Customer Churn Prediction in Mobile Operator Using

Combined Model

Jelena Mamčenko and Jamil Gasimov

Information Technologies Department, Vilnius Gediminas Technical University, Saulėtekio al. 11, Vilnius, Lithuania

Keywords: Data Mining, Churn Detection, Neural Network, Cox Regression, Decision Tree, Combined Model.

Abstract: Data Mining technologies are developing very rapidly nowadays. One of the biggest fields of application of

data mining is prediction of churn in service provider companies. Customers who switch to another service

provider are called churned customers. In this study are described main techniques and processes of Data

Mining. Customer churn is defined, different types and causes of churn are discussed. Social aspects of

churn are brought to attention and specifically related to realities of Azerbaijan.

1 INTRODUCTION

Mobile market is very competitive and changing all

the time. Due to those changes companies have to

spend more resources to prevent customers from

switching service provider because it is getting much

more expensive to attract new customer rather than

to retain existing one.

Relevance of this work is defined by high

competition on mobile operator market after third

company entered with lower prices. It is also

planned to implement MNP (Mobile Number

Portability) service this year what will enable

subscribers to switch service provider and keep their

old number. Churn is a worldwide problem because

it is very difficult to win customers’ loyalty in

modern virtualized world. There are almost none

personal bonds between mass service providers and

their subscribers.

This work, like all other researches, also has its

limitations. One of the major limitations of this

research was data classification and data

confidentially in mobile operator that prevented

from having access to a part of customer‘s data such

as billing and credit data as well as call details

records. This helped to build social graph of people

interaction and apply social analysis techniques for

determining strong ties and how people’s decision to

churn is affected by their social group. For

companies, the cost of acquiring new customers is

increasing day by day. Therefore, a new era has

begun in marketing industry. Instead of organizing

campaigns to win new customers, companies are

searching different variety of programs to emphasis

on customer satisfaction, to increase customer-based

earnings and to have higher customer loyalty. The

only method to achieve those goals is preventing

customer churn before it happens. At this point,

customer churn modeling has created an important

competitive advantage and a new workspace. A

good modeling reveals which customer is close to

churn and which is loyal. With the development in

database systems and the variability of customer

behavior, an extraordinary increase in the size of the

data has occurred. This causes to extract previously

unknown information and relationships in huge

amount of data. This information requires applying

different techniques according to the structure of the

data sets to be analyzed. The results of the analysis

are used to plan a comprehensive promotional

campaigns and new strategies (Huang, 2012).

1.2 Churn and Its Prediction

Customer churn is term to denote the customers

which are willing to leave for competing companies.

It is estimated that to attract new customer is five

times more expensive than to keep existing one.

Customer churn is accepted as inevitable part of the

market (Geppert, 2003).

There are several concepts and methods to detect

customers who are about to switch to another

operator. A good churn prediction system should not

only detect at potential churners, but also provide a

sufficiently long term forecast. When potential

233

Mam

ˇ

cenko J. and Gasimov J..

Customer Churn Prediction in Mobile Operator Using Combined Model.

DOI: 10.5220/0004896002330240

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 233-240

ISBN: 978-989-758-027-7

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

churners are identified, the marketing department

usually contacts them and, if the customers are

established as high churn risk, takes appropriate

actions to prevent loss of customers.

Modern churn-analysis tools are divided into two

categories: tools based on patterns of usage and ones

based on billing data. Usage-based tools watch for

customer usage patterns and try to predict when a

customer will leave. Diagnostic models based on

usage can be as simple as tracking price-plan

changes or as complicated as watching certain

customers' day-to-day usage. A usage-based model,

for example, might record that a customer on a $75

monthly service plan switched to a $49 plan. The

next month, he switched to a $29 plan. That pattern

signifies the customer is significantly altering his

usage and likely will churn soon (Geppert, 2003).

