Generalized Net Model of the Methodology for Analysis of the

Creditworthiness and Evaluation of Credit Risk in SMEs Financing

George L. Shahpazov

1

, Lyubka A. Doukovska

1

and Krassimir T. Atanassov

2

1

Institute of Information and Communication Technologies, Bulgarian Academy of Sciences,

Acad. G. Bonchev str., bl. 2, 1113 Sofia, Bulgaria

2

Institute of Biophysics and Biomedical Engineering, Acad. G. Bonchev str., bl. 105, 1113 Sofia, Bulgaria

atlhemus@abv.bg, doukovska@iit.bas.bg, krat@bas.bg

Keywords: Generalized Net Model, Small and Medium-Sized Enterprises (SMEs), Credit Risk, Creditworthiness.

Abstract: The launch of the new programming period of the EU in 2014 will lead to many changes in the way the EU

budget is funded. The European Commission is considering various ways to generate their own income to

make it more independent of the Member States. Unfortunately the consequences of the reforms might have

negative influence to European and in particular to the Bulgarian economy and especially for SMEs. The

effective results in these conditions are to ensure financial resources for SMEs beneficiaries - increasing the

amount of advance payments, creating additional financial instruments. Prior to SMEs financing, a

methodology for analysis of creditworthiness and credit risk assessment procedures are applied. The aim of

the methodology is to contribute and establish an unified and systematic approach to analyzing and

assessing credit risk, which is to lead to a more thorough and objective assessment of the credit and

minimize the risk undertaken by the financial institution. The system of credit risk assessment is a

collaboration of estimates of the specified indicators. The final conclusion of the process should result into a

motivated standpoint, based on which, a decision on further conduct of the Bank towards the loan request

will be made (guarantees and other commitments, bearing credit risk), along with periodic risk assessment

procedure on already granted loans. In this paper is provided an analysis using the Generalized Nets. They

are used as a tool for modelling of different processes in industries and medicine. In the present paper, an

application of these nets apparatus for assistive technology and the advantages of using such model, for

SMEs financial support mechanism are discussed.

1 INTRODUCTION

Considering the harder economic conditions, to

which SME’s are exposed, the attitude to external

financing changes. The research of the sector show

that 10 years ago about 7% of enterprises utilized

investment loans, 17% had access to working capital

funds, and 67% didn’t have any access to financing.

The aggressive development of banking system

along with EU structured funds, significantly

increased the accession of SME’s to venture

funding. From year 2010 onwards, about 55% of

companies are able to reach financing of any type.

In 2010 most popular sources of financing

between SME’s was own resources (about 42%),

illegitimate financing from frends and relatives

(close to 17%), and at last EU funds and Bank

financing (near 30%). A year earlier above 50% of

companies are financed with own equity.

Limitations and obstacles in financing occur mainly

due to the reduced investment intentions of SME’s

within the last few years. Main reasons for it are lack

of economic stability within the country and EU,

along with gradual increase of intercompany

leverage. The figures show that, intercompany debp

over the past 3 years has gone up over 100%.At

present time about 83% of all SME’s have

uncollected receivables (Bulgarian Industrial

Association).

One third of all investments made by SME’s are

into new equipment and machinery (about 35%), re

qualification, training and advertisement is the

second investment direction (29%), development of

present and design of additional newer products

(22%), introduction of systems for intercompany

management processes (9%).

Alternative ways of raising funds by SME’s are

via leasing schemes, where at present about 32% of

292

Shahpazov G., Doukovska L. and T. Atanassov K.

Generalized Net Model of the Methodology for Analysis of the Creditworthiness and Evaluation of Credit Risk in SMEs Financing.

DOI: 10.5220/0004776702920297

In Proceedings of the Third International Symposium on Business Modeling and Software Design (BMSD 2013), pages 292-297

ISBN: 978-989-8565-56-3

Copyright

c

2013 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

SME’s are able to reach their investment goals,

whereas couple of years earlier the figure is close to

45%.

