Non Technical Loses Detection

Experts Labels vs. Inspection Labels in the Learning Stage

Fernanda Rodr

´

ıguez, Federico Lecumberry and Alicia Fern

´

andez

Instituto de Ingenir

´

ıa El

´

ectrica, Facultad de Ingenier

´

ıa, Universidad de la Rep

´

ublica,

J. Herrera y Reissig 565, 11300, Montevideo, Uruguay

Keywords:

Electricity Fraud, Support Vector Machine, Optimum Path Forest, Unbalance Class Problem, Combining

Classifier, UTE.

Abstract:

Non-technical losses detection is a complex task, with high economic impact. The diversity and big number

of consumption records, makes it very important to find an efficient automatic method for detection the largest

number of frauds with the least amount of experts’ hours involved in preprocessing and inspections. This

article analyzes the performance of a strategy based on learning from expert labeling: suspect/no-suspect,

with one using inspection labels: fraud/no-fraud. Results show that the proposed framework, suitable for

imbalance problems, improves performance in terms of the F

measure

with inspection labels, avoiding hours of

experts labeling.

1 INTRODUCTION

Improving non-technical loss detection is a huge chal-

lenge for electric companies. In Uruguay the na-

tional electric power utility (henceforth UTE) faces

the problem by manually monitoring a group of cus-

tomers. A group of experts inspect at the monthly

consumption curve of each customer and indicates

those with some kind of suspicious behavior. This

set of customers, initially classified as suspects are

then analyzed taking into account other factors (such

as fraud history, electrical energy meter type, etc.).

Finally a subset of customers is selected to be in-

spected by an UTE’s employee, who confirms (or not)

the irregularity. The procedure is illustrated in Fig-

ure 1. The procedure described before, has major

drawbacks, mainly, the number of customers that can

be manually controlled is small compared with the to-

tal amount of customer (around 500.000 only in Mon-

tevideo).

Several studies with a Pattern Recognition ap-

proach have addressed the detection of non-technical

losses, both supervised or unsupervised. Leon et al.

review the main research works found in the area

between 1990 and 2008 (Leon et al., 2011). Here

we present a brief review that builds on this work

and wide it with new contributions published between

2008 and 2013. Several of these approaches con-

sider unsupervised classification using different tech-

niques such as fuzzy clustering (dos Angelos et al.,

2011), neural networks (Markoc et al., 2011; Sforna,

2000), among others. Monedero et al. use regression

based on the correlation between time and monthly

consumption, looking for significant drops in con-

sumption (Monedero et al., 2010). Then they make

a second stage where suspicious customers are elim-

inated if the consumption of these depend on the

economy of the moment or the year’s season. Only

major customers were inspected and 38% were de-

tected as fraudulent. Similar results (40%) were ob-

tained in (Filho et al., 2004) using a tree classifier

and customers who had been inspected in the past

year. In (Depuru et al., 2011) and (Yap et al., 2007)

SVM is used. In the latter, Modified Genetic Al-

gorithm is employed to find the best parameters of

SVM. In (Yap et al., 2012), is compared the methods

Back-Propagation Neural Network (BPNN), Online-

sequential Extreme Learning Machine (OS-ELM) and

SVM. Biscarri et al. (Biscarri et al., 2008) seek for

outliers, Leon et al. (Leon et al., 2011) use General-

ized Rule Induction and Di Martino et al. (Di Mar-

tino et al., 2012) combine CS-SVM classifiers, One

class SVM, and C4.5 OPF using various features de-

rived from the consumption. Different kinds of fea-

tures are used among this works, for examples, con-

sumption (Biscarri et al., 2008; Yap et al., 2007),

contracted power and consumed ratio (Galvn et al.,

1998), Wavelet transformation of the monthly con-

624

Rodríguez F., Lecumberry F. and Fernández A..

Non Technical Loses Detection - Experts Labels vs. Inspection Labels in the Learning Stage.

DOI: 10.5220/0004823506240628

In Proceedings of the 3rd International Conference on Pattern Recognition Applications and Methods (ICPRAM-2014), pages 624-628

ISBN: 978-989-758-018-5

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

Figure 1: Manual fraud detection scheme.

sumption (Jiang et al., 2002), amount of inspections

made to each client in one period and average power

of the area where the customer resides (dos Angelos

et al., 2011), among others.

