Analysis of Downward Product Substitution in a Recoverable System

Fethullah Gocer

1

, S. Sebnem Ahiska

1

and Russell E. King

2

1

Industrial Engineering Department, Galatasaray University, Ortakoy, Istanbul, 34349, Turkey

2

Edward P. Fitts Department of Industrial and Systems Engineering, North Carolina State University, Raleigh, NC, U.S.A.

Keywords: Product Substitution, Remanufacturing, Manufacturing, Inventory Control, Markov Decision Process.

Abstract: We consider the inventory control problem for an infinite-horizon stochastic hybrid manufacturing /

remanufacturing system with product substitution under stochastic demand and returns. Remanufactured

and manufactured products are considered as two different products, having different costs and selling

prices as well as separate demand streams. Remanufactured products have a higher stock out risk because

the remanufacturing capacity is mainly dependent on the amount of returns available for remanufacture.

One way to cope with the stock-out issue for remanufactured products is to use a downward substitution

strategy, which allows a manufactured product (i.e. higher value item) to be substituted for a

remanufactured product (i.e. lower value item) in case the latter runs out of stock. We formulate this

problem as Markov Decision Process in order to determine the optimal manufacturing and remanufacturing

decisions under product substitution, and through numerical experimentation, we investigate the effects of

stochastic demand/return distributions on the profitability of the substitution strategy.

1 INTRODUCTION

More and more manufacturers are collecting back

their products from customers after usage or at the

end of their life due to both environmental

regulations and concerns as well as the potential

economic benefits of product recovery. Product

recovery, especially remanufacturing, can

substantially reduce the resource consumption and

waste disposal, which consequently results in

savings in material, energy and disposal costs.

During the early years of the remanufacturing

operations, manufacturers considered only savings

in costs. As governments tighten environmental laws

and regulations, many manufacturers are required to

incorporate product recovery activities where a

significant portion of production uses recovered

material. As product returns increase, the

profitability of hybrid recoverable manufacturing

systems increase (Robotis et al., 2005). While

manufacturers often consider remanufacturing as an

obligation forced by government regulations, in

recent years, they have also realized that customers

may also prefer remanufactured products for the

price advantage as well as environmental awareness.

In this study, we consider inventory control of a

hybrid manufacturing/remanufacturing system,

which has two modes of supply in order to satisfy

customer demand: manufacturing of new items and

remanufacturing of returned items. Here production

planning and control focuses on the effective

utilization of resources in order to satisfy customer

demand in a cost-efficient manner. In a hybrid

system where the new and remanufactured items are

viewed as not having the same value, there are

mainly three types of inventories: manufactured

items, returned items and remanufactured items.

Here, we consider product substitution among

manufactured and remanufactured items to mitigate

lost sales (backorders) in a cost effective way.

In most hybrid systems studies, the manufactured

and remanufactured items are assumed to be alike;

therefore they are stored in the same serviceable

inventory and have a common demand stream. In

some cases though, customers may perceive lower

quality in a remanufactured item and expects to pay

less for it than for a new item resulting in a

segmented market among the items. When

manufactured and remanufactured items are non-

identical, product substitution may be used in case of

a stock-out. The substitution style varies depending

on whether it is customer- or manufacturer-driven.

Under ‘upward substitution’ a customer demanding

a newly manufactured product agrees to accept a

108

Gocer F., Sebnem Ahiska S. and King R..

Analysis of Downward Product Substitution in a Recoverable System.

DOI: 10.5220/0004833301080115

In Proceedings of the 3rd International Conference on Operations Research and Enterprise Systems (ICORES-2014), pages 108-115

ISBN: 978-989-758-017-8

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

remanufactured product. This customer driven

process is known as two-way substitution such that

when a customer’s first-choice product is out-of-

stock, he/she buys a similar product within same

category (Huang et al., 2011). Alternatively,

‘downward substitution’ (or one-way substitution) is

manufacturer-driven such that a higher-value item is

substituted for a stocked-out lower-value item. This

strategy is commonly used by automotive spare part

manufacturers, e.g. for parts such as injectors and

engine starters (Ahiska et al., 2013).

We analyse a periodically reviewed stochastic

hybrid manufacturing/remanufacturing system under

downward substitution. Using a Markov decision

process (MDP), we find optimal inventory control

(i.e. optimal manufacturing and remanufacturing

decisions). Our research extends earlier research by

numerically investigating how the profitability of a

product substitution strategy is affected by the

characteristics of the demand/return distributions.

