Secure Second Price Auctions with a Rational Auctioneer

Boaz Catane and Amir Herzberg

Department of Computer Science, Bar Ilan University, Ramat Gan, 52900, Israel

Keywords:

Auctions, Cryptographic Auction Schemes, Cryptographic Protocols, Vickrey Auctions.

Abstract:

We present novel security requirements for second price auctions and a simple, efficient and practical pro-

tocol that provably maintains these requirements. Novel requirements are needed because commonly used

requirements, such as the indistinguishability-based secrecy requirement of encryption schemes presented by

(Goldwasser and Micali, 1982), do not fit properly in the second price auctions context. Additionally, the pre-

sented protocol uses a trustworthy supervisor that checks if the auctioneer deviated from the protocol and fines

him accordingly. By making sure the expected utility of the auctioneer when deviating from the protocol is

lower than his expected utility when abiding by the protocol we ascertain that a rational auctioneer will abide

by the protocol. This allows the supervisor to optimize by performing (computationally-intensive) inspections

of the auctioneer with only low probability.

1 INTRODUCTION

Various types of auctions are used worldwide (En-

glish, Dutch, sealed bid, etc.), each with its own

advantages and disadvantages. Special interest has

been given to second

1

price sealed bid auctions (also

known as Vickrey auctions (Vickrey, 1961)), because

of their efficiency and simplicity: each bidder sends

only a single sealed bid, and the winning bidder

(sender of the maximal bid) pays the amount of the

second (or k

th

) highest bid. The optimal strategy for

players is to bid their true valuation of the goods,

hence these auctions are executed efficiently and se-

curely (assuming rational bidders).

In sealed bid auctions, the auctioneer advertises

the auction details, receives sealed bids and declares

the winner and the price she

2

has to pay for the goods

(the clearing price). Many works on such auctions fo-

cus on the actions taken by the bidders and regard the

auctioneer as part of the auction mechanism, assum-

ing he abides by the protocol. Because in such sealed

bid auctions only the auctioneer sees the bids and de-

clares the auction’s outcome, a ‘real world’ auction-

eer may misbehave, e.g. output false results or insert

a fictitious bid just below the highest honest bid to de-

ceitfully raise the clearing price. Hence, a mechanism

1

For simplicity, we focus on second price auctions, but

our results apply also to k

th

price auctions.

2

For clarity, we use ”she”, ”her”, etc. to refer to the

bidders, and ”he”, ”his”, etc. for other entities.

that carries out an auction correctly even in the face

of a misbehaving auctioneer is required.

We present a simple and efficient protocol ensur-

ing that a rational auctioneer will not misbehave, i.e.,

his expected utility from outputting the wrong out-

come or dishonestly affecting the outcome will be

lower than his expected utility when outputting the

auction’s true outcome. The protocol is based on a

trusted supervisor, that (randomly) inspects the out-

come reported by the auctioneer; we show that infre-

quent random inspections are sufficient to ensure that

a rational auctioneer will operate correctly. This is

significant since the supervisor - in our protocol and

other protocols - is an external entity trusted by both

bidders and auctioneer, which implies significant pro-

cessing costs.

1.1 Auctions: Entities and Interests

So far, there were only few real-world applications of

secure auction protocols, in spite of the many works

and protocols published. One reason for this may be

that existing proposals are rather complex, conceptu-

ally and computationally. Our goal is to design a sim-

ple and practical protocol for secure auctions.

A secure auction protocol would protect the in-

terests of all parties: bidders, auctioneer and owner.

Since these interests may be conflicting, we assume

the parties agree on an additional trusted party, whom

we refer to as the supervisor. The roles and interests

158

Catane B. and Herzberg A..

Secure Second Price Auctions with a Rational Auctioneer.

DOI: 10.5220/0004526101580169

In Proceedings of the 10th International Conference on Security and Cryptography (SECRYPT-2013), pages 158-169

ISBN: 978-989-8565-73-0

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

of the parties are as follows:

Owner. The entity owning goods to be auctioned.

The owner wants to receive a maximal price for

the goods, and in particular to receive the value of

the second-highest bid (minus the fee paid to the

auctioneer, if it exists).

Bidders. Parties that are interested in buying the auc-

tioned goods. They send sealed bids to the auc-

tioneer in order to win the auction. The winning

bidder is a bidder that bid the highest bid. The

winner pays no more than her bid and receives the

goods. Bidder interests include confidentiality of

the submitted bids (from other bidders and from

the auctioneer, at least while the auction takes

place), and integrity of the auction’s result (i.e.

that the correct (highest bidding) bidder wins and

that she is charged the correct amount offered in

the second-highest bid).

Auctioneer. Manages the auction by receiving bids

and outputting the winning bidder and the clear-

ing price. The auctioneer (usually) is a proxy for

the owner of the goods. Note that the auctioneer

may also be interested in purchasing the goods,

and may participate in the auction as a bidder by

inserting his own bids.

Supervisor. An entity trusted by the bidders and

owner which is used to ensure that the auction-

eer operates correctly and does not try to cheat.

The auctioneer also trusts the supervisor to oper-

ate adequately, e.g. to follow the protocol and al-

low the auction to end correctly. In practice, in

order for all parties to trust the supervisor he may

be implemented using tamper-resistant hardware

running attested-software, or using a set of mul-

tiple machines operated by different entities for

redundancy; both cases imply significant compu-

tational and communication costs. To decrease his

(amortized) work, the supervisor only checks the

auctioneer randomly; we show that this suffices

(for a rational auctioneer).

1.2 Contribution

This paper’s contributions are:

1. Presentation of novel security requirements ap-

propriate for second price auction schemes. These

requirements include validity, rational correct-

ness, secrecy and non-malleability. The com-

monly used encryption related security require-

ments, such as the indistinguishability-based se-

crecy (Goldwasser and Micali, 1982), do not

fit properly in the auctions context since an ad-

versary may legitimately learn some information

about bids (see Section 1.4).

2. Presentation of a simple and practical auction

scheme that provably maintains the aforemen-

tioned requirements. This is achieved using a

trusted supervisor that randomlyvalidatesthe auc-

tioneer’s behavior, which enables the protocol to

be very efficient.

1.3 Goals and Protocol Overview

Our protocol’s goals are threefold: Firstly, keep bids

secret from other bidders and from auctioneer until

the end of the bidding phase. If bids are not secret

then a correct clearing price cannot be guaranteed.

A malicious bidder might insert a bid that is only

slightly lower than the highest honest bid, resulting in

a fictitiously high clearing price. This goal is achieved

by using cryptographic tools such as encryption.

Secondly, minimize the trust in the auctioneer. In

sealed bid auctions the auctioneer declares the auc-

tion’s outcome after he alone receives all bids, which

are kept secret from all other entities. Such an entity

can easily manipulate the auction’s results by adding

or removing bids or by declaring false outcome. Min-

imizing the trust in the auctioneer is needed if bidders

are to participate in such an auction. This is attained

in the presented protocol by modeling the auctioneer

as a rational adversary and having a supervisor fine

him in case a false outcome is detected. The fine

is high enough such that the auctioneer’s expected

utility when abiding by the protocol is higher than

when cheating. Thus, a rational auctioneer will not

cheat. The supervisor, as opposed to the auctioneer,

is trusted either because he has less motivation to de-

viate from the protocol (since the bidders do not send

him money at any stage of the protocol) or because his

computation is done using secure and costly means

(e.g. secure hardware or secure multiparty computa-

tion).

