Technology Migration Determination Model for DRAM Industry

Ying-Mei Tu and Chao-I Wang

Department of Industrial Management, Chung Hua University, 300, HsinChu City, Taiwan

Keywords: Technology Migration, Dram, Technology Roadmap, Learning Curve.

Abstract: Due to short life cycle of DRAM industry over the past decade, the product generation and technology

migration have to be quickly enhanced. When technology migration occurred, DRAM companies always

used the past experiences to proceed with process changes. However, the issues are totally different

particularly in the best practice of technology migration that caused the companies suffered many

uncertainties. In this work, a model to determine the timing of technology migration is proposed. The model

is based on technology roadmap to set the timing of migration under maximum profit condition. A stable

growth trend is assumed for market demand to decide the revenue. Furthermore, the time-cost function of

new generational equipment and the theory of learning curve are introduced as the factors to determine the

manufacturing cost and profit. Consequentially, the best timing is determined with maximum profit.

1 INTRODUCTION

DRAM industry is a capital intensive, high-tech

industry with complex processes and technology

migration for DRAM manufacturers has been a very

challenging aspect and more time consuming. Since

there is no any physical capacity expansion over the

past 5 years in Taiwan, all DRAM manufacturers

were relying more than ever on technology

migration to increase supply and reduce cost.

Furthermore, product generation and technology had

been quickly enhanced due to short product life

cycle. When new technology emerges, it reveals that

a lower cost and more effective operation model

emerged (Cainarca, 1989). Simultaneously, it also

means the current competitive advantages of the

company will be jeopardized (Hastings, 1994).

Under this circumstance, manufactures have to

launch new technology and retrofit generational

equipment to meet the market demand and reduce

manufacturing cost. Chou et al., (2007) pointed out

the technology life cycle of semiconductor

manufacturing usually won’t be over three years and

the time of technology generational transition should

take about nine months. Therefore, the

semiconductor manufacturers always face the

dilemma between capacity expansion and new

technology migration. Generally, the major

competition factor of DRAM industry is the

manufacturing cost. That is why the frequency of

technology migration is higher than foundries.

There are many researches regarding to the

influence of new technology introducing. Chand

and Sethi based on the enhancement of process

stability by the new generational equipment to plan

the replacement of new generation capacity.

However, the impacts on the other factors and the

lead time of replacement were not taken into account.

Cohen and Halperin proposed a method to determine

the timing of technology migration which was based

on the price changes of new equipment as well as its

impact on the cost to find the best timing for

migration. Rajagopalan et al. combined the above

two studies and proposed a capacity planning model

under the impact of technology evolution. The linear

programming was applied and the concept of

timeline was added to the decision of capacity

expansion or replacement decisions. Pak et al.,

(2004) proposed a methodology of capacity planning

which focused on the capacity shortage to plan the

capacity requirement and the influence from cost of

new technology capacity was taken into account.

Furthermore, the sensitivity analysis was applied to

determine how sensitive of this plan in the changes

of market demand. Chien and Zheng, (2002)

proposed a mini–max regret strategy for capacity

planning under demand uncertainty to improve

capacity utilization and capital effectiveness in

semiconductor manufacturing. Seta et al. studied

optimal investment in technologies characterized by

389

Tu Y. and Wang ..

Technology Migration Determination Model for DRAM Industry.

DOI: 10.5220/0004409503890394

In Proceedings of the 15th International Conference on Enterprise Information Systems (ICEIS-2013), pages 389-394

ISBN: 978-989-8565-59-4

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

the learning curve. They emphasized that if the

learning process is slow, firms invest relatively late

and on a larger scale. If the curve is steep, firms

invest earlier and on a smaller scale. It is obvious

that most of these researches focused on the market

demand to decide the timing of technology

migration. However, the market demand is full of

uncertainties and hard to handle. Therefore, there

will be great difficulty in the practical applications.

The purpose of this work is to propose a model

to determine the timing of technology migration.

The model is based on technology roadmap to set

the timing of migration under maximum profit

condition. A stable growth trend is assumed for

market demand to decide the revenue. Furthermore,

the time-cost function of new generational

equipment and the theory of learning curve are

introduced as the factors to determine the

manufacturing cost and profit. Consequentially, the

best timing is determined with maximum profit.

