Towards a Sustainable Smart e-Marketplace

A Stable, Efficient and Responsive Smart Exchange with Strategic Conduct

Wafa Ghonaim

1

, Hamada Ghenniwa

1

and Weming Shen

2

1

Electrical and Computer Engineering Dept., Western University, 1150 Richmond Street, London, Ontario, Canada

2

Integrated Manufacturing Technologies Institute, National Research Council, London, Ontario, Canada

Keywords: Smart Exchange, Double Auction, GSP Auction, Reverse GSP Auction, GSP Matching, Bidding Language,

Strategic Rules, Bidding Lifecycle, Preference Elicitation, Preference Formulation, Winner Determination.

Abstract: The landscapes of e-marketplaces are changing profoundly, evident in the phenomenal growth and potential

of online services, consumers, and enabling mobile technologies. However, it is unleashing grave concerns

about sustainability due to the fierce competitions, fuzzy dynamics and rapidly shifting powers. While it is

attributed to the game-theoretic economics and computation complexities of the decentralized combinatorial

allocation problem, this work establishes, denying e-traders expressing fair strategic choice is unfounded of

adverse strategic risk. In fact, free market dynamics realize impact of smart learning on strategic conduct.

The fact strategic rules enable faster consumer-to-market bidding lifecycle is another compelling factor.

Hence, the work introduces the novel rule-based bidding language and GSPM double auction for the smart

exchange that facilitates expressions of strategic rules, while uniquely exploits forward and reverse GSP

auctions for efficient, tractable, stable, and budget balanced e-marketplace. The e-marketplace deliberates

on rules for effective preference elicitation, while bringing self-prosperity in socially efficient ecosystem.

1 INTRODUCTION

Emerging e-marketplaces as in online advertising

are undergoing seismic changes, quite evident in the

phenomenal growth and potential of online services,

engaged e-users, and enabling mobile technologies.

However, it is unleashing serious concerns about its

sustainability due to the fierce competitions, fuzzy

dynamics and rapidly shifting powers. In fact, the

striking impact of digital markets is stirring industry

to diligently fetch more viable service delivery and

revenue models that thrive in a e-market ecosystem

(Moore, 1996). Hence, the enduring power struggle

amongst rivals is polarizing towards fetching more

efficient and sustainable ecosystem friendly dynamic

mechanisms for trading of services and information

liquidity. While it is attributed to the game-theoretic

economics and computational complexities of the

decentralized combinatorial allocation problem

(CAP) of services amongst self-interest rational e-

traders (i.e. agents), who may strategize on private

preferences, this work establishes, denying e-traders

expressing fair strategic conduct is unsubstantiated

of adverse strategic risk. In fact, the emerging trend

of real-time bidding on user attentions increases the

complexity of economically inspired decentralized

CAPs. While this work investigates and realizes the

complexities of e-marketplaces, formally, it reveals

and examines, also, few strategic overlooked issues.

The first issue relates to the fact present e-

marketplaces restrain scope of strategic conduct thru

mechanisms that grant incentives for non-strategic

acts or, rather, penalize levies to be paid to losing

bidders due to strategizing. For instance, the VCG

(Vickrey, 1961) (Clarke, 1971) (Groves, 1973)

mechanisms, penalize for strategizing, by reporting

non truthful preferences to align payoffs with social

welfare, rather than the desirable self-prosperity.

Ironically, truthful mechanisms often benefit the

revenue maximizing intermediaries (marketplaces),

rather than their alleged computation efficiency. In

fact, trading restrictions, often, promote adverse

strategic natural reactions of rational smart agents

that may extend to incomplete or false information

revelation, given higher expected payoffs. Adverse

strategies may be manifested by fraud, deception,

collusion, shilling, free riding, shading, snipping or

hidden actions. In fact, e-marketplaces are more

vulnerable to adverse strategies than classic markets.

Software agents might collude by submitting

untruthful reduced bids for false partial requirements

or form coalitions that benefit from super-agent

338

Ghonaim W., Ghenniwa H. and Shen W..

Towards a Sustainable Smart e-Marketplace - A Stable, Efficient and Responsive Smart Exchange with Strategic Conduct.

DOI: 10.5220/0004316503380345

In Proceedings of the 5th International Conference on Agents and Artificial Intelligence (ICAART-2013), pages 338-345

ISBN: 978-989-8565-39-6

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

power. Traders may, also, unleash several agents

with multiple identities for false name bidding.

Hence, this work establishes, denying e-traders (e-

buyers and e-sellers) expressing strategic conduct,

allegedly, to improve computation efficiency as in

Google DoubleClick, Microsoft AdECN, Yahoo

Right Media, and Facebook FBX, is unsubstantiated

of dire business impact, given modern enabling hi-

tech is transforming computation into commodity.

Indeed, the flexible expressions of fair strategic

conduct that bring self-prosperity would, ultimately,

mitigate adverse strategies that may defy markets,

considering, often, higher risks and lower expected

returns (Fair vs. adverse strategies to be examined in

a coming work), given the dynamics of smart

learning thru social interactions and repetitive trades.

In fact, Adam Smith envisions traders interacting in

free markets act as if guided by “invisible hand” that

leads to desirable outcomes (i.e. efficiency and

stability) due to markets’ inherent flexibility of

natural free choice and smart interaction. In fact,

free market dynamics promote realizing impact of

continuous learning on strategic conduct. However,

free market efficiency would, often be realized with

market thickness, uncongested interaction, and safe

privacy (Roth, 2007). This work extends it, also, to

applying fair rules of game-theoretic encounter (i.e.

no enforced monopolistic rules). However, while

online services gold rush and thriving technologies

have tilted trader tactics to conceding to e-market

restrictions, apparently, at the expense of strategic

benefits, for the direct gains of easy access to the

wealth of inventories and information liquidity,

sustainability would be exposed, at which priorities

align with the natural expression of strategic conduct

higher returns, and better quality of service.

