Lagrangian Road Pricing

Vianney Boeuf

1

and S

´

ebastien Blandin

2

1

´

Ecole Polytechnique Paristech, Paris, France

2

IBM Research Collaboratory, Singapore, Singapore

Keywords:

Road Pricing, Traffic Assignement, User Equilibrium, Congestion Toll Pricing, Multicommodity Flows.

Abstract:

We consider the problem of trajectory-based road pricing with the objective of reducing congestion on a road

network. It is well-known that traffic conditions resulting from typical non-cooperative behavior of selfish

drivers do not minimize total travel time spent on the road network. In the context of real-time GPS data

collection from all vehicles, drivers can be charged differently based on their origin and destination, and

according to the path they take from that origin to that destination. In this work, we propose a new formulation

of the set of multi-commodity prices based on a price potential, and describe an efficient algorithm to construct

such multi-commodity prices. We provide an analysis of the subset of valid prices satisfying several specific

user-driven constraints. The numerical performances of the method proposed are assessed on a benchmark

network, and the social benefits resulting from the commodity-based potential pricing scheme introduced in

this article are discussed.

1 INTRODUCTION

Congestion pricing, which dates back to 1969 with

the work of (Vickrey, 1969), is motivated by the fun-

damental difference existing between the natural state

of traffic, typically assumed to be a user equilibrium

or Wardrop equilibrium, and the best possible alloca-

tion of traffic, or “social optimum”. The difference

between these two states of traffic has been called

the “price of anarchy” (Papadimitriou, 2001). A user

equilibrium can be arbitrarily far from the social opti-

mum, as soon as instances of Braess paradox (Braess,

1968) exist in the network.

Pricing schemes aim at designing a tolled user

equilibrium coinciding with the social optimum of

the network. A basic solution consists of “internaliz-

ing externalities” by charging users with the marginal

costs they occur to the network (Pigou, 1920). How-

ever, more specific operator or user-driven constraints

such as profit maximization, or fairness guarantees,

have historically motivated the search for other pric-

ing schemes.

The recent improvement in real-time positioning

capabilities using GPS devices (Mobile Millenium,

2008) creates new possibilities and challenges for

congestion pricing. Charging users based on their

path properties, and not only at sparse locations on

the road network, is now technically feasible.

In this article, we consider the problem of char-

acterizing feasible Lagrangian (trajectory-based) toll

sets achieving a given flow allocation on the network.

We allow different prices for different origin - desti-

nation pairs (multi-commodity pricing), and provide

an extension of the toll set formulation first proposed

by (Hearn and Ramana, 1998), as the translation of

the set of prices generated by a potential on the nodes

of the network. In particular, we show that the set of

feasible prices obtained for trajectory-based pricing is

convex (Boyd and Vandenberghe, 2004).

We provide an algorithm to construct a pricing

scheme for different strategies (Hearn and Ramana,

1998) and assess the performance of our pricing

schemes against benchmark pricing algorithms. Nu-

merical simulations and performance analysis are per-

formed in Python using a convex optimization library

(Dahl and Vandenberghe, 2008).

The rest of the article is organized as follows.

In section 2, we introduce notations. In section 3,

we present our main results, on the characterization

and properties of a commodity-based potential pric-

ing scheme. Section 4 presents a numerical study of

the problem. Finally, section 5 provides concluding

remarks and discusses extensions to this work.

144

Boeuf V. and Blandin S..

Lagrangian Road Pricing.

DOI: 10.5220/0004287102920297

In Proceedings of the 2nd International Conference on Operations Research and Enterprise Systems (ICORES-2013), pages 292-297

ISBN: 978-989-8565-40-2

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

2 PRELIMINARIES

In this section, we introduce the notations and prelim-

inary results leading to our problem formulation and

the main results of the following section.

2.1 Notations

Let graph G = (N , A) represent the road network,

and K denote the set of origin-destination (OD) pairs

(if k ∈ K, k = (p, q), p, q ∈ N ), and (d

k

)

k∈K

the travel

demand for pair k. Several representations of the traf-

fic flow on the network can be used.

