Managing Price Risk for an Oil and Gas Company

António Quintino

1,2

, João Carlos Lourenço

1

and Margarida Catalão-Lopes

1

1

CEG-IST, Instituto Superior Técnico, Universidade de Lisboa, Lisbon, Portugal

2

Galp Energia, Refining and Distribution Risk Dept., Lisbon, Portugal

Keywords: Portfolio Hedging, Risk Tolerance, Multi-criteria Decision Analysis.

Abstract: Oil and gas companies’ earnings are heavily affected by fuels price fluctuations. The use of hedging tactics

independently by each of their business units (e.g. crude oil production, oil refining and natural gas) is

widespread to diminish their exposure to prices volatility. How much should be hedged and which

derivatives should be selected according to the company risk profile are the main questions this paper

intends to answer. The present research formulates an oil and gas company’s integrated earnings structure

and evaluates the company’s risk tolerance with four approaches: Howard’s, Delquie’s, CAPM and a risk

assessment questionnaire. Stochastic optimization and Monte Carlo simulation with a Copula-GARCH

modelling of crude oil, distillates and natural gas prices is used to find the derivatives portfolios according

to company risk tolerance hypothesis. The hedging results are then evaluated with a multi-criteria model

built in accordance with the expressed company’s representatives preferences upon four criteria: payout

exposure; downside gains; upside gains; and risk premium. The multi-criteria analysis revealed a decisive

role in the final hedging decision.

1 INTRODUCTION

Oil and gas (O&G) companies’ earnings are

substantially affected by the price fluctuations of

crude oil, natural gas and refined products, which

induce these companies to find ways to minimize

price risk exposure. Almost all O&G companies use

derivative instruments, like swaps and options, to

share price risks with other counterparties. This

research intends to propose a methodology to help

answer the main question that an O&G company

faces when trying to meet its budget goals: which

amount (if any) should be hedged and in which

derivatives. This work does not intend to be an

intensive research on complex derivatives but

instead evaluates the robustness of the hedging

decisions based on risk tolerance parameters and

confronts the results with a multi-criteria evaluation

model. For confidentiality reasons, the name of the

company will not be mentioned.

Deregulation of the United States energy markets

in the 1970’s provided the ingredients for the steady

growth of derivatives in the energy markets. Several

studies have focused the pros-and-cons of hedging

practices in O&G companies, some of them

presenting serious doubts on a company’s value

increase. However, in general, there exists a

common agreement on a better financial leverage

(Haushalter, 2000) and a lower unpredictability on

the earnings side (Jin and Jorion, 2006). The

introduction of the decision-maker utility as a

decision criterion (von Neumann and Morgenstern,

1944) assured the foundations for risk and return

concepts across the economic thinking, including

the early use of utility functions in portfolio

optimization (Levy and Markowitz, 1979).

The remainder of this paper is organized as

follows. Section 2 describes the problem

formulation, section 3 presents the price variables

stochastic modelling and correlation fitting, section

4 describes the risk modelling, section 5 shows the

results obtained by stochastic optimization of four

hedging approaches, section 6 presents a multi-

criteria model built to evaluate eight hedging options

against four criteria (payout exposure, downside

gains, upside gains, and risk premium) and section 7

presents the conclusions.

2 PROBLEM FORMULATION

The O&G company is organized in three business

units: the Exploration and Production unit (E&P)

produces only a partial amount of the crude the

127

Quintino A., Lourenço J. and Catalão-Lopes M..

Managing Price Risk for an Oil and Gas Company.

DOI: 10.5220/0004856901270138

In Proceedings of the 3rd International Conference on Operations Research and Enterprise Systems (ICORES-2014), pages 127-138

ISBN: 978-989-758-017-8

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

Refining and Distribution (R&D) unit needs (crude

oil buying is regular), and the Natural Gas unit (NG)

imports natural gas from foreign suppliers and sells

it to final consumers. The company has not an

integrated approach to manage price risk, since the

price risk management is made separately at each

business unit level, missing the risk mitigation

benefits across business units and not evaluating the

company entire price risk exposure. In fact, does not

exist a corporate risk measure to align hedging

operations with the company supposed risk

preferences. Since this research is focused on

commodities price risk, we take as reference the

company’s revenues affected in first instance by

price fluctuations, i.e. the Gross Margin, calculated

as the difference between the value of the goods sold

(crude oil, refined products and natural gas) and

acquired goods (crude oil and natural gas).

2.1 Physical Earnings Formulation

2.1.1 Exploration and Production

Crude oil production in oilfields of the Exploration

and Production (E&P) business unit takes place

under the two most applied agreements regulating

profits between O&G companies and host

governments (Kretzschmar et al., 2008): “Production

Sharing Contracts” (PSC) and “Concessions”. PSC

are common in African and non-OECD countries. In

these regimes the O&G company receives a defined

share of the production remaining after cost

recovery, the Entitled Production quantity e

p

(in

barrels of crude oil, bbl) is given by:

e

p

p

o

c

o

p

(1)

where c

o

is the Cost Oil (oil produced and allocated

to cover the capital and operating costs of the

company project), p

o

is the Profit Oil (remaining

‘profit’ allocated between company and State) and p

is the crude oil market price in U.S. dollars per

barrel ($/bbl). The Entitled Production quantity is

converted in earnings depending on the crude oil

market price.

Concession regimes have more straightforward

agreements and the earnings e (in $) is given by:

e qp c

p

o

t

x

,

(2)

where q is the total production of crude oil (in bbl),

p is the crude price ($/bbl), c denotes the operating

costs, p

o

is the Profit Oil and t

x

is the tax rate due to

host governments. The general formula for the E&P

earnings for both regimes m

e

(in $) is:

m

e

e

p

p

e

(3)

The crude oil price has two major world reference

indexes: the Brent price in Europe and the Western

Texas Intermediate price (WTI) in the U.S.A.

2.1.2 Refining and Distribution

The Refining and Distribution (R&D) business unit

is composed by the refining industrial complex and

the distribution network (wholesale and retail). The

price risk affects essentially the refining business,

which is smashed between the very volatile prices of

the inputs (crude oil) and outputs (refined products).,

The price differential between crude oil and some

refined products can be unfavourable for some

periods and negative refining margins can occur,

especially in older and less complex refineries,

explaining why some of them are being shutdown.

