Faustmann Optimal Pine Stands Stochastic Rotation Problem

Eduardo Navarrete

and Jaime Bustos

Department of System Engineering, FRONTERA University, Francisco Salazar 01145, Temuco, Chile

Keywords: Optimal Tree Cutting, Logistical Diffusion, Real Options.

Abstract: The Faustmann optimal rotation harvesting pine stands models under Logistic and Gompertz wood stock

and Brown price stochastic diffusion processes are reformulated as stochastic one dimensional optimal

stopping problem, which are solvable with the Hamilton-Jacobi-Bellman equations. The stochastic models

predict a significant increase of the deterministic optimal cut, with 47.0% and 48.0% in the cases of the

Logistical and Gompertz wood stock diffusion respectively. The application of these models to a Chilean

forest company shows discrepancies due to the absence of consideration to wood stock and price

uncertainties that the company actual cut policy shows. The experimental data significantly validate the

Faustmann stochastic logistic model. They give a better approximation of the company cut policy,

underestimating it by 8.09% and producing a more reliable saturation volume than the Gompertz model.

The sensitivity analysis shows that both volatilities have a similar linear effect in the optimal cut, but the

wood stock volatility volume elasticity of 0.687 almost doubles the stumpage price volume elasticity of

0.350, showing the importance of this uncertainty.

1 INTRODUCTION TO RADIATA

PINE STANDS EXPLOITATION

The need to incorporate uncertainty in wood stock

and price is not new. Samuelson (1976) not only

validated Faustmann’s deterministic formula (1995)

as the correct one, but also considered that the

forestry economist’s “simple notion of stationary

equilibrium needs to be replaced by the notion of

perpetual Brownian motion”. The majority of the

early papers considered only price stochastic

diffusion and simple harvest rotation see (Clark and

Reed, 1989); Others like (Morck & Schwartz,1989);

(Insley, 2002; and Alvarez et al., 2006) considered

also wood stochastic diffusion. Few of them (Insley

& Rollins, 2005; Willasen, 1998) formulated these

problems as stochastic impulsive control and

considered price and wood stock stochastic diffusion

for the multiple rotation or Faustmann model. In a

previous paper Navarrete (2011) extended the single

and multiple optimal rotations harvesting pine stands

models without the stands’ regeneration cost for

Logistic wood stock and Brown price stochastic

diffusion processes, and reformulated it as an

optimal stopping problems with only one stochastic

diffusion, solvable with the Hamilton-Jacobi-

Bellman differential equations.

The objective of this paper is to extend those

stochastic results to the Faustmann formula with the

stands regeneration cost for Logistic and Gompertz

wood stock and Brown price diffusions, to solve the

stochastic rotation of even aged pine stands

harvesting and to validate these results by applying

them to a Chilean forest company.

2 METHODOLOGY

2.1 Model Formulation

Given the following variable and parameters

Vt = Wood stock at time t

µ(Vt) = Wood stock diffusion drift parameter

σ(Vt) = Wood stock volatility parameter

Pt = Wood stumpage spot price at time t

Po = Initial stumpage wood price

α = Wood price diffusion drift rate

β = Wood price volatility

W = Wiener diffusion

C = Stands regeneration cost

c = C/Po

R, Q = Probabilistic metrics

F = Functional Objective

57

Navarrete E. and Bustos J..

Faustmann Optimal Pine Stands Stochastic Rotation Problem.

DOI: 10.5220/0004285402050212

In Proceedings of the 2nd International Conference on Operations Research and Enterprise Systems (ICORES-2013), pages 205-212

ISBN: 978-989-8565-40-2

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

The model considers ITO diffusion for the wood

stock and a geometric Brown diffusion for the wood

price respectively, given by equations (1) and (2).

dV

t

= µ(V

t

)dt + σ(V

t

) dW (1)

dP

t

= αP

t

dt + βP

t

dW (2)

Under the assumption of a weak solution (Vt, t) for

the diffusion equations (1, 2) and initial conditions

(V0

0, P0

0), the multiple actualized harvest

value or Faustmann model (3), (see Johnson, 2006)

is given by objective functional (3).

00

sup ( )

(,) ( )

() 1

Rrt

F

tt

rt

o

EePV C

FVP

tt e

(3)

2.2 Reformulation of the Multiple

Harvest Rotation Problem

The stochastic model (1, 2, and 3) is difficult to

solve. The following theorem reduces this model

to a one dimensional stopping problem that is more

amenable.

