Policy Design, Eco-innovation and Industrial Dynamics

in an Agent-Based Model

An Illustration with the REACH Regulation

Nabila Arfaoui

1

, Eric Brouillat

2

and Maider Saint Jean

2

1

GREDEG, University of Nice Sophia Antipolis,250 rue Albert Einstein, Valbonne, France

2

GREThA, University of Bordeaux, Avenue Leon Duguit, Pessac, France

Keywords: ABM, Policy Design, Eco-innovation, REACH.

Abstract: The paper proposes an agent-based model to study the impact of European regulation REACH on industrial

dynamics. This new regulation adopted in 2007 establishes a new philosophy in how to design

environmental protection and health. For this reason, REACH appears as a privileged object of study to

analyze the impact of regulation on innovation strategies of firms and the market structure. Our model

focuses on the interactions between clients and suppliers in order to take into account interdependencies at

the heart of vertical relationships that are upset by the new principles introduced by REACH. The main

contribution of this paper is to show, through an agent-based model, how different combinations of flexible

and stringent instruments designed on REACH regulation (Extended Producer Responsibility, authorization

process and restrictions) create the incentives and the constraints to shape market selection and innovation.

1 INTRODUCTION

In 2006, after a long ‘legislative battle', the

European Union (EU) adopted the REACH

Regulation (Registration, Evaluation and

Authorization of Chemicals) one of the most

ambitious stringent regulation. This regulation

introduces a new legislative philosophy in how to

handle chemicals. Firstly, REACH adopts the

“principle of reversal of the burden of proof” from

authorities to industry. This principle postulates that

manufacturers and importers of chemicals must

register each substance used in a quantity higher

than one tone per year, and assess the health and

environmental risks associated; otherwise they will

be automatically excluded from the market ("No

data, no market"). Secondly, REACH extends

responsibility also to users, since they are now

responsible for the compliance of their production

factors to the requirements of the new regulation.

The downstream user is closely associated with

regulatory compliance, by actively supporting the

efforts of producers of substances. REACH does not

apply only to the chemical industry but concerns all

the industries. Lastly, a revolutionary aspect of

chemicals regulation under REACH lies in a process

of authorization and restriction to the most

dangerous substances. Public authorization is

required for the production and use of chemicals

considered to be especially worrisome: so-called

substances of very high concern (SVHC) "with the

aim of substituting them". SVHC are to be gradually

identified and once included in the Annex, they

cannot be placed on the market or used after a date

to be set (the so-called "sunset date") unless the

company is granted an authorization. All request of

authorization must be accompanied by a safety

report and an analysis of alternatives. Thus, with the

REACH Regulation, the precautionary principle is

complemented by a substitution principle.

From the start, REACH has been designed to

balance environmental objectives with

competitiveness aims, and has the scope to induce

the development and adoption of eco-innovation as a

side-effect of the regulation itself. Eco-innovation

can be defined as “the production, assimilation or

exploitation of a product, production process,

service or management or business methods that is

novel to the organization (developing or adopting it)

and which results, throughout its life cycle, in a

reduction of environmental risk, pollution and other

negative impacts of resources use (including energy

517

Arfaoui N., Brouillat E. and Saint Jean M..

Policy Design, Eco-innovation and Industrial Dynamics in an Agent-Based Model - An Illustration with the REACH Regulation.

DOI: 10.5220/0004623705170528

In Proceedings of the 3rd International Conference on Simulation and Modeling Methodologies, Technologies and Applications (MSCCEC-2013), pages

517-528

ISBN: 978-989-8565-69-3

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

use) compared to relevant alternatives” (MEI

Report, 2007). In the economic literature, many

authors have emphasized a positive correlation

between innovation and environmental regulation

(cf. EEA, 2011, for an overview). However, eco-

innovations cannot be considered to be a systematic

response to regulation. Policy design turns to be

essential in inducing the development of eco-

innovations (Ashford et al., 1985); (Hahn, 1989);

(Johnstone, 2007); (Jänicke, 2008). In this respect, a

number of criteria such as stringency, flexibility,

timing and credibility are important factors to

consider. REACH seems to fit perfectly in this

context and appears as a privileged object of study to

analyze how policy design can stimulate or allow

eco-innovation.

This paper tries to model the key principles and

mechanisms on which REACH relies on in an agent-

based model. We try to show how different

combinations of flexible and stringent instruments

designed on REACH regulation (such as derived

from the Extended Producer Responsibility principle

and from the approval process and restrictions)

create the incentives and the constraints to shape

market selection and innovation. In particular, the

model is intended to assess in which extent

increased obligations on SVHC through

authorization provisions may lead to increased

moves towards the substitution of those substances

through the supply chain.

The paper is organized as follows. Section 2

draws on the literature on eco-innovation to

underline the importance of policy design in

inducing the development of eco-innovation. In this

perspective, we bring into light the main

mechanisms of the REACH regulation that can

stimulate innovation and substitution of chemical

substances. Section 3 presents the model following

the ODD (Overview, Design concepts, Details)

protocol (Grimm et al., 2006), (Grimm et al., 2010).

Such a protocol provides a standard procedure for

describing Agent-Based Models (ABMs) in order to

make them easier to analyze, understand and

communicate. Section 4 presents the baseline

simulations and examines the impact of regulation

upon the market dynamics by considering various

configurations in the policy design, especially

through the flexibility and the stringency variables.

Section 5 concludes.

2 ENVIRONMENTAL

REGULATION AND

INNOVATION

Theoretical and empirical analyses on the

relationship between environmental regulation and

innovation agree that eco-innovations are essentially

“policy-driven” (Jänicke, 2008). Policy design turns

to be essential, especially to spur eco-innovation.