Thirdly, have a practical and efficient protocol.

This goal, which is of utmost importance in our

scheme because of the use of costly means to imple-

ment a trusted supervisor, is achieved by using the

supervisor occasionally, i.e. only with some (small)

probability.

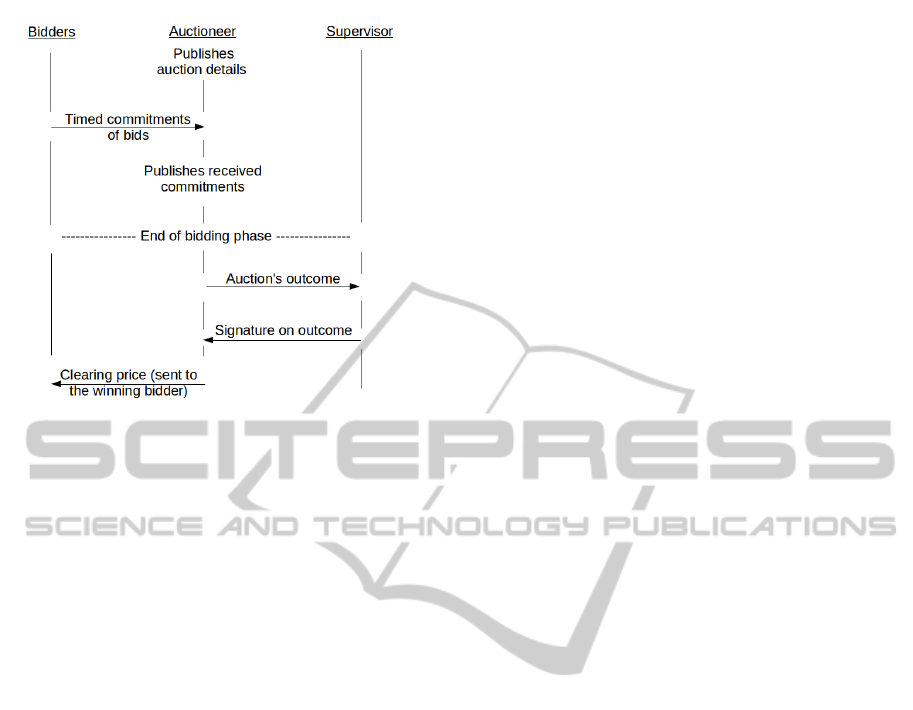

Figure 1 shows the high level overview of the pre-

sented protocol. In it, the auctioneer publishes the

auction details (e.g. item to be auctioned, deadline for

bid commitment submission, etc.), and bidders send

timed-commitments of their bids to the auctioneer.

The commitments are timed such that the auctioneer

is able to reveal the value of the bids but not before

the end of the bidding phase. The auctioneer pub-

SecureSecondPriceAuctionswithaRationalAuctioneer

159

Figure 1: Overview of the presented protocol: Auctioneer

publishes auction details. Bidders send timed-commitments

of bids to Auctioneer, and Auctioneer publishes them. After

the bidding phase Auctioneer sends the computed auction’s

outcome to Supervisor. After Supervisor signs on the out-

come Auctioneer sends clearing price to the winning bidder.

lishes the received commitments on a bulletin board

(e.g. the auctioneer’s website). After the end of the

bidding phase the auctioneer computes the auction’s

outcome (i.e. winning bidder and clearing price). The

supervisor (possibly) verifies auction’s outcome. If he

detects that the auctioneer tried to cheat he fines the

auctioneer. Otherwise, the supervisor signs the out-

come and sends his signature to the auctioneer. The

auctioneer then sends the supervisor-signed outcome

to the winning bidder.

Loosely speaking, the protocol ensures it will not

be beneficial for the auctioneer to cheat, i.e. devi-

ate from the protocol. Auctioneer’s cheating may

include influencing the auction’s outcome in a vari-

ety of ways: First, he can ignore bid commitments.

Second, the auctioneer can declare arbitrary false re-

sults (wrong winning bidder or wrong clearing price).

Third, the auctioneer can use knowledge about re-

ceived bids to add or remove specific bids. This may

influence the auction’s outcome in different ways:

1. After opening the commitments and seeing all

bids the auctioneer might insert a bid that is only

slightly lower than the highest honest bid. This

will make the winning bidder pay a fictitiously

high clearing price.

2. The auctioneer might insert in advance many dif-

ferent bids. After seeing the honest bids he might

remove bids that he inserted and that are higher

than the highest honest bid but leave the rest,

again making the winning bidder pay a fictitiously

high clearing price.

The protocol ensures that deviation from the protocol

would not be the auctioneer’s rational move.

Notice that some actions taken by the auctioneer

to influence the auction’s outcome are legitimate, and

do not result in a fine; in our formal modeling of utili-

ties these actions are legitimate and do not harm other

parties, although arguably in a practical deployment

some of these actions may be deemed inappropriate.

Firstly, the auctioneer may insert (himself or by a col-

laborating bidder) a commitment for a bid, and in case

his bid is the highest bid he wins the auction. This ef-

fectivelyintroducesa minimal price for the goods (i.e.

inserting such a bid ensures that the goods will not be

sold for a price lower than the auctioneer’s bid). This

is a legitimate strategy and we do not try to prevent

it. Secondly, in case of a tie (e.g. a few bidders bid

the highest bid) the auctioneer may choose a winner

arbitrarily. Such actions are not considered a fraud

since no bidder is harmed: The winning bidder pays

an amount equal to her bid (i.e. the second highest

bid) and receives the goods which she values as equal

to the paid price. Likewise, other bidders do not pay

or receiveanything and so no damage is inflicted upon

them. In reality, there may be some objection to this

modeling, e.g., since bidders may have preferred to

bid elsewhere, but this is not captured by the usual

modeling of utilities and will require further research.

1.4 Related Work

Auctions are a well studied subject; a few of the many

good references in this area include (Engelbrecht-

Wiggans, 1980; Milgrom and Weber, 1982; Klem-

perer, 2004). Special interest is given to second price

auctions (also known as Vickrey auctions) (Vickrey,

1961), in which the bidders’ optimal strategy is to bid

their true value of the auctioned goods.

Much work on the use of cryptography for con-

ducting secure auctions has focused on the goal of

complete privacy, where no one (including the auc-

tioneer) learns information about the bids even after

the auction has ended (e.g. (Harkavy et al., 1998;

Naor et al., 1999)); unfortunately, these solutions

have high computational requirements. Our proto-

col is much more efficient and hence more practi-

cal, although allowing the auctioneer and supervisor

to learn the values of the bids (but only after the end

of the bidding phase).