This turns the yearly earnings of a refinery a difficult

guess and explains why hedging is a common

practice (Ji and Fan, 2011). On the opposite side, in

deregulated markets, Distribution has almost zero

risk, since any change in the cost of the refined

products is quickly transferred to the final consumer.

Therefore, in this paper we will only focus on the

refining price risk. The refining gross margin m

r

(in

$/bbl) is given by:

m

r

y

i

x

i

p

i1

n

q

r

(4)

where y

i

is the yield (the percentage of each i refined

product taken from a unit of crude), x

i

is the unitary

price of each refined product i, p is the unitary price

of crude and q

r

is the yearly crude quantity refined

(in tonnes).

2.1.3 Natural Gas

The Natural Gas (NG) business unit buys natural gas

from other countries, based on long-term contracts

with complex price formulas indexed to the prices of

crude oil and refined products baskets. The selling

price formulas are diversified according to

consumer’s types (households, power plants and

industrial consumers) and have usually the Brent

price as the index reference (αBrent formulas) or

other indexes. The NG gross margin m

g

(in $) is

given by:

m

g

z

i

s

i

w

j

b

j

j1

n

i1

n

q

g

,

(5)

where s

i

and b

j

are respectively the selling and

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

128

buying price indexes, z

i

and w

j

are respectively the

selling and buying weights, and q

g

is the yearly total

quantity of natural gas (measured in m

3

or kWh).

2.2 Derivatives Payout Formulation

As the goal underneath this research is at least one

year term hedging we will choose the most common

and tradable derivatives for each business unit,

which includes swaps and european options priced

in the OTC (over the counter) market through large

banks and Brent crude futures (ICE Brent) priced in

the ICE exchange (a NYSE company).

2.2.1 Exploration and Production (E&P)

For the E&P business unit we will consider selling

crude oil futures, since the counterparty’s risk is

almost null and this procedure avoids the options

premium’s high costs (Energy Information

Administration, 2002). The unitary payout d

e

(in

$/bbl) is given by:

d

e

f p

t

,

(6)

where f is the future price for the Brent ($/bbl), and

p

t

is the Brent price at future exercise time t. If the

Brent price p

t

before maturity time, is lower than the

f sell price, E&P receives the difference between

these two prices, otherwise it loses the difference.

2.2.2 Refining

For Refining we will choose the following

derivatives: selling swaps which allows protection

from lowers margins (even losing the potential

benefit of higher margins) and collars (i.e. selling

calls and buying puts), since they provide a

bandwidth to benefit from price movements without

incurring in costs.

These derivatives have as underlying a simplified

refining margin (also known as crack spread), based

on the refined products with most traded forward

prices. We will name this simplified refining margin

the “Hedge Margin” m

h

(in $):

m

h

y

i

x

i

p

i1

5

q

h

,

(7)

where y

i

is the yield of product i entering in the

“Hedge Margin” (only 5 of the 18 products from the

production of the refinery have enough forward

price liquidity to enter in a hedge basket), x

i

is the

market price of product i, p is the Brent price and q

h

is the quantity to be hedged. The difference between

the real margin m

r

and the hedging margin m

h

is

called the “basis risk” b (in $), which is given by:

b

m

r

m

h

(8)

The hedge margin swap is a derivative based on a

fixed hedge margin price where the swap seller (the

company) receives or pays the price difference

between the fixed agreed price and the spot price at

each future fixed time legs, usually monthly till the

end of contract. The swap payout definition for the

swap hedge margin d

s

(in $/bbl)

is given by:

d

s

f

s

p

h

(9)

where f

s

is the initial agreed fixed price for the hedge

margin ($/bbl), usually the average forward price of

the hedging margin m

h

for the contract duration, and

p

h

is the hedge margin spot price at each future

month t, until the end of the contract, usually one or

more years.

The collar is a derivative instrument resulting

from buying a put and selling a call. In practical

terms, if the spot price at maturity is between the

low (“floor”) and the high (“cap”) pre-agreed prices,

no monthly payout exchange is made between the

company and the counterpart. If the spot price at

maturity is lower than the floor price, the company

receives the difference from the counterparty and in

the opposite situation, the company pays. The collar

payout d

c

(in $/bbl)

is given by:

d

c

min f

c

f

p

h

;0

max f

c

c

p

h

;0

(10)

where f

c

f

and f

c

c

are respectively the floor and the

cap agreed fixed price for the hedge margin m

h

and

p

h

is the hedge margin spot price at each future

month t until the end of the contract.

2.2.3 Natural Gas (NG)

The NG business unit acts as an importer and

distributor and is concerned with natural gas prices

increases that may not transfer to clients, affecting

the natural gas margin. With the same logic of the

refining margin, selling swaps of the natural gas

margin allows protection from lower natural gas

margins even the potential gains from higher

margins are partially transferred to the counterparty,

depending on the quantities agreed. The monthly

swap payout definition d

g

(in $/kWh) is given by:

d

g

f

g

p

g

(11)

where f

g

is the initial fixed agreed price for the

natural gas margin, usually the average forward

natural gas margin m

g

for contract duration and p

g

is

the natural gas margin spot price at each future

maturity month t, until the end of the contract.

ManagingPriceRiskforanOilandGasCompany

129

2.3 Company Earnings Formulation

The company’s total derivatives payout d (in $) is

given by:

d d

e

q

e

d

s

q

s

d

c

q

c

d

g

q

g

(12)

where q

e

, q

s

, q

c

and q

g

are the

quantities (a.k.a

notional amounts in swaps and options and number

of contracts in futures market) hedged and to be

found in the hedging optimization, ahead in the

present research.

The sum of the total derivatives payout d with

the physical margin of each business unit, m

e

, m

r

and

m

g

gives the gross margin for the company m (in $):

m d m

e

m

r

m

g

(13)

The option to include all physical earnings and

derivatives payouts to evaluate the company’s risk

reduction instead of doing it separately by business

unit is based on previous analyses where the risk

reduction is more effective by optimizing at once all

business units and inherent derivatives basket

(Quintino et al., 2013), having also the advantage of

minimizing the “basis risk”, b, since physical margin

m

r

and hedged margin m

h

will be optimized in the

same process.

3 PRICES MODELING

3.1 Stochastic Prices Modelling

For this research we will follow the main historic

pricing reference for energy markets, the Platts

(2012) quoted for the Northwest Europe (a.k.a.

Rotterdam prices) from 2006 to 2012. For the OTC

forward prices we follow the Reuters (2012) quoted

monthly prices for the Northwest Europe to 2013

and the ICE Brent for future prices.