The next generation of churn-analysis tools is

more complex and uses more variables. It takes into

account thousands of factors, such as where a

customer called, when he called and his cell-site

movement patterns, to predict when he is likely to

churn. These churn-analysis models have not been

fully implemented by any mobile operator yet. Parts

of this model were implemented by some

companies, but the models they use are proprietary.

Churn analysis of next generation requires a heavy

commitment and careful planning, which many

operators do not want to do.

2 CUSTOMER CHURN

2.1 Churn Definition

If a customer stops the contract with one company

and becomes a customer of a competitor, this

customer is considered lost customer or churn

customer. Customer loss is very closely related with

customer loyalty. Today’s economic trend dictates

that price cuts are not the only way to build

customer loyalty. Accordingly, adding new value

added services to the products has become an

industry norm to have loyal customer. The main goal

of customer lost study is to figure out a customer

who will likely be lost and is to calculate cost of

obtaining those customers back again. During the

analysis, the most important point is the definition of

the churner customer. In some cases, to make a

definition is very difficult. A credit card customer,

for instance, can easily start using another bank’s

credit card without cancelling credit card of current

bank. In this specific case, a decrease in spending

can be taken into consideration to understand the

customer’s loss. Customer’s loss is a major problem

for companies which are likely to lose their

customers easily. Banks, insurance and

telecommunication companies can be given as

examples (Lazarov, 2007).

2.2 Types of Churn

Active/Deliberate – customer decides to quit his

contract and to switch to another provider.

Reasons for this may include: dissatisfaction

with the quality of service, too high prices, no

rewards for customer loyalty, bad support, no

information about reasons and predicted

resolution time for service problems, privacy

concerns.

Rotational/Incidental – the customer quits

contract without the aim of switching to a

competitor. It usually happens because of

changes in the circumstances that make it

impossible to use the service, e.g. financial

problems, when customer can’t pay; or change of

the geographical location which is not covered

by company.

Passive/Non-voluntary – the company

discontinues the contract itself. Reason can be

fraud, debt or long period of inactivity (Tuğba,

2010).

There are two categories of rotational churn:

when subscriber stops paying after contract ends or

while it is still active. Jonathan Burez calls them

commercial and financial churn respectively (Burez,

2008).

Voluntary churn (active, rotational) is hard to

predict. And while incidental churn only explains a

small fraction of overall churn it is very useful to

predict and react taking appropriate action to prevent

deliberate churn. To prevent voluntary churn

operator has to identify churner with high

probability and to find reasons why he wanted to

switch mobile operator.

Furthermore, churning can be divided also into

three other groups:

Total – the agreement is officially cancelled;

Hidden – the contract is not cancelled, but the

customer is not actively using the service since a

long period of time;

Partial – the agreement is not cancelled, but the

customer is not using the services to a full extent

and is using only parts of it, and is instead using

constantly a service of a competitor.

Depending on the company, the contract type

and the business model that is being applied hidden

or partial churning can lead to considerable money

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

234

loss and also needs to be identified and action should

be taken in order not to lose completely the customer

(Khalatyan, 2010).

2.3 Problems and Threats

Preventing customer churn is critical for the survival

of mobile service providers because it is estimated

that the cost of acquiring a new customer is about

$300 or more if the advertising, marketing, and

technical support are all taken into consideration. On

the other hand, the cost of retaining a current

customer is usually as low as the cost of a single

customer retention call or a single mail solicitation

(Berson et al., 2002). High acquisition cost makes it

imperative for mobile service providers to devise

ways to predict the churn behavior and execute

appropriate proactive actions before customers leave

the company (Berson et al., 2002).

In addition to lost revenue, customer churn

means increased activation and deactivation costs. In

the global wireless industry, these amount to $10

billion per year, according to an August 2001 study

by International Data Corporation (Geppert, 2003).

Geppert (2003) indicated that a high churn rate

also puts pressure on companies to win new

customers. The cost of acquiring each new customer

ranges from $350 to $475 and providers need to

retain these new customers for more than four years

to break even (Geppert, 2003).

