Evidencing the “Robot Phase Transition” in Human-agent Experimental

Financial Markets

John Cartlidge and Dave Cliff

Department of Computer Science, University of Bristol

Merchant Venturers Building, Woodland Road, Bristol BS8 1UB, U.K.

Keywords:

Software Agents, Financial Markets, Algorithmic Trading, High-frequency Trading, Computational Finance.

Abstract:

Johnson, Zhao, Hunsader, Meng, Ravindar, Carran, and Tivnan (2012) recently suggested the existence of a

phase transition in the dynamics of financial markets in which there is free interaction between human traders

and algorithmic trading systems (‘robots’). Above a particular time-threshold, humans and robots trade with

one another; below the threshold all transactions are robot-to-robot. We refer to this abrupt system transition

as the ‘robot phase transition’. Here, we conduct controlled experiments where human traders interact with

‘robot’ trading agents in minimal models of electronic financial markets to see if correlates of the two regimes

suggested by Johnson et al. (2012) occur in such laboratory conditions. Our results indicate that when trading

robots act on a super-human timescale, the market starts to fragment, with statistically lower human-robot

interactions than we would expect from a fully mixed market. We tentatively conclude that this is the first

empirical evidence for the robot phase transition occurring under controlled experimental conditions.

1 INTRODUCTION

In February 2012, Johnson et al. (2012) published a

working paper that immediately received widespread

media attention. Having analysed millisecond-by-

millisecond stock-price movements, Johnson et al.

(2012) argued that there was evidence for a phase

transition in the behaviour of financial markets at the

sub-second time-scale. At the point of this transition,

the market dynamics switch from a domain involv-

ing interactions among a mix of human traders and

‘robot’ automated algorithmic trading systems, to a

newly-identified domain in which the robots interact

only among themselves, with no human traders in-

volved. At sub-second timescales, below the transi-

tion, the robot-only market exhibits ‘fractures’ (ultra-

fast swings in price) that are undesirable, little under-

stood, and intriguingly appear to be linked to longer-

term instability of the market as a whole. This discov-

ery is potentially significant for the global financial

markets. If the short term micro-effects can indeed

give some indication of longer-term macro-scale be-

haviour then it is possible that new methods for mon-

itoring the stability of markets could be developed,

offering early-warning systems for major crashes.

In March 2012, we were commissioned by the

UK Government Office for Science’s Foresight unit

to run a series of agent-human experiments exploring

the robot transition under controlled laboratory condi-

tions (see Cartlidge and Cliff, 2012, for full details).

1

We did this by varying the speed/reaction of robot-

trader agents in OpEx (OpEx SourceForge, 2012), an

“artificial stock exchange” that had been developed as

an apparatus for evaluating human-robot and robot-

robot interaction in electronic markets. Our aim was

to test the hypothesis that when robot trader agents

are able to act/react on a timescale quicker than the

human traders are, we will see a transition from a

mixed market (where humans and robots are equally

likely to interact with one another) to a more frag-

mented market where robots are more likely to trade

with robots, and humans with humans. Our results

support the existence of the robot phase transition, al-

though in our experiments the effects of increasing

robot speed seem to give a progressive response rather

than a step-change. To our knowledge, this is the first

time that the robot phase transition, a newly identified

real-world phenomenon, has been synthesised under

1

Our study was one of the 31 background reviews com-

missioned by the UK Government Office for Science’s

Foresight project investigating the future of computer trad-

ing in the financial markets. The final report from that in-

vestigation was published in October 2012, and is available

at: http://bit.ly/UvGE4Q.

345

Cartlidge J. and Cliff D..

Evidencing the “Robot Phase Transition” in Human-agent Experimental Financial Markets.

DOI: 10.5220/0004185603450352

In Proceedings of the 5th International Conference on Agents and Artificial Intelligence (ICAART-2013), pages 345-352

ISBN: 978-989-8565-38-9

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

laboratory conditions.

The remainder of this paper is structured as fol-

lows. In Section 2 we introduce relevant background

material, before describing our experimental methods

in Section 3. Results are presented in Section 4 and

discussed in Section 5. Finally, Section 6 concludes.

2 BACKGROUND

An ‘ideal’ market can be perfectly described by the

aggregate quantity supplied by sellers and the aggre-

gate quantity demanded by buyers at every price-point

(i.e., the market’s supply and demand schedules). At

some price-point, the quantity demanded will equal

the quantity supplied. This is the theoretical mar-

ket equilibrium, with price and quantity (P

0

, Q

0

) de-

termined by the intersection between the supply and

demand schedules. The dynamics of competition in

the market will tend to drive transactions toward this

equilibrium point. However, in the real world, mar-

kets are not ideal. They will always trade away from

equilibrium at least some of the time. We use the

following metrics to calculate the ‘performance’ of a

market by how far from ideal equilibrium it trades:

Smith’s Alpha, following Smith (1962), we measure

the equilibration (equilibrium-finding) behaviour of

markets as α, the root mean square difference be-

tween each of n transaction prices, p

i

(for i = 1 . . . n)

over some period, and the P

0

value for that period,

expressed as a percentage of the equilibrium price:

α =

100

P

0

s

1

n

n

∑

i=1

(p

i

− P

0

)

2

(1)

In essence, α captures the standard deviation of trade

prices about the theoretical equilibrium. A low value

of α is desirable, indicating trading close to P

0

.