Path Flows. For k = (p, q) ∈ K, let R

k

denote the

set of directed acyclic paths connecting the origin p

with the destination q, and let R := ∪

k∈K

R

k

. h =

(h

r

)

r∈R

is the path flow. h is feasible if it is positive

and satisfies demand. H is the set of feasible path

flows.

∑

r∈R

k

h

r

= d

k

∀k ∈ K and 0 ≤ h

r

∀r ∈ R . (1)

If we note Γ the OD-paths incidence matrix, then

equation (1) can be written as :

Γ

T

h = d and 0 ≤ h.

Let h ∈ H be a feasible flow. We note R

k,h−eff

=

{r ∈ R

k

|h

r

> 0} , and R

h−eff

= ∪

k∈K

R

k,h−eff

the set

of paths for which the flow h is positive.

We note R

i, j

the set of paths from i to j.

Commodity Arc Flows. Let w

k

a

be the flow of ve-

hicles from OD pair k = (p, q) going through arc a,

and w

k

the vector of arc flows for OD pair k. In

this context, k is a commodity and w

k

an OD-flow or

commodity-flow. w

k

a

=

∑

r∈R

k

,a∈r

h

r

.

We note E the node-arc incidence matrix, and for

k = (p, q), i

k

∈ ℜ

|N |

the node-OD incidence vector,

i.e. the vector such that for n ∈ N , i

k

n

= +1 if n = q,

i

k

n

= −1 if n = p and 0 otherwise. w is feasible if and

only if:

Ew

k

= d

k

i

k

∀k ∈ K and 0 ≤ w

k

∀k ∈ K. (2)

W is the set of feasible commodity flows.

We denote by

˜

E the matrix

E 0 .. 0

0 E .. 0

...

0 0 .. E

such

that

˜

Ew = (d

k

i

k

)

k∈K

.

Arc Flows. An aggregate flow f = ( f

a

)

a∈A

is de-

fined on each arc a as the total traffic flow on each arc

of the network. It can be computed from h or w:

f

a

=

∑

r∈R ,a∈r

h

r

∀a ∈ A or f = Λh (3)

f

a

=

∑

k

w

k

a

∀a ∈ A or f =

∑

k

w

k

(4)

where Λ is the arc-path incidence matrix (Λ)

a,r

=

δ

a∈r

.

A flow f is feasible if it is the sum of feasible com-

modity flows or of a feasible path flow. F is the set of

feasible flows f .

We call the three flows f , w

k

, k ∈ K, h equivalent

if f and w can be computed from h and if one of the

three given flows is feasible.

Finally, we use the generic notation v = (v

i

)

i∈I

to

denote the arc, path or commodity formulation. We

denote by V the set of feasible flows v, n = |I| the

number of traces on which v is defined, A the matrix

of linear constraints (

˜

E if v = w and Γ

T

if v = h) and

p the number of rows of A (resp. |N | and |K|).

If v denotes a flow with only one OD pair,

R

v−eff

i, j

= {r ∈ R

i, j

|h

r

> 0} where h is the path flow

associated to v.

2.2 Tolled User Equilibrium

A standard approach to congestion pricing consists

in creating a tolled user equilibrium (UE), coinciding

with the social optimum. In this section we assume

that all users have the same value of time, so that in a

pure user equilibrium (UE), enforcing a toll at a road

of the network is equivalent to adding a certain de-

lay to the experienced travel time on the correspond-

ing arc of the graph. Let ρ be the vector of prices

(expressed as a delay) on every element of the flow

representation, v ∈ V the corresponding flow vector,

and l(v) the latency function, the effective travel cost

experienced by a user is l(v) + ρ.

