A Fraud Detection Visualization System Utilizing Radial Drawings and

Heat-maps

Evmorfia N. Argyriou

1

, Antonios Symvonis

1

and Vassilis Vassiliou

2

1

School of Applied Mathematical & Physical Sciences, National Technical University of Athens, Athens, Greece

2

Vodafone Greece, Halandri, Greece

Keywords:

Information Visualization, Fraud Management Systems, Data Visualization, Fraud Detection.

Abstract:

We present a prototype system developed in cooperation with a business organization that combines informa-

tion visualization and pattern-matching techniques to detect fraudulent activity by employees. The system is

built upon common fraud patterns searched while trying to detect occupational fraud suggested by internal

auditors of a business company. The main visualization of the system consists of a multi-layer radial drawing

that represents the activity of the employees and clients. Each layer represents a different examined pattern

whereas heat-maps indicating suspicious activity are incorporated in the visualization. The data are first pre-

processed based on a decision tree generated by the examined patterns and each employee is assigned a value

indicating whether or not there exist indications of fraud. The visualization is presented as an animation and

the employees are visualized one by one according to their severity values together with their related clients.

1 INTRODUCTION

Internal fraud detection gains more and more atten-

tion as fraudulent activity appears in ascendant trend

during the last years. Fraud is defined as “the inten-

tional misuse or abuse of the assets of a company (As-

sociation of Certified Fraud Examiners, 2012)” and

may be committed by employees, clients or other en-

tities. Studies on business fraud show that most of the

reported fraud cases have been committed by trusted

associates and this is referred to as “occupational or

employee fraud”. Such schemes may continue for

years until fraud is confirmed, producing a huge cost

both to the global economy and to the company. As

a result of fraud, business reputation, company value

and public and client trust are negatively affected.

Even though advanced information technology

has been incorporated into organizations to reduce

the risk of internal fraud, monitoring diverse systems

that produce textual logs in non-uniform formats is a

time-consuming task. Information visualization can

be promising, since it facilitates the quick identifica-

tion of fraudulent activity. In this paper, we present a

system developed in cooperation with a business or-

ganization that exploits the advantages of information

visualization and pattern recognition to detect suspi-

cious patterns concerning fraudulent financial state-

ments in systems in which a pair of entities (em-

ployee and client) are involved. Towards this direc-

tion, the system produces a multi-layer radial drawing

(see Fig. 1) representing the activity of employees and

clients along with other significant information that

enable the identification of possible fraud patterns.

Since occupational fraud schemes are well-hidden

in the huge amount of data, we were seeking for an

approach that would present to the auditor all the

recorded events according to their severity. On the

other hand, visualizing large data-sets simultaneously

is confusing and inefficient. For this reason, the sys-

tem measures the similarity of the activity of the em-

ployees based on fraud detection patterns (suggested

by auditors based on their experience and the frame-

work of the company on internal fraud risk reduction)

and appropriate heat-maps are generated and incorpo-

rated in the system. The produced visualization is pre-

sented as an animation. The system supports supple-

mentary functionalities such as a database log viewer,

export log mechanisms, storing and post-processing

of data, plots and charts.

2 RELATED WORK

Fraud detection has been studied enough in the lit-

erature. To the best of our knowledge, there exist

only few works oriented exclusively on occupational

153

N. Argyriou E., Symvonis A. and Vassiliou V..

A Fraud Detection Visualization System Utilizing Radial Drawings and Heat-maps.

DOI: 10.5220/0004735501530160

In Proceedings of the 5th International Conference on Information Visualization Theory and Applications (IVAPP-2014), pages 153-160

