A Study of Decision-making Model Considering Priorities based on Two

Kinds of Evaluation

Decision Making Methodology Applying Risk Evaluation based on Prospect Theory

Rumiko Azuma

1

and Shinya Nozaki

2

1

Department of Social Informatics, Aoyama Gakuin University, Sagamihara, Kanagawa, Japan

2

Transdisciplinary Research Organization for Subtropics and Island Studies, University of the Ryukyus, Okinawa, Japan

Keywords:

Decision-making Model, Analytic Hierarchy Process, Risk Evaluation, Prospect Theory.

Abstract:

The Analytic Hierarchy Process (AHP) is a multi-criteria decision-making approach aimed at reflecting a

human’s subjective judgment or vagueness. The conventional evaluation in AHP is considered to be a kind of

utility. However, there are some cases where the traditional utility theory cannot explain risk aversion. This

paper presents a new decision-making methodology for considering risk evaluation. We propose the hierarchy

model that contains return and risk categories, and an AHP method that applies prospect theory, which is

able to explain people’s decisions when they face situations involving risks. Therefore, by proposing an AHP

method that utilizes it, we enable the evaluation of alternatives under return and risk.

1 INTRODUCTION

In decision-making problems, it is necessary to si-

multaneously estimate benefits and risks. For ex-

ample, in assessing supply chains, when companies

find new suppliers for offshore sourcing decisions,

they consider positive criteria, which may include low

wages, lower-transportation costs, and higher reliabil-

ity. These elements are generally expressed with a

positive value as return. On the other hand, there are

various types of risk such as poor quality, logistical

failures, and natural disasters.

There are studies that solve the offshoring de-

cision problem. Schoenherr’s research (Schoenherr

et al., 2008) proposed a method using Saaty’s AHP

(Analytic Hierarchy Process) (Saaty, 1980) to assess

supply chain risks. The AHP is widely used for tack-

ling multi-attribute decision-making problems in real

situations. It uses a hierarchical model for the de-

cision problem and is based on the use of pairwise

comparisons, which lead to the elaboration of a ratio

scale. In AHP, the degree of risks is also determined

by a paired comparison. However, it is difficult to

evaluate risk using a humans subjective judgments.

In our previous study, we extended AHP method

for handling a satisfaction and a risk on the same

structure, and proposed a decision-making model

having pair criterion (Azuma and Miyagi, 2009). Be-

cause the conventional evaluation in AHP is consid-

ered to be a kind of utility, risk is represented by the

utility of the probability of damage in the model. Fur-

thermore, the expected utility is integrated, consider-

ing that satisfaction is a positive utility and damage

by risk is a negative utility. Then, we applied the ex-

pected utility theory to the model by defining satisfac-

tion as a positive utility and risk as a negative utility.

However, studies have shown that an actual behavior

of person is uncertain when choosing between risky

alternatives (Barberis et al., 2003). In this kind of sit-

uation, it is considered inappropriate to use the utility

theory for decision-making methods under risks.

In this study, we propose the introduction of the

prospect theory (Kahneman and Tversky, 1979) con-

cept to AHP for problem solving. The aim of our

study is to develop a method that evaluates alterna-

tives on the basis of return and risk standpoints.

2 PROSPECT THEORY

Prospect theory was developed as a psychologically

more accurate description of preferences compared

to expected utility theory. It is a theory of decision-

making under conditions of risk. The theory says that

555

Azuma R. and Nozaki S..

A Study of Decision-making Model Considering Priorities based on Two Kinds of Evaluation - Decision Making Methodology Applying Risk Evaluation

based on Prospect Theory.

DOI: 10.5220/0004326605550558

In Proceedings of the 5th International Conference on Agents and Artificial Intelligence (ICAART-2013), pages 555-558

ISBN: 978-989-8565-39-6

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

preferences between positive and negative prospects

are different.

The formula of prospect theory is given by

U =

n

∑

i=1

π(p

i

)v(x

i

), (1)

where U is the overall or expected utility of the

outcomes to the individual making the decision,

x

1

,x

2

,... are the potential outcomes and p

1

, p

2

,...