Replacing old customers with new ones carries

other burdens. In addition to marketing and

advertising, companies incur costs associated with

provisioning new customers, as well as increased

risks associated with billing issues and other revenue

assurance matters. Customer churn also generates

soft costs: loss of brand value when dissatisfied

customers tell others about their experiences, lost

opportunities for cross-selling of complementary

products and services, and a potential domino effect

with respect to the carrier‘s remaining customer

base. Further, the deactivation and disconnection of

customers brings inherent risk of revenue and

margin deterioration, particularly when multiple

service providers are involved. Finally, the potential

impacts on profitability that come from inactive,

underutilized, and otherwise unprofitable network

facilities must be considered

2.4 Techniques for Churn Prediction

Marcin Owczarczuk (2010) in his article “Churn

Models for Prepaid Customers in the Cellular

Telecommunication Industry Using Large Data

Marts” described methods to predict churn for

prepaid customers where big data marts are available

for analyses. He used datasets with 1381 variables

for each of about 80000 customers.

“In this article, we evaluated usefulness of

regression and decision trees approach to the

problem of modeling churn in the prepaid sector of

the cellular telecommunication company. Linear

models are more stable than decision trees that get

old quickly and their performance weakens in time,

especially in top deciles of the score. Nevertheless,

we showed that prepaid churn can be effectively

predicted using large data mart” (Owczarczuk,

2010).

Situation described in Marcin Owczarczuk’s

work is somehow similar to the one in this work. In

this work is also used big datamart of prepaid

customers containing 637 fields. But an attempt to

reduce amount of variables is made to make

understanding of model easier and to reduce time

needed to build a model. It was also experimentally

proven that small number of variables is enough to

churn with high accuracy (Verbeke et al., 2012).

“Customer Churn Analysis in

Telecommunication Sector” by Umman Tuğba

Şimşek Gürsoy. used similar techniques like

Decision Tree and Logistic Regression Analysis but

focuses mostly on determining the reasons why

customers decide to churn. He compared and

analyzed different parameters and variables for

churning and non-churning customers and got

interesting results. He discovered that incoming calls

have big influence on customers’ decision as well as

discount offers which they get (Tuğba et al., 2010).

In their article “Turning Telecommunications

Call Details to Churn Prediction: a Data Mining

Approach” Chih-Ping Weia and I-Tang Chiub were

using call detail data to determine customer

behavior: “.. we propose, design, and experimentally

evaluate a churn-prediction technique that predicts

churning from subscriber contractual information

and call pattern changes extracted from call details.

This proposed technique is capable of identifying

potential churners at the contract level for a specific

prediction time-period. In addition, the proposed

technique incorporates the multi-classifier class-

combiner approach to address the challenge of a

highly skewed class distribution between churners

and non-churners“ (Weia et al., 2002).

V. Yeshwanth et al. and Ying Huang, Tahar

Kechadi

paper presents predictive modeling of

customer behavior based on the application of

hybrid learning approaches for churn prediction in

the mobile network: “Our proposed framework deals

CustomerChurnPredictioninMobileOperatorUsingCombinedModel

235

with a better and more accurate churner prediction

technique compared to the existing ones as it

incorporates hybrid learning method which is a

combination of tree induction system and genetic

programming to derive the rules for classification

based on the customer behavior” (Yeshwanth et al.,

2011).

Next work has similar objectives: “To obtain

more accurate predictive results, we present a novel

hybrid model-based learning system, which

integrates the supervised and unsupervised

techniques for predicting customer behavior”

(Huang et al., 2013).

These articles helped to make decision to use

neural network, cox regression and decision tree

techniques in conjunction to build model that

predicts churn customers with high probability like

neural networks and which decisions could be

explained like decision tree model.

2.5 Social Ties and Their Influence

Churn is not only statistical phenomenon; it also

should be discussed from sociological point of view.

