Evaluating Artificial Neural Networks and Traditional Approaches for

Risk Analysis in Software Project Management

A Case Study with PERIL Dataset

Carlos H. M. S. Timoteo, Meuser J. S. Valenca and Sergio M. M. Fernandes

Computer Engineering Department, University of Pernambuco, Rua Benfica, Recife, Brazil

Keywords:

Software Project, Risk Management, Risk Analysis, Support Vector Machine, MultiLayer Perceptron, Monte

Carlo Simulation, Linear Regression Model.

Abstract:

Many software project management end in failure. Risk analysis is an essential process to support project

success. There is a growing need for systematic methods to supplement expert judgment in order to increase

the accuracy in the prediction of risk likelihood and impact. In this paper, we evaluated support vector machine

(SVM), multilayer perceptron (MLP), a linear regression model and monte carlo simulation to perform risk

analysis based on PERIL data. We have conducted a statistical experiment to determine which is a more

accurate method in risk impact estimation. Our experimental results showed that artificial neural network

methods proposed in this study outperformed both linear regression and monte carlo simulation.

1 INTRODUCTION

How risky are software projects? Several studies

about effectiveness of software cost, scope, schedule

estimation techniques; surveys from software profes-

sionals in industry; and analysis of project portfolios

have been done to answer this question (Budzier and

Flyvbjerg, 2013). However, there is not a consensus.

Some authors (Schmidt et al., 2001) have noticed

that many software development projects end in fail-

ure. They showed that around twenty five percent

of all software projects are canceled outright and as

many as eighty percent of all software projects run

over their budget, exceeding it by fifty percent in av-

erage. Industry surveys suggest that only a quarter

of software projects succeed outright, and billions of

dollars are lost annually through project failures or

projects that do not deliver promised benefits (Ban-

nerman, 2008). Moreover, that study showed evi-

dences that it’s a global issue, impacting private and

public sector organizations.

Risk can be defined as the possibility of loss or in-

jury (Boehm, 1991). This definition can be expressed

by risk exposure formula. This study takes into a def-

inition whereupon project risk is a certain event or

condition that, if it occurs, has a positive or nega-

tive effect on one or more project objectives (Institute,

2008). A complement that definition risk is a mea-

sure of the probability and severity of adverse effects

(Haimes, 2011).

A limitation can be found in Boehm’s risk defini-

tion - it is very difficult, in practice, to estimate the

probability of many risk factors, especially in soft-

ware projects (Bannerman, 2008). Probability and

impact can only be meaningfully determined for ac-

tivities that are repeated many times, under controlled

circumstances, so the one-off nature of many software

project activities mitigates accurate estimates.

So, there is an increasing need for more systematic

methods and tools to supplement individual knowl-

edge, judgment, and experience. Human traits are

often sufficient to address less complex and isolated

risks. For example, a portion of the most serious is-

sues encountered in system acquisition are due to ig-

nored risks under low likelihood, until they create se-

rious consequences (Higuera and Haimes, 1996).

Monte Carlo Simulation (MCS) is cited as a good

method for project risk analysis (Institute, 2008).

However, there are some limitations that becomes

it unfeasible (Support, 2005). Simulations can lead

to misleading result if inappropriate inputs, derived

from subjective parametrization, are entered into the

model. Commonly, the user should be prepared to

make the necessary adjustments if the results that are

generated seem out of line. Moreover, Monte Carlo

can not model risks correlations. It means that num-

bers coming out in each draw are random, in conse-

quence, an outcome can vary from its lowest value,

472

Timoteo C., Valença M. and Fernandes S..

Evaluating Artificial Neural Networks and Traditional Approaches for Risk Analysis in Software Project Management - A Case Study with PERIL Dataset.

DOI: 10.5220/0004885704720479

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 472-479

ISBN: 978-989-758-027-7

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

in one period, to the highest in the next. Therefore,

alternative approaches must be investigated to predict

risks.

The main purpose of this paper is to analyze which

is a more efficient approach to software project risk

analysis: MCS technique or Artificial Neural Net-

works (ANN’s) alternatives, through Multilayer Per-

ceptron (MLP) and Support Vector Machine (SVM),

to improve accuracy and decrease error prone. A Lin-

ear Regression Model (LRM) is also considered as

baseline during the method.

The methodology adopted in this study is a sta-

tistical experiment to evaluate the prediction error of

risk impact from PERIL dataset (Kendrick, 2003), a

framework to identify risks in software project man-

agement. The four selected techniques must estimate

the outcome to risk impacts. Mean Absolute Error

(MAE) will be calculated thirty times for each ap-

proach, and then a hypothesis test may be necessary

to achieve the study goal.

