Administration of Government Subsidies Using Contactless Bank

Cards

Aleksejs Zacepins

1

, Nikolajs Bumanis

1

and Irina Arhipova

2

1

IT Competence Centre, Lačpleša iela, Riga, Latvia

2

Ecommerce Accelerator, Skanstes 54, Riga, Latvia

Keywords: Subsidy Administration, Electronic Cards (e-Cards), Contactless Bank Cards, Public Transport Subsidies.

Abstract: Subsidization of major and minor government branches is common strategy with the aim to optimize

government funds, increase residents’ welfare and overall infrastructures’ efficiency, including public

transportation system. Within the different countries subsidization is being approached using specific

models of calculation and payment. However, most of them use the same subsidy administration approaches

– cash transfers or social services. The aim of this paper is to describe proposed improvements of transport

subsidy administration approach by implementation of e-cards for payments. It is proposed to improve

subsidy payment procedure by promoting that subsidy should be paid directly to subsidy receiver. This will

allow managing only real transactions and only subsidy receiver is interested in subsidy utilization.

Proposed approach to process the subsidy administration and payments can be realized by using existing

banking infrastructure and novel product as electronic cards.

1 INTRODUCTION

In many countries subsidy administration is an

actual problem and open question on government

level. This problem is important because in most

cases (Drevs, Tscheulin, 2014) residents’ taxes are

used for subsidy payments. Several residents groups

with ability to apply for different subsidies can be

mentioned, for example pupils, seniors, unemployed

people etc.

In Latvia subsidy administration and its payment

strategy is also widely discussed issue. In

16.02.2012 the goal (Latvian Ministry Cabinet,

2012) for Welfare Ministry to realize reform of

Latvian social assistance system was defined by the

Latvian Ministry cabinet, which states

implementation of reform by gradually transforming

assistance system from passive (subsidy social

assistance system) to active (client motivating

system). It is required to improve situation with

existing social system by providing possible biggest

added value for clients and for society overall

(Latvian Ministry Cabinet, 2012).

To start improvement of social safety system and

to grant reasonable decision making offering

optimization events for mentioned branch, in year

2013 World Bank research is carried out in Latvia

with title “Expenditure and performance

benchmarking country level, Expenditure and

performance of welfare benefits and employment

programs in Latvia” (The World Bank, 2013).

Results of this research were very significant and

together with evaluation of whole system, several

disadvantages and problems of social assistance

system, including labour market policy, State social

benefits and taxation were identified. As well main

residents risk groups were defined. As most

significant problem area in whole social safety

system, which is clarified during mentioned World

Bank research is “lack of state and government

support purposefulness and the necessity to improve

system relating to poorest residents”. Social

assistance and welfare programs are non-

contributory benefits (or services) targeted at the

poorest residents, as well at families with children,

disabled and other categories of the population who

may need income support or other help (The World

Bank, 2013).

Social assistance programs and approaches differ

across EU countries (Palme, 2013) and share spent

on cash benefits versus benefits in-kind (social

services) also differs. It can be mentioned that

Nordic countries deliver significant share of social

128

Zacepins A., Bumanis N. and Arhipova I..

Administration of Government Subsidies Using Contactless Bank Cards.

DOI: 10.5220/0004950901280132

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 128-132

ISBN: 978-989-758-029-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

assistance through social services compared to the

new EU member countries, like Estonia and Poland

where the majority of social assistance is provided in

form of cash transfers. During the last decade in

Latvia more than half (approximately 60 %) of

social assistance benefits were delivered as cash

transfers, and not by social services. This should be

changed in future, minimising the amount of cash

transfers. In Latvia only about one fifth of total

social protection spending is allocated to non-

contributory social assistance programs (The World

Bank, 2013).

Latvian social assistance (welfare) programs

include social assistance benefits such as benefits for

meals and food, health care benefits and transport

benefits. These benefits are meant for people

qualifying the means-tested eligibility threshold or

other eligibility criteria set by municipalities, and

being administered by municipalities.

The aim of this paper is to describe proposed

transport’s subsidy administration approach by

implementation of e-cards for payments. To improve

subsidy granting and administration procedure,

existing situation is analysed and new subsidy

administration and payment approach is proposed.