On the other hand, Romero proposes (Romero,

2012) a method to estimate and reduce non-technical

losses, such as advanced metering infrastructure,

fraud deterrence prepayment systems, system remote

connection and disconnection, etc. Lo et al. based on

real-time measurements, design (Lo et al., 2012) an

algorithm for distributed state estimation in order to

detect irregularities in consumption.

To improve the efficiency of fraud detection and

resource utilization, in (Di Martino et al., 2013) was

implemented a tool that automatically detects suspi-

cious behavior analyzing customers historical con-

sumption curve. This approach has the drawback of

requiring a base previously tagged by the experts, in

order to use it in the training stage.

In this paper we set out to analyze the behavior

of the proposed framework to fraud classification and

compare it by using labels based on the inspection re-

sults instead of labels defined by experts. This new

approach does not require that the company person-

nel conduct a manual study of the customers’ con-

sumption curve, since it use labels resulting from in-

spections in the past. We investigate performance im-

provement originated by training with individual al-

gorithms and their combinations with labels of fraud

and no fraud (based on inspections) and the impor-

tance of choosing the appropriate performance mea-

sure to solve the problem.

The paper is organized as follows. Section 2 de-

scribes general aspects of the class imbalance prob-

lems, Section 3 describes the strategies to be com-

pare, Section 4 presents the obtained results and, fi-

nally Section 5 concludes the work.

2 THE CLASS IMBALANCE

PROBLEM AND THE CHOICE

OF PERFORMANCE MEASURE

When working on fraud detection problems, we can

not assume that the number of people who commit

Table 1: Confusion matrix.

Labeled as

Positive Negative

Positive TP (True Positive) FN (False Negative)

Negative FP (False Positive) TN (True Negative)

fraud are near the same than those who do not, usu-

ally they are a minority class. This situation is known

as class imbalance problem, and it is particularly im-

portant in real world applications where it is costly to

misclassify examples from the minority class. In this

cases, standard classifiers tend to be overwhelmed by

the majority class and ignore the minority class, hence

obtaining suboptimal classification performance. In

order to confront this type of problem, different strate-

gies can be used on different levels: (i) changing class

distribution by resampling; (ii) manipulating classi-

fiers; (iii) and on the ensemble of them, as proposed

in (Di Martino et al., 2013).

Another problem which arises when working with

imbalanced classes is that the most widely used met-

rics for measuring the performance of learning sys-

tems, such as Accuracy and ErrorRate, are not ap-

propriate because they do not take into account mis-

classification costs, since they are strongly biased to

favor the majority class (Garcia et al., 2012). Then

others measures have to be considered:

• Recall is the percentage of correctly classified

positive instances, in this case, the fraud samples.

Recall =

T P

T P + FN

• Precision is defined as the proportion of labeled

as positive instances that are actually positive.

Precision =

T P

T P + FP

Where T P, FN and FP are defined in Table 1.

• The combination of this two measurements, the

F

measure

, represents the geometric mean between

them, weighted by the parameter β,

F

measure

=

(1 + β

2

)Recall × Precision

β

2

Recall + Precision

(1)

Depending on the value of β we can prioritize

Recall or Precision. For example, if we have few

resources to perform inspections, it can be useful to

prioritize Precision, so the set of samples labeled as

positive has high density of true positive.

When working with inspection labels the imbal-

ance problem is worst, in terms of unbalance, than

dealing with experts labels. In the experts labels

method, the ratio of suspect to no suspect is near 10%,

while in the one based on inspection labels, the ratio

is near 0.4%.