Section 2 presents basic concepts to perform the

experiment. Section 3 presents the methodology for

this study, including dataset characterization. Section

4 presents the result analysis and establishes the best

analyzed technique. In the end, Section 5 concludes

this work and presents limitations and future works.

2 STATE OF ART

After a short bibliographic revision, we have identi-

fied numerous alternative approaches to risk analy-

sis, which includes Bayesian Belief Networks, Arti-

ficial Neural Networks (ANN), Decision Tree (DT),

Fuzzy Set Theory (FST), Neuro-Fuzzy System (NFS)

(Huang et al., 2004) (Hu et al., 2007) (Attarzadeh and

Ow, 2010) (Dzega and Pietruszkiewicz, 2010) (Yu,

2011) (Saxena and Singh, 2012) (Dan, 2013).

Genetic algorithm was utilized to improve ANN

estimator (Hu et al., 2007). Experimental results

showed that it achieved higher accuracy when com-

pared to a SVM model. Moreover, a proposed

ANN model that incorporates with Constructive Cost

Model (COCOMO) was improved through particle

swarm optimization, to estimate the software devel-

opment effort accurately. Another authors improved

cost estimation for COCOMO’81, towards a gen-

eral framework for software estimation based on NFS

(Huang et al., 2004).

A model based on fuzzy theory have overcome the

difficulty of qualitative and quantitative assessment of

traditional methods (Yu, 2011). Neuro-fuzzy tech-

niques also was explored to design a suitable model

to improve software effort estimation for NASA soft-

ware projects, on purpose a NFS had the lowest pre-

diction error compared to existing models (Saxena

and Singh, 2012).

Results from risk analysis experiments performed

through data mining classifiers - C4.5, RandomTree,

classification and regression tree algorithms - have

been presented (Dzega and Pietruszkiewicz, 2010).

The authors described how boosting and bagging

metaclassifiers were applied to improve the outcomes,

but also have analyzed influence of their parameters

on generalization and in prediction accuracy. Al-

though, the authors rejected MLP and SVM prema-

turely.

2.1 Project Risk Management

According to PMI (Institute, 2008), project risk man-

agement includes planning, identification, analysis,

response planning, monitoring and controlling risks.

Its purpose is to increase likelihood and impact of

positive events and reduce probability and severity

of negative events. From management point of view,

making informed decisions by consciously assessing

what can go wrong, as well as its likelihood and sever-

ity of the impact, is at the heart of risk management.

Project risk management processes are:

• Planning risk management: The process of defin-

ing how conduct risk management activities;

• Identifying risks: The process of determining

risks that can affect project and documenting its

characteristics;

• Performing qualitative risk analysis: The process

of prioritizing risks to analyze through assessment

and combination of its occurrence probability and

impact;

• Performing quantitative risk analysis: The pro-

cess of analyzing numerically the effect of pre-

vious identified risks, in terms of general project

objectives;

• Planning risk responses: The process of develop-

ing options and actions to increase opportunities

and decrease threats to project objetives;

• Monitoring and controlling risks: The process of

implementing risk responses planning, tracking

identified risks, monitoring residual risks, identi-

fying new risks and assessing the efficacy of risk

treatment process during the whole project.

2.1.1 Risk Analysis

Analysis is the conversion of risk data into risk

decision-making information. Analysis provides the

basis for the project manager to work on the most

EvaluatingArtificialNeuralNetworksandTraditionalApproachesforRiskAnalysisinSoftwareProjectManagement-A

CaseStudywithPERILDataset

473

critical risks. Boehm (1991) defines risk analysis ob-

jective as the assessment of the loss probability and

magnitude for each identified risk item, and it as-

sesses compound risks in risk-item interactions. Typ-

ical techniques include performance and cost mod-

els, network analysis, statistical decision analysis and

quality-factor (like reliability, availability, security)

analysis.

Risk analysis depends on a good mechanism to

identify risks. However, most of the methods as-

sume that managers have the required experience to

be aware of all pertinent risk factors, but it can not be

the situation. Moreover, many of these methods can

be time-consuming and thus too costly to use on a reg-

ular basis. Therefore, one popular method for identi-

fying risk factors has been the use of checklists. Un-

fortunately, these checklists are based in small sam-

ples or, even worse, flawed in their risk historical data

collection methods.

PMI (Institute, 2008) cites sensibility analysis,

earned monetary value (EMV), modeling and simu-

lation, specialized opinion as most used techniques.