A tolled UE v

∗

is solution of the following con-

vex optimization problem, extension of Beckmann’s

formula (Beckmann et al., 1956):

min

f ≥0,v∈V

∑

a

Z

f

a

0

l

a

(x)dx + ρ

T

v.

where l

a

(·) is the arc latency function, assumed non-

decreasing. The tolled UE can also be expressed as

a variational inequality problem (VIP), (Dafermos,

1980), as:

∀v ∈ V, (l(v

∗

) + ρ)

T

(v − v

∗

) ≥ 0. (5)

Remark. When the latency functions are strictly

monotonic, the solution v to the tolled UE problem is

unique and the set of valid flow vectors is a singleton.

LagrangianRoadPricing

145

Assuming that the latency functions are strictly

monotonic, we define the toll problem:

Find v

∗

, ρ such that:

(

v

∗

is a solution of min

v∈V

v

T

l(v)

∀v ∈ V, (l(v

∗

) + ρ)

T

(v − v

∗

) ≥ 0.

3 LAGRANGIAN PRICING

SCHEMES AND POTENTIAL

PRICING

In this section, we present our results on the mathe-

matical theory of commodity-based potential pricing.

Our main result states that, for a given flow allocation,

the set of valid multi-commodity tolls (such that the

tolled user equilibrium corresponds to this flow) can

be expressed as the sum of three terms: 1 - the oppo-

site of travel time on the arcs, 2 - any potential field

defined on the nodes of the network for each com-

modity (or, more precisely, the potential difference

between the end node and the start node of the arc), 3

- any positive toll on the arcs where the flow vanishes

(Theorem 3.3).

3.1 Set of Feasible Prices

We denote by w

∗

the commodity flow at which we

want to stabilize the tolled user equilibrium. We

use the characterization of prices introduced in equa-

tion (5):

Q(w

∗

) = {ρ ≥ 0 | (l(w

∗

)+ρ)

T

(w−w

∗

) ≥ 0 ∀w ∈ W }.

The two following results are due to (Hearn and

Ramana, 1998):

Lemma 3.1. −l( f

∗

) is a valid pricing to reach the

flow w

∗

; −l( f

∗

) ∈ Q(w

∗

).

Lemma 3.2. The toll set Q(w

∗

) is a shifted polyhe-

dral cone: if f is the arc flow corresponding to w,

Q(w

∗

) = −l( f

∗

) + N(w

∗

,W), (6)

where N(w

∗

,W) = {u ≥ 0 | u

T

(w−w

∗

) ≥ 0 ∀w ∈ W }.

Definition (Potential pricing). p ∈ ℜ

|A|

is a potential

pricing if there exists a vector π ∈ ℜ

|N |

defined on the

nodes of the network such that p = E

T

π, with E the

node-arc incidence matrix defined in section 2.1. π is

the price potential. For a = (i, j) an arc joining the

nodes i and j, p

a

= π

j

− π

i

.

p is a shifted potential pricing associated with v if p

is the sum of a potential pricing Eπ, of the opposite

of the travel times on the arcs −l(v) and of positive

scalars µ

a

on the arcs for which v

a

= 0.

We extend this definition to the case of multicom-

modity arcs, p =

˜

E

T

π is a potential pricing composed

of the commodity potential pricings E

T

π

k

. The total

tolls levied between two nodes i and j for commodity

k are π

k

j

− π

k

i

: tolls do not depend on the path taken

from i to j. With k = (p, q), we define Λ

k

= π

k

q

− π

k

p

the sum along a path of R

k

of the commodity arc po-

tential pricing. It does not depend on the path chosen.

Theorem 3.3. The toll set Q(w

∗

) is the set of all

shifted potential pricings:

Q(w

∗

) = − l( f

∗

) + Im(

˜

E

T

) + vect

+

(e

k

a

, k, a s.t. w

k

a

= 0)

Q(w

∗

) ={(−l

a

( f

∗

a

) + (E

T

π

k

)

a

+ µ

k

a

δ

w

k

a

=0

)

k∈K,a∈A

| µ

a

k

≥ 0 ∀k ∈ K, a ∈ A}.

