Investigating on the Role of EA Management in Mergers and

Acquisitions

Initial Findings from a Literature Analysis and an Expert Survey

Andreas Freitag and Christopher Schulz

Technische Universität München, Boltzmannstraße 3, 85748 Garching b. München, Germany

Andreas.Freitag@mytum.de, Christopher.Schulz@mytum.de

Keywords: Enterprise Architecture Management, Mergers and Acquisitions, Literature Analysis, Expert Survey.

Abstract: Mergers and Acquisitions (M&A) lead to substantial changes for the companies involved. The resulting

enterprise transformation is challenging as it includes, among others, elements like business processes,

organizational units, applications, data, and infrastructure components. Enabling the alignment of business

and information technology (IT), the discipline of Enterprise Architecture (EA) management provides a

holistic perspective on those elements as well as their relationships. Moreover, EA management fosters

communication and provides a consistent information base and therefore is able to contribute to the success

of M&A. However, currently there exists only little work investigating on the role, benefit, and usage of EA

management in M&A. In this paper, we therefore peruse EA management literature to identify tasks and

artifacts beneficial for this type of enterprise transformation. Furthermore, we compare these findings with

the results of a survey conducted among experts at three European EA management conferences. Both,

literature analysis and expert survey help to build a basis for further research regarding the application of

EA management during M&A.

1 MOTIVATION

Over the past century, the appearance of Mergers &

Acquisitions (M&A) remained remarkably high. As

an ongoing trend, enterprises increasingly establish

M&A as a strategic management instrument (Gerds

& Schewe 2009; Jansen 2008). Regarding the future,

analysts likewise predict a high level of M&A

activities (Capital 2011). Consequently, for many

enterprises M&A are not considered as individual

events, but rather represent common instruments of

modern business strategies.

M&A affect the whole enterprise and result in a

multitude of complex transformation projects (Gerds

& Schewe 2009; Jansen 2008; Penzel 1999). The

transformation includes the majority of an

enterprise’s domains, among others, elements like

business strategy, financials, law, products,

processes, applications, and infrastructure. Figure 1

depicts a typical M&A process which consists of

three phases: merger planning, transaction, and post-

merger integration (PMI). Along this way, it

includes activities relating to different

interdependent management disciplines involving a

variety of special experts as well as internal and

external stakeholders (Jansen 2008; Picot 2008).

Figure 1: M&A process.

The merger planning phase typically includes

strategic planning of M&A activities, analysis of the

environment, identification of candidates, and a

high-level valuation of possible target scenarios. The

transaction phase starts with the initial contact and

negotiations with a target enterprise. This phase

includes financial planning, due diligence, pre-

closing integration planning, and corporate

valuation. It ends with the official announcement of

the merger, contract signing, antitrust clearance and

is completed with the final closing that includes the

payment. At this time the formerly independent

enterprises close their deal and legally become one

single company. During the PMI phase, a post-

closing integration plan is worked out allowing to

implement the integration of strategy, organization,

business processes, systems, administration,

107

Freitag A. and Schulz C.

Investigating on the Role of EA Management in Mergers and AcquisitionsInitial Findings from a Literature Analysis and an Expert Survey.

DOI: 10.5220/0004461601070112

In Proceedings of the Second International Symposium on Business Modeling and Software Design (BMSD 2012), pages 107-112

ISBN: 978-989-8565-26-6

Copyright

c

2012 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

operations, culture, and external relationships of the

enterprise. Further activities include monitoring of

progress, a formal post-merger audit, and a possible

follow-up restructuring (Jansen 2008; Picot 2008).