2.1 Policy Design

We know from Porter and van der Linde (1995) that

« properly designed environmental standards can

trigger innovation that may partially or more than

offset the costs of complying with them » in some

instances (p.98). Porter argues that more stringent

environmental policies will lead to innovations to

reduce inefficiencies, and this, in turn, will

eventually reduce costs. This process may take some

time. Thus, only well-designed regulations lead to

innovation. In particular flexible regulatory policies

give firms greater incentives to innovate and thus are

better than prescriptive forms of regulation. In many

instances, these innovations are likely to more than

offset the cost of regulation.

According to Ashford et al. (1985) and Hahn

(1989), regulators must be careful to the severity, the

flexibility and the timing of the regulation. Policy

design is essential in inducing the development of

eco-innovations (Jänicke, 2008). The policy design

should in particular be based on ambitious and

reliable targets; and provide a flexible policy mix

supporting the innovation process from invention to

diffusion.

In the way REACH has been designed, the

European Commission was very attentive to these

criteria. A combination of hard and soft law has

been preferred such that REACH relies more on

open-ended standards (Fuchs, 2011) that combine

different criteria: stringent, reachable and flexible.

As a matter of fact, the consequences of an incorrect

application of the REACH Regulation are serious

and immediate as they result in exclusion from

market "No data, no market”. Moreover, Fuchs

(2011) describes REACH as a pragmatic regulation

which is both ambitious and realistic in his goals in

order to represent real incentive to undertake

innovation. Pragmatism lies also in other provisions

such as the multiple deadlines for phase-in

substances, the collective setting of priorities under

the authorization and restriction processes, the

various exemptions incorporated in the regulation, or

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

518

the limited risk assessment requirements for

substances placed on the market in proportions of

less than 10 tones. Lastly, flexibility is present

through open-ended standards, flexible and revisable

guidelines, and other forms of “soft law”. It was

important that the system remain flexible in order to

ensure its workability (Fuchs, 2011). Moreover,

REACH promotes a mode of governance based on

the idea of "self-responsibility". This approach

involves giving more responsibilities to companies

and more flexibility on how to achieve the goals

(Fuchs, 2011). In total, these mechanisms can adapt

to diversity, tolerate alternative approaches to

problem-solving, and make it easier to revise

strategies and standards in light of evolving

knowledge (Scott and Trubek, 2002).

2.2 The Effect of REACH

on Innovation

REACH has been designed to enhance innovation.

For Nordbeck and Faust (2003), innovation is "the

most important advantage of the REACH

regulation". It is possible to modify the

technological trajectory in the chemical industry and

increase innovation towards sustainable

development. According to Eurostat (2009), a

number of innovation-friendly mechanisms in the

chemical industry are present in REACH. In our

model, we mainly focus on two crucial mechanisms

that can promote innovation in the chemical

industry: the authorization process and the extended

responsibility principle.

The authorization procedure for substances of

very high concern is connected to the principle of

substitution. The purpose of the authorization is to

ensure that the risks from substances of very high

concern are properly controlled and that these

substances are progressively replaced by other

substances or technologies where these are

economically and technically viable. The

authorization procedure is based on several steps:

identification of substances; request for

authorization before the sunset date; granting or

refusing authorization; review of authorization.

Substances eligible for authorization are

identified by a Member State or the European

Commission and are included in a list of substances

of concern “substances of very high concern”

(SVHC) listed in Annex XIV. Once included in that

Annex, every firm willing to use such a substance

must request for authorization before the “sunset

date”. Thus, SVHC cannot be placed on the market

or used after the “sunset date” unless the company is

granted an authorization.

The granting or refusal of authorization is

primarily based on the existence of economically

and technically viable alternatives. So, in the event

that there are economically viable alternatives,

companies will no longer be allowed to use

substances after the sunset date. However if there are

no technically and economically viable alternatives,

authorizations are granted only if firms prove that

they carry out serious analyses of alternatives. In

fact, under Article 5 of the regulation, all request of

authorization must be accompanied by a safety

report and an analysis of alternatives with

information about activities of Research and

Development (R&D). In that case, authorizations are

granted until a specific date by which the holder of

the authorization will have to resubmit an

application. Review dates are set on a case by case

basis and are driven by the information provided by

the applicant, in particular the substitution plan and

the analysis of alternatives. To renew an

authorization, a revised report must be sent to ECHA

(the European Chemicals Agency) before the expiry

date of the time-limited review period defined in

the authorization decision. Meanwhile, the

authorization may be reviewed or suspended by the

Commission at any time, if information regarding

possible replacement substances becomes available

or the circumstances of the authorization have

changed. So firms are encouraged to maintain

technology watch on alternatives. We see that the

process of authorization is characterized by different

time variables that combine stringency (the sunset

date) and flexibility (review date), but also

pragmatism (cost-benefit analysis) in order to

support the innovation process from invention to

diffusion.

The second innovation-friendly mechanism

present in REACH lies in the extended

responsibility to users since they are now

responsible for the compliance of their factors of

production to the requirements of the new

regulation. According to Wolf and Delgado (2003),

innovation in the chemical industry is influenced by

many factors, including the demand and supplier-

client relationships. By extending the principle of

responsibility, the aim of REACH is to place the

environmental impact of the activity throughout the

production chain, and to change the demand of

downstream users towards environmentally

friendlier products. The extension of the principle of

responsibility is accompanied by the obligation to

communicate in the supply chain. According to the

Eurostat report (2009), many companies state a

PolicyDesign,Eco-innovationandIndustrialDynamicsinanAgent-BasedModel-AnIllustrationwiththeREACH

Regulation

519

positive impact on innovation of that

communication. “The communication in the supply

chain provides chemical companies with new

information about customers and their needs”. This

illustrates the importance of information in the

innovation process as well as the need for

coordination and collective action to spur

innovation.

Since the introduction of REACH, organic

solvents are subject to the authorization procedure

which requires producers to develop and adopt

alternatives. Bio-solvents are good candidates to

replace organic solvents since they are less toxic,

have lower VOCs emissions and are biodegradable

(IRSST, 2010). Because of the extended producer

responsibility, downstream users are now induced to

change their preferences and to transmit their needs

to suppliers regarding product quality constraints

that must be achieved with alternative solvents.