Allocative Efficiency, for each trader, i, the maxi-

mum theoretical profit available, π

∗

i

, is the difference

between the price they are prepared to pay (their ‘limit

price’) and the theoretical market equilibrium price,

P

0

. Efficiency, E, is used to calculate the performance

of a group of n traders as the mean ratio of realised

profit, π

i

, to theoretical profit, π

∗

i

:

E =

1

n

n

∑

i=1

π

i

π

∗

i

(2)

As profit values cannot be negative (traders in these

experiments are not allowed to enter into loss-making

deals), a value of 1.0 indicates that the group has

earned the maximum theoretical profit available, π

∗

i

,

on all trades. A value below 1.0 indicates that some

opportunities have been missed. Finally, a value

above 1.0 means that additional profit has been made

by taking advantage of a trading counterparty’s will-

ingness to trade away from P

0

.

Profit Dispersion is a measure of the extent to which

the profit/utility generated by a group of traders in the

market differs from the profit that would be expected

of them if all transactions took place at the equilib-

rium price, P

0

. For a group of n traders, profit disper-

sion is calculated as the root mean square difference

between the profit achieved, π

i

, by each trader, i, and

the maximum theoretical profit available, π

∗

i

:

π

disp

=

s

1

n

n

∑

i=1

(π

i

− π

∗

i

)

2

(3)

Low values of π

disp

indicate that traders are extracting

actual profits close to those available if all trades take

place at the equilibrium price P

0

; while higher values

of π

disp

indicate that traders’ profits differ from those

expected at equilibrium. The attraction of this statistic

is that it is not masked by zero-sum effects between

buyers and sellers.

Delta Profit is used to calculate the difference in

profit maximising performance between two groups,

x and y, as a percentage difference relative to the mean

of the two groups:

∆P(x − y) =

2(π

x

− π

y

)

π

x

+ π

y

(4)

Delta profit directly measures the difference in profit

gained by two groups. In a perfect market with iden-

tically matched groups, delta profit should be zero,

since all groups should trade at P

0

.

For all the experiments described in this paper,

we use the Adaptive-Aggressive (AA) strategy for

our robot trader algorithms. AA has previously been

demonstrated to be the dominant robot algorithm in

the academic literature (De Luca and Cliff, 2011). AA

robots have short-term and longer-term learning pro-

cesses. In the short-term, robots update the aggres-

siveness of their bidding behaviour; with more ag-

gressiveness meaning an agent will sacrifice profit to

improve its chance of transacting. In the longer-term,

robots learn how to best combine their aggressiveness

with their estimation of the market equilibrium price,

calculated by observing transaction prices over a time

window, to choose which bids or asks to submit in the

market (for full details, see Vytelingum, 2006).

3 METHODOLOGY

Open Exchange (OpEx) is a real-time financial-

market simulator specifically designed to enable eco-

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

346

Table 1: Permit-schedule timetable. Six permit types are

issued to each market participant, depending on their role.

For each role, there is one human and one robot participant.

Permit values show limit price - P

0

. Numbers in brackets

show the time-step sequence in which permits are allocated.

1 2 3 4 5 6

Buyer1 77 (1) 27 (4) 12 (7) -9 (10) -14(13) -29 (16)

Buyer2 73 (2) 35 (5) 8 (8) -5 (11) -22 (14) -25 (17)

Buyer3 69 (3) 31 (6) 16 (9) -1 (12) -18 (15) -33 (18)

Seller1 -77 (1) -27 (4) -12 (7) 9 (10) 14 (13) 29 (16)

Seller2 -73 (2) -35 (5) -8 (8) 5 (11) 22 (14) 25 (17)

Seller3 -69 (3) -31 (6) -16 (9) 1 (12) 18 (15) 33 (18)

nomic trading experiments between humans and au-

tomated trading algorithms (robots). Developed

at the University of Bristol by Marco De Luca,

OpEx is freely available for open-source download

from SourceForge.net (OpEx SourceForge, 2012),

under the terms of the Creative Commons Public Li-

cense. We used OpEx to conduct 24 experiments on

21/03/2012.

2

In each experiment, the market con-

tained six human traders (arranged as 3 buyers and

3 sellers) and six robot traders (similarly arranged as

3 buyers and 3 sellers). All human participants (24 in

total) were registered full-time students at the Univer-

sity of Bristol. Participants were paid £25 for partici-

pating in the trading experiments, plus, to incentivise

traders to make profit, the two human traders scoring

the highest profit were rewarded with an Apple iPad.

We ran four sessions, each consisting of six

rounds of experiments. For each session, a new group

of human volunteers was used. Participants were told

that their aim was to make as much profit as possible

by trading client orders that arrive over time. Partici-

pants were given a short tutorial on the system lasting

approximately 10 minutes, after which six rounds of

experiments were run, with each experiment having a

market open period of 10 minutes.