Customers make decision to churn based not only on

their personal preferences or some objective reasons

such as price and quality of the service but also

based on their social surrounding, influence from

family members and friends.

First in the list, the oldest and most cited article

is “Social Ties and their Relevance to Churn in

Mobile Telecom Networks” by Koustuv Dasgupta et

al. (2008). In this article authors used detailed call

record data of mobile operator for one month. Data

contains detailed information about voice calls,

SMS, value-added calls of users. They built graph

for all connections between subscribers based on

calls made between them. To reduce graph’s size

and eliminate biased data they excluded one-

direction only connections and short numbers. They

possessed only this CDR files and no additional

information about customers like demographics,

when he started using service, how much spent

during last months. Such practical limitations made

the problem very challenging, but authors succeed to

demonstrate how reasonable prediction accuracy can

still be achieved using only link information.

In another work “An Efficient Method of

Building the Telecom Social Network for Churn

Prediction” by Pushpa and G Shobha, authors made

accent on finding groups of customers within social

graph. Contrary to the previous article they paid a lot

of attention on the types of relationships between

nodes. They wroite about two types of social

networks: Homogeneous and Heterogeous.

Homogeneous social networks are those where is

only one kind of relationship between the customer

for example the relationship may be friendship

between the two customers are linked heterogeneous

social networks represent several kinds of

relationship between customers, and can be called as

Multi-relational social networks. Example of

different relationship types may be: friendship,

acquaintance, professional, family. Based on the

duration of voice calls, call frequency etc. for each

of these relationship types it is possible to define

unique behavioral pattern. Authors concluded that

the accuracy of the churning model can be increased

by considering the multiple relationship between the

customers while construction of the telecom social

network to extract the hidden communities of the

churners and non-churners (Pushpa et al., 2012).

Next work is called “Predicting customer churn

in mobile networks through analysis of social

groups” by Yossi Richter et al. (2010). In this work

author implemented opposite approach to on in

previous article by concentrating on social groups

first and eliminating weak ties between groups. By

doing so he got several completely separated groups.

Richter calls it the group-first social networks

approach because first he calculates churn prediction

for the group rather than individual customer as is

done in most researches. He used decision tree

algorithm for scoring each group’s churn based on

defined KPI’s of the group. After that author

calculated churn prediction for individual

subscribers by first computing their relative churn

score (Tuğba et al., 2010).

Xiaohang Zhang (2012) “Predicting Customer

Churn through Interpersonal Influence” used

methods for social network analysis described in

aforementioned article by Koustuv Dasgupta (2008)

but also combined it with personal characteristic of

the customer. He built three models based only on

network attributes, only traditional attributes and

combination of both. He applied three popular data

classification techniques including logistic

regression (LR), decision tree (DT) and neural

network (NN) methods. Then author compared the

prediction results of traditional attributes-based

models, network attributes-based models and

combined attributes models and found that

incorporating network attributes into predicting

models can greatly improve prediction accuracy. In

addition he proposed a novel prediction model based

on the propagation process that accounts for

interpersonal influence and customers’ personalized

characters. The empirical results show that the

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

236

proposed propagation model outperforms traditional

classification models (Zhang, 2012).