Enterprise Architecture (EA) management is an

approach for analyzing, planning, and controlling as-

is and target states of the enterprise in terms of

business, information systems, and technology

architecture, based on an overarching EA model

(Aier, Riege & Winter 2008; Buckl & Schweda

2011). Thereby, the main benefits EA management

offers are (cf. (Aier, Riege & Winter 2008; Buckl &

Schweda 2011; The Open Group 2009)):

Creation of a holistic perspective on the

enterprise, comprising business & IT elements

Foster communication by defining a common

language for multidisciplinary stakeholders

Gathering information from differing sources

and provisioning of consistent decision base

These aspects are considered as challenges

enterprises are confronted with during M&A (Gerds

& Schewe 2009; Picot 2008; Penzel 1999). By

contrast, different authors (e.g., van den Berg & van

Steenbergen 2010; Ross, Weil & Robertson 2006)

explicitly propose EA management as a holistic

approach for enterprise transformation. However,

the application of EA management methods and

models in enterprise transformations like M&A has

not been subject to in-depth research yet. In this

paper we therefore address five central questions

detailing the role of EA management in M&A from

a literature and industry perspective. Thereby, the

questions range from general to specific:

Is there a general reference to M&A in EA

management literature?

For which phases of an M&A process is EA

management relevant?

Which are typical EA management tasks

carried out during M&A?

Which EA management artifacts are used to

perform these tasks?

Have these artifacts been designed and/or

evaluated by empirical means?

To answer these questions we follow a three-fold

approach. In the first step, we conducted a literature

analysis covering current EA management books.

Secondly, we captured the opinion of experts

attending three leading European practitioner

conferences for EA management with the help of a

survey. Lastly, we compared their experience with

our findings originating from literature.

The remainder of this article is structured as

follows: Section 2 describes the results gained by

means of the literature study. Section 3 documents

planning and execution of the expert survey and

compares its results with those from the literature

study. Finally, Section 4 concludes with a summary

complemented by a critical reflection and

indications on future research topics in this area.

2 LITERATURE ANALYSIS

2.1 Focus and Method

Over the last years, the body of knowledge with

regards to EA management matured steadily (Aier,

Riege & Winter 2008). However, the application of

this knowledge in the light of an enterprise

transformation such as M&A just starts to be subject

of research (Freitag, Matthes & Schulz, 2010; Ross,

Weill & Robertson 2006). We conducted a literature

study comprising 13 recent English and German EA

management books published between 2005 and

2011, focusing on their contribution towards M&A.

We focused our literature study on EA management

books, as they summarize findings of continuous

and quality-assured research work being gained

throughout years of research and knowledge

accumulation. Thereby, we build a solid foundation

to complement our literature study with journals and

conference papers in a next research step.

We studied EA management literature in five

stages ranging from the relationship to concrete EA

management tasks and artifacts. In Step 1 we

examined the general relationship between EA

management and M&A, i.e., if the books refer to

M&A at all, e.g., as an application domain, a use

case, or a driver. In the course of Step 2 we worked

out if the author(s) refer(s) to a distinct phase of the

M&A process in which EA management can be

applied. In Step 3 we investigated if the author(s)

address(es) a concrete M&A task being supported by

EA management. During Step 4 we identified details

on the specific artifact in terms of concrete methods,

models, or visualizations. Finally, in Step 5 we

examined the sources regarding the usage of

empirical means, e.g., interviews, case studies, or

surveys.

2.2 Analysis Results

Five EA management books, Bernard (2005),

Johnson and Ekstedt (2007), Niemann (2006),

Schekkerman (2008), Wagter et al. (2005) do not

refer to M&A at all. A second group of books refers

to M&A but does not explicitly dwell on this topic.

Proper et al. (2008, p. 6) mention M&A as one

Second International Symposium on Business Modeling and Software Design

108

driver for change, while Hanschke (2009, p. 328)

provides a definition of the term as part of her

book’s glossary.

Two books speak of the PMI phase as an

application domain for EA management and list

corresponding tasks (Engels et al. 2008, p. 84-86,

169, 232, 277; Keller 2006, p. 98). Engels et al.

(2008) list consolidation of business processes and

the application landscape as EA management tasks.

Additionally, they mention M&A as a reason for

data redundancies. Keller (2006, p. 98) considers

application and infrastructure consolidation as EA

management tasks during the PMI phase and

proposes patterns for application consolidation

including influence factors and risks.