REACH can thus involve innovation in the product

chain favored by a partnership and a support from

users in the experimentation stage of the new

processes for the concerned applications. We argue

that our ABM model can enable to illustrate how

REACH can stimulate the development and

adoption of alternatives to organic solvents.

3 THE MODEL

In this section, we present the model we have used

to analyse the impact of REACH upon innovation.

3.1 ABMs and the ODD Protocol

REACH aims at “ensuring a high level of protection

of human health and the environment while

enhancing innovation and competitiveness”. In order

to investigate such a relationship, we use an agent-

based model (ABM) because simulation models

provide a powerful tool for exploring such complex

systems as innovation and industrial dynamics.

ABM is used to deal with complex systems made up

of autonomous entities. It allows modeling the

behavior of heterogeneous agents, technological

diversity and the change in selection environment

that result from policy measures.

The objective is to study how system level

properties emerge from the adaptive behavior of

individuals as well as how, in turn, the system

affects individuals. This model is used as a learning

tool, and is not intended for accurate prediction. It

aims to provide insights about the directional effect

of instruments underlying the authorization

procedure of REACH on firms' innovation strategy

and the associated shift to alternative substances.

In order to present the model we have built, we

use the ODD protocol (Grimm et al., 2006, 2010).

The ODD protocol provides a standard protocol for

describing ABMs in order to make them easier to

analyze, understand and communicate. The protocol

consists in structuring the information about an

ABM in the same sequence: Overview, Design

concepts and Details (cf. Table 1). The logic behind

the ODD sequence is to first provide context and

general information, followed by more strategic

considerations, and finally more technical details.

Such a sequence allows the reader to easily absorb

information in a progressive way.

Table 1: The three blocks of the ODD protocol.

Overview

Purpose

State variables and scales

Process overview and scheduling

Design concepts Design concepts

Details

Initialization

Input

Submodels

3.2 Description of the Model

We follow the sequence given in Table 1.

3.2.1 Purpose

The purpose of our model is to understand how

different configurations in the policy design of

REACH affect the dynamics of eco-innovation and

shape market selection and innovation.

In our model we take into account the supplier-

user interactions since they represent an essential

element in the development of new technologies,

particularly in the chemical industry. Technological

progress is driven by an endogenous stochastic

innovation process relying on firms' R&D strategies.

We illustrate the competition between organic

solvents and biosolvents in the surface treatment

activity. The objective is to examine in which extent

different combinations of flexible and stringent

instruments of the REACH regulation can lead to

develop and diffuse alternative solvents

(biosolvents).

3.2.2 State Variables and Scales

The model comprises eight low-level entities:

supplier, client, two types of product (Technology 1

and Technology 2), and four product characteristics

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

520

(technological performance, production cost, VOCs

emissions and biodegradability).

Suppliers produce and sell products (technology

1 and/or technology 2). They are mainly

characterized by the state variables: identity number

and identity of the technology portfolio. Suppliers

which do not perform well and do not have enough

budget will exit the market; they are automatically

replaced by new entrants. These new entrants are

characterized by the same state variables as the

suppliers. Clients buy and use one type of product

(technology 1 or technology 2) in their production

processes. They are characterized by the state

variables: identity number, identity of the product

they have bought, preferences, requirement

thresholds, reservation price and minimum product

quality.

There are two types of product-related

technology that may co-exist: T1 (e.g. organic

solvents) and T2 (e.g. biosolvents). Technology 1 is

characterized by an identity number and technology

2 is characterized by an identity number and initial

switching costs. At the start of the simulation run,

only T1 exists and is developed by the suppliers.

Each product is described by four attributes in a

Lancaster way (1971): technical performance,

production cost, VOCs emissions, biodegradability.

Technical performance X

k

is related to the solvent

power and is measured by the Kauri butanol index

(Kb). A good solvent power is characterized by an

index of Kb greater than 100. Production costs Cost

k

depend on the raw materials that are used (petrol vs

biomass) but also on the production facility

(traditional refinery vs biorefinery). Emissions of

volatile organic compounds (VOCs), VOC

k,

represent those gases and vapors containing

chemical elements emitted by the solvent. VOCs are

emitted during the manufacture, storage or use of the

solvent. The volatility of these chemicals can have

serious consequences on health and the environment.

VOCs emissions are measured by the evaporation

rate in kilo Pascal. Biodegradability, Bio

k,

represents

the capacity of air emissions from solvents to

degrade readily and to have a short atmospheric

lifetime.

Each of these attributes is characterized by a

potential of evolution which can be exploited by

suppliers according to their R&D and innovation

activities. The potential of evolution takes into

account the difference in order of magnitude

between the best (biosolvent) and the worst solvent

(conventional solvent). Technical performance is

characterized by a maximum limit X

max

; production

cost is characterized by a minimum limit Cost

min

;

VOCs emissions are characterized by a minimum

limit VOC

min

and biodegradability is characterized

by a minimum limit Bio

max

. These outer limits are

assumed to be different depending on the technology

T1 or T2. In particular, the potential of improvement

regarding environmental characteristics is higher for

the green technology T2 than for the conventional

technology T1: Cov

min T2

< Cov

min T1

and Bio

min T2

<

Bio

min T1

. We also take into account the technology

difference between T1 and T2 in the initial values.

Since the green technology T2 is emergent

compared to the well-established T1, we assume that

T2 has a disadvantage in terms of techno-economic

characteristics such that production costs are higher

and technical performance is lower than T1.

3.2.3 Process Overview and Scheduling

In the model, one time step represents one period of

purchase and simulations are run for 200 periods.

Within each time step, six modules are processed in

the following order: purchase, budget, entry/exit,

technology portfolio, R&D watch/innovation, rebuy.