And the last article in this review of social aspect

of churn is called “Estimating the effect of word of

mouth on churn and cross-buying in the mobile

phone market with Markov logic networks” by

Torsten Dierkes et al. (2011). His main goal was to

optimize network analysis process by introducing

Markov logic networks (MLNs) as this method have

recently been suggested as a significant step forward

in this field. The method draws on Markov Random

Fields and ILP (inductive logic programming) and is

able to handle larger data sets compared to earlier

ILP implementations such as FOIL. They collected

customers’ call data and built social graph just like

researchers from previous articles that was

described. But this time authors inserted this data in

a relational database creating multiple relations

between nodes. They used Alchemy – open source

software for learning Markov logic networks from

data. Markov logic networks (MLNs) are a

collection of formulas from first-order logic, to each

of which a weight is assigned. In other words, it

describes a probabilistic logic. Ideas from estimating

Markov networks are then applied to learn the

weights of the formulas. The vertices of the MLN

graph are atomic formulas, and the edges are the

logical connectives used to construct the logical

formula. A Markov network is a model for the joint

distribution of the properties of underlying objects

and relations among them. It was established that

MLNs have higher predictive accuracy (+8%) and

sensitivity (+19.7%) than the benchmark logistic

regression (Dierkes et al., 2011).

2.6 Concept of Customer Retention

In order to reduce amount of people who stop using

service of the company different customer retention

techniques are being used. Marketing department

should use information provided by data analysis

team and offer to customers who are predicted to

churn new services to keep them. Because

companies have limited human resources to call or

somehow interact with customers who are suspected

to churn some bonuses or discounts could be offered

to larger group of customers without significant

effort. But even for these campaigns there should be

reasonable amount of subscribers to whom

campaign is offered. Usually top 10% of predicted

customers who have highest probabilities of churn

and most value for the company are contacted

personally and offered some discounts. Next 2-3

deciles are offered some free minutes or time-limited

discounts.

Usually each customer is considered individually

during churn prediction. The goal is to predict each

customer’s likelihood of churning in the near future,

where usually a forecast horizon of a month to three

months is considered. To this end, dozens to

hundreds of complex Key Performance Indicators

(KPIs) are generated per customer; these KPIs span

the customer’s personal characteristics as well as

trends in their call activities over a long period. The

information then serves as input to a statistical

regression model (usually a logistic regression

variant) that outputs a churn score. In other words,

this approach focuses on identifying patterns that are

uncommon to a given customer, and are correlated

with churn (Kim et al., 2012).

Other system try to solve churn prediction

problem by monitoring customers’ calls to the

mobile carrier’s call center, such systems apply

speech and emotion analysis to the calls, and

together with additional information (number and

length of calls by the customer, number of transfers,

hold period, etc.) try to quantify the customer’s

dissatisfaction level and hence the associated churn

risk. The system can then react by prioritizing

pending ‘churners’, even suggesting retention

packages. This approach has a major disadvantage:

although it may accurately pinpoint the potential

churners, the forecast horizon it provides is very

short as the system identifies customers that have

already expressed dissatisfaction with the service. At

this stage, retention prospects are lower while cost is

significantly higher. Even when combining the long

term and ad-hoc churn prediction systems, one

drawback is fairly obvious: we clearly rely on the

assumption that a churning customer either changes

calling patterns or contacts the carrier’s call center to

express dissatisfaction prior to switching carriers.

While this may be true in some cases, there are

certainly many scenarios in which these assumptions

are violated. For example, this may occur when

customers come to believe that they have found a

better deal with a competitor and churn immediately.

Another, less obvious, drawback of traditional

solutions is that they focus exclusively on the

individual customer without taking into account any

social influence. Clearly, there are many social

aspects to churn, as witnessed in other consumer

areas, where a dominant example is when a churning

customer influences other customers to churn as

well. Thus, developing churn prediction systems that

take social aspects into account poses an emerging

theoretical challenge with potentially great practical

implications.

CustomerChurnPredictioninMobileOperatorUsingCombinedModel

237

The nature of the churn prediction problem

dictates a specific non-standard performance

measure. Recall that once the prediction system

produces its churn scores, the retention department

makes contact with the subscribers that are most

likely to churn, in an attempt to preserve each

customer that is established to be a churn risk.