3.2 Time Series Modelling

Historic prices will be modelled by their monthly

price returns and used to define the stochastic

behaviour of the forward prices, permitting to

evaluate how the margin m in expression (13) varies

in the months ahead.

The price return r

t

(in %) for a product is given

by:

r

t

ln

p

t

p

t1

(14)

where p

t

is the average price of month t and p

t–1

is

the average price in month t – 1. The Generalized

Autoregressive Conditional Heteroscedasticity

model (GARCH) proposed by Bollerslev (1986)

achieved the best fit for each of the prices returns

(SIC-Schwarz information criterion and the AIC-

Akaike information criterion were used as goodness

of fit measures), which was also confirmed by

Nomikos and Andriosopoulos (2012). The monthly

spot prices returns r

t

(in $) for a GARCH(1,1)

process is given by:

r

t

t

z

t

with

t

2

r

t1

2

t1

2

(15)

where μ is the series trend, z

t

are independent

variables from a Normal distribution Ɲ(0,1) and the

conditional variance σ

t

2

assumes an autoregressive

moving average process (ARMA), with α weighing

the moving average part and β affecting the auto-

regressive part, being ω > 0, α ≥ 0, β ≥ 0. The term

(α + β) should be less than one to assure long-term

stability and β is defined as the “persistence term”,

reflecting the speed at which the shocks to the

variance revert to the long run variance. The higher

the persistence the slower the times series revert to

the long run variance. The absence of

autocorrelation was confirmed by the Ljung-Box

statistic. Figure 1 shows the high variability of Brent

prices returns, with other refined products exhibiting

a similar pattern.

Figure 1: Brent monthly price returns modelled with a

GARCH(1,1) model.

3.3 Correlation Modelling

Modelling correlation between the different products

prices, assuring nonlinear and complex

interdependencies, leads us to copula’s functions.

The Sklar (1959) theorem provides the theoretical

foundation for the application of copulas’ functions.

It assumes a stochastic multi-variable vector (X

1

,

X

2

,…X

n

), where X

i

is in our case the price of product

i with continuous marginals and cumulative density

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

130

function F

i

(x

i

)=P(X

i

≤ x

i

). Applying the probability

integral transform to each component:

[U

1

,U

2

,…U

n

]=[F

1

(X

1

),F

2

(X

2

),…,F

n

(X

n

)], having

U

i

є]0;1[ continuous margins.

The copula function C is defined as the joint

cumulative distribution function of [U

1

,U

2

,…U

n

],

where C[u

1

,u

2

,…,u

n

]=P[U

1

≤ u

1

,U

2

≤ u

2

,…, U

n

≤ u

n

].

The copula C contains all information on the

dependence structure between the components of

(X

1

, X

2

,…X

n

), whereas the marginal cumulative

distribution functions F

i

contain all information on

the marginal distributions. The great advantage of

copula’s functions is to allow the correlation pattern

modelled by the copula function to be independent

from the random variable X

i

marginal’s. Copula’s

functions are considered the most powerful and

flexible tool for portfolio management and risk

analysis (Jobst et al., 2006); (Rosenberg and

Schuermann, 2006); (Chollete, 2008).

3.4 Copula-GARCH Model

Natural Gas and Refining business units have very

narrow gross margins, which depend on complex

formulas involving several products prices,

demanding a powerful correlation method to assure

the margins’ values adhere to reality. Time series

functions and correlation functions, after long

testing, led us to the Copula-GARCH models (Lu et

al., 2011). Our method can be synthesized in three

steps: first, modelling the independent prices returns

with a GARCH model as described in (15) and,

second, find the best copula function to correlate

each GARCH price returns residuals z

t

.

z

t

r

t

t

(16)

Applying the SIC and the AIC criteria (Fermanian,

2005) we obtained the Student’s t copula (t-copula)

as the best copula function to model the prices return

residuals correlation. The Student’s t copula is

defined by:

Cu

1

;u

n

;

, d

T

d,

t

d

1

u

1

, t

d

1

u

n

(17)

where T is the t-copula with d degrees of freedom

and correlation matrix ρ, t

–1

is the inverse Student’s t

distribution with d degrees-of-freedom, and u

n

are

the marginal distributions of the n variables (the

price returns residuals, z

t

in our case).

The degree of tail dependency in the t-copula is

defined by d (degrees of freedom).

Finally, the third step evaluates each stochastic

price return p

t

using:

p

t

pe

r

t

(18)

where p is each forward price and r

t

is each price

return, given by the combination of a GARCH and a

t-copula function T being

Z

*

t

the residual correlated

with each other price returns residuals:

r

t

r

t1

2

t1

2

T

d,

t

d

1

u

t

Z

*

t

(19)

Unlike the Gaussian copula, the t-copulas have the

advantage of preserving the tail dependence in

extreme events (Asche et al., 2003), having steady

use in advanced portfolio risk estimation (Huang et

al., 2009), (Shams and Haghighi, 2013) and oil

hedging strategies (Chang et al., 2011).

4 RISK MODELLING

4.1 Risk Measures

Exposure, also called impact (Kaplan and Mikes,

2012), is the foreseen potential loss in money or in

other measurable variable if the risk occurs. The

importance of confronting an O&G gross margin

“exposure” with a measure of the respective

“uncertainty” is to guarantee that a company meets

its obligations with a previously imposed degree of

confidence (Haushalter, 2000). Artzner et al., (1999)

defined the axioms necessary and sufficient for a

risk measure to be coherent: positive homogeneity,

translation-invariance, monotonicity and sub-

additivity. Rockafellar and Uryasev (2000) proved

that standard deviation and Value-at-Risk (VaR)

created by J. P. Morgan (1992) are not coherent risk

measures, because the first violates translation

invariance and monotonicity, while VaR fails sub-

additivity. They proposed Conditional Value-at-Risk

(CVaR) as a coherent risk measure, which assures

the essential sub-additivity property and, as

presented in Figure 2 measures how large is the

average loss into the left tail ($720x10

6

), while VaR

only defines the loss frontier for a given probability

($600x10

6

).

Conditional Value-at-Risk (CVaR) is given by:

CVaR

1

EX

VaR

1

(20)

where X

α

is the value defined for having VaR for a

confidence level of 1 – α.

ManagingPriceRiskforanOilandGasCompany

131

Figure 2: Company downside earnings measured by VaR

and CVaR with a 95% confidence level.