Purchase depends on the utility that a product,

given its four attributes, brings to a client provided

economic and technical constraints are first satisfied

(reserve price and minimum technical quality). Once

a product is selected by a client, the corresponding

supplier registers a sale.

Budget of each supplier takes into account the

R&D expenses and the profit derived from the sales.

Within the exit/entry module, each supplier with

a negative budget exits and is replaced by a new

firm so that a constant number of suppliers is

observed over the whole time period. Each new

entrant will be able to copy an installed firm with

more or less success (absorptive capacity).

Technology portfolio enables a supplier to adopt

T2 or not on the one hand and to keep or abandon

T1 on the other hand so that in the end the supplier’s

portfolio can be constituted by T1 and/or T2.

R&D watch and innovation allow suppliers to

improve the characteristics of their product. R&D

watch concerns only suppliers that have not yet

adopted T2 but are required (by regulation) to prove

they are searching for substitutes and thus

accumulate knowledge on T2. Innovation activities

may then involve improvements on T1 and/or T2

depending on the technology portfolio of each

supplier.

Rebuy allows each client to compare the

performance achieved by its current supplier with its

requirement levels. If the current supplier does not

under-performs, the client keeps the same supplier;

PolicyDesign,Eco-innovationandIndustrialDynamicsinanAgent-BasedModel-AnIllustrationwiththeREACH

Regulation

521

otherwise, the client switches to a new supplier and

selects one with the purchase module.

3.2.4 Design Concepts

Our model draws on basic principles developed by

the evolutionary theory of technological change

(Chiaromonte and Dosi, 1993); (Malerba et al.,

1999, among others). Thus, a strong emphasis is put

on dynamics, changing structures and disequilibrium

processes with an evolutionary perspective. We find

several design concepts common to ABMs in our

model.

According to the evolutionary approach,

bounded rationality characterizes economic agents

that have limited cognitive capacities to collect and

treat information. Suppliers seek for increased

market share thanks to innovation while users seek

for selecting the best product according to their

preference and requirement criteria. Individuals

cannot predict the future conditions they will

experience; they are myopic and their decisions

follow some routines and a satisficing principle

rather than a maximizing one. In our model,

suppliers make their decisions regarding technology

portfolio by considering specific thresholds that

reflect bounded rationality. Likewise, in the rebuy

module, clients compare the performance achieved

by their current supplier with their own requirement

threshold and decide to keep or leave the supplier.

The decision rules are adaptive which means the

agents adapt according to their performance and

their past experience. In our model, suppliers adapt

their R & D investment based on sales achieved in

the past, and customers adapt their requirement

levels according to suppliers’ performance.

Adaptation is thus modeled through the change in

threshold levels used in the decisions of agents.

Given that decision rules are agent-specific,

heterogeneity among individuals is a core aspect of

such an evolutionary theory. Interactions between

heterogeneous agents generate permanent diversity.

Industry dynamics emerge from the behavior of the

heterogeneous individuals.

Innovation is an endogenous and uncertain

process. Indeed, firms cannot know with certainty

the results of their R&D activity. That is why we

model a stochastic process of innovation. Other

stochastic processes are included where behavioral

parameters are randomly drawn. Like the innovation

process, the accumulation of knowledge that results

from technology watch on T2 is stochastic. Lastly,

the selection of a supplier by a client is also based on

a purchase probability (reflecting errors or imperfect

information).

Regarding innovation, a distinction is implicitly

made between incremental and radical innovation.

Incremental innovation allows small changes

whereas radical innovation leads to a technological

jump with significant cost and experience effects. In

our model, the adoption of T2 brings radical changes

that are materialized by high switching costs.

3.2.5 Initialization

At the start of a simulation run, the number of

suppliers is 10 and the number of users is 200. Some

initial values of the state variables are chosen

randomly in a range of parameters. Others are scale

parameters which have been set to plausibly

calibrate the model.

For product characteristics (VOCs emissions,

biodegradability, costs and technological

performance), initial values are based on data to

account for the difference in order of magnitude

between organic solvent and biosolvent (IRSST,

2010).

3.2.6 Input Data

The model does not use input data to represent time-

varying processes.

3.2.7 Submodels

Here, we specify the equations and the assumptions

underlying them to better understand the modules

listed in process overview and scheduling (cf.

subsection 3.2.3).

Purchase: The demand for products is expressed as

a demand for specific product characteristics in the

Lancaster vein. The purchase probability is

proportional to the utility derived by each client

(j=1,…,200) from each product present on the

market (k=1,2). We consider the following utility

function:

,,

,,

,,

,,

,,

,

0,0.1

(1)

With ,,,, ∈

0,1

. So the purchase decision

depends on the performance achieved by each

supplier (i=1,…,10) on each characteristic and on

the client’s preferences with respect to the product

characteristics represented in the parameters a, b, c

and d. A, B, C and D are technical parameters only

used to avoid negative terms in the utility

calculation. u(0,0.1) is drawn from a uniform

distribution with values between 0 and 0.1. The

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

522

parameter e can be interpreted as a bandwagon

effect (Leibenstein, 1950) reflecting imitation

behaviors. Indeed, there is information asymmetry

regarding suppliers’ performance. So clients refer to

the behavior of other customers buying similar

goods (Cowan et al, 1997). The clients use also the

market share of the firm (Ms) which reflects the

relative reputation of the supplier. The market share

as an indicator provides information on the quality

of the product observed by customers who have

already adopted.

Each client is also supposed to be limited by

economic and technical constraints. So we assume a

reserve price and a minimum technical performance

for each client. If one of these constraints is not

satisfied when selecting a product on the market, the

associated utility will be equal to zero.

The price P is deduced from the production cost

by applying a mark-up rate:

,,

1

,,

(2)

Where µ is a mark-up rate over production costs. For

simplicity, µ is supposed to be constant and identical

for every firm.