NonTechnicalLosesDetection-ExpertsLabelsvs.InspectionLabelsintheLearningStage

625

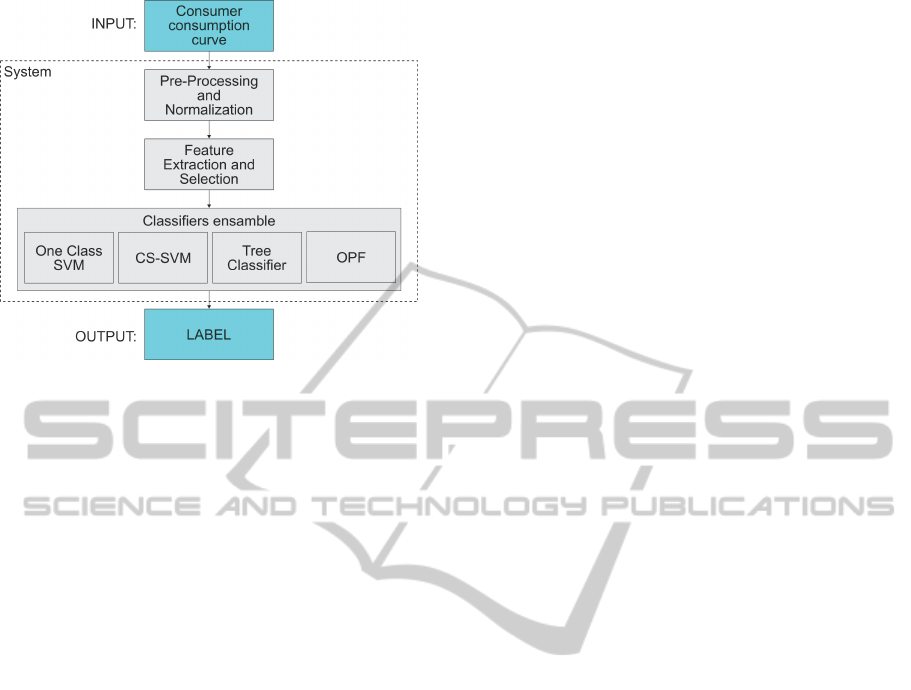

Figure 2: Block Diagram of the automatic fraud detection

system.

3 FRAMEWORK

The system presented consists basically on three mod-

ules: Pre-Processing and Normalization, Feature Ex-

traction and Selection, and Classification. Figure 2

shows the system configuration. The system input

corresponds to the last three years of the monthly con-

sumption curve of each costumer.

The first module, Pre-Processing and Normaliza-

tion, modifies the input data so that they all have nor-

malized mean and implements some filters to avoid

peaks from billing errors. A feature set was pro-

posed taking into account UTE’s technician exper-

tize in fraud detection by manual inspection and re-

cent papers on non technical loss detection (Alcete-

garay and Kosut, 2008), (Muniz et al., 2009), (Nagi

and Mohamad, 2010). Di Martino et al. use a list of

the features extracted from the monthly consumption

records (Di Martino et al., 2013). In this work, we

use the framework illustrated in Figure 2 and a sub-

set of the same set of features used in (Di Martino

et al., 2013) but doing a selection of them taking into

account the label type (based on inspection or exper-

tise’s criterion).

It is well known that finding a small set of relevant

features can improve the final classification perfor-

mance; this is why we implemented a feature selec-

tion stage. We used two types of evaluation methods:

filter and wrapper. Filters methods looks for subsets

of features with low correlation between them and

high correlation with the labels, while wrapper meth-

ods evaluate the performance of a given classifier for

the given subset of features. In the wrapper methods,

we used as performance measure the F

measure

, also,

the evaluations were performed using 10 fold cross

validation over the training set.

As searching method, we used Bestfirt, for which

we found in this application a good balance between

performance and computational costs.

Different feature subsets were selected from the

original set proposed in (Di Martino et al., 2013) for

both approaches. For example, for the experts’ labels

approach, the features include:

• Consumption ratio for the twelve months and the

average consumption.

• Difference between fourth Wavelet coefficient

from the last and previous years.

• Euclidean distance of each customer to the mean

customer, where the mean customer is calculated

by taking the mean for each month between all the

customers.

• Module of the first Fourier coefficient of the total

consumption.

While for inspection label approach, the features in-

clude:

• Difference between the first two Fourier coeffi-

cients from the last and previous years.

• Variance of the consumption curve.

Some features are selected in both approaches, such

as:

• Consumption ratio for the last three and six

months and the average consumption.

• Difference between fifth Wavelet coefficient from

the last and previous years.

• Slope of the straight line that fits the consumption

curve.

