Examining Potentials of Building M&A Preparedness

Nilesh Vaniya, Peter Bernus and Ovidiu Noran

Centre of Enterprise Architecture Research and Management (CEARM), Griffith University,

170 Kessels Road, Nathan, Queensland, Australia

Keywords: Mergers, Acquisitions, Post-merger Integration (PMI), M&A Preparedness Building.

Abstract: Enterprises are systems of systems that continuously evolve during their lifespan, be it in a directed or

emergent way. As enterprises are in fact socio-technical systems, this evolution may occur in one or more

specific areas - such as the human / organizational, the technology and / or the Information System that

integrates the activities performed by humans and machines (technology). This paper addresses a special

type of change, brought about by enterprise mergers or acquisitions (M&As). M&As are an important

strategic transformation instrument in the hands of management; however, literature reveals that an

alarming high percentage of M&As do not achieve their declared objectives. In this paper we attempt to a)

demonstrate that the success of such strategic changes depends on several essential and largely overlooked

factors, and b) outline a possible approach of building preparedness for M&As), so as to improve the

chances of success. This paper also presents a retrospective M&A case analysis to demonstrate the types of

potential problems that could have been effectively addressed by anticipatory transformation facilitated by

the proposed preparedness building approach.

1 INTRODUCTION

Enterprises as socio-technical systems are subject to

continuous evolution. In addition, enterprises are

also required to permanently adapt so as to satisfy

the dynamic requirements of the environment in

which they operate. The purpose of the research

reflected in this paper is to demonstrate the

principles and use of a Mergers and Acquisitions

(M&A) Preparedness Building Methodology

(MAPBM) built on Enterprise Architecture (EA)

concepts in order to create and support strategically

important transformational activities.

In order to demonstrate the use of EA in M&As,

firstly we summarize the approaches suggested in

the literature in order to tackle the issues that cause

failures in M&As, the solutions attempted to address

those issues and the current gaps in related theory

and practice. Secondly, we summarise the proposed

MAPBM which aims to support enterprises in

acquiring the necessary systemic properties before

merger/acquisition and thus build preparedness for

the desired type of M&A. Subsequently, we describe

a merger case study and using the MAPBM we

demonstrate how, with strategic intent, a

multifaceted transformation of the participating

organisations could have been performed so as to

achieve a state where the organisation was ready to

perform a strategically attractive merger. Finally, we

summarise the results and outline future work.

2 M&A: PROBLEMS

AND TYPICAL SOLUTIONS

Kumar (2009) categorizes M&As as: horizontal

(also known as ‘mergers of equals’), vertical (where

two or more participants have different position in

the supply chain), and conglomerate. In addition to

this typology, there are other differentiating aspects

when one considers the nature of an M&A – e.g., is

the deal forced or voluntary, do the original

identities of the participants change as a result of the

transaction, etc. Irrespective of the type, M&As can

deliver positive outcomes for the participants. Based

on the goal and the type of the deal, Walter (2004,

pg. 62-77) lists some major advantages achievable

through M&As: market extension, economies of

scale, cost (or revenue) economies of scope, other

operating efficiencies, etc.

Unfortunately, according to recent research

(Rodriguez, 2008, p.65), while the rate of M&As has

199

Vaniya N., Bernus P. and Noran O..

Examining Potentials of Building M&A Preparedness.

DOI: 10.5220/0004418201990210

In Proceedings of the 15th International Conference on Enterprise Information Systems (ICEIS-2013), pages 199-210

ISBN: 978-989-8565-61-7

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

increased in the recent past, the probability of

achieving the above-mentioned potential benefits

has dropped to less than half (Rodriguez 2008, p.65).

The precise percentage of the deals that fail to

achieve the declared synergies and desired levels of

integration varies according to industry, but is

generally agreed to be greater than 50% (Alaranta

and Henningsson, 2008); (Mehta and Hirschheim,

2007); (Rodriguez, 2008). M&A problems have

been researched from different perspectives and

viewpoints. Next, we summarise the findings of

current literature, with the intent of categorising and

highlighting major M&A issues from an Information

Systems (IS) researcher’s perspective.

2.1 M&A Issues

We reviewed a wide range of M&A literature to

identify typical issue types (or issue categories) that

are believed to have significant impact on the

outcome of M&As. Major issues having the highest

impact on M&A success are claimed to be in the

domains of IS and organizational integration

(Larsen, 2005); (Mehta and Hirschheim, 2007); (Mo

and Nemes, 2009); (Rodriguez 2008); (Schuler and

Jackson 2001). Major M&A issues have also been

highlighted in (Baro et al., 2008); (Chatterjee, 2009);

(Epstein, 2004); (Hwang, 2004); (Larsen, 2005);

(McDonald et al., 2005); (Mehta and Hirschheim,

2007); (Rodriguez, 2008); (Stylianou et al., 1996);

(Walsh, 1989). We identified three issue types

illustrated below:

1) Business Management issues/concerns,

regarding

Merger motive, expectations and planning,

Level of Coherency of Integration Strategy,

IS/Information Technology (IT) Involvement in

M&A planning,

Organisational integration management.

2) Human Resource (HR) issues, due to the

Requirement of strong integration team, executive

leadership,

Need to consider not only general HR issues but

the individual human side of M&A,

Need for top-down communication of vision,

M&A strategies, and of M&A planning,

Personnel concerns (such as benefits, retention

and cut-offs),

Lack of supporting programs, advanced

notification, extended benefits, outplacement

activities.

3) IT and IS issues, resulting from

IT Attributes,

IT Integration Management,

Information and Communication Technology

(ICT) vision,

Enterprise Systems / Applications integration such

as ERP, SCM, CRM, etc.,

Data integration issues,

Technical compatibility.

Thus, most issues in strategic transformations

(and M&As as a special case thereof) fall in three

main categories: Business Management, Human /

Organizational and IT / IS). Clearly, solving only

one type of issues (e.g. HR) without considering the

relationships with the other issue types would be less

effective than expected or may be altogether

ineffective. Hence for any enterprise-wide

transformation methodology we must consider how

to jointly solve these three types of issues.

Note that not all of the above issues can be

addressed in detail during preparedness building in

all circumstances. The ability to address such issues

during preparedness building relies on the ability to

sense their root causes as well as the ability to

respond and control them.

2.2 Existing Solutions

Recent developments in M&A research aimed to

study the reasons of M&A failures and improve their

success rate. As discussed below, most of the studies

focused on a single issue and proposed a solution to

it without considering the relationship/effect of that

solution on other issue types and sources. In our

view, this is due to a lack of a systemic view; hence,

the outcomes of these studies could be in fact

synthesized to develop a comprehensive solution.

Similar to the discussion of M&A issues, M&A

solutions can be structured into three categories:

Business/Operations, HR/Organisational and IS/IT.