Naturally, only a small fraction of the subscriber

pool can be contacted at any given time, and the

subscribers with the highest churn scores are

assigned top priority. Therefore, a churn prediction

system should be measured by its ability to identify

churners within its top predictions. Formally,

performance is measured using the lift metric. For

any given fraction 0 < T < 1, lift is defined as the

ratio between the number of churners among the

fraction of T subscribers that are ranked highest by

the proposed system, and the expected number of

churners in a random sample from the general

subscribers pool of equal size. For example, a lift of

3 at a fraction T = 0:01 means that if we contact the

1% of subscribers ranked highest by the proposed

system, we expect to see three times more people

who planned to churn in this population than in a

0:01-fraction random sample of the population (Kim

et al., 2012).

3 BUILDING CHURN MODELS

In this part models based on the data that were

prepared are being built. For modeling it was

planned to use several available modeling nodes.

For modeling and evaluating of models data set

was divided into training and testing partitions.

Separating data into training and testing sets is an

important part of evaluating data mining models. By

using similar data for training and testing it is

possible to minimize the effects of data

discrepancies and better understand the

characteristics of the model.

After running C5.0 model it produced output in a

form of decision tree. Predictor importance chart is

also shown in the model output window. As can be

observed from the picture below the most important

predictor is chosen total credit amount on the

subscriber’s account during week 1. Among other

most important fields are Count of outgoing

destination calls on week 1, duration of incoming

weekend calls for week 1 and sum of consecutive

two-day periods without outgoing calls.

Strange thing here is that all subscribers with

total credit of less than 112.532 were classified as

non-churners. Even though prediction is remarkably

precise and results hold for other data sets model

should be revised often to eliminate over fitting

problem.

Precision of prediction is shown on Figure 1.

Cox regression model was used as a specific

implementation of survival analysis.

Normally one model is used to predict a target. It

is possible to try several types of models, but in the

end there will be one model left. Most of data-

mining projects also develop one model, but data

mining implies usage of several approaches to

analysis. Neural Network and Cox regression

models’ outcomes are combined since they had

lower accuracy than C5.0 model.