Theorem 1: A probabilistic measure Q exists and

is equivalent to the actual metric R, such that: (see,

Appendix A)

)

1

(sup[

)

1

(

)(

sup

),(

)(

0

00

rt

t

tr

Q

rt

tt

rt

R

o

e

Ve

EP

e

VPe

E

tt

PVF

(4)

Furthermore, under the metric Q, the process V

t

follows the diffusion (5).

WdVdtVVdV

tttt

)()}()({

(5)

An optimization strategy previously developed by

the author (see Navarrete, 2011) was used. The

functional objective (3) was parameterized for

different time values t=t

n,

generating a family of n

stochastic optimization problems. Since

)1/(

n

rt

eC

is constant for each t

n,

we can apply

theorem 1 and reformulate each of these problems as

the following optimal stopping problem with one

dimensional ITO diffusion.

F

F

(V) = sup (E

P

[

n

rt

e

P

t

V

t

]-C)/(1-

n

rt

e

))

= P

o

sup{E

Q

[

n

tr

e

)(

V

t

/(1-

n

rt

e

)]– C/(1-

n

rt

e

}

(6)

Dividing by the constant Po, this objective is

reformulated as

F(V) = Max { E

Q

[

n

tr

e

)(

V

t

/(1-

n

rt

e

)]

– c/(1-

n

rt

e

)}

(7)

with the following wood stock diffusion under the

metric Q.

WdVdtVVdV

tttt

)()}()({

(8)

The formulation of the Hamilton Jacobi Bellman

equation for this problem is given by the following

inequation with the capitalized interest rate r

t

= r/ (1-

n

rt

e

).

Max{ ½σ

2

V

2

F´´(V) + [µ(V) + βσ(V)] F´(V)

– [r

t

-α] F(V) – c r

t

, (V-c)/(1-

n

rt

e

)-F(V)} = 0

(9)

In this case the differential equation for the

continuation region (V< V*) is given by the non

homogenous differential equation (10).

½σ

2

V

2

F´´(v) + [µ(V)+βσ(V)] F´(V)

- (r

t

-α) F(V) – c r

t

= 0

(10)

with F(0) = -(r

t

/r)c.

And by equation (11) for the stopping zone (V< V*).

(V-c)/ (1-

n

rt

e

)-F (V) = 0

(11)

The solution of this ordinary differential equation

under the initial condition for a given capitalized

interest r

t

is given in (12), with ψ(V) the solution of

the homogenous part and [ r

t

/r]c the particular

solution of equation (10).

F

F

(V,r

t

) = {

*)1/()(

*]/[)(

VVecV

VVcrrVA

rt

t

(12)

In this case the smooth pasting condition for each

parameter r

t

is given by:

AΨ (V*)-(r

t

/r) c = (V*-c)/ (1-e

-rt

) = (r

t

/r) (V*-c) and

Aψ´ (V*) = r

t

/r . So V*

t

must fulfill a similar

smooth-pasting condition to the Vicksell model for

each parameter r

t

.

Ψ (V*) = V* ψ´ (V*) (13)

This solution series is then optimized for the

Faustmann functional objective equation (7) under

metric Q by inspection of its values.