ISBN: 978-989-758-005-5

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

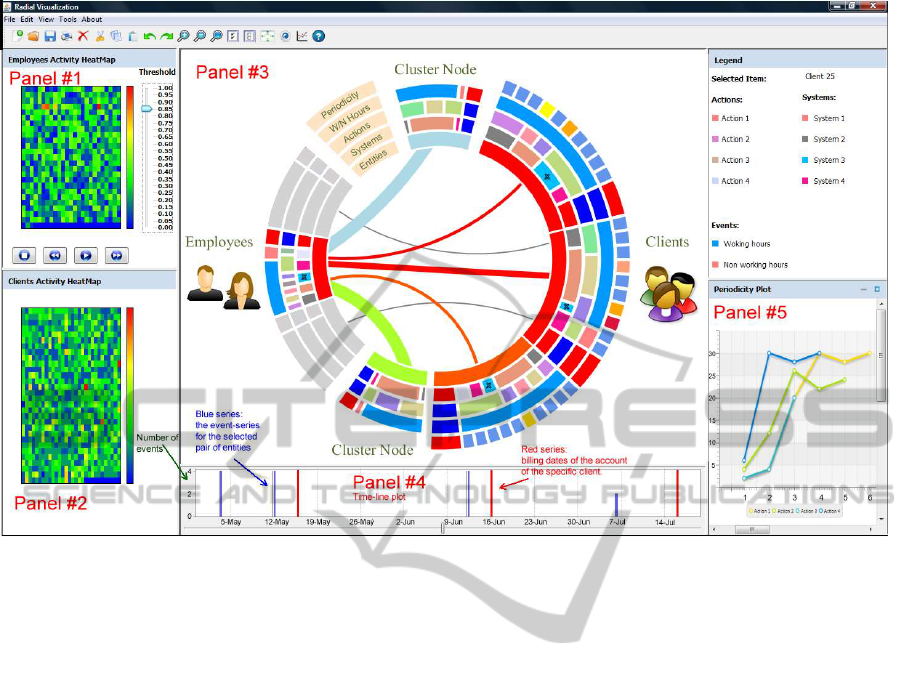

Figure 1: A snapshot of the interface of the system.

fraud detection. Luell (Luell, 2010) utilizes data-

mining and visualization techniques to detect client

advisor fraud in a financial institution. Eberle and

Holder (Eberle and Holder, 2009) detect structural

anomalies in transactions and processes propagated

by employees using a graph representation. Syner-

Scope (SynerScope, 2011) is an industrial tool capa-

ble of detecting financial fraud using a visualization

scheme similar to ours representing the billing links

and relations between the company and other entities.

The main difference is that our system is oriented on

occupational fraud detection based on patterns sug-

gested by auditors and, thus, it is equipped with a de-

tection mechanism that preprocesses the data and the

visualization conforms to these patterns. We also uti-

lize animations to avoid cluttering the visualization.

A visualization system based on concentric circles

was presented in (Argyriou and Symvonis, 2012) aim-

ing at identifying periodic events using an algorithm

for periodicity detection. Our system extends the one

presented in (Argyriou et al., 2013a) that detects pe-

riodic patterns that may conceal occupational fraud

in several ways: (i) The visualization of our system

provides a complete view of all the examined patterns

and the results of the examination on each pattern (in

(Argyriou et al., 2013a), the detection procedure was

a “black-box” determining the order of the presenta-

tion of the clients in a video representing their activ-

ity in which suspicious clients appeared first; partial

results of the detection procedure were illustrated in

additional plots and charts, which hindered the inves-

tigation), (ii) the detection mechanism is based on a

decision tree even though we have incorporated most

of the patterns presented in (Argyriou et al., 2013a),

(iii) for periodicity detection, we apply a variation of

the Longest Common Subsequence algorithm (Vla-

chos et al., 2003) that tackles noisy data, (iv) a par-

allel coordinates plot has been added to detect un-

usual employee behavior, (v) the system provides a

database-viewer to facilitate the investigation proce-

dure. Many of the existing works on fraud detection

in general, use data-mining (Bolton and Hand, 2002),

(Kou et al., 2004), (Phua et al., 2010) and pattern

matching or graph pattern matching approaches (Sen-

ator et al., 1995), (Senator et al., 2002), (Wolverton

et al., 2003). Visualizations have also been used for

financial crime detection (Chang et al., 2008),(Huang

et al., 2009),(Giacomo et al., 2010), (Didimo et al.,

2011), (Didimo et al., 2012). For details on the above

works refer to (Argyriou et al., 2013b). This paper is

structured as follows: In Section 3, we describe the

detection procedure. In Section 4, we present the fea-

tures of the visualization. Section 5 presents a case-

study based on real data. We conclude in Section 6

with open problems and future work.

IVAPP2014-InternationalConferenceonInformationVisualizationTheoryandApplications

154

3 DETECTION PROCEDURE

As input, the system takes log files from diverse con-

trol systems that are appropriately parsed and stored

in a database using a uniform format. Records may

be generated by systems involving an employee and

a client consist (among other secondary fields) of a

time-stamp, an employee ID, a client ID and an ac-

tion. An event, say e, is defined as a 4-tuple (t, u,c,a),

where: (i) t corresponds to the time-stamp of the oc-

currence of e, (ii) u corresponds to an employee, (iii) c

represents a client, and (iv) a is the action taken by

the employee. For an event e = (t,u, c,a), we say

that client c is related to e and is also related to em-

ployee u. For a pair of employee-client (u,c), an

event-series T

u,c

= {e

1

(u,c)

,e

2

(u,c)

,.. .} is a sequence of

events e

i

(u,c)

= (t

i

,u, c,a

i

) related to client c and em-

ployee u.