Budget: The budget B is determined by the residual

budget from the previous period, the profit and the

R&D expenses:

For typical suppliers:

,

,

,

,

(3)

For new T2 adopters:

,

,

,

,

,

(3’)

Where SC are the switching costs resulting from the

adoption of the radically new technology T2.

The profit is determined as follows:

,

,

,

(4)

Where

,

is the total number of products sold by

firm i; FC are the fixed costs which are supposed to

be identical for all the firms for simplicity reasons.

Entry/Exit Processes: Firms with a negative budget

B go bankrupt and disappear from the market. When

one firm exits the market, we assume that a new firm

enters so that the number of firms in the industry is

kept constant.

Entry occurs with a new firm imitating an

existing one. This choice is based on probabilities

proportional to the installed firms’ market shares.

The new firm copies the technology portfolio and

the product characteristics of the imitated firm. We

assume that the new firm has an absorptive capacity

which enables her to copy the attributes of the

imitated firm in a range of [0.8;1.2]. This allows the

new entrant to under-perform or inversely to over-

perform in comparison with the imitated firm.

The initial budget (B) and the initial fixed costs

(FC) of the new firm are set in the same way as for

the firms created at the start of a simulation run. The

knowledge stock (K) and the switching costs (SC) of

the new firm are function of the industry average.

Technology Portfolio: Every period, firms examine

the possibility to change their technology portfolio.

They compare an adoption index with a certain

threshold.

When T2 has not yet been adopted by anyone,

we have the following adoption index:

,

,

(5)

K stands for the knowledge stock cumulated on the

green technology T2 derived from the firm’s activity

of technological watch. φ is a parameter reflecting

the “first-mover advantage” i.e. the advantage

gained by the very first firm adopting T2.

When T2 has already been adopted, the

probability that a firm adopts the green technology

T2 depends on the following adoption index:

,

,

(5’)

Ms

T2

represents the total market share of the Green

technology T2. Thus the probability to adopt T2

depends positively on the stock of knowledge K

accumulated on T2 but also on how T2 has diffused

on the market.

The decision to adopt T2 follows a two steps

procedure. First, the firm compares its adoption

index with an adoption threshold under which the

firm will not adopt T2. If its adoption index is above

the threshold, then the second step determines if the

firm has a sufficient budget to bear the switching

costs related to the green technology.

For firms that decide to adopt the green

technology, they can continue to produce and sell

the conventional technology T1. They will have a

technology portfolio constituted of T1 and T2.

However firms can decide to abandon the

conventional technology and focus only on the

development of the green technology T2. Here we

assume that firms calculate the return on investments

of technology T1 and compare it with a certain

threshold. The return on investment is based on the

ratio:

,

,

,

,

(6)

The ratio turnover/R&D gives an indication of the

ability of the technology to recover one euro spent in

R&D in the total return. The lower the return on

PolicyDesign,Eco-innovationandIndustrialDynamicsinanAgent-BasedModel-AnIllustrationwiththeREACH

Regulation

523

investment of technology T1 compared to the

minimum threshold, the higher the likelihood to be

abandoned.

Innovation Process and Green Technological

Watch: At each period, every firm can improve the

product performance in their portfolio by carrying

out R&D and innovation activities.

Every firm will allocate a certain proportion of

its budget to R&D activities:

,

,

(7)

Then, each firm is assumed to split its global R&D

budget between both technologies T1 and T2:

1

,

,

(8)

2

,

1

,

(9)

Where

is the share of total R&D allocated to

R&D1 (technology T1).

For firms developing only the green technology

T2,

0. For firms developing both technologies

T1 and T2,

0.5. For firms developing only the

conventional technology T1,

0.5 since they

devote the other part to technological watch on the

green technology T2 (RDwatch).

R&D watch follows a stochastic process.

Success occurs if the following condition is

satisfied:

1

,

0,1

(10)

Where

is a scale parameter determining the

speed at which the level of the current R&D

expenditure allows knowledge accumulation and

2

,

represents R&D expenses allocated to

technology T2. u(0,1) is a uniform random value

selected between 0 and 1. The closer to 1, the more

difficult it is to satisfy the condition (10) with a

given R&D investment.

In case of success, new knowledge on T2 is

accumulated and the switching costs linked to the

potential adoption of T2 decrease.

,

,

0,1

,

(11)

,

,

0,1

(12)

Where

and

are scale parameters.

The innovation process is similar to the previous

procedure. Two steps are considered for each

product characteristic. First, the innovation

probability depends on the R&D investment

allocated to the technology. Success of innovation

depends on the following condition:

1

,,

0,1

(13)

Where

represents the speed of the innovation

process and

,,

the R&D expenses devoted by

firm i to product k at time t.

Then, in case of success, the outcome of innovation

needs to be calculated. For the different

characteristics, we have:

∆

,,

0,1

,,

(14)

∆

,,

0,1

,,

(15)

∆

,,

0,1

,,

(16)

∆

,,

0,1

,,

(17)

Where

,

,

are scale parameters;

u(0,1) is a uniform random value selected between 0

and 1 which reflects the efficiency of the R&D

activity and thus impacts the innovative outcome.

The last term of the equation represents the distance

to the technological frontier associated to each

product characteristic. By doing so, when the level

of a given product characteristic comes closer and

closer to the limit of what is achievable with the

considered product design, a given R&D

expenditure will achieve less and less further

progress (lower technological opportunities and

R&D decreasing returns).

Rebuy: each client j is assumed to use one single

product at the same time and to renew its purchase

every period. When renewing the product, the client

compares its minimum thresholds on each

characteristic with the performance actually

achieved by its current supplier. Requirement

thresholds change with the average performance in

the industry. For the technical performance criteria,

_

,,

_

,,

0,

,

_

,,

(18)

And so on for the other criteria (equations 19, 20 and

21). The parameters a, b, c and d represents the

client’s preferences for the considered characteristic;

is a scale parameter; for each product k, the

average performance of industry on each

characteristic is given by:

,

∑

,,

⁄

;

,

∑

,,

⁄

;

,

∑

,,

⁄

;

,

∑

,,

⁄

If one of the minimum thresholds is not met (i.e. is

below the current supplier’s performance), then the

client leaves the current supplier and chooses

another one through the purchase procedure.