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

58

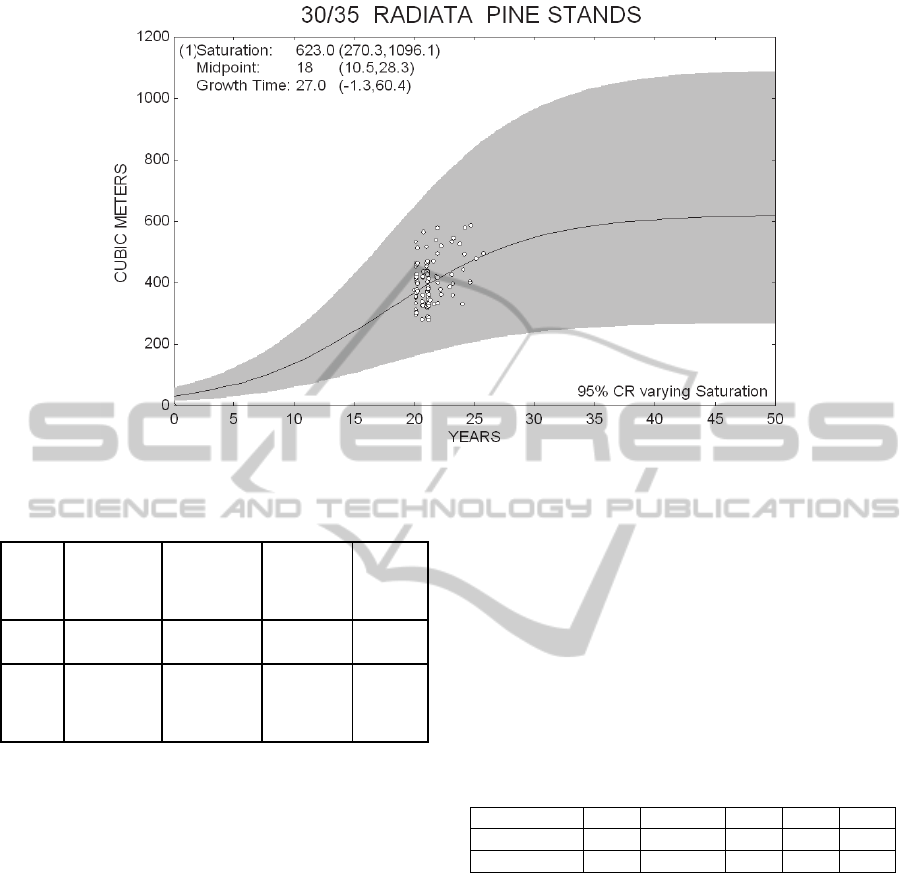

Figure 3.1: VOLUME (m3/ha) versus years, single plot.

3 EXPERIMENTAL DATA

AND PARAMETERS FITTING

3.1 Logistic Diffusion Fitting

The experimental data was provided by a Chilean

forest company. These data belongs to 128 harvest

stock of its pine stocks stands between 1999 and

2005 and came from different sample plots which

belong to site indexes between 30 and 35 meters and

represent sites with high forest aptitude and a tree

average initial volume of 32 m3/ha after the end of

the first 4 years initial seed cultivation period. This

information is located outside the 95% range of

confidence for the logistic adjusted figure, forming

an initial series of 122 data points, which are plotted

in figure 3.1.

dV = µ V (1- γ V) dt + σ Vdw (14)

The basic requirement of a pine stand growing

diffusion is its sigmoid pattern (Garcia, 2005). The

logistic diffusion, equation (14) is a special case of

the sigmoid model given by µ(V) = µV(1-γV) and

σ(V) = σ V, where µ and γ are the drift and

saturation parameters and σ is the volatility

parameter.

t

t

t

m

dsWsExpV

WtExpV

V

])

2

[([1

)

2

[(

2

0

2

0

(15)

The integration of the value of V is given by

equation (15) (Kloeden& Platen, 1991, page 125)

and its expected value is given by equation (16)

)(

1

1

)(

m

tt

t

e

VE

(16)

With; 1/γ = saturation volume, µ = growth rate

parameter = L

n

(81)/Δ

t

, Δ

t

= time necessary to

increase volume from 10% to 90% of saturated

volume and t

m

= time to achieve the midpoint of the

saturation volume.

The standard deviation Sd(∞) at the saturation

zone is constant and σ can be easily estimated by

equation (17).

σ = Sd(∞)/V

s

= (95% saturation confidence

interval)/(2 *1.96 *Vs)

(17)

The logistic diffusion model was fitted using a

logistical nonlinear regression and a Monte

Carlo/Bootstrap simulation sampling method,

implemented by Meyer et al. (Loglet Lab.1 software,

1999).

The result is presented in figure 3.2, showing the

drift parameter and its 95% confidence interval for

the whole series and for its saturation zone. The

summary of the parameter fitting is shown in table

3.1.

200

250

300

350

400

450

500

550

600

650

700

19 20 21 22 23 24 25 26

A

GE (years)

VOLUME (m3/ha))

FaustmannOptimalPineStandsStochasticRotationProblem

59

Figure 3.2: Expected logistic fitting for the stands 30/35 site.

Table 3.1: Logistic fitting parameters.

Site

Index

mts.