The visualization may be generated either based

on the whole data-set of the database or on queries

performed by the auditor in the startup screen of the

system. As mentioned above, data have to be prepro-

cessed before producing the visualization such that

employees with strong indication of fraud are distin-

guished. For this reason, for a given employee u,

the event-series with each related client will be evalu-

ated based on fraud patterns and a value indicating the

severity of the related events (within range [0,1]) will

be assigned first to the event-series and then, to the

employee. If several fraud patterns are identified, em-

ployee u is assigned the maximum severity value of

the already calculated event-series related to u. The

evaluation is performed based on a decision tree gen-

erated by the following patterns suggested by the au-

ditors (see Fig. 2): (i) There exist more than X events

related to employee u and client c within a time inter-

val of Y days/months where X,Y are configurable by

the auditor (refer to the green rectangular node of the

first layer belowthe root of the decision tree in Fig. 2),

(ii) the employee has performed unauthorized actions

(based on a list of actions provided by the auditors)

and, (iii) the employee operated in systems that she

is not authorized to use. In the case where patterns

(ii) or (iii) occur, the event-series of the employee is

assigned the maximum value (i.e., value 1) such that

the employee is definitely distinguished in the visual-

ization. However, in the case where pattern (i) occurs,

the investigation has to proceed further. Then, the pat-

terns that are taken into consideration are:

• Event-series periodicity: A common pattern

while examining such fraud schemes is the occur-

rence of events in regular time basis. For instance,

an employee modifies intentionally the account of

a client every month within the billing cycle of

the account and more precisely, before its billing

date. Assuming that event-series T

u,c

related to

employee u and client c is ordered according to

the time-stamps of the events, the system aims

to detect similarities between pattern time-series

based on a variation of Longest Common Subse-

quence algorithm (Vlachos et al., 2003), which is

robust under noisy conditions. The pattern time-

series include the ideal time-series if the events

between the entities appear in time intervals that

equal exactly to 1, 7,15,30 and other time-series

identified in the past as fraud patterns. In the case

where similarity with any of the above time-series

is detected, we consider the event-series of the

employee to be periodical.

• Events occurring outside working hours:

Fraudulent activities usually occur outside work-

ing hours, on holidays or at the end of the em-

ployee’s shift. For this reason, if such events oc-

cur they have to be taken under consideration.

• Employee’s frequency in recorded systems:

Each employee according to her responsibilities

operates in specific business systems. If this is

not the case, then the employee has to justify the

recorded event. Also, in several systems such as

fraud management systems (FMS), it is expected

that an employee monitors the activity of a suspi-

cious client. Hence, events stemming from these

systems have to be given smaller weight.

• Actions taken by the employee: Similarly to the

previous case, there exist some actions that an em-

ployee is unlikely, but not unauthorized to per-

form since they do not conform to her duties.

The idea behind the decision tree was to corre-

spond to each layer one fraud pattern and create a

path according to the result of the examination on

each pattern. We consider the importance of pat-

terns based on their corresponding layer in the de-

cision tree, such that the higher ones (closer to the

root) are more important. Let x = [x

1

,x

2

,x

3

,x

4

,x

5

]

be the pattern vector examined (e.g., x = [0, 0,0, 0,0]

corresponds to non-fraudulent activity) and let y =

[y

1

,.. . ,y

5

] be the vector resulting from the traversal

of the decision tree from its root to its leaves accord-

ing to the evaluation of the events of pair (u,c) on

each factor. If the examination of the events leads to

“Unauthorized action” or “Unauthorized system” the

event-series is directly assigned value 1. Else, each

tree layer i is assigned a weight, say w

i

,i = 1,. .., 5,

based on the formula presented in (Stillwell et al.,

1981) such that dissimilarities between the two vec-

tors that occur at higher levels of the tree will be

more important. For this reason, the distance be-

AFraudDetectionVisualizationSystemUtilizingRadialDrawingsandHeat-maps

155

Same pair of

Employee-Client

Unauthorized

Action

Unauthorized

System

No pattern

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

NoYes NoYes

NoYes NoYes No

Yes

NoYes

Periodicity ?

Working Hours ?

Is Employee a

Common

Actions ?

1 1 10

1

0

0 0

0 0 0 0 0 0 0 0

00

01

1 1 1

1

1

1 1 1 1 1 1 1 1

0

w

1

w

2

w

3

w

4

w

5

Employee

Frequent User

of the System?

Access Within

Figure 2: The decision tree based on which the event-series of the employees are assigned a severity value.

tween vectors x,y, say d(x,y), representing the dis-

similarity by the pattern vector,is calculated by apply-

ing the normalized Weighted Euclidean Distance met-

ric formula d(x,y) =

q

∑

5

i=1

(x

i

− y

i

)

2

∗ w

i

/

q

∑

5

i=1

w

i

.

This value (or the maximum of the already calcu-

lated values, if more than one fraud patterns exist)

corresponds to the severity value of the event-series

of employee u, which is the value finally assigned

to the employee. Based on these values the sys-

tem generates a heat-map representing all employees

by rectangular nodes and gradient colors from blue

to red (refer to the upper-left heat-map of Fig. 1),

such that nodes with color close to color-red represent

employees with strong indications of fraud, whereas

blue colored nodes employees with no suspicion of

fraud. Similarly to the severity calculation of the

event-series of employees, the system assigns also a

severity value to clients based on the above patterns.