2 LITERATURE REVIEW

Hybrid manufacturing and remanufacturing systems

are more difficult to control than the traditional pure

manufacturing systems due to many factors. First,

the flow of product returns in terms of quantity and

timing is uncertain. Second, the manufacturing and

remanufacturing processes are usually interrelated

because they either share common production

resources (such as common storage area, production

line or workforce) or produce products that are

substitutable. Hence, for an efficient control of

manufacturing and remanufacturing systems, the

coordination between them is essential. The

inventory management of hybrid production systems

has received significant attention in the literature

over the last couple of decades. However, the studies

that specifically analyse the use of product

substitution strategies in these systems are scarce.

Most of these studies consider a single-period

setting. Inderfurth (2004) investigates analytically

the structure of optimal inventory policy for a hybrid

system under one-way product substitution in a

single-period setting. Kaya (2010) considers partial

substitution of manufactured and remanufactured

products in a single-period newsvendor setting. Jin

et al. (2007) use a threshold level to control when to

offer new products as substitutes for remanufactured

products in a single-period monopoly setting.

Robotis et al. (2005) consider a single-period multi-

product stochastic system with downward

substitution where there is only remanufacturing of

the used products. Considering the quality of the

used items, some portion of them is resold to

secondary markets while the remaining part is

remanufactured. Bayindir et al. (2005) use a

continuous-review inventory policy to control the

hybrid system, and they determine whether the

remanufacturing option is profitable under one-way

substitution policy. Bayindir et al. (2007) extend

their study by adding a capacity constraint for the

single-period version of the problem, and they

investigate the effect of substitution on the optimal

utilization of remanufacturing.

Some work on hybrid systems with product

substitution assumes a deterministic environment for

demand and returns. Pineyro and Viera (2010)

formulate an NP-hard deterministic economic lot-

sizing problem where new items can substitute for

remanufactured items. They find an optimal or near

optimal solution using a Tabu-search procedure. Li

et al. (2006) propose a dynamic program in order to

minimize manufacturing, remanufacturing, holding

and substitution costs for an uncapacitated multi-

product production planning problem with time-

varying demands in a finite time horizon with no

disposal or backlog. In another study by Li et al.

(2007), the finite-horizon multi-period two-product

capacitated dynamic lot sizing problem is analysed

for deterministic time-varying demands. They apply

a genetic algorithm and then develop a dynamic

programming approach to provide the optimal

solution to capacitated production planning model

with remanufacturing and substitution problem.

Inventory models with two-way substitution is

another stream of research that enable consumers to

substitute products within the same category.

Korugan and Gupta (2001) is among the earliest

work on product substitution in a stochastic hybrid

system. They study a system where the demand for a

certain type of product is satisfied with either new

items or remanufactured items. In a later work,

Korugan (2004) considers alternative substitution

policies for hybrid manufacturing/remanufacturing

system using an MDP.

Recently, Ahiska et al., (2013) discuss multi-

period periodic-review inventory control problem

for a hybrid manufacturing/remanufacturing system

with product substitution to find the optimal

inventory policies for both with and without one-

way product substitution using discrete-time MDPs.

They assume stochastic demands and returns and

one period lead time for manufacturing and

remanufacturing operations.

In this paper, we analyse the profitability of the

downward substitution strategy under different

AnalysisofDownwardProductSubstitutioninaRecoverableSystem

109

stochastic demand and return settings for a

periodically-reviewed hybrid system.

3 PROBLEM DESCRIPTION

We consider a recoverable manufacturing system

with two production processes: manufacturing and

remanufacturing. Manufacturing produces new items

using externally supplied virgin materials while

remanufacturing uses a returned item to produce a

remanufactured item. Remanufactured products are

viewed as having an inferior value by customers,

therefore they are sold for a lower price than new

items and have a different customer profile. Hence,

there is a segmented market for manufactured (i.e.

new) and remanufactured items. In real-world

situations, demand is stochastic, which may cause

excessive inventory to build up or lost sales to occur

if poor production decisions are made. The classic

tradeoff exists between lost sales or excess inventory

to avoid loss of customer goodwill. In this paper,

downward substitution is considered to reduce the

lost sales risk for remanufactured products such that

when the remanufactured item inventory runs out of

stock, a new item is sold to the customer at the

remanufactured item price (i.e. the discounted price).

No explicit cost associated with substitution is

considered other than the opportunity cost of selling

the manufactured item at the discounted price.