In the second issue, the work establishes the lack

of rapid consumer-to-marketplace automation during

bidding lifecycles is another compelling challenge to

expressing strategic conduct. In fact, the time wasted

in bidding processes at e-marketplaces like eBay,

Amazon, etc. is an irritating engagement experience.

For instance, a bidding lifecycle may take days, for

an e-Bay auction, with rather manual configurations.

Hence, the work introduces the concept of “bidding

lifecycle”, examine it effectiveness in divers trades

and establishes, the flexible expressions of strategic

rules (i.e. sub-programs) during the bidding process

that are collected, stored and exploited by the smart

exchange (SX), to deliver rapid bidding lifecycles.

The third challenge relates to the mounting

combinatorial complexity of online ad problem

evident in the emerging real-time bidding (RTB) of

single users’ attentions. RTB allows advertisers bid

for single impressions, using user profiles, cost

thresholds, and campaign goals to optimally assign

bid values at real-time. RTB provides more liquidity,

visibility, and competitive bidding, essential for the

sustainable growth. In fact, contemporary e-markets

are exploiting the complex multichannel engagement

user experiences of online services that facilitate

better market openness, and transparency. However,

the combinatorial complexity (i.e. cherry-picking) of

user level trades lack of efficient control, massive

growth, and fierce competition are main concerns

Finally, a common issue in the decentralized e-

markets relates to the implemented computation

mechanism design for SX-CAP. The game-theoretic

economics and computation complexities of the SX-

CAP are observed in the GSP auction (Varian, 2007)

(Edelman, Ostrovsky, & Schwartz, 2007), while it is

allocative efficient (AE), it is not incentive

compatible (IC) and often, maximizes auctioneer’s

revenue, rather than traders’. Conversely, while

VCG auction is efficient and stable it is, often,

intractable and runs at deficit. The iterative models

(Ausubel & Milgrom, 2006) (Parkes, 2006), take

longer time to converge with no guarantees of either

AE or stability, an issue tackled, for instance, by

iterative VCG (Parkes, 2001).The work, hence,

targets a SX model that delivers an efficient, stable

and tractable e-trading allocation for self-interested

rational traders with independent private information

and strategic conduct of rather conflicting goals.

This work examines and reflected on overlooked

issues and, ultimately, develops a novel “rule-based”

bidding language (RBBL) for smart exchange (SX)

that allows for flexible expressions of smart strategic

rules formulae. The RBBL is fully symmetric that

enables flexible and rapid e-trading while unlocking

the natural expressions of strategic conduct, not only

for e-buyers, but, also, for e-sellers, often, confined

with the reserved values. The RBBL empowers the

SX to deliberate smart rules for rapid preference

elicitations and valuations that ultimately, delivers

rapid bidding lifecycle. The inherent game-theoretic

economics and computation complexities of SX and

the emerging combinatorial complexity of e-trading

of user attentions, inspire designing the GSP based

double auction (DA) matching (GSPM) that

uniquely blends forward and reverse GSP auctions

to achieving self-prosperity (i.e. max utility), social

efficiency, strategic stability and computational

tractability. The GSPM exploits the recent business

successes and endorsements of the efficient, yet

simple GSP auction (Edelman, Ostrovsky, &

Schwartz, 2007) (Varian, 2007) and the theoretical

Nash stability of GSP repeated best response auction

(Nisan, Schapira, Valiant, & Aviv, 2011). The

RBBL and GSPM, ultimately, empower bidders and

SX with flexible expressions of smart rules and

interaction pattern, smart preferences elicitation and

efficient winner determination. The SX would,

eventually, provide a timely seamless access to the

TowardsaSustainableSmarte-Marketplace-AStable,EfficientandResponsiveSmartExchangewithStrategicConduct

339

ever growing inventory and information liquidly

with stability self-prosperity, and social efficiency,

while reducing friction and refining transparency.

Thus, sustainability is secured the win-win dynamics

of the naturally free e-market ecosystem. Section 2

presents a formal model of online ad problem and

pertaining issues. Section 3 introduces the rule based

bidding language, while the formal GSPM double

auction model is investigated in section 4. Section 5

concludes with a remark on the ongoing work.

2 ONLINE PROBLEM MODEL

2.1 The Online Problem Description

This work targets a class of multiple-unit, multiple-

attribute CAP of online services (i.e. impressions)

amongst self-interest rational e-trader agents with

conflicting goals that motivate strategic conduct,

expressed as smart rules for, indeed, maximizing

their expected utilities, given their belief about other

trader preferences. The GSPM DA for SX-CAP

assumes, however, truthful states of choices for a

sound mixed integer program (MIP) and winners’

determination (WD) matching problem. For online

ad problem, the commodity of the e-marketplace is

ad impression, (i.e. a single viewing of single ad by

a single user). The SX allows symmetric bidding of

both e-buyers and e-sellers with rather expressions

of smart rules on factor-groups (FG). FG may, for

instance, be an age group, location, interest, etc.