An experimental market is defined by the aggre-

gate supply and demand of participants; i.e. the sup-

ply and demand schedules. The units of supply and

demand are allocated to market participants progres-

sively during the course of an experiment. Rather than

allocate all units when the market opens, units to trade

are continuously drip-fed into the market throughout

the market open period. Table 1 shows the permit

schedule timetable that describes how units are al-

located to participants. During an experiment, each

participant receives six permit types (of 8 units each).

The value indicates the limit price of the permit; limit

2

During one run, the user interface of a human partic-

ipant crashed, causing the participant to achieve very low

profit. Hence, we use only results from the other 23 experi-

ments to perform our statistical analysis.

Table 2: Experiment schedules.

Experiment P

0

Cyclical?

1 272 Yes

2 209 No

3 291 Yes

4 241 No

5 258 Yes

6 239 No

values set the ceiling price at which a buyer can buy

and the floor price at which a seller can sell, and are

all given relative to the market equilibrium value, P

0

.

Values in parentheses indicate the time-step that the

permit is allocated to a market participant. For all ex-

periments, the inter-arrival time of permits, or time-

step, was fixed at 4 seconds. Permits are always allo-

cated in pairs symmetric about P

0

, such that the the-

oretical market equilibrium is not altered. To ensure

equality between humans and robots, each time a per-

mit is allocated to a human, an identical permit is

allocated to a robot that has the same role (Buyer1,

Buyer2, etc.); i.e., each human in the market has a

‘shadow’ robot playing exactly the same role.

For each experiment, markets are configured to be

either ‘cyclical’, or ‘random’. Table 2 summarises

the schedules used for each experiment, indicating P

0

,

and whether permits are allocated cyclically, or ran-

domly. In cyclical markets, permits are allocated in

strict sequence for the duration of an experiment, fol-

lowing the timetable of Table 1. After 18 time-steps

(72 seconds), the cycle restarts. This is repeated 8

times before the market is closed. By contrast, in ran-

dom markets, the permit sequence across the entire

run is randomised. However, permits are still allo-

cated in symmetric Buyer-Seller pairs, and each per-

mit is received by a human and robot playing the same

role. Overall, the aggregate market supply and de-

mand schedules are unaltered, only the order of allo-

cation varies. In previous continuous-market human-

robot experiments (De Luca et al., 2011; Cartlidge et

al., 2012), cyclical-replenishment was used, replicat-

ing the design used by (Cliff and Preist, 2001). By

using cyclical replenishment, therefore, it is easier to

compare new results with those from the literature.

However, cyclical replenishment is manifestly artifi-

cial: real markets are not cyclically refreshed with

new supply and demand in such a regular fashion. For

this reason, we introduce random-replenishment here

to add more realism. Further, we test both cyclical-

replenishment and random-replenishment in order to

see if any artifactual differences are introduced in the

results. This lets us infer that if a statistical difference

Evidencingthe"RobotPhaseTransition"inHuman-agentExperimentalFinancialMarkets

347

Table 3: Agent configurations used in experiments.

Name Agent Sleep-Wake Internal

AA-0.1 AA 0.1 0.05

AA-1 AA 1 0.5

AA-5 AA 5 2.5

AA-10 AA 10 2.5

is present in results from cyclical-replenishment mar-

kets that is not present in random-replenishment mar-

kets, then the difference is an artifactual consequence

of the artificial experimental constraint of cyclically

replenishing the traders’ entitlements to buy and sell

(for a lengthy discussion on the importance of incor-

porating ‘realism’ into experimental design, see De

Luca, Szostek, Cartlidge, & Cliff, 2011).

For each experiment, all robots were configured

with an identical parameter set, detailed in Table 3.

Agents were selected from one of four configurations:

AA-0.1, AA-1, AA-5, and AA-10. The numerical

suffix indicates a robot’s sleep-wake cycle time in

seconds. The greater the value, the longer the robot

‘sleeps’ between actions. By varying this sleep pa-

rameter, we are able to control the ‘speed’ at which

robots act. Johnson et al. (2012) suggest that: “in

many areas of human activity, the quickest that some-

one can notice [a] cue and physically react, is ap-

proximately 1000 milliseconds”. Thus, to test the ef-

fect of robot speed on the market, we select sleep val-

ues that comfortably range from well below human

reaction speed (0.1s) to well above human reaction

speed (10s). In this way we should be certain that our

collection of robot configurations ‘cross the bound-

ary’ of human reaction time, enabling us to com-

pare the dynamics of markets containing robots that

act at super-humanly fast speeds, with markets con-

taining robots that act on human time-scales. To en-

sure that robots are able to act sensibly upon waking

from sleep, robots are enabled to observe the market

and perform internal calculations during their ‘sleep’

phase. To achieve this, a second ‘internal’ timer is

used to control when a robot will observe and cal-

culate. Table 3 shows the internal timers used for

each robot configuration; in each case, the internal

timer has a shorter period than the sleep-wake cycle.

Robots are also configured to wake from sleep upon

a new order stimulus and new trade stimulus. Finally,

all robots have a ‘maximum spread’ parameter set to

0.01, meaning that if the spread between the best ask

price and best bid price is less than 1%, the agent will

automatically cross with the best bid/ask on the other

side (for further details, see Cartlidge & Cliff, 2012).