The only difference is that for a given client c, the

severity value is calculated on all the events related to

c (not only the ones that concern a specific employee).

In this manner, a client involved in suspicious activity

with two or more employees will be distinguished.

4 FEATURES OF THE SYSTEM

The visualization window

1

consists of two heat-maps

representing the severity of the activity of employees

and clients (refer to Panels #1 and #2 of Fig. 1, resp.).

Due to space constraints, details about the selection of

the particular type of color-maps can be found in (Ar-

gyriou et al., 2013b). At startup only the heat-map

representing the activity of the employees is gener-

1

The reader is suggested to print the paper in color.

ated. The auditor selects a threshold value that deter-

mines the employees that will be presented based on

their severity values. The visualization is animated

and each time an employee together with her related

clients is illustrated. Before an employee is presented,

the heat-map for her related clients is generated.

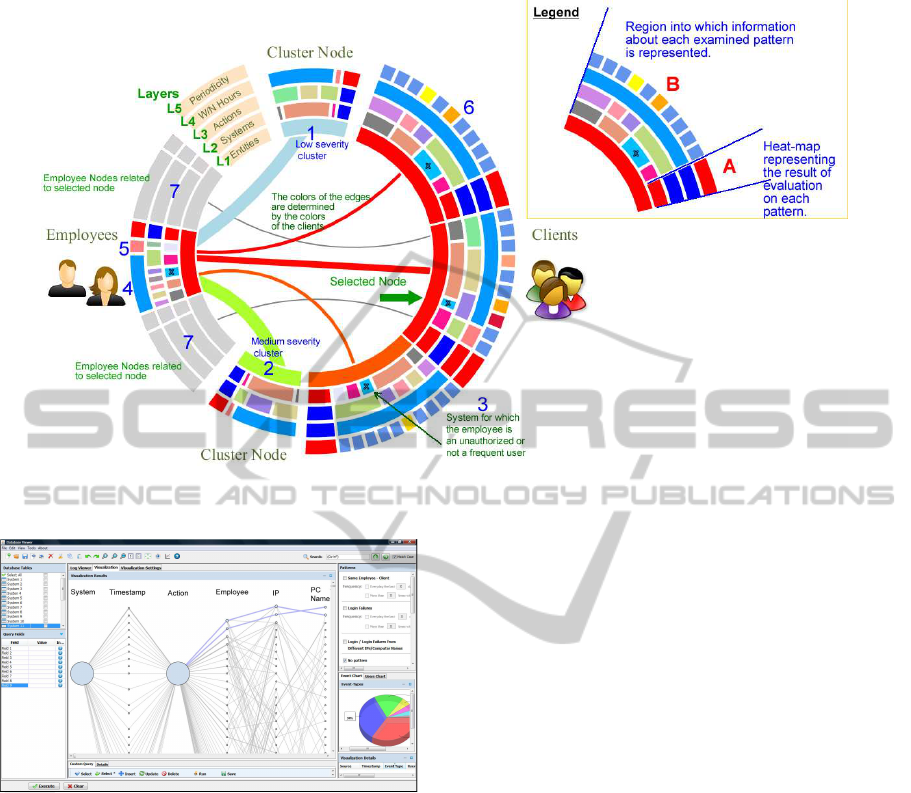

The main visualization of the system is a multi-layer

radial drawing where each layer L

1

,.. . ,L

5

(see Fig. 3)

represents a different aspect of the audit data (sys-

tems, actions, within working hours or not, periodic-

ity) and each circular sector corresponds to an entity

(employee, client or cluster). Then, a graph is gener-

ated; its nodes correspond to each of the above enti-

ties, whereas its edges correspond to the connections

among them. The innermost layer of the visualiza-

tion (layer L

1

of Fig. 3) accommodates the nodes of

the graph (drawn as portions of a ring). Nodes rep-

resenting employees are drawn to the left-part of the

visualization where the ones representing their related

clients to the right part. To avoid cluttering the visu-

alization with nodes representing clients with no indi-

cation of fraud, the auditor can specify thresholds that

split clients in one or two clusters (low-severity clus-

ter and/or medium-severity cluster) according to their

severity values. These nodes are accommodated on

top and to the bottom part of the visualization. The

color of the nodes (apart from the ones representing

clusters and the gray-colored ones that will be ex-

plained later) follows the color of the corresponding

entities in the heat-maps. The light-blue (green, resp)

colored cluster-node corresponds to the low (medium,

resp) severity cluster (refer to reference points 1 and

2 of Fig. 3, resp.). Regarding the edges of the draw-

ing, the system supports either circular arc edges or

straight-line edges. The thickness of an edge is pro-

portional to the number of connections between the

employee and the client while its color is determined

IVAPP2014-InternationalConferenceonInformationVisualizationTheoryandApplications

156

by the color of the client. In a fraud context, “fat”

edges (unless referring to cluster nodes) and in partic-

ular, the red-colored ones may be indications of fraud

that have to be further examined.