2.1.2 Monte Carlo Simulation

Monte Carlo simulation is a technique that computes

or iterates the project cost or schedule many times

using input values selected at random from probabil-

ity distributions of possible costs or durations, to cal-

culate a distribution of possible total project cost or

completion dates (Institute, 2008).

A model is developed, and it contains certain in-

put variables. These variables have different possible

values, represented by a probability distribution func-

tion of the values for each variable. The Monte Carlo

method is a detailed simulation approach through in-

tensive computing to determine the likelihood of pos-

sible outcomes of a project goal; for example, the

completion date. The inputs of the procedure are ob-

tained randomly from specific intervals with probabil-

ity distribution functions for the durations of schedule

activities or items from cost baseline. Those differ-

ent input values are used to construct a histogram of

possible results to the project and its relative prob-

ability, but also the cumulative probability to calcu-

late desired contingency reserves for time or cost.

Additional results include the relative importance of

each input in determining the overall project cost and

schedule (Kwak and Ingall, 2007).

2.2 Artificial Neural Networks

An ANN is a massively parallel distributed proces-

sor made up of simple processing units, which has

a natural propensity (Haykin, 1994). It adopts non-

parametric regression estimates made up of a number

of interconnected processing elements between input

and output data.

2.2.1 MultiLayer Perceptron

MLP model is constituted of some neurons organized

in at least three layers. The first of them is the input

layer, in which input variables are directly connected

to a exclusive neuron. The next is the hidden layer

that completely connects the neurons from previous

layer to the neurons in output layer. Lastly, output

layer represents ANN outcome. Each input in a neu-

ron has an associated weight to be adjusted by training

algorithm. Common MLP models contain one bias

neuron. MLP is a direct graph, in which inputs data

are propagated from input layer to hidden layers and

from hidden layers to output layer. The data flow in

forward way is known as ”forward phase”. The data

flow in the opposite way is the ”backward phase”.

One major concern of ANN is the stability-

plasticity dilemma. Although continuous learning is

desired in ANN, further learning will cause the ANN

to lose memory when the weights have reached a

steady state (Haykin, 1994). The Backpropagation al-

gorithm is used as training method because it allow

us to adjust weights of multilayer networks, towards

Generalized Delta Rule (Rumelhart et al., 1985).

2.2.2 Support Vector Machine

Support Vector Machine (SVM) is an elegant tool for

solving pattern recognition and regression problems.

It has attracted a lot of attention from researchers due

to its ability to provide excellent generalization per-

formance. The goal of SVM regression is to estimate

a function that is as ”close” as possible to the target

outcomes for every input data in training set and at

the same time, is as ”flat” as possible for good gen-

eralization. More details about SVM can be found in

(Shevade et al., 1999).

3 METHODOLOGY

In this paper, we analyzed which is a more efficient

approach to risk analysis of software projects: MCS,

MLP, SVM or a LRM. A LRM was considered as

baseline approach. The analysis was made in terms

of prediction accuracy. Accuracy means the degree of

closeness of a predicted outcome to the true value. A

metric of accuracy is the Mean Absolute Error (MAE)

given by

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

474

MAE =

1

n

n

∑

i=1

|e

i

|, (1)

where e

i

= f

i

− y

i

, f

i

is the calculated outcome, y

i

is the expected outcome and n is the number of data

pairs.

The four selected techniques have predicted the

outcome to risk impacts. Mean Absolute Error was

calculated thirty times for each method. Neverthe-

less, a Non-paired Wilcoxon Test (Siegel, 1956) may

be necessary to assert which is a more efficient ap-

proach to fit PERIL. Non-paired Wilcoxon Test is

used because there were no evidence that the samples

came from a normally distributed population, either

there were no relation between outcomes from differ-

ent samples.

One important requirement considered in this

study is that the same prediction method must be

adopted for each approach. Furthermore, cross-

validation (Amari et al., 1996a) must be used to avoid

the occurrence of overfitting of data training. For in-

stance, early stopping training was used to identify

the beginning of overfitting because this method has

been proved to be capable of improving the gener-

alization performance of the ANN over exhaustive

training (Haykin, 1994) (Amari et al., 1996b). There-

fore, cross-validation method are used for each alter-

native, excluding Monte Carlo Simulation, to promote

higher generalization performance.

3.1 PERIL Data Set

A better risk management starts identifying potential

problems, asserted here as risk factors. The adoption

of available methods like: reviewing lessons learned,

brainstorming, interviews and specialized judgment

are relative efficient alternatives, otherwise in most of

situations it involves high costs. A low cost, exten-

sive and accessible proposal is to use PERIL dataset

(Kendrick, 2003).