Hence, an ad impression is designated by specific

factors (i.e. webpage, user profile, service content,

etc.) within a time period. Considering time is a set

of discrete decision periods during which multiple e-

services are allocated to multiple winners, the work

assumes allocation and pricing decisions are taken

off-line at the end of any decision periodτ. The SX-

CAP manifests sequence of events, as fairly tabled

in (Mansour, Muthukrishnan, & Nisan, 2012) for ad

exchange. Followed is a formal description of the

online ad problem in the ad SX during period:

1. Upon online users browsing of publishers

(e-sellers) webpages,∀

∈

…

…

,

forms

impressions,

…

…

of user, publisher and webpage profiles.

,

…

,

…

,

, ad

asset has

distinct FG attributes∀

∈

.

2.

, bids

⋃

,

,

,“asks” on impression

assets

.

,

,

, is sets of

ask-bids,

∋

is impressions set,

∋

is

associated ask-prices set and

∋

is smart

rules set.An ask-bid price is sum of factor-

group values of

impression asset in

: Let

…

…

ask values of

; then

ask-bid price is

∑

.

The pricing model may exploit cost per-factor

(cpf), per-group (cpg) or per-impression (cpi).

3. The SX announces impressions contextual info

and quality scores

⋃

.

,

, to advertisers

…

…

∀

,

,

,,

is SX quality scores (QS) on webpage publisher

and user at τ as derived by SX intelligence and

deliberation. The SX stores bidding rules

of

publishers while hiding prices

to mitigate

strategic impact of exposure problem.,

…

…

is publishers’ impression assets,

while

…

…

is SX QS set.

4. Advertisers,

∈, collect

,

,

info

and returns request-bids that target either user

attentions or segment

⋃

,

,

,

,

,

for

asset.

, is allocated budget.

,

,

is request bid with

, bid values and

, the

associated rules of

…

…

∋

=

,

…

,

…

,

;

∈

=

…

…

.

…

…

, is

the pricing set of

∈

.∀

, let

…

…

set of best bid-price values

on

FGs, the total offered-price on

is

∑

,

bid for, given

≥

if matched else no bid returned. RBBL is

used for bid choices, valuations and smart rules.

5. The SX applies GSPM double auction (DA)

matching allocations and payments for winners

using forward and reverse GSP auctions, fter

collecting all request and ask bids. The SX

computes efficient allocations and payments. It

returns

,

∗

,

,

∗

to wining

, ∀

and

,

∗

,

∗

to wining

,∀

.

∗

,

∗

, are SX pricings for matched

,

pair on

, while

∗

, is media asset to

be dispatched and

is

budget.

6. Publisher

serves webpage

with winning

ad

∗

atτ for ad impression

.

, allocates

the dispatched

∗

to a specific location that

fulfils the impression- request as matched with

impression-asset.

Example: An advertiser wish to bid ad impressions

at Segment level

:

:,

:

: or at user level

∪

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

340

: Loc,

:California), (

:Ag,

:Gen X)}, or

∪ {(

:Day part,

:Morning),

(

:Content,

: Super Bowl)},etc. of possible

factor-group values

…

…

and total

∑

. Figure 1, depicts the

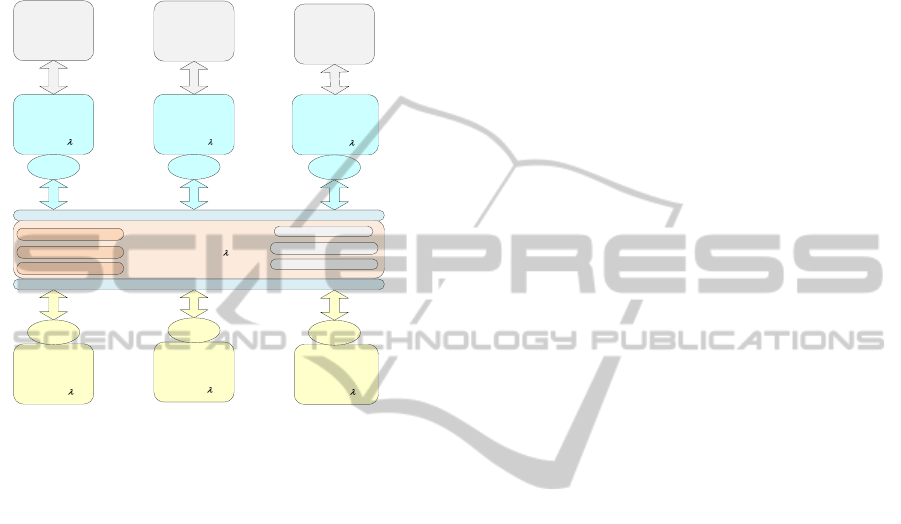

online ad problem model in smart exchange.

Publisher (e-Seller) 1

Local Problem: LP

P

1

Impression Assets: I

P

1

QS: QS

P

1

Utility: u

P

1

(

x

)

Publisher (e-Seller) j

Local Problem: LP

P

j

Impression Assets: I

P

j

QS: QS

P

j

Utility: u

P

j

(

x

)

Advertiser (e-buyer) 1

Local Problem: LP

A

1

Requests: I

A

1

QS: QS

A

1

Utility: u

A

1

(

x

)

Publisher (e-Seller) m

Local Problem: LP

P`

m

Impression Assets: I

P

m

QS: QS

P

m

Utility: u

P

m

(

x

)

Advertiser (e-Buyer) i

Local Problem: LP

A

i

Requests: I

A

i

QS: QS

A

i

Utility: u

A

i

(

x

)