Some protocols achieve complete privacy by

bidder-resolved multi-party computation (Brandt,

2006). However, in many cases privacy is achieved

by using third parties, either through numerous auc-

tioneers or by asymmetric models in which in addi-

tion to the auctioneer the entity of a supervisor (or

SECRYPT2013-InternationalConferenceonSecurityandCryptography

160

auction issuer) is assumed (Naor et al., 1999; Lip-

maa et al., 2003). Parkes et al. (Parkes et al., 2008)

settle for verifiable correctness and trustworthiness in

combination with complete secrecy to all parties ex-

cept the auctioneer. However, their scheme demands

considerable time for preparation and verification of

auctions.

In contrast to the aforementioned work, we define

and require novel security requirements to capture the

notions of correctness, secrecy, and non-malleability

in the auctions context. Past works did not formally

define these requirements or even require all of them,

e.g. non-malleability, although using malleable en-

cryption for preserving bid secrecy can be disastrous,

as shown by Dolev et al. (Dolev et al., 1991). In addi-

tion, close observation reveals that the indistinguisha-

bility based secrecy definition (Goldwasser and Mi-

cali, 1982) commonly used for encryption schemes is

not fit for use in auctions, since an attacker may distin-

guish between encrypted messages and win the cryp-

tographic experiment by using legitimately learned

information about encrypted bids (i.e. the identity

of the winning bidder or the clearing price). Thus,

we settle for complete secrecy for all bidders (but

not the auctioneer or supervisor) and non-malleability

of bids, and analytically prove correctness. This is

achieved by using a supervisor and assuming the auc-

tioneer will deviate from the protocol if and only if it

maximizes his utility function.

In the following protocol we use timed commit-

ments. The general notion of timed cryptography

(e.g. an encrypted message that can only be decrypted

after a predetermined amount of time has passed)

was first introduced by (Rivest et al., 1996). Timed-

commitments, a commitment scheme in which there

is an optional forced opening phase enabling the re-

ceiver to recover (with effort) the committed value

without the help of the sender, were later presented

by (Boneh and Naor, 2000). Although their scheme

is sound, it has considerable computational overhead.

We note that our scheme can be adapted to use their

cryptographic primitive, but for efficiency reasons we

implement timed-commitments using a Time Lapse

Cryptography (TLC) Service that is similar to the one

presented in (Rabin and Thorpe, 2006). This TLC

service provides a commitment scheme which, in ad-

dition to the general hiding and binding properties of

commitments, ensures that the committed value can

be revealed at an exact time in the future even without

the help of the committing party.

A privacy and efficiency comparison of various

protocols is presented in Table 1. For each protocol

we count the (average) number of modular exponen-

tiations computed by each entity.

1.5 Current and Full Paper Versions

Some parts of this paper were omitted in the current

version due to lack of space and will appear only in

the full version

3

. The omitted parts include:

• Full proofs showing that the presented scheme

maintains all security requirement. In this version

only proof sketches are presented.

• Discussion about adversarial bidders. The current

version discusses only an adversarial auctioneer.

• Discussion regarding future research.

2 PRELIMINARIES

2.1 Model

In the supervised auction model there are n bidders

participating in an online sealed bid second price auc-

tion with an untrusted auctioneer. Each bidder ψ has

a private valuation v

ψ

for the goods being auctioned,

and each sends her bid b

ψ

to the auctioneer. Note that

in a second price auction bidding one’s true valuation

is the optimal strategy (i.e. b

ψ

= v

ψ

). The auction-

eer should output (ψ

win

, p) where ψ

win

is the winning

bidder (i.e. a bidder that bid the highest bid) and p

is the amount she has to pay (i.e. the clearing price,

which is equal to the second highest bid). If it maxi-

mizes his utility function, the auctioneer might output

different values than the true values of (ψ

win

, p). In

order to prevent him from deviating from the proto-

col and outputting false results a trusted third party, a

supervisor, checks the auction’s outcome, settles dis-

putes, and fines the auctioneer (if needed).

2.2 Time Lapse Cryptography Service

In the presented protocol we use timed-commitments

for hiding the bid values until the end of the bidding

phase. Implementation of timed-commitments can

be done using cryptographic methods, as presented

by (Boneh and Naor, 2000). For efficiency reasons,

our protocol uses a Time Lapse Cryptography (TLC)

Service resembling the one presented by Rabin and

Thorpe (Rabin and Thorpe, 2006). The TLC service

provides a cryptographic timed-commitment protocol

that enables the use of commitments with the classi-

cal hiding and binding properties. In addition, it pre-

vents bidders from refusing to open committed bids

3

The full version will be available at http://

eprint.iacr.org/

SecureSecondPriceAuctionswithaRationalAuctioneer

161

Table 1: Comparison of various secure auction schemes. Legend: n - Number of bidders; α - Probability that a third party

verifies auctioneer’s output; l - Maximum number of bits needed to represent a single bid; k - A constant used in (Parkes et al.,

2008).

Protocol Bids Privacy Kept No. of Modular Exponentiations

Single Bidder Auctioneer Third Party

Boneh and Naor, 2000 None 1 0 N/A

Our protocol From other bidders 2 2n+ 1 2+α(n−1)

Parkes et al., 2008 From other bidders n+ 5 kn + 3

(typically

k > 5400)

n

Lipmaa et al., 2003 From bidders and

Auctioneer. Third

party learns bid

statistics

O(l) O(2

l

) O(l)

Naor et al., 1999 From all entities O(l) O(nl) O(nl)

Juels and Szydlo, 2003 From all entities 2 (+ O(l) modular

multiplications)

O(nl) O(nl)

and also prevents the auctioneer from dropping re-

ceived commitments after he published them, claim-

ing not to have been able to open the committed bids.

The supervisor, acting as the TLC service provider,

publishes a public key of a non-malleable encryption

scheme before the auction begins, and sends the cor-

responding private key only when no new bids can be

sent (i.e. after the bid submission deadline).

Whenevertimed commitments are used in the pro-

tocol it is to say that a bidder encrypts her bid using

the supervisor-generated public encryption key. This

encrypted bid is to be opened later by the auctioneer

after receiving the corresponding decryption key.

2.3 Notation

If A is a probabilistic polynomial time (p.p.t) algo-

rithm that runs on input x, then A(x) denotes the ran-

dom variable corresponding to the output of A on in-

put x and uniformly random coins. In addition, we de-

note computational indistinguishability (Goldwasser

and Micali, 1984) of ensembles A and B by A

c

≈ B.

We will need to discuss vectors of values. A vec-

tor is denoted in bold font, as in x. We denote by |x|

the number of components in x, and by x.i the i-th

component, so that x = (x.1, ..., x.|x|). We extend set

membership notation to vectors, writing e.g. x ∈ x to

mean that x is in the set {x.i : 1 ≤ i ≤ |x|}. We also

extend the notation for algorithms with variables as

input to accept also vectors as input with the under-

standing that operations are performed component-

wise. Thus if A is an algorithm then x ← A(y) is

shorthand for the following: for 1 ≤ i ≤ |y| do x.i ←

A(y.i).