Drift

Parameter

µ

Drift

Saturation

Parameter γ

Saturation

Standard

Deviation

Volatilit

y

σ

30/35

0.163 0.00161 210.66 0.339

Deter

minist

ic

0.163 0.00161 0.00 0.00

See Navarrete 2011

3.2 Gompertz Diffusion Fitting

Another important sigmoid diffusion is the

Gompertz geometrical diffusion, which is given by

the following equation (18)

dV=kV[θ-ln(V)]dt + σVdW (18)

This equation is integrated to the following

expression, (see Gutierrez 2009)

V(t)= exp[ ln(V

0

)e

-

k

t

+ {(kθ-σ

2

/2)/k} (1-e

-k

t

)

+ σe

-kt

∫dW]

(19)

The expected value takes the following expression

E[V(t)]= exp [ln(V

0

)e

-kt

+ {(θ-σ

2

/(2k)}(1-e

-

kt

) + (σ

2

/(4k))(1-e

-2kt

)]

(20)

Taking natural logarithm and rearranging it, we get

ln E[V(t)]= A- Bx-Cx

2

(21)

with A= θ-σ

2

/(4k), B=θ-σ

2

/(2k) - ln(V

0

), C=σ

2

/(4k)

and x= e

-kt

Given a value for k, a quadratic fitting for e

-kt

and

e

-2kt

can be done estimating the value of A, B and C

until a common value for θ can be obtained from A

and B, determining the estimation for θ, k and σ.

The deterministic parameter only requires a linear

fitting with e

-kt,

. Both fittings were done for the

initial value V

0

= 32 (m3/ha.) and the results are

summarized in table 3.2.

Table 3.2: Gompertz Diffusions Parameters Estimations.