For more than a decade, in Risk Management

Workshops, Kendrick (Kendrick, 2003) have col-

lected six hundred and forty nine anonymous risk reg-

isters from hundreds of project leaders dealing with

their past project problems. He has compiled this data

in the PERIL database, which summarizes both a de-

scription of what went wrong and the amount of im-

pact it had on each project. The dataset provides a

sobering perspective on what future projects may face

and is valuable in helping to identify at least some of

what might otherwise be invisible risks.

In projects, the identified risks can be classified as

”known”, those anticipated during planning, or ”un-

known”, further identified during project execution.

The purpose of this dataset is to provide a framework

to identify risks, in such a way to increase the number

of ”known”, and decrease the amount of ”unknown”

risks.

Some characteristics of PERIL are:

• the data are not relational, they contain only most

significant risks from tens of thousands projects

undertaken by the project leaders from whom they

were collected;

• they present bias, the information was not col-

lected randomly; they are worldwide, with a ma-

jority from the Americas and they do not identify

opportunities;

• the relative impact is based on the number of

weeks delayed the project schedule;

• typical project had a planned duration between

six months and one year and typical staffing was

rarely larger than about twenty people.

Risk registers are categorized as scope, schedule

and resource. Scope is decomposed in change and

defect subcategories. Schedule is decomposed in de-

pendency, estimative and delay. Resources is de-

composed in money, outsourcing and people subcate-

gories. One benefit of PERIL is that the author con-

templates black swans - risks with large impact, diffi-

cult to predict and with rare occurrence (Taleb, 2001).

3.2 Data Preprocessing

First of all, PERIL contains nominal and numeric val-

ues. Nominal variables were expressed through bi-

nary variables. In that point, we have utilized twelve

binaries variables to represent eight selected nominal

variables. Secondly, impact which represents the real

output, are integer numbers. We have noticed that

impact probability distribution function fits with log-

normal and gamma distribution functions. Therefore,

we have performed a gamma data normalization (Han

et al., 2006). Data preprocessing was suggested by

(Valenca, 2005).

Figure 1 and Figure 2 introduce input variables in

histograms. All data are binary values represented by

bar graphs, that means the number of occurrences for

each value interval. Figure 3 presents gamma nor-

malized real outcome from PERIL in a histogram. A

shape of the distribution fitting function is also pre-

sented in a curve under the histogram. Commonly,

the curve under the histogram should seems with nor-

mal function graph. Unlikely, we have realized that

predicting risk impact from PERIL is not a easy task.

EvaluatingArtificialNeuralNetworksandTraditionalApproachesforRiskAnalysisinSoftwareProjectManagement-A

CaseStudywithPERILDataset

475

INPUT 1

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300

INPUT 2

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300 400

INPUT 3

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300 400

INPUT 4

VALUES

OCCURRENCES

0.0 0.4 0.8

0 50 150 250

INPUT 5

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300

INPUT 6

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300 400

Figure 1: First six input variables.

INPUT 7

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300 400 500

INPUT 8

VALUES

OCCURRENCES

0.0 0.4 0.8

0 50 150 250 350

INPUT 9

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300

INPUT 10

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300

INPUT 11

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 300 500

INPUT 12

VALUES

OCCURRENCES

0.0 0.4 0.8

0 100 200 300 400 500

Figure 2: Last six input variables.

3.3 Tools

In sum, we have used several tools during this study.

First, MCS was performed in Microsoft Office Ex-

cel, we have utilized Data Analysis complement to

obtain random values from customized sample. Sec-

ond, R software was utilized to conduct a experi-

ment with Multiple Linear Regression (MLR) and Re-

gression Tree Model (RTM). R is also a program-

ming language for statistical computing, data manip-

ulation, calculation and graphical display (Venables

et al., 2002). Third, MLP model was developed in

Java. The source code implements data preprocess-

ing, training, cross-validation, testing and MAE eval-

uation. It was based on (Valenca, 2005) book. Finally,

Histogram of Impact

Normalized Impact

OCCURRENCES

0.5 0.6 0.7 0.8 0.9

0 20 40 60 80 100 120 140

Figure 3: Histogram of impact and shape of the distribution

fitting function

we have utilized WEKA API (Hall et al., 2009) to

program SVM. The built-in implementation of SVM

is SMOreg (Smola and Schoelkopf, 1998). The au-

thors proposed an iterative algorithm, called sequen-

tial minimal optimization (SMO), to solve the regres-

sion problem using SVM. SMOreg, a SMO program,

come across our needs because the regression model

could be generated after testing and cross-validation

as stopping criteria.