their respective probabilities. The function π is a

probability weighting. v is called value function that

is defined on deviations from s-shaped the reference

point. It expresses losses (= risk) have a significant

influence more than gains feel good. A value function

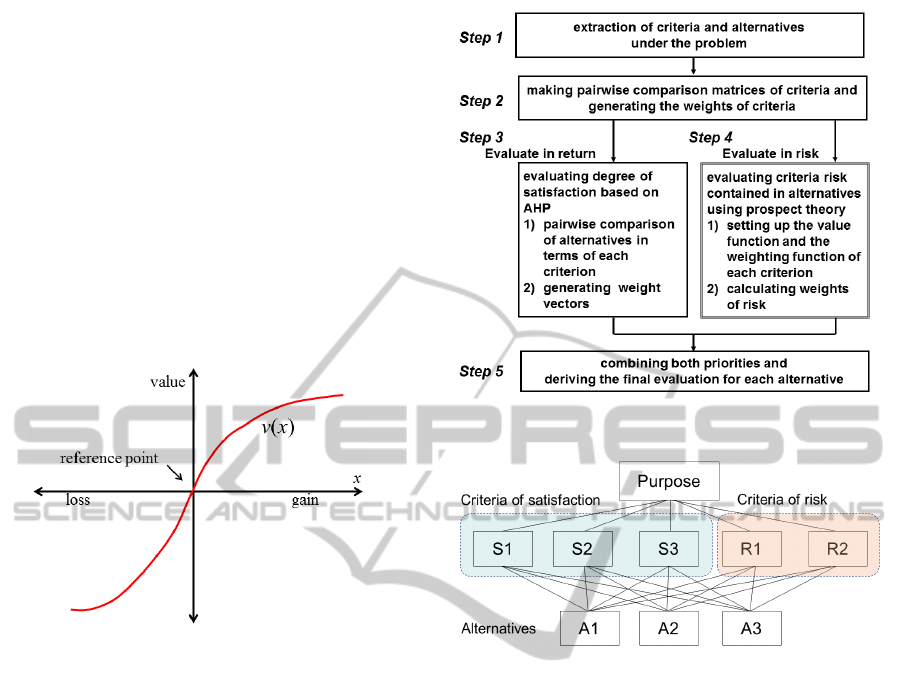

is displayed in Figure 1.

Figure 1: Example of a value function.

3 THE DEVELOPMENT OF THE

AHP MODEL BASED ON

PROSPECT THEORY

We propose a decision making model which evaluates

considering a satisfaction and a risk. The feature of

proposed model is that priorities of risk are evaluated

based on prospect theory. Generally, risk is defined

as the product of probability and resulting degree of

damage. On the other hand, some scholars redefined

the risk by using expected utility theory. We apply

prospect theory as a non-linear expected utility theory

for the evaluation of risks.

Specifically, flowchart of proposed method in Fig-

ure 2 is described as follows.

Step 1). Decision-maker is asked to extract the deci-

sion criteria and alternatives and to make up a hierar-

chy structure. This hierarchy model involves criteria

of both satisfactions and risks, the structure of which

can be seen in Figure 3.

Step 2). In this step, decision-maker makes up pair-

wise comparison matrices in criteria of satisfaction

Figure 2: Flowchart in the proposed method based on AHP

for risk.

Figure 3: The hierarchy model for satisfaction and risk.

and risk. This procedure is same as AHP which is rel-

ative measurement approach. To calculate its eigen-

vector determines the weight of criteria.

The pairwise comparison matrix S in criteria of

satisfaction is constructed:

S = [s

ii

′

], i,i

′

= 1,2,...,m, (2)

and (i,i

′

) is the number of criteria. The value of s

ii

′

is given by linguistic scale of decision-maker as in

Table 1. The scale is ratio-scale measure. In Table

1, the value is chosen under each criterion by an-

swering question such as : How important is low-

cost than high-quality when you determine a offshore

company? Decision criteria are compared in pairs to

assign weights. The relation between matrix S, its

eigenvector w

s

and maximum eigenvalue λ

max

is rep-

resented as

Sw

s

= λ

max

w

s

, (3)

where

w

T

s

= (ω

s

1

,ω

s

2

,...,ω

s

m

),

and ω

s

i

represents a weight of ith criterion.

Similarly, we define the pairwise comparison ma-

trix R in criteria of risk as

R = [r

kk

′

], k,k

′

= 1,2,...,n. (4)

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

556

By the same approach, we derive the vector of priori-

ties for the matrix R

Rw

r

= λ

′

max

w

r

, (5)

where w

T

r

= (ω

r

1

,ω

r

2

,...,ω

r

n

).

and ω

r

j

represents a weight of jth criterion in risk.

Table 1: Example of linguistic scale of paired comparison.

linguistic scale

value satisfaction risk

1 equally important equally damage

3 moderate important moderate damage

5 important strong damage

7 very important heavy damage

9 absolutely important extreme damage

Step 3). The next step derives the weights of al-

ternatives under each criterion. Then, we analyze

weight of alternatives for satisfaction. The weights

in satisfaction are derived by the same technique

as Saaty’s AHP. Decision-maker compares the al-

ternatives based on each criterion S

i

respectively,

then constructs pairwise comparison matrices A

s

i

(i =

1,... , m) of alternative. The weights are acquired

by calculating each eigenvector from matrices. The

eigenvector of A

s

i

regards as weight vector w

s

i

, then

it can be represented by Eq.(6).

w

T

s

i

= (ω

s

i

a

k

) = (ω

s

i

a

1

,ω

s

i

a

2

,...,ω

s

i

a

l

), (6)

k = 1, 2,...,l.