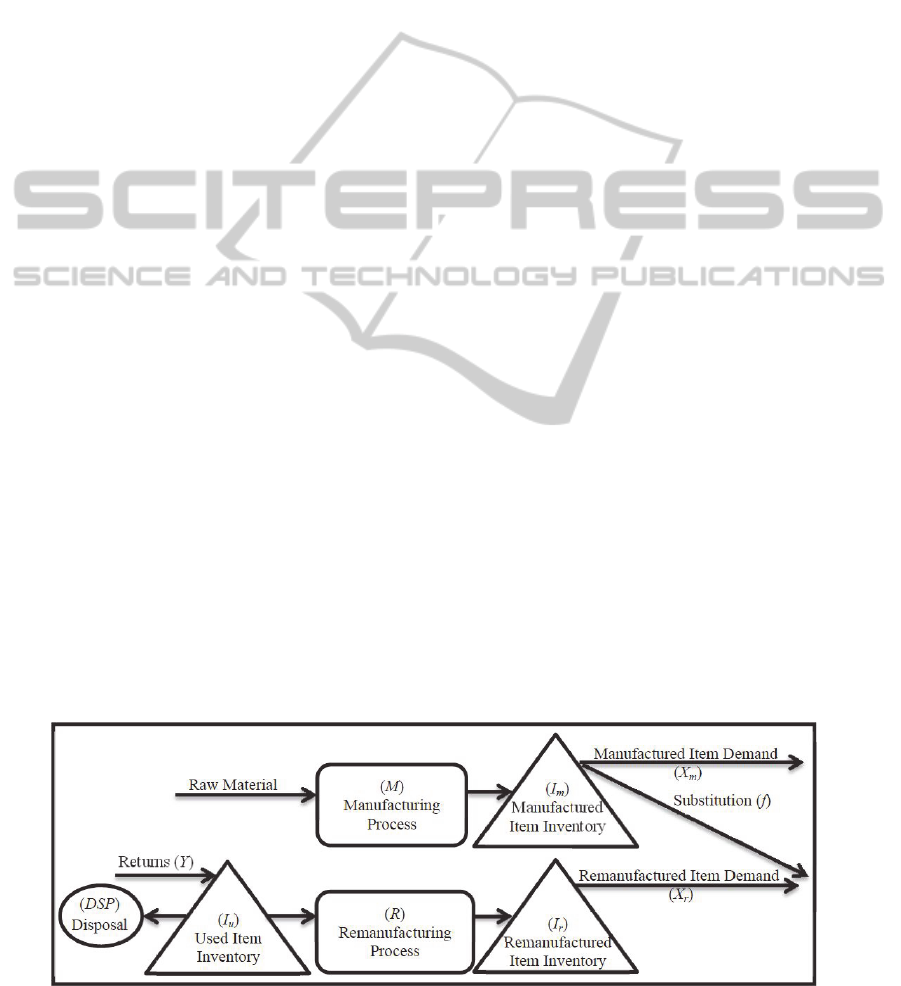

Fig. 1 illustrates the hybrid manufacturing/

remanufacturing system under downward product

substitution. There are three stocking points in this

system: the recoverable inventory that includes the

used or returned items, the remanufactured items

inventory and the manufactured items inventory.

The incoming returned items are disposed only if

recovered item inventory is full, otherwise they are

stored for later remanufacture. After manufacturing

and remanufacturing operations, the resulting items

are stored in their respective inventories. During

each period, demand for the manufactured and

remanufactured items diminish the corresponding

inventory levels. At the beginning of every period,

the quantities to manufacture and remanufacture

must be determined.

This problem was formulated by Ahiska et al.,

(2013) as a discrete-time MDP to find the optimal

manufacturing and remanufacturing decisions. The

MDP model formulation is briefly described below.

The state of the system in a period, denoted by S

,

is represented by three variables I

u

, I

r

, and I

m

which

are the inventory levels of used (i.e. recoverable),

remanufactured and manufactured items

respectively. These inventory levels are bounded as

,

and 0

.

means that backordering of the demand is

allowed up to

for j=r,m if

0

.

In this system we have to make the decisions of

how many units to manufacture (d

m

), and to

remanufacture (d

r

). For each system state, we find

the feasible values for (d

m

, d

r

) decisions considering

the production and storage capacities.

Given that the current state is S=(I

u

, I

r

, I

m

), the

manufacturing and remanufacturing decisions are d

r

and d

m

, and manufactured item demand (X

m

),

remanufactured item demand (X

r

) and returns (Y)

take the values x

m

,x

r

and y, respectively, the next

state will be

,

,

where

,

and

are

calculated as follows.

The inventory level for used items decreases for

each unit sent into the remanufacturing process and

increases by the amount of used items that are

returned, but cannot exceed the used item storage

capacity, as shown below.