For evaluating statistical significance we use the

nonparametric Robust Rank Order (RRO) test re-

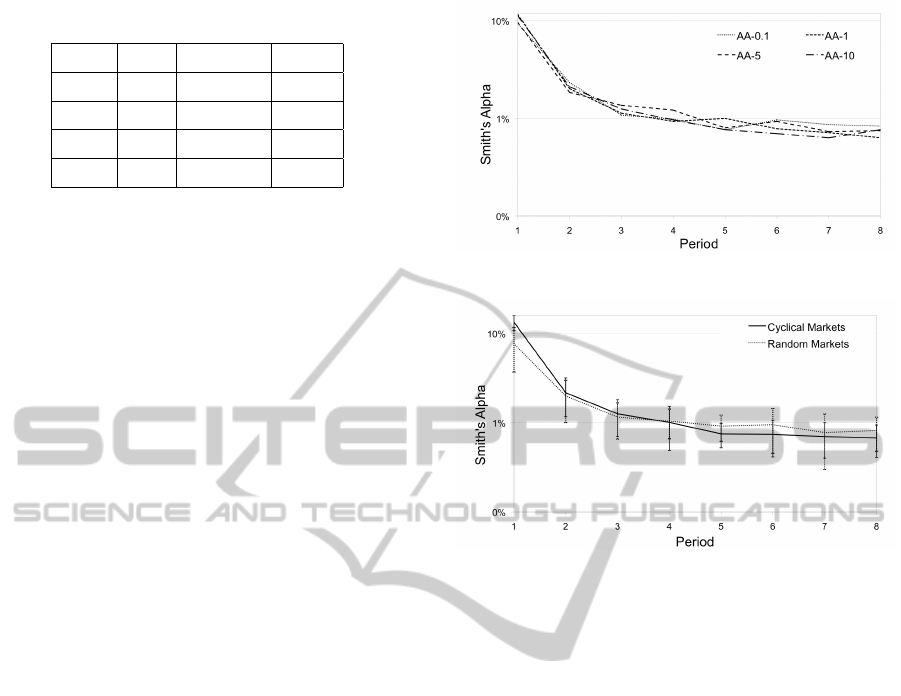

Figure 1: Smith’s α for each robot type.

Figure 2: Smith’s α for each market type (±95% C.I.).

ported by Feltovich (2003).

4 RESULTS

4.1 Smith’s α

In Fig. 1 we can observe the equilibration behaviour

of the markets by plotting Smith’s α for each cycle

period (on a log-scale). We see that there is no differ-

ence between robots. Under all conditions, α rapidly

falls from a value close to 10% in the initial period, to

α ≈ 2% in period two; α then continuous to fall more

gradually over the course of an experiment, tending to

α ≈ 1% by market close.

In Fig. 2 we see mean α (±95% confidence inter-

val) plotted for cyclical and random markets. Under

both conditions, α follows a similar pattern, tending

to α ≈ 1% by market close. However, in the first pe-

riod, cyclical markets produce significantly greater α

than random markets (RRO, p < 0.0005). This is due

to the sequential order allocation of permits in cycli-

cal markets, where limit prices furthest from equilib-

rium are allocated first. This encourages ‘exploratory’

quotes and trades to occur far from equilibrium. In

comparison, in random markets, permits are not or-

dered by limit price, thus making it likely that limit

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

348

prices of early orders are closer to equilibrium than

they are in cyclical markets.