Proof. An expression of Q(w) is given in equation

(6). Q + l( f ) is the intersection of an affine set with

the set of positive flows : Q + l( f ) = {w |

˜

Ew =

˜

d} ∩ (ℜ

+

)

|K|.|A|

.

If a, k are such that (w

∗

)

k

a

> 0, then it is not possi-

ble to find λ 6= 0 such that λ(w

k

a

− (w

∗

)

k

a

) > 0 for ev-

ery w ∈ W , as it is possible to choose w ∈ W such that

w

k

a

> (w

∗

)

k

a

and u ∈ W such that u

k

a

< (w

∗

)

k

a

. Hence,

if w

∗

> 0, then {u ≥ 0 | (w − w

∗

)

T

(u) = 0 ∀w ∈

W } = {u ≥ 0 | w

T

u = 0 ∀w,

˜

Ew = 0} = ker(

˜

E)

⊥

.

Hence, N(w

∗

,W) = (ker(

˜

E)

⊥

)

+

. N(w

∗

,W) is the re-

striction to positive vectors of a vector space of di-

mension (|K|.|A| − dim(ker

˜

E)).

Let I

0

= {(a, k) | w

k

a

= 0} and suppose I

0

is not

empty. Then the space of solutions is larger. More

precisely, for i ∈ I

0

, ∀w ∈ W, w

i

− w

∗

i

≥ 0. Hence, ev-

ery u

i

≥ 0 is a valid toll for trace i. Then N(w

∗

,W) =

ker(

˜

E)

⊥

+ {

∑

µ

i

e

i

| i ∈ I

0

, λ

i

≥ 0}. As w

∗

i

reaches a

physical limit w

∗

i

= 0, the control operated through

prices is relaxed and the i

th

-component of the valid

prices only has to be positive.

We now have Q(w

∗

) = −l(w

∗

) + ker(

˜

E)

⊥

+

vect

+

(e

k

a

, (a, k) ∈ I

0

). A well known result of linear

algebra states that ker(

˜

E)

⊥

= Im(

˜

E

T

) = {

˜

E

T

π, π ∈

ℜ

|N |.|K|

}.

This theorem provides new alternative tolls for

pricing users in order to reach the desired flow w

∗

.

Additionally, those tolls depend of the values of the

flow in the network only through −l( f ), hence pro-

vide greater robustness to measurement error. Finally,

the set of valid tolls set is simply expressed as an un-

constrained vector space.

In the following section, we extend these results

to the case of positive pricing in Q(v

∗

). We also show

that this pricing technique allows one to stabilize the

network allocation around flows that are not stabiliz-

able using a traditional positive arc pricing.

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

146

3.2 Positive Prices

The objective of this section is to determine under

which conditions we can find a pricing scheme such

that a user of the network is never charged a negative

toll.

Definition (Acyclic Flow). Let v be a flow defined on

the arcs of a network. v is acyclic if v is not positive

on all the arcs of a directed cycle of the graph G. It

is equivalent to saying that the subgraph G

v

of G con-

sisting of all arcs for which v is positive is acyclic. In

the following we say that w is acyclic if the related

commodity flows w

k

are acyclic.

Algorithm 1 (Construction of a Potential Pricing

σ(v)). Let v be an acyclic arc flow and G

v

the asso-

ciated subgraph, hence acyclic. l

a

, a ∈ A are the la-

tencies on the arcs of the network for flow v. N

v

is the

set of nodes of G

v

with the partial order ≺ such that

i ≺ j if there exists a directed path from i to j in G

v

.

We note i = prec( j) if there exists an arc a = i → j.

We define σ(v) through the following steps:

1. Let E =

/

0.

2. Choose i a minimal element of N

v

r E

3. Define π

i

= max{0, {π

j

+l

a

| j = prec(i), a = j →

i}}

4. Update E = E ∪{i}.

5. If N

v

r E is not empty go to step 2.