We will consider relations of arity d where d will

be polynomial in the security parameter k. Rather

than writing R(x

1

, . . . , x

d

) we write R(x, x) meaning

that the first argument is special and the rest are

bunched into a vector x with |x| = d − 1.

Regarding the auctioneer’s utility we use the fol-

lowing notations:

U denotes the auctioneer’s utility when abiding by

the protocol. This utility comprises the salary he

receives for functioning as an auctioneer plus any

rightfully won auction gains (in case he bid and

won the auction).

U

+

σ

denotes, for a given cheating (i.e. deviating from

the protocol) strategy σ, the auctioneer’s utility

when playing σ and not being caught.

U

−

σ

denotes, for a given cheating strategy σ, the auc-

tioneer’s utility when playing σ and being caught.

α denotes the probability that the auctioneer’s cheat-

ing will be caught (i.e. the probability that the

supervisor will check the auction’s outcome).

Note that the auctioneer’s expected utility when not

abiding by the protocol and playing some cheating

strategy σ is

(1− α)U

+

σ

+ αU

−

σ

(1)

Hence, abiding by the protocol would maximize his

expected utility iff for every cheating strategy σ the

following holds:

U ≥ (1 − α)U

+

σ

+ αU

−

σ

(2)

That is, a rational auctioneer would not cheat if his ex-

pected utility when abiding by the protocol is greater

than his expected utility when deviating from it.

2.4 Syntax of Auction Schemes

An auction scheme AUC = (KG, Bidder, De-

code, Auctioneer, Supervisor, Winner) consists of six

polynomial-time algorithms:

SECRYPT2013-InternationalConferenceonSecurityandCryptography

162

• The probabilistic key generation algorithm KG

takes as input an entity ψ ∈ {1, . . . , n} ∪ {A, S}

and a sting 1

k

, where k ∈ N is the security param-

eter, and returns a (Public key, Private key) pair.

• The probabilistic bidding algorithm Bidder takes

the following as input: As local input, Bidder re-

ceives a (Public key, Private key) pair and a nu-

meric bid value bid. Bidder also receives pub-

lic information (that may consist of the auction-

eer’s public key, details about the planned auction,

etc.). Additional information (such as the supervi-

sor’s public key) is received off-band. Bidder then

outputs a vector message that consists of mes-

sage.encoded

bid and message.id such that mes-

sage.encoded bid encodes bid while message.id

contains additional information (bidder’s identi-

fication information, commitment to pay for the

item in case the bidder won the auction, etc.).

Generating message.encoded

bid may require bid

and a secret key. In addition, the encoding string

may hide the numeric value of bid (i.e. may be the

output of an encryption process). The encoding is

reversible, namely bid can be retrieved from mes-

sage.encoded

bid by the Decode algorithm (see

below).

• The deterministic decoding algorithm Decode

takes as input a key Dec and a string en-

coded

bid and outputs the numeric value bid that

was used by Bidder to generate encoded

bid,

or ⊥ if no such bid exists. Formally, Decode

outputs bid such that for any auction

details,

bidder’s public and secret keys (pk, sk), nu-

meric bid value bid, auctioneer’s public key

A.pk, and supervisor’s public key S.pk and key

pair (Enc, Dec), if (message.encoded

bid, mes-

sage.id) ← Bidder(auction details, S.pk, A.pk,

pk, sk, Enc, bid) then bid ← Decode(Dec, mes-

sage.encoded

bid), otherwise ⊥ ← Decode(Dec,

message.encoded

bid).

We note that the Decode algorithm is mainly for

defining and proving the security requirements

(see Sections 2.5 and 4), and does not necessar-

ily need to be implemented in a real auction.

• The probabilistic auctioneering algorithm Auc-

tioneer takes as local input a (Public key, Private

key) pair. Furthermore, Auctioneer receives pub-

lic keys (such as the bidders’ or supervisor’s), and

may receive additional public or private informa-

tion (e.g. encoded bids) and a stage stg ∈ {‘init’,

‘receive’,‘outcome’}. If stg = ‘init’ the algorithm

outputs details about a planned auction. If stg =

‘receive’ the algorithm outputs state information

to be used later. If stg = ‘outcome’ the algorithm

outputs an auction’s outcome (i.e. the winning

bidder and the clearing price).

• The probabilistic auction supervising algorithm

Supervisor takes as input a (Public key, Private

key) pair, public information (that may consist

of the auctioneer’s public keys), additional in-

put from the auctioneer (such as auction details

or outcome), a probability α, and a stage stg ∈

{‘sign’, ‘generate’, ‘verify’}. If stg = ‘sign’ the

algorithm outputs a signature on the auction de-

tails input. If stg = ‘generate’ the algorithm out-

puts a (Public key, Private key) pair of a non-

malleable CPA-secure encryption scheme. If stg

= ‘verify’ it outputs either the string ‘Verified out-

come’ or a proof that the auctioneer cheated and

an amount fine the auctioneer needs to pay.

• The deterministic winner finding algorithm Win-

ner takes as input bids, a vector of bidders’ bids

and messages, a vector containing outputs of

the Bidder algorithm (namely, a vector of (en-

coded

bid, id) pairs) such that bidder i’s bid is

bids.i, and her encoded bid and identity informa-

tion is messages.i.encoded

bid and messages.i.id,

respectively. The algorithm outputs the winning

bidder ψ

winner

according to the auction rules (i.e.

ψ

winner

is the bidder that bid the highest bid. In

case more than one bidder bid the highest bid the

algorithm outputs the bidder whose encoded bid

has lexicographic precedence).

2.5 Requirements

An auction scheme is required to be secure, as defined

below.

Definition 1. An auction scheme is secure iff it is

valid, correct for a rational auctioneer, preserves se-

crecy, and non-malleable (as detailed below).

2.5.1 Validity

An auction scheme is said to be valid if, when the

supervisor checks the auction’s outcome, in case the

auctioneer deviated from the protocol he will be

caught with overwhelming probability. Formally, for

any auction scheme AUC = (KG, Bidder, Decode,

Auctioneer, Supervisor, Winner), adversary Adv and

k ∈ N we associate Experiment 1. In it, Adv has four

stages: init, details, encode and cheat. In the init stage

Adv is given a unary string 1

k

and outputs n ∈ N, the

number of participating bidders. In the details stage,

after a public and private key pair was issued to each

entity (the bidders, the auctioneer and the supervisor),

SecureSecondPriceAuctionswithaRationalAuctioneer

163

Adv receivesthe secret keys of all bidders

4

along with

all public keys. He then outputs an auction details

string that defines the auction. Possible details may be

the item to be auctioned, maximum allowed bid, etc.

Later, in the encode stage, Adv is invoked on behalf

of the bidders and is given the public key Enc gener-

ated by the supervisor. He outputs a vector messages

as the output of all bidders which is comprised of n

(bid encodings, identification string) pairs. Adv is in-

voked again, this time as the auctioneer, in the cheat

stage. He is given the key Dec and outputs the en-

coded bid of the winning bidder winning

encoded bid

and a clearing price p as the auction’s outcome. The

Supervisor is then given his private and public keys

along with the auction details, all encoded bids, the

declared outcome (winning

encoded bid, p), and 1 as

the probability to validate this auction, and outputs a

verification string. If Adv deviated from the proto-

col (i.e. winning

encoded bid is not the encoded bid

of the winning bidder or p is not the second highest

bid) while verification = ‘Verified outcome’ then the

experiment outputs 1, Otherwise it outputs 0. Note

that in addition to the above, in the details and encode

stages Adv outputs state information to be used later.