Here, ω

s

i

a

k

is a weight of alternative A

k

based on cri-

terion S

i

. After calculating weights for each level of a

class, the final weights of satisfaction are derived by

these results as

u

s

= (u

sa

k

) = [w

s

1

,w

s

2

,...,w

s

m

] · w

s

, (7)

where u

sa

k

is a priority weight of alternative A

k

in sat-

isfaction.

Step 4). In order to calculate the weights in risk, we

utilize the utility of damage and its probability. In

evaluation of risk, to calculate the weight of alterna-

tive A

k

for each criterion R

j

, we adopt prospect theory.

p

jk

represents a probability that risk R

j

will occur un-

der A

k

. According to prospect theory, when the dam-

age of R

j

under A

k

is represented as x

jk

, the weight

ω

r

j

a

k

of A

k

based on R

j

can be expressed as follows

using Eq.(1).

w

T

r

j

= (ω

r

j

a

k

) = (ω

r

j

a

1

,ω

r

j

a

2

,...,ω

r

i

a

l

), (8)

k = 1,2, . . . ,l

ω

r

j

a

k

= π(p

jk

)v(x

jk

) (9)

where w

r

j

is a weight vector of alternatives based on

risk R

j

. In a case that probability of a risk is not able

to be expressed as a objective value, it is given as sub-

jective value by linguistic scale, such as quite high,

very high, high and so on (Takemura, 1996). All the

weight vectors are generated after normalization.

From these results, weights of the whole hierarchy

about risks are estimated. Assume weights of each

alternative in risk are u

ra

1

,u

ra

2

,...,u

ra

l

, respectively.

Then, a weight vector u

r

can be formulated as

u

r

= (u

ra

k

) = [w

r

1

,w

r

2

,...,w

r

n

] · w

r

(10)

Step 5). Final evaluation is obtained in Step 5. The

ultimate priority vector U is finally acquired by satis-

faction evaluation and risk evaluation of alternatives.

It is calculated from the ratio of each degree of satis-

faction to a risk as

U = (u

a

k

) = (u

sa

k

/u

ra

k

) (11)

= (u

sa

1

/u

ra

1

,u

sa

2

/u

ra

2

,...,u

sa

l

/u

ra

l

)

T

.

We reach the final weights after normalization such

that

l

∑

k=1

u

a

k

= 1. (12)

4 CONCLUSIONS

This study suggested a new approach to construct a

decision-making model for risk management. The

proposed method is based on Saaty’s AHP method

and applied prospect theory for evaluating risk. By

applying prospect theory to AHP it makes possible

to quantify damage, which is derived by a human’s

judgments under risks. As a result, we think our ap-

proach enables people to make a decision about prob-

lems involving risk such as decision problems in sup-

ply chains.

In this study, the linear measurement of Saaty is

used as the measurement of return in a paired com-

parison. On the other hand, since the measurement of

a risk is calculated based on a value function which

is nonlinear. In our future works, it needs to exam-

ine consistency of each measurement. One plan is to

use the exponential measurement as relative value of

return. We have to reconsider the method of compre-

hensive evaluation which is expressed in Eq.(11) in

the case.

Moreover , in our previous model, we assumed

that one criterion consists of the pair of return and

risk. Then, we proposed a method for evaluating the

AStudyofDecision-makingModelConsideringPrioritiesbasedonTwoKindsofEvaluation-DecisionMaking

MethodologyApplyingRiskEvaluationbasedonProspectTheory

557

weights of alternativesfor criteria using expected util-

ity. Therefore, one of the future areas of study in-

volves applying a new method using prospect theory

to our previous model instead of the expected utility.

Furthermore, it is necessary to verify the effectiveness

of our proposed method by comparing it with other

methods.

REFERENCES

Azuma, R. and Miyagi, H. (2009). Ahp for risk manage-

ment based on expected utility theory. In IEEJC,EISS.

IEEJ.

Barberis, N., Huang, M., and Thaler, R. (2003). Indivi-

sual preferences, monetary gambles and the equity

premium. In Working paper, University of Chicago.

University of Chicago.

Kahneman, D. and Tversky, A. (1979). Prospect theory :

An analysis of decision under risk. In Econometrica.

Wiley-Blackwell.

Saaty, T. L. (1980). The Analytic Hierarchy Process. Mc-

GrawHill, NewYork.

Schoenherr, T., Tummala, V. M. R., and Harrison, T. P.

(2008). Assessing supply chain risks with the ana-

lytic hierarchy process. In Journal of Purchasing and

Supply Management. Elseview.

Takemura, K. (1996). Ishikettei No Shinri (in Japanese).

Fukumura Shuppan, Tokyo.

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

558