Due to worsen economic environment and

interbanking debt, weaker turnover and profit

results, most SME’s are unable to rely on own

resources. This is valid to such an extent that the

financing with own funds has decreased 10 times

and in spite of the difficulties, concerning the receipt

of a bank loan, it has turned into the most preferred

source of funds.

The most popular source of financing among

commercial banks and leasing companies is public

procurement. Statistics show that about 15% of

SME’s take advantage of public procurement.

Raising funds via government programs was used by

2.9% of the companies, and access to financing via

programs of non-government organizations has a

share of 2%. Financing via EU structured funds had

an insignificant portion (1.6%) up until few years

ago. Nowadays the percentage has increased

considerably and 45% of SME’s is making efforts to

receive the embedded financing and grant schemes,

(Bulgarian Small and Medium Enterprise Promotion

Agency).

Regardless of the above mentioned statistics

there hasn’t been any considerable changes in

regards to the specific difficulties, with which SME

are confronted upon the receipt of a bank loan. Most

of which they encounter are:

• Considerableinterest rates and requirements for

sufficient loan collateral. Often companies do not

dispose with the necessary real estates, and the

interest rates are close to the profitability of their

assets.

• Lacking or insufficient credit history (valid to an

even greater extent for the new companies). The

reason for this often is the concealing of tax,

despite the decrease in the tax and social security

burden in the last years.

• The relatively low economic and legal general

knowledge of the owners of SMEs.

• Incapacity for the preparation of a long-term plan

for the development of business. This is the

result of the unstable economic environment, as

well as of the incapacity of SMEs to prepare

reliable long-term financial forecasts.

• High fees, “hidden” interest and the heavy

paperwork, associated with loan granting/project

financing.

• Requirements for minimum equity and minimum

turnover.

2 SHORT REMARKS ON

GENERALIZED NETS

Generalized Nets (GN) (Atanassov, 1991,

Atanassov, 2007) are extensions of Petri nets and

other modifications of them. They are tools intended

for the detailed modelling of parallel processes.