M

odels V

0

V

s

k θ σ

Gompertz 32.00 1046.68 0.058 7.0 0.171

D

eterministic 32.00 1083.09 0.058 6.984 0.000

3.3 Gompertz versus Logistical

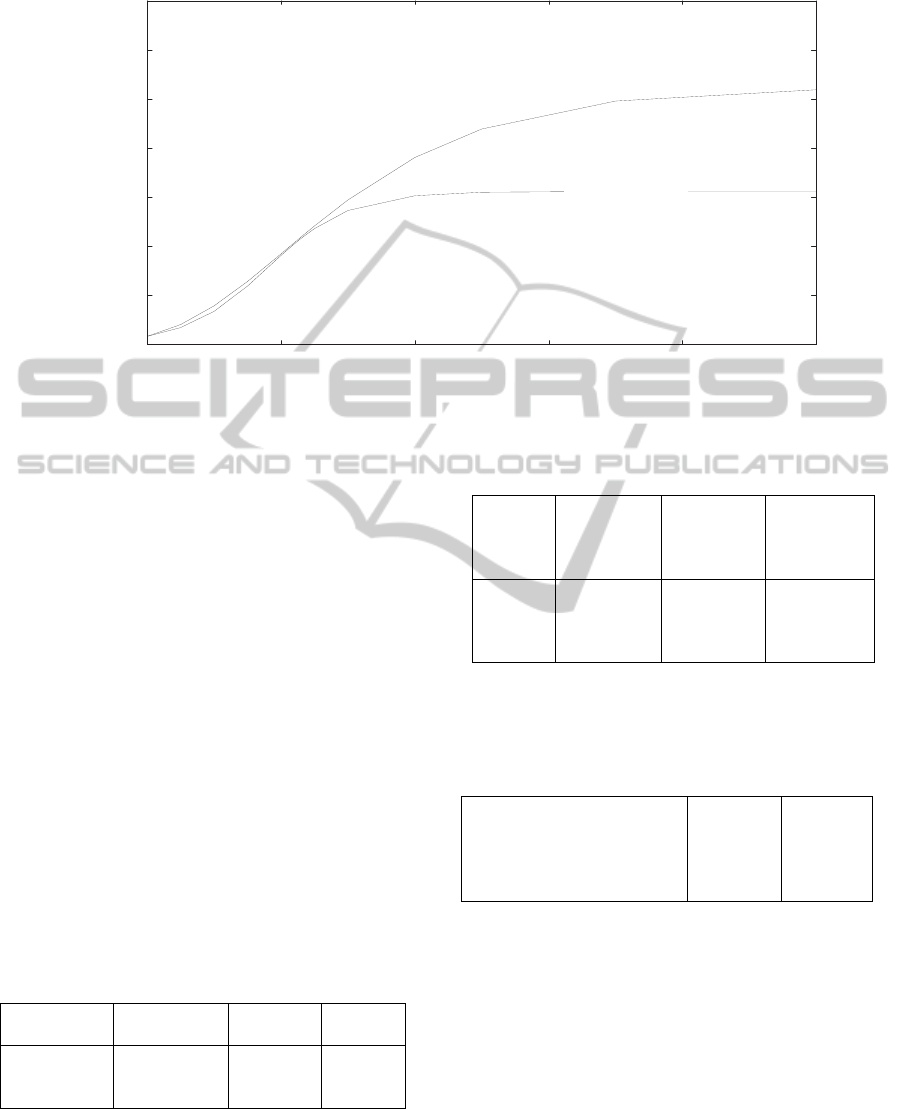

Diffusion Fitting

The expected drift growing pattern of the Logistic

and Gompertz Wood Stock diffusion are shown in

figure 3.3.

Both models have fitting advantages and

disadvantages.

The Logistic model is a better representation of

the sigmoid growth pattern of the tree stands and

produces a more reliable estimation of the saturation

zone. Unfortunately they cannot be adjusted by

maximum likelihood estimates, and must be adjusted

by a Bootstrap simulating sampling method, see

(Beskos et al., 2006), similar as the one used.

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

60

Figure 3.3: Wood Stock growing diffusion pattern.

The Gompertz model can be fitted by common

statically features, such as Maximum likelihood. See

Gutierrez, et al, (2008) or a Quadratic fitting, which

were the methods used. It also presents a better

adjustment to the experimental data given its lower

volatility parameter, but it produces a worst

estimation equal to 1046.6 m3/ha of the saturation

zone for the tree growth stands, which was not

validated by the experimental data used. Given its

higher initial estimation of the growth parameter and

its lower volatility parameter it will always produce

a lower stochastic optimal solution than the Logistic

model.

3.4 Wood Price Diffusion Fitting

The stumpage stands price Brown diffusion

parameters were estimated by Navarrete, (2011).

The summary of Brown diffusion parameters for the

pulp commercial and stumpage prices is given in

Table 3.3 and for actual stumpage price in table 3.4.

Table 3.3: Stumpage Price Diffusion Parameters.

Summary

Stumpage

logs

Saw logs

Pulp

logs

Percentage 100 % 83.9 16.1

Price drift α 2.9% 3.08 1.79

Volatility β 15.9% 16.52 12.74

See Navarrete 2011

Table 3.4: Stumpage Actual Price Estimation.

YEARS

Saw log

price

(83.9%)

US$/m3

Pulp log

price

(16.1%)

US$/m3

Stumpage

log price

(100%)

US$/m3

2007 43 20 39.30

2008 46 22 42.14

2009 41 21 37.78

Average 39.74

Source: IFOP Anuario Forestal 2010

The regeneration costs of Radiata Pine Stands in

2009 are given in table 3.5

Table 3.5: Radiata Pine Stands Regeneration Cost.

Stands regeneration cost C US$/ha 882

Actual stumpage log price

P

T

US$/ha 39.74

Initial stumpage price P

0

US$/ha 21.43

c=C/P

0

41.16

Source: CEFOR-UACH

3.5 Capital Cost Estimation

The capital cost is estimated by using the CAPM

model for the Chilean Forest industrial sector. The

risky rate of return “r” was estimated as the

international Weight Average Cost of Capital

WACC given the high volatility of actual financial

markets.

Chilean equity capital cost K

e

= R

f

+ β( E(R

m

) –

R

f

)= 3.3+(1.01) 6 = 9.4

0

200

400

600

800

1000

1200

1400

0 20 40 60 80 100

WOOD VOLUME (m3/ha)

AGE (years)

GOMPERTZ

LOGISTIC

LOGISTIC

FaustmannOptimalPineStandsStochasticRotationProblem

61

Chilean Company WACC= 0.76 (12.4)

+0.24(7.6) (1-0.17) = 11%

International Company WACC = r = 11.8 ~12%

Source: CMPC Corp Search June 2009

4 STOCHASTIC RADIATA PINE

HARVESTING RESULTS

4.1 Wood Stock Logistic and Brown

Price Diffusion

Two of the more common sigmoid diffusion

processes used in this area (see Garcia, 2005) are the

Gompertz and the Logistic geometric diffusion. The

logistic geometric diffusion wood stock diffusion

parameters are; µ(V) = µV (1- γV) and σ

V

= σ V.