4.2 Risk Tolerance

Utility theory, firstly proposed by Bernoulli (1738)

and developed by von Neumann and Morgenstern

(1944), allows determining a rational decision-

maker behaviour under risk and uncertainty. A

utility function u(x) describes a decision-maker

preferences and risk attitude allowing to translate,

e.g., dollars into utility units. A risk-averse decision-

maker would have a concave utility function,

meaning that she would exchange a higher expected

value of an uncertain game by a lower sure amount.

A risk-prone decision-maker (one that prefers a

higher expected value of an uncertain game to a

lower certain amount) would have a convex utility

function. A risk neutral decision-maker would have

a linear utility function.

The Certainty Equivalent (CE) is a key concept

in risk analysis. In the simple example lottery

depicted in Figure 3, the decision-maker may

consider the option “gamble”, with an outcome of

$100 (u(x) = 1) with a probability of 60%, and an

outcome of $0 (u(x) = 0) with a probability of 40%

indifferent to the option “not gamble”, if the certain

outcome of “not gamble” is $45. Thus, we would

say that CE = $45 and u($45) = u($100) × 0.6 +

u($0) × 0.4 = 0.6. The risk premium r (in $) is

given by:

r = E(x) – CE.

(21)

Consequently, for the above presented example, r =

($100 × 0.6 + $0 × 0.4) – $45 = $15.

Figure 3: Certainty equivalent meaning in a lottery.

Measuring corporate risk tolerance requires

assessing tradeoffs between potential upside gains

and downside losses under conditions of uncertainty.

As a result, the selection of the optimal

derivatives portfolio is influenced by the decision-

maker’s attitudes towards financial risk. This is the

point where utility theory commands the evaluation

of the optimal portfolio, assessing the decision

maker’s risk tolerance. The exponential utility

function (22) is one of the most widely used, and is

well tested on portfolio risk management in the oil

industry (Walls, 2005).

u(x) 1e

x

(22)

Its single parameter (the risk tolerance ρ), no initial

wealth dependence and constant absolute risk

aversion (–u''(x)/u'(x)=c

te

) (Pratt, 1964) explain the

exponential utility function wide use. In a lottery

game, the risk tolerance value ρ is the value that the

decision maker is willing to accept in order to play a

game where there are only two outcomes: winning

the amount ρ with a 50% probability or lose ρ/2 with

50% probability.

The exponential utility function performs better

than other utility functions, including the quadratic

utility function inherent to the Markowitz’s portfolio

optimization (Kirkwood, 2004) but using a utility

function advises a post sensitivity analysis to assure

the results robustness. The exponential utility

function certainty equivalent is:

CE

x

ln p

i

e

x

i

11

n

(23)

but can be simplified (Pratt, 1964, Clemen, 1996) for

outcomes with normal distributions (which is our

case, after K-S test) to:

CE

x

x

2

2

(24)

where μ(x) is the yearly average gross margin for the

company according to expression (13),

x

2

is the

gross margin variance and ρ is the company’s risk

tolerance.

4.3 Risk Tolerance Estimation

Numerous studies proposed evaluation methods for

corporate values of risk tolerance for exponential

utility functions. The most referred research suggests

setting the risk tolerance ρ at 6% of sales, 1 to 1.5

times net income, or 1/6 of equity in the “O&G”

companies (Howard, 1988). A more analytic

approach presented by Delquie (2008) proposes the

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

132

risk tolerance to be set to a fraction of the maximum

acceptable loss the company can afford for a given p

significance level, which can be considered a proxy

for the Value-at-Risk (VaR

1–p

):

VaR( p)

ln p

(25)

With a significance level p = 5% this implies that

the risk tolerance ρ is equal to one third of the

VaR

95%

.

Another common way to estimate corporate risk

tolerance is through a questionnaire answered by a

decision group panel who represents the company

risk profile (Board, CEO, CRO, CFO) for the most

important decisions.

Confronting each decision maker with a list of

questions in which he must choose between one of

two outcomes, x

1

or x

2

, with probabilities p

1

and p

2

,

respectively, it is possible to calculate iteratively the

certainty equivalent CE and the inherent risk

tolerance ρ that matches equation (23) (Walls

(2005)).

Another risk tolerance method estimation,

derived from the Capital Asset Pricing Method-

CAPM (Sharpe, 1964) is to assume the CE as the

effective cash-flow when each year t nominal cash-

flow CF

t

is discounted through the ratio of the risk

free rate r

f

to the rate that the company demands for

investments, the Weighted Average Cost of Capital

(WACC).

CE

t

CF

t

1r

f

t

1WACC

t

(26)

where CF

t

is the Project Cash-Flow in year t and r

f

is the free rate of return.

4.4 Risk Tolerance Results

Let us now explaining the results of the four

approaches employed:

a) With Howard’s we obtain the most conservative

estimation, e.g. one year of the company’s net

results is assumed to be the company’s risk

tolerance ($317x10

6

);

b) For Delquie’s, we estimate the VaR

95%

for the

company’s one year gross margin ($505×10

6

)

with p=5% in expression (25), which gives a risk

tolerance of $166

×10

6

;

c) For CAPM, we evaluated all the forecasted

project cash-flows 10 years ahead (essentially

E&P based) and we estimate the average

certainty equivalent applying (26), which gives a

risk tolerance of $220

×10

6

;

d) For the risk assessment questionnaire, we

confronted the CFO and his advisers with a set of

questions to evaluate the amount of money about

which they were indifferent, as a company, in

order to have a 50-50 chance of winning that

sum or losing half of it. A complementary set of

questions was made on the risk premium they

were willing to pay in order to receive with

certainty the average gross margin estimated for

next year’s budget. Applying expression (23) to

the first set of answers and expression (21) to the

second set of answers, it was possible to have a

series of risk tolerances values, with a mean of

$180

×10

6

and a standard deviation of $42×10

6

.

The risk tolerance results for the four methods are

presented in Table 1.

Table 1: Risk Tolerance results (in $10

6

).

Method Measure Value

Risk

Tolerance

Howard Net Income

317 317

Delquie VaR

95%

505 166

CAPM CE

370 220

Questionnaire Gross Margin

760

180

Delquie (2008) method has the most

conservative risk tolerance, while Howard’s method

estimated the highest value. The other ratios

proposed by Howard (equity and sales) give us even

larger risk tolerance values.