,

(1)

The inventory levels for both items at the end of the

current period depend on current inventories,

demand for corresponding items and manufacturing

and remanufacturing decisions, and also on the

product substitution strategy such that unfulfilled

remanufactured item demand is met from the

manufactured item stock if stock is available after

first satisfying the demand for manufactured items.

The amount of remanufactured item demand

satisfied from new item stock, i.e. the amount of

substitution, f, is computed as follows.

Clearly, if I

r

≥x

r

(no shortage for remanufactured

items) or if I

m

≤x

m

(no manufactured items left in

stock after satisfying demand for manufactured

items), no product substitution will occur (f=0). In

this case, the amount of remanufactured item

demand that remains unsatisfied, denoted by l, is

l=max{x

r

-I

r

, 0}. If I

r

<x

r

(i.e. there is a shortage of x

r

-

I

r

remanufactured items) and if I

m

>x

m

, then there are

I

m

-x

m

items left in manufactured item stock that can

be used to deal with the remanufactured item

shortage. In this case, the amount of substitution is

f=min{I

m

-x

m

,x

r

-I

r

} and the amount of

remanufactured item demand that remains

unsatisfied after product substitution occurs is

l=max{x

r

-I

r

-f, 0}. General formulations for f and l

that cover all the ‘if’ conditions defined in this

paragraph can be formed as: f=[min{I

m

-x

m

, x

r

-I

r

}]

+

and l=[x

r

-I

r

-f]

+

where[x]

+

=max{x,0}.

The substitution amount f and unsatisfied

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

110

remanufactured item demand l being defined as

above, the inventory levels for manufacturing and

remanufacturing items at the beginning of next

period are formulated as:

,

(2)

,,

(3)

The state transitions under a no substitution strategy

can be simply obtained by setting f=0 in the

formulations above.

The transition probability from S to

under

decision

,

, represented by ,

,

,

equals the sum of the probabilities of occurrence for

demands and returns, (x

m

, x

r

, y), that lead to

transition from S to

under the

decision

,

.The objective of this problem is to

maximize the expected profit per period. The profit

is simply defined by the total revenue obtained from

selling the products minus the total cost including

manufacturing and remanufacturing cost, holding

costs for different stocking points, backordering

cost, lost sales cost and disposal cost.

The following notation is used.

p

m

: unit price for manufactured product

p

r

: unit price for remanufactured product

s

m

: setup cost for manufacturing

s

r

: setup cost for remanufacturing

c

m

: unit manufacturing cost

c

r

: unit remanufacturing cost

h

m

: manufactured product period unit holding cost

h

r

: remanufactured product period unit holding cost

h

u

: used (returned) product period unit holding cost

b

m

: manufactured product period unit backorder cost

b

r

: remanufactured product period unit backorder

cost

l

m

: unit lost sales cost for manufactured products

l

r

: unit lost sales cost for remanufactured products

k: unit disposal cost for used products

DSP: disposal amount for the current period

LS

m

: current period manufactured items lost sales

LS

r

: current period remanufactured items lost sales

BO

m

: current period backordered manufactured item

demand

BO

r

: current period backordered remanufactured

item demand

Given that the system state is S, demand is x

m

and x

r

units for manufactured and remanufactured items

respectively, y units of return occur, and decisions d

r

and d

m

are made, the profit is calculated as:

,

,

,

,

,

(4)

where Q

r

and Q

m

represent the amounts of

remanufactured and manufactured items sold for

their corresponding prices, respectively.

,0

(5)

,0

(6)

0

0

0

(7)

0

0

0

(8)

,

0

(9)

(10)

0

(11)

Figure 1: Hybrid manufacturing/remanufacturing system under downward substitution.

AnalysisofDownwardProductSubstitutioninaRecoverableSystem

111

0

(12)

0

(13)

Then the expected profit in a given period is

calculated as:

,

,

,

,

,

,

,

,

,

,

,

where

,

,

represents the joint probability

mass function for the random variables X

m

, X

r

and Y.

The formulation is solved with a variant of the

Howard (1960) policy iteration method using the

fixed policy successive approximation method by

Morton (1971) for computational efficiency.

4 NUMERICAL EXPERIMENTS

AND RESULTS

In this section, we analyse numerically the

profitability of using the downward substitution

strategy under different demand/return distributions.

For the numerical experimentation, we consider

a product produced by an international automotive

spare part manufacturer. Due to privacy concerns,

the data is scaled and the identity of the firm is kept

anonymous. Due to the vigorous competition in the

sector, over the last few years the firm noticed that

the lost sales due to stock-outs of remanufactured

products were resulting in loss of customers and

damage to the image of the firm in the market.