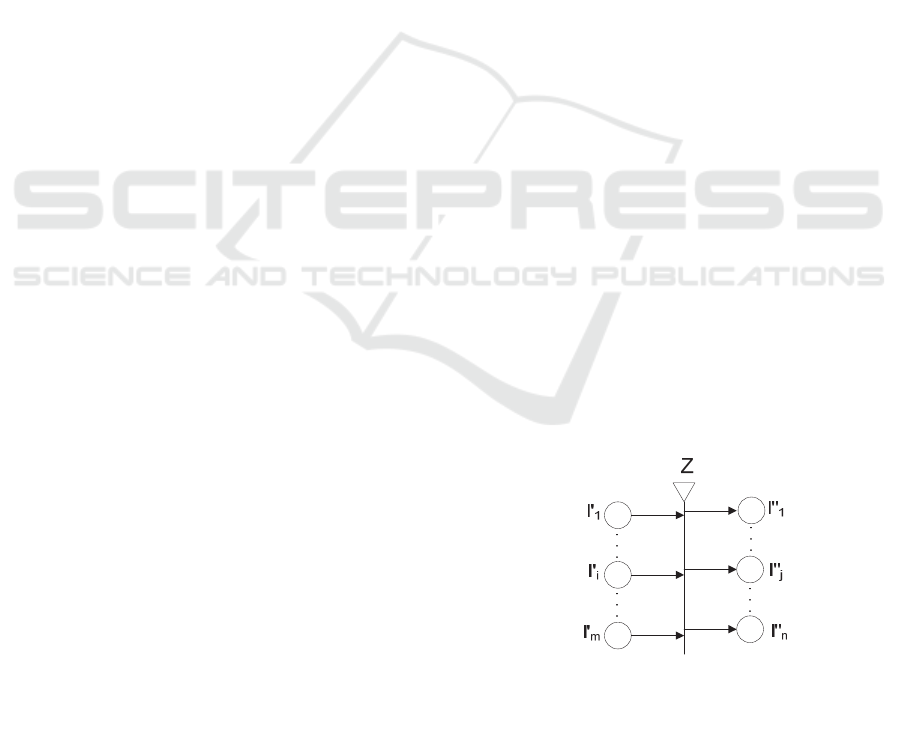

A GN is a collection of transitions and places

ordered according to some rules (see Figure 1). The

places are marked by circles. The set of places to the

left of the vertical line (the transition) are called

input places, and those to the right are called output

places. For each transition, there is an index matrix

with elements called predicates. Some GN-places

contain tokens – dynamic elements entering the net

with initial characteristics and getting new ones

while moving within the net. Tokens proceed from

an input to an output place of the transition if the

predicate corresponding to this pair of places in the

index matrix is evaluated as “true”. Every token has

its own identifier and collects its own history that

could influence the development of the whole

process modelled by the GNs.

Two time-moments are specified for the GNs:

for the beginning and the end of functioning,

respectively.

A GN can have only a part of its components. In

this case, it is called reduced GN. Here, we shall

give the formal definition of a reduced GN without

temporal components, place and arc capacities, and

token, place and transition priorities.

Formally, every transition in the used below

reduced GN is described by a three-tuple:

Z =

L

, L

, r

(1)

where:

Figure 1: A GN transition.

(a) L and L are finite, non-empty sets of places (the

transition’s input and output places, respectively),

for the transition these are:

Generalized Net Model of the Methodology for Analysis of the Creditworthiness and Evaluation of Credit Risk in SMEs

Financing

293

L = {

m

lll ',...,','

21

} and L = {

n21

"l,...,"l,"l

};

(b) r is the transition’s condition determining which

tokens will pass (or transfer) from the

transition’s inputs to its outputs; it has the form of

an Index Matrix (IM):

)1,1(

)(

'

...

'

...

'

"..."..."

,

,

1

1

njmi

predicater

r

l

l

l

lll

r

ji

ji

m

i

nj

where r

i,j

is the predicate that corresponds to the i

-th

input and j

-th

output place.

When its truth value is “true”, a token from the

i

-th

input place transfers to the j

-th

output place;

otherwise, this is not possible.

The ordered four-tuple:

E = A, K, X,

(2)

is called a reduced Generalized Net if:

(a) A is the set of transitions;

(b) K is the set of the GN’s tokens;

(c) X is the set of all initial characteristics which

the tokens can obtain on entering the net;

(d)

is the characteristic function that assigns

new characteristics to every token when it makes the

transfer from an input to an output place of a given

transition.

Many operations (e.g., union, intersection and

others), relations (e.g., inclusion, coincidence and

others) and operators are defined over the GNs.

Operators change the GN-forms, the strategies of

token transfer and other. There are six types: global,

local, hierarchical, reducing, extending and dynamic

operators.