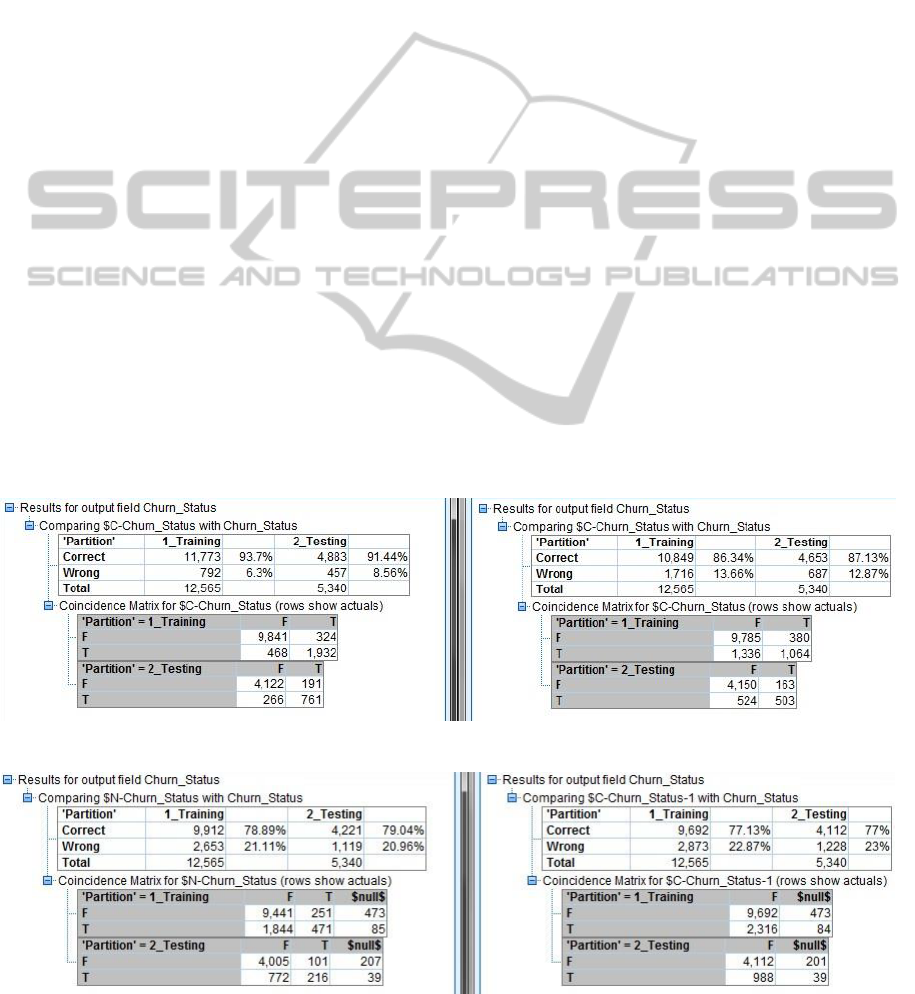

At the picture below on the left side are results of

full data set analysis and on the right – for reduced

fields. It can be seen that results for reduced fields

are slightly worse than for full set but not

significantly.

4 TESTS AND RESULTS

4.1 Evaluation of Models

There is 91.44% accuracy against 87.13% for

Figure 1: Neural network model results.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

238

reduced fields for testing data partition (Figure 2).

Analysis revealed that the best results are achieved

using C5.0 decision tree model. Principal

components analysis reduction technique was used

to reduce number of fields and compared how the

same model performed on full set of fields

against reduced data set. Results for neural network

and Cox regression models are significantly less

even though they were built over all available fields

except those that were removed during data

preparation phase. On the Figure 3 results for both

models are reflected. On the left side is shown result

for neural network which is 79.04% accurate on

testing partition. And on the right side Cox

regression output is presented with 77% accuracy.

One way to increase accuracy of the model is

already described method of combining models. Pay

attention to the ‘Comparing agreement with Churn

Status’ table and if to be more precisely, to the

correct percentage in the testing column. Their

combined accuracy increased to 83.84% compared

to 79.04% and 77% they had respectively.It is also

possible to evaluate model with Evaluation node

which shows how model performed on graph.

5 CONCLUSIONS AND

RECOMMENDATIONS

Churn is directly related to customer loyalty and

defines a process of switching service provider.

Churn can be of several categories which are defined

based on the reasons why it happened. These types

are active or deliberate churn, rotational or

incidental churn and passive or non-voluntary.

Active churn is initiated by subscriber which wants

to change service provider, rotational happens

without intention to switch but for different reasons.

It is not easy to distinguish those two. And passive

churn covers cases when provider disconnects

customer for inactivity. It is the most dangerous type

because is difficult to discover. Various reasons

which lead to customer churn are also discussed.

Establishing reasons of churn usually happen based

on questionnaires and surveys.

Social network and interpersonal relationship

specific to Azerbaijan were discussed. As a result

few points related to Azerbaijani society were

brought to attention.

Achieved results showed that C5.0 is still the most

precise model while neural network and cox

regression perform worse. After combining last two

models result was improved but was still worse

compared to C5.0 model. Main downside of C5.0

model is that it can be over fitted to the expected

result. That’s why this model should be reviewed

and calibrated for new data sets.

During preparation of this work several

recommendations to mobile operator came up which

are worth mentioning. From social network analysis

Figure 2: C5.0 for all fields vs reduced factors results.

Figure 3: Neural network (left), Cox regression (right) results.

CustomerChurnPredictioninMobileOperatorUsingCombinedModel

239

part where mentality of Azerbaijani society was

discussed recommendations were to consider giving

higher value to married, working men because they

have more influence on the family and can be cause

of his family members’ churn if he decides to

change mobile operator himself; other important

factor is prestige and willingness to show it which

can be used to create positive impression around the

brand and particular product; parents can have

strong influence on their children even if they are

not underage anymore because most of young

people live with parents till marriage and respect

their opinion very much. Other approach of using

social information could be creation of social

network graph of the customers using call data

records.