3.4 Experiment

For our purpose, PERIL was split into three dis-

joint subsets - training, cross-validation and test sub-

sets, corresponding to fifty, twenty-five and twenty

five percent of the dataset, respectively. Split-sample

cross-validation method was used for MLRM and

RTM models. Whereas early stopping and split-

sample cross-validation methods were combined and

used for MLP and SVM training (Priddy and Keller,

2005).

MCS technique used the entire dataset. In order

to increase the performance prediction, we have fil-

tered only the possible real outcomes to generate the

calculated outcome. Towards this decision, we have

reduced prediction issues and have improved its per-

formance.

The source code of MLR model was adapted from

Torgo (Torgo, 2003) in order to perform linear regres-

sion model training, cross-validation, outcome pre-

diction and MAE evaluation. MLR and RTM models

were analyzed statistically to define the baseline lin-

ear regression model for further analysis. The results

are presented in Section 4.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

476

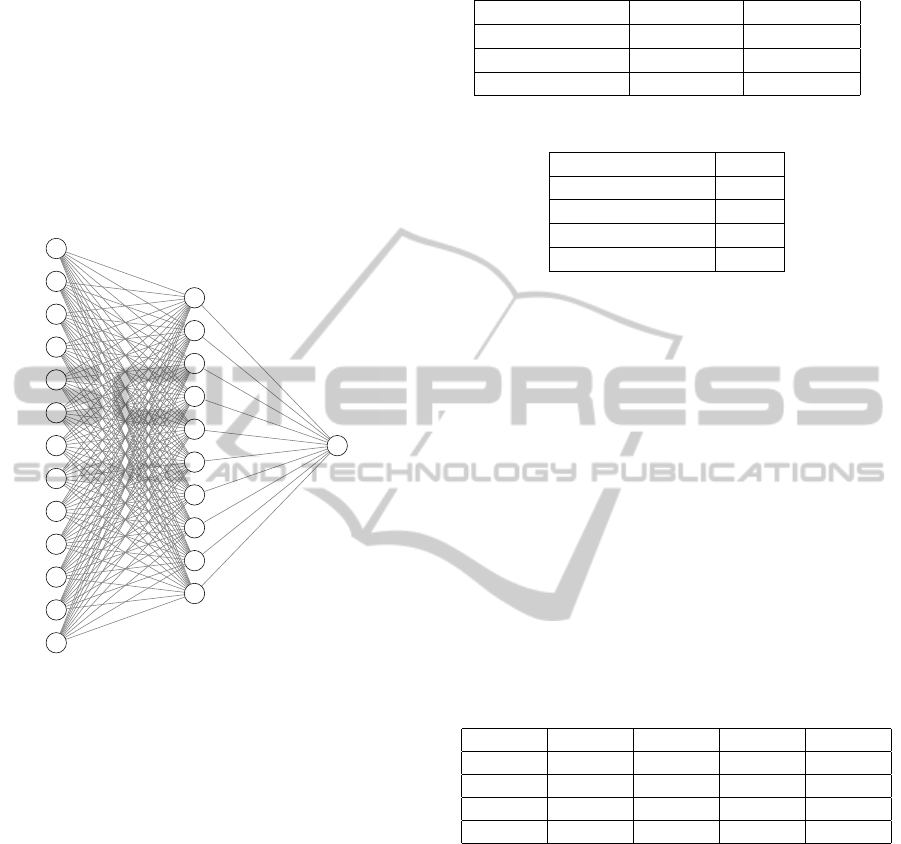

A three layered back-propagation MLP model was

established to model risk impact predictor. That

model consists of one input layer, one hidden layer,

and one output layer. The input layer had thir-

teen neurons, which represent the twelve indepen-

dent variables plus the bias. The output layer has

one neuron, which represents the single impact out-

come. The transfer function in hidden and output

layer was sigmoid-logistic. The architecture of the

MLP is demonstrated in Figure 4.

INPUT LAYER

HIDDEN LAYER

OUTPUT LAYER

Figure 4: MLP model utilized in the study.

The number of neurons in the hidden layer and

other paramenters were determined by trial and er-

ror, a fast approach aiming to achieve a more accurate

performance of MLP. For the analysis, the maximum

training epochs has been set at six hundreds. Starting

with one neuron in the hidden layer, the MLP model

was trained and tested. At each time, the number of

neurons was increased by one, until reach ten, from

then the number of neurons was increased by ten, un-

til reach one hundred. Learning rate and momentum

were increased by 0.1, varying from 0.1 to 0.9.

Learning rate, momentum and neurons in hidden

layer varied from values presented in Table 1. A better

parameters configuration solution is shown in Table 2.