The Faustmann deterministic optimum is given

by the optimization of the deterministic functional

objective in equation (22).

t

rt

tt

tt

r

e

r

CVP

VP

)1(

)´(

(22)

Replacing it in the equation (22) P

t

= P

o

e

αt

and V

t

´ =

µV

t

(1-γV

t

) we finally obtain

V

t

= {(α+µ-r

t

) + √[(α+µ-r

t

)

2

+ 4µγcr

t

e

-αt

]}

/(2µγ)

(23)

In the stochastic case, the positive function ψ (V), is

the solution of the homogenous component (24) of

the differential equation (10), (see Navarrete 2011)

½ σ

2

V

2

F´´(v) + [µV(1-γV) + β σV] F´(V) -

(r

t

-α) F (V) = 0

(24)

The solution of equation (24) is given by the

Kummer expression (25)

ψ(V) = V

θ

KummerM {

2

2

V

, θ, 2θ

+

2

)(2

}

(25)

with θ the positive root is given by equation (26)

2

2

22

)(2

)

2

1

(

2

1

r

(26)

The Faustmann deterministic optimum is obtained

by intersecting curve (24) with the logistic curve

(16). The solution is programmed in Maple 15 for

both curves, and the optimum obtained is V* =

245.7 m

3

/h. The Faustmann stochastic solution, in

(13), for different values of the capitalized interest r

t

= r/ (1-e

-rt

) is programmed in Maple 15, using its

KummerM function. The optimum is obtained by

evaluating the Faustmann functional objective under

the Q metric (20) for the different V*

t

solutions of

equation (13). The summary of all optimal cuts

results for the aggregate 30/35 site index series of

the multiple rotation harvest or Faustmann formula

is given in table 4.1.

These results show that the Faustmann

deterministic optimum underestimates the actual

policy cut by 37.47% and its stochastic optimum

also underestimates the actual average cut by 8.09%,

so that the Stochastic optimum is 47.0 % bigger than

the deterministic value.

Table 4.1: Multiple Harvest Rotation Optimal Results

Wood stock Logistic diffusion.

Optimum

Stands

cuts

m

3

/ha

Percentage

Increase

%

Percentage

Increase %

Deterministic 245.7 -37.47 100

Actual 392.9 100

Stochastic 361.12 -8.09 47.0

4.2 Wood Stock Gompertz and Brown

Price Diffusion

In this case the parameters of the diffusion are: µ(V)

= k V (θ- ln(V)), and σ(V) = σ V. The deterministic

optimum is obtained by replacing P

t

=P

0

e

αt

andV =

exp (ln(V

0

)e

-kT

+ θ(1-e

-kT

) in equation (22) resulting

equation (28). Which intersection with equation (20)

gives the optimal volume V

opt

.

V ={r

t

ce

-αt

+ k(θ - ln(V

0

)) exp(θ – kT - (θ -

ln(V

0

))e

-kT

}/{r

t

- α}

(27)

The stochastic increasing function ψ(V), in this case,

is given by the solution of the homogenous part of

the differential equation (10) or equation (28).

½ σ

2

V

2

F´´(v) + [kV(θ - ln(V)) + β σV]

F´(V) - (r

t

- α) F (V) = 0

(28)

Choosing θ´= θ - σ

2

/(2k) + βσ/k and r = r

t

- α, the

equation is similar to the exponential Ornstein

Ulhembeck equation whose positive solution ψ(V)

is given by equation (29), (see Johnson, 2005)

eVzbaKummerM

eVzbaKummerUbba

V

),,(

),,()}1(/)1({

{)(

(29)

with a= (r

t

- α)/(2k) b= 0.5 and z= (k/σ

2

) [θ -

σ

2

/(2k)+ βσ/k-ln(V)]

2

.