This approach improves subsidy payment procedure

by promoting that subsidy should be paid directly to

subsidy receiver. This will allow managing only real

transactions and only subsidy receiver is interested

in subsidy utilization. This approach excludes

conflicts of interests and makes more efficient

spending of subsidy funds. For new subsidy

administration approach implementation use of

existing banking infrastructure and electronic cards

is proposed.

2 ANALYSE OF GOVERNMENT

SUBSIDY ADMINISTRATION

APPROACHES

Basically the transport subsidy related literature

sources distinguishes between research neglecting

spatial location decisions and the labour-leisure

choice (Mohring, 1972; Parry, Small, 2009)

approaches disregarding spatial location decisions

but considering labour supply decisions (Wrede,

2000; Calthrop, Leuven, 2001; Richter, 2006;

Dender, 2003; Borger, Wuyts, 2009) and research

where location choice is explicitly taken into

account but labour supply is exogenously given

(Zenou, 2000; Martin, 2001; Wrede, 2001;

Brueckner, 2005; Borck, Wrede, 2009; Borck,

Wrede, 2008; Borck, Wrede, 2005; Su, DeSalvo,

2008; Wrede, 2009).

Subsidies and benefits can be administered in

different ways and using different models, thus,

creating overall problem of choosing the correct

model for administrating purpose. The existence of

different models for administrating of the same

subsidy is prevalent (Yang et al., 2010). As example,

decentralization of prescription drugs within the

Pharmaceutical Benefits Scheme has two models

(Bergström, Karlberg, 2007): a population based and

a prescribed based.

Additionally, exists so called ‘Transfer of fare

revenue’, which is one of the fare compensation

measures for ‘fare-discount schemes’, which are set

by local authorities. In Japan, this scheme was

introduced from the 1970s for public bus operators

(Sakai, Shoji, 2010). Sakai and Shuji stated that

most local governments that own municipal bus

companies have implemented this scheme, but this

policy measure was aimed at improving the welfare

of senior citizens and the disabled and therefore, it is

not precisely identical to the actual subsidies. “Since

the fare discount for senior citizens and the disabled

is not stipulated by law, there are considerable

variations among local authorities regarding

concessionary fare schemes” (Sakai, Shoji, 2010).

It is known that government grants public

transport subsidies to reduce operating cost of public

transport enterprises and the individual travel cost of

public transport, therefore making decision of

choosing public transport over private more

expectable. It was stated (Yang et al., 2010) that

reducing trip expenses by public transport using

public transport subsidies will lead to private car

reduction, therefore, increasing overall volume of

public transport passengers and decreasing amount

of private cars on the roads. This scenario can be

preceded until balance between excessive trips and

public transport cost is achieved.

Nowadays in Latvia there are two main methods

or approaches for government subsidy (grant)

administration.

First subsidy administration method (see Fig.1):

residents’ subsidies are administered by service

providers (merchandisers) and subsidies (subsidy

payments) are transferred directly to service

provider’s account.

Several issues can be mentioned about such

subsidy administration method. There can be

expected mistakes in distribution of grants, because

service providers are in conflict of interests and

delays in payments for service providers. As well

service providers are interested to apply for subsidy

Administration of Government Subsidies Using Contactless Bank Cards

129

Client

(resident)

Service

provider

Government

Grants

subsidy

Applies for subsidy

payment

Pays subisdy

Pays for servce

(price - subsidy)

Figure 1: Subsidy administration by service providers.

payments as more as possible, and can do this

unfairly.

Second subsidy administration method (see

Fig.2): residents pay for service a full price and after

that provide receipts for the government institution

to receive subsidy payment.

Client

(resident)

Service

provider

Government

Grants subsidy

Pays subisdy

Applies for subsidy payment

Pays for service (full price)

Figure 2: Subsidy administration by government.

Issues of this method are that government cannot

precisely verify the subsidised deal; therefore,

service provider can unfairly create check for the

deal and client can apply for subsidy without taking

a service.

Common issue of mentioned approaches is non-

effective spending of subsidy funding.