During M&A-related transformations, one of the

key business success factors is to maintain business

and IS alignment. To maintain such alignment,

Wijnhoven et. al. (2006) suggests using Henderson

and Venkataraman’s (1993) strategic alignment

model. However, they only concentrate on the

selection of IT-integration methods for a given type

of merger and IT integration objectives. To explain

the process of post-merger integration, Mo and

Nemes (2009) suggest developing the metaphor of

an architectural ‘DNA’ (biological DNA)

inheritance. Using this ‘DNA EA’ concept, they

explain post-merger integration as the inheritance of

DNAs (process, knowledge, control, data, people

and asset) of the involved organizations into the

DNAs of the merged organization. Mo and Nemes

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

200

(ibid.) propose a solution methodology to implement

post-merger integration by treating six DNA

components separately; however, details of how to

integrate those six DNAs are not provided.

Post-merger integration planning needs to

consider the level of integration required: Vernadat

(2007) suggests an categorization framework, based

on the targeted level of interoperability. According

to Vernadat (ibid. p139) for Coordination a Business

level, for Co-operation an Application level, and for

interoperable Communication a Physical System

level integration is required. This model can help

plan the expected level of interoperability and

required level of integration.

Most researchers agree that HR issues are

complex to resolve and have high impact on the end

result of M&As deals. The majority of HR issues are

caused by the anxiety and low degree of bottom-up

participation and involvement in the transformation

process, consequently Rodriguez (2008) highlights

the critical importance of top-down communication

and bottom-up participation during M&As. To

address other HR issues, Schuler and Jackson (2001)

suggest a three-stage HR integration model (pre-

combination, combination and solidification). Their

model covers major HR activities, strategies and

planning for successful post-merger integration.

They consider strategic HR concerns such as cut-

offs, retentions, promotions and communication

during M&A transformations. Although some of the

practitioners and researchers suggest the idea of

unfreeze-transform-freeze as a solution; such

simplistic concepts are highly criticised for not

considering emergent issues (such as those brought

about by the dynamicity and complexity of the

change process, inabilities of change leaders and

inefficiencies of micro level linear planning (Lauser,

2009)) and also for the unrealistic view of human

resources as a commodity by the HR community

(Dooreward and Benschop, 2003). Recent research

in HR also advocates the strategic role of HR in

enterprise-wide change endeavours (Bhaskar, 2012).

Unfortunately, the impact of the decisions made to

resolve HR concerns on IS and Business integration

is not addressed in the proposed model (ibid.); thus,

the validity of these suggestions remains unclear.

Although the planning of post-merger integration

is considered vital and complex, the need for careful

planning is still often neglected during the pre-

merger phase (Larsen, 2005). Larsen (ibid.) suggests

a model to create an ICT vision for the M&A; such a

model enables considering ICT integration during

pre-merger planning. Bannert and Tschirky (2004)

suggest an integration planning model for IT

intensive M&As. According to their explanation,

technology integration should cover various IS

components such as enterprise applications,

platforms (including operating systems,

communication, security, and database systems).

Giacomazzi, Panella, Pernici and Sansoi (1997)

suggest a model of post-merger IS integration and

provide a list of options available (Total Integration,

Partial Integration, No Integration and Transition)

for a given computer architecture and software

architecture. In addition, they provide a descriptive

model in order to explain how to implement each of

the IS integration options. With the wide use of ERP

systems, it is also necessary to develop an

Application Integration Strategy; Eckert, Freitag,

Matthes, Roth and Schilz (2012) provide a

methodology for this, based on the type of M&As

and the aimed synergy. To better understand post-

merger integration, Mehta and Hirschheim (2007)

suggest an IS Integration decision making

framework that to guide decisions for Post-merger

integration. The framework is based on the strategic

alignment model (Hirschheim and Sabherwal, as

cited in Mehta and Hirschheim (2007)).

Ross, Weill and Robertson (2006) suggest that

the level of business process integration (sharing

data across parts of the organization, and therefore

requiring business data integration) and the level of

business process standardization (use of uniform

business processes across the organization) can

decide an operating model for the organization.

They (ibid, pages 29-39) suggest a framework to

differentiate four operating models, based on the

level of business process integration and business

process standardization. It appears that an operating

model can be decided based on the choices made for

business process integration and standardization,

technology- and organizational integration, and

making strategic choices based on this model can

guide further M&A implementation.

It seems that none of the solutions outlined above

are able to address all the issues or to consider the

impact on and/or relationships with the other issues.

In addition, the models and theories noted above

focus on individual aspects of M&A, and results

documented in the current literature need to be

synthesized in order to adopt a comprehensive

approach for solving M&A issues in concert.

2.3 Gaps in Theory and Practice

In their review of the last 30 years of M&A

literature, Cartwright and Schoenberg (2006) found

that M&A research is still incomplete.

ExaminingPotentialsofBuildingM&APreparedness

201

Based on our own survey, major gaps in M&As

research can be summarised as follows:

Lack of a multi-disciplinary approach (Cartwright

and Schoenberg, 2006, pg. 5);

“the study of M&A desperately needs a new

perspective and a new framework for analysis”

(Epstein, 2005, pg. 37);

Need to consider the emergent nature of M&A

(Lauser, 2009);

Lack of agile, flexible, quick-responsive

framework suitable to M&As’ complexity (Mo &

Nemes, 2009);

Lack of Systems approach (Mo and Nemes, 2009,

pg. 4; Larsen, 2005; DiGeorgio, 2002), whereupon

a systems approach would provide a unified

framework that able to represent the range of

problems that arise from the transformation of two

systems into a single system

3 THE SYNTHESIZED

SOLUTION: M&A

PREPAREDNESS BUILDING

From the above discussion it is clear that a systems

approach is required to address the high failure rate

of M&As. It is unlikely that once an M&A deal is on

the horizon there will be sufficient time to perform

groundwork and planning for post-merger

integration to address relevant problems.

Therefore, the management of an organization

should consider preparing the enterprise for such

types of transformation before any concrete M&A

deal is considered. This is to ensure that the

organisation has the right capabilities and systemic

properties (such as flexibility, agility, etc.) required

to perform post-merger integration tasks. We

therefore recommend a preparedness building

program for organisations that want to consider such

strategic moves as future options.

The discussion below presents the proposed

timing of preparedness building (in contrast to the

conventional view of the M&A process) and then

outlines the actual process of preparedness building.

3.1 The M&A Process

Based on the discussion of M&A problems, it is

evident that individual solutions addressing issues

independently are neither feasible nor optimal.

Unfortunately, at the time an actual merger or

acquisition is considered, there is typically not

enough time to spend on comprehensive planning of

post-merger integration. Thus, there seems to be a

contradiction between having to make fast decisions

to seize the opportunity and the need to perform

comprehensive planning.