5 OPTIMIZATION RESULTS

In order to evaluate the consequences of the risk

tolerance estimates in Table 1, we ran optimizations

for a range of eight risk tolerance values, including

the four presented in Table 1, maximizing the

company certainty equivalent by inserting

expression (13) into expression (24):

max CE max m(d, m

e

, m

r

, m

g

)

m

2

2

(27)

We used a stochastic optimization algorithm

(Optquest, 2012) having the hedge quantities q

e

, q

s

,

q

c

and q

g

in expression (12) as the variables to be

determined. The stochastic price p

t

of each product

is embedded in the gross margin of each business

unit, m

e

, m

r

, m

g

and in the derivatives payout d, at

the same time.

After having achieved the optimal solution for

each of the eight risk tolerance values, we ran a

Monte Carlo simulation (5000 runs) using

ModelRisk (2012).

ManagingPriceRiskforanOilandGasCompany

133

The solutions from the integrated model (27)

have the advantage of obtaining the eight optimal

derivatives solutions while minimizing the “basis

risk” b. Figure 4 presents the density probability

curve for the un-hedged and hedged scenario for a

risk tolerance of $25

×10

6

.

Figure 4: Hedged and un-hedged margin for a $25×106

risk tolerance.

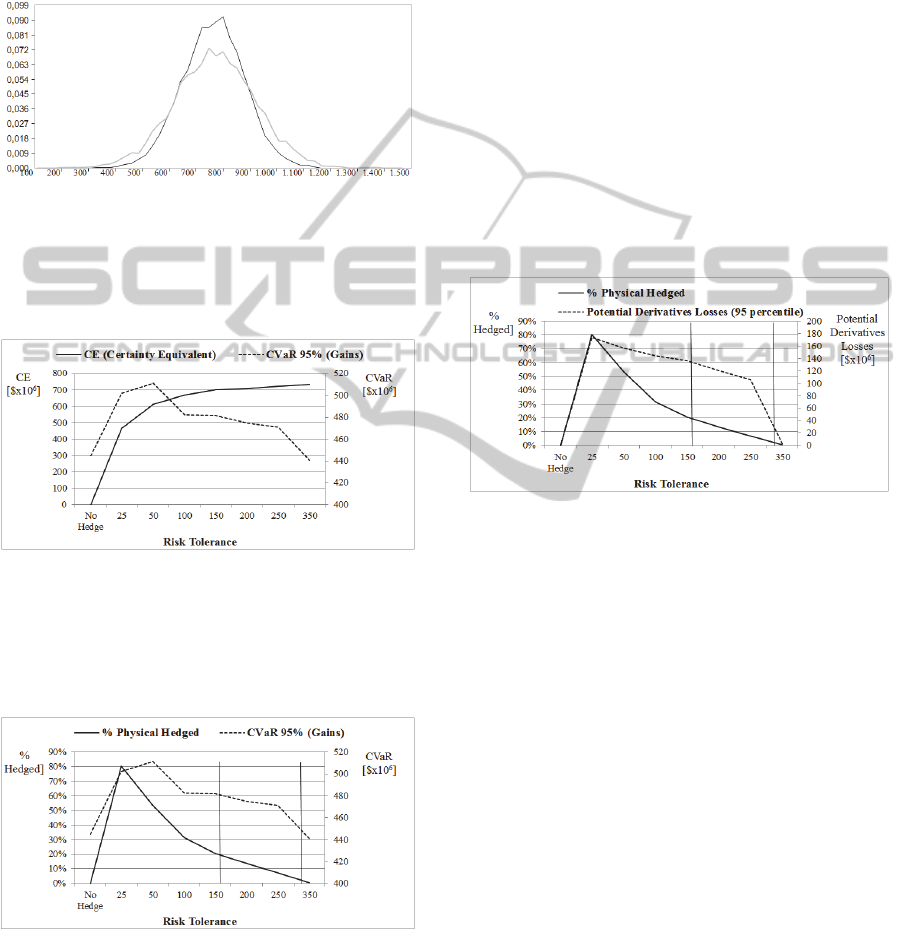

Figure 5 shows the risk tolerance impact in the

company certainty equivalent and into the CVaR

95%

(the risk measure).

Figure 5: CE and CVaR

95%

as a function of risk tolerance.

As risk tolerance increases, the certainty

equivalent increases, since the risk premium

decreases (see (24)). However, after a risk tolerance

of $ 50

×10

6

, we see a drop in the company CVaR.

Figure 6: CVaR

95%

and % Physical Hedged as a function

of Risk Tolerance ($10

6

).

Looking at Figure 6, the decrease in CVaR is

explained by the decreasing amount of derivatives d

in the optimized solutions, which allows greater

potential upside gains but greater potential downside

losses. The “% Physical Hedged” is the ratio

between the notional amounts of derivatives

contracts and the total physical company production,

both amounts in tons.

Less hedging means that the minimum gains (or

losses) get lower. Looking at the risk tolerance

vertical lines, the Delquie method implies about

20% hedging, the risk questionnaire about 15%,

CAPM about 7% hedging and Howard method

would imply only 3% hedging. The main question

that arises is about the “real” company risk

tolerance, because different risk tolerances imply

noticeable differences in terms of potential

derivatives losses, as is shown in Figure 7. Yearly

potential derivatives losses may vary from $20

×10

6

to $140×10

6

, which can have a heavy impact in the

Mark-to-Market (MTM) company quarterly

financial statements.

Figure 7: % Physical hedged and potential derivatives

losses as a function of risk tolerance.

6 MULTI-CRITERIA

EVALUATION

As we can observe in the results presented in section

5, the risk tolerance estimation widely affects the

hedging optimal solutions, and it is not clear if the

in-house risk assessment questionnaire defined

accurately the company risk profile. Therefore, we

will test in what extent the questionnaire reflects

with confidence the decision maker’s risk

preferences.

The company is interested in selecting the most

attractive hedging option from the set of eight

options previously built. However, the CFO and his

advisers, which constitute the company’s decision-

making group (DM), are not sure about which one to

select. In fact, they suspect that there is no option

that is the best according to all points of view that

came to their mind. To help the DM we developed a

multi-criteria evaluation model (Belton and Stewart

(2002)) using the MACBETH approach (Bana e

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

134

Costa and Vansnick, 1999; (Bana e Costa et al.,

2012), which required the group to: discuss their

points of view and select the criteria that should be

used to evaluate the hedging options; associate a

descriptor of performance to each criterion; build a

value function for each criterion; and weight the

criteria.