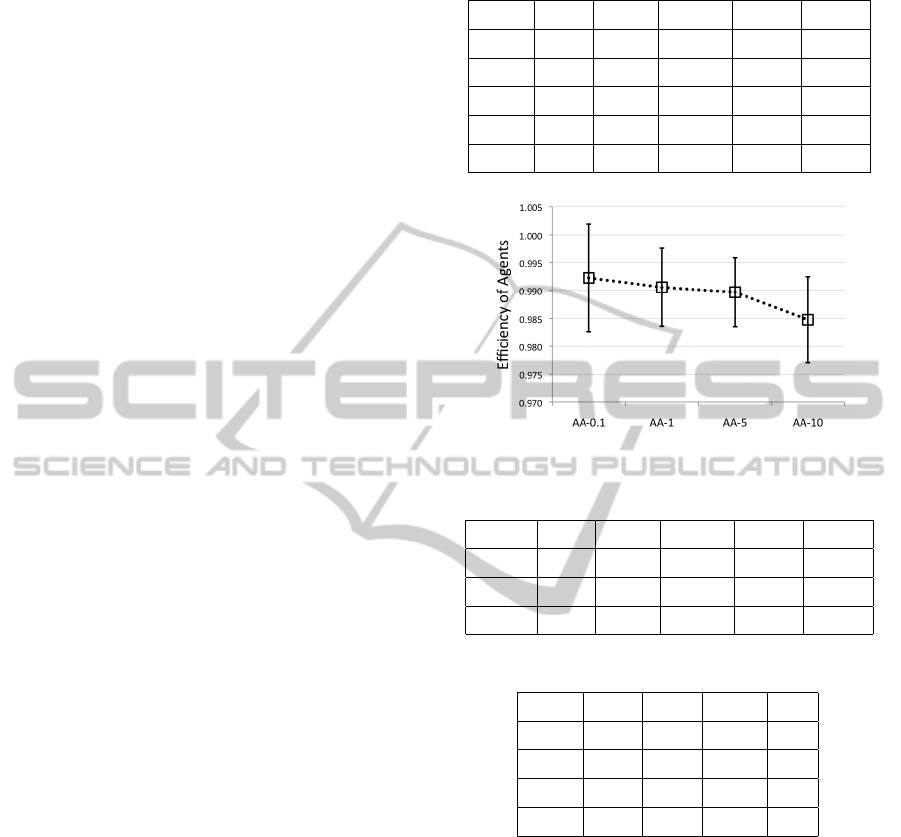

4.2 Efficiency

Mean efficiency results for each robot type averaged

across all experiments are summarised in Table 4. We

see that the efficiency of robots is greater than the ef-

ficiency of humans under every condition, with robots

securing a delta profit gain of 0.4% – 1.8%. Across all

experiments, robots achieve a significantly greater ef-

ficiency (RRO, p < 0.025). Grouping by market type,

robots achieve significantly greater efficiency in ran-

dom markets (RRO, p < 0.1) and robots achieve sig-

nificantly greater efficiency in cyclical markets (RRO,

p < 0.1). When comparing the efficiencies of robots

with the efficiencies of humans across all markets

grouped by robot type, robots are still shown to be

more efficient but the difference is only significant

for robots AA-0.1 and AA-5 (RRO, p < 0.104). The

difference between robots AA-10 and humans is not

significant at the p = 0.104 level and the difference

between robots AA-1 and humans is not significant at

the p = 0.104 level.

Fig. 3 plots mean efficiency (±95% confidence

interval) of robots grouped by type. As robot sleep

time decreases, the efficiency of robots appears to in-

crease, however, across all markets this difference is

not significant. However, when comparing data from

only cyclical markets, AA-0.1 robots attain a mean

efficiency score significantly higher than AA-1 (RRO,

p = 0.05), AA-5 (RRO, p = 0.05), and AA-10 (RRO

p = 0.1).

4.3 Profit Dispersion

Table 5 summarises profit dispersion by market type.

We see that random markets have significantly lower

profit dispersion (RRO, 0.005 < p < 0.01), signif-

icantly lower profit dispersion of humans (RRO,

0.025 < p < 0.05), and significantly lower profit dis-

persion of agents (RRO, 0.001 < p < 0.005). How-

ever, when comparing profit dispersion by robot types

(data not presented), we find no significant difference

in profit dispersion of markets, robots, or humans.

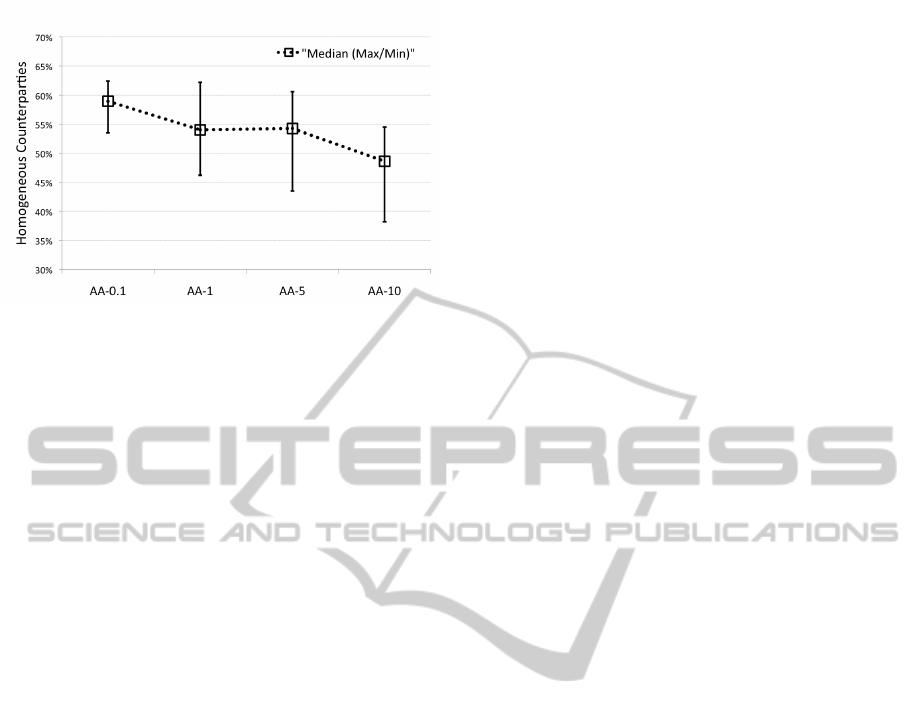

4.4 Execution Counterparties

Table 6 shows the mean proportion of counterparty

executions grouped by robot type. In a fully mixed

market, we expect roughly half of all trades to have

homogeneous counterparties (humans trading with

humans and robots trading with robots) and the other

half to have heterogeneous counterparties (humans

Table 4: Mean efficiency and ∆Profit(Robot - Human).