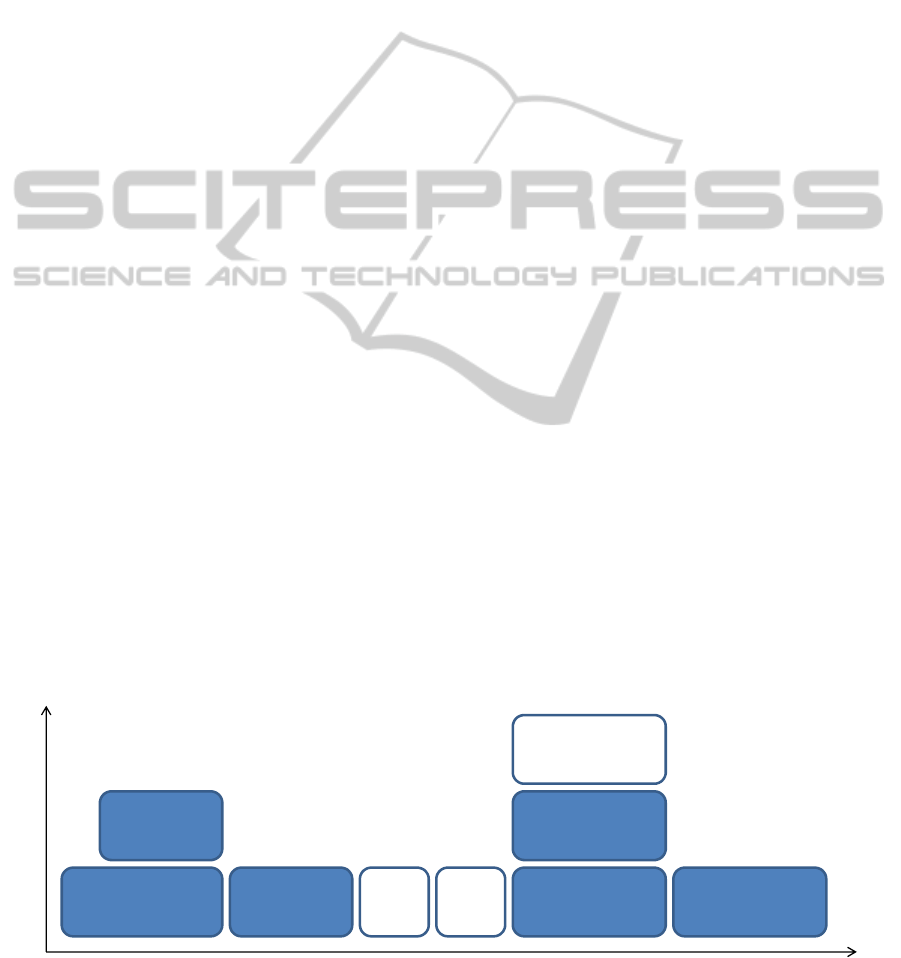

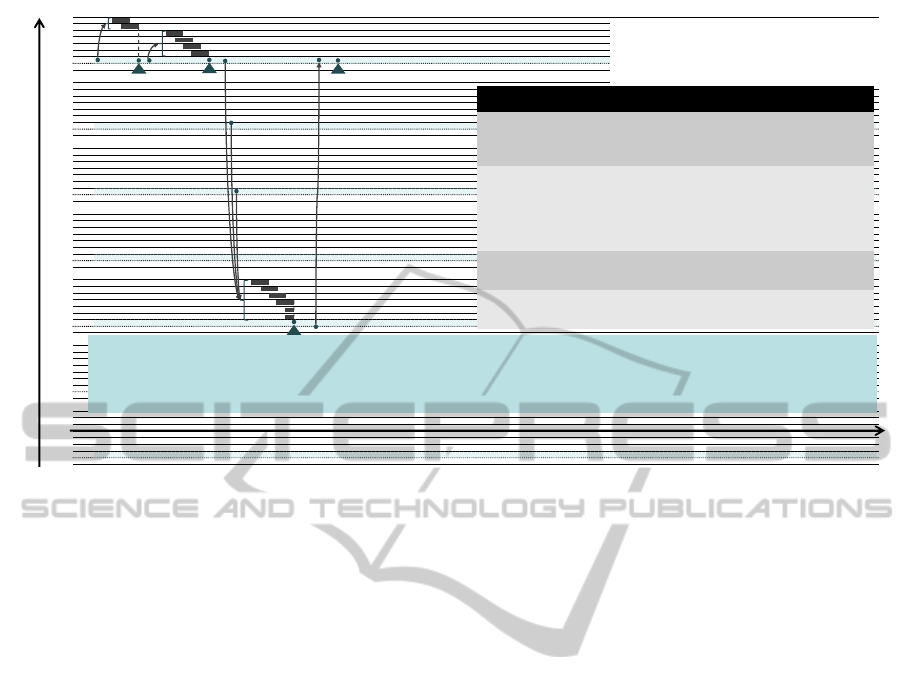

To solve the above problem (as described in

detail in Vaniya (2011) and shown in Figure 1), we

could consider desirable life trajectories of an

enterprise prior to having actual merger or

acquisition plans. Therefore, instead of using the

conventional view of a three-stage M&A process

(Pre-merger, Merger and Post-merger) we introduce

an additional M&A preparedness building stage.

During this stage, some groundwork can be

completed to better position the enterprise, so that by

the time an opportunity is sighted, the enterprise is

in the position to quickly make necessary decisions

and finalise comprehensive integration planning. We

call these activities ‘preparedness building’. They

aim to achieve the acquisition of important systemic

(system level) properties such as flexibility, agility

and interoperability as enablers of future

transformations

Preparedness

Building

Operation Company A

Operation

Company A

(Prepared for

M&A)

Pre-

Merger

Stage

Merger

Day

Operation Company B

Post-Merger

Integration

Stage

Operation Company A

Merged Operation

Stage

Time

OperationalStages

Figure 1: Preparedness Building in M&A Process.

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

202

3.2 The M&A Preparedness Building

Methodology and the

Transformation Process

In the following, we shall demonstrate how to

conduct the Preparedness Building stage shown in

Fig. 1. For this purpose we employ a high-level

three-step reference methodology Vaniya and

Bernus (2012), as follows:

Step 1: Identify Enterprise entities;

Step 2: Show the role of each entity in the

preparedness building transformation;,

Step 3: Demonstrate the relative sequence of

transformational activities, using life history

diagrams.

Step 1 identifies the participating enterprise

entities. They can be existing entities (for example

existing Management team, business units, affected

business processes, IT infrastructure, etc.)

contributing to building preparedness or can be

additional entities required in building preparedness

(for example Preparedness Building Strategic

Program, Gap Analysis Project, Business-, HR- and

IS- Preparedness Building Projects, etc., or even

strategic partners).

Step 2 shows the role of each entity in the

preparedness building transformation. Various

graphical models can be used for this particular step;

we have chosen the so-called ‘dynamic business

models’ proposed by the IFIP-IFAC Task Force

(1999) showing the role of each entity in other

entities’ lifecycle phases.

Step 3 attempts to demonstrate the relative

sequence of transformation activities. This step

follows the previously identified roles of each of the

entities; based on those roles, we first identify

activities to match entities’ responsibilities and then

we establish their relative sequence using so-called

‘Life History Diagrams’ (see section 5.3).

Note that MAPBM aims to serve as a reference

model, with the details and approaches of each step

being adapted to meet the specific business needs,

management decisions and current business

scenarios.