4 RESULTS

Before presenting the results of our simulations, we

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

524

first expose the simulation protocol we have

followed

4.1 The Experimental Protocol

Results are analyzed through specific indicators and

are based on a high number of simulations in order

to deal with stochastic processes.

4.1.1 Main Indicators Characterizing

the Industrial Dynamics

The following indicators are used to exhibit the main

characteristics of the industrial dynamics:

The inverse Herfindahl-Hirshman index of

concentration (1/HHI with HHI the sum of the

squares of the firms’ market shares), which value

is comprised between 1 (monopoly) and N

(atomicity). The higher invHHI the higher the

degree of competition and inversely;

The number of failures, which takes into account

the number of exiting firms in each period. In our

model, the higher the number of failures, the

higher the number of new entrants that come and

replace the exiting firms;

The respective market share of technology T1 and

technology T2;

A global environmental indicator which traces

back the stock of VOCs emissions at the industry

level. We consider the following equation:

,

,

(22)

Where ABS stands for the assimilative capacity of an

ecosystem receiving pollution (VOCs emissions) at

each period. It is set exogenous and constant over

time. According to equation (22), the current stock

of VOCs emissions depends on the previous stock of

VOCS (the ‘history’ of pollution flows) less

assimilated emissions by the ecosystem plus the

current flow of emitted VOCs. Such a global

environmental indicator enables to grasp the ability

of the industry to decrease its VOCs emissions over

time. Such a decrease in VOCs can result from two

effects: a qualitative effect through innovation

(decrease in the VOC and/or Bio characteristics) and

a quantitative effect through lower market size in the

case where clients cannot afford the product (too

costly and/or too low quality).

4.1.2 The Baseline Simulations

and the Regulation Module

The baseline simulations serve as a benchmark to

study the effect of regulation upon industrial

dynamics. In order to cope with stochastic processes,

the results of our benchmark are drawn from a

battery of 500 simulations. For each indicator, the

average over 500 simulations is computed at

different time steps: 0, 50, 100, 150 and 200.

The regulation module includes the authorization

procedure and the extended responsibility principle.

The purpose of the authorization process is to

progressively replace substances of very high

concern by other substances or technologies where

these are economically and technically viable. Two

action leverages are considered in our model.

First, target-thresholds for techno-economic

performances of alternative solutions (X* and

Cost*) are incorporated. If technology T2 reaches

both thresholds of technical and economic

performance, then the public authorities can consider

the existence of viable solutions and can prohibit the

use of technology T1 after the sunset date. On the

contrary, if technology T2 does not reach the target

thresholds, the public authorities can consider that

there are no techno-economically viable alternatives.

In that case, authorizations are granted and firms can

use technology T1 after the sunset date, but only if

they prove that they carry out serious analyses of

alternatives providing information on their R & D

activity.

In our model, the budget allocated to R&D

watch on T2 is used to check whether a firm is

searching for new alternatives. Below a certain

threshold, authorization will not be granted. Above

the threshold, authorizations are granted for a period

and can be reviewed if “new information on

possible substitutes is available”. The threshold for

R&D watch depends on the average R&D watch

performed in the industry multiplied by a parameter

(

RDwatch

*) which value expresses the degree of

severity of regulation (the closer to 1 the stricter the

regulation, the closer to 0 the softer the regulation).

The timing of regulation is the second action

leverage for public authorities. Indeed an early

sunset date associated to close revision dates can be

considered to be strict. On the contrary a late sunset

date and distant revision dates impose softer

constraints. In order to take timing into account, we

assume that the probability to adopt technology T2

(equation 5’) is modified as follows:

,

,

1α

t

T

(5’’)

The meaning of T and thus its value depends on

whether it is the first time a deadline is given to

firms before public authorities check the existence of

suitable alternatives (in such a case, T=the sunset

date, T

sunset

) or if authorization has been granted and

PolicyDesign,Eco-innovationandIndustrialDynamicsinanAgent-BasedModel-AnIllustrationwiththeREACH

Regulation

525

subsequent checks will be carried out (in such a case

T=the revision date, T

revision

). α

i

R

is a parameter

reflecting the credibility that a firm i confers to

regulation (ranges between 0 and 1).

With equation (5’’), we thus assume that

regulation positively influences the adoption of the

green technology T2: the earlier and the closer to the

sunset date, the higher the adoption index; the more

frequent the revision of authorization the higher the

adoption index; the higher the credibility given to

regulation, the higher the adoption index.

By extending the responsibility principle,

REACH aims at changing the demand of

downstream users of chemical products towards less

toxic and harmful substances. In order to take into

account such a change in our model, we will now

consider that the technology portfolio hold by

suppliers matters in the clients’ decisions such that:

first, the utility of a product (equation 1) will tend to

decrease for suppliers which portfolio is only

constituted by technology T1; in that case the utility

is weighted by a factor

1α

where α

j

R

is a

parameter reflecting the credibility that a client j

gives to regulation (ranges between 0 and 1) and T

will represent alternatively the sunset date or the

revision date; second, the decision made by a client

to leave its current supplier will be subject to a

probability of defection based on

α

when

the supplier’s portfolio is only constituted by

technology T1. According to these changes, the

closer the sunset date or the revision date, the lesser

the weight given to suppliers holding a portfolio

with only technology T1 in the calculation of utility

(equation 1) in the purchase module but also in the

update of requirements in the rebuy module

(equations 20 and 21).

4.2 The Impact of Regulation upon

the Market Dynamics

In the following, we study two opposite

configurations (cf. Table 2), the “less stringent

scenario” and the “most stringent scenario”,

depending on the target-thresholds and on the timing

of regulation.