Figure 4 presents MLP model with the better configu-

ration for PERIL. The model contains ten neurons in

hidden layer.

In SVM source code, RegSMOImproved class

contains optimization algorithm method and PolyK-

ernel was the kernel function described in (Shevade

et al., 1999). Other parameters were set in default.

Table 1: Parameters intervals to MLP model.

Parameter Min. Value Max. Value

Momentum 0.5 0.9

Learning rate 0.1 0.5

Hidden Neurons 1 100

Table 2: A better parameters configuration to MLP model.

Parameter Value

Momentum 0.5

Learning rate 0.1

Hidden Neurons 10

Maximum Cycles 600

4 RESULT ANALYSIS

Initially, the previous analysis consisted of choosing

between MLRM and RTM as baseline approach. It

could be performed after discussing the information

provided in Table 3 and in Figure 5.

Table 3 shows descriptive statistics of normalized

MAE’s to both algorithms. Mean, standard devia-

tion, minimum and maximum value are calculated

for MLRM (cv.lm.v1), RT M

1

(cv.rpart.v1), RT M

2

(cv.rpart.v2) and RT M

3

(cv.rpart.v3). RT M

1

, RT M

2

and RT M

3

are regression tree models instances auto-

matically generated by R in this analysis. The first

method had lower values in all statistics.

Table 3: Descriptive statistics for normalized errors of linear

regression models.

MLRM RT M

1

RT M

2

RT M

3

Mean 0.09912 0.10238 0.10305 0.10361

Std Dev 0.00391 0.00423 0.00441 0.00426

Min. 0.08956 0.09214 0.09321 0.09372

Max. 0.10746 0.11231 0.11267 0.11359

In Figure 5, normalized MAE’s boxplots after pre-

dictions for RT M

3

, RT M

2

, RT M

1

and MLRM are

presented. The last boxplot, placed more in the left

was obtained to MLRM.

We could realize that MLRM is a more efficient

and precise model and will be introduced in the exper-

iment as baseline method. It is justifiable because that

model showed lesser MAE’s, minor average/ standard

deviation/ minimum/ maximum values and a more

parsimonious model compared with RTM.