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

62

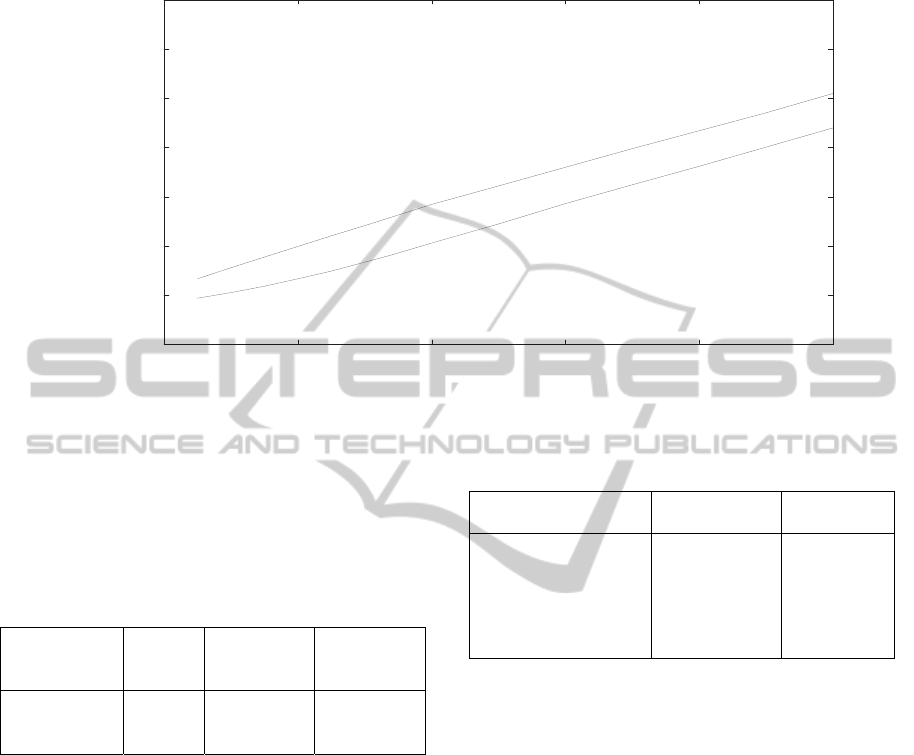

Figure 4.4: Faustmann stochastic optimal cut sensitivity.

The deterministic and stochastic optimum were

programed in Maple 15, using in this case the

KummerU function of the program, the results are

summarized in table 4.2.

Table 4.2: Multiple Harvest Rotation Optimal Results

Wood Stock Gompertz diffusion.

Optimum

Stands

cuts

m

3

/ha

Percentage

Increase %

Percentage

Increase

%

Deterministic 182,6 -53.45 100

Actual 392.9 100

Gompertz 211.13 -46.26 15.62

4.3 Growing Pattern of the Wood Stock

Logistic Diffusion Process

The sensitivity of the Faustmann model shows

similar effects for both volatilities in the optimal cut,

being the Inventory elasticity lower than the

stumpage price elasticity. Obviously, this is due to

the higher volatility of inventory 33.9% over price

15.9%.

4.4 Summary

Table 4.3 shows the summary of the results.

Table 4.3: Results summary.

Optimum

Logistic

Diffusion %

Gompertz

Diffusion %

Deterministic

Optimum

-37.47 -53.45

Actual Policy 100 100

Stochastic Optimum -8.09 -46.26

Stochastic optimum

increment

47.0 15.62

5 CONCLUSIONS

The effects of the wood Stock and price stochastic

diffusion processes are important for the optimal cut.

The Logistic diffusion increases the deterministic

optimum by 47.0%, and the Gompertz diffusion by

15.62%. The difference is due to the lower volatility

estimation of the Gompertz model.

The deterministic optimums in both cases

significantly underestimate the company actual

average cut, and the stochastic optima, being higher,

also underestimate the Company actual average. The

discrepancy in the theoretical and practical cut

policy can be explained by the absence of

consideration that the Company gives to the

Faustmann model and the stochastic behavior of

price and wood stock.

The experimental data significantly validate the

Faustmann stochastic logistic model. They give a

better approximation of the company cut policy (-

0

200

400

600

800

1000

1200

1400

0 20 40 60 80 100

OPTIMAL

VOLUME (m3/ha)

VOLATILITY (%)

WOOD STOCK LOGISTIC VOLATILITY SENSITIVITY

Wood Stock volatility

elasticity 0.687

Stumpage Price volatility

elasticity 0.350

FaustmannOptimalPineStandsStochasticRotationProblem

63

8.09%) and produce a more reliable saturation

volume than the Gompertz model.