REFERENCES

Ballings, M., Poel, D., V., 2012. Customer Event History

for Churn Prediction: How Long Is Long Enough?,

Expert Systems with Applications: An International

Journal archyve, Vol. 39 Issue: 13517-13522.

Berson, A., Smith S and Thearling K, New York, 2002,

Building Data Mining Applications for CRM, ISBN

978-0071344449.

Burez, J., Poel, D., 2008. Separating financial from

commercial customer churn: A modeling step towards

resolving the conflict between the sales and credit

department, Expert Systems With Applications, 35(1-

2): 497-514

Dasgupta, K., Singh, R., Viswanathan, B., et al, 2008.

Social Ties and their Relevance to Churn in Mobile

Telecom Networks, EDBT: 668-677

Dierkes, T., Bichler, M., Krishnan, M., 2011. Estimating

the effect of word of mouth on churn and cross-buying

in the mobile phone market with Markov logic

networks, Decision Support Systems archyve, Vol. 51

Issue 3: 361-371.

Geppert, KPMG & Associates, 2003. Customer Churn

Management: Retaining High-Margin Customers with

Customer Relationship Management Techniques,

Journal of International Business Disciplines, Volume

4, Number 2: 18-19.

Huang, B., Kechadi, M., T., Buckley, B., 2012. Customer

Churn Prediction in Telecommunications, Expert

Systems with Applications: An International Journal

archyve, Vol. 39 Issue 1: 1414-1425.

Huang, Y., Kechadi, T., 2013. An Effective Hybrid

Learning System for Telecommunication Churn

Prediction, Expert Systems with Applications.

Yeshwanth, V., Raj, V., Saravanan, M., 2011.

Evolutionary Churn Prediction in Mobile Networks

Using Hybrid Learning, FLAIRS Conference, AAAI

Press.

Khalatyan, A., 2010. Churn Management in

Telecommunications, iSCHANNEL 05: 21-26.

Kim, Y.,S., Moon, S., 2012. Measuring the Success of

Retention Management Models Built on Churn

Probability, Retention Probability, And Expected

Yearly Revenues, Expert Systems with Applications,

Vol. 39, Issue 14: 11718–11727.

Lazarov, V., Capota, M., 2007. Churn Prediction, TUM

computer science.

Owczarczuk, M., 2010. Churn Models for Prepaid

Customers in the Cellular Telecommunication

Industry Using Large Data Marts, Expert Systems with

Applications: An International Journal archyve, Vol.

37 Issue 6: 4710-4712.

Pushpa, Shobha, G., 2012. An Efficient Method of

Building the Telecom Social Network for Churn

Prediction, International Journal of Data Mining &

Knowledge Management Process, Vol. 2, Number 3.

Richter, Y., Yom-Tovy, E., Slonim, N., 2010. Predicting

customer Churn in Mobile Networks through Analysis

of Social Groups, SDM: 732-741.

Tuğba, U., Gürsoy, Ş, 2010. Customer Churn Analysis in

Telecommunication Sector, Journal of The School of

Business Administration

, Vol.39, Number 1: 35-49.

Verbeke, W., Dejaeger, K., Martens, D., Hur, J., Baesens,

B., 2012. New Insights into Churn Prediction in The

Telecommunication Sector: A Profit Driven Data

Mining Approach, European Journal of Operational

Research, Vol. 218, issue 1: 211-229.

Weia, C.-P., Chiub, I.-T., 2002. Turning

Telecommunications Call Details To Churn

Prediction: A Data Mining Approach, Expert Syst.

Appl. 23(2): 103-112.

Zhang, X., Zhu, J., Xu, S., Wan, Y., 2012. Predicting

Customer Churn Through Interpersonal Influence,

Knowl.-Based Syst. 28: 97-104.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

240