Hence, customer satisfaction is very important, and

in order to guarantee a high level of customer

satisfaction, the company is considering a stock-out

based substitution strategy. The product for which

we evaluate the substitution strategy is an ‘engine

starter’ which is a type of electric motor. This

product family was among the firm’s first

production, and a better service level for this product

is considered to be prestigious by the manufacturer

(Ahiska et al., 2013).

The unit selling prices for the manufactured (i.e.

new) and remanufactured engine starter are 68.39€

and 51.85€, respectively, and the unit manufacturing

and remanufacturing costs are 22.74€ and 17.46€.

The manufacturer tolerates the backordering of the

manufactured item demand up to a certain level (i.e.

0) while backordering of the remanufactured

item demand is not allowed (i.e.

0) due to

the risks associated with receiving returns when

needed. If some remanufactured item demand

remains unsatisfied after the substitution is done,

then this demand is lost. Unit backordering cost for

manufactured product per period is calculated as

20% of its unit price while unit lost sales cost (cost

of goodwill loss) for both manufactured and

remanufactured products are calculated as 25% of

the corresponding unit price. The annual holding

costs for manufactured and remanufactured items

are calculated as 20% of the corresponding unit cost,

and the holding cost for a used item is considered to

be half of the holding cost for a remanufactured

item. The lead times for manufacturing and

remanufacturing are both one period. No set up costs

exists for either production option.

We design the first set of experiments in order to

investigate how the profitability of product

substitution strategy is affected as the means of the

demand and return distributions change. In this set

of experiments, we use bounded discrete stochastic

distributions with three different shapes for the

manufactured and remanufactured item demands and

used item returns, which are uniform, normal, and

right skewed. The mean of each different-shape

stochastic distribution is assigned three different

values: low, medium and high, as shown in Table 1.

Table 1: Mean values for different distributions.

Mean

Distribution shape High Medium Low

Uniform (Uni) 2.00 1.50 1.00

Normal (Nrm) 2.51 2.00 1.50

Right skewed (RS) 1.20 1.05 0.54

In all, 27 combinations of the three means are

created by assigning the three different levels of the

mean of the distribution for manufactured item

demand (E[X

m

]), remanufactured item demand

(E[X

r

]) and used item returns (E[Y]). These 27

combinations coupled with the three distribution

shapes yield a total of 81 scenarios. For each

scenario, the optimal expected profits per period for

the hybrid system under substitution and no

substitution strategies are determined by solving the

MDP as defined in the previous section.

The % improvements in profit gained by

substitution vs. no substitution are reported in Table

2. We make the following observations: When the

mean of remanufactured item demand is at least as

much as the mean of returns (E[X

r

]≥E[Y]), the

substitution strategy results in additional profit for

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

112

the manufacturer. Among the 54 scenarios where

E[X

r

]≥E[Y], the highest improvement in profit was

85%. When returns are substantially higher than the

remanufactured item demand (i.e. E[X

r

]<E[Y]), the

use of substitution is not economically justified. It

caused loss of profit but only up to 3% among the 27

scenarios we considered (see Table 2). Further

experimentation (not shown here) reveals that if the

average returns exceed the demand but at a lower

level than the amounts shown in Table 1,

substitution is still profitable.

It is worth noting that the mean of manufactured

item demand does not affect the amount of change in

profit by substitution. However because the profit of

manufacturing is lower for lower manufactured item

demand, a same amount of change in profit by

substitution corresponds to a higher percent change

of profit over no substitution case as the mean of

manufactured item demand decreases. In short, the

profitability of product substitution strategy is

mainly dependent on the size of remanufactured

item demand relative to that of returns.