4 CASE STUDY: THE MERGER

OF TWO TERTIARY STUDY

INSTITUTIONS

4.1 Background

Faculty F within university U contained several

schools, with schools A and B having the same

profile. School A is based at two campuses situated

at locations L1 and L2, while school B is based at a

single campus, situated at location L3 (as shown in

the AS-IS state, see Figure 2). Historically, the

schools have evolved in an independent manner,

reflecting

the local specific educational needs and

a) Dean F and HOS MS are

distinct

b) Dean F is also HOS MS

c) HOS MS is one of the DHOS,

nominated by rotation or Pro-

Vice Chancellor

Legend:

F: Faculty

=======================

A…D: schools within F

L1.. L3: physical locations

=======================

SMP: Schools merger project

=======================

VS: Virtual School (VO)

=======================

HOS: Head of School

DHOS: Deputy HOS

PA: Personal Assistant

SAO: School Admin Officer

=======================

L1

L2

C (L1)

B (L3)

D (L3)

F

A

F

MS

L1 L3

AS-IS

TO-BE

L2

SMP

Dean F

HOS MS

DHOS L2

DHOS L1

DHOS L3

Organisation:

One F Dean, one HOS of MS and

a DHOS on each MS campus

a)

b)

c)

c)

a)

c)

HOS C HOS D

PA

PA

PA

PA

SAO

SAO%

SAO

PA

Selected org. model

D (L3)

C (L1)

Figure 2: Rich picture of AS-IS and possible TO-BE states (incl. organisational scenarios).

ExaminingPotentialsofBuildingM&APreparedness

203

demographics. This has led to different

organisational cultures, HR and financial

management approaches. For example, school B

enjoyed a large international student intake

providing funds that supported heavy reliance on

sessional (contract) staff for teaching and wide

availability of discretionary funds. In contrast, staff

in school A had a larger teaching load and had less

funds available due to a smaller student intake.

Staff profile level between schools was

significantly different (i.e. less high-level positions

at school B). Course curriculums also evolved

separately in the two schools, with similarly named

courses containing significantly different material.

Thus, although of the same profile, and

belonging to the same F and U, schools A and B

were confronted with a lack of consistency in their

profiles, policies, services and resources. This

situation caused additional costs in student

administration and course / program design /

maintenance, unnecessary financial losses as well as

staff perceptions of unequal academic and

professional standing between campuses, all of

which were detrimental to the entire faculty.

Therefore, the management of U and F have

mandated that the problems previously described

must be resolved and have defined the goals of

schools A and B becoming consistent in their

products and resources strategy, eliminating internal

competition for students and being subject to a

unique resource management approach. As a

solution, it has been proposed that the schools

should merge into a single, multi-campus Merged

School (MS in the ‘TO-BE’ state in Fig. 2). The

unified MS management and policies would

promote consistency in the strategy regarding the

products delivered and the resources allocated to its

campuses.

After further consultation, the Heads of the

participating Schools have set an organisational goal

allowing the individual campuses to retain a

significant part of their internal decisional and

organisational structure after the merger, perhaps

with an added higher layer of an overall governance

structure. This structure was supported by the HR

department as the simplest to implement and least

painful transition-wise.

From the point of view of Information Services,

the proposed merger presented the opportunity to set

the goal to unify and streamline software and

hardware deployments across campuses.

The business aspect of the merger goals

concerned the elimination of internal competition

(with the potential of increased enrolments and

income) and a unique merged school image that was

more attractive and less confusing to the national

and international prospective market.

4.2 The Results

The Merged School Project has succeeded, albeit

with some difficulties. The decisional, functional,

information, resources and organisational models

created during the merger have helped significantly

to understand the present situation and to select an

optimal future state. The use of languages easy to

understand and able to manage complexity has

resulted in stakeholder buy-in for the project and

middle-management consensus on the essential

aspect of the future Merged School.

Unfortunately however, most modelling and

mappings (including the pre-merger AS-IS

situation!) occurred during the merger project rather

than before; thus, there was insufficient time to

achieve appropriate detail modelling. This has led to

the ‘devil in the detail’ situation: the human

resources allocated to accomplish the merger and

post-merger integration tasks were unable to do so

appropriately due to the lack of proper

understanding of what needed to be done.

In addition to their inappropriate granularity, the

available models were only partially applied. For

example, an organisational model showing changes

in roles and decisional framework in the transition

from the AS-IS to the TO-BE states was

implemented only at the top layer due to the lack of

time and proper preparation. As a result, the new

Head of the Merged School had to spend significant

amounts of time ‘putting out fires’ (finding short

term solutions to re-occurring product / resources

imbalances). Thus, unfortunately the interventionist

and turbulence issues outlined in the pre-merger

(AS-IS) organisational and decisional models were

not effectively addressed.

Staff consultation has taken place; however, a

significant amount of feedback never translated into

changes to the proposed organisational model. This

has reduced the level of acceptance among staff.

Importantly, the detailed process modelling was

never completed and as such the implementation

went ahead without detailed models and guidance, in

a ‘cold turkey’ manner (i.e. overnight changeover)

resulting in a state of confusion as to ‘who does

what, now’ lasting several months and affecting both

staff and clients (students) In other words, there was

little attention given to post-merger integration.

On the positive side, the Merged School did

achieve a unique image, and in time reached an

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

204

increased level of integration and consistency across

campuses and more efficient resource management.

4.3 Lessons Learned

To sum up, there were a few lessons learned from

the successes and short-term failures of this project.

To start with, such a project needs an enduring

‘champion’ in an authoritative management position

in order to back the project for its entire duration.

The modelling processes involved in M&As

must start early; ideally, a reference model

repository should be built in advance and constantly

enriched based on each merger post-mortem. Some

human-specific processes (such as trust building,

negotiations etc) cannot be rushed and thus,

preparedness is key.

The detailed design and implementation phases

of M&As must be properly planned for and

performed. Especially when organisational changes

involving human aspect are involved, suitable detail

must be provided so that people understand their

new/changed roles. Feedback from stakeholders

must be gathered, refined and incorporated in the

final models, being crucial in post-merger

integration.

5 APPLYING

THE PREPAREDNESS

BUILDING METHODOLOGY

Preparedness can be built for announced and

potential M&As. Here the merger partners were

known, therefore this is a case of preparedness

building for an announced merger.

Out of the three categories of issues (as outlined in

section 2.1), major issues presented by the case

study are Business and Management and Human

Resource issues. IS / IT issues are limited to the

challenges in achieving consistency in the way IS

and IT are managed for the involved schools.

Therefore, the aim of preparedness building could be

the following:

Identify obstacles to the transformation and

implement appropriate preventive actions;

Plan for post-merger integration based on the

expected outcomes;

Prepare a Post-Merger Integration (PMI) Plan and

an Integration Strategy

Involve key stakeholders (both schools’

management, administration and academic staff) in

the preparedness building activities

5.1 Step 1: Identify Enterprise Entities

From the discussion of the case study, the entities

affected by preparedness building are the Heads of

Schools (HOSs), academic and administration Staff,

students, services, technical infrastructure and

Information Services.

Preparedness building requires a strategic

program typically governing several projects

covering the proposed organisation-wide change,

running for extended periods. A possible list of the

program and projects involved is: a Preparedness

Building Strategic Program (PBSP), a Business

Preparedness Building Project (BPBP) and a HR

Preparedness Building Project (HRPBP). In practice,

the list of enterprise entities is negotiated between

the project / program managers, key stakeholders

and the relevant governance body.