Besides integration, Ross et al. (2006, p. 176-

181) mention knowledge transfer and provision of

standardized best practices as relevant EA

management tasks. The authors describe the effects

of M&A on the enterprise’s foundation for execution

and the influence of different architecture maturity

levels at the acquirer and seller company side. They

propose architectural approaches like unification,

replication, coordination that can be applied in

M&A situation. Additionally, the authors illustrate

these strategies by means of three case studies (UPS,

CEMEX, and 7eleven Japan).

In addition to the PMI phase, Schwarzer (2009,

p. 85-86) also refers to the merger planning phase, in

which EA management provides information about

necessary measures that have to be prepared and

implemented. The author points out that IT plays an

important role during M&A since it provides the

basis for the future integration of the business

processes. Furthermore, she emphasizes that EA

management helps to consolidate of IT organization

and IT landscape in the PMI phase by as-is and

target architecture planning.

The work of Lankhorst et al. (2005, p. 108-110)

focuses on EA modeling. The authors name

modeling of processes, organizational structure,

business functions, IT, applications, and services, as

well as the creation of a common understanding

among stakeholders and application consolidation as

EA management tasks during M&A. The authors

include a PMI example from the insurance industry

to demonstrate the applicability of their EA models.

Berg and Steenbergen (2010, p. 4, 25, 27, 37, 50,

134, 137) refer to M&A, including all phases, as one

application domain for EA management. Based on a

fictitious M&A example from the banking industry,

the authors motivate the importance of EA

management and the implementation of an EA

framework. The researchers propose EA

management in order to achieve synergies between

both companies being one key goal of M&A. The

EA framework can be applied to map the

architectural landscape, detect overlaps, and identify

what needs to be changed and what needs to

continue. As concrete tasks, they mention the

homogenization of infrastructure and processes and

the support of standardization.

2.3 Summary

Five authors do not bring up M&A at all, while eight

publications at least mention the topic. However,

these EA management books do not elaborate on

M&A in detail, the description of tasks remains

vague. If M&A is addressed, authors dedicate a

maximum of five pages. Most contributions are

limited to the PMI phase. EA tasks mentioned are

mostly focused on IT consolidation and integration

work as well as support of communication and

modeling. The authors do not provide concrete EA

artifacts explicitly addressing the challenges of

M&A. When it comes to empirical means, the

authors stick to fictitious examples or case studies.

3 EA MANAGEMENT SURVEY

After shedding light on the role of M&A in EA

management from a literature point of view, this

section presents the key results of a survey

conducted among EA management practitioners. In

line with the literature analysis, the survey centered

on how EA management is contributing to M&A

today as well as expectations regarding its future

role. Subsequently, we summarize the results from

the survey and compare them to the literature.

Table 1: EA management survey and participation details.

Conference name Location / Date Issued Returned

EAM Forum 2011 Frankfurt, Germany; Feb 2011 50 14 (28%)

The Open Group Architecture Practitioners Conference London, UK; May 2011 50 16 (32%)

EAMKON 2011 Stuttgart, Germany; May 2011 35 14 (40%)

Investigating on the Role of EA Management in Mergers and Acquisitions - Initial Findings from a Literature Analysis and

an Expert Survey

109

3.1 Survey Setup

In terms of the survey setup we followed the

questionnaire design process suggested by Frazer

and Lawley (2000). Aiming at a high return rate and

completeness of the answers, the survey was limited

to one page, containing 15 concise questions. The

distributed sheet was subdivided into three main

parts: participant’s background, questions about the

company’s EA management, and questions referring

to M&A. The survey was conducted at three

European EA management conferences between

February and May 2011 (cf. Table 1). We selected

these conferences on purpose as their audience

represents a homogenous sample of EA practitioners

in Europe. However, the survey sample cannot be

considered to be formally representative (cf. Mayer

2008). In total, 44 of 135 participants returned the

fully completed survey, resulting in a response rate

of 33%.