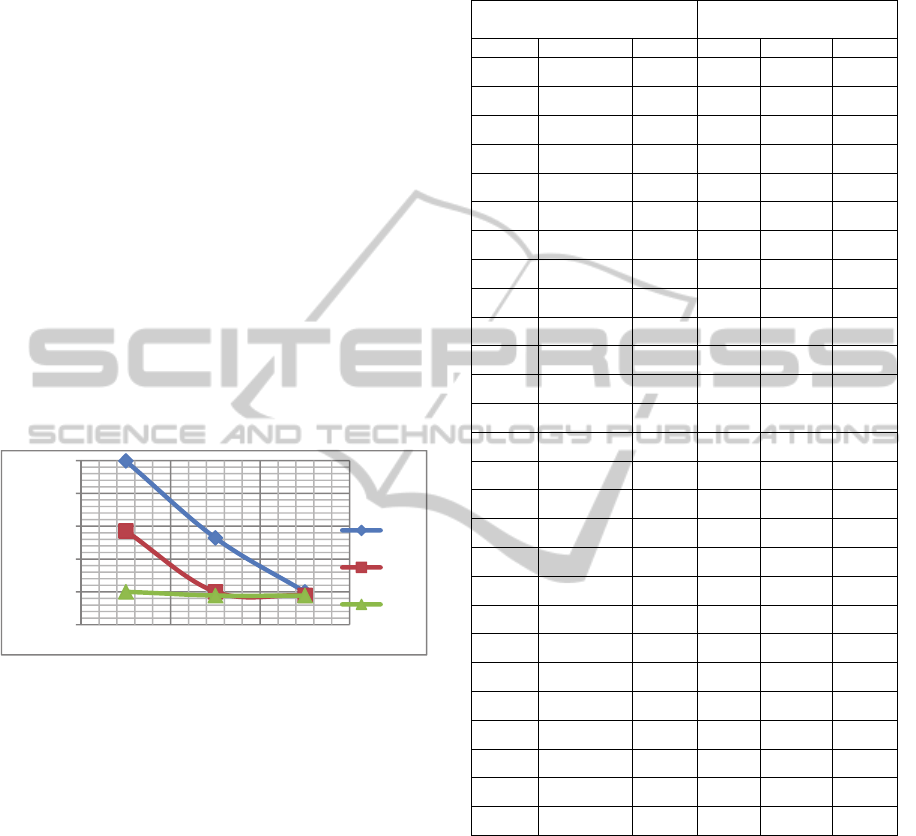

Figure 2: % improvement in profit as E[X

r

] and E[Y]

change (for Normal-shape distribution and low E[X

m

]).

Clearly, substitution results in a higher

improvement in profit when the expected

remanufactured item demand gets higher and/or the

expected return gets lower. For representative results

supporting this comment, see figure 2, which plots

the % improvements in profit by substitution for

nine scenarios with the low level of mean

manufactured item demand and the Normal shaped

distribution, and the mean of remanufactured item

demand and returns as low, medium and high. As

the ratio of the mean remanufactured item demand

to the mean returns increases from lowest

(E[X

r

]=low, E[Y]=high) to highest (E[X

r

]=high,

E[Y]=low), the percent change of firm’s profit when

the product substitution strategy is used increases

from -1.1% to 39.9%.

Table 2: The improvement in profit by substitution (%) for

different combinations of E[X

m

], E[X

r

] and E[Y] under

different-shape distributions.

Means

Improvement in profit by

substitution (%)