3 GENERALIZED NET MODEL

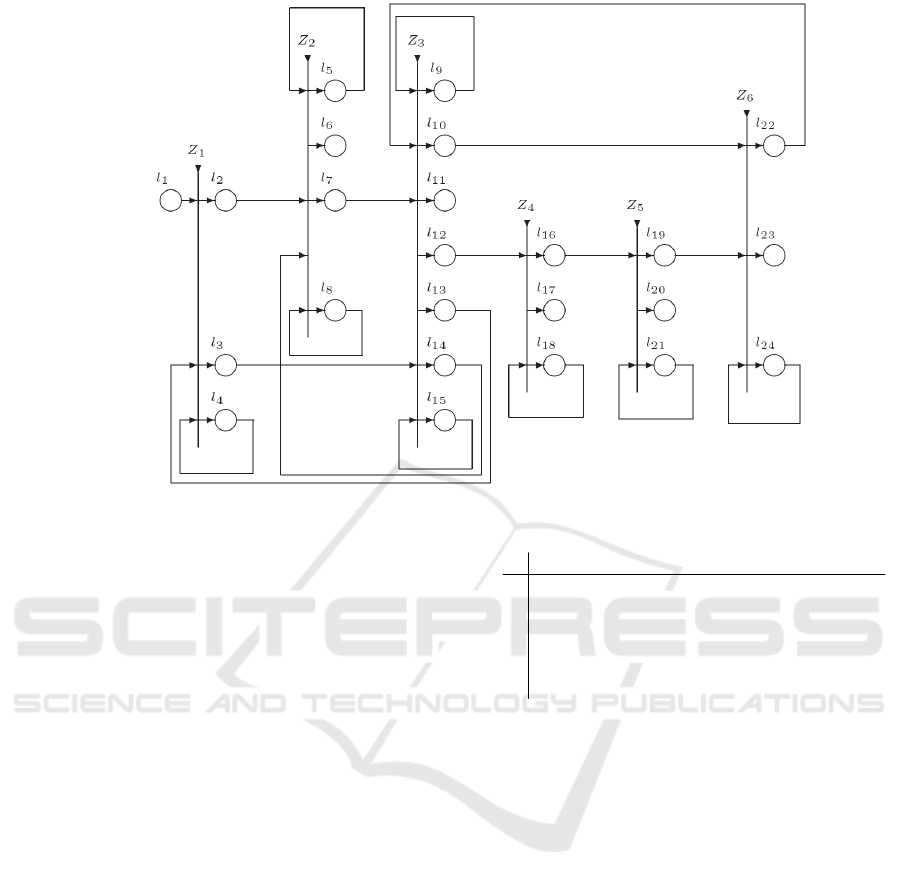

A GN model is described in In this paper will be

used GN shown on Figure 2. Five types of tokens

move in this GN.

The tokens from the first type are

1

and

2

, and

they represent bank-administrators. The tokens have

the initial and current characteristics: “Credit

specialist at branch level” in place l

8

and “Experts

at Headquarters level” in place l

15

.

The tokens from the second type are the

-tokens

that permanently enter place l

1

with initial char-

acteristic “Potential SME Borrower”.

The tokens from the third type are

1

,

2

and

3

,

representing Bank management. They have the

initial and current characteristics: “Credit Council”

in place l

18

, “Management Board” in place l

21

and

“Supervisory Board” in place l

24

.

In some time-moments, some token

will split

to the original token

and a token

, while some

-token and the

3

-token will split to the original

-

or

3

-token and a

-token. These new types of

tokens will be discussed below.

114132341

{, , },{ , , },

Z

lll lll r

(3)

234

44,24

1

,

1

3

13

,

lll

r

l false false true

lWWtrue

l false false true

where:

W

4,2

= “There is a SME client that has prepared a

project”,

W

4,3

= “There is an answer from the SME client to a

question from the credit specialist at branch level”.

Token

enters place l

4

without a new

characteristic.

Token

4

enters place l

4

and unites with token

,

staying there.

If W

4,2

= true, then token

splits to the original

token

and token

. The second one enters place l

2

and there it obtains the characteristic “Loan

application, based upon a prepared project”. If

W

4,3

= true, then token

splits to the original token

and token

1

. The second one enters place l

3

and

there it obtains the characteristic “Requested

additional information in regards to submitted

project”. This token is generated in a result of token

4

that enters place l

4

.

2 25814 5678 2

{ , , , },{ , , , },

Z

llll llll r

(4)

5678

2

55,5 5,6 5,7

8,7

8

1

2

4

,

llll

r

l true false false false

l W W W false

W

l

f

alse false true

f

alse false truel

false

Third International Symposium on Business Modeling and Software Design

294

Figure 2: Generalized net model.

where:

W

5,5

= „By the moment, there is not a solution for

the project”,

W

5,6

= “Project rejected at first level (at branch

level)”,

W

5,7

= “Project accepted at branch level, sent to

Headquarters for further detailed research”,

W

8,7

= “There is an answer of a question initiated

by Headquarters experts in regards to the submitted

project”.