Advertiser (e-Buyer) n

Local Problem: LP

A

n

Requests: I

A

n

QS: QS

A

n

Utility: u

A

n

(

x

)

Publisher

Agent-P

j

Advertiser

Agent-A

1

Smart Exchange e-Marketplace: SX

Global Problem: SX-CAP

Social Objective: f(U

P

(S),U

A

(S))

Allocation Rule:

x

Payment Rule: π

x

QS: QS

x

j

Ask

Bid

Bid

Bid Ask

Ask

Online User 1

Profile: U

1

QS: QS

u

1

Online User m

Profile: U

m

User QS: QS

u

m

Online User j

Profile: U

j

QS: QS

u

j

B

r

o

w

s

e

Browse

Browse

Advertiser

Agent-A

i

Advertiser

Agent-A

n

Publisher

Agent-P

1

Publisher

Agent-P

m

• • •

• • •

• • •

• • •

Rule-Based Bidding Language (RBBL) with Smart Rules

Rule-Based Bidding Language (RBBL) with Smart Rules

Stored Smart Rules

Smart Preference Elicitation

GSPM DA Matching

Smart Rules Delibration

Preference Elicitation Queries

Smart Rules Analysis

Figure 1: The Online ad problem Model in Smart

Exchange.

2.2 The SXCAP AE Matching Problem

The SX computes an efficient-trade rather than

optimal- revenue-trade, as there are many competing

e-traders and networks, so it is unfeasible to exercise

monopoly power. The work assumes e-trader agents

act exclusively as either service providers or service

consumers. The SX computes an efficient outcome

allocations and payments from agents’ reported

valuations, or smart rules preference elicitation that

usually, involve solving an NP-hard CAP. In fact,

the WDP in CAs (and thus also in CEs) is NP-hard

(Rothkopf, Pekec, & Harsrad, 1998). Generally, the

objective of the SX is to implement a trade

∗

for the

SX-CAP at period that delivers social efficiency.

The SX selects then payment rule that drives IC,

individual rationality (IR) (i.e. agent expected payoff

payoff of non‐participating), with budget balance

(BB) (i.e. total cross SX payments =0, or non‐

negative). Formally, assume

∅

0 with free

disposal (i.e. agents have weakly increasing values

for services

∀

⊃

. Let e-

trade

,

=

1, points to impressions

and

are matched (i.e.

=

for same FG

attributes, and the request-bid on

and ask-bid on

are eligible for trade;

,

0,

otherwise. ∀ e-trader agents of quasi-linear utilities

,

∀

∈

∀clearing price,

∈.

, is negative, if

bidder receives a payment for the trade. Bidders are

modeled as being risk neutral (i.e. agent pays as

much as the expected value of an item) with budget

constraints (i.e.

) for ad campaign (e.g. frequency

of playback of ad

. The SX-CAP is limited by

constraints (bids and budgets), rules, objectives, and

mechanism. Given instance

,,

at period,

the efficient

∗

is, then, given as follows:

Definition 1: Given instance

,,

of true bids

at,

1 if

,

0 otherwise,

then efficient trade

∗

solves:

.

∀,1

;

∀

,∀

∈

,0

..

1,∀

,∀

2

1,∀

,

3

.

∀

,

4

.

05

|

|

,|

|

6

,

∈

0,1

∀

,

7

Constraint (C7) ensures integrality, while (C2, C3)

restrict a request-bid on specific unique impression

to be assigned at most to one ask bid of the same

unique ad impression, and restrict an ask-bid on an

offered unique impression to be assigned at most

one request- bid of the same. The SX-CAP, hence,

turns into the generalized assignment problem

known to be NP-Hard; (C4, C5) ensure budget

balance (BB), and restricts budget boundaries

(i.e.

), while (C6) impose strict balance in items’

supply-demand by free disposal. The above SXCAP

problem is an instance (i.e. reduction) of set-packing

problem (SPP) (deVries & Vohra, 2003). In fact, the

SPP is a functional reduction of the SXCAP

transformed in polynomial time (i.e. SPP

SXCAP). The SPP is NP-Hard, but the recognition

version is NP-complete (deVries & Vohra, 2003).

Thus, the SXCAP is NP-complete and can’t be

solved using exact approaches (i.e. branch and

bound, Cutting planes etc.). Due to the decentralized

TowardsaSustainableSmarte-Marketplace-AStable,EfficientandResponsiveSmartExchangewithStrategicConduct

341

nature of the problem, however, this work adopts an

economic based approach for SX-CAP modeling.

3 THE RBBL SMART BIDDING

3.1 Expressing Strategic Conduct

Economists often advocate free markets as the right

way to organize economic activities, in which

economic social welfare is not a priority, but rather

self-prosperity. However, free markets have proven

successful in organizing economic activities for the

social well-being (Mankiw, 2012), despite their

inherent flexibility that enables traders to exploiting

strategic conduct. However, present e-marketplaces

restrain scope of strategic conducts, due to alleged

computation limitations. This work argues, denying

users expressing their natural strategic conduct,

while limiting preference space would have a dire

impact on business sustainability. In fact, the tight

restrictions on strategic behaviour and e-trading

practices, often, promote adverse strategic reactions

that disrupt social efficiency. Hence, this work

envisions a sustainable SX e-marketplace empowers

consumers with strategic conduct on e-trading and

interaction patterns using a flexibly expressive

bidding language (BL). The SX should deliberate on

smart rules for effective preference elicitation, while

computing efficient allocations and payments. The

SX, should, eventually, provide a seamless access to

the ever increasing online services, inventories and

information liquidly, for the benefit of consumers

and e-marketplaces, the result of win-win dynamics

in naturally free markets ecosystem.