E[X

m

] E[X

r

] E[Y] Uni Nrm RS

high high high 1.75 0.00 2.29

high high med 15.25 12.00 7.63

high high low 37.11 27.61 43.84

high med high -1.06 -0.77 -0.53

high med med 1.16 0.00 2.18

high med low 17.49 13.02 32.81

high low high -1.24 -0.80 -1.63

high low med -1.23 -0.79 -1.64

high low low 0.47 0.02 1.11

med high high 2.03 0.00 2.47

med high med 18.23 13.86 8.30

med high low 46.42 32.63 49.31

med med high -1.27 -0.89 -0.59

med med med 1.38 0.01 2.37

med med low 21.58 15.28 36.74

med low high -1.53 -0.95 -1.86

med low med -1.51 -0.94 -1.87

med low low 0.57 0.02 1.22

low high high 2.44 0.00 3.47

low high med 22.73 16.43 11.84

low high low 62.10 39.87 84.82

low med high -1.58 -1.04 -0.82

low med med 1.70 0.02 3.42

low med low 28.14 18.54 61.82

low low high -2.00 -1.13 -3.03

low low med -1.97 -1.12 -3.02

low low low 0.73 0.03 2.01

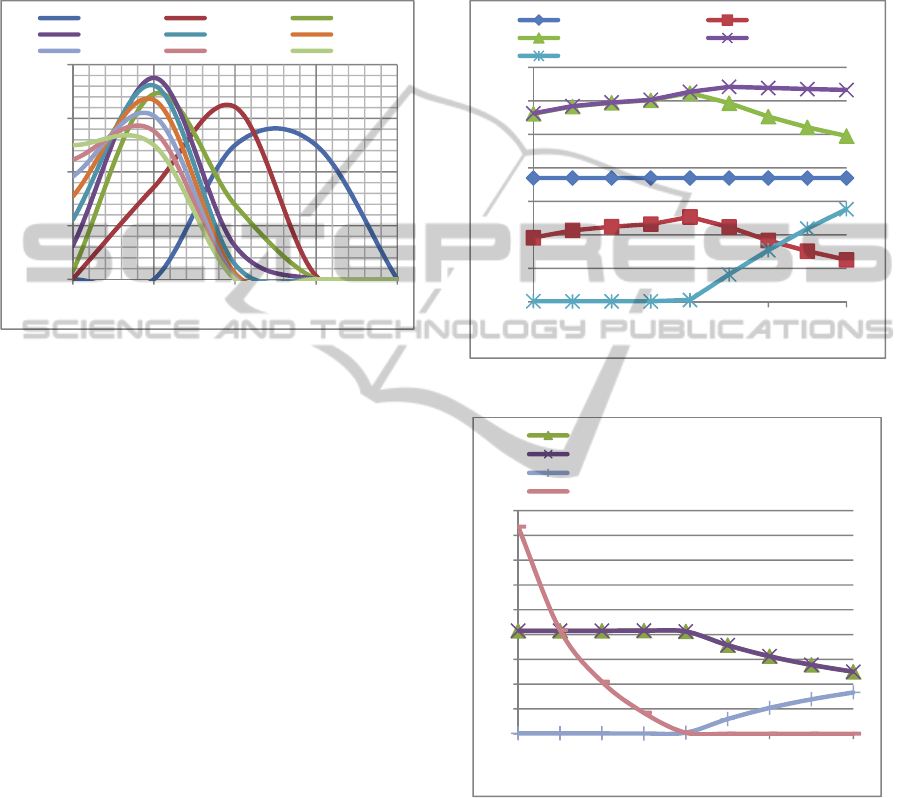

We performed a second set of experiments in

order to clearly see how the economic attractiveness

of the substitution strategy varies as the return

distribution changes. For this purpose, nine different

return distributions are created with different

coefficients of variations (CVs) ranging from 0.2 to

1.0 with an increment of 0.1, which are plotted in

figure 3. All the distributions have the standard

deviation of 0.5, hence they differ only by their

mean, which ranges from 2.5 to 0.5 as CV changes

from 0.2 to 1.0. The return distribution with

coefficient of variation of 0.6 is also used as the

demand distributions for remanufactured and

manufactured items in this set of experiments.

-10

0

10

20

30

40

% Imp. by

Substitution

low med high E[Y]

High

Med

Low

E[Xr]

AnalysisofDownwardProductSubstitutioninaRecoverableSystem

113

Figure 4 shows how the expected profits for the

hybrid system with/without product substitution

change as the mean of the return distribution

decreases from 2.5 to 0.5 (or CV increases from 0.2

to 1). The expected profits from the remanufacturing

and manufacturing processes are also plotted

separately for the no substitution case.

Figure 3: The return distributions with different coefficient

of variations (CVs).

The following observations are made: Recall that

the CV of remanufacturing item demand distribution

was set 0.6. Hence, in all the scenarios with return

distribution’s CV<0.6, the mean of return is higher

than the mean of remanufactured item demand

(E[Y]>E[X

r

]). When CV<0.6, the use of substitution

does not provide substantial additional profit over no

substitution case (only around 0.2%) since the

amount of returns available are typically sufficient to

meet remanufactured item demand. However when

CV exceeds 0.6 (i.e. E[Y] goes below E[X

r

]), a

decrease in returns increases the economic

attractiveness of product substitution from 0.6% to

nearly 28%.

Another observation is that when CV<0.6, an

increase in CV (i.e. decrease in expected return)

results in an increase in remanufacturing process

profit while the effect is opposite for CV>0.6. This

can be explained as follows: For CV<0.6, the

expected remanufacturing amount (consequently, the

sales revenue for remanufactured items and the

remanufacturing cost) remains unchanged as

expected returns decrease because the returns are

sufficient to meet the remanufactured item demand

and the expected remanufacturing amount is just as

much as remanufactured item demand. In this case

the increase in profit for remanufacturing process is

explained by the significant amount of savings

obtained in disposal cost since less disposal is

needed as returns get lower (see figure 5). For

CV>0.6 (i.e. returns are not sufficient to meet all

remanufactured item demand), a decrease in

expected return decreases the profit for

remanufacturing process because in this case sales

revenue from remanufactured items decreases and

the lost sales cost increases (see figure 5).

Figure 4: The expected profits under different CVs.

Figure 5: Expected values for remanufacturing amount,

sales/lost sales for remanufactured items and disposal

amount for used items for the no substitution case under

different return CVs.

5 CONCLUSIONS

We analyze a periodically reviewed stochastic

manufacturing/remanufacturing system where the

remanufacturing items have an inferior value from

0,00

0,20

0,40

0,60

0,80

01234

Probability

Return Values

CV=0.2 CV=0.3 CV=0.4

CV=0.5 CV=0.6 CV=0.7

CV=0.8 CV=0.9 CV=1.0

0,00

10,00

20,00

30,00

40,00

50,00

60,00

70,00

0,20 0,40 0,60 0,80 1,00

CV of Return Distribution

Profit-Man. Profit-Rem.