The additive value function model was selected

to provide an overall measure of the attractiveness of

each hedging option:

vx

1

,...x

n

w

i

v

i

x

i

i1

n

with

w

i

1,

i1

n

w

i

0

(28)

where v is the overall score of an hedging option x

with the performance profile (x

1

,…, x

n

) on the n

criteria, v

i

(i =1, …, n) are value functions, w

i

(i =1,

…, n) are the criteria weights. (Note that by applying

the additive value function model we are admitting

that a poor performance of an option in one criterion

may be compensated by good performances of that

option in other criteria. However, this working

hypothesis must be validated by the decision-making

group.)

The DM members discussed the points of view

they considered relevant for evaluating hedging

options having in mind the next year gross margin

budget as overall objective. After discussion, four

evaluation criteria were selected: 1) downside gains,

2) upside gains, 3) payout exposure and 4) risk

premium.

The performances of the hedging alternatives in

all criteria are their earnings expressed in $10

6

. The

5

th

and 95

th

earnings’ percentiles from the Monte

Carlo simulation results were used to define the

upper and lower reference levels, respectively, on

each descriptor of performance; three other

intermediate levels, between the upper and the lower

reference levels, were created on each descriptor of

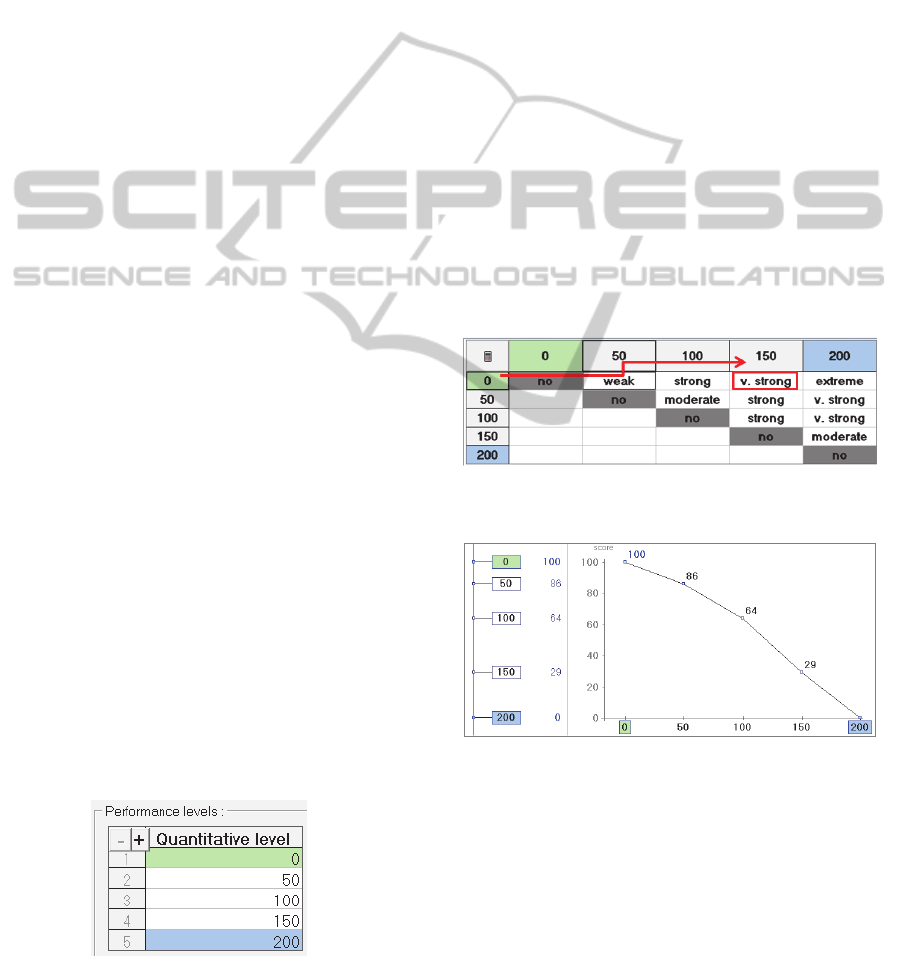

performance. For example, Figure 8 presents the

performance levels of criterion “payout exposure”,

where 0 and 200 were defined as the upper and

lower reference levels, respectively, and 50, 100 and

150 are the intermediate levels; Figure 11 shows the

performance levels of all criteria).

Figure 8: Performance levels for the “payout exposure”

criterion (in $10

6

).

A value function was built for each criterion

using the MACBETH method and software

(www.m-macbeth.com), fixing 100 and 0 as the

value scores of the upper reference level and lower

reference level, respectively, on all criteria.

According to the MACBETH questioning protocol,

the decision-makers had to judge the difference in

attractiveness between each two levels of the

descriptor of performance using the semantic scale:

very weak, weak, moderate, strong, very strong or

extreme. For example, in the matrix of judgments for

criterion “payout exposure” (see Figure 9) the

decision-makers considered the difference in

attractiveness between $0 and $150

×10

6

to be very

strong (“v. strong” in Figure 9). After, M-

MACBETH proposed a value function scale

compatible with all the judgments inputted in the

matrix of judgements, using the linear programming

procedure presented by Bana e Costa et al. (2012).

The decision-makers were then asked to validate the

proposed scale in terms of the proportions between

the resulting scale intervals, and adjust them, if

needed. Figure 10 shows the value function scale for

the “payout exposure” criterion.

Figure 9: MACBETH matrix of judgments for the “payout

exposure” criterion.

Figure 10: Value function for the “payout exposure”

criterion (performances in $10

6

).