Agent Trials Agents Humans Market ∆ Profit

AA-0.1 6 0.992 0.975 0.984 1.8%

AA-1 5 0.991 0.977 0.984 1.4%

AA-5 6 0.990 0.972 0.981 1.8%

AA-10 6 0.985 0.981 0.983 0.4%

All 23 0.990 0.976 0.983 1.34%

Figure 3: Mean efficiency of robots (±95% C.I.).

Table 5: Summary of profit dispersion by market type.

Market Trials Agents Humans Market ∆ Profit

Cyclical 12 89.6 85.4 88.6 1.32%

Random 11 50.2 57.2 55.6 1.36%

All 23 70.0 71.9 72.8 1.34%

Table 6: Mean proportion of counter-party executions.

Agent Trials Homo Hetero Sum

AA-0.1 6 0.585 0.415 1.0

AA-1 5 0.542 0.458 1.0

AA-5 6 0.535 0.465 1.0

AA-10 6 0.475 0.525 1.0

trading with agents, or vice versa). Fig. 4 plots the

median number of homogeneous counterparties in

markets containing each of the four robot types, with

error bars showing the range of values. There appears

to be an inverse relationship between robot sleep time

and proportion of homogeneous counterparties. RRO

tests show that the proportion of homogeneous in-

teractions in AA-0.1 markets is significantly higher

than AA-1 and AA-5 markets (p < 0.051), and AA-10

markets (p = 0.0011); and for AA-1 and AA-5 mar-

kets the proportion is significantly higher than AA-

10 (p < 0.104). For AA-10 robots, the proportion of

homogeneous counterparties is significantly lower in

random markets than cyclical markets (p < 0.05). For

all other robot types, there is no significant difference

in the proportion of homogeneous counterparties be-

Evidencingthe"RobotPhaseTransition"inHuman-agentExperimentalFinancialMarkets

349

Figure 4: Proportion of homogeneous executions.

tween markets.

If we assume a normal distribution for the counter-

party distributions, then calculating confidence inter-

vals shows that in all (six) markets containing AA-0.1

robots, the proportion of homogeneous counterparties

is significantly greater than 50% (p < 0.0001). In

contrast, for markets containing AA-1 robots (five),

AA-5 robots (six), and AA-10 robots (six), the null

hypothesis that the proportion of homogeneous coun-

terparties is 50% is not rejected at the 10% level of

significance. This suggests that for the fastest robots

(AA-0.1) there is a trend to market fragmentation,

with humans trading with humans and robots trading

with robots more than would be expected by chance.

5 DISCUSSION

5.1 Evidence for the Phase Transition

Here, we summarize the main results that hold across

all our market experiments. In Section 5.2 we dis-

cuss results that demonstrate significant differences

between cyclical and random markets.

Across all markets, and for all robot types, robots

are shown to outperform humans, securing greater al-

locative efficiency scores under every condition and

gaining a delta profit increase of between 0.4%-1.8%.

These results are significant across all markets and

robot types, except AA-10, the slowest of the robots.

For readers familiar with previous papers (such as De

Luca et al., 2011; Cartlidge, De Luca, Szostek, &

Cliff, 2012), this result may come as something of a

surprise: prima facie, this is the first time that robots

have been shown to be more efficient than humans

in a continuous replenishment, real-time experimen-

tal market with liquidity drip-fed into the market over

time. There is weak evidence (not statistically sig-

nificant) of a trend for the efficiency of agents to de-

crease as sleep time of agents increases, suggesting

that speed is beneficial to agents. This is an intu-

itively appealing interpretation, but is not confirmed

with a reasonable level of statistical significance by

our results. Furthermore, the prima facie novelty of

this result is primarily due to problems with the earlier

results (published in De Luca et al., 2011; Cartlidge

et al., 2012). Those earlier results, we learned in the

course of analysing the results of the experiments re-

ported here, were affected by a bug in the OpEx im-

plementation of the AA robot-trader algorithm, and

fixing that bug was the main cause of the increase in

efficiency with respect to those earlier results (for fur-

ther details, see Cartlidge & Cliff, 2012).

Across all markets, α values start high (α ≈ 10%)

as traders ‘explore’ the space of prices, and then

quickly reduce, with markets tending to an equili-

bration level of α ≈ 1%. This demonstrates mar-

kets trading at a level much closer to equilibrium

than previously observed in De Luca et al. (2011) and

Cartlidge et al. (2012); and suggests that the mar-

ket’s price-discovery is readily finding values close

to P

0

. These results demonstrate a well-functioning

robot-human market trading near equilibrium, with

robots out-competing humans on profit. This is an

interesting result, but for our purpose of exploring

the robot phase transition described by Johnson et al.