After that, we could perform the main analysis in

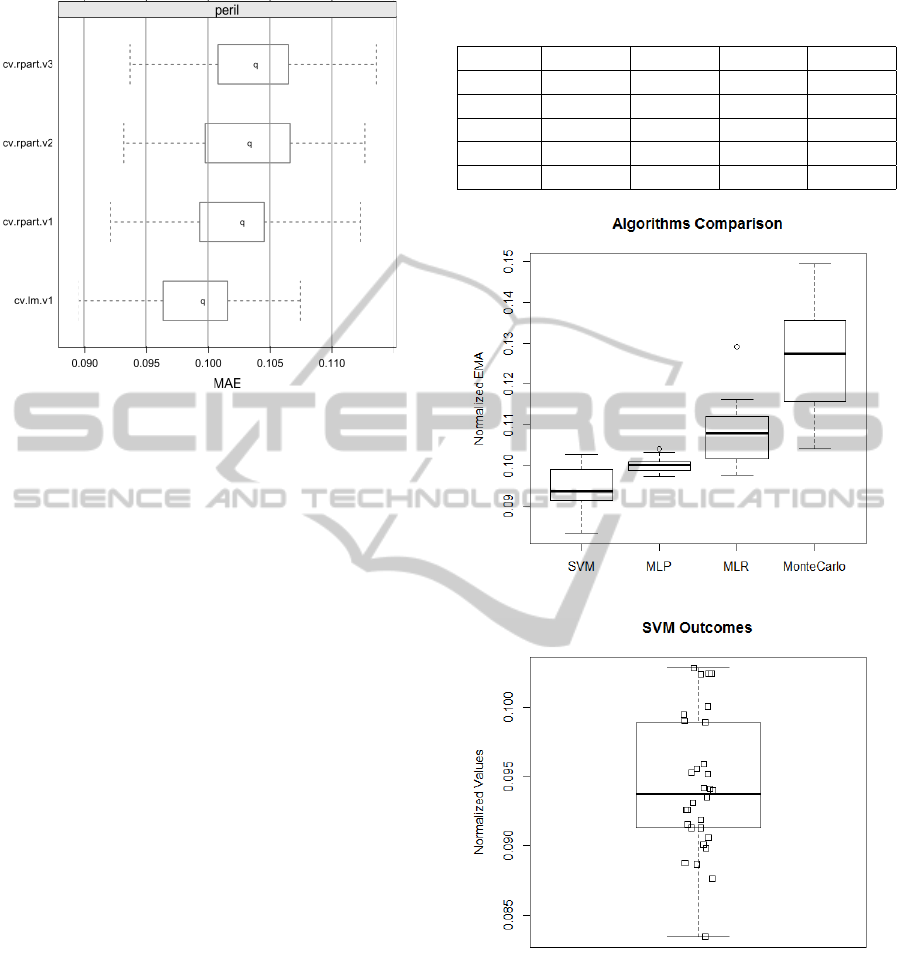

this paper. Table 4 shows descriptive statistics of nor-

malized MAE’s for ANN’s (SVM and MLP), MLR

and MCS. It was perceived that SVM had lower val-

ues for minimum (Min.), median, mean and maxi-

mum (Max.) errors. Nevertheless, MLP had minor

EvaluatingArtificialNeuralNetworksandTraditionalApproachesforRiskAnalysisinSoftwareProjectManagement-A

CaseStudywithPERILDataset

477

Figure 5: Boxplots for normalized errors of linear regres-

sion models.

standard deviation (Std.) value.

In Figure 6, it is observed that the traditional tech-

nique, MCS (monte carlo simulation), had a large

standard deviation. It is due to randomness in MCS

method, one of its limitation. Besides that, MCS had

higher statistics. On the other hand, comparing MCS

with MLR it is noticed that MLR had better statistics.

Thus, for this study, we could not identify a reason

to justify MCS usage for risk analysis, proposed by

(Institute, 2008). That was one of our premises.

Besides that, MLP seemed to be a promising al-

ternative because it is like a optimized MLR, because

MLP is a universal approximator of nonlinear func-

tions and its efficiency was proven in the most differ-

ent application areas. In this study, MLP was a more

precise method to risk impact estimation.

Commonly, SVM has a higher generalization ca-

pability, which means 1.5% better results compared

with MLP, approximately (Haykin, 1994). That is be-

cause SVM can distinguish small subsets in training

data. However, it requires a long training time due to

its complexity.

Therefore, accordingly with this study, SVM

seems to be a more accurate method to risk impact es-

timation using PERIL. We can conclude that because

it explored a lesser MAE and had a good generaliza-

tion capability, since its inter-quartil interval was the

second shorter, according to Figure 6. But above all,

SVM could explore MAE optimization problem. We

can realize it observing Figure 7, in which the most of

values are near and above median value.

Table 4: Descriptive statistics for SVM, MLP, MLR and

MCS.

SVM MLP MLR MCS

Min. 0.08347 0.09736 0.09764 0.10410

Median 0.09374 0.10014 0.10798 0.12740

Mean 0.09430 0.10005 0.10798 0.12640

Std. 0.00488 0.00154 0.00794 0.01250

Max. 0.10284 0.10413 0.12927 0.14950

Figure 6: Boxplots of analyzed methods.

Figure 7: SVM boxplot with individual values.

5 CONCLUSION

This paper has investigated the use of artificial neu-

ral networks algorithms, like SVM and MLP, for es-

timation of risk impact in software project risk analy-

sis. We have carried out a statistical analysis using

PERIL. The results were compared to MLRM and

Monte Carlo Simulation, a traditional approach pro-

posed by (Institute, 2008). We have considered im-

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

478

proving risk impact estimation accuracy during soft-

ware project management, in terms of MAE mean

and standard deviation. We have observed that MLP

had minor standard deviation estimation error, and

showed to be a promissory technique. Moreover,

SVM had minor estimation error outcomes using

PERIL, which a more accurate method. Therefore,

the selected ANN algorithms outperformed both lin-

ear regression and MCS. Future works should analyze

another ANN models and MLP training methods.

REFERENCES

Amari, S., Murata, N., M

¨

uller, K.-R., Finke, M., and Yang,

H. (1996a). Statistical theory of overtraining-is cross-

validation asymptotically effective? Advances in neu-

ral information processing systems, pages 176–182.

Amari, S.-i., Cichocki, A., Yang, H. H., et al. (1996b).

A new learning algorithm for blind signal separation.

Advances in neural information processing systems,

pages 757–763.

Attarzadeh, I. and Ow, S. H. (2010). A novel soft com-

puting model to increase the accuracy of software

development cost estimation. In Computer and Au-

tomation Engineering (ICCAE), 2010 The 2nd Inter-

national Conference on, volume 3, pages 603–607.

IEEE.

Bannerman, P. L. (2008). Risk and risk management in soft-

ware projects: A reassessment. Journal of Systems

and Software, 81(12):2118–2133.