5.2 Step 2: Show the Role of each

Entity in Preparedness Building

Transformation

The next step is to show how the identified entities

will interact with each other to conduct the

preparedness building transformation. This can be

achieved by developing so-called ‘dynamic business

models’; the models applicable to the case study are

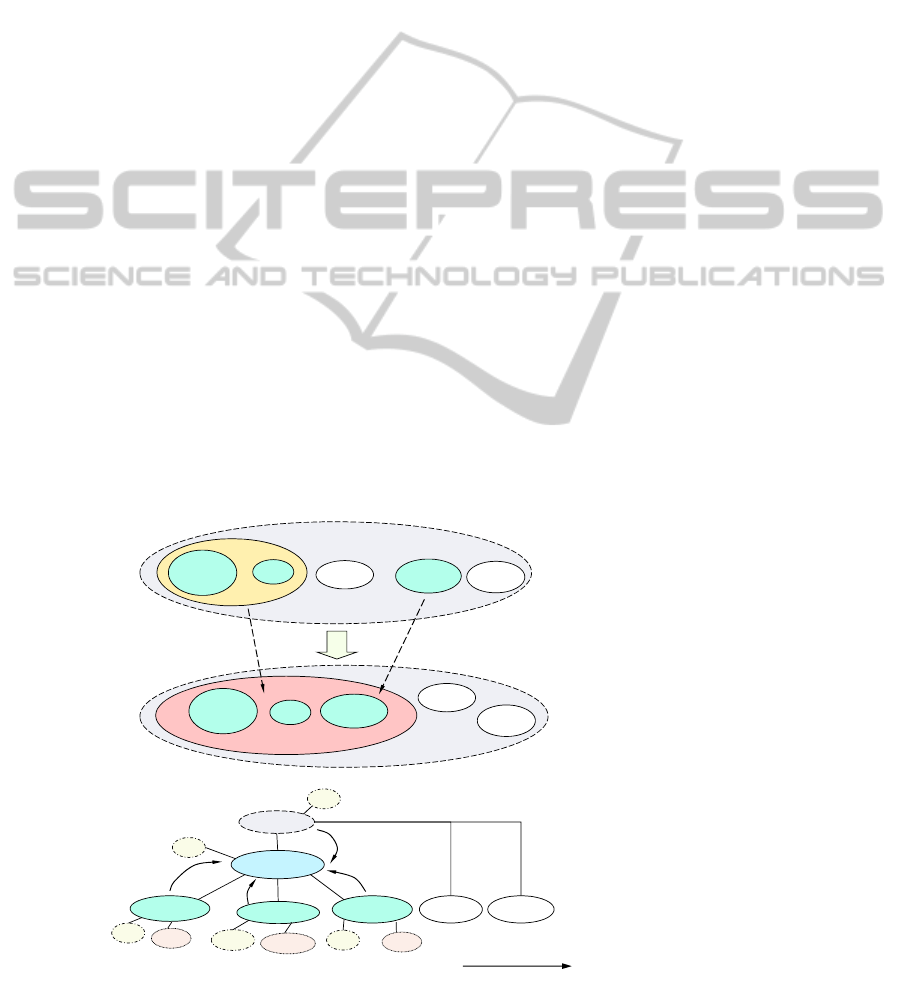

shown in Fig. 3 and Fig. 4. It should be noted that, in

these models, each ‘relationship’ is considered a

contribution of an entity to another entity’s lifecycle

activities; According to ISO 15704, for each

relationship the acting entities would typically use

available reference / partial models to create the

design solution for their particular target entity (see

Appendix A).

Figure 3 shows the role of existing entities in

establishing the required program and project

entities. The management at the University and

Faculty levels in consultation with HOSs of schools

A and B decide to prepare for upcoming M&As.

Therefore they decide, identify, conceptualise and

specify the requirements (mandate) of the

Preparedness Building Strategic Program (PBSP),

structure a strategic management team, and provide

the basis for a master plan of the program

(Relationship 1). Potentially, PBSP management can

be made up of both HOSs, with one of them being

the Program Manager, and key staff of all two

schools in addition to members from University and

Faculty. From here on, PBSP management is

responsible for the design and implementation of

PBSP. In the detailed design, program management

designs the program team, and plans their tasks. This

ExaminingPotentialsofBuildingM&APreparedness

205

planning follows a project-based design to develop

the detailed design of the program (i.e. to identify

projects, their tasks and prepare a mandate for each

project) (Relationship 3); in doing so, the Program

Management Team also seeks the guidance of all

staff of two schools (Relationship 2).

U

1

Staff

A, B

HOS

A, B

F

PBSP

2

3

BPBP

4

6

HRPBP

5

7

8

Legend

U: University HOS: Head of School

F: Faculty A,B: Two schools

PBSP: Preparedness Building Strategic Program

BPBP: Business Preparedness Building Project

HRPBP: HR Preparedness Building Project

Figure 3: Establishment of Preparedness Building Program

& Projects.

For the identified change activities, the PBSP

defines two separate projects which can be called

BPBP (Business-) and HRPBP (HR-) Preparedness

Building Projects with BPBP being the governing

project to maintain the strategic alignment during the

transformation. The PBSP program team identifies

conceptualises and specifies the mandate of BPBP

(Relationship 4) but only identifies and

conceptualises HRPBP (Relationships 5). This is

because HRPBP’s mandate will have to be defined

by the BPBP (Relationships 7). Relationships 6 and

8 represent the self-designing and re-engineering

capabilities of BPBP and HRPBP respectively.

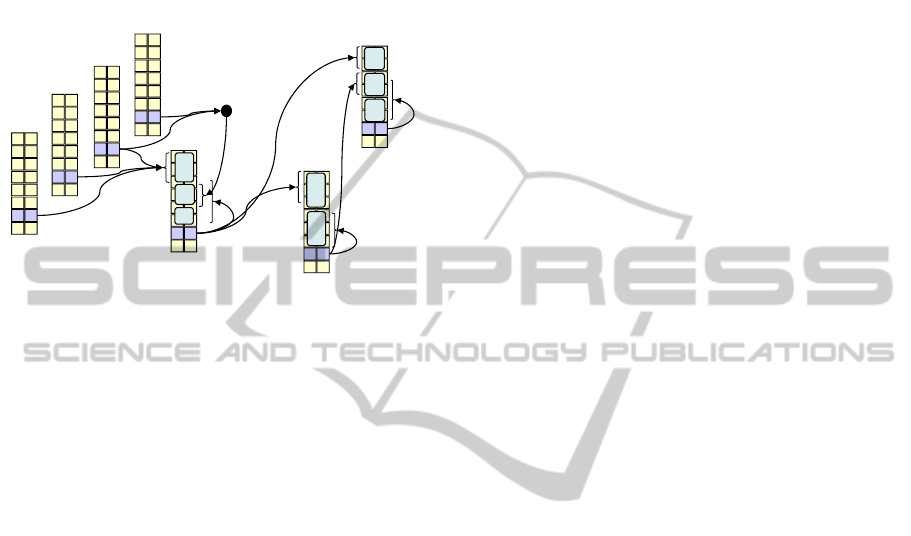

Figure 4 shows the preparedness building

changes initiated by PBSP, BPBP and HRPBP. The

role of PBSP is to govern and monitor the progress

of M&A preparedness building, and the operations

of BPBP as well as HRPBP. BPBP is responsible for

planning and implementing preparedness building

(key tasks: Gap Analysis, Requirement

Specifications, preparing mandates for HRPBP, plan

for business processes & product integration,

improve consistency in current operation). The role

of HRPBP is critical for our case, as HRPBP would

be responsible for preparing staff for the merger,

achieving consistent organisational structure and HR

management practices across the campuses.