The advantage of adversary Adv in breaking the

validity of AUC is denoted by

Advantage

Validity

AUC , Adv

(k) =

Pr[Exp

Validity

AUC , Adv

(k) = 1] (3)

Definition 2. An auction scheme AUC is valid if for

any polynomial-time adversary Adv and k ∈ N the

function Advantage

Validity

AUC , Adv

(k) is negligible.

2.5.2 Rational Correctness

An auction scheme is correct for a rational auction-

eer if a rational auctioneer will not deviate from the

protocol, i.e. his expected utility when deviating from

the protocol is not greater than when abiding by it.

Formally, for every auctioneer’s strategy σ Equation

2 should hold (See Section 2.3).

2.5.3 Secrecy

An auction scheme preserves secrecy if no colluding

set of bidders is able to learn any nonessential infor-

mation about other bids even after the auction is over.

Consider two adversarially-chosen bidders (ψ

0

and

4

Although it may be sufficient to give Adv the secret

keys of colluding bidders only, we simplify this experiment,

as well as Experiments 2 and 3, by giving him the secret

keys of all bidders, as done in other works (e.g. (Bellare

et al., 2003)).

ψ

1

) who are assigned two adversarially-chosen bids

(bid

0

and bid

1

). A colluding group of (other) bidders

should not be able to tell which of ψ

0

and ψ

1

bade

either of the two bids with probability significantly

better than guessing.

Experiment 1: Exp

Validity

AUC , Adv

(k).

1: n ← Adv(‘init’, 1

k

)

2: for each ψ ∈ {1, . . . , n} ∪ {A, S} do

(ψ.pk, ψ.sk) ← KG(ψ, 1

k

)

3: (auction

details, St

1

) ← Adv(‘details’, S.pk,

A.pk, A.sk, 1.pk, 1.sk, . . . , n.pk, n.sk)

4: (Enc, Dec) ← AUC .Supervisor(‘generate’,

auction

details, S.pk, S.sk, A.pk, 1

k

)

5: (messages, St

2

) ← Adv(‘encode’, St

1

, Enc)

⊲ |messages| = n

6: (winning

encoded bid, p) ←Adv(‘cheat’, St

2

,

Dec)

7: verification ← AUC .Supervisor(‘verify’,

auction

details, S.pk, S.sk,

messages.1.encoded

bid, ...,

messages.n.encoded bid, Dec,

winning

encoded bid, p, 1)

8: for each i ∈ {1, . . . , n} do

9: bids.i ← AUC .Decode(Dec,

messages.i.encoded

bid)

10: ψ

winner

← AUC .Winner(bids, messages)

11: if

winning

encoded bid 6=

messages.ψ

winner

.encoded bid ∨ p 6=

second

highest(bids)

∧ verification = ‘Ver-

ified outcome’ then return 1

12: else return 0

Formally, for any auction scheme AUC = (KG,

Bidder, Decode, Auctioneer, Supervisor, Winner), ad-

versary Adv, k ∈ N and bit b we associate Experiment

2. In it, Adv has five stages: init, details, choose, en-

code and guess. In the init stage Adv outputs n, the

number of participating bidders, s.t. n > 1. In the de-

tails stage, after each entity (the bidders, the auction-

eer and the supervisor) received a public and private

key pair, Adv receives the secret keys of all bidders

and all public keys. He then outputs state information

St

1

and an auction

details string that defines the auc-

tion. Possible details may be the item to be auctioned,

maximum allowed bid, and so on. Later, in the choose

stage, Adv is given the public key Enc generated by

the supervisor and outputs state information St

2

along

with two special bidders ψ

0

, ψ

1

∈ {1, . . . , n} and two

bids bid

0

, bid

1

for these bidders. For each special bid-

der ψ

i

the following takes place: the Bidder algorithm

is invoked with bidder ψ

i

’s keys and bid bid

b⊕i

. Ad-

ditionally, the Auctioneer algorithm receives Bidder’s

output and saves state information in state. Later, for

SECRYPT2013-InternationalConferenceonSecurityandCryptography

164

Experiment 2: Exp

Secrecy-b

AUC , Adv

(k).

1: n ← Adv(‘init’, 1

k

) ⊲ n > 1

2: for each ψ ∈ {1, . . . , n} ∪ {A, S} do

(ψ.pk, ψ.sk) ← KG(ψ, 1

k

)

3: (auction

details, St

1

) ← Adv(‘details’, S.pk,

A.pk, 1.pk, 1.sk, . . ., n. pk, n.sk)

4: (Enc, Dec) ← AUC .Supervisor(‘generate’,

auction

details, S.pk, S.sk, A.pk, 1

k

)

5: (bid

0

, bid

1

, ψ

0

, ψ

1

, St

2

) ← Adv(‘choose’,

St

1

, Enc) ⊲ |bid

0

| = |bid

1

|, ψ

0

, ψ

1

∈

{1, . . . , n}, ψ

0

< ψ

1

6: state ← ⊥

7: for each i ∈ {0, 1} do

8: messages.ψ

i

←

AUC .Bidder(auction details, S.pk, A.pk,

ψ

i

.pk, ψ

i

.sk, Enc, bid

b⊕i

)

9: state ← AUC .Auctioneer(‘receive’,

auction

details, S.pk, A.pk, A.sk, 1.pk, . . .,

n.pk, messages.ψ

i

, state)

10: for each i ∈ {1, . . . , n} \ {ψ

0

, ψ

1

} do

11: (messages.i, St

2

) ← Adv(‘encode’,

St

2

, messages.ψ

0

.encoded

bid,

messages.ψ

1

.encoded bid, i)

12: state ← AUC .Auctioneer(‘receive’,

auction

details, S.pk, A.pk, A.sk, 1.pk, . . .,

n.pk, messages.ψ

i

, state)

13: (ψ

winner

, p) ← AUC .Auctioneer(‘outcome’,

state, Dec)

14: if ψ

winner

∈ {ψ

0

, ψ

1

} then b

′

← Adv(‘guess’,

St

2

)

15: else b

′

← Adv(‘guess’, St

2

, ψ

winner

, p)

16: if b

′

= b then return 1

17: else return 0

each non-special bidder i Adv is invoked in stage en-

code. Adv receives St

2

, i, and the encoded bids of the

two special bidders and outputs a vector message for

that bidder. The Auctioneer algorithm then receives

the vector message and outputs state. After all mes-

sages were received by Auctioneer he is invoked in

stage outcome with state and Dec as input and out-

puts the auction’s outcome, namely the winning bid-

der ψ

winnder

and the clearing price p. In the guess

stage, if the winning bidder is one of the two special

bidders then Adv receives state information St

2

only.