So it is clear that it is needed to change subsidy

administration approach to grant, that subsidy will

be received directly by person whom subsidy is

granted. This approach excludes conflict situations

and makes administration of subsidy funding more

efficient. This approach guarantees that only real

service providers deals (transactions) are fixed. To

implement new subsidy administration approach is it

proposed to use cheap and fast electronic way for

payment for subsidised services or products by using

existing banking infrastructure.

3 DESCRIPTION OF PROPOSED

APPROACH FOR

GOVERNMENT SUBSIDY

ADMINISTRATION USING

CONTACTLESS BANK CARDS

It is proposed to use existing banking infrastructure

for administration of subsidies by implementation of

specific electronic cards (E-cards) for payment for

subsidised services or products. E-card is

multifunctional and personalised payment card with

additional non-contact function (including

VISA/MaterCard payment cards), where is

combined Bank payment cards functionality with

person verification and recognition functions. This

card should be issued by Bank for subsidy

administration.

Cities (governments) delegates banks to issue

contactless payment cards with established design

and with rights for residents to receive grants, but

still governments defines a list of subsidy receivers,

provides subsidy calculation scenarios and defines

list of service/product providers which can accept E-

cards for service/product payment.

Banks identify residents, open bank account for

pupils and socially unprotected residents, and issue

contactless cards in schools, in social centres and in

bank’s branches.

Pupils and socially unprotected residents pay for

subsidized products/services using banking

infrastructure.

Grants are calculated by the fact of successful

transaction, based on city defined scenario (fixed

rate, % of payment, etc.) and taking into account

defined subsidy limits (transaction count, daily

payment, monthly payment, etc.).

Bank processes payments between card’s owners

and service providers simultaneously with grant’s

payments from cities to grant’s receivers bank

account (see Fig.3).

Client

(resident)

Service

provider

Government

Grants

subsidy

Pays

subsidy

Pays for servce

with E-card (price -

subsidy)

Bank

Provides fundings for

subsidies

*Simultaneously

Figure 3: Concept of novel approach for government

subsidy administration.

ICEIS 2014 - 16th International Conference on Enterprise Information Systems

130

Costs for implementation of such approach for

residents are very minimal, because

issuance/cancellation of payment cards for residents

should be free of charge, calculation and

management of grants for city – free of charge,

transaction of grant’s from city’s to grant’s

receiver’s bank account is also free of charge. Costs

for the above mentioned services are included in

banking commission rate for acceptance of payment

card’s by service providers.

3.1 Possible Data Structure of Subsidy

Formulation

Subsidy provider transmits Subsidy formulation to

all Issuer banks, where Subsidy provider’s

(sub_send_name) subsidy’s receivers

(sub_rec_name) are clients (pers) of E-card’s Issuer

(issuer). Subsidy can be assigned to one or group of

persons, where Subsidy is calculated based on

specific calculation scenario (sub_scenario).

Calculation scenario is valid for specific time

interval (from_date to till_date). There is specific

limit (sub_total) of sum of assigned Subsidies for

one client. The limit is valid for specific time

interval. Subsidy’s receiver (sub_rec_name) receive

Subsidy making deals with merchant (merchant)

using E-card as payment instrument, which requires

personal ID code or card’s ID (there is possibility to

have both). IssuerID is unique for all Issuer banks,

and is listed in unified registry, maintained by Issuer

banks. Possible data structure of Subsidy

formulation is demonstrated in Figure 4:

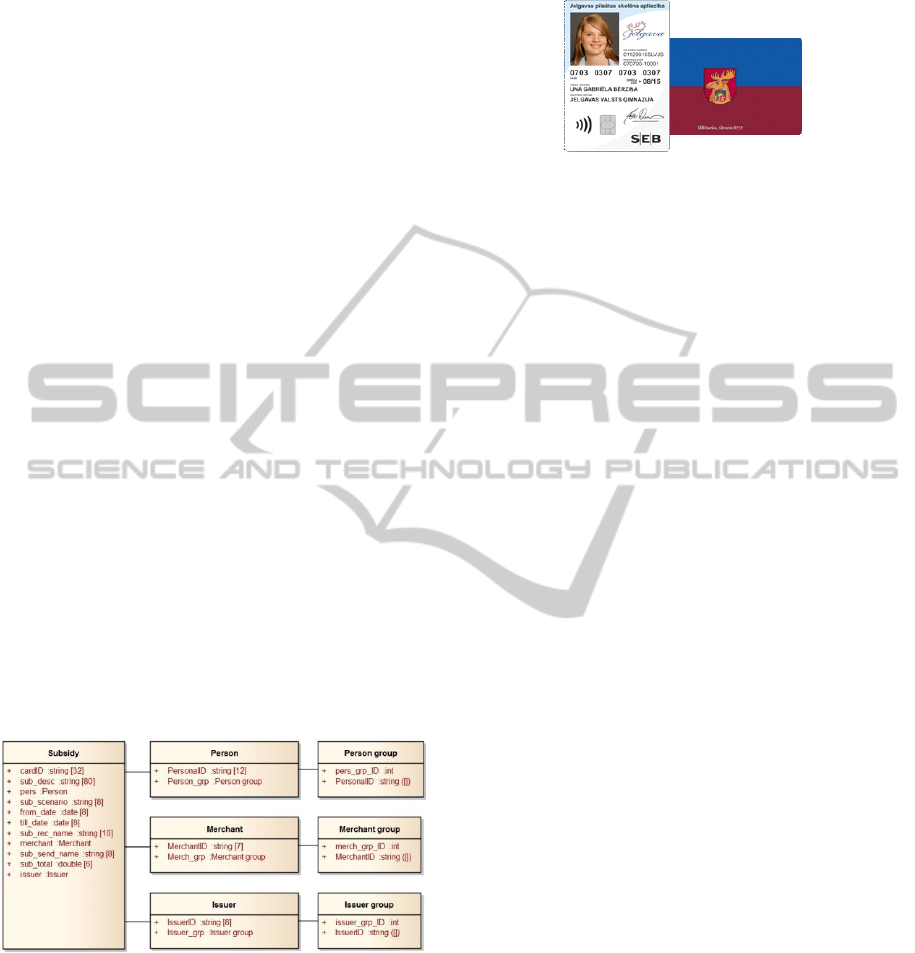

Figure 4: Structure of Subsidy formulation.

3.2 Example of Described Novel

Subsidy Administration Approach

Described subsidy administration approach is

implemented in Latvia, in Jelgava city for

administration of subsidies for pupils. Subsidy is

granted for usage of public transportation and for

taking a meal in the school. Pupils are using specific

e-card for payment of subsidised services (see

Fig.5).

Figure 5: Example of e-card for payment of subsidised

service.

There are many benefits of implemented subsidy

administration approach:

• Additional parental control, which allows

monitoring children spending by controlling the

amount of funding on E-card.

• Maintaining of confidentiality of social status of

children and residents – everyone pays the same

amount and receive grants on their bank account.

• Service/product providers receives full price for

products/services on their bank account on the next

working day.

• Subsidies are calculated only according to actual

transaction and are transferred directly to grant’s

receiver’s bank account.

• Grants’ receivers receive information about full

price of products/services and amount of provided

grant.

• This solution is economically effective because of

direct transactions within the bank and use of

existing banking infrastructure.

• Time saving – fast service because of integration

with cash register.

4 CONCLUSIONS

Subsidization as problem on government level was

being analysed and subsidy calculation models were

introduced in many economic researches. However,

it was not stated that subsidies paid by cash transfers

can be used unfairly by private organizations.

Latvia’s transportation system was taken as

example, and solution for optimization of subsidy

administration is introduced.

In Latvia the main problem of existing subsidy

administration approach is non-effective spending of

subsidy funding. To improve the administration of

subsidies novel approach is proposed. This approach

is implemented and is practically verified in Jelgava

city in Latvia for subsidy administration of public

transportation and meals for pupils in schools.

This approach improves subsidy payment

Administration of Government Subsidies Using Contactless Bank Cards

131

procedure, by promoting that subsidy should be paid

directly to subsidy receiver. This will allow

managing only real transactions and only subsidy

receiver is interested in subsidy utilization. This

approach excludes conflicts of interests and makes

more efficient spending of subsidy funds.

Additionally to subsidy administration,

proposed approach allows better organization of

pupil’s daily life.

