Modelling Financial SaaS as Service Components

Muthu Ramachandran and Victor Chang

School of Computing, Creative Technologies and Engineering, Leeds Metropolitan University,

Leeds, LS6 3QS, U.K.

Abstract. Financial applications demand better performance and accuracy in a

cloud than the traditional computing platforms. Therefore, designing financial

software as a service (FSaaS) requires engineering and systematic approach.

This paper has designed a financial SaaS component model and a service archi-

tecture supporting required flexibility, scalability, and allowing change in envi-

ronment. This paper has proposed an integrated service-oriented architecture

and a SaaS component model for financial domain that provides trequired

scalability, flexibility and customisation. We have also demonstrated the design

and customisation of service component interfaces to the financial simulation

so that it provides automatic prediction models for investors to know accurate

results in buy and sale prices. Therefore, large-scaled simulations can be

achieved within a matter of seconds (13.5 seconds).

1 Introduction

Financial applications require on-demand services that are offered by cloud compu-

ting with cost-benefits. Therefore, financial domain has begun to reap these benefits

with emerging financial SaaS such as FinancialForce which is developed by

SalesForce, NetSuite, Intacct, and Oracle’s financial SaaS. NetSuite [11] claims

helped companies to increase their revenues by 95% by