Otherwise, if the winning bidder is non-special then

Adv additionally receives the winning bidder’s name

and the clearing price. In either case Adv then out-

puts his guess, a bit b

′

. If b

′

= b then the experiment’s

output is 1, otherwise it returns 0.

The advantage of adversary Adv in breaking the

secrecy of AUC is denoted by

Advantage

Secrecy-b

AUC , Adv

(k) =

Pr[Exp

Secrecy-b

AUC , Adv

(k) = 1] − Pr[Exp

Secrecy-b

AUC , Adv

(k) = 0]

(4)

Definition 3. An auction scheme AUC preserves se-

crecy if for any polynomial-time adversary Adv, k ∈ N

and bit b the function Advantage

Secrecy-b

AUC , Adv

(k) is negli-

gible.

2.5.4 Non-malleability

Informally, non-malleability requires that an attacker,

after receiving an encoding of some bid, cannot mod-

ify it into an encoding of a different bid whose “mean-

ingfully related” to the original bid. This requirement

ensures that a set of colluding bidders and the auction-

eer cannot insert bids whose values depend on bids

of honest bidders. Following the work of Pass et al.

(Pass et al., 2006), we present this non-malleability

requirement using an indistinguishability based ex-

periment.

Formally, for any auction scheme AUC = (KG,

Bidder, Decode, Auctioneer, Supervisor, Winner), ad-

versary Adv and k, l ∈ N we associate Experiment 3.

In it, Adv has four stages: init, details, choose and

guess. In the init stage Adv outputs the number of

bidders that will participate in the auction. A public

and secret key pair is then generated and given to each

entity. In the details stage Adv receives the supervi-

sor’s public key along with the public and secret keys

of the auctioneer and all bidders (to capture the possi-

bility of an adversary colluding with both the auction-

eer and bidders). He then outputs the auction details

of his choice and state information St

1

. The supervi-

sor is then invoked and is given the auction details,

his public and private keys and the auctioneer’s pub-

lic key, and outputs a newly generated key pair (Enc,

Dec). Afterwards, in the choose stage, Adv is given

Enc and St

1

and is required to output a bidder ψ, two

bids bid

0

and bid

1

and state information St

2

. The Bid-

der algorithm is then invoked with auction

details, the

supervisor’s and auctioneer’s public keys, bidder ψ’s

public and private keys, Enc and bid

b

as input and

outputs a (encoded

bid, id) pair. In the guess stage

Adv receives St

2

along with bidder ψ’s encoded bid

and outputs a vector of length l containing encoded

strings. The experiment outputs a corresponding vec-

tor containing, for each encoding c

i

, the symbol ⊥ if

c

i

is identical to the challenge encoded

bid, or a de-

coding of c

i

(using the Decode algorithm) otherwise.

Adv is successful if the vector returned by the exper-

iment is computationally distinguishable when b = 0

compared to when b = 1.

SecureSecondPriceAuctionswithaRationalAuctioneer

165

Experiment 3: Exp

Non-Mal-b

AUC , Adv

(k, l).

1: n ← Adv(‘init’, 1

k

)

2: for each ψ ∈ {1, . . . , n} ∪ {A, S} do

(ψ.pk, ψ.sk) ← KG(ψ, 1

k

)

3: (auction

details, St

1

) ← Adv(‘details’, S.pk,

A.pk, A.sk, 1. pk, 1.sk, . . . , n.pk, n.sk)

4: (Enc, Dec) ← AUC .Supervisor(‘generate’,

auction

details, S.pk, S.sk, A.pk, 1

k

)

5: (ψ, bid

0

, bid

1

, St

2

) ← Adv(‘choose’, Enc, St

1

)

⊲ |bid

0

| = |bid

1

|

6: (encoded

bid, id) ←

AUC .Bidder(auction

details, S.pk, A.pk,

ψ.pk, ψ.sk, Enc, bid

b

)

7: (c

1

, ..., c

l

) ← Adv(‘guess’, St

2

, encoded

bid)

8: return (d

1

, ..., d

l

) where d

i

=

(

⊥ if c

i

= encoded

bid

AUC .Decode(c

i

) otherwise

Definition 4. Let AUC be an auction scheme and

let the random variable Exp

Non-Mal-b

AUC , Adv

(k, l) where b ∈

{0, 1}, Adv is an adversary algorithm and k, l ∈ N

denote the result of Experiment 3. AUC is non-

malleable if for any p.p.t algorithm Adv and for any

polynomial p(k), the following two ensembles are

computationally indistinguishable:

n

Exp

Non-Mal-0

AUC , Adv

(k, p(k))

o

k∈N

c

≈

n

Exp

Non-Mal-1

AUC , Adv

(k, p(k))

o

k∈N

(5)

3 THE PROTOCOL

3.1 Assumptions

In the presented protocol we assume the following:

• All entities have signature key pairs. Public keys

are known to all.

• All entities have synchronized clocks.

• The auctioneer has a certified bulletin board (such

as a website) to post public information.

• Communication delays for all messages are at

most ∆.

In addition to the above, the protocol uses an

encryption scheme that is non-malleable with re-

spect to chosen-plaintext attacks. We use the

indistinguishability-based definition of such non-

malleability, as presented by Pass et al. (Pass et al.,

2006). Informally, a non-malleable encryption

scheme with respect to chosen-plaintext attack en-

sures that an attacker, after choosing two plaintexts

and receiving an encryption of one of them, cannot

modify this encryption into an encryption of a dif-

ferent message that is “meaningfully related” to the

original one. Such an encryption scheme is needed to

maintain both the auction scheme’s secrecy and non-

malleability requirements.