Starting with the operation of BPBP, the BPBP

identifies necessary changes at the HOS level to

achieve consistency in managing schools, their staff

and products (Relationship 1). HOSs are the leaders

for their respective schools and they are also part of

the PBSP team, therefore it is necessary to first

implement changes at their level. Such initiatives

reflect that preparedness building has executive

management’s commitment and support.

Similarly, the HRPBP, with the help of BPBP,

suggest equivalent changes for the staff such as

preparing staff for future organisational structure

(Relationship 2). Key transformational activities

may involve identifying and categorising roles that

would become redundant, remain unchanged and

any new roles required after the merger. This would

also require changes into the staff structure and

organisational processes. For example, for a course

offered at multiple campuses we might need a new

role such as Primary Course Convener supervising

(existing) Campus Conveners. In addition these

smaller teams must plan for possible changes into

designs and structures of their respective courses and

should come up with an integration plan for their

respective courses/programs. To reflect such major

changes into organisational structure, the schools

also need to identify changes in current reporting

mechanisms, communication methods, promotion

arrangements. Another major task for HRPBP would

be to plan, initiate and continuously foster the

culture change. Cultural change would be critical for

transforming two competitive teams into a

collaborating one and prevent residual ‘us and them’

feelings that normally result unplanned/unsuccessful

cultural integration. If needed, arrangements should

be available to transition/support the students

affected by the school merger (Relationship 3).

Staff of the two schools must make necessary

changes to their products (Relationship 4). Based on

guidelines from BPBP, major transformational

activities are to analyse the designs of degrees, the

structures and contents of courses, and plan for

making the products consistent across the campuses.

To manage resources effectively, HOSs need to

identify a way to manage and maintain resources in

a unified way. Therefore they must identify and

changes current resource arrangements (Rel’ship 5).

Staff and HOSs of all schools must suggest changes

to existing Technical Infrastructure and IT

Applications/Services, particularly to support post-

merger planning of integrating products.

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

206

PBSP

BPBP

HRPBP

U

F

1

HOS

A, B

2

Staff

A, B

Products

A, B

Resources

IT Applications

/Services

Technical

Infrastructure

4

5

6

7

8

9

10

3

Students

A, B

Figure 4: Transformational Initiatives in Building Preparedness.

After PMI, support is needed for cross-campus

communication and resources sharing. Such changes

support the organisations in preserving the

established M&A Preparedness (Rel’ship 6 & 7).

While making all the precautionary changes in

the current arrangements, BPBP and HRPBP teams

may identify relevant changes at the Faculty and

University levels to maintain the strategic alignment.

Such changes could be in the current policies and

principles, reporting systems, management and

controlling procedures. As noted by Mcdonald,

Coulthard and Lange (2005) such changes in

existing strategy are required for an effective M&A

implementation. Therefore BPBP and HRPBP can

inform the PBSP team about such changes

(Relationship 8). In turn PBSP team recommends

those changes to the Faculty and University

Management (Relationships 9 & 10).

Changes will then be proposed to U&F, which

may approve (or not); nevertheless, they must reach

consensus that can maintain strategic alignment

between M&A strategy and corporate goals, and that

of the Business, HR and IS strategy for M&A

Preparedness building.

In this discussion we have argued that a possible

Preparedness Building Exercise can be planned to

achieve basic systemic properties/design properties,

so that change can become a natural and dynamic

exercise rather than the occasional forceful

imposition on the organisation. In this case study,

there were no explicit shared representations of

processes (in a formal enough manner), which

would have allowed to define the new processes

needed by the merged organisation. Preparedness

building would have entailed the development of

explicit and shared process models. As no resources

were allocated to perform the necessary modelling

even after the merger, the distributed operation of

MS was affected by process inefficiencies.

5.3 Step 3: Demonstrate Relative

Sequence of Transformational

Activities

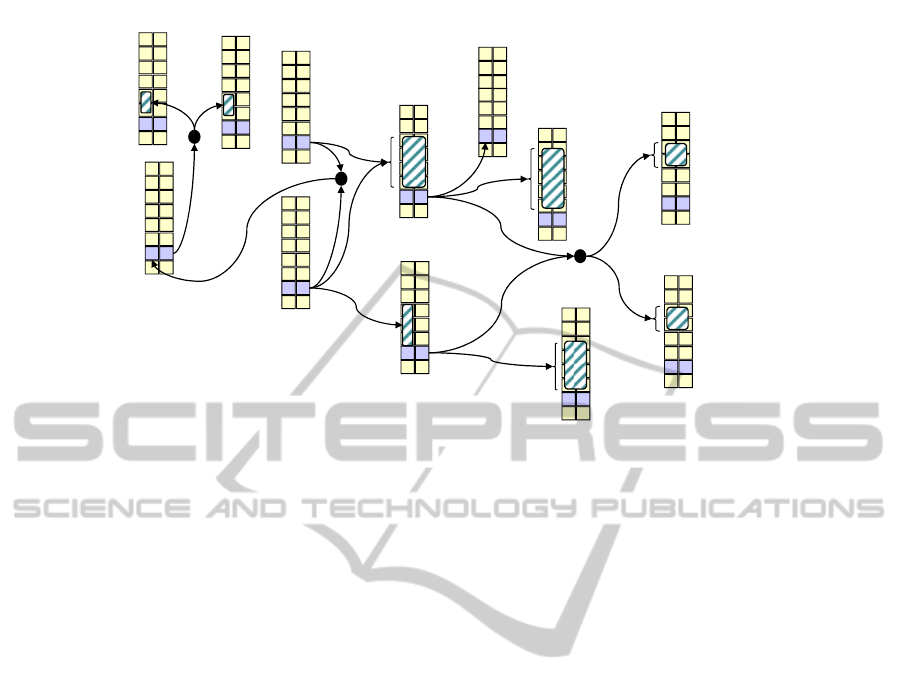

Finally, once the mandate of preparedness building

transformation is finalised, it is important to identify

the detailed activities that must be performed as well

as by whom and when.

For this particular step we have used so-called

‘life history’ diagrams (c.f. ISO 15704), that show

entities and their lifecycle phases on a vertical axis

and time on the horizontal axis. Such diagrams show

major milestones and then may become the basis for

project management charts (such as Gantt). As

explained in Vaniya and Bernus (2012), MAPBM is

developed based on EA concepts using GERAM

(IFIP-IFAC Task Force, 1999, ISO/IEC, 2005).

Figure 5 presents an extract from the set of life

history diagrams developed for the case study. In

such diagrams we can also show the concurrent

activities such as activity 3 as shown in Fig. 5.