6. For a ∈ G

v

, µ

a

= 0.

7. For a ∈ G r G

v

, a = (i, j), µ

a

= π

i

− π

j

+ l

a

.

8. σ(v) = E

T

π + µ.

As N

v

is partially ordered, the iteration in this algo-

rithm terminates, when E = N

v

.

We have the following invariant: ∀i ∈ E, π

i

=

max

r∈R

v−eff

p,i

l

r

(v).

Theorem 3.4. Let v be a positive flow defined on the

arcs, there exists a potential pricing in Q(v) strictly

positive everywhere if and only if v is acyclic.

Proof. Let ε > 0. We modify σ(v) defined in Al-

gorithm 1 by modifying step 3: π

i

= max{ε, {π

j

+

l

a

| j = prec(i), a = i → j}} and step 7: µ

a

= π

i

−

π

j

+ l

a

+ ε. For a ∈ G

v

, σ(v)

a

= π

j

− π

i

> 0 because

a ∈ G

v

⇒ i ≺ j. For a ∈ G r G

v

, σ(v) ≥ ε > 0.

Now suppose that there exists a potential pricing

Eπ + µ in Q(v) strictly positive everywhere, and sup-

pose G

v

contains a directed cycle i

0

→ .. → i

k

→ i

0

.

Then µ vanishes on the arcs of this directed cycle (as

it belongs to G

v

) and π is such that π

0

< .. < π

k

< π

0

which is absurd. Hence, if there exist a potential pric-

ing strictly positive everywhere, G

v

is acyclic and the

same holds for v.

Corollary 3.5. Let v be a feasible flow defined on the

arcs of the network, acyclic, then there exists a posi-

tive shifted potential pricing in Q(v).

Proof. Let σ(v) be the potential pricing defined in Al-

gorithm 1. ˜s defined as ˜s = −l(v) + σ(v) is a positive

shifted potential pricing in Q(v).

Corollary 3.6. If w

SO

is a multi-commodity flow solu-

tion of a SO problem, then the set of positive commod-

ity toll vectors leading to w

SO

is given by Q(w

SO

)

+

=

Q(w

SO

) ∩ ℜ

+

and Q(w

SO

)

+

6=

/

0.

Proof. As for each commodity k, w

k

is acyclic, corol-

lary 3.5 prooves that the set is non empty. Character-

ization of the set comes from theorem 3.3.

Algorithm 2 (Construction of Multicommodity Pric-

ing Vector s(w)). Let w be an acyclic multicommod-

ity flow. For k ∈ K, let σ

k

= σ(w

k

) be the poten-

tial pricing associated with arc commodity flow w

k

a

and arc travel times l

a

( f

a

). We define s(w): s(w)

k

a

=

−l

a

( f

a

) + σ

k

a

.

Remark. The potential field associated with s(w) is

such that π

k

i

≥ max

r∈R

w

k

−eff

j,i

, j≺i

l

r

(v) + π

k

j

, ∀i ∈ N .

Proposition 3.7. Let s(w) denote the pricing scheme

constructed in Algorithm 2, s(w) is the minimum of

Q(w)

+

: every positive pricing leading to commodity

flow w

k

is the sum of s(w) and of positive prices on

every arc of the network.

Q(w)

+

=s(w) + {

˜

E

T

π| (E

T

π

k

)

a

≥ 0 ∀a, k s.t. w

k

a

> 0}

+ vect

+

(e

k

a

, k, a s.t. w

k

a

= 0).

Proof. Every positive pricing must satisfy the follow-

ing inequality: ∀i ∈ N , π

k

i

−π

k

p

−max

r∈R

w

k

−eff

p,i

l

r

(v) ≥

0. The case of equality, as for s(w), gives the mini-

mum of the valid positive prices.

Corollary 3.8. The pricing scheme s(w) is the posi-

tive toll vector that realizes the minimum of the total

tolls levied.