(2012) it only serves as demonstrative proof that our

experimental markets are performing as we would ex-

pect. The real interest lies in whether we can ob-

serve a phase transition between two regimes: one

dominated by robot-robot interactions, and one domi-

nated by human-robot interactions. We seek evidence

of this by observing the proportion of homogeneous

counterparties within a market; that is, the number

of trade executions that occur between a pair of hu-

mans or a pair of robots, as a proportion of all market

trades. Theory suggests that in a fully mixed mar-

ket with no asymmetry in the behaviour of partic-

ipants, we should expect 50% of trade counterpar-

ties to be homogeneous, and 50% to be heteroge-

neous, as traders execute with counterparties at ran-

dom. From Section 4.4, our results demonstrate that

for markets containing AA-0.1 robots, the proportion

of homogeneous counterparties is significantly higher

than we would expect in a mixed market, whereas

with slower-acting robots, the proportion of homo-

geneous counterparties cannot be significantly differ-

entiated from 50%. We present this as tentative first

evidence for a robot-phase transition in experimental

markets with a boundary between 100 milliseconds

and 1 second, although in our experiments the effects

of increasing robot speed seem to give a progressive

response rather than a step-change. However, we feel

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

350

obliged to caveat this result as non-conclusive proof

until further experiments have been run, and until our

results have been independently replicated.

The careful reader may have noticed that the

results presented have not demonstrated ‘fractures’

– ultra-fast series of multiple sequential up-tick or

down-tick trades that cause market price to deviate

rapidly from equilibrium and then just as quickly re-

turn – phenomena that Johnson et al. (2012) revealed

in real market data. Since we are constraining mar-

ket participants to one role (as buyer, or seller) and

strictly controlling the flow of orders into the market

and limit prices of trades, the simple markets we have

constructed do not have the capacity to demonstrate

such fractures. For this reason, we use the proportion

of homogeneous counterparties as proxy evidence for

the robot phase transition.

5.2 Artefacts or Evidence?

As we argued in Section 3, the cyclical-replenishment

experimental markets used by De Luca et al. (2011)

and Cartlidge et al. (2012) are a poorer approxi-

mation to real-world markets than are the random-

replenishment markets. For that reason, where re-

sults from cyclical markets show a significant effect

of agent-speed, that is not also present in our random

markets, we interpret as another indication that in-

troducing artificial constraints into experimental mar-

kets for ease of analysis runs the risk of also intro-

ducing artefacts that, because they are statistically

significant, can be misleading. The following rela-

tionships were all observed to be statistically signifi-

cant in cyclical-replenishment markets and not statis-

tically significant in random-replenishment markets;

providing further support for the argument for real-

ism in artificial-market experiment design, previously

advanced at length by De Luca et al. (2011):

1. Cyclical-replenishment markets produced signif-

icantly greater α values in the first period of

trade. This is a direct consequence of cyclical-

replenishment allocating orders in a monotoni-

cally decreasing sequence from most profitable

to least profitable. As such, the first orders allo-

cated into the market have limit prices far from

equilibrium. Since the market is empty, there

is no mechanism for price discovery other than

trial-and-error exploration; leading to large α. In

random-replenishment markets, the initial orders

entering the market are drawn at random from the

demand and supply schedules. This leads to lower

bounds on limit prices and hence lower α. Subse-

quently, price discovery is led by the order book,

resulting in lower α over time.

2. In cyclical-replenishment markets, the efficiency

of AA-0.1 robots is significantly higher than the

efficiency of the other robot types. While there is

some evidence of an inverse relationship between

robot sleep time and robot efficiency across all

markets, we infer that this difference is an artefact

of cyclical replenishment until further experimen-

tal trials can confirm otherwise.

3. When comparing random and cyclical markets,

profit dispersion in cyclical-replenishment mar-

kets is significantly higher for agents, humans,

and the market as a whole. Since lower profit dis-

persion is a desirable property of a market, this

suggests that the relatively high profit dispersion

observed in previous cyclical-replenishment ex-

periments (De Luca et al., 2011; Cartlidge et al.,

2012) is an artefact of the experimental design.

5.3 Future Work

We have gathered tentative evidence to support the ex-

istence of the robot phase transition. The next step is

to see if we can observe market dynamics analogous

to the market ‘fractures’ reported by Johnson et al.

(2012). To achieve this, it may be necessary to in-

troduce role diversity (e.g. enabling participants to

buy and sell and hence act as ‘market makers’). If

we are able to achieve this goal, we will then have a

controlled method for exploring the relationship be-

tween localised ultra-fast mini-crashes and longer-

term global instabilities (flash-crashes) observed in

real-world markets. Any progress in this area could

have significant positive impact on our understanding

of the global financial markets and offer potential new

regulatory mechanisms to avoid the occurrence of fu-

ture flash-crash events.

Other questions that have arisen from this research

and require further exploration, include:

• What happens if we vary the rate of order replen-

ishment inter-arrival times? When orders start to

arrive faster than humans can react, do we see a

robot phase transition here?

• What happens if we vary the proportion of robots

in the market? Are market dynamics significantly

different when the market is dominated by robots?

How does this affect the robot phase transition?

• What happens if robots do not wake up on new

trade stimuli? Does this make a fairer proxy of

agent ‘speed’? How does this change affect the

robot phase transition?