ExaminingPotentialsofBuildingM&APreparedness

207

I

C

R

AD

DD

B

O

D

U

I

C

R

AD

DD

B

O

D

F

I

C

R

AD

DD

B

O

D

HOSs

I

C

R

AD

DD

B

O

D

Staff

I

C

R

AD

DD

B

O

D

PBSP

I

C

R

AD

DD

B

O

D

BPBP

I

C

R

AD

DD

B

O

D

HRPBP

1

1

2

2

No Mi Description

3A,

3B,

3C

The strategic management team identifies PBSP and

develops the concept, tasks and the master plan of

the program.

3 The strategic management team have prepared the

program master plan as an opportunity building

program proposal including a draft of the business

plan which covers the estimated time, risk and

resources

4 The strategic management team submits the M&A

PBSP proposal to U.

4 The PBSP proposal has been approved in principle by

U.

3A

3

4

4

3B

3C

Abbreviations

U: University F: Faculty HOSs: Heads of Schools PBSP: Preparedness Building Strategic Program

BPBP: Business Preparedness Building Project HRPBP: HR Preparedness Building Project

The Life History Diagram of the M&A

Preparedness Program

• Numbered arrows represents events (No.)

• Numbered triangles represents milestones (Mi)

Time

Entities and their Lifecycle Phases

Figure 5: An example of Life History Diagram for Preparedness Building.

6 CONCLUSIONS AND FUTURE

RESEARCH

The paper has reviewed three categories of issues

that are commonly considered the reason for high

failure rates for M&As. Using a systems view of

enterprise transformation (based on an EA

approach), we have identified a contradiction

between the need to address post-merger integration

planning in detail and the usual time pressure when

an M&A deal is considered.

Our main contribution is that we proposed a

solution called ‘preparedness building’, that allows

enterprises to consider M&As as strategic possibility

(even if not actual yet), and determine what systemic

changes are necessary in the three categories

(business, IS / IT and HR), so that the organisation

can develop flexibility in these areas. To achieve

such preparedness building requires strategic

initiative and organisational change. Given the

complexity of this transformation we used an

Enterprise Architecture approach to demonstrate

how a simultaneous transformation of business, HR

and IS/IT aspects can be orchestrated to achieve

M&A preparedness as a systemic property of the

enterprise. We have also discussed a case study, and

what areas could have been addressed by the

proposed preparedness building methodology, so as

to improve the speed and efficiency of the Merger

that was eventually completed.

The proposed M&A Preparedness Building

Methodology could be evolved into a Preparedness

Building package aiming to improve M&A success

rate by addressing the root causes of issues, so that

an enterprise is ready for M&As and similar

enterprise-wide change endeavours. It is also

important to have a mechanism to determine

whether the organisation is ready for the desired

type of M&A. Based on such a determination, a

prescriptive list of activities can be provided as a

roadmap towards building preparedness for the

desired type of M&A. Therefore, research is in

progress to develop the checklist of key M&A issues

and their solutions, define the state of M&A

Preparedness in terms of systemic properties and

develop an optimal list of M&A Preparedness

Building Activities for different types of M&As.

For the above goals, a mixed-method research

will involve an international survey and follow-up

semi-formal interviews to consider industry response

to the M&A Preparedness Building Methodology

development. The results of this research will also

be verified by an expert panel consisting of M&A

practitioners and researchers.

REFERENCES

Alaranta, M. and Henningsson, S. (2008). An approach to

analyzing and planning post-merger IS integration:

Insights from two field studies. Information Systems

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

208

Frontiers, 10(3), 307-319,

Bannert, V. and Tschirky, H. (2004). Integration planning

for technology intensive acquisitions. R&D

Management, 34(5), 481-494.

Baro, G. A., Chakrabarti, A. and Deek, F. (2008).

Organizational and Informational System Factors in

Post-Merger Technology Integration. AMCIS 2008

Proceedings, Paper 359, http://aisel.aisnet.org/

amcis2008/359.

Bhaskar A. U. (2012). HR as business partner during

mergers and acquisitions: The key to success is to get

involved early. Human Resources Management

International Digest, 20(2), 22-23,

Cartwright, S. and Schoenberg, R. (2006). Thirty years of

mergers and acquisitions research: Recent advances

and future opportunities. British Journal of

Management, 17(S1-S5), 1-5.

Chatterjee, S. (2009). The Keys to Successful Acquisition

Programmes. Long Range Planning, 42(2), 137-163,

DiGeorgio, R. (2002). Making mergers and acquisitions

work: What we know and don’t know – Part I.

Journal of Change Management, 3(2), 134-148.

Doorewaard, H. and Benschop, Y. (2003). HRM and

organizational change: an emotional endeavor. J of

Organizational Change Management, 16(3), 272–286,

Eckert, M., Freitag, A., Matthes, F., Roth, S. & Schilz, C.

(2012). Decision support for selecting an application

landscape integration strategy in mergers and

acquisition. ECIS 2012 Proceedings, Paper 88,

http://aisel.aisnet.org/ecis2012/88.

Epstein, M. J. (2004). The Drivers of Success in Post-

Merger Integration. Organizational Dynamics, 33(2),

174-189, doi:10.1016/j.orgdyn.2004.01.005.

Epstein, M. J. (2005). The determinants and evaluation of

merger success. Business Horizons, 48, 37-46

Giacomazzi, F., Panella, C., Pernici, B. and Sansoi, M.

(1997). Information Systems integration in mergers

and acquisitions: A normative model. Information &

Management, 32, 289-302.

Henderson, J. and Venkatraman, N. (1993). Strategic

alignment: Leveraging information technology for

transforming organization. IBM Systems Journal,

32(1), 4-16.

Hwang, M. (2004). Integrating Enterprise Systems in

Mergers and Acquisitions. AMCIS 2004 Proceedings,

Paper 12, http://aisel.aisnet.org/amcis2004/12.

IFIP-IFAC Task Force. (1999). The generalised enterprise

reference architecture and methodology (GERAM).

Retrieved May 1, 2010, from http://

www.ict.griffith.edu.au/~bernus.

ISO/IEC. (2005) 'Annex A: GERAM'. In ISO/IS

15704:2000/Amd1:2005: Industrial automation sys-

tems - Requirements for enterprise-reference

architectures and methodologies,

ISO/IEC. (2007) ISO/IEC 42010:2007: Recommended

Practice for Architecture Description of Soft-ware-

Intensive Systems,

Kumar, R. (2009). Post-merger corporate performance: an

Indian perspective. Management Research News

32(2), 145-157.

Larsen, M. H. (2005). ICT Integration in an M&A

Process. PACIS 2005 Proceedings, Paper 95,

http://aisel.aisnet.org/pacis2005/95.

Lauser, B. (2009). Post-merger integration and change

processes from a complexity perspective. Baltic

Journal of Management, 5(1), 6-27

Mcdonald, J., Coulthard, M. and Lange, P. D. (2005).

Planning for a Successful Merger or Acquisition:

Lessons from an Australian Study. Journal of Global

Business and Technology, 1(2), 1-11.

Mehta, M. and Hirschheim, R. (2007). Strategic

Alignment In Mergers And Acquisitions : Theorizing

IS Integration Decision making. Journal of the

Association for Information Systems 8(3), 143-174.