3.2 Bidding Lifecycle Analysis

An inspiring drive to developing the RBBL is to

improving consumer-to-marketplace performance by

extending the bidding “lifecycle” and exploiting

distributed computing. The bidding lifecycle relates

to the period bid can be active throughout diverse

trades before it get expired and dropped off the

trading platform. The work realizes the performance

impact of frequent biddings that might require

frequent manual setups (i.e. eBay, Amazon, etc.).

While irrelevant in classic markets, it has a major

impact on digital e-markets, considering the huge

number of online transactions. Hence, minimizing

bidding lifecycle would have a crucial impact on

designing effective SXs another compelling for

applying smart rules. For instance, iterative bidding

of indirect mechanisms (i.e. English auction), has

short multiple round bidding lifecycles to each trade

and requires extra time for bid formulation. Hence,

clock auction mitigates impact by enforcing time

constraint for rapid response. The proxy iterative

bidding shortens the bidding lifecycle using proxy

agents (see (Parkes, 2006)) with valuation bounds

and provisional allocation that works until market

clears, for single e-trades. On the other extreme

there are the bidding programs (Nisan, 2000), in

which the complete formal problem model is sent to

and solved by the e-marketplace. However, bidding

programs are not feasible due to core computation,

valuation and privacy problems. Direct mechanisms

(i.e. GSP auction) use complex bidding, with short

lifecycle that ends each e-trade with the execution of

WD. This work develops, hence, the RBBL for

distributed multiple trades. The RBBL enables rapid

bidding lifecycle by using complex rules stored in

the SX for smart preference elicitation on multiple e-

trades that enables rapid performance. The RBBL

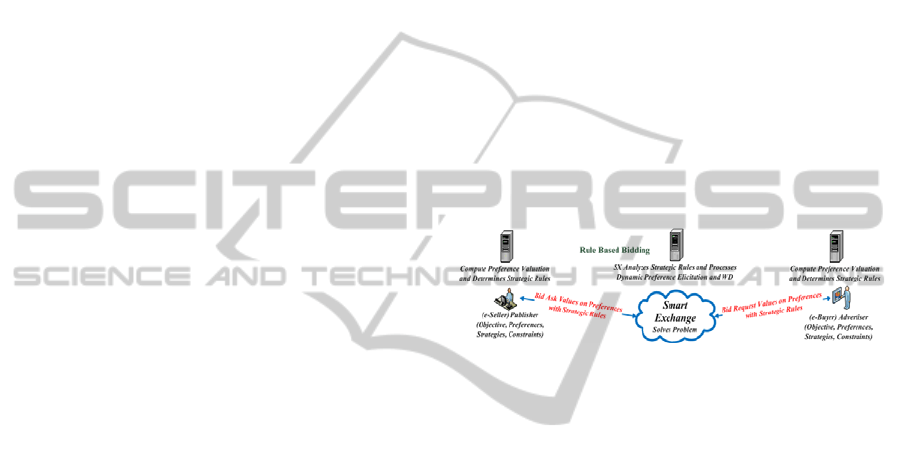

enables, also, distributed computation between e-

trader software agents and SX engine (see Figure 2).

Figure 2: Rule Based Bidding (Distributed for Multiple

Trades).

3.3 The Rule Based Bidding Language

This work presents the SX computation model to

managing online trading using an expressive bidding

structure that empower consumers with complex

rational interaction patterns, and flexible level of

strategic freedom. In that vein, the work introduces

the RBBL that generalizes and blends the TBBL in

(Cavallo, et al., 2005), logical

and

(Boutilier

& Hoos, 2001), that include

,

,

, OR‐of‐

XORs, XOR‐of‐ORs, and

∗

with Nisan’s bidding

programs (Nisan, 2000), and various preference

elicitation models in (Sandholm & Boutilier, 2006),

while facilitating expressions of strategic conduct

with flexibility, expressiveness, consciences for a

computationally tractable, efficient and stable. The

RBBL is symmetric that allows e-traders to bidding

buys and sells in single tree structure that exploits

“complex rule” operators (

) for smart preference

elicitation, formulation, and efficient WD.