4.2.1 Initialization

The initial values for techno-economic performances

are chosen in relation with the size of the techno-

economic potential which can be covered by

innovators. In the low stringency configuration, 90%

of the potential must be covered while in the high

stringency configuration 10% needs to be covered.

Table 2: Policy variables in the REACH model.

Scenario

Policy variables

Less

stringent

Most

stringent

Target-

thresholds

Techno-eco

performances

High X* Low X*

Low Cost* High Cost*

R&D watch

R&Dwatch

*

close to 0

R&Dwatch

*

close to 1

Timing

Sunset date T

sunset

late T

sunset

early

Revision

date

T

revision

distant

T

revision

close

The mechanism is the following: at the sunset date,

if the average cost of T2 is below the corresponding

target-threshold and the average technical

performance of T2 is above the corresponding

target, then T1 is forbidden for every firm in the

industry. If not, the budget of R&D watch is checked

for each firm. If such a budget is below a certain

threshold, then T1 is forbidden for the considered

firm. If not, it is possible to continue developing T1

as if the authorization had been individually granted

until a certain period of time. At the revision date, a

similar sequential checking is made.

4.2.2 Main Results

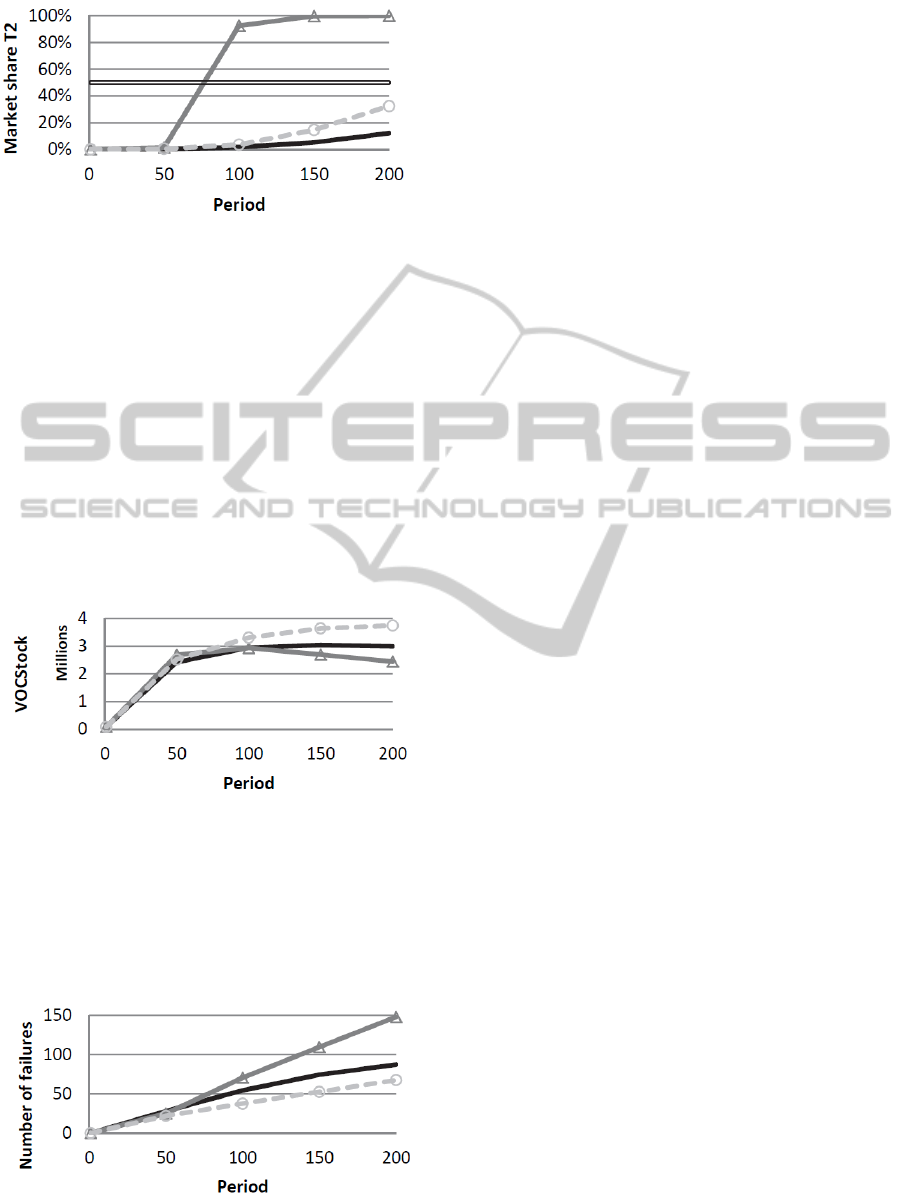

The graphs below depict the evolution of each

indicator in the different cases: the benchmark

scenario (black line), the less stringent scenario

(grey dotted line) and the most stringent

scenario (grey full line).

Results show that regulation increases

industrial concentration all the more strongly

that regulation is more stringent (cf. Figure 2).

Figure 2: Evolution of the inverse HHI (average for 500

simulations).

Figure 3 shows that regulation helps technology T2

to take off and to increase its market share compared

to the benchmark scenario where T2 was doomed to

a niche (12% in average at t=200). However, only

the most stringent scenario allows domination of T2

due to an early ban of T1 (in t=50).

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

526

Figure 3: Evolution of market shares for T2 (average for

500 simulations).

As to the stock of VOCs, we observe a kind of

inverted U curve in the most stringent scenario as

VOCs emissions rise in a first place and then fall

with the advances of innovation and the diffusion of

T2 but also with a decrease in market size (cf. Figure

4). By contrast, the less stringent scenario exhibits

systematically higher levels of VOCs over time

compared to the benchmark. This is due to the fact

that firms specialised on T1 (and very efficient in

improving the product characteristics) are disturbed

by regulatory mechanisms during the whole time

period without yet experiencing complete

prohibition of T1.