2 TECHNOLOGY MIGRATION

DETERMINATION MODEL

The purpose of technology migration is to make

more profit for the company. Under the assumption

of demand stable growth, the best timing of

technology migration is the time which can make the

maximum profit for the company. Based on the

literature review and market survey, the trend of

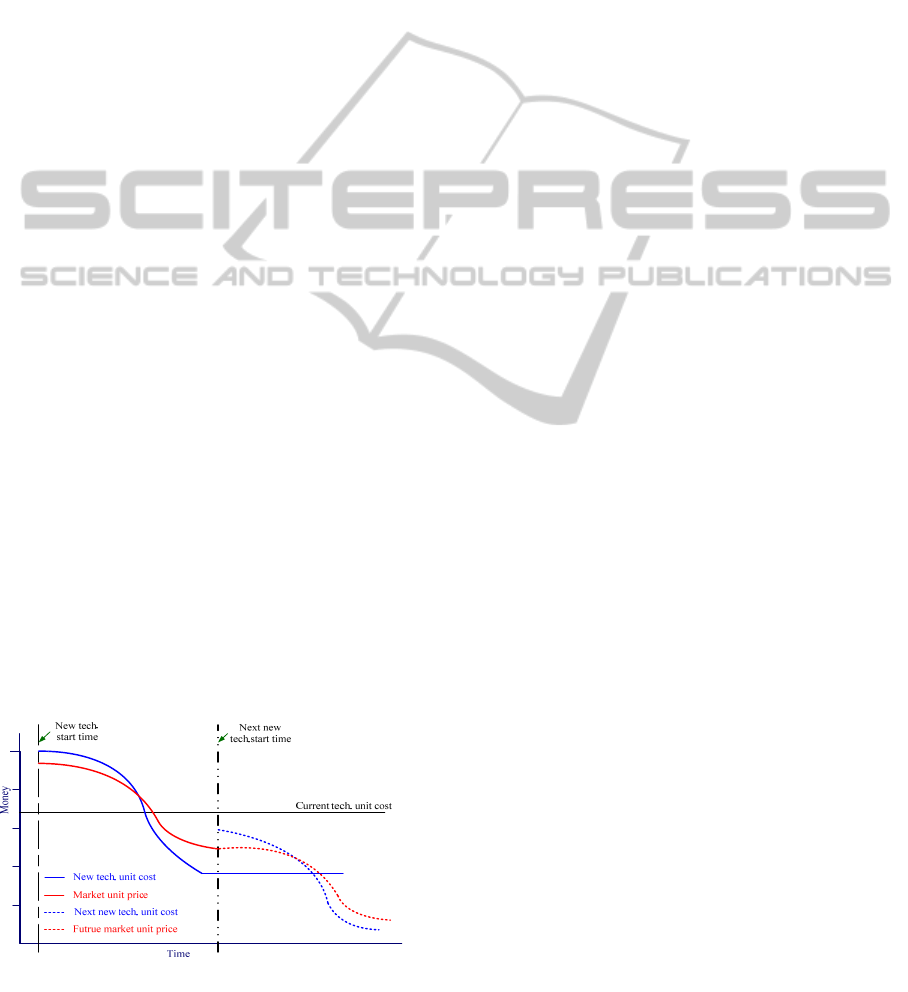

DRAM unit cost and market price is as Fig. 1.

Because the equipment depreciation and product

yield is stable under the current production status,

the production cost of per giga bit DRAM is almost

the same. However, the market price will be dropped

off due to the business strategy, new product or

technology emerged. The trend of market price can

be gotten from history data. Regarding to the unit

cost produced by new technology, it will be higher

Figure 1: The relationship between unit cost and unit price

of per giga bit DRAM.

than current mature technology due to the higher

price of new equipment and lower yield of

production in the beginning. However, the yield will

be improved after a period of time and the unit cost

also can be dropped off and even lower than the

product from current technology. Based on the

abovephenomena, it shows that the best timing of

technology migration will be occurred between the

emerged time of new technology and the next

generation technology.

In order to analyse and establish the model easily,

we called the horizon between the emerged time of

new technology and the next generation technology

as the life cycle of new technology and divided it

into n periods. The profit function is established as

Eq. 1 and there are three parts, total revenue, total

manufacturing cost and the income of equipment

disposal, included. The details are described in the

follows.