Remark (Path Tolls). The total amount of tolls

charged to a user on path r (on which the flow does

not vanish at equilibrium) is the sum of the commodity

arc tolls charged to him, i.e. Λ

k

− l

r

(h).

Pricing based on Origins. As the aggregation of

all commodity flows having a same origin is still an

acyclic flow, it is possible to apply a positive pricing

scheme depending only on the origins of the users and

not on their destinations. This speeds up the compu-

tation, as it decreases the size of the pricing vector.

LagrangianRoadPricing

147

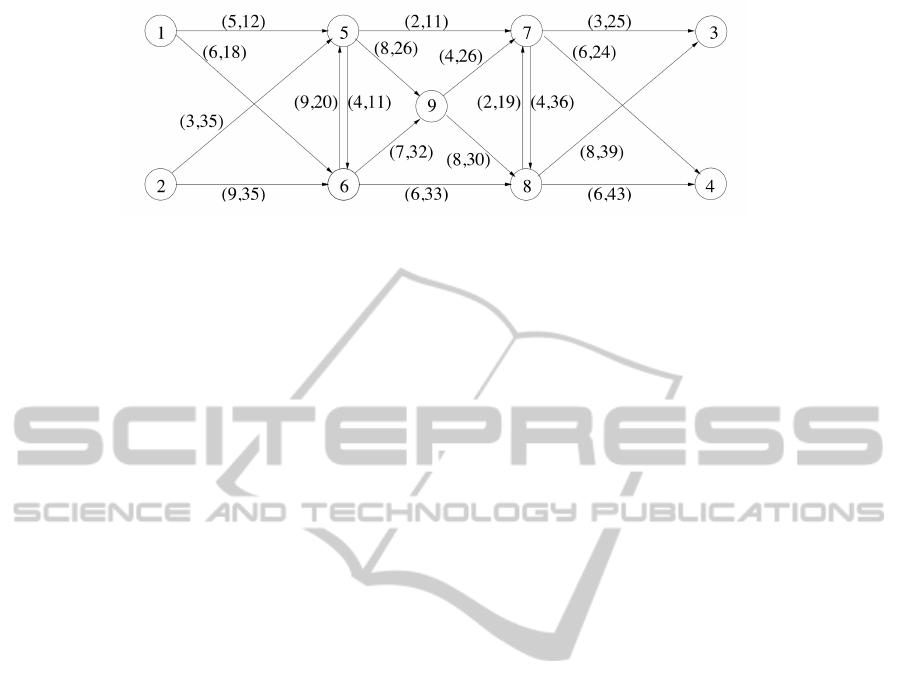

Figure 1: Nine Node Network.

4 NUMERICAL RESULTS

In this section, we present results obtained on a

benchmark network. In (Hearn and Ramana, 1998),

the authors propose different secondary objectives for

a toll problem. The problem MINSYS consists in

minimizing the total amount of toll.

In this section, we provide a comparison of our

multicommodity MINSYS algorithm, or MMINSYS,

introduced in this article, with the MINSYS algo-

rithm, on a synthetic network. We present results

for the Nine Node network described in (Hearn and

Ramana, 1998), and illustrated in figure 1. The arcs

are given “Bureau of Public Roads” (BPR) latency

functions. The tuple near an arc denotes its free flow

travel time followed by its capacity in the sense of

BPR. There are four OD pairs, with four different

travel demands.