3.2 Practitioners’ Perspective and

Comparison to Literature

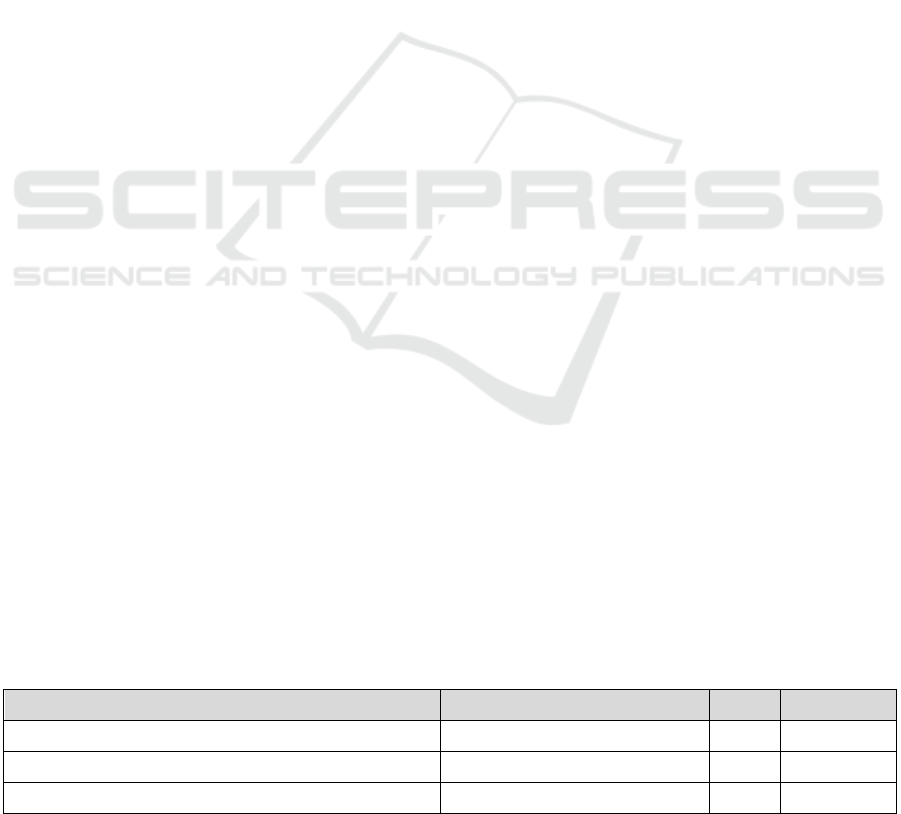

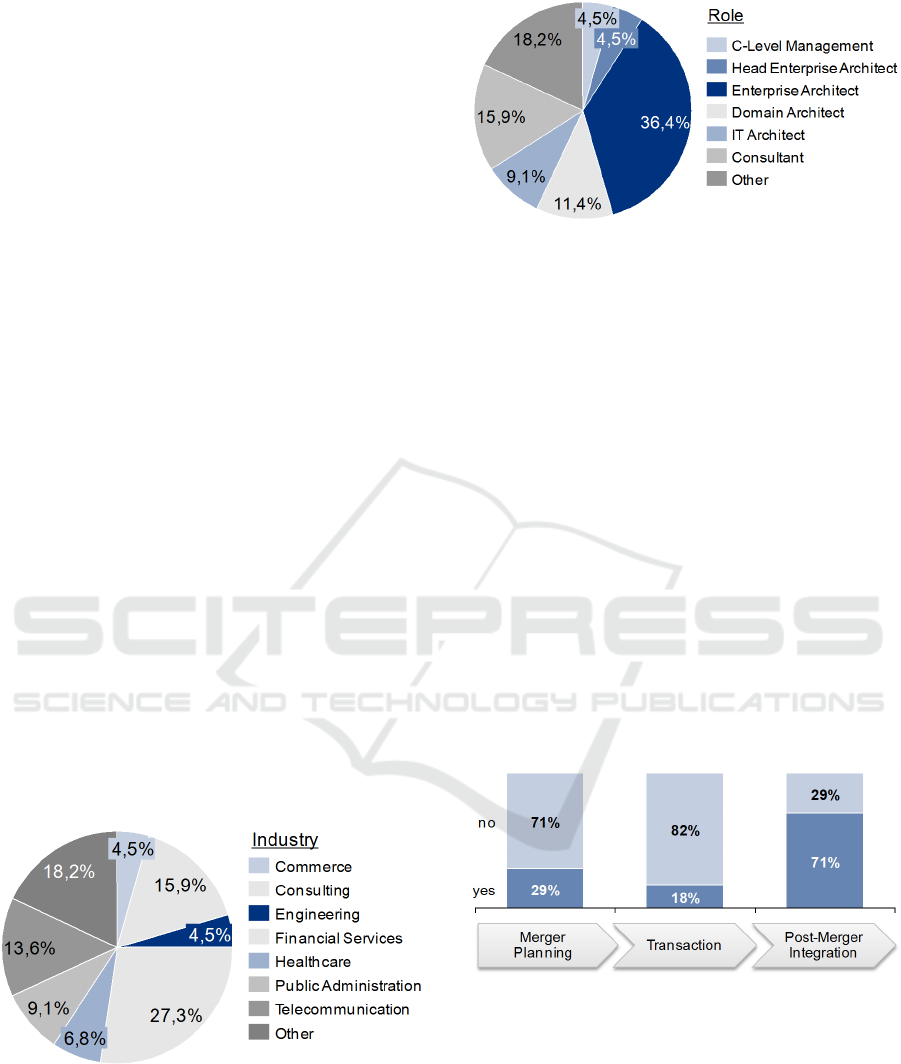

The first questions addressed the company’s

industry sector and the individual role of the survey

participant. From their industry background, the

participants represent a homogenous group.

Regarding their roles, the majority of participants

follow an EA management profession. Domain

architect subsumes different roles that focus on one

architecture domain (e.g. business, application, and

technology). In both charts (cf. Figure 2, 3), all

responses mentioned only once have been assigned

to the category ‘other’.

Figure 2: Participants’ background (1).

With respect to the overall relevance of M&A,

63.6 % of the participant’s companies have been

involved in M&A in the past, while 56.8 % expect

M&A to be relevant for their company in future.

With a group of four questions, we addressed the

current

role of EA management during M&A. The

Figure 3: Participants’ background (2).

support of M&A projects is seen as a responsibility

for EA management in 29.6 % of the participant’s

companies (47.7 % no, 22.7 % not specified).

Looking back, 23.3 % of the participants indicated

that in their companies, enterprise architects have

been engaged in M&A projects in the past (62.8 %

no, 13.9 % not specified). While for current

literature, M&A is considered as application domain

for EA management, the topic has still not found its

way into the minds of the practitioners.

To go into more detail regarding the role of EA

management, we asked those participants whose

companies did engage enterprise architects in M&A,

to indicate the respective process phase. As Figure 3

displays, enterprise architects mainly contribute to

the PMI phase with minor involvement in the

merger planning and transaction phase. This

situation is accounted for in current EA management