∑

,

,

,

(1)

Where

:

Total profit which the technology

migrated from t period

:

The time of technology migration

:

Revenue of j generation technology

,

:

Fixed cost of g generation

technology per period which is

migrated at i period

:

Fixed cost of g-1 generation

technology per period

,

:

Variable cost of g generation

technology per period which is

migrated at i period

:

Variable cost of g-1 generation

technology per period

,

:

The income from the deposal of g-

1 generation equipment at t period

2.1 The Function of Total Revenue

The environment of supply demand balance is an

assumption of this work. Therefore, all products can

be sold by market price. The total revenue means the

revenue of n periods. If the new technology is

migrated at t period, the revenue from current

technology will be the revenue from period 1 to

period t-1 and the revenue from new technology will

be from period t to period n. Down below is the

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

390

equation of current technology revenue andnew

technology revenue.

2.1.1 The Revenue from Current Technology

If the current technology is not eliminated after new

technology emerged, the current technology is still

under production. Because the current technology is

under a stable stage, the market price and production

quantity of the company will keep almost the same.

Therefore, the revenue from current technology is

established as follows.

,

(2)

Where

:

The average market price of g-1

generation technology

,

:

The total quantity of g-1 generation

technology at period i

2.1.2 The Revenue from New Technology

The calculation of the revenue from new technology

is still formula by the price multiplying the quantity.

Due to the new technology belonging to the growing

stage, the market price and production quantity of

the company will be changed by time. Based on the

historical data analysis, the market price can be

modelled as a Sigmoid function. The output of

Sigmoid function is between 0 and 1. Therefore, the

managers should forecast the rate of price change

and the saddle point of price curve. Besides, the

normalization is used to fit the actual DRAM price.

Regarding to the production quantity, due to the

unfamiliarity of new technology process, the yield of

products will be lower in the beginning. After a

period of time, the yield can be improved and

products quantity will be increased as well. This

concept is similar to the learning curve. Therefore,

the concept of learning curve is applied to model the

production quantity of new technology. The

equation of the revenue from new technology is as

follows.

,

,

(3)

,

,

,

,

(4)

1

1

(5)

1

1

(6)

Where

,

:

The average price of g generation

technology at i period

,

:

The maximum price of g generation

technology

,

:

The minimum price of g generation

technology

:

The normalization value of Sigmoid

function

:

The rate of price change

:

The saddle point of Sigmoid function

:

Production quantity at i period

:

Release quantity per period

:

The initial failure rate of new

technology

:

The learning rate of production

failure rate, set by the managers

2.2 The Function of Total Cost

As the characteristics of DRAM industry, the

company can get more profit from new generation

technology. However, a huge of cost should be paid

for new generational equipment behind profit. This

cost is called as capacity acquired cost. Therefore,

the calculation of production cost can be divided

into two part, fixed cost and variable cost. The fixed

cost is the cost of equipment for new technology and

the depreciation of current equipment. There is no

depreciation for the deposal equipment. The variable

cost is the expense for the production. The details

are as follows.

2.2.1 Fixed Cost of New Technology

Due to the migration to new generational

technology, the new generational equipment is

required. Generally, the price of new generational

equipment will be reduced by time. In this work we

assume the price will be linear decreasing. Besides,

the required equipment quantity depends on its

throughput. Based on these concepts, the fixed cost

is formulized as follows.

,

,

(7)

,

,

1

(8)

,

(9)

TechnologyMigrationDeterminationModelforDRAMIndustry

391

,

1

(10)

(11)

Where

,

:

The quantity of generation g

equipment which purchased ati period

:

The reducing value of equipment per

period

,

The price of generation g equipment

which purchased at i period

The fixed cost of generation g-1

equipment which is disposed at period

t

:

The residual value of generation g

equipment

:

N

umbers of depreciation period

:

The capacity of generation g

equipment

:

The wafer numbers which producing

by the generation g equipment

:

The numbers of IC which producing

by the generation g equipment

:

The memory size per die which

producing by the generation g

equipment

2.2.2 Variable Cost of New Technology

Generally, the variable cost of production will

decrease as the yield increase. The yield increasing

is the result of the mature of co-operating in man-

machine and the accumulation of engineer’s

experiences. Therefore, the variable cost will present

same as the concept of manufacturing progress

function and it is applied in the formulation of

variable cost.

VC

,

C

it1

(12)

Where

:

The variable cost which the migration

occurred at

t

p

erio

d

:

The learning rate of variable cost, set

by

the mana

g

ers

2.3 The Income from the Disposal of

Equipment

The equipment which cannot process the new

generation technology will be disposed. The income

from the disposal of equipment is as the following

equation.