Profit-NoSub Profit-Sub

% Imp by Sub

0

0,2

0,4

0,6

0,8

1

1,2

1,4

1,6

1,8

0,20 0,40 0,60 0,80 1,00

CV of Return Distribution

Remanufacturing Amount

Sales for Remanufactured Items

Lost Sales for Remanufactured Items

Disposal Amount for Used Items

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

114

customers’ point of view compared to newly

manufactured items. A downward product

substitution strategy is employed in case of a stock-

out for remanufactured items. The problem is

formulated as a discrete-time MDP in order to find

the optimal inventory policies for both with and

without product substitution. Through a numerical

study based on real data for a product produced by

an automotive spare part manufacturer, the

profitability of substitution is investigated under

different demand and return distributions. The

results show that the substitution strategy is

economically attractive when the expected demand

for remanufactured items is at least as much of

expected returns, and the improvement in profit by

substitution increases significantly as the size of

returns decreases relative to the size of

remanufactured item demand. These results should

encourage the manufacturers operating hybrid

systems to use the product substitution strategy since

it may increase significantly their profit along with

improving the service level by reducing the expected

lost sales for remanufactured parts.

Opportunities for future work include performing

extensive experimentation using a broad range of

input parameters to better understand the scenarios

best suited for substitution and those least suited. In

addition, characterization of the optimal policies will

lead to implementable policies.

ACKNOWLEDGEMENTS

This work has been financially supported by

Galatasaray University research fund grant no.

13.402.002 and the Laboratory for Additive

Manufacturing and Logistics at N.C. State

University. The authors would like to thank Emre

Kurtul for his help in collecting data from the

automotive spare part manufacturer.

REFERENCES

Ahiska, S. S., Kurtul, E., King, R. E., 2013. Determining

the value of product substitution for a stochastic

manufacturing/remanufacturing system, Proceedings

of Industrial and Systems Engineering Research

Conference, San Juan, Puerto Rico.

Bayindir, Z. P., Erkip, N., and Gullu, R., 2005. Assessing

the benefits of remanufacturing option under one-way

substitution, Journal of the Operational Research

Society, 56, 286-296.

Bayindir, Z. P., Erkip, N., and Gullu, R., 2007. Assessing

the benefits of remanufacturing option under one-way

substitution and capacity constraint, Computers &

Operations Research, 34, 487-514.

Howard, R. A., 1960. Dynamic Programming and Markov

Processes, The MIT Press, Cambridge.

Huang, D., Zhou, H., Zhao, Q. H., 2011. A competitive

multiple product newsboy problem with partial

product substitution, Omega, 39, 302-312.

Inderfurth, K., 2004. Optimal policies in hybrid

manufacturing/remanufacturing systems with product

substitution, International Journal of Production

Economics, 90, 325-343.

Jin, Y., Ana M., Yihao L., 2007. On the profitability of

remanufactured products, 18th Annual Conference of

POMS, 4-7.

Kaya, O., 2010. Incentive and production decisions for

remanufacturing operations, European Journal of

Operational Research, 201, 442-453.

Korugan, A., Gupta, S. M., 2001. Substitution policies for

a hybrid system, SPIE Proceedings, Vol. 4193, 1-6.

Korugan, A., 2004. The effect of product substitution at

non-boundary inventory states, Optics East.

International Society for Optics and Photonics, 224-

233.

Li, Y., Chen, J., and Cai, X., 2006. Uncapacitated

production planning with multiple product types,

returned product remanufacturing, and demand

substitution, OR Spectrum, 28, 101-125.

Li, Y., Chen, J., and Cai, X., 2007. Heuristic genetic

algorithm for capacitated production planning

problems with batch processing and remanufacturing,

International Journal of Production Economics, 105,

301-317.

Morton, T. E., 1971. Asymptotic convergence rate of cost

differences for Markovian Decision Processes,

Operations Research, 19, 244-248.

Pineyro, P., and Viera, O., 2010. The economic lot-sizing

problem with remanufacturing and one-way

substitution, International Journal of Production

Economics, 124, 482-488.

Robotis, A., Bhattacharya, S., Van Wassenhove, L. N.,

2005. The effect of remanufacturing on procurement

decisions for resellers in secondary markets, European

Journal of Operational Research, 163(3), 688-705.

AnalysisofDownwardProductSubstitutioninaRecoverableSystem

115