literature, where the majority of publications refer to

the PMI phase while only a small number mentions

earlier process phases.

Figure 4: EA management support per M&A phase.

In the survey we offered an additional free text

field to collect those tasks which are assigned to

enterprise architects during M&A today. The tasks

mentioned by the survey participants are mainly part

of the PMI phase or general EA management tasks,

with one exception. Regarding the PMI phase,

subsequent tasks were mentioned: integration

planning, consolidation or respectively integration of

IT and processes, business and IT integration,

Second International Symposium on Business Modeling and Software Design

110

migration of applications and data, and software

selection. General EA management tasks included

scoping, providing transparency, IT master planning,

target architecture design, governance, and project

management. One participant brought up due

diligence as an activity performed during the

transaction phase.

Complementary, we offered a free text field to

find out how enterprise architects could support

M&A projects in the future. Some of the tasks

mentioned here as future EA management

responsibilities have also been stated as tasks

performed today, namely: due diligence, target

architecture design, consolidation of IT and

processes, providing transparency, and project

management. In addition, the participants mentioned

the review of a target enterprise’s as-is architecture

and support of C-level management (e.g., CIO,

CTO) in decision making (e.g. by pointing out costs

of integration) which are part of the merger planning

phase. Furthermore, they stated the following

general EA management tasks: development of

integration scenarios, preparation of a business

capability roadmap, dependency analysis, providing

a consolidated information base, and mapping of

business and IT capabilities.