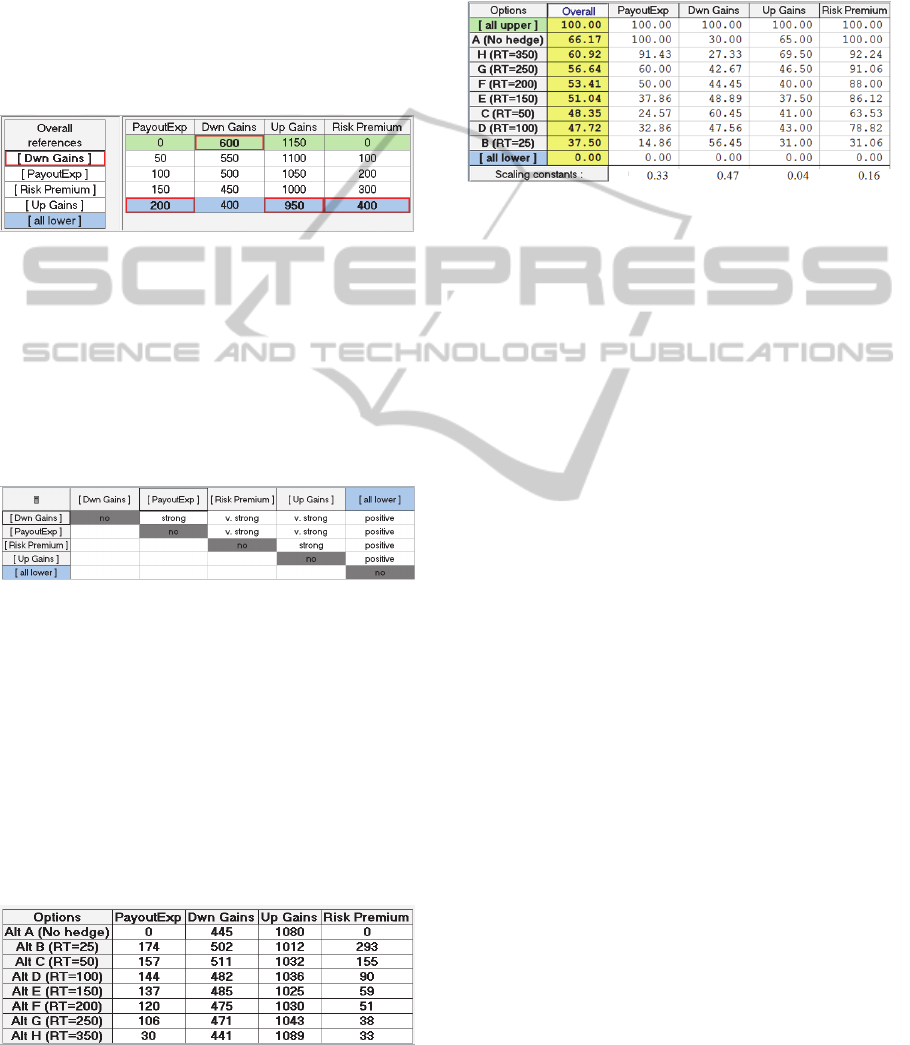

The following step consisted in eliciting weights

for the criteria. For that purpose five hedging

fictitious options were built: one option with a

performance at the upper reference level in one

criterion and performances at the lower reference

levels in the other three criteria with no repetitions

(what gives four fictitious options), and one

fictitious option with performances at the lower

reference levels in all the four criteria. Figure 11

ManagingPriceRiskforanOilandGasCompany

135

shows that the fictitious option “[Dwn Gains]” (see

the cell at top in column “Overall references” in

Figure 11) has a performance at the upper reference

level in criterion “Dwn Gains” (600) and

performances at the lower reference levels in the

other three criteria (“PayoutExp” – 200; “Up Gains”

– 950, “Risk premium” – 400). Then, the decision-

makers ranked the fictitious options by decreasing

order of their overall attractiveness, which resulted

in the rank shown in the “Overall references”

column in Figure 11.

Figure 11: Performance levels on the four criteria (in

$10

6

).

After, the decision-making group judged the

differences in attractiveness between each two

fictitious options, which allowed filling in the

MACBETH weighting judgments matrix show in

Figure 12. We underline that by accepting to make

these trade-offs, the group is validating our working

hypothesis of compensation between criteria.

Figure 12: MACBETH weighting judgments.

M-MACBETH then generated the criteria

weights by linear programming (see Bana e Costa et

al., 2012), which were show to the group for

validation and possible adjustment. The final criteria

weights (in %) were: Downside Gains (47%);

Payout exposure (33%); Risk premium (16%); and

Upside gains (4%).

In the last step, the performances of the eight

hedging options – from A (no hedge) until H

(tolerance risk of $350×10

6

) – were inputted in M-

MACBETH (see Figure 13).

Figure 13: Performances of the eight alternatives on the

four criteria (in $10

6

).

Note that the performances of the options are the

results generated for each of the eight risk tolerance

scenarios in section 5. With these data inputted the

partial (on each criterion) and overall value scores of

the hedging options were calculated by M-

MACBETH (see Figure 14).

Figure 14: Overall and partial value scores of the

alternatives and criteria weights.

In Figure 14 (column “Overall”) we see that the

most overall attractive option considering the

expressed preferences of the decision-makers is

option A (No hedge). Option H which corresponds

to the highest risk tolerance (ρ = $350

×10

6

), is

ranked second, whereas the least preferred hedging

option is B, which corresponds to lowest risk

tolerance (ρ = $25

×10

6

).

7 CONCLUSIONS

The multi-criteria evaluation of the hedging options

using the judgments of the same decision-makers

who answered the questionnaire gave us different

results in terms of preferred hedging options. The

most preferred hedging option “A”, and inherent

null hedging is closer to the Howard risk estimation

(ρ ≈ $350

×10

6

) and confirms Smith (2004)’s

findings that “large companies with reasonably

diversified shareholders should have risk tolerances

that are much larger than those typically suggested

in the decision analysis literature” (p. 114). In fact,

our research suggests the most preferred alternatives

have higher risk tolerance values than initially

estimated by the questionnaire.

With this research we show that it is possible to

perform a structured approach to model the entire

O&G company business model and evaluate price

risk management in an integrated way. Gross

margins from the three business units and a basket of

derivatives enter at once in a certainty equivalent

maximization problem and it becomes clear how the

hedging solutions vary with risk tolerance.

Defining a preliminary risk tolerance measure for

the company through a tailored risk assessment

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

136

questionnaire and comparing with other reference

methods of risk tolerance estimation allows

achieving preliminary solutions based on stochastic

portfolio optimization for each risk tolerance.

However, a multi-criteria final assessment should be

done, using the Monte Carlo simulation results, in

order to ascertain how decision-makers valuate the

underneath multiple consequences from each

hedging option. This multi-criteria final risk

tolerance evaluation can in fact help the company in

the always difficult decision “to hedge or not to

hedge” and, if yes, which amount to hedge.