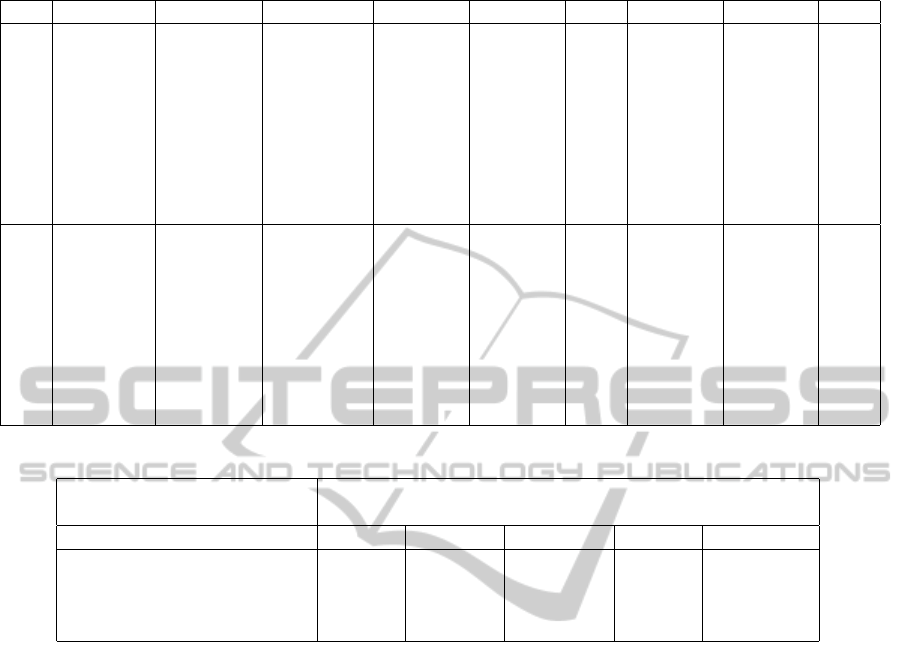

OD pair: [1,3] [1,4] [2,3] [2,4]

Demand: 10 20 30 40

Results are presented in table 1. The aggregate

flow and commodity flows corresponding to the dif-

ferent OD pairs, at social optimum, are explicited for

each arc of the network. Origin based-arc tolls, solu-

tion of the algorithm 2, are also listed.

The Λ

k

, potential difference between the desti-

nation and the origin, are respectively 30.59, 29.21,

32.95, 31.57 for the above OD pairs. It is also an

upper bound to the tolls charged to one user of the

OD pair. As journeys for the different OD pairs are

similar in terms of travel times, the fixed part (which

does not depend on the path choosen by the user) is

approximately the same for each commodity.

A comparison of general properties of MMINSYS

program with other secondary objectives is presented

in table 2. The toll vectors are computed as explained

in the previous section.

Let us focus on the new formulation MMINSYS

compared to the other classical programs.

• MMINSYS solution gives a lower total of tolls

than MINSYS. This is mathematically evident, as

MINSYS is a problem restriction of MMINSYS.

MMINSYS total tolls are 9.5 % lower: allowing

multicommodity tolls helps minimizing the total

number of tolls raised.

• MMINSYS solution gives also interesting values

for the number of tolled arcs or for the maxi-

mum arc toll: there are respectively 4 and 5 arcs

tolled for origins 0 and 1, which represents 5 arcs

tolled to the operator point of view. The maxi-

mum arc toll is 8.00 for one commodity, 12.00 for

the other, which is greater than MINSYS solution

and MINTB solution (identical in this problem).

• The main benefit of this new algorithm is that the

pricing vector has an analytical expression and

can be computed in a linear time in the product of

the number of arcs of the network and the number

of different origins of the OD pairs. It does not

need numerical solvers. On the contrary, MIN-

SYS is the solution of a linear program with poly-

nomial complexity, not expected to be linear in

general.

5 CONCLUSIONS

In this article, we introduce the notion of commodity-

based potential pricing in order to design optimal

OD-pair differentiated congestion charges, in the con-

text of real-time GPS sensing. Our contributions in-

clude the mathematical construction and analysis of

commodity-based potential pricing schemes, the de-

sign of algorithmic methods for efficient computation

of these potentials, and the theoretical and numerical

analysis of their properties.

We show that our potential-based formulation pro-

vides a new characterization of the set of pricing

schemes such that the charge incurred on each arc is

positive, whose existence is equivalent to the acyclic

property of the commodity flows. The proof of this

equivalence result is constructive, and is based on a

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

148

Table 1: Nine Node Network - Flows and tolls for each commodity (tolls are identical for OD pairs with same origin).