Figure 4: Evolution of the global stock of VOCs (average

for 500 simulations).

In our model, failures result from a combination of

different effects: low sales (and thus insufficient

budget) and attachment of clients to their suppliers

(fidelity effect) that both prevail in the benchmark

scenario; forced exit due to not enough R&D watch

Figure 5: Evolution of failures (average for 500

simulations).

on T2 or to T1 ban when regulation is incorporated.

Results show that the number of failures due to this

combination of effects is much higher in the most

stringent scenario than in the benchmark while it is

lower in the less stringent scenario (cf. Figure 5).To

summarize, we see that the most stringent scenario

characterized by strict timing (early sunset date and

frequent revisions) and strict techno-economic

performances for alternative substances (low price-

quality ratio for T2) pushes radical environmental

innovation by allowing strong and early take-off of

technology T2 and prohibition of technology T1.

But being detrimental to incremental innovation on

T1, such a scenario leads to lower global

environmental performances (higher stock of VOCs)

in the short term. This illustrates the tension between

the short and the long term underlying the

development of radical environmental technologies.

5 CONCLUSIONS

This paper intends to contribute to a better

understanding of the relationship between policy

design and eco-innovation through an agent-based

model. Stringency, flexibility and timing of

regulation are crucial to spur eco-innovation. These

are key aspects to consider in the REACH

regulation, especially to foster the development of

alternative substances (like biosolvents) to replace

toxic and harmful substances (like organic solvents).

The ABM model we propose in this paper is

original in many aspects: evolutionary modeling of

innovation and industrial dynamics; vertical

interactions between suppliers and users; technology

portfolio; authorization procedure and extended

producer responsibility. The model is used as a

learning tool, and is not intended for accurate

prediction. It aims to provide insights about the

directional effect of instruments underlying the

authorization procedure of REACH on firms'

innovation strategy and the associated shift to

alternative substances.

ACKNOWLEDGEMENTS

The authors would like to thank the Regional

Council of Aquitaine for its financial support in the

ECOCHIM project.

PolicyDesign,Eco-innovationandIndustrialDynamicsinanAgent-BasedModel-AnIllustrationwiththeREACH

Regulation

527

REFERENCES

Ashford, N. A, Ayers, C., Stone, R., 1985. Using

regulation to change the market for innovation,

Harvard Environmental Law Review, 9 (2):419-66

Chiaromonte, F., Dosi, G., 1993. Heterogeneity,

competition and macroeconomic dynamics. Structural

Change and Economic Dynamics 4 (1), pp. 39-46

Cowan, R., Cowan, W., Swann, P., 1997. A model of

demand with interactions among consumers,

International Journal of Industrial Organization, vol.

15, n° 6, 711-732.

EEA Technical report, 2011. Environmental tax reform in

Europe: opportunities for eco-innovation. n°17,

Publications Office of the EU.

European Commission-DG Environment, 2007. Designing

environmental policy to be innovation friendly, Final

report CM International.

Eurostat, 2009. The REACH baseline study,

Methodologies and working papers, European

Commission.

Fuchs, O., 2011. REACH: A new paradigm for the

management of chemical risks, Health and

Environment Report n°4, IFRI.

Grimm, V., Berger, U., Bastiansen, F., Eliassen, S., Ginot,

V., Giske, J., Goss-Custard, J., Grand, T., Heinz, S.,

Huse, G., Huth, A., Jepsen, J.U., Jørgensen, C., Mooij,

W.M., Müller, B., Pe’er, G., Piou, C., Railsback, S.F.,

Robbins, A.M., Robbins, M.M., Rossmanith, E.,

Rüger, N., Strand, E., Souissi, S., Stillman, R.A.,

Vabø, R., Visser, U., DeAngelis, D.L., 2006. A

standard protocol for describing individual-based and

agent-based models. Ecological Modelling, 198, 115–

126.

Grimm, V., Berger U., DeAngelis D.L., Polhill J.G., Giske

J., Railsback S.F., 2010, The ODD protocol: A review

and first update, Ecological Modelling, 221, 2760-

2768.

Hahn, R.W., 1989. Economic prescriptions for

environmental problems: How the patient followed the

doctor’s orders, Journal of Economic Perspectives, 3

(2), 95-114.

IRSST, 2010. La substitution des solvants par les esters

méthyliques d’acides gras d’huiles végétales.

RAPPORT B-079.

Jänicke, M., 2008. The policy design of environmental

innovation and sustainable production, Portoroz,

Slovenia, 14-16 May.

Johnstone, N., 2007. Environmental Policy and Corporate

Behaviour, Edward Elgar.

Lancaster, K., 1971. Consumer demand: A new approach,

Columbia Studies in Economics, n°5 New York and

London, Columbia University Press.

Leibenstein, H., 1950. Bandwagon, Snob, and Veblen

effects in the theory of consumers’ demand, The

Quarterly Journal of Economics, vol.64, n°2, 183-207.

Malerba, F., Nelson, R., Orsenigo, L., Winter, S., 1999.

History-friendly models of industry evolution: the

computer industry, Industrial and Corporate Change 8

(1), pp. 3-40.

MEI Report, 2007, Measuring Eco-innovation, MEI

project, UM MERIT.

Nordbeck, R.; Faust, M., 2002. European chemical

regulation and its effect on innovation - An assessment

of the EU's White Paper on the strategy for a future

chemicals policy, Leipzig: UFZ Centre for

Environmental Research.

Porter, M., Van der Linde, C., 1995. Toward a New

Conception of the Environment-Competitiveness

Relationship, in Journal of Economic Perspectives 9,

pp. 97-118.

Scott, J., Trubek, D., 2002. Mind the Gap: Law and New

Approaches to Governance in the European Union,

European Law Journal, 2002, n° 1

Wolf, O., Delgado, L., 2003. The impact of REACH on

innovation in the chemical industry, EC-JRC, EUR

20999 EN.

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

528