Boehm, B. W. (1991). Software risk management: principle

and practices. IEEE Software, 8:32–41.

Budzier, A. and Flyvbjerg, B. (2013). Double

whammy-how ict projects are fooled by random-

ness and screwed by political intent. arXiv preprint

arXiv:1304.4590.

Dan, Z. (2013). Improving the accuracy in software ef-

fort estimation: Using artificial neural network model

based on particle swarm optimization. In Service Op-

erations and Logistics, and Informatics (SOLI), 2013

IEEE International Conference on, pages 180–185.

IEEE.

Dzega, D. and Pietruszkiewicz, W. (2010). Classification

and metaclassification in large scale data mining ap-

plication for estimation of software projects. In Cy-

bernetic Intelligent Systems (CIS), 2010 IEEE 9th In-

ternational Conference on, pages 1–6. IEEE.

Haimes, Y. Y. (2011). Risk modeling, assessment, and man-

agement. John Wiley & Sons.

Hall, M., Frank, E., Holmes, G., Pfahringer, B., Reutemann,

P., and Witten, I. H. (2009). The weka data min-

ing software: an update. ACM SIGKDD Explorations

Newsletter, 11(1):10–18.

Han, J., Kamber, M., and Pei, J. (2006). Data mining: con-

cepts and techniques. Morgan kaufmann.

Haykin, S. (1994). Neural networks: a comprehensive foun-

dation. Prentice Hall PTR.

Higuera, R. P. and Haimes, Y. Y. (1996). Software risk man-

agement. Technical report, DTIC Document.

Hu, Y., Huang, J., Chen, J., Liu, M., and Xie, K. (2007).

Software project risk management modeling with neu-

ral network and support vector machine approaches.

In Natural Computation, 2007. ICNC 2007. Third In-

ternational Conference on, volume 3, pages 358–362.

IEEE.

Huang, X., Ho, D., Ren, J., and Capretz, L. F. (2004). A

neuro-fuzzy tool for software estimation. In Software

Maintenance, 2004. Proceedings. 20th IEEE Interna-

tional Conference on, page 520. IEEE.

Institute, P. M. (2008). A Guide to the Project Management

Body of Knowledge.

Kendrick, T. (2003). Identifying and managing project risk:

essential tools for failure-proofing your project. Ama-

com: New York.

Kwak, Y. H. and Ingall, L. (2007). Exploring monte carlo

simulation applications for project management. Risk

Management, 9(1):44–57.

Priddy, K. L. and Keller, P. E. (2005). Artificial Neural

Networks: An introduction, volume 68. SPIE Press.

Rumelhart, D. E., Hinton, G. E., and Williams, R. J. (1985).

Learning internal representations by error propaga-

tion. Technical report, DTIC Document.

Saxena, U. R. and Singh, S. (2012). Software effort esti-

mation using neuro-fuzzy approach. In Software En-

gineering (CONSEG), 2012 CSI Sixth International

Conference on, pages 1–6. IEEE.

Schmidt, R., Lyytinen, K., Keil, M., and Cule, P. (2001).

Identifying software project risks: an international

delphi study. Journal of management information sys-

tems, 17(4):5–36.

Shevade, S., Keerthi, S., Bhattacharyya, C., and Murthy, K.

(1999). Improvements to the smo algorithm for svm

regression. In IEEE Transactions on Neural Networks.

Siegel, S. (1956). Nonparametric statistics for the behav-

ioral sciences.

Smola, A. and Schoelkopf, B. (1998). A tutorial on support

vector regression. Technical report. NeuroCOLT2

Technical Report NC2-TR-1998-030.

Support, I. P. (2005). Monte Carlo Simulation. Ibbot-

sonAssociates, 225 North Michigan Avenue Suite 700

Chicago, IL 60601-7676.

Taleb, N. (2001). Fooled by randomness. Nwe York: Ran-

dom House.

Torgo, L. (2003). Data mining with r. Learning by

case studies. University of Porto, LIACC-FEP. URL:

http://www. liacc. up. pt/ltorgo/DataMiningWithR/.

Accessed on, 7(09).

Valenca, M. J. S. (2005). Aplicando redes neurais: um guia

completo. Livro Rapido, Olinda–PE.

Venables, W. N., Smith, D. M., and Team, R. D. C. (2002).

An introduction to r.

Yu, P. (2011). Software project risk assessment model based

on fuzzy theory. Computer Knowledge and Technol-

ogy, 16:049.

EvaluatingArtificialNeuralNetworksandTraditionalApproachesforRiskAnalysisinSoftwareProjectManagement-A

CaseStudywithPERILDataset

479