Arc From to Aggr. flow Travel time Pair [1 3] Pair [1 4] Tolls Pair [2 3] Pair [2 4] Tolls

0 1 5 9.411 5.283 3.976 5.435 0. 0.000 0.000 0.

1 1 6 20.589 7.540 6.024 14.565 0. 0.000 0.000 0.

2 2 5 38.334 3.648 0.000 0.000 0. 22.185 16.149 0.

3 2 6 31.666 9.905 0.000 0.000 0. 7.815 23.851 0.

4 5 6 0.000 9.000 0.000 0.000 0. 0.000 0.000 0.

5 5 7 21.303 6.220 2.104 3.029 8. 7.569 8.602 12.

6 5 9 26.442 9.283 1.872 2.406 0. 14.617 7.547 4.

7 6 5 0.000 4.000 0.000 0.000 0. 0.000 0.000 0.

8 6 8 39.474 7.843 2.361 11.145 7.2 4.501 21.467 7.2

9 6 9 12.781 7.027 3.664 3.420 0. 3.313 2.384 0.

10 7 3 29.608 3.885 6.042 0.000 7.2 23.566 0.000 7.2

11 7 4 20.757 6.503 0.000 6.390 3.2 0.000 14.367 3.2

12 7 8 0.000 2.000 0.000 0.000 0. 0.000 0.000 0.

13 8 3 10.392 8.007 3.958 0.000 0. 6.434 0.000 0.

14 8 4 39.243 6.625 0.000 13.610 0. 0.000 25.633 0.

15 8 7 0.000 4.000 0.000 0.000 0. 0.000 0.000 0.

16 9 7 29.062 4.937 3.938 3.361 0. 15.997 5.765 0.

17 9 8 10.162 8.015 1.597 2.465 0. 1.933 4.166 0.

Table 2: Nine Node Network - Alternative Tolls.

SO total time 2253.92

UE total time 2455.84 (8.95% greater)

Problem solution MSCP MINSYS MINMAX MINTB MMINSYS

Total tolls 1493.46 887.57 1167.57 887.57 803.6

Total tolls / SO total time (%) 66.38 39.38 51.80 66.38 35.65

Number of toll booths 14 5 7 5 6

Max. arc toll 16.88 11.20 8.00 11.20 12.00

linear algorithm for the definition of a minimal posi-

tive pricing scheme.

Further directions of research include applications

of this new formulation to efficient computation of

more complex constrained network pricing problems:

robustness of pricing schemes around the social op-

timum, introduction of multi-class users or more so-

phisticated modeling of users preferences.

REFERENCES

Beckmann, M., McGuire, C. B., and Winsten, C. B. (1956).

Studies in the Economics of Transportation. Yale Uni-

versity Press.

Boyd, S. and Vandenberghe, L. (2004). Convex Optimiza-

tion. Cambridge University Press.

Braess, D. (1968).

¨

Uber ein paradoxon aus der verkehrspla-

nung. Unternehmensforschung, 12.

Dafermos, S. (1980). Traffic equilibrium and variational

inequalities. Transportation Science, pages 42–54.

Dahl, J. and Vandenberghe, L. (2008). Cvxopt: A python

package for convex optimization.

Hearn, D. W. and Ramana, M. V. (1998). Solving conges-

tion toll pricing models. Equilibrium and Advanced

Transportation Modeling, pages 109–124.

Mobile Millenium (2008). http://traffic.berkeley.edu.

Papadimitriou, C. (2001). Algorithms, games, and the in-

ternet. In Proceedings of the 33rd Annual ACM Sym-

posium on the Theory of Computing, pages 749 – 753.

Pigou, A. (1920). Wealth and Welfare. Macmillan, London.

Vickrey, W. (1969). Congestion theory and transport invest-

ment. The American Economic Review, 59:251–260.

LagrangianRoadPricing

149