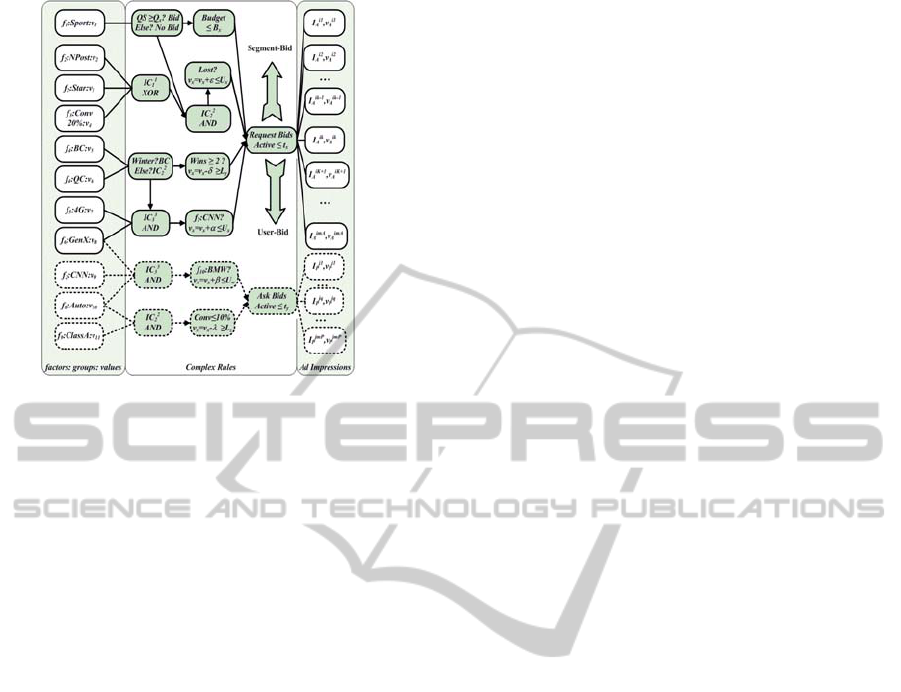

An instant of the RBBL bid tree structure is

shown Figure 3. The gray blocks refers to the

‘s

that may be expressed using propositional logic

(PL), first order logic (FOL), temporal logic (TL),

etc. (not shown in this work) that reflects the

dynamic constraints applied to a given situation. The

may represents campaign duration, if “Ask bids

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

342

Figure 3: RBBL bid structure.

active time

”); tactics, “At lost trade, increase

value of factor by for next trade, stop at upper

bounds

”; “When number of win trades 2,

reduce value by, stop at lower limit

”; “CNN

ad impressions? Increase value by for next trade,

stop at upper bound

”; logic operators “”,

“If, then, else” rule;

TBBL, AND, OR, XOR,

OR*, etc.

′ , reduce the complexity of dynamic

choices. The SX stores

′ for smart deliberation

and effective preference elicitation, rather than

solving complete bidding programs. The SX

descripts

′, then, rather than full enumeration; it

deliberates

′ to elicit preferences and

valuations. In fact, the diverse types of

′, add

smart filters to reducing combinatorial complexity

by narrowing down the feasible solution space. Bids

are expressed as annotated bid trees of either e-sell

or e-buy nodes. RBBL has

′ on internal nodes

for propagating values within the tree. Leaves of the

tree are annotated with traded items and nodes are

annotated with changes in values. RBBL facilitates

direct (one-shot) and indirect (iterative) mechanisms

and is captured as MIP, while facilitating effective

rules deliberation and smart preference elicitation

for efficient winner determination.

3.4 The RBBL Properties

Followed are propositions on the RBBL that briefly

define related game-theoretic and computational

properties. Analyses, formal proofs and verification

of which, though, are found in another work:

Proposition 1: RBBL generalizes pervious bidding

languages (i.e.

,

and

,

,

, OR‐

of‐XORs, XOR‐of‐ORs, and

∗

, TBBL, extended

TBBL) and extends to complex rules, constrains and

valuations for direct and indirect mechanismsis.

Proposition 2: RBBL facilitates direct (one-shot) and

indirect (iterative price-taking) mechanisms.

Proposition 3: RBBL captured as MIP, facilitates

effective preference formation and elicitation for

efficient winner determination. The SX stores and

descripts complex rules of all bids, then, rather than

full enumeration; it applies smart learning heuristics

to elicit dynamically preferences and valuations.

Proposition 4: RBBL is scalable, allows for sub-bids

that can be analyzed by multiple processors. RBBL

prevent the exposure problem by hiding budgets,

using XOR like substitutable bids.

4 THE GSPM DOUBLE AUCTION

Double auctions are, often, used in exchange

markets, such as stock exchange (i.e. NYSE),

commodity markets (i.e. CME), etc. While the work

targets desirable IC, AE, etc. for the DA design of

SX, it is, often hard for a DA to have them all. In

(McAfee, 1992) and (Wurman, Walsh, & Wellman,

1998) , for instance, there is no DA that is both AE

and IC. This work , however, introduces a unique

GSP based DA the exploits the fact while GSP is not

IC, GSP repeated best response strategies converge

to Nash equilibrium with VCG AE IC outcomes and

payments, as analyzed and validated in (Edelman &

Ostrovsky, 2007) (Varian, 2007) and (Nisan,

Schapira, Valiant, & Aviv, 2011). Hence, the GSP

based DA for SX achieves desired properties with

repeated best repose strategies. While at IC, traders

maximize their utilities with truthful revelation of

private choices, AE assures maximizing aggregate

valuations of buyers and sellers. Other desired

proprieties are BB (i.e. total surplus generated equal

available surplus at NE), SX profit maximization

(i.e. max sum of differences between request and ask

bid prices of all matched pairs) and IR, where the net

benefit to each e-trader from using the DA is less

than the net benefit of any alternative.

4.1 The GPM Double Auction Model

The DA equilibrium matching (EM) (Wurman,

Walsh, & Wellman, 1998) is a common sealed-bid

matching that is IC, in which clearing price does not

depend on matching bid prices, but externalities. EM

finds uniform equilibrium prices

∗

that balances

request and ask bids so all eligible requests with

price

∗

and asks with

∗

are matched

using 4‐Heap algorithm that implements the IC last

matched

auction for single‐unit sellers and first

unmatched 1

auction for single‐unit buyers.

TowardsaSustainableSmarte-Marketplace-AStable,EfficientandResponsiveSmartExchangewithStrategicConduct

343

However, EM IC is not applicable to multi‐unit bids

or symmetric buys and sells. In fact, EM DA can be

IC or AE but not both (McAfee, 1992). To maximize

matches, it is essential to allow price discrimination

in which different matches cleared at different

prices. IC is hard to achieve, also, in dynamic DA

(e.g. stock exchange), where bids are entering or

leaving over time and there is more than one

matching to search sequentially (Parkes, 2007). The

work in (Zhao, Zhang, & Perrusse, 2010), presented

maximal matching (MM) DA that maximizes market

liquidity, allocations, and profit, yet, is not IC.