Similar to the asked experts, literature considers

consolidation of organization and business

process, applications, and infrastructure,

dependency and redundancy analysis,

identification of focus areas (scoping) and

measures required, and

as-is and target-architecture planning

as tasks which should be performed in the course of

the PMI phase. However, instead of providing in-

depth details perused sources solely lists those tasks.

Standardization of best-practices as well as

knowledge transfer are considered as being general

EA tasks from both, literature and participants.

Additionally, literature proposes EA modeling and

the creation of a common understanding. Both tasks

were not mentioned by the participants. In turn,

participants considered governance, project

management, due diligence, application and data

migration, preparation of business capability

roadmap, and support of management decision

making as essential EA task during M&A.

Remarkably, these activities were not addressed by

examined EA management literature.

Finally, we approached the participants with our

central question straightforward. We asked for their

opinion on the potential of EA management to

contribute to the success of M&A as a special type

of enterprise transformation. In retrospective, 60.0 %

of our survey participants stated that EA

management would have made an M&A in their

company more successful, while only a very small

percentage of 2.5 % did not see any value in

applying EA management (37.5 % not specified).

These figures show that practitioners see a real value

of EA management in the context of M&A.

Certainly, the outcome for this last question is

biased, as the majority of participants (61.4 %) were

enterprise architects who work in this management

discipline. The literature analyzed does not explicitly

confirm that the application of EA management

improves the success rate of M&A.

3.3 Summary

The survey revealed that the majority of

practitioners think that in retrospective EA

management would have made M&A more

successful. However, today only one out of three

practitioners sees support of M&A as a

responsibility of EA management while even a

smaller number was actively involved in enterprise

transformations. Nonetheless, the survey participants

pointed out several EA management tasks they

consider beneficial for M&A. These tasks were not

limited to the PMI phase. Furthermore, practitioners

stated that today EA management mainly contributes

to the PMI phase with minor involvement in the

merger planning and transaction phase.

4 CONCLUSIONS

As one special type of enterprise transformation,

M&A often struggle to capitalize the initially

expected benefits. EA management is promoted as

an approach of enterprise transformation. Given that

only minor research has been conducted regarding

the role of EA management in M&A, this paper

investigates on the topic. We perused 13 current EA

management books focusing on their contribution

towards M&A. Afterwards, findings were compared

with results from an expert survey conducted at

three European EA practitioner conferences.

As we found out in our studies, examined

literature discusses the role of EA management in

M&A only on a very general level. While current

EA practitioners consider M&A as one of their

application domains, their actual degree of

involvement was low at the time we conducted the

survey.

We are aware of the introductory character of our

results researching on EA management in the

Investigating on the Role of EA Management in Mergers and Acquisitions - Initial Findings from a Literature Analysis and

an Expert Survey

111

context M&A. Our primary goal is to provide a

starting point by incorporating findings from the

literature analysis as well as from a practitioner

survey. For this reason and the page limit constraint

of six pages, the analyzed literature was limited to

recent EA management books. An extension of

literature analysis during further research steps could

include other publication types and sources from

related research domains. Regarding the expert

survey, further work should increase the sample size,

be extended to groups other than enterprise

architects, and could be enhanced with

complementary questions detailing on specific

aspects in more detail.

In all, the expected applicability of EA

management has to be proven in practice. Therefore,

enterprise transformation and in particular M&A

remain an important research field for EA

management. Besides the communication of

empirically gained experience and lessons learned,

future research should include the design and

evaluation of concrete EA management artifacts that

can be applied during M&A.

ACKNOWLEDGEMENTS

The research findings presented in this paper were

possible thanks to the support of all survey

participants. We wish to acknowledge the experts

for sharing their experiences and their time spent.

REFERENCES

Aier, S., Riege, C., Winter, R. 2008. Unternehmens-

architektur - Literaturüberblick und Stand der Praxis.

Wirtschaftsinformatik. 50(4):292–304.

van den Berg, M., van Steenbergen, M. 2010. Building an

Enterprise Architecture Practice. 1st ed. Springer,

Dordrecht/Netherlands.