While these questions are interesting, progress will

necessarily be slow. Unlike many facets of computer

science, where variations on a question theme can be

Evidencingthe"RobotPhaseTransition"inHuman-agentExperimentalFinancialMarkets

351

easily tweaked by altering the values of some parame-

ters and then pressing ‘run’, experimental economics

offers the pragmatic challenge of soliciting and incen-

tivizing human participants, arranging a venue, en-

suring participants arrive, and finally, ensuring that

the system is ‘correctly’ configured and functioning

error-free during the ‘one-shot performance’ of each

experiment. For many empirical computer scientists

working on artificial intelligence and autonomous

software agents, this is an alien landscape.

6 CONCLUSIONS

We have presented results from a series of human-vs.-

robot experimental financial markets to test the hy-

pothesis that when robot trader agents in OpEx are

able to act/react on a timescale quicker than the hu-

man traders are, we will see a transition from a mixed

market (where humans and robots are equally likely

to interact with one another) to a more fragmented

market where robots are more likely to trade with

robots, and humans with humans, similar to the robot

phase transition that Johnson et al. (2012) argue for

the existence of in real financial markets. Our primary

conclusion is that our results are supportive of John-

son et al.’s (2012) hypothesis concerning the existence

of the robot phase transition, although in our experi-

ments the effects of increasing robot speed seem to

give a progressive response rather than a step-change.

This result could have potentially profound conse-

quences. By evidencing the robot phase transition un-

der controlled laboratory conditions, we have opened

a new pathway for studying this recently observed

phenomenon. Hopefully, future work will replicate

sub-second ‘fractures’ and subsequent global insta-

bilities (‘crashes’). We will then be in a position to

dynamically observe the relationship between these

intriguing phenomena, enabling us to design monitor-

ing tools and/or introduce safety mechanisms, in or-

der to avoid, or contain, future ‘flash crash’ events in

the global financial markets.

We also explored the effects of increasing the ‘re-

alism’ of the structure of the experiments conducted

on OpEx. In doing this, we discovered that some

statistically significant effects observed in artificial,

constrained experimental set-ups, disappear when the

experiments are more realistic and less constrained.

This leads us to our second conclusion: that in exper-

iments such as those reported here, the more realistic

the set-up of the experiment, the more the results can

be trusted.

ACKNOWLEDGEMENTS

We are extremely grateful to all the participants of our

experiments. Thanks also to Angela Cheng, who pro-

vided administrative support during the experiments

and Neil Johnson for comments on an early version

of the paper. Primary financial support for Dave

Cliff’s research comes from EPSRC grant number

EP/F001096/1; John Cartlidge is supported by EP-

SRC grant number EP/H042644/1. Financial assis-

tance in the funding of the prizes came from Syritta

Algorithmics Ltd and Electric Lamb Ltd.

REFERENCES

Cartlidge, J., & Cliff, D. (2012). Exploring the “robot phase

transition” in experimental human-algorithmic mar-

kets. Foresight, The Future of Computer Trading

in Financial Markets, Driver Review DR25, Crown

Copyright. Available [online] bitly.com/SvqohP.

Cartlidge, J., De Luca, M., Szostek, C., & Cliff, D. (2012).

Too fast too furious: faster financial-market trading

agents can give less efficient markets. In Filipe, J., &

Fred, A. (Eds.), 4th Int. Conf. Agents & Art. Intell.,

Vol. 2 (ICAART-2012), pp. 126–135. SciTePress.

Cliff, D., & Preist, C. (2001). Days without end: On

the stability of experimental single-period continu-

ous double auction markets. Tech. rep. HPL-2001-

325, Hewlett-Packard Labs.

De Luca, M., & Cliff, D. (2011). Human-agent auction in-

teractions: Adaptive-aggressive agents dominate. In

Walsh, T. (Ed.), 22nd Int. Joint Conf. Artificial Intel-

ligence (IJCAI-11), pp. 178–185. AAAI Press.

De Luca, M., Szostek, C., Cartlidge, J., & Cliff, D. (2011).

Studies of interactions between human traders and

algorithmic trading systems. Foresight, The Future

of Computer Trading in Financial Markets, Driver

Review DR13, Crown Copyright. Available [online]

http://bit.ly/RoifIu.

Feltovich, N. (2003). Nonparametric tests of differences

in medians: Comparison of the wilcoxon-mann-

whitney and robust rank-order tests. Experimental

Economics, 6, 273–297.

Johnson, N., Zhao, G., Hunsader, E., Meng, J., Ravindar,

A., Carran, S., & Tivnan, B. (2012). Financial black

swans driven by ultrafast machine ecology. Working

paper published on arXiv repository. Available [on-

line] http://arxiv.org/pdf/1202.1448v1.pdf.

OpEx, SourceForge (2012). Author: Marco De Luca.

https://sourceforge.net/projects/open-exchange/.

Smith, V. (1962). An experimental study of comparative

market behavior. J. Political Economy, 70, 111–137.

Vytelingum, P. (2006). The Structure and Behaviour of the

Continuous Double Auction. Ph.D. thesis, Sch. Elec-

tron. & Comput. Sci., Univ. Southampton, UK.

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

352