Token

enters place l

5

without any new char-

acteristic. Token

5

enters place l

8

and unites with

token

1

.

When W

5,5

= true, token

continues to stay in

place l

5

without a new characteristic. When W

5,6

=

true, token

enters place l

6

with a characteristic

“Project rejected (due to specific motives)”. When

W

5,7

= true, token

enters place l

7

with a

characteristic “Project accepted (due to specific

motives)”. If W

8,7

= true, then token

1

splits to the

original token

1

and token

2

. The second one

enters place l

7

and there, it obtains the characteristic

“Answer from branch level”.

3 3 7 9 5 22 9 10 11 12 13 14 15 3

{, , , },{, , , , , , },

l

Z

lllll lllllll r

(5)

9 101112131415

3

3

77,9 7,15

9 9,9 9,11 9,12

15 15,10 15,13 15,14

22

ll ll l l l

r

l false false false false false false true

l W false false false false false W

l W false W W false false false

l false W false false W W true

l false false false false false f

,

alse true

where:

W

7,9

= “The current token is from

-type”,

W

7,15

= “The current token is from

5

-type”,

W

9,9

= „By the moment, there is not a solution for the

project”,

W

9,11

= “Rejected at Headquarters level”,

W

9,12

= “Accepted and prepared for loan granting”,

W

15,10

= “An inquiry is initiated and addressed to

the Supervisory Board”,

W

15,13

= “An inquiry is initiated and addressed to

the SME Client-borrower”,

W

15,14

= “An inquiry is initiated and addressed to

branch level”.

Token

1

enters place l

15

and unites with token

2

.

When W

7,9

= true, token

enters place l

9

without

a new characteristic.

When W

9,15

= true, token

2

enters place l

15

and

unites with token

2

, that obtains the above

mentioned current characteristic.

When W

9,9

= true, token

contains to stay in

place l

9

without a new characteristic.

Generalized Net Model of the Methodology for Analysis of the Creditworthiness and Evaluation of Credit Risk in SMEs

Financing

295

When W

9,11

= true, token

enters place l

11

with a

characteristic “Project rejected at Headquarters

level (due to specific motives)”.

When W

9,12

= true, token

enters place l

12

with a

characteristic “Project accepted at Headquarters

level (due to specific motives)”.

When W

15,10

= true, token

2

splits to the original

token

2

and token

3

. The second one enters place

l

10

and there, it obtains the characteristic “An inquiry

is addressed to the Supervisory Board for specific

project” or “An answer of Head quarters level to

the Supervisory Board”

When W

15,13

= true, token

2

splits to the original

token

2

and token

4

. The second one enters place

l

13

and there, it obtains the characteristic “An inquiry

is addressed to the SME Client-borrower in regards

to a specific detail of the project”.

When W

15,14

= true, token

2

splits to the original

token

2

and token

5

. The second one enters place

l

14

and there, it obtains the characteristic “An inquiry

is addressed to Branch level in regards to specific

details of the project”.

124181617184

{,},{, ,},

Z

ll lll r

(6)

16 17 18

4

12 12,16 12,17

18 18,18

,

lll

r

lW W true

lfalsefalseW

where:

W

12,16

= “There is a positive decision by Credit

council in regards to specific project”,

W

12,17

= “There is a negative decision by Credit

council in regards to specific project”,

W

18,18

= “There is a token in place l

12

”.

When W

12,16

= true, token

enters place l

16

with

a characteristic “The project is voted and accepted

for financing by the Credit council under the

original or new updated parameters”.

When W

12,17

= true, token

enters place l

17

without any characteristic.