It is important to note that these results were

obtained with data and preference judgements

concerning a specific moment in time. Few months

before or later, with different crude and refined

products prices, would lead to different decisions

under this approach. On the other side, each year,

the company has different goals, the market value

can grow or shrink along with the earnings and gross

margins. Further research should be done to evaluate

the results of the model in different price conditions

and involving other decision makers, preferably also

including board directors.

REFERENCES

Artzner, P., Delbaen, F., Eber, J.-M. & Heath, D. 1999.

Coherent measures of risk. Mathematical Finance, 9,

203–228.

Asche, F., Al, E., Gjølberg, O. & Völker, T. 2003. Price

relationships in the petroleum market: An analysis of

crude oil and refined product prices. Energy

Economics, 25, 289-301.

Bana e Costa, C. A., De Corte, J. M. & Vansnick, J. C.

2012. MACBETH. International Journal of

Information Technology & Decision Making, 11, 359-

387.

Bana e Costa, C. A. & Vansnick, J. C. 1999. The

MACBETH approach: Basic ideas, software, and an

application. In: Meskens, N. & Roubens M. R. (eds.)

Advances in Decision Analysis. Kluwer Academic

Publishers, Dordrecht, pp. 131-157

Belton, V. & Stewart, T. J. 2002. Multiple Criteria

Decision Analysis: An Integrated Approach, Kluwer

Academic Publishers, Boston, MA.

Bernoulli, D. 1738. Exposition of a new theory on the

measurement of risk. Econometrica, 22, 23-39.

Bollerslev, T. 1986. Generalized autoregressive

conditional heteroskedasticity. Journal of Economics,

31, 307-327.

Chang, C.-L., Mcaleer, M. & Tansuchat, R. 2011. Crude

oil hedging strategies using dynamic multivariate

GARCH. Energy Economics, 33, 912-923.

Chollete, L. 2008. Economic implications of copulas and

extremes. Penger og Kreditt - Norges Bank, 2, 56-58.

Clemen, R. T. 1996. Making Hard Decisions: An

Introduction to Decision Analysis. Duxbury Press,

Belmont, CA, 2nd edition.

Delquie, P. 2008. Interpretation of the risk tolerance

coefficient in terms of maximum acceptable loss.

Decision Analysis, 5, 5-9.

Energy Information Administration 2002. Derivatives and

risk management in the petroleum, natural gas, and

electricity industries. U.S. Department of Energy.

Fermanian, J.-D. 2005. Goodness-of-fit tests for copulas.

Journal of Multivariate Analysis, 95, 119-152.

Haushalter, D. 2000. Finance policy, basis risk and

corporate hedging: Evidence from oil and gas

producers. The Journal of Finance, 55, 107-152.

Howard, R. A. 1988. Decision analysis: Practice and

promise. Management Science, 34, 679-695.

Huang, J.-J., Lee, K.-J., Liang, H. & Lin, W.-F. 2009.

Estimating value at risk of portfolio by conditional

copula-GARCH method. Insurance: Mathematics and

Economics, 45, 315-324.

J.P.Morgan 1992. RiskMetricsTM—Technical Document.

In: J.P.Morgan/Reuters (ed.) Fourth Edition, 1996

Ji, Q. & Fan, Y. 2011. A dynamic hedging approach for

refineries in multiproduct oil markets. Energy, 36,

881-887.

Jin, Y. & Jorion, P. 2006. Firm value and hedging:

Evidence from U.S. oil and gas producers. The

Journal of Finance, 61, 893-919.

Jobst, N. J., Mitra, G. & Zenios, S. A. 2006. Integrating

market and credit risk: A simulation and optimisation

perspective. Journal of Banking & Finance, 30, 717-

742.

Kaplan, R. S. & Mikes, A. 2012. Managing risks: A new

framework. Harvard Business Review, 90, 48-60.

Kirkwood, C. W. 2004. Approximating risk aversion in

decision analysis applications. Decision Analysis, 1,

51-67.

Kretzschmar, G. L., Kirchner, A. & Reusch, H. 2008. Risk

and return in oilfield asset holdings. Energy

Economics, 30, 3141-3155.

Levy, H. & Markowitz, H. M. 1979. Approximating

expected utility by a function of mean and variance.

American Economic Review, 69, 308-17.

Lu, X. F., Lai, K. K. & Liang, L. 2011. Portfolio value-at-

risk estimation in energy futures markets with time-

varying copula-GARCH model. Annals of Operations

Research, doi: 10.1007/s10479-011-0900-9

Modelrisk 2012. Vose Software. http://

www.vosesoftware.com/

Nomikos, N. & Andriosopoulos, K. 2012. Modelling

energy spot prices: Empirical evidence from NYMEX.

Energy Economics, 34, 1153–1169.

Optquest 2012. OptTek Systems. http:// www.opttek.com/

OptQuest.

Platts 2012. Market Data – Oil, www.platts.com

Pratt, J. W. 1964. Risk aversion in the small and in the

large. Econometrica, 32, 122-136.

Quintino, A., Lourenço, J. C. & Catalão-Lopes, M. 2013.

An integrated risk management model for an oil and

gas company. Proceedings of EBA 2013, 16-19 July,

ManagingPriceRiskforanOilandGasCompany

137

Rhodes, Greece, pp. 144-151.

Reuters 2012. Commodities: Energy.

Rockafellar, R. T. & Uryasev, S. 2000. Optimization of

conditional value-at-risk. Journal of Risk, 2, 21-41.

Rosenberg, J. V. & Schuermann, T. 2006. A general

approach to integrated risk management with skewed,

fat-tailed risks. Journal of Financial Economics, 79,

569-614.

Shams, S. & Haghighi, F. K. 2013. A Copula-GARCH

Model of Conditional Dependencies. Journal of

Statistical and Econometric Methods, 2, 39-50.

Sharpe, W. F. 1964. Capital asset prices: A theory of

market equilibrium under conditions of risk. The

Journal of Finance, 19, 425-442.

Sklar, A. 1959. Fonctions de répartition à n dimensions et

leurs marges. Publications de l'Institut de Statistique

de l'Université de Paris, 229–231.

Smith, J. E. 2004. Risk sharing, fiduciary duty, and

corporate risk attitudes. Decision Analysis, 1, 114-127.

Von Neumann, J. & Morgenstern, O. 1944. Theory of

Games and Economic Behavior. Princeton University

Press, Princeton, NJ.

Walls, M. R. 2005. Measuring and utilizing corporate risk

tolerance to improve investment decision making. The

Engineering Economist, 50, 361-376.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

138