3.2 The Protocol

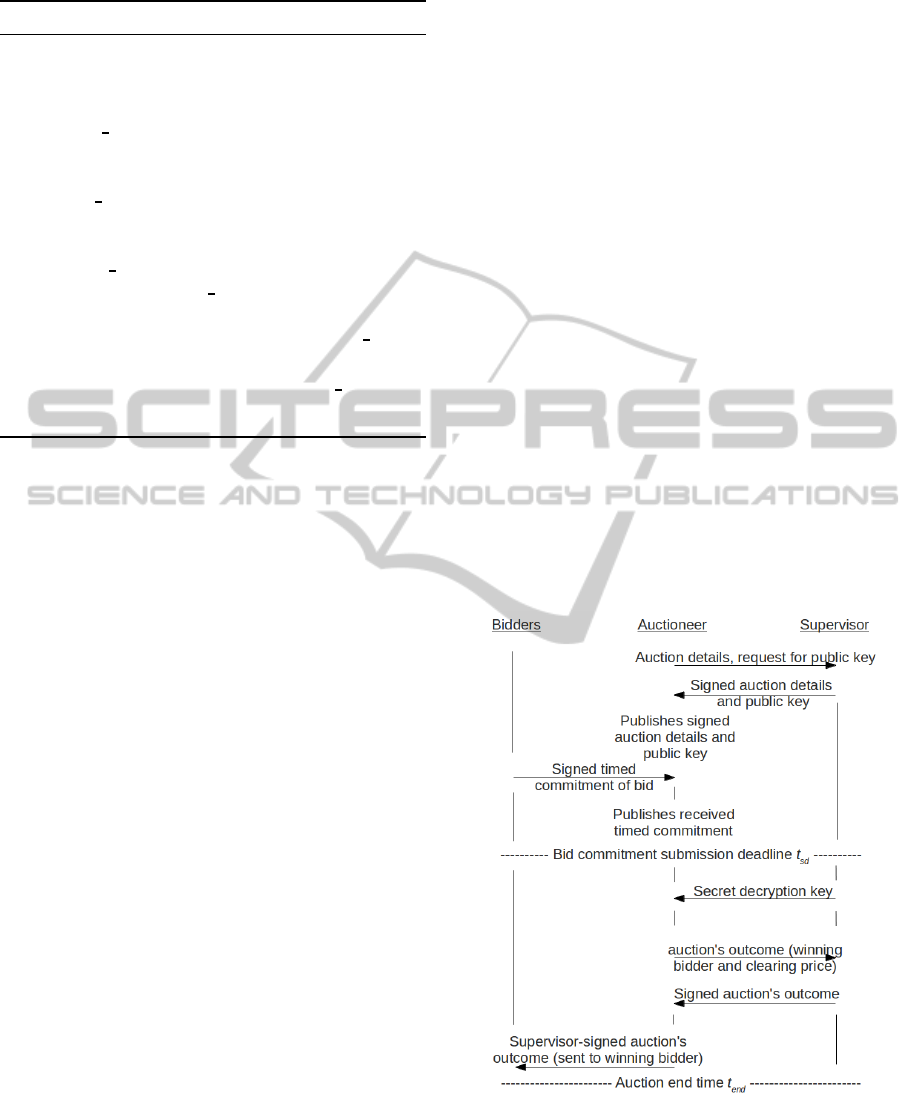

Below are details of the presented protocol, as de-

picted in Figure 2.

1. The auctioneer sends auction details to the super-

visor and asks him to participate in the auction.

The auctioneer may pay the supervisor for his ser-

vices. Auction details include: details of the auc-

tioned goods; maximum allowed bid b

maxAl

; le-

gal commitment by the auctioneer to pay a fine

of value fine in case the supervisor presents proof

that the auctioneer deviated from the protocol; bid

commitment submission deadline t

sd

; maximum

number of bidders n

max

; auction ending time t

end

(see Section 3.2.1 for detailed computation of the

auction ending time).

2. If the supervisor accepts the auction details he ar-

Figure 2: Outline of the protocol. Auctioneer asks Super-

visor to participate in the auction and publishes auction de-

tails. Bidders send timed-commitments of bids to Auction-

eer. Supervisor helps Auctioneer open bids and compute

auction’s outcome, and then Supervisor (possibly verifies

and) signs on the outcome. Auctioneer sends clearing price

to winning bidder.

SECRYPT2013-InternationalConferenceonSecurityandCryptography

166

bitrarily sets α such that

α ≥

b

maxAl

fine+ b

maxAl

(6)

and sends the auctioneer a public key of a CPA-

secure non-malleable encryption scheme, along

with the supervisor’s signature on the key and the

auction details.

3. The auctioneer publishes the signed auction de-

tails and public key.

4. Each bidder i sends the auctioneer an encryption

of her bid. The bidder also sends a legal com-

mitment to pay for the goods (a price not higher

than her committed bid) in case the auctioneer

presents, no later than the auction ending time

t

end

, a supervisor-signed statement saying that this

bidder won the auction and needs to pay such and

such as clearing price. The message is signed by

the bidder’s private signing key.

5. After receiving each message the auctioneer ver-

ifies both that the bidder’s signature is valid and

that an identical encryption was not published ear-

lier on the bulletin board (otherwise the auction-

eer ignores the message). He then publishes the

encrypted bid on the bulletin board.

In case a bidder detects that her encrypted bid was

not published she will resend it to the supervi-

sor, who in turn, after verifying the bidder’s signa-

ture and that such an encrypted bid was not pub-

lished already, will forward it to the auctioneer. If

the auctioneer ignores encrypted bids forwarded

to him by the supervisor then the supervisor will

stop participating in the auction.

6. After time t

sd

+ 3∆, the supervisor saves all pub-

lished bid commitments (to be used later in case

he would verify the auction’s outcome), and sends

the secret decryption key to the auctioneer

5

.

7. The auctioneer decrypts all bids and computes

(i

′

, p

′

) where i

′

is the bidder with the highest bid

and p

′

is the amount she has to pay (i.e. the second

highest bid). He sends (i

′

, p

′

) to the supervisor.

In case of a tie the auctioneer chooses a winner

arbitrarily out of the set of highest bidders (e.g.

he chooses the highest bidder with lexicographi-

cal precedence.).

8. With probability α, the supervisor validates the

auction’s outcome: He decrypts all encrypted bids

he previously saved and verifies that the winning

bidder and clearing price are indeed (i

′

, p

′

). If the

5

According to Section 3.2.1 and Footnote 6, the last mo-

ment in which the supervisor might receive legitimate en-

crypted bids is t

sd

+ 3∆.

supervisor detects that the auctioneer cheated he

will fine him. In case the supervisor did not de-

tect cheating (either the auctioneer did not deviate

from the protocol or the supervisor did not verify

the auction’s outcome) he sends the auctioneer his

signature on (i

′

, p

′

).

9. The auctioneer sends the supervisor-signed values

(i

′

, p

′

) to the winning bidder.

3.2.1 Auction Ending Time

Note that the auctioneer can compute in advance an

upper bound for the auction’s ending time t

end

. The

ending time for the auction is no later than the time to

send a bid to the auctioneer in the worst case

6

, which

is t

sd

+ 4∆, plus time to decrypt n

max

encryptions and

compute the auction’s outcome twice (in case the su-

pervisor verifies the auctioneer’s computed outcome),

plus time to send 3 more messages (the auctioneer

sends outcome to the supervisor, supervisor replies

with signature, auctioneer sends outcome to winning

bidder). This computed bound is t

end

.

4 SECURITY ANALYSIS

Theorem 1. The presented scheme is secure.

Proof. Security of the scheme follows from Lemmas

1, 2, 3 and 4 asserting that the scheme is valid, correct

for a rational auctioneer, preserves secrecy, and non-

malleable, respectively.

Below are proof sketches for the aforementioned

lemmas. Full proofs will be presented in the full pa-

per

7

.

4.1 Validity

Lemma 1. The presented scheme is valid.

Proof sketch. We prove that the probability that the

auctioneer will not be caught by the supervisor when

deviating from the protocol if the supervisor validates

the auction’s outcome is negligible. This is done by

dividing the protocol into three phases, analyzing de-

viation at each phase separately, and proving that the

auctioneer cannot deviate in any phase without being

caught with overwhelming probability.

6

e.g. a bidder sends a bid at the last moment possible,

the auctioneer does not publish it, and the bidder resends it

to the auctioneer via the supervisor. So the last message is

received by the auctioneer at time t

sd

+ 4∆.

7

For the full paper version see footnote 3.

SecureSecondPriceAuctionswithaRationalAuctioneer

167

The protocol can be divided into the following

phases:

1. The preliminary phase: up until the auctioneer

publishes the auction details.