ACKNOWLEDGEMENTS

This research is part of a project „Competence

Centre of Information and Communication

Technologies” run by IT Competence Centre,

contract No. L-KC-11-0003, co-financed by

European Regional Development Fund.

REFERENCES

Bergström, G., Karlberg, I. (2007) Decentralized

responsibility for costs of outpatient prescription

pharmaceuticals in Sweden: Assessment of models for

decentralized financing of subsidies from a. Health

Policy, Vol. 81(2-3), p. 358–367.

Borck, R., Wrede, M. (2005) Political economy of

commuting subsidies. Journal of Urban Economics,

Vol. 57, p. 478–499.

Borck, R., Wrede, M. (2008) Commuting subsidies with

two transport modes. Journal of Urban Economics,

Vol. 63, p. 841–848.

Borck, R., Wrede, M. (2009) Subsidies for intracity and

intercity commuting. Journal of Urban Economics,

Vol. 66, p. 25–32.

Borger, B. De, Wuyts, B. (2009) Commuting, transport tax

reform and the labour market: employer-paid parking

and the relative efficiency of revenue recycling

instruments. Urban Studies, Vol. 46, p. 213–233.

Brueckner, J. (2005) Transport subsidies, system choice,

and urban sprawl. Regional Science and Urban

Economics, Vol. 35, p. 715–733.

Calthrop, E., Leuven, K. (2001) On subsidising

auto0commuting! CESifo Working Paper Series 566.

Dender, K. Van (2003) Transport taxes with multiple trip

purposes. The Scandinavian Journal of Economics,

Vol. 105, p. 295–310.

Drevs, F., Tscheulin, D. (2014) Crowding-in or crowding

out: An empirical analysis on the effect of subsidies on

individual willingness-to-pay for public transportation.

Transportation Research, p. 250–261.

Latvian Ministry Cabinet (2012) Latvian government

action plan.

Martin, R. (2001) Spatial mismatch and costly suburban

commutes: Can commuting subsidies help? Urban

Studies, Vol. 38, p. 1305–1318.

Mohring, H. (1972) Optimization and scale economies in

urban bus transportation. The American Economic

Review, Vol. 62, p. 591–604.

Palme, J. (2013) Unemployment Benefits in EU Member

States. Uppsala University, Department of Economics,

Working Paper Series, Center for Labor Studies, (15),

p. 25.

Parry, I., Small, K. (2009) Should urban transit subsidies

be reduced? The American Economic Review, Vol. 99,

p. 700–724.

Richter, W. (2006) Efficiency effects of tax deductions for

work-related expenses. International Tax and Public

Finance, Vol. 13, p. 685–699.

Sakai, H., Shoji, K. (2010) The effect of governmental

subsidies and the contractual model on the publicly-

owned bus sector in Japan. Research in

Transportation Economics, Vol. 29(1), p. 60–71.

Su, Q., DeSalvo, J. (2008) The effect of transportation

subsidies on urban sprawl. Journal of Regional

Science, Vol. 48, p. 567–594.

The World Bank (2013) Expenditure and performance

benchmarking country level. Scientific research:

Latvia: “Who is unemployed, inactive or needy?

Assessing post-crisis policy options,” p. 74.

Wrede, M. (2000) Tax deductibility of commuting

expenses and leisure: On the tax treatment of time-

saving expenditure. FinanzArchiv/Public Finance

Analysis, Vol. 57, p. 216–224.

Wrede, M. (2001) Should commuting expenses be tax

deductible? A welfare analysis. Journal of Urban

Economics, Vol. 49, p. 80–99.

Wrede, M. (2009) A distortive wage tax and a

countervailing commuting subsidy. Journal of Public

Economic Theory, Vol. 11, p. 297–310.

Yang, Y., Qi, K., Qian, K., Xu, Q., Yang, L. (2010) Public

Transport Subsidies Based on Passenger Volume.

Journal of Transportation Systems Engineering and

Information Technology, Vol. 10(3), p. 69–74.

Zenou, Y. (2000) Urban unemployment, agglomeration

and transportation policies. Journal of Public

Economics, Vol. 77, p. 97–133.

ICEIS 2014 - 16th International Conference on Enterprise Information Systems

132