,

,

,

(13)

Where

,

:

The price of g-1 generationa

l

equipment at t period

,

:

The equipment quantity of g-1

generational equipment

3 NUMERICAL EXAMPLE

Here, a numerical example is illustrated to

demonstrate the modelling and determination

process of the proposed model. The environment of

this example is a 300mm DRAM fab with 30K

wafers per month. The major product is DDRII and

1300 chips per wafer. New generation technology is

DDRIII and 1800 chips per wafer. The sales quantity

is equal to the production quantity under the

assumption of strong market demand condition.

Besides, the duration of period is one month and all

cost, price and revenue are counted by US dollar.

The following is the detailed modelling and

determination process. Furthermore, t=8 is assumed

for all calculation.

3.1 Total Revenue

3.1.1 The Revenue from Current Technology

Assume the price of current technology is $0.8 per

giga bit and production yield is 0.98. Therefore, the

revenue from current technology is as follows.

R

1.2130030K0.98

45,864,0007

321,048,000

3.1.2 The Revenue from New Technology

Regarding to the price of DDRIII, the data from Aug.

2009 to July 2012 is collected to formula the

Sigmoid function. Assume the parameters of

Sigmoid function T is 16 and a is 0.3. The maximum

and minimum price of DDRIII is 2.5 and 1.2. The

price of new technology is as follows.

X

1

1e

.

0.9168

P

,

0.9168

2.51.2

1.22.3918

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

392

Due to the improvement of product yield, the

production quantity will increase. Assume the

product yield is 0.45 in the beginning of migration

and c

1

equals to 0.85. The production quantity of

period 8 is calculated as follows.

Q

,

54,000K

1

0.55

881

.

23,220,000

a

log0.9

log2

0.152

The revenue from new technology is as follows.

R

P

,

Q

,

1,504,087,017

3.2 Total Cost

3.2.1 Fixed Cost

Assume the depreciation for equipment is six years.

Three sets of g-1 generation should be replaced and

their original cost is 0.1 billion. Total equipment

cost of old technology excluding the disposals is 2

billion. The parameters of product by new and old

technology are as follows.

ICC

g

=1GB, CP

g

=1800, MP

g

=10000

ICC

g-1

=1GB, CP

g-1

=1300, MP

g-1

=10000

Therefore, C

g

and C

g-1

equals to 18,000,000 and

13,000,000. The new generational equipment

quantity can be determined by Eq. 10.

x

130000000.983

180000000.61

13

Assume the price of new generational equipment

is 1 billion per set in the beginning and its

residual

value is 0.2 billion. Therefore, if the new

generational equipment is purchased at period 8,

its price is calculated as follows.

100,000,00020,000,000

72

1,111,111

MP

,

100,000,0001,111,1117

$92,222,222

Based on the assumptions above, the total fixed

cost is calculated as follows.

FC

,

92,222,2223

72

2,000,000,000

72

31,620,370

,

,

1,121,157,407

3.2.2 Variable Cost

Assume c

2

= 0.82, C

t

=10,600,000 and VC

g-

1,i

=7,141,000

Then a

log0.82/log20.377069649

VC

10,600,000881

.

10,600,000

VC

,

156,956,539

The following is the calculation of total variable

cost.

VC

,

,

7,141,0007156,956,539

206,943,539

The total cost is fixed cost plus variable cost.

TotalCost1,121,157,407

206,943,5391,328,100,946

3.3 The Income from the Disposal of

Equipment

Assume the disposal equipment has been purchased

for 47 months at the time of new technology

emerged. Therefore, the total value at the period 8 is

as follows.

I

,

,,.

17100,000,0000.2

3

3

38,888,888

3.4 Total Profit

Finally the total profit is as follows if the technology

migration occurred at period 8.