2. The submission phase: from the end of the pre-

liminary phase until the auctioneer stops receiving

new submissions (time t

sd

+ 4∆).

3. The outcome revelation phase: from time t

sd

+ 4∆

until the end of the auction (t

end

).

In the preliminary phase, publishing a supervisor-

signed false auction details will require forging of the

supervisor’s signature. In the submission phase the

auctioneer cannot ignore commitments since they will

be resent to the supervisor. He cannot learn informa-

tion about submitted bids and submit commitments

according to them because of the hiding property of

commitments. He cannot ignore bids after decrypting

them because the supervisor independently calculates

the auction’s outcome and will notice if the outcome

was changed because of bid ignoring. In the outcome

revelation phase the auctioneer can’t send the super-

visor wrong information since everything is already

published on the bulletin board. He cannot send a

bidder false outcome because the outcome needs to

be signed by the supervisor.

4.2 Rational Correctness

Lemma 2. The presented scheme is correct for a ra-

tional auctioneer.

Proof sketch. Equation 6 is used to show that the

auctioneer’s expected utility when cheating is non-

positive. Therefore, for any non-negativeutility U for

abiding by the protocol a rational auctioneer will not

cheat.

4.3 Secrecy

Lemma 3. The presented scheme preserves secrecy.

Proof Sketch. Secrecy of bids in the face of colluding

bidders is shown by reduction: If an adversary Adv

exists that has a non-negligible advantage in the se-

crecy experiment (Experiment 2) then an adversary

Adv’ can be constructed that has a non-negligible ad-

vantage in the non-malleability experiment of the un-

derlying CPA-secure encryption scheme: Adv’ uses

Adv to have a non-negligible advantage in the non-

malleability experiment defined by Bellare and Sahai

(Bellare and Sahai, 1999). This definition is strictly

weaker than the definition of Pass et al. (Pass et al.,

2006) which we use, and therefore Adv’ breaks the

non-malleability of the encryption used by the auc-

tion scheme.

4.4 Non-malleability

Lemma 4. The presented scheme is non-malleable.

Proof Sketch. The proof is fairly straightforward: if

an adversary Adv exists that can break the non-

malleability of the presented auction scheme then

an adversary Adv’ can be constructed that breaks

the non-malleability of the underlying encryption

scheme.

5 CONCLUSIONS

In this paper we presented novel security definitions

for the validity, rational correctness, secrecy, and non-

malleability of second price auction schemes. In ad-

dition, a simple and efficient scheme is presented in

which the security requirements hold. This is done

using a trusted supervisor which randomly validates

the auction’s outcome.

One may wonder,in case such a trusted supervisor

exists, why not let this trusted entity run the auction

instead of the auctioneer. One answer is that an entity

that validates the outcome but which does not receive

payments from the bidders (such as the supervisor)

has less incentive to cheat, as opposed to the auction-

eer. More importantly, in case there is a need for a

highly trusted supervisor, the supervisor program may

be run using secure means such as special hardware

or secure multiparty computation. Employing such

costly means for the supervisor may introduce sub-

stantial overhead. To ensure the protocol’s efficient

and practicality, such a costly supervisor may choose

to participate only in auctions where α is low enough,

guaranteeing both that the auction is secure and that

the supervisor has a low amount of expected compu-

tation. Notice, however, that requiring α to be small

may induce a high fine, since according to Equation 6

the lower bound of fine is:

fine ≥

(1− α)b

maxAl

α

(7)

Still, we believe there is enough freedom in tuning the

supervisor’s workload to ensure the scheme is practi-

cal.

ACKNOWLEDGEMENTS

We thank Alon Rosen, Yehuda Lindell, and Benny

SECRYPT2013-InternationalConferenceonSecurityandCryptography

168

Pinkas for their comments. Additionally, we thank the

following organizationsfor financially supporting this

research: The Israeli Ministry of Science and Tech-

nology, and the RSA division of EMC corporation.

REFERENCES

Bellare, M., Micciancio, D., and Warinschi, B. (2003).

Foundations of group signatures: Formal definitions,

simplified requirements, and a construction based on

general assumptions. In EUROCRYPT, pages 614–

629.

Bellare, M. and Sahai, A. (1999). Non-malleable

encryption: Equivalence between two notions,

and an indistinguishability-based characterization.

In Advances in cryptology-CRYPTO99, pages 78–

78. Springer. http://cseweb.ucsd.edu/∼mihir/papers/

nm.pdf.

Boneh, D. and Naor, M. (2000). Timed commitments. In

CRYPTO, pages 236–254.

Brandt, F. (2006). How to obtain full privacy in auc-

tions. International Journal of Information Security,

5(4):201–216.

Dolev, D., Dwork, C., and Naor, M. (1991). Non-malleable

cryptography. In Proceedings of the twenty-third an-

nual ACM symposium on Theory of computing, pages

542–552. ACM.

Engelbrecht-Wiggans, R. (1980). Auctions and bidding

models: A survey. Management Science, pages 119–

142.

Goldwasser, S. and Micali, S. (1982). Probabilistic en-

cryption & how to play mental poker keeping secret

all partial information. In Proceedings of the four-

teenth annual ACM symposium on Theory of comput-

ing, pages 365–377. ACM New York, NY, USA.

Goldwasser, S. and Micali, S. (1984). Probabilistic en-

cryption. Journal of computer and system sciences,

28(2):270–299.

Harkavy, M., Tygar, J., and Kikuchi, H. (1998). Elec-

tronic auctions with private bids. In Proceedings of

the 3rd USENIX Workshop on Electronic Commerce,

volume 31.

Klemperer, P. (2004). Auctions: theory and practice.

Lipmaa, H., Asokan, N., and Niemi, V. (2003). Secure

vickrey auctions without threshold trust. In Financial

Cryptography, pages 87–101. Springer.

Milgrom, P. and Weber, R. (1982). A theory of auctions

and competitive bidding. Econometrica: Journal of

the Econometric Society, pages 1089–1122.

Naor, M., Pinkas, B., and Sumner, R. (1999). Privacy pre-

serving auctions and mechanism design. In Proceed-

ings of the 1st ACM conference on Electronic com-

merce, pages 129–139. ACM.

Parkes, D., Rabin, M., Shieber, S., and Thorpe, C. (2008).

Practical secrecy-preserving, verifiably correct and

trustworthy auctions. Electronic Commerce Research

and Applications, 7(3):294–312.

Pass, R., Vaikuntanathan, V., et al. (2006). Construction of

a non-malleable encryption scheme from any semanti-

cally secure one. In Advances in Cryptology-CRYPTO

2006, pages 271–289. Springer.

Rabin, M. and Thorpe, C. (2006). Time-lapse cryptography.

Rivest, R., Shamir, A., and Wagner, D. (1996). Time-lock

puzzles and timed-release crypto.

Vickrey, W. (1961). Counterspeculation, auctions, and

competitive sealed tenders. The Journal of finance,

16(1):8–37.

SecureSecondPriceAuctionswithaRationalAuctioneer

169