Mo, J. P. T., and Nemes, L. 2009. Issues in Using

Enterprise Architecture for Mergers and Acquisitions

(235-262). In G. Doucet, J. Gotze, P. Saha, & S.

Bernard (Eds.) Coherency Management. Author

House, Bloomington Indiana.

Rodriguez, A. (2008). Mergers and Acquisitions in the

Banking Industry: The Human Factor. Organization

Development Journal, 26(2), 63-74.

Ross, J.W., Weill, P. and Robertson, D.C. (2006).

Enterprise architecture as strategy: Creating a

foundation for business execution. Harvard Business

School Press, Boston, Massachusetts.

Schuler, R. and Jackson, S. (2001). HR issues and

activities in mergers and acquisitions. European

Management Journal, 19(3), 239-253,

Stylianou, A. C., Jeffries, C. J. and Robbins, S. S. (1996).

Corporate mergers and the problems of IS integration.

Information & Management, 31, 203-213

Vaniya, N. (2011). Building Preparedness for M&As: The

role of EA practice. Retrieved September 25, 2011

from www.ict.griffith.edu.au/cearm/docs/pubs/vaniya-

2011a.pdf

Vaniya, N. & Bernus, P. (2012). Strategic Planning to

build Transformational Preparedness: An Application

of Enterprise Architecture Practice. ACIS 2012

Proceedings, http://dro.deakin.edu.au/view/DU:3004

9142.

Vernadat, F.B. (2007). Interoperable enterprise systems:

Principles, concepts, and methods. Annual Reviews in

Control, 31, 137-145

Walsh, J. P. (1989). Doing a deal: Merger and acquisition

negotiations and their impact upon target company top

management turnover. Strategic Management Journal,

10, 307-322

Walter, I. (2004). Mergers and acquisitions in banking and

finance. Oxford University Press, New York.

Wijnhoven, F., Spil, T., Stegwee, R. and Fa, R.T.A.

(2006). Post-merger IT integration strategies: An IT

alignment perspective. Journal of Strategic

Information Systems, 15, 5-28.

ExaminingPotentialsofBuildingM&APreparedness

209

APPENDIX A

Some Basic Ea Concepts

Some concepts of Enterprise Architecture (EA) as

defined in GERAM (a standardized generalization of

EA framework concepts IFIP-IFAC Task Force

(1999) and ISO 15704), are explained below.

Enterprise Entities: GERAM defines the concept

of Enterprise Entities (EEs) through exemplification.

EEs are managed / controlled systems that have a

mandate or purpose. One can categorise entities

according to how they contribute to the life of other

entities. For example, Strategic Enterprise

Management Entities may create Change

Programmes, Change Programmes may create

Change Projects, these in turn may create or change

Business Units, which in turn may change or create

Products etc. (GERAM calls these ‘recursive’ type

definitions).

Lifecycle: GERAM defines the concept of life cycle

as an ordered list of activity types (or functions) that

consider an entity on various levels of functional

abstraction. (I.e. the ordering is based on one

function’s output constraining the next function’s

input). This ordering is not temporal (because

feedbacks exist among life cycle activities). ‘Life-

cycle phases’, or ‘life cycle activity types’

associated with the life of an entity shown in Figure.

Life History: The life history of an entity is the

representation in time of life cycle activity instances

carried out on the particular entity during its entire

life span (IFIP-IFAC Task Force (1999) and ISO

15704). In a sense by building the life history

diagrams of all involved entities in an organizational

change effort, one can describe all required

organizational processes and operations to carry out

that organizational change. Interestingly such life

history diagrams can help to anticipate and

systematize the operational structures of processes;

for example, identification of all involved processes,

prioritization of those processes, identification of

sequence of processes, identification of parallel

processes, etc. At any moment in time multiple

activity instances may be active on the same entity,

in parallel.

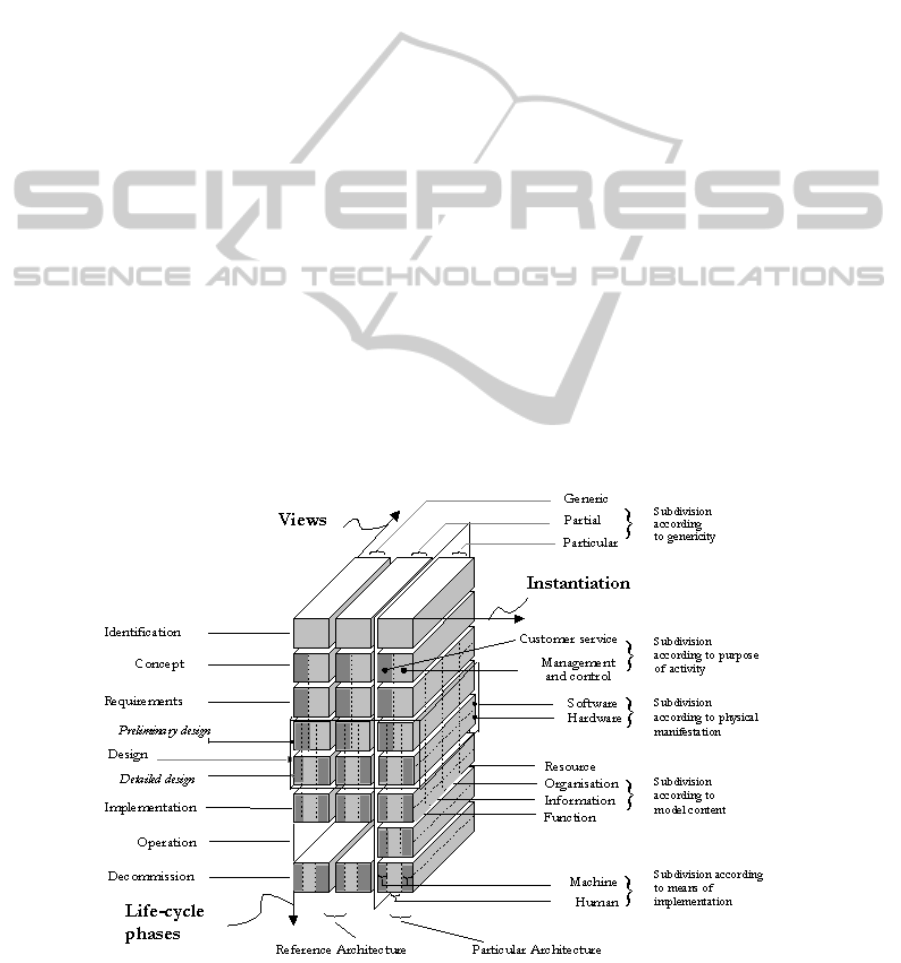

Viewpoints: Viewpoints (originally called views in

GERAM 1.6.3) are categorized in GERAM’s GERA

‘modelling framework’, and represent types of

models which may be created at various levels of

abstraction to answer various concerns about the

Enterprise Entity. These types of models may be

categorized according to Model Content, Entity

Purpose, Entity Implementation and Physical

Manifestation. The following discussion briefly

explains these four types.

Figure 6: GERA Modelling Framework with Lifecycle Phases, Viewpoints.

Source: (IFIP-IFAC Task Force (1999) and ISO 15704)

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

210