The sensitivity analysis of both volatilities of the

Logistic models shows similar linear relations with

the stochastic optimal cut. The wood stock volatility

elasticity of 0.687 almost double the stumpage price

volatility elasticity of 0.350 due to its lower actual

volatility.

REFERENCES

Alvarez L. R., Koskela E., 2007. Optimal Harvesting

under Resource Stock and Price Uncertainty, Journal

of Economics Dynamics & Control, Vol. 31 , Issue 7,

pp. 2461-2485.

Beskos A., Papaspliopoulos O., Roberts G., 2006. Exact

computationally efficient likelihood-based estimation

for discretely observed diffusion, J. Statist.Soc.

B,68Part2, pp1-29.

Clark R., Reed W., 1989. The Tree Cutting Problem in a

Stochastic Environment, Journal of Economics

Dynamics and Control, N° 13. 569-595.

Faustmann M., 1995, (Originally,1849). Calculation of the

Value which Forest Land and Immature Stands

Processess for Forestry, Journal of Forest Economics

Vol.1: pp.7-44.

Garcia O., 2005. Unifying Sigmoid Univariate Growth

Equations, FBMIS.

Gutierrez R.,Gutierrez-Sanchez , Nafidi A:, 2008.

Modelling and forecasting vehicle stocks using trends

of stochastic Gompertz diffusion models,

Appl.Stochastic Model Bus.Ind., 25,:385.

Insley M., (2002). “A Real Option Approach to the

Valuation of a Forestry on Investment,” Journal of

Environmental Economics and Management. Vol. 44,

471-492

Insley M., Rollins K., 2005. On solving the multi-

rotational timber harvesting problem with stochastic

prices: a linear complimentarily formulation.

American Journal of Agriculture Economics.Vol87, N

3, pp. 735-755.

Jacco,J. J.,Thijssen, 2010. Irreversible Investment and

discounting: an arbitrage pricing approach, Annals of

Finance, Volume 6, Number 3, 295-315.

Johnson T.C., 2006. The optimal Timing of Investment

Decisions, PhD thesis, University of London.

Kloeden P., Platen E., 1991. Numerical Solution of

Stochastic Differential Equation, page 125, Springer-

Verlag Berlin

Meyer P., Yung J., Ausubel J., 1999. A primer on Logistic

Growth and Substitution: The Mathematics of the

Logolet Lab Software, Technological Foresting and

Social Change.

Morck, R., E. Schwartz, 1989. The valuation of Forestry

Resources under Stochastic Prices and Inventories, J.

Financial and Quantitative Analysis.Vol. 24, pp 473-

487.

Navarrete E., 2011. Modelling Optimal Pine Stands

Harvest under Stochastic Wood Stock and Price in

Chile, Journal of Forest Policy and Economics,

Doi:10.1016/j.forpol.2011.09.005.

Oksendal, B., 2000. Stochastic Differential Equations,

(Fith Ed.) Springer Verlag.

Samuelson P., 1976. Economics of Forestry in an evolving

Economy, Economic Inquiry Vol.14, pp. 466-491

Willassen Y., 1998. The stochastic rotation problem: a

generalization of Faustmann`s formula to a

stochastic forest growth, Journal of Economics

Dynamics & Control. 22, 573-596.

APPENDIX A

Proof of Lemma 1

Theorem 1: A probabilistic measure Q exists and is

equivalent to the actual metric R, such that it is

proven (see, Jacco J.J. Thijssen, 2010)

)}1/()(sup{

)1/()(

)(

sup

),(

)(

0

00

rt

t

trQ

rt

tt

rtR

o

V

eVeEP

eVPeE

tt

PVW

(A1)

Furthermore, under the metric Q, the process Vt

follows the diffusion (A2)

WdVdtVVdV

tttt

)(})(){

(A2)

Proof.

Replacing the integral solution of (2) in this last

expression (A1), Pt = P0 eαt exp {βWt - 1/2β2t],

since Mt = exp {βWt - 1/2β2t] is a martingale, a new

metric Q (dQ/dR = Mt ) can be defined via the

Radon-Nikodym derivative. Considering that, in this

case, β is positive, a straightforward application of

Girsanov´s theorems I and II (Oksendal, 2000,

pages155-157) yields the equivalent objective for

metric Q, and the ITO diffusion (A2)

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

64