As stated earlier, to tackle the combinatorial

complexity of RTB, this work introduces the GSPM

DA, GSP discriminatory pricing model. As shown

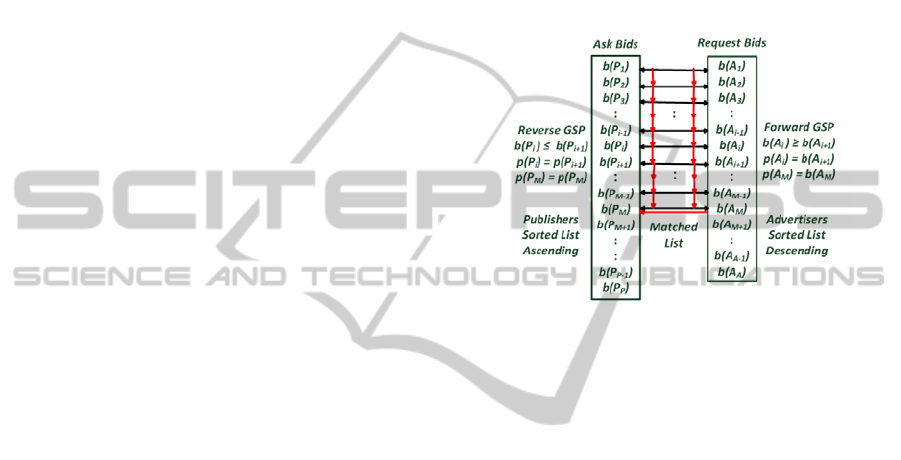

Figure 4, GSPM exploits the GSP forward auction

for e-buyers, while proposes a reverse-GSP auction

for e-sellers. At time, given requests

∈

and

ask bids

∈

, the GSPM algorithm: (1) Qualifies

eligibility by identifying and grouping eligible pair

matches (i.e.

w.r.t. factor-groups, (2)

Sorts eligible ask (request) bids in ascending order

of forward GSP (descending of reverse GSP) auction

w.r.t. bid values; (3) Process Matching, start at the

top, add ask‐request pairs to the matching list, if ask-

bid pricerequest-bid price as per definition 2; (4)

Computes Allocations, based on results, assign

matched pair

,

to advertiser

and publisher

; and (5) Assigns prices, following definition 3.

4.2 The GSPM Properties

The development of GSPM model is inspired by the

analysis of (Edelman, Ostrovsky, & Schwartz, 2007)

for envy-free Nash equilibrium, (NE) that is

equivalent to the “Symmetric NE” (Varian, 2007) as

well as the findings in (Nisan, Schapira, Valiant, &

Zohar, 2011), in which, while truth telling is not

dominant strategy under GSP, the full information

repeated best response strategy (BRS) GSP has NE

with VCG AE IC outcomes. Followed are brief

definitions and theorems that briefly define the

GSPM game-theoretic economics and computation

properties. However, the analyses, formal proofs and

verification of which are detailed in another work:

Definition 2: [GSPM DA Matching and Allocation

Rules]: Let ∪the set of traders, and ∩ ∅,

for exclusive trade, as per problem assumption. Let

∪

set of request and ask bids. Let ask-bid

,

=

∈

and request bid

,

=

∈

. Sort eligible ask

(request

) bids in

ascending order of forward GSP (descending of

reverse GSP) auction w.r.t. bid values. Then, the

ordered set of matched ask-request pairs

,

…

,

…

,

is a GSPM DA

matching set, if ∀matched ordered pair

,

,

prices

, ∀

,

, .

Then, is a GSPM list of eligible ordered pairs.

Definition 3 [GSPM DA Pricing Rule]: the ask-price

for≤ matched pair is

,

,

the ask price of 2

nd

matched pair

,

. The

request-bidder price for matched pair

is

,

, the request-price of 2

nd

matched pair

,

. For last match ,

traders pay their request and ask bid values,

,

;

,

).

Figure 4: GSPM double auction model for ad impressions.

Proposition 5 [GPSM DA AE]: The GSPM DA

mechanism that implements AE social choice (SC)

function, maximizes total payoffs by maximizing

total valuations of e-buyers, while minimizing total

cost of e-sellers given IR e-trader agents, hence,

maximizing the total profit the SX marketplace.

Theorem 1: The GSPM DA with BRS is AE

Theorem 2: The GSPM DA maximizes SX revenue.

Theorem 3: The GSPM with repeated BRS is IC.

Theorem 4: GSPM DA is ex post weak BB.

Theorem 5: GSPM DA is ex-post IR.

Definition 4 [locally envy-free NE]: Equilibrium

(“Symmetric NE” (Varian, 2007)) of the GSP

simultaneous-move game is locally envy-free if

bidder cannot improve payoff by switching bids

with the bidder ranked one position above her”

(Edelman, Ostrovsky, & Schwartz, 2007)

Theorem 5: GSPM has NE with repeated BRS.

5 CONCLUSIONS

This work presents formal analysis and modeling of

the GSPM, GSP based double auction and RBBL,

rule-based bidding language for smart exchange.

