PRTM Management Consultants about

Global Supply Chain Trends 2010–2012 with 350

participating manufacturing and service companies

(Geissbauer and D’heur, 2011).

Risk management in such a complex and

dynamic environment requires a continuous tracking

of events, trends and risks, their analysis and

integration into the decision-making processes. Data

about exchange, enterprises, economy, environment

and politics, as well as country and sector analysis

are available on the Internet. However, the

exponential growth of information does not

necessarily lead to better knowledge. Without a

systematic methodology and efforts to remain

70

Emmenegger S., Laurenzini E. and Thönssen B..

Improving Supply-Chain-Management based on Semantically Enriched Risk Descriptions.

DOI: 10.5220/0004139800700080

In Proceedings of the International Conference on Knowledge Management and Information Sharing (KMIS-2012), pages 70-80

ISBN: 978-989-8565-31-0

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

informed one drowns in the flood of information

which is also the problem of lack of selectivity

(Priddat, 2002). Albeit, today risk management in

procurement is barely supported with tools and

appropriate methods are missing. According to a

study of Wyman (2010) more than 70% of the

surveyed companies command “unstructured” (18%)

or “re-active” (55%) risk management in

procurement. A survey published in The McKinsey

Quarterly in 2006 revealed that nearly one-quarter of

the interviewees said that their company does no

formal risk assessment, and almost half lack

company-wide standards to help mitigate risk

(Pergler and Lamarre, 2009).

The APPRIS project seeks to remedy this. It

aims at integrating risk, procurement and knowledge

management into one early warning system. To do

so an enterprise ontology is used for knowledge

representation stored in a triple store, risk

assessment is implemented in Java and the graphical

user interface is realized within a project partner’s

commercial Supply-Management-System.

The paper is structured as follows: In chapter two

the APPRIS-approach is introduced. The approach

illustrates the project principles based on risks and

indicators, introduces an enterprise ontology for the

risk domain and provides an insight into

implementation details and technologies used. In

chapter three we highlight related research and we

close in chapter four with a conclusion and an

outlook.

2 THE APPRIS APPROACH

2.1 Principles

The APPRIS approach is based on a study by

Grosse-Ruyken and Wagner (2011) who identified

ten top procurement risks. Grosse-Ruyken and

Wagner (2011) developed a matrix for each of the

ten risks characterizing the sources of a risk

(organizational risk sources, environmental risk

sources and network-related risk sources) and four

crises (stakeholder crisis, strategy crisis, operational

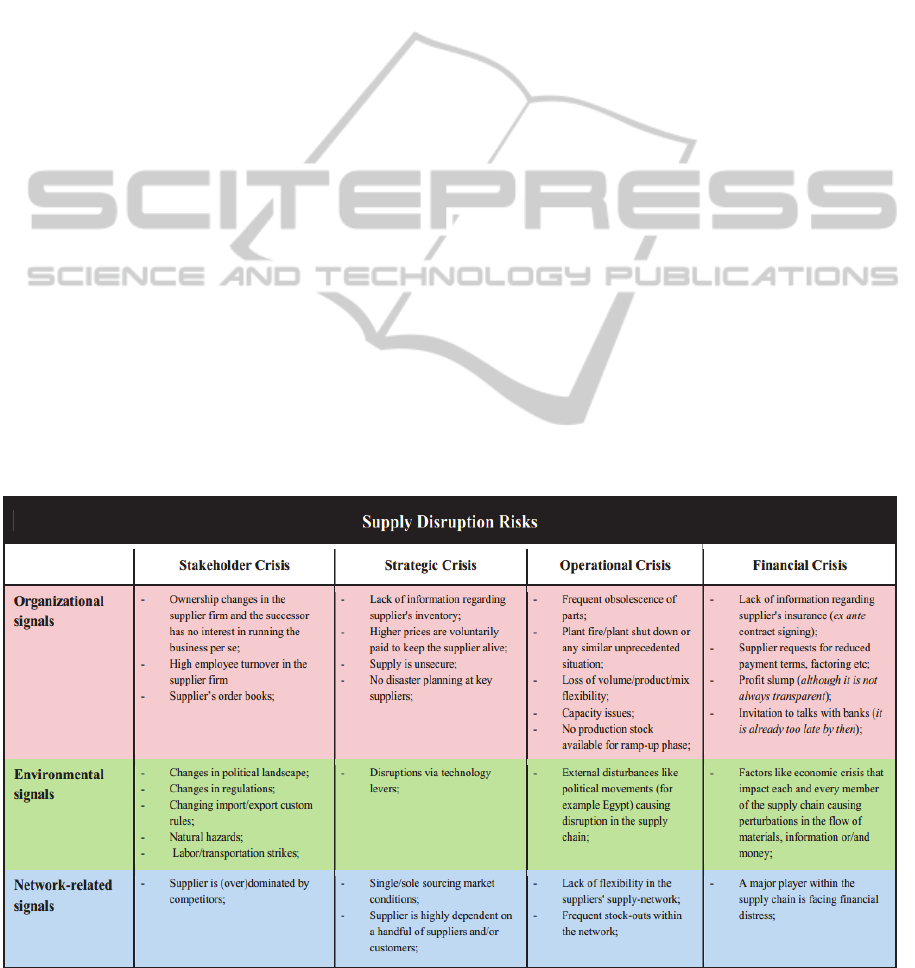

crisis and financial crisis). Figure 1 depicts the

matrix for the Supply Disruption Risk. For each of

the top ten risks warning signals have been

identified and classified into the matrix. We took

these matrixes as starting point and determined risk

indicators for warning signals, which have been

considered most important by the project’s business

partners. For 10 out of a total of approximately 180

warning signals, risk indicators have been derived.

Risk indicators can be very different since one

can be a number (e.g. of force majeure events per

year), another one can be mode (e.g. the

transportation mode of a deliverer) and third one can

be a specific business event (e.g. the production

manager leaves the supplier). All indicators need

different scales of measure.

In order to have the best possible basis different

kind of information sources and types are

Figure 1: Supply Disruption Risks' Matrix (Grosse-Ruyken and Wagner, 2011).

ImprovingSupply-Chain-ManagementbasedonSemanticallyEnrichedRiskDescriptions

71

considered: data extracted from a company’s ERP

system, data delivered by a service provider like

Dun and Bradstreet (who is a project partner),

information allocated by a news provider like

LexisNexis (who is also a project partner),

information extracted from web-sites (e.g. company

sites or commercial registers) and user-generated

input, as some information isn’t available publicly.

Results of risk identification and assessment

must be displayed in an easy-to-understand way.

Therefore monitor suspension system is developed

enhancing the graphical user interface of a project

partner’s commercial Supply-Management-System.

2.2 Knowledge Representation

Using an ontology for enterprise modeling is a well-

known and accepted approach and several models

have been developed, for example the Toronto

Virtual Enterprise (TOVE) by Fox et al. (1996), the

Enterprise Ontology (EO) by Uschold et al. (1997),

the Core Enterprise Ontology (CEO) by Bertolazzi

et al. (2001), the Enterprise Ontology by Dietz

(2006) and more recently the ContextOntology by

Thönssen and Wolff (2010). Despite the consent

about using an ontology for describing enterprise

entities no standard or even an agreement has been

achieved yet on the appropriate representation

language for an enterprise ontology.

For the APPRIS approach we derived the

following requirements:

The enterprise ontology must

be formally represented in a language which is

understood by humans and machines alike,

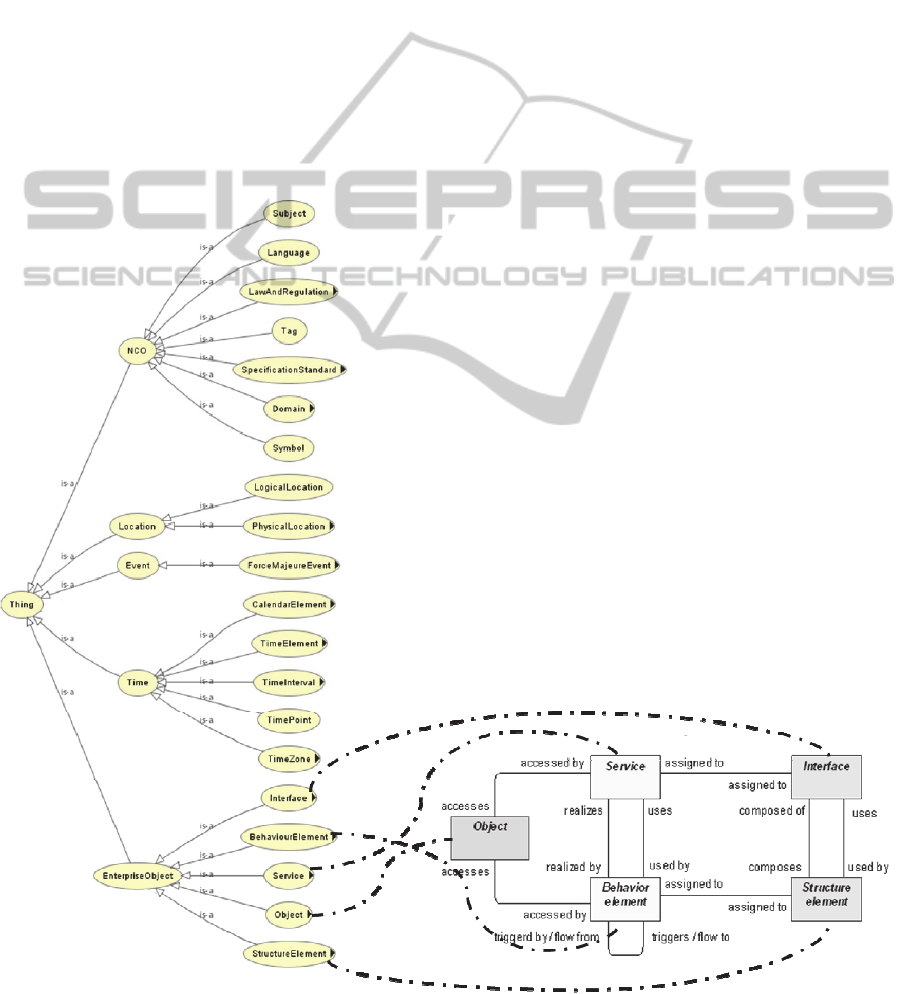

Figure 2: ArchiMEO concepts derived from the ArchiMate Standard (The Open Group, 2009).

KMIS2012-InternationalConferenceonKnowledgeManagementandInformationSharing

72

allow for operational use and thus must be

decidable,

be linked to external data sources to integrate

information of already existing applications

(e.g. ERP Systems, Supply-Chain-Management

Systems),

be based on standards to ensure

exchangeability and re-use,

be easy to use to allow enhancements and

adaptations by business users.

As none of the existing ontologies mentioned

above meets these requirements an ontology has

been developed based on the ArchiMate standard

and represented in RDFS. ArchiMate is a modeling

notation which intentionally resembles the UML

notation. It is intuitive and much lighter than

currently proposed by UML 2.0 (The Open Group,

2009). According to (Matthes, 2011), a Dutch co-

operation from government, industry and education

developed ArchiMate. Since 2008 ArchiMate has

been supported by the Open Group and V (1.0)

became a technical standard in 2009. Since

ArchiMate is not formalized enough to be machine

understandable its concepts and relations have been

transformed into an ontological representation. We

call the ontology ArchiMEO to indicate these roots.

Figure 2 depicts ArchiMEO’s top-level concepts

and its sub-concepts. As shown, the ArchiMate

concepts are all considered sub-concepts of the top-

level concept EnterpriseObject. As ArchiMate

focuses on the inter-domain relationships but risks

evolve from external events, addition top-level

concepts have been introduced, namely time, event,

location and NCO. NCO is top-level concept

introduced for ‘non-categorized objects’, i.e.

concepts of general interest. Moreover, concepts and

relations of the ArchiMate business layer have been

detailed as the granularity level of the standard was

not sufficient enough for risk modeling. Table 1

shows the enhancements which have been made to

ArchiMate for that reason.

Table 1: ArchiMate concepts and its ArchiMEO sub-

concepts.

ArchiMate ArchiMEO

BusinessObject To

p

10ProcurementRis

k

CrisisPhase

Warnin

g

Si

g

nal

R

iskIndicato

r

B

usinessEvent

R

iskEvent

BusinessActor Person

L

e

g

alEntiti

y

B

usinessCollaboration

B

usinessRelationshi

p

BusinessRole Su

pp

lie

r

Custome

r

Since demands on the expressive power are

rather low but decidability and performance is

important, the ontology RDFS is chosen as

representation language for ArchiMEO. ArchiMEO

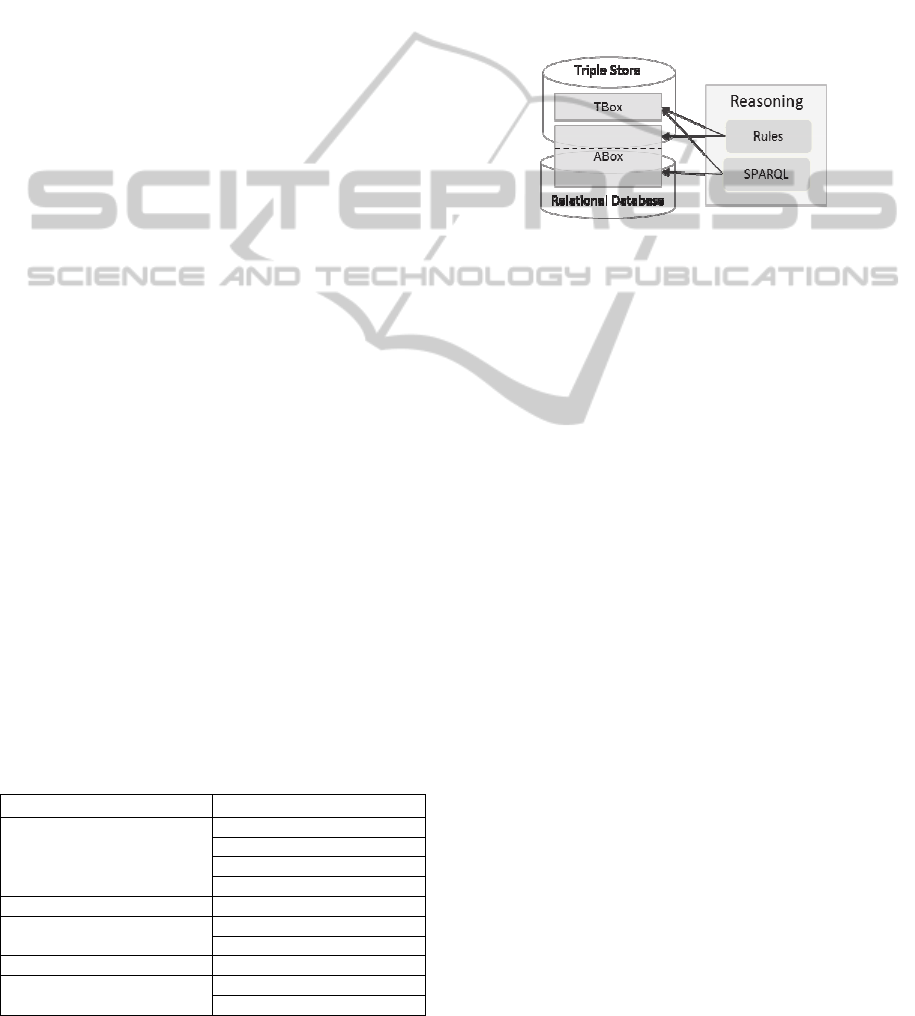

is stored in a triple store. Since data extracted from

ERP systems is already stored in a relational

database, a direct mapping is chosen instead of

replication. Thus, a part of the A-Box is stored in the

RDBMS (Figure 3), namely instances of events. For

APPRIS we have chosen D2RQ (Cyganiak, 2012)

mainly because of its simplicity and support in an

active community.

Figure 3: Hybrid storage.

D2RQ provides a declarative mapping language

to describe the relation between the ontology and the

relational data model. The mapping file can be

generated out of the database schema. The instances

in the relational database are queried with SPARQL

(Prud’hommeaux and Seaborne, 2008) and will be

further processed for the risk assessment with Java.

For inferred knowledge resp. risks, rules are applied.

2.3 Implementation

The APPRIS approach is implemented as a

prototype of an Early Warning System (EWS). The

prototype might be evolutionary and further

integrated or transformed in a solution by one of the

technical partners of the project.

The EWS prototype is built as loosely coupled

extension to an existing Supply-Chain-Management-

System of a project partner. Hence the EWS can

draw upon complex visualisation components and

focus on functionality. Enterprise internal data, like

extracts of ERP (Enterprise-Resource-Planning)

systems, are stored in a relational database.

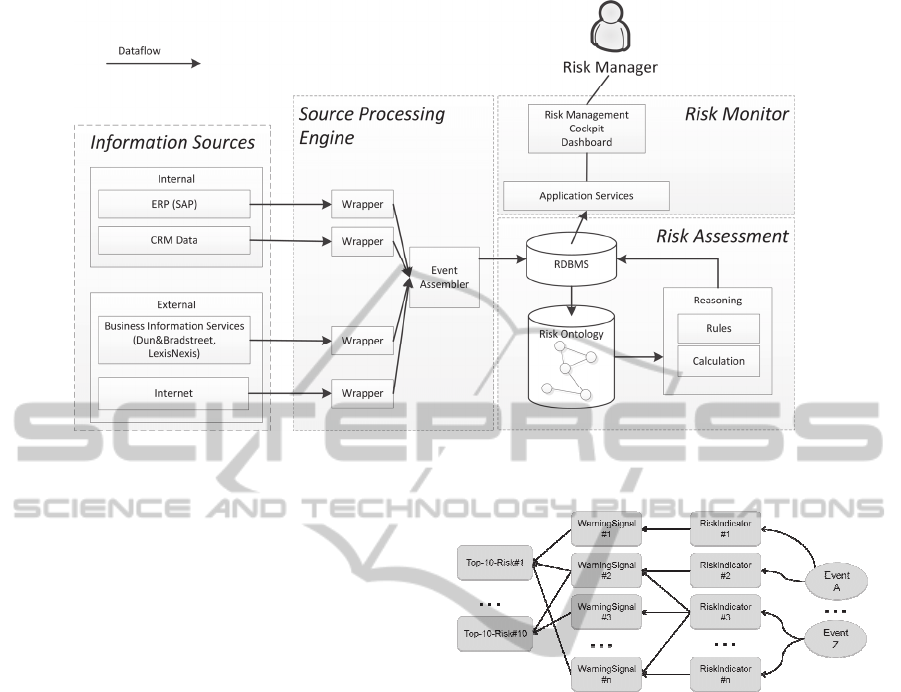

The prototype provides three functional modules

(Figure 4) with semantically enriched risk

management capabilities:

- Source processing engine,

- Risk assessment, and

- Risk Monitor.

ImprovingSupply-Chain-ManagementbasedonSemanticallyEnrichedRiskDescriptions

73

Figure 4: EWS system context diagram with functional modules.

2.3.1 Source Processing Engine

The source processing engine of the EWS monitors

internal and external information providers and

creates and assembles risk events, which are further

processed during the risk assessment.

Sources are integrated through web-services (e.g.

provided by LexisNexis, Dun&Bradstreet, Twitter),

via a batch import from an ERP (i.e. SAP) to the

relational database or via direct access of internet

resources based on HTTP.

The sources are either actively monitored or if a

notification service is available, the source

processing engine is triggered. In both cases queries

resp. filters are applied to retrieve only the

information of interest. Terms used in the filters and

queries are for example “Earthquake”,

“Bankruptcy”, “Location changes”, etc.

If notable information has been identified

relevant terms for the risk detection are extracted,

e.g. the name of a supplier, or the location of an

event. Based on this information a risk event for the

internal processing is created and stored in the

relational database. For example: A key supplier is

located in Japan and we receive the news about an

earthquake in Japan from Twitter. The source

processing engine extracts relevant information

about this disaster: Location, Magnitude, Time, etc.

and creates a specific risk event

(NaturalDisasterEvent), which will be further

processed in the risk assessment module.

Figure 5: Core risk concepts.

2.3.2 Risk Assessment

The risk assessment module can be seen as the core

part of the early warning system. This module is

based on the semantic model, the risk indication and

the risk evaluation components.

2.3.2.1 Semantic Risk Model

The semantic risk model is an extension of

ArchiMeo as described in chapter 2.2.

The integrated development environment used

for modelling the risk ontology is Protégé. The core

risk model is based on the concepts RiskEvent,

RiskIndicator, CrisisPhase, WarningSignal and

Top10ProcurementRisk. For simplification the

system is explained based on these concepts and

relationships shown in Figure 5.

Starting point is the risk event, depicted at the very

right hand side of Figure 5.

RiskEvent

A risk event in our context is either a business – or a

KMIS2012-InternationalConferenceonKnowledgeManagementandInformationSharing

74

force majeure event with a potential impact on the

company’s supply-chain risks. An example for a

business event is the information that a supplier has

financial problems and is close to go bankrupt. A

force majeure event might be a flood disaster. In our

context this can have an impact on suppliers located

in the area of this natural disaster.

A risk event has properties like temporal

information (creation time, effective date), the

source (information provider) and a reliability value.

The reliability value is determined by the reliability

of the different sources (ERP, newspapers, blog etc.)

and by time. For instance, master data provided by

the internal ERP-System has a higher reliability than

a newspaper message or even a post on a social

media platform.

The aspect of time is considered to differ

between news and facts. News are statements made

about the future, like the news that a company plans

to buy a competitor. Facts are statements provided

by official sources (company registries) or master

data systems like the internal ERP system. Since we

express this all in one reliability value, the handling

and the risk event evaluation in a risk indicator

becomes quite generic.

The reliability calculation is done with the

following formula:

Reliability

Facts

= Reliability

Source

* 1.0 (1)

Reliability

News

= Reliability

Source

* 0.7 (2)

For example: Consider an event in the future where

the information source is the newspaper X from

Table 2. Applying the formula (2) we can expect the

following result:

Reliability

News

= 0.7 * 0.7 = 0.49 (3)

Table 2: Examples for source reliabilities.

Source Reliability

ERP (ex. SAP) 1.0

Serious Newspaper X 0.7

Social Media (ex. Twitter) 0.4

Government service 1.0

The reliability values for the source can be

defined by the risk manager when setting up the

early warning system.

For each detected risk event the assigned risk

indicators are checked.

RiskIndicator

According to The Institute of Operational Risk

(2010) risk indicators are metrics used to monitor

identified risk exposures over time and these

indicators must be capable of being quantified as an

amount, percentage, ratio, number or count. In the

EWS we either count the number of events (e.g.

number of earthquakes in the last year in a certain

area) or we consider the latest event and its value

(e.g. the latest company rating delivered from Dun

& Bradstreet). In both cases, the result value is rated

based on pre-defined ranges. Table 3 gives an

example of a metric for a risk indicator, for example

to assess the number of NaturalDisasterEvent.

Table 3: RiskIndicator scores and ranges.

Score Ranges

>= <

1 0 2

2 3 3

3 4 5

4 6 -

Assume, in the last six month LexisNexis

reported four times about earthquakes in a certain

area. According to Table 3, the number of

earthquakes would be rated with score 3. The score

is a value of 1-4 (1=Low risk, 2=Medium risk,

3=High risk, 4=Extreme risk). Whereas the metric is

the same for all risk indicators boundaries differ

depending on the type of event. Scores and

boundaries of the RiskIndicators can be defined by

the risk manager, too.

Taking into account the reliability of the risk

event source, we applied the following formula:

weightedScore = score * reliability (4)

After the weighted scores are associated with the

risk indicators, a warning signal is substantiated if a

certain threshold is exceeded.

WarningSignals

Warning signals are pointers to risks. Depending on

the crisis phase they belong to, they lead to different

risk importance.

To take into account the different importance of

the crisis phases, from being only stakeholder-

related to being critical to the very survival of the

firm. (Grosse-Ruyken and Wagner, 2011), phases

are differently weighted (value 0.2 – 1). Table 4

shows the four different values the warning signals

can get.

Table 4: Crisis phase and their values.

Crisis Phase Value

Stakeholder Crisis Phase 0.2

Strategic Crisis Phase 0.5

Operational Crisis Phase 0.8

Financial Crisis Phase 1

ImprovingSupply-Chain-ManagementbasedonSemanticallyEnrichedRiskDescriptions

75

Each warning signal is assigned to one or more of

the top 10 risks according the matrix of (Grosse-

Ruyken and Wagner, 2011).

Top10Risk

(Grosse-Ruyken and Wagner, 2011) have

determined 10 procurement risks to be the most

relevant for

businesses today. These top 10 risks have been

implemented in the semantic model as instances of

Top10Risk:

- Supplier default risk

- Supply quality risk

- Contract management risk

- Pricing risk

- Logistics/transportation risk

- Supply disruption risk

- Supplier capacity risk

- Sourcing management risk

- Socio-political risk

- E-procurement technology, process, and

infrastructure risk

As more than one warning signal may trigger the

same risk, we would need a formula to somehow

aggregate the two warning signals’ values to get the

overall top ten risk value.

If we aggregated both values by means taking an

average, the final risk’s outcome would drastically

decrease its importance.

For instance let’s take “1” (warning signal

belonging to the financial crisis) and “0.2” (warning

signal belonging to the stakeholder crisis):

(1 + 0.2) / 2 = 0.6

(5)

In order to avoid this problem, a formula has

been proposed and validated by the APPRIS team as

well as their business partners. The following is the

formula:

(6)

Where “P” is the value of an early warning

signal, and “n” is the number of early warning

signals in a top ten procurement risk.

This formula is based on the independent events

in the theory of probability. It regards a rather

general and established concept which can be found

in many textbooks and paper such as the fourth

chapter of (Billinton and Allan, 1992). The formula

is appropriate for this case because it satisfies the

following conditions:

- The warning signals are independent, i.e. one

signal does not affect another one;

- The formula assigns an increasing value to

each potential warning signal based to the

crisis phase it belongs to, i.e. a warning signal

belonging to the Stakeholder Crisis phase

would get a value less than one belonging to

the Financial Crisis.

- Also the warning signals’ values that are not

triggered (with a value of “0”) can be

considered in the formula because they do not

decrease the final importance of the top ten

risks.

In the evaluation step, the formula is applied and

the respective result is then shown on the monitor

suspension system by means of a coloured flag.

2.3.2.2 Technical Implementation

To work smoothly with the risk ontology in Java, an

ontology to object mapping framework has been

evaluated. Here we had to choose between two

approaches the currently available frameworks or

the libraries support. So either we generate the

objects out of the semantic model or we use Java

Annotations. We decided to go with the annotation

approach, since this one integrates smooth in the

Java environment and provides more flexibility.

With Empire (Grove, 2012) we have even found a

JPA (Java Persistence API) implementation which

fits our requirements best. JPA is well known by

experienced Java programmers and it makes it easy

to work with the Ontology. The example shows the

class WarningSignal and it’s mapping annotations:

@Namespaces({"risk",

"http://ch.fhnw.risk#"})

@RdfsClass("risk:WarningSignal")

@Entity

public class WarningSignal{

@RdfProperty("risk:hasThreshold")

private float threshold;

@ManyToMany

@RdfProperty("risk:belongsToRisk")

Private List<Top10Risk> risks;

…

The risk calculation as described in 2.3.2.1 is

implemented in Java. More knowledge resp. risks

are inferred through SQWRL queries (O’Connor and

Das, 2011). SQWRL is an OWL query language. It

is based on the SWRL (Horrocks et al., 2004) rule

language and uses SWRL’s strong semantic

foundation. JESS (Friedman-Hill, 2008) is chosen to

execute queries written in SQWRL. This library fits

well in the Protégé development environment.

Protégé supports the creation of SQWRL queries

KMIS2012-InternationalConferenceonKnowledgeManagementandInformationSharing

76

through a plugin. SQWRL queries have still to be

defined by an expert. In the operational environment

we use the SESAME triple store.

The calculated risk value is stored in the

relational database. The customized supply-chain

management system frontend reads the risk value

and makes it available in different views and

aggregation levels to users like the management as

well as the procurement manager.

2.3.2.3 Use Case Example

To illustrate the overall approach of the risk

assessment in the following an example is given.

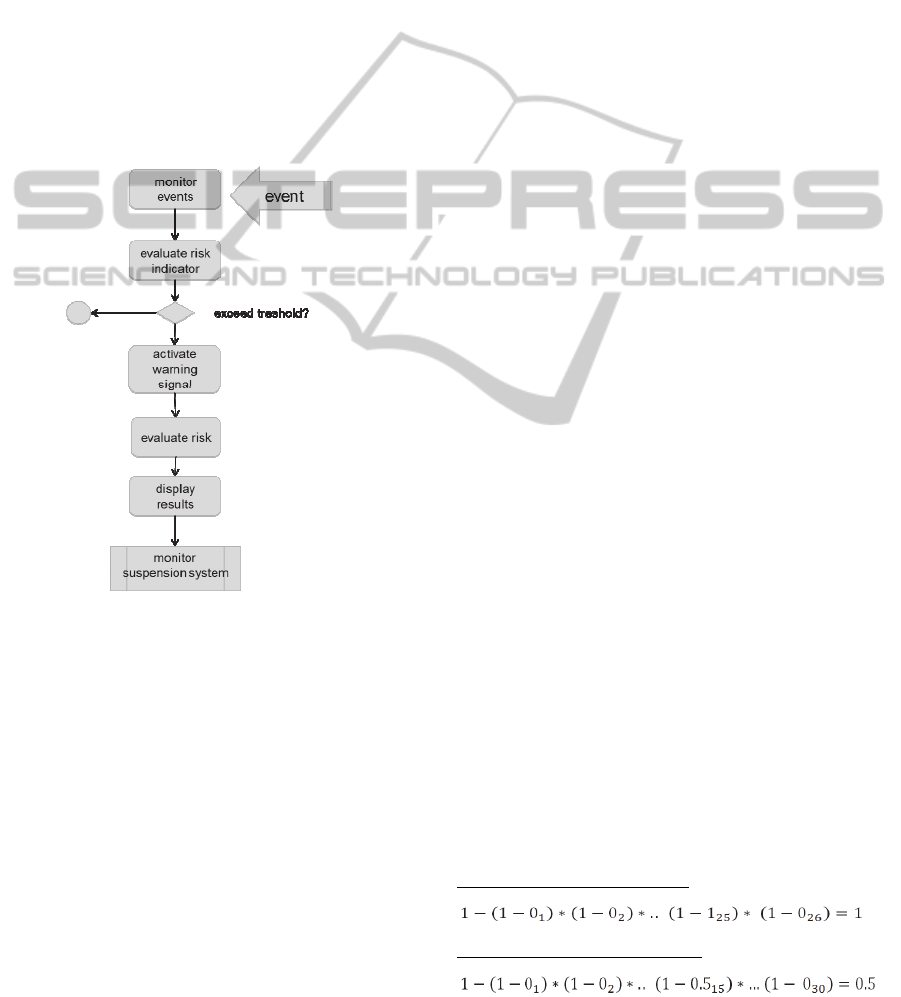

The general risk assessment procedure, depicted

in Figure 6, will underpin the use case example

along its description.

Figure 6: The risk assessment procedure.

An automaker that uses vacuum pumps for

generating negative pressure to the brake booster of

passenger cars and light trucks has two suppliers of

the pumps. Assume that one of the suppliers runs

out of business. The news of the supplier’s

bankruptcy is delivered by an information provider

electronically, and the relevant terms for risk

detection ‘SupplyAnyWhere’ (BusinessActor) and

‘Bankruptcy’ (BusinessEvent) are extracted.

After the event is detected (top of Figure 6), the

risk indicator ‘company went bankrupt’ is identified.

The risk indicator value, that comes out from the

step ‘evaluate risk indicator’ (Figure 6), exceeds the

respective threshold and thus, it triggers the warning

signal ‘A subsidiary/ sister company of the supplier

recently filed for bankruptcy or was recently

liquidated’. This warning signal belongs to the

‘Supplier Default Risk’. As this warning signal is

classified as ‘financial crises’ it is considered of high

importance (the warning signal gets the value ‘1’).

However, this is not the only risk the automaker

faces. Exploiting the backward-chaining strategy,

inter alia creating queries written in SQWRL, it

allows inferring further risk indicators’ values.

In our use case, as by now one supplier of the

vacuum pumps dropped out, the number of the left

suppliers should be checked. With the following

SQWRL query it is possible to determine the

number of the suppliers delivering vacuum pumps.

Product(?x)

∧

BusinessRelationship(?y)

∧

productIsInvolvedInBusinessRelationship(?x, ?y)

∧

LegalEntity(?z)

∧

legalEntityIsSupplierInBR(?z, ?y)

∧

OutOfBusiness(?a)

∧

legalEntityIsAssociatedWithBusinessEvent(?z, ?a) ˚

sqwrl:makeSet(?setOne, ?z) ˚

sqwrl:size(?nOne, ?setOne)

∧

LegalEntity(?b)

∧

legalEntityIsSupplierInBR(?b, ?y)

∧

sqwrl:makeSet(?setTwo, ?b)

∧

sqwrl:size(?nTwo, ?setTwo)

∧

swrlb:subtract(?c,

?nTwo, ?nOne) →

sqwrl:select(?c)

∧

sqwrl:select(?y)

Variable ‘x’ represents the product Vacuum

Pump, while variable ‘y’ represents the business

relationship in which the product as well as the

suppliers is involved.

The result of the query is then used in Java code

to give the appropriate value to the respective risk

indicator: ‘Single supplier for product’. Next, the

warning signal ‘Single/sole sourcing market Figure

6 ‘strategic crises’, and thus, the warning signal gets

the value ‘0.5’.

So far two different warning signals have been

activated which belong respectively to two top ten

risks: ‘Supplier Default Risk’ and ‘Supply

Disruption Risk’.

After that, the formula for evaluating each top

ten risk value (step ‘evaluate risk’ of Figure 6) is

applied.

In this case all the warning signals, except the

ones mentioned, have ‘0’ as they are not been

substantiated. Thus the results of the formula appear

as follows:

Supplier Default Risks Value

Supply Disruption Risks Value

ImprovingSupply-Chain-ManagementbasedonSemanticallyEnrichedRiskDescriptions

77

In the last step, the risk values are passed to the

risk monitor and the display now shows a red flag

associated to the Supplier Default Risks and a

yellow flag for the Supply Disruption Risks.

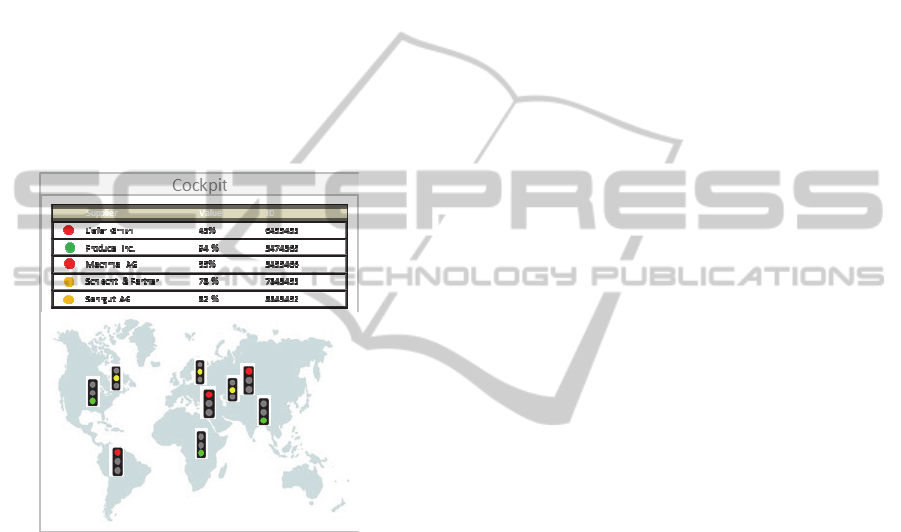

2.3.3 Risk Monitor

Detecting and assessing risks are one part of an early

warning system, the presentation of the results is

another. The calculated risk values shall be shown to

the users on an aggregation level appropriate to their

role. The management board is interested in overall

figures on the company level, whereas the individual

procurement manager is mostly interested to see the

risks of suppliers, resp. products he is responsible

for. Another view can be based on the location of

risk events and suppliers as shown in Figure 7.

Figure 7: Risk cockpit and dashboard.

In the APPRIS project we customize a solution

of one of the project partner. This system is

integrated through a relational database and allows

already viewing different aggregations levels. The

location of supplier and its risk value can be shown

on a map. The system provides also notification

service and allows sending emails triggered by risk

value changes. This alerting service might be a first

simple step towards an active monitoring system,

instead of a simple risk reporting dashboard. But

monitoring means more. Events and risks should be

integrated in the enterprise risk management

processes. An advanced system might run automated

workflow processes and support the management in

the active risk mitigation and handling.

3 RELATED RESEARCH

Tah and Carr (2001) figured out, that procurement

managing teams of an enterprise use different

terminology to describe risks, use different methods

and techniques for analyzing and managing risks and

thus produce different and contradicting results.

Furthermore, risk management is often is performed

on an ad hoc basis and is depending on individual

assessments of responsible staff members. To

address the afore mentioned issues, Tah and Carr

(2001) introduced a common language for

describing risks. Therefore they provide a

hierarchical risk breakdown structure for risk

classification quite similar to the approach chosen in

the APPRIS project by Grosse-Ruyken and Wagner

(2011). The class diagram for project risk

management suggested by Tah and Carr (2001)

provided valuable input for modelling ArchiMEO,

too. However, ArchiMEO goes beyond their

approach by formalizing the knowledge in a

machine understandable and executable way.

Xiwei et al. (2010) suggest the use of linguistic

techniques for risk evaluation. To cope with the

problem of fuzzy information about risks the authors

presented a method, based on linguistic decision

analysis to assess an overall risk value and suggest

ways of mitigating risks. Whether the approach of

Xiwei et al. (2010) could be re-used or adapted for

APPRIS will be further investigated in a later phase

of the project.

The use of ontology for modelling supply chain

(interoperability) has been investigated by Grubic

and Fan (2010). Based on literature review six

supply chain ontology models were identified.

Although the authors explain method and search

criteria, the selection seems somehow arbitrary.

Ontologies were evaluated that have not been

specifically designed for supply chain issues, for

example the Enterprise Ontology (Uschold et al.,

1997) and TOVE (Fox and Grüninger, 1998), but are

general approaches for representing enterprise

architecture (description). Other ontologies,

developed for a similar purpose but less well-known,

like REA (Geerts and McCarthy, 2000), CEO

(Bertolazzi et al., 2001), the Context-based Ontology

(Leppänen, 2005) or the Context Ontology

(Thönssen and Wolff, 2010) were not considered.

However, Grubic and Fan (2010) developed a

comparison framework to evaluate the six selected

ontologies and identified nine gaps in existing

supply chain ontology models. Five of them are

addressed by the ontology used for APPRIS

(Thönssen, 2012).

KMIS2012-InternationalConferenceonKnowledgeManagementandInformationSharing

78

However, for operational use – as APPRIS

strives for – knowledge representation is not enough

but an enterprise ontology must be enhanced to an

enterprise repository as suggested by Hinkelmann et

al. (2010), Thönssen (2011), (2010)). In our

approach we go in this direction by mapping entities

of the Supply Management System’s database to

ontological concepts.

Chi (2010) developed a rule-based ontological

knowledge base for monitoring partners across

supply network. Although Chi (2010) provides a

sound methodology for modelling the domain of the

supply network in an ontology, its content remains

application specific since no standard is considered.

Furthermore, as forward-chaining is the applied

technique for inferring new knowledge it can be

assumed that the knowledge base increases largely

over time and thus becomes unmanageable in the

end. But most important is that the approach is not

integrated in the daily operations but an isolated

task.

4 CONCLUSIONS / FURTHER

WORK

Detecting risks as early as possible is of vital interest

for all enterprises. At present risk management is

performed – if ever – on the basis of in-house

information, e.g. extracted from ERP systems like

delays in delivery. More and more information

would be available, either offered by information

providers like Dun & Bradstreet or LexisNexis or

publicly available on the web. Yet, risks are often

detected too late due to late publication, not

recognized importance or hidden impacts.

Our approach of an early warning system

addresses this problem by combining the analysis of

different information sources, types and formats in

order to early identify and assess risks in the supply-

chain. We showed how an enterprise ontology is

used to represent domain knowledge and how it is

integrated into the EWS by Direct Mapping to

entities of an RDBMS, and ontology to object

mapping based on Java annotations. The results of

our approach, i.e. of the risk evaluation, are

interpreted and displayed within a commercial

Supply-Management-System that has been enhanced

for this purpose. Our approach contributes

significantly to improving risk management in the

supply chain and thus is of considerable economic

importance.

The EWS will be formally evaluated by the

APPPRIS project’s business partners and the

technical partner will implement the prototype’s

functionality in his Supply-Management-System.

However, there are still several aspects not

considered yet, for example how the EWS could be

improved to identify not only risks but also

opportunities, how a replacement for a product

could be automated, or how supplier selection could

be supported, to name a few.

REFERENCES

Bertolazzi, P. et al., 2001. An Approach to the Definition

of a Core Enterprise Ontology : CEO. In International

Workshop on Open Enterprise Solutions: Systems,

Experiences, and Organizations - OES-SEO 2001.

Rome, pp. 104-115.

Chi, Y.-L., 2010. Rule-based ontological knowledge base

for monitoring partners across supply networks.

Expert Systems with Applications, 37(2), pp.1400-

1407. Available at: http://linkinghub.elsevier.com/

retrieve/pii/S0957417409006514 [Accessed March 6,

2012].

Chung, W. W. C., Yam, A. Y. K. & Chan, M. F. S., 2004.

Networked enterprise: A new business model for

global sourcing. International Journal of Production

Economics, 87(3), pp.267-280. Available at: http://

linkinghub.elsevier.com/retrieve/pii/S0925527303002

226 [Accessed July 12, 2011].

Cyganiak, R., 2012. The D2RQ Platform – Accessing

Relational Databases as Virtual RDF Graphs.

Available at: http://d2rq.org/.

Dietz, J. L. G., 2006. Enterprise Ontology. Theory and

Methodology, Berlin Heidelberg: Springer-Verlag.

Emmerson, C., 2011. Global Risks 2011 Sixth Edition,

Fox, M. S. & Grüninger, M., 1998. Enterprise Modeling.

AI Magazine, 19(3), pp.109-121.

Fox, M. S. et al., 1996. An Organization Ontology for

Enterprise Modelling. Simulating Organizations:

Computational Models of Institutions and Groups,

(AAAI/MIT Press), pp.131-152.

Friedman-Hill, E., 2008. Jess, the Rule Engine for the Java

Platform V7.1., pp.1-198. Available at: http://

www.jessrules.com/jess/index.shtml.

Geerts, G. L. & McCarthy, W. E., 2000. The Ontological

Foundation of REA Enterprise Information Systems,

Geissbauer, R. & D’heur, M., 2011. 2010-2012. Global

Supply Chain Trends,

Grosse-Ruyken, P. T. & Wagner, S. M., 2011. APPRIS

Project Report, Zürich.

Grubic, T. & Fan, I.-shing, 2010. Computers in Industry

Supply chain ontology : Review , analysis and

synthesis. Computers in Industry, 61(8), pp.776-786.

Available at: http://dx.doi.org/10.1016/

j.compind.2010.05.006.

Hinkelmann, K., Merelli, E. & Thönssen, B., 2010. The

Role of Content and Context in Enterprise

Repositories. In Proceedings of the 2nd International

ImprovingSupply-Chain-ManagementbasedonSemanticallyEnrichedRiskDescriptions

79

Workshop on Advanced Enterprise Architecture and

Repositories - AER 2010.

Horrocks, I. et al., 2004. SWRL : A Semantic Web Rule

Language Combining OWL and RuleML. Syntax,

(May), pp.1-31.

Leppänen, M., 2005. A Context-Based Enterprise

Ontology. In G. Guizzardi & G. Wagner, eds.

Proceedings of the EDOC International Workshop on

Vocabularies, Ontologies and Rules for the Enterprise

(VORTE’05). Enschede, Netherlands: Springer Berlin,

pp. 17-24.

O’Connor, M. & Das, A., 2011. SQWRL: a Query

Language for OWL.

Park, K. H. & Favrel, J., 1999. Virtual Enterprise -

Information System and Networking Solution.

Computers & Industrial Engineering, 37, pp.441-444.

Pergler, E. & Lamarre, M., 2009. Risk: Seeing around the

corners,

Priddat, B. P., 2002. E-Government als

Virtualisierungsstrategie des States. Demokratisierung

der Wissensgesellschaft und professioneller Staat.

TECHNIKFOLGENABSCHÄ TZUNG Theorie und

Praxis, 11(3/4).

Prud’hommeaux, E. & Seaborne, A., 2008. SPARQL

Query Language for RDF. Available at: http://

www.w3.org/TR/rdf-sparql-query/.

Tah, J. H .M. & Carr, V., 2001. Towards a framework for

project risk knowledge management in the

construction supply chain. Advances in Engineering

Software, 32(10-11), pp.835-846. Available at: http://

linkinghub.elsevier.com/retrieve/pii/S0965997801000

357.

The Institute of Operational Risk, 2010. Key Risk

Indicators,

The Open Group, 2009. ArchiMate 1.0 Specification,

Available at: http://www.ncbi.nlm.nih.gov/pubmed/

20087110.

Thönssen, B., 2010. An Enterprise Ontology Building the

Bases for Automatic Metadata Generation. In

Proceedings of the 4th International Conference on

Metadata and Semantics, MTSR1200. Madrid, pp.

195-210.

Thönssen, B., 2011. Forrmalizing low - level governance

instruments for a more holistic approach to automatic

metadata generation. In Proceedings of the 5th

International Conference on Methodologies,

Technologies and Tools enabling e-Government.

Camerino, Italy, pp. 1-12.

Thönssen, B., 2012. Turning Risks Into Opportunities.

Electronic Government, tbp. Available at: http://

www.inderscience.com/browse/index.php?journalID=

72.

Thönssen, B. & Wolff, D., 2010. A broader view on

Context Models to support Business Process Agility.

In S. Smolnik, F. Teuteberg, & O. Thomas, eds.

Semantic Technologies for Business and Information

Systems Engineering: Concepts and Applications.

Uschold, M. et al., 1997. The Enterprise Ontology,

Volatier, L., Cordon, C. & Gallery, C., 2009. Suppliers

and vendors first. International Association For

Contract & Commerical Management (IACCM).

Available at: https://www.iaccm.com.

Xiwei, W., Stöβlein, M. & Kan, W., 2010. Designing

knowledge chain networks in China — A proposal for

a risk management system using linguistic decision

making. Technological Forecasting and Social

Change, 77(6), pp.902-915. Available at: http://

linkinghub.elsevier.com/retrieve/pii/S0040162510000

03X [Accessed November 16, 2011].

KMIS2012-InternationalConferenceonKnowledgeManagementandInformationSharing

80