The performance analysis considers, SVM al-

gorithm, one-class classifier (O-SVM) and cost-

sensitive learning (C-SVM), Optimum Path Forest

(OPF) (Ramos et al., 2010), a decision tree proposed

by Roos Quinlan, C4.5 and Iterative Combination

proposed in (Di Martino et al., 2012). The latter

method performs an optimal combination of the be-

fore mentioned classifiers. The choice of combina-

tion’s weights is done exhaustively in order to maxi-

mize the F

measure

.

4 EXPERIMENTS AND RESULTS

In this work we used a data set of 456 industrial pro-

files obtained from the UTE’s database. Each profile

is represented by the customers monthly consumption

in the last 36 months and has two labels, one dictated

manually by technicians previous the inspection and

ICPRAM2014-InternationalConferenceonPatternRecognitionApplicationsandMethods

626

Table 2: Fraud detection with experts label training.

Description Recall Precision F

measure

(%) (%) (%)[β = 1]

OPF 39 27 32

Tree (C4.5) 38 23 29

O-SVM 51 22 30

CS-SVM 35 20 26

Iterative

Combination 77 22 35

another based on the inspection results. Training was

done considering both labels separately and perfor-

mance evaluation was done given the inspection la-

bels, using a 10-fold cross validation scheme.

Tables 2 and 3 shows the results obtained when

experts and inspection labels are used to train the

different classifiers respectively. The Iterative Com-

bination technique with expert label training obtains

the best result for fraud detection clearly overpassing

the other methods, however the number false positive

(FP) is relatively high, since

FP

T P

=

1

Precision

− 1 ≈ 4.

On the other hand, if we use the inspection labels the

Iterative Combination also obtains the best results for

fraud detection, but reducing in a half the number of

FP (

FP

T P

≈ 2).

If we compare both approaches, we see that learn-

ing from the inspection labels could get better results

(in the F

measure

sense) than learning from the labels

set by experts. The former has the additional advan-

tage of not requiring that the experts made the manual

labeled of the training base.

The results for the method performed manually by

experts, i.e. validating the expert labels with inspec-

tion labels, are Recall = 38%, Precision = 51% and

F

measure

= 44%.

Comparing the F

masure

obtained manually by the

experts (44%) and automatically by the Iterative

Combination (46%) both are similar. However, the

former consider other features as the history’s fraud

detection, contracted power, number of estimated

readings, etc. and not only the monthly consumption,

as the automatic one.

5 CONCLUSIONS AND FUTURE

WORK

In this work we compare the performance of a

strategy based on learning from expert labeling:

suspect/no-suspect, with one using inspection labels:

fraud/no-fraud. In the F

measure

sense with all the tested

Table 3: Fraud detection with inspection label training.

Description Recall Precision F

measure

(%) (%) (%)[β = 1]

OPF 36 34 35

Tree (C4.5) 33 37 35

O-SVM 71 31 44

CS-SVM 74 33 46

Iterative

Combination 77 33 46

classifiers the classification with inspection label ob-

tains better results than using experts labels. Among

them the Iterative Combination obtains the best result

and also better than the manual method.

In future work we propose to include new cate-

gorical attributes as the history’s fraud detection, con-

tracted power, number of estimated readings, etc. We

also want to explore a semi-supervised approach that

allows to learn from data with and without previous

inspection labels.

ACKNOWLEDGEMENTS

This work was supported by the program Sector Pro-

ductivo CSIC UTE. Authors would like to thank

UTE, especially Juan Pablo Kosut and Fernando San-

tomauro, for providing datasets and share fraud detec-

tion expertise.

REFERENCES

Alcetegaray, D. and Kosut, J. (2008). One class svm para

la detecci

´

on de fraudes en el uso de energ

´

ıa el

´

ectrica.

Trabajo Final Curso de Reconocimiento de Patrones,

Dictado por el IIE- Facultad de Ingenier

´

ıa- UdelaR.

Biscarri, F., Monedero, I., Leon, C., Guerrero, J. I., Bis-

carri, J., and Millan, R. (2008). A data mining method

based on the variability of the customer consumption

- A special application on electric utility companies,

volume AIDSS, pages 370–374. Inst. for Syst. and

Technol. of Inf. Control and Commun.

Depuru, S. S. S. R., Wang, L., and Devabhaktuni, V. (2011).

Support vector machine based data classification for

detection of electricity theft.