5 1621 192021 5

{, },{, , },

Z

ll lll r

(7)

19 20 21

5

16 16,19 16,20

21 21,21

,

lll

r

lW W true

lfalsefalseW

where:

W

16,19

= “The Project receives affirmative decision

when voted by Management Board”,

W

16,20

= “The Project receives negative decision

when voted by Management Board”,

W

21,21

= “There is a token in place l

16

”.

When W

16,19

= true, token

enters place l

19

with

a characteristic “The project is voted and accepted

for financing by the Management Board under the

original or new updated parameters”.

When W

16,20

= true, token

enters place l

20

without any characteristic.

6 101924 222324 6

{, , },{, , },

Z

lll lll r

(8)

22 23 24

6

10

19 19,23

24 24,22 24,24

,

lll

r

l false false true

l false W false

l W false W

where:

W

19,23

= “Final decision by Supervisory Board”,

W

24,22

= “There is an answer of the Supervisory

Board to the Management Board level or there is an

answer of the Supervisory Board to a question from

the Credit council ”,

W

24,24

= “There is a token in place l

19

”.

Token

3

enters place l

24

and unites with token

3

.

When W

19,23

= true, token

enters place l

23

with

a characteristic “Final decision (positive or nega-

tive) of the Supervisory Board about the project”.

When W

24,22

= true, token

3

splits to two tokens

– the original token

3

and token

6

that obtains the

characteristic “Answer of the Supervisory Board”.

4 CONCLUSIONS

The so constructed GN model describes the most

important steps of the process of evaluation of a

business project proposal intended for financing

. In

a next research, the authors plan to elaborate the

model in the aspect related to the process of decision

making within the frames of the bank

administration.

First, the model can be used for real-time control

of the processes, flowing in a particular bank. If this

is the case, the databases of the model will

correspond to the real databases of that bank, and the

process of adding new characteristics of the

respective GN-tokens will correspond to the process

of inputting new information in the bank's databases.

The tokens, representing the bank's clients, will have

Third International Symposium on Business Modeling and Software Design

296

as initial characteristics their specific parameters and

with their real project proposals intended for

financing

. The movement of these real projects will

be observed and information for the current status of

each of them can be obtained from the model.

Practically, the GN-model will synchronize the real

processes, related to the above described procedure.

Second, it can be a tool for prognostics of

different situations, related to the modeled

processes, for example in a given moment of time, a

large number of projects may be submitted, and

these have to be evaluated in parallel or compete for

a limited amount of funding.

Third, on the basis of the model, some changes

of the process of evaluation can be simulated and the

results can be used for searching the optimal

scheduling of the separate steps of this process.

ACKNOWLEDGEMENTS

The research work reported in the paper is partly

supported by the project AComIn “Advanced

Computing for Innovation”, grant 316087, funded

by the FP7 Capacity Programme (Research Potential

of Convergence Regions) and partially supported by

the European Social Fund and Republic of Bulgaria,

Operational Programme “Development of Human

Resources” 2007-2013, Grant № BG051PO001-

3.3.06-0048.

REFERENCES

Bulgarian Small and Medium Enterprise Promotion

Agency – www.sme.government.bg

Shahpazov G., L. Doukovska - Structuring of Growth

Funds with the Purpose of SME’s Evolution under the

JEREMIE Initiative, Proc. of the Second International

Symposium on Business Modeling and Software

Design - BMSD'12, 4-6 July 2012, Geneva,

Switzerland, ISBN 978-989-8565-26-6, pp. 159-164,

2012.

European Commission, “SEC (2011) 876 final/2”,

Brussels, 27.10.2011.

The Global Competitiveness Report 2011, www.ced.bg.

Atanassov K. - Generalized Nets. World Scientific,

Singapore, New Jersey, London, 1991.

Atanassov K. - On Generalized Nets Theory, “Prof. M.

Drinov” Academic Publishing House, Sofia, Bulgaria,

2007.

Generalized Net Model of the Methodology for Analysis of the Creditworthiness and Evaluation of Credit Risk in SMEs

Financing

297