The work argues denying traders free expressions of

fair strategic conduct, challenges sustainability and

provokes adverse strategic reactions. This work

establishes, also, lack of consumer-to-marketplace

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

344

rapid bidding cycles is another compelling factor to

realizing the strategic choice. The work examines

the bidding lifecycle model and establishes strategic

bidding delivers more efficiency, better automation

and fairly distributed computing. Hence, the RBBL

enables the flexible expressions of strategic conduct

using smart rules. The smart exchange exploits the

smart rules to deliberating on effective preference

elicitation. The GSPM tackles inherent and evolving

combinatorial complexities by uniquely exploiting

both forward and reverse GSP auctions, for a

truthful, efficient, stable and tractable matching that

delivers rapid automation, self-prosperity, and social

efficiency with a seamless access to the massively

growing inventories and information liquidly. The

smart exchange e-marketplace secures, ultimately,

the business sustainability, by reducing friction and

improving transparency, in the win-win dynamics of

the naturally free e-markets ecosystem. The work is

ongoing, however, on game-theoretic economics and

computation efficiency of the GSPM and RBBL

with focus on sound empirical validation and results.

REFERENCES

Ausubel, L., & Milgrom, P. (2006). Ascending Proxy

Auctions. In P. Cramton, Y. Shoham, & R. Steinberg,

Combinatorial Auctions (pp. 79-98). MIT Press.

Boutilier, C., & Hoos, H. (2001). Bidding languages for

combinatorial auctions. Proceedings of the 17th

International Joint Conference on Artificial

Intelligence, (pp. 1211–1217).

Cavallo, R., Parkes, D. C., Juda, A. I., Kirsch, A., Kulesza,

A., Lahaie, S., et al. (2005). TBBL: A Tree-Based

Bidding Language for Iterative Combinatorial

Exchanges. Multidisciplinary Workshop on Advances

in Preference Handling (IJCAI).

Clarke, E. H. (1971). Multipart pricing of public goods.

Public Choice, 11, 17-33.

deVries, S., & Vohra, R. V. (2003). Combinatorial

auctions:A survey. Informs Journal on Computing,

15(3), 284–309.

Edelman, B., & Ostrovsky, M. (2007). Strategic bidder

behavior in sponsored search auctions. Decision

Support Systems, 43, pp. 192–198.

Edelman, B., Ostrovsky, M., & Schwartz, M. (2007,

March). Internet Advertising and the Generalized

Second Price Auction: Selling Billions of Dollars

Worth of Keywords. American Economic Review,

97(1), 242-259.

Groves, T. (1973). Incentives in teams . Econometrica ,

41, 617-631.

Mankiw, G. N. (2012). Principles of Microeconomics (6E

ed.). South-Western Cengage Learning.

Mansour, Y., Muthukrishnan, S., & Nisan, N. (2012).

Doubleclick Ad Exchange Auction (Submitted).

Computer Science and Game Theory.

McAfee, R. P. (1992). A Dominant Strategy Double

Auction. J. Economic Theory, 56, 434–450.

Moore, J. F. (1996). The Death of Competition:

Leadership and Strategy in the Age of Business

Ecosystems. New York: Harper Business.

Nisan, N. (2000). Bidding and Allocation in

Combinatorial Auctions. Proc. ACM Conf. Electronic

Commerce (pp. 1-12). ACM Press.

Nisan, N., Schapira, M., Valiant, G., & Aviv, Z. (2011).

Best-Response Auction. Proceedings of the 12th ACM

conference on Electronic commerce. ACM.

Nisan, N., Schapira, M., Valiant, G., & Zohar, A. (2011).

Best-Response Auctions. Proceedings of the 12th

ACM conference on Electronic commerce (EC '11).

ACM.

Parkes, D. C. (2001). An Iterative Generalized Vickery

Auction: Strategy Proofness without Complete

Revelation. Proceedings of AAAI Spring Symposium

on Game Theoretic and Decision Theoretic Agents,

(pp. 78-87).

Parkes, D. C. (2006). Iterative Combinatorial Auctions. In

P. Cramton, Y. Shoham, & R. Steinberg,

Combinatorial Auctions (pp. 41-77). MIT Press.

Parkes, D. C. (2007). Online Mechanisms. In N. Nisan, T.

Roughgarden, E. Tadros, & V. Vazirani (Eds.),

Algorithmic Game Theory (pp. 411-439). Cambridge

University Press.

Roth, A. E. (2007). The Art of Designing Markets.

Harvard Business Review , 85(10), 118–126.

Rothkopf, M. H., Pekec, A., & Harsrad, R. M. (1998).

Computationally manageable combinatorial auctions.

Management Science, 44(8), 1131-1147.

Sandholm, T., & Boutilier, C. (2006). Preference

elicitation in combinatorial auctions. In P. Cramton, Y.

Shoham, & R. Steinberg (Eds.), Combinatorial

Auctions. MIT Press.

Varian, H. R. (2007). Position Auctions. International

Journal of Industrial Organization, 25(7), 1163-1178.

Vickrey, W. (1961). Counterspeculation, auctions and

competitive sealed tenders. Finance , 19, 8-37.

Wurman, P., Walsh, W., & Wellman, M. (1998). Flexible

double auctions for electronic commerce: Theory and

implementation. Decision Support Systems, 24, 17−27.

Zhao, D., Zhang, D. K., & Perrusse, L. (2010). Maximal

Matching for Double Auction. Australasian

Conference on Artificial Intelligence, 516-525.

TowardsaSustainableSmarte-Marketplace-AStable,EfficientandResponsiveSmartExchangewithStrategicConduct

345