Di Martino, J., Decia, F., Molinelli, J., and Fern

´

andez, A.

(2012). Improving electric fraud detection using class

imbalance strategies. 1st International Conference In

Pattern Recognition Aplications and Methods, pages

135–141, volumen 2.

Di Martino, M., Decia, F., Molinelli, J., and Fernndez, A.

(2013). A novel framework for nontechnical losses

detection in electricity companies. In Latorre Car-

mona, P., Snchez, J. S., and Fred, A. L., editors, Pat-

tern Recognition - Applications and Methods, volume

NonTechnicalLosesDetection-ExpertsLabelsvs.InspectionLabelsintheLearningStage

627

204 of Advances in Intelligent Systems and Comput-

ing, pages 109–120. Springer Berlin Heidelberg.

dos Angelos, E., Saavedra, O., Corts, O., and De Souza,

A. (2011). Detection and identification of abnormal-

ities in customer consumptions in power distribution

systems.

Filho, J. R., Gontijo, E. M., Delaiba, A. C., Mazina, E.,

Cabral, J. E., and Pinto, J. O. P. (2004). Fraud identi-

fication in electricity company customers using deci-

sion tree.

Galvn, J., Elices, E., Noz, A. M., Czernichow, T., and Sanz-

Bobi, M. (1998). System for detection of abnormali-

ties and fraud in customer consumption.

Garcia, V., Sanchez, J., and Mollineda, R. (2012). On the

suitability if numerical performance evaluation mea-

sures for class imbalance problems. 1st International

Conference In Pattern Recognition Aplications and

Methods, pages 310–313, volumen 2.

Jiang, R., Tagaris, H., and Laschusz, A. (2002). Wavelets

based feature extraction and multiple classifiers for

electricity fraud detection.

Leon, C., Biscarri, F. X. E. L., Monedero, I. X. F. I., Guer-

rero, J. I., Biscarri, J. X. F. S., and Millan, R. X. E. O.

(2011). Variability and trend-based generalized rule

induction model to ntl detection in power companies.

Lo, Y.-L., Huang, S.-C., and Lu, C.-N. (2012). Non-

technical loss detection using smart distribution net-

work measurement data. In Innovative Smart Grid

Technologies - Asia (ISGT Asia), 2012 IEEE, pages

1–5.

Markoc, Z., Hlupic, N., and Basch, D. (2011). Detection of

suspicious patterns of energy consumption using neu-

ral network trained by generated samples.

Monedero, I., Biscarri, F., Len, C., Guerrero, J., Biscarri,

J., and Milln, R. (2010). Using regression analysis

to identify patterns of non-technical losses on power

utilities. In Setchi, R., Jordanov, I., Howlett, R., and

Jain, L., editors, Knowledge-Based and Intelligent In-

formation and Engineering Systems, volume 6276 of

Lecture Notes in Computer Science, pages 410–419.

Springer Berlin Heidelberg.

Muniz, C., Vellasco, M., Tanscheit, R., and Figueiredo, K.

(2009). Ifsa-eusflat 2009 a neuro-fuzzy system for

fraud detection in electricity distribution.

Nagi, J. and Mohamad, M. (2010). Nontechnical loss de-

tection for metered customers in power utility using

support vector machines. IEEE TRANSACTIONS ON

POWER DELIVERY, VOL. 25, NO. 2.

Ramos, C., de Sousa, A. N., Papa, J., and Falcao, A.

(2010). A new approach for nontechnical losses de-

tection based on optimum-path forest. IEEE TRANS-

ACTIONS ON POWER SYSTEMS.

Romero, J. (2012). Improving the efficiency of power dis-

tribution system through technical and non-technical

losses reduction.

Sforna, M. (2000). Data mining in power company cus-

tomer database.

Yap, K. S., Hussien, Z., and Mohamad, A. (2007). Abnor-

malities and fraud electric meter detection using hy-

brid support vector machine and genetic algorithm.

Yap, K. S., Tiong, S. K., Nagi, J., Koh, J. S. P., and Nagi, F.

(2012). Comparison of supervised learning techniques

for non-technical loss detection in power utility.

ICPRAM2014-InternationalConferenceonPatternRecognitionApplicationsandMethods

628