Subsequent layers (i.e., layers L

2

− L

5

) represent

the patterns described in Section 3 and are split into

two regions A and B (refer to Fig. 3). Region A repre-

sents a heat-map indicating the result of the examina-

tion of the entity in the specific pattern. Red color in-

dicates identification of suspicious pattern. Region B

illustrates information about each corresponding ex-

amined pattern. In layer L

2

, the differentbusiness sys-

tems related to the each of the entities are represented.

Each such system is characterized by a specific color

and occupies space proportional to the corresponding

aggregate percentage of use by the entity. For each

employee, this percentage is calculated based on the

aggregated percentage of use on all clients that are

currently drawn in the visualization, whereas for each

client based on the percentage of use by the employee

currently visualized (unless more than one employ-

ees related to a client are drawn simultaneously in the

visualization). Similarly, for cluster nodes the aggre-

gated percentage of use for all clients that belong to

the cluster is calculated. Systems for which the em-

ployee is an unauthorized or not a frequent user are

marked by an X (refer to reference point 3 of Fig. 3).

Layer L

3

corresponds to the actions reported for

each entity, and are drawn in a similar manner as the

ones in layer L

2

. Again unauthorized or suspicious

actions are marked with an X. Layer L

4

represents

the percentage of events that occur within or outside

working hours. The light-blue colored parts represent

events occurring within working hours, whereas the

light-red colored parts indicate the existence of events

occurring outside working hours (e.g., see reference

points 4 and 5 of Fig. 3, resp). For each client node

there exists an additional layer (refer to L

5

of Fig. 3,

e.g., see reference point 6) that indicates whether or

not the event-series of the client is periodical. The

event-series is compared with the pattern time-series

stored in the system and a heat-map is generated in-

dicating the degree of similarity with each pattern.

Again, light-red colors indicate suspicious cases.

Regarding the investigation procedure, as already

mentioned the auditor specifies a threshold and the

employees with assigned severity value above the

threshold are presented with their related clients in

the visualization one by one. The auditor is able to

start, pause or stop the video and process the visual-

ization. In the case where a client node is selected,

additional related employees can be added to the vi-

sualization, which facilitates the possible identifica-

tion of two or more employees that may cooperate in

committing fraud (the case where an employee node

is selected is treated similarly). In Fig. 3, gray col-

ored nodes (see reference point 7) represent nodes

added during post-processing when a client node is

selected (refer to the node pointed by the green ar-

row of Fig. 3). If more than one node representing

employees exist simultaneously in the visualization,

the auditor is able to select one of them and add the

related employees to the visualization. Gray-color

is utilized for non-selected employee nodes together

with their edges and related clients (if they are not

related also to the selected employee) to avoid dis-

tracting the auditor. In the case where a cluster node

is selected, the corresponding rectangles in the heat-

map representing clients are marked with an X such

that they can be added (if desired) to the visualiza-

tion. However, the system permits a specific number

of additions of employee or client nodes in order to

avoid cluttering the visualization area. If this num-

ber is exceeded, optionally a new visualization can be

produced, where only the inner-most layer of the ra-

dial drawing (i.e., the one corresponding to the clients

and employees) is drawn along with the relations be-

tween them. Again, the width of the edges is pro-

portional to the number of events that relate two enti-

ties. In the case where further investigation is needed

the auditor selects the desired node (which becomes

larger) and the other layers of the radial drawing (i.e.,

L

2

− L

5

) that correspond to the particular node appear

in the visualization. In this manner, the system is able

to visualize simultaneously a larger set of entities and

reveal the relations between them. However, this may

slow down the investigation and for this reason, we

adopted the animation approach and the simultaneous

visualization of all layers for each node. Due to space

constraints, details about the ordering of the nodes

in the visualization can be found in (Argyriou et al.,

2013b).

Panel #4 of Fig. 1 accommodates a time-line plot

representing the event-series for the selected pair of

entities (refer to the blue series), where the x−axis

corresponds to the date of the occurrence of each

event and the y−axis to the number of events occurred

during the specific date. The red series represents the

billing date of the account of the specific client for

each month. This plot facilitates the identification

of possible periodic activity especially close to the

billing date of the account of the client. In employee

fraud schemes, it is also possible that the event-series

related to a pair of entities is periodical only based on

a specific action. For this reason, we have incorpo-

rated in the system a second plot (refer to Panel #5

of Fig. 1) that presents all reported actions by distinct

series. In this plot, the y−axis corresponds to the day

AFraudDetectionVisualizationSystemUtilizingRadialDrawingsandHeat-maps

157

Figure 3: Description of the main-visualization of the system. “Fat” edges (unless referring to cluster nodes) and in particular,

the red-colored ones may be indications of fraud that have to be further examined.

Figure 4: A parallel coordinates plot to monitor failed login

attempts in a specific system.

of the month that event x related to a specific action

occurred (e.g., the first event related to an action that

occurred on the 15th day of a month will be drawn on

point (1,15). For this case, we ignore multiple occur-

rences of events related to the same action occurred

the same day of the month. In the case where peri-

odicity occurs for a specific action, the corresponding

series will have part (or the whole series) almost par-

allel to x−axis.

The system supports also mechanisms to detect

patterns of unusual employee behavior such as unau-

thorized access to computers, business systems and

accounts of employees or clients by producing a par-

allel coordinates plot (see Fig. 4). In this case, each

record consists of an employee, a time-stamp, an IP

indicating the address of the employee’s computer, a

computer name and an action (i.e., login, login fail-

ure, etc). The size of the nodes and the edges is pro-

portional to the number of their occurrences in the

database. The nodes on each layer are ordered by

their number of occurrences in the data-set. The pat-

terns commonly used in this scenario are: (i) More

than X failed login attempts within a time intervalofY

days/months, where X,Y are configurable by the au-

ditor, and (ii) Login attempts or failed login attempts

occurring from different IPs and/or computer names.

5 CASE STUDY

We present the results of the evaluation of the sys-

tem on real data-sets stemming from two control sys-

tems of a business company. All data provided to us

were anonymous for data privacy reasons. The data-

set consists of 180.637 entries lying within a time in-

terval of six months. The data-set consists of 710 dis-

tinct employees and 83.030 distinct clients. The audi-

tors have also included a set of entries corresponding

to a “fictional” fraud case scenario in which an em-

ployee modifies the account of a client. We were not

communicated any information regarding the billing

dates of the accounts of the clients.

Since one of the data-sets stems from a fraud man-

agement system, it is expected that reoccurring ac-

tivity between the same pair of employee and client

will occur (a “suspicious” client is expected to be su-

pervised by an employee). For this reason, we con-

IVAPP2014-InternationalConferenceonInformationVisualizationTheoryandApplications

158

centrated our study in identifying pairs of employees

and clients that appear to have more that 10 related

events and occur in regular time basis, and in partic-

ular, monthly. The employees’ heat-map indicated 41

employees that were related with the same client with

more than 10 events. Among these employees, 17 of

them had periodic activity and events occurring out-

side working hours (the corresponding rectangles in

the employees’ heat-map were “close to” color-red),

while the remaining 24 employees had events occur-

ring outside working hours (the corresponding rect-

angles in the employees’ heat-map were “close to”

color-orange). Also, no employee used unauthorized

systems or actions, whereas only one employee had

used non common actions.

Due to space constraints, we will only present the

“fictional” fraud case. A detailed description of the

case study can be found in (Argyriou et al., 2013b). In

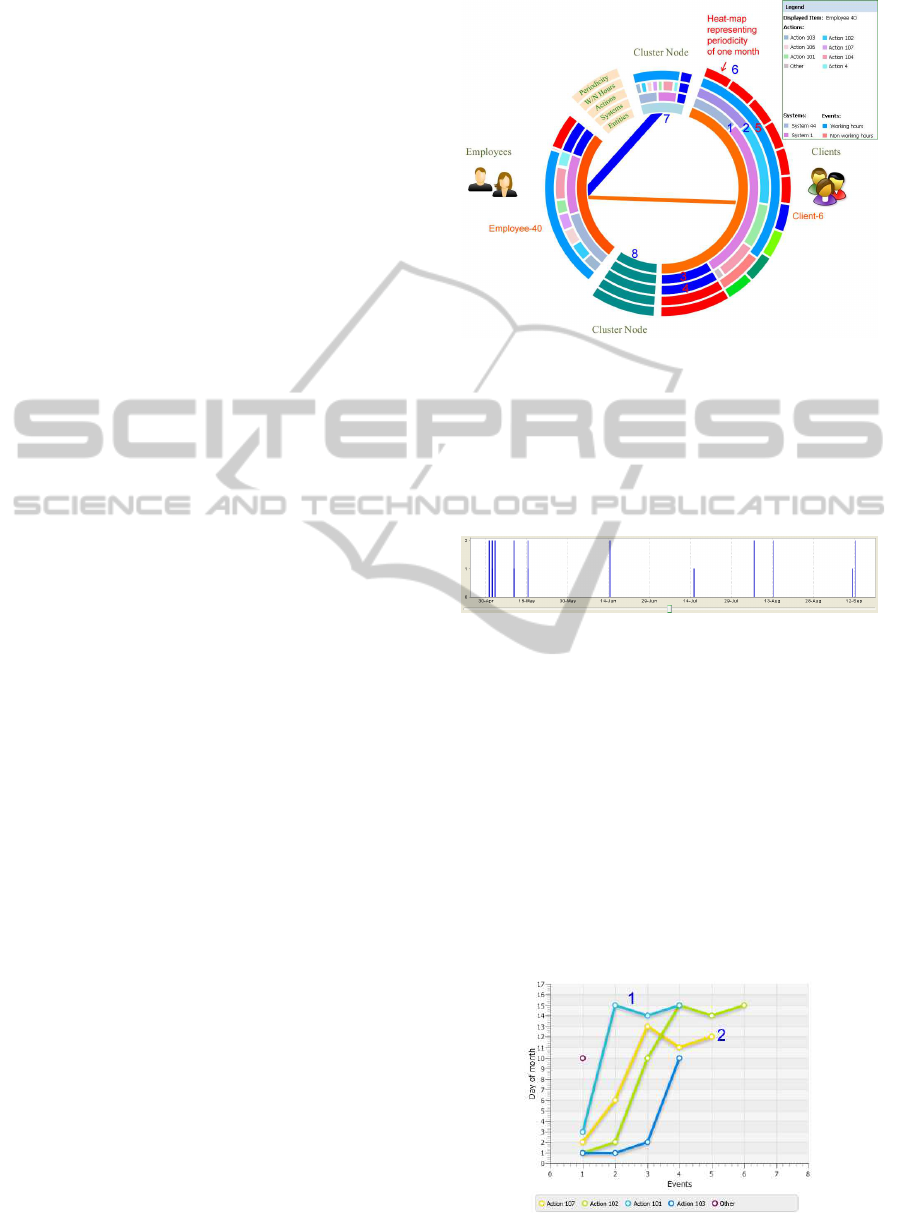

Fig. 5, Employee-40 is related to Client-6 with more

than 10 events, using two business systems for which

she is a frequent user and common actions (see refer-

ence points 1 and 2 of Fig. 5; the parts representing

the systems and the actions are not marked by an X,

which implies that the user was frequent for the spe-

cific systems or had performed common actions, and

the corresponding heat-maps are blue-colored; see

reference points 3 and 4 of Fig. 5). All the events that

related these entities occurred within working hours

(see reference point 5 of Fig. 5). However, the event-

series of Employee-40 appears to have strong sim-

ilarity with six fraud pattern time-series, including

the one that corresponds to periodicity of one month,

which is represented by the first heat-map of the each

periodicity layer (see reference point 6 of Fig. 5).

Also, Client-6 was not related to any other employee

(when selected, no other employee was added to the

visualization). All other clients related to Employee-

40, where placed in the low-severity cluster, whereas

no client was placed in the medium-severity cluster

(see reference points 7 and 8 of Fig. 5, resp.). The

first suspicions according to the auditors, are raised

by the fact that there exists activity between the two

entities stemming from two business systems.

The auditors explained that the time-line plot (re-

fer to Fig. 6) matches to a fraud case scenario accord-

ing to which there exists some activity at the begin-

ning (between April - May) with no specific period-

icity and then, appears periodic activity (from May to

September). In the first time interval, the fraudster is

trying to organize her fraud by performing a number

of actions. Once the fraud is organized, only peri-

odic actions are required. Another suspicious obser-

vation is that the events from May to September occur

close to the same dates of each month (from 10th to

Figure 5: A frame of the animation illustrating the activity

of Employee-40.

15th). Of course, there exist some “noisy” data that

have to be excluded in order to understand the fraud

pattern. These may have been caused either on pur-

pose to cover up the fraud or were part of the duties

of the employee.

Figure 6: The time-line plot indicates monthly activity.

The above assumption is reinforced by the plot of

Fig. 7 which reveals the periodic occurrence of each

performed action. For instance, “Action 101” (see ref-

erence point 1) appears to have periodicity around the

15th day of the month from its second occurrence and

later. Also, “Action 107” (see reference point 2) ap-

pears to have periodicity around the 11th-13th day of

the month from its third occurrence and later. In par-

ticular, the vast majority of events are recorded be-

tween the 10th and the 15th day of the month. We

could be more convinced that this case consists fraud

if we knew exactly the billing cycle of the account of

the client.

Figure 7: A plot indicating the periodic pattern for the per-

formed actions.

AFraudDetectionVisualizationSystemUtilizingRadialDrawingsandHeat-maps

159

In a similar manner, the frames of the animation

illustrating the other highly-ranked employees were

investigated. We gave more attention to the 17 frames

of the animation containing periodic events. Fortu-

nately for the company, the only real evidence of

fraud existed in the fictional data added by the au-

ditors. However, the auditors had not identified all

these cases while examining the data-sets manually

and they had to make an additional investigation.

6 CONCLUSIONS AND FUTURE

WORK

We presented an integrated fraud management visual-

ization system that aims to identify patterns that may

conceal occupational fraud through a combination of

pattern recognition and visualization. Our work opens

several aspects for future work such as incorporation

of more fraud patterns, use of more statistical methods

and, extension of the system in order to identify more

complicated fraud schemes (client fraud, telecommu-

nication fraud, etc.) in a wider variety of business

systems.

ACKNOWLEDGEMENTS

The work of Evmorfia N. Argyriou has been co-

financed by the European Union (European Social

Fund ESF) and Greek national funds through the

Operational Program ”Education and Lifelong Learn-

ing” of the National Strategic Reference Framework

(NSRF) - Research Funding Program: Heracleitus II.

Investing in knowledge society through the European

Social Fund.

REFERENCES

Argyriou, E. N., Sotiraki, A., and Symvonis, A. (2013a).

Occupational fraud detection through visualization. In

ISI, pages 4–7.

Argyriou, E. N. and Symvonis, A. (2012). Detecting peri-

odicity in serial data through visualization. In ISVC,

volume 7432, pages 295–304.

Argyriou, E. N., Symvonis, A., and Vassiliou, V. (2013b).

A fraud detection visualization system utilizing ra-

dial drawings and heat-maps. Technical report,

arXiv:submit/0845288.

Association of Certified Fraud Examiners (2012). Report to

the Nation on Occupational Fraud and Abuse.

Bolton, R. J. and Hand, D. J. (2002). Statistical fraud de-

tection: A review. Statistical Science, 17:2002.

Chang, R., Lee, A., Ghoniem, M., Kosara, R., and Ribarsky,

W. (2008). Scalable and interactive visual analysis of

financial wire transactions for fraud detection. Infor-

mation Visualization, 7(1):63–76.

Didimo, W., Liotta, G., and Montecchiani, F. (2012).

Vis4aui: Visual analysis of banking activity networks.

In GRAPP/IVAPP, pages 799–802.

Didimo, W., Liotta, G., Montecchiani, F., and Palladino, P.

(2011). An advanced network visualization system for

financial crime detection. In PacificVis, pages 203–

210.

Eberle, W. and Holder, L. B. (2009). Mining for insider

threats in business transactions and processes. In

CIDM, pages 163–170.

Giacomo, E. D., Didimo, W., Liotta, G., and Palladino, P.

(2010). Visual analysis of financial crimes. In AVI,

pages 393–394.

Huang, M. L., Liang, J., and Nguyen, Q. V. (2009). A vi-

sualization approach for frauds detection in financial

market. IV ’09, pages 197–202.

Kou, Y., Lu, C.-T., Sirwongwattana, S., and Huang, Y.-P.

(2004). Survey of fraud detection techniques. In Net-

working, Sensing and Control, 2004 IEEE Int. Conf.,

volume 2, pages 749–754.

Luell, J. (2010). Employee fraud detection under real world

conditions. PhD thesis.

Phua, C., Lee, V. C. S., Smith-Miles, K., and Gayler, R. W.

(2010). A comprehensive survey of data mining-based

fraud detection research. CoRR, abs/1009.6119.

Senator, T. E., Goldberg, H. G., Shyr, P., Bennett, S.,

Donoho, S., and Lovell, C. (2002). chapter The

NASD regulation advanced detection system: inte-

grating data mining and visualization for break detec-

tion in the NASDAQ stock market, pages 363–371.

Senator, T. E., Goldberg, H. G., Wooton, J., Cottini, M. A.,

Khan, A. F. U., Klinger, C. D., Llamas, W. M., Mar-

rone, M. P., and Wong, R. W. H. (1995). The financial

crimes enforcement network ai system (fais) identify-

ing potential money laundering from reports of large

cash transactions. AI Magazine, 16(4):21–39.

Stillwell, W. G., Seaver, D. A., and Edwards, W. (1981).

A comparison of weight approximation techniques in

multiattribute utility decision making. Organ. Behav-

ior and Human Performance, 28(1):62 – 77.

SynerScope (2011). http://www.synerscope.com/.

Vlachos, M., Hadjieleftheriou, M., Gunopulos, D., and

Keogh, E. (2003). Indexing multi-dimensional time-

series with support for multiple distance measures. In

ACM SIGKDD int. conf. on Knowledge discovery and

data mining, KDD ’03, pages 216–225.

Wolverton, M., Berry, P., Harrison, I., Lowrance, J., Mor-

ley, D., Rodriguez, A., Ruspini, E., and Thomere, J.

(2003). Law: A workbench for approximate pattern

matching in relational data. In IAAI, pages 143–150.

IVAPP2014-InternationalConferenceonInformationVisualizationTheoryandApplications

160