TP

8

321,048,0001,504,087,017

1,328,100,94638,888,888

535,922,959

TechnologyMigrationDeterminationModelforDRAMIndustry

393

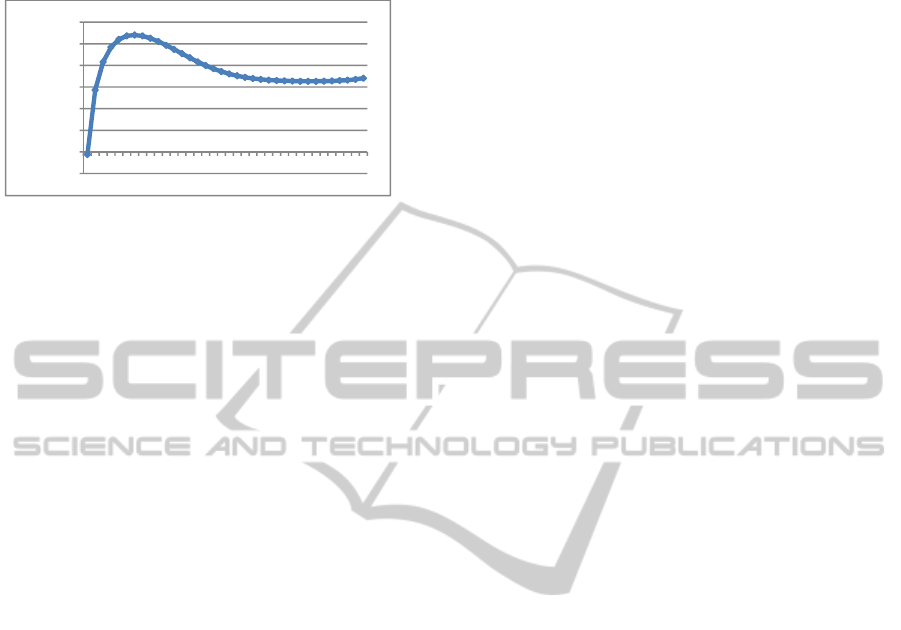

Based on the above calculation, the relationship of

total profit vs. the migration time t is shown as Fig. 2.

Figure 2: The relationship between total profit and

migration time t.

The best time for generational transition can be

determined as period 7 from Fig. 2.

4 CONCLUSIONS

DRAM industry is a capital intensive, high-tech

industry and the product generation has been quickly

enhanced. Due to the huge investment for the

technology migration, the migration timing is very

important for the company. In this work, a model to

determine the best timing for the technology

migration is established. The maximum profit is the

objective to determine the migration time in the

model. All revenue and cost of technology migration

are considered. We expect this model can be applied

in other industries with same situation.

ACKNOWLEDGEMENTS

The authors would like to thank the National Science

Council of the Republic of China for financially

supporting this research under Contract No. NSC 100-

2628-E-216-002-MY2.

REFERENCES

Cainarca, C. (1989). Dynamic Game Results of the

Acquisition of New Technology. Operations Research,

37(3), 410-425.

Chand, S. and Sethi, S. (1982). Planning Horizon

Procedures for Machine Replacement Models with

Several Possible Replacement Alternatives. Naval

Research Logistics Quarterly, 29(3), 483-493.

Chien, C. F. and Zheng J. N. (2011), Mini-max regret

strategy for robust capacity expansion decisions in

semiconductor manufacturing, Journal of Intelligent

Manufacturing DOI: 10.1007/s10845-011-0561-1, 1-9.

Chou, Y. C., Cheng, C. T., Yang F. C. and Liang, Y. Y.

(2007).Evaluating alternative capacity strategies in

semiconductor manufacturing under uncertain demand

and price scenarios, International Journal of

Production Economics, 105(2), 591-606

Cohen, M. A. and Halperin, R. M. (1986). Optimal

Technology Choice in a Dynamic Stochastic

environment. Journal of Operations Management,

6(3), 317-331.

Hastings, J. (1994). AmCoEx Five Year Comparison of

Used Computer Prices, Computer Currents, 9, 20-24.

Pak, D., Pornsalnuwat, N. and Ryan, S. M. (2004),The

effect of technological improvement on capacity

expansion for uncertain exponential demand with lead

times, The Engineering Economist: A Journal Devoted

to the Problems of Capital Investment, 49(2), 95-188.

Rajagopalan, S., Singh, M.R., and Morton, T.E.

(1998).Capacity expansion and replacement in

growing markets with uncertain technological

breakthroughs. Management Science, 44(1), 12-30.

Seta, M. D., Gryglewicz, S. and Kort, P. M. (2012),

Optimal investment in learning-curve technologies,

Journal of Economic Dynamics and Control, 36(10),

1462-1476.

‐100

0

100

200

300

400

500

600

1 3 5 7 9 11131517192123252729313335

Million

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

394