Bernard, S. A. 2005. An Introduction to Enterprise

Architecture. 2nd ed. AuthorHouse, Breinigsville/

USA.

Buckl, S.; Schweda, C.M. 2011. On the State-of-the-Art in

Enterprise Architecture Management Literature.

Technical Report, Chair for Software Engineering of

Business Information Systems. Technische Universität

München, Munich/Germany

Capital 2011. Kenn-Ziffern zu Firmenübernahmen.

Engels, G., Hess, A., Humm, B., Juwig, O., Lohmann, M.,

& Richter, J.-P. 2008. Quasar Enterprise:

Anwendungslandschaften serviceorientiert gestalten.

1st ed.. Dpunkt.Verlag, Heidelberg/Germany.

Frazer, L., Lawley, M. 2000. Questionnaire Design and

Administration: A Practical Guide. 1st ed. John Wiley

& Sons Ltd, Milton/Australia.

Freitag, A., Matthes, F., & Schulz, C. 2010. A method for

consolidating application landscapes during the post-

merger integration phase. (ABICT). Wisla/Poland.

Gerds, J., Schewe, G. 2009. Post Merger Integration:

Unternehmenserfolg durch Integration Excellence.

Springer-Verlag, Berlin/Germany.

Hanschke, I. 2009. Strategic IT Management: A Toolkit

for Enterprise Architecture Management. 1st edition.

Springer, Berlin and Heidelberg/Germany.

Jansen, S. A. 2008. Mergers & Acquisitions:

Unternehmensakquisitionen und -kooperationen. Eine

strategische, organisatorische und kapitalmarkt-

theoretische Einführung. 5th ed. Gabler,

Wiesbaden/Germany.

Johnson, P., Ekstedt, M. 2007. Enterprise Architecture:

Models and Analyses for Information Systems

Decision Making. 1st ed. Professional Pub Serv,

Pozkal/Poland.

Keller, W. 2006. IT-Unternehmensarchitektur. Von der

Geschäftsstrategie zur optimalen IT-Unterstützung. 1st

ed. Dpunkt.Verlag; Heidelberg/Germany.

Lankhorst, M. 2005. Enterprise Architecture at Work.

Modeling, Communication and Analysis. 1st ed.

Springer, Berlin and Heidelberg/Germany.

Mayer, H. O. 2008. Interview und schriftliche Befragung.

5th ed. Oldenbourg Wissenschaftsverlag, München/

Germany.

Niemann, K. 2006. From Enterprise Architecture to IT

Governance: Elements of Effective IT Management.

1st ed. Vieweg+Teubner, Wiesbaden/Germany.

Op’t Land, M., Proper, E. 2008. Enterprise Architecture:

Creating Value by Informed Governance. 1st edition.

Springer, Berlin and Heidelberg/Germany.

Penzel, H.-G. 1999. Post Merger Management in Banken

und die Konsequenzen für das IT-Management.

Wirtschaftsinformatik, 41(2):105-115.

Picot, G. 2008. Handbuch Mergers & Acquisitions. 4th ed.

Schäfer-Poeschel, Stuttgart/Germany.

Ross, J. W.; Weill, P.; Robertson, D. 2006. Enterprise

Architecture as Strategy: Creating a Foundation for

Business Execution. 1st ed. Mcgraw-Hill Professional,

Boston/USA.

Schekkerman, J. 2008. Enterprise Architecture Good

Practices Guide: How to Manage the Enterprise

Architecture Practice. 1st edition. Trafford Publishing,

Victoria/Canada.

Schwarzer, B. 2009. Einführung in das Enterprise

Architecture Management. 1st edition. Books on

Demand GmbH, Norderstedt/Germany.

The Open Group 2009. TOGAFTM Enterprise Edition

Version 9.http://pubs.opengroup.org/architecture/

togaf9-doc/arch/. Accessed Aug, 12th 2011.

Wagter, R., van den Berg, M., Luijpers, J., van

Steenbergen, M. 2005. Dynamic Enterprise

Architecture: How to Make It Work. 1st ed. John

Wiley & Sons, Hoboken/USA.

Second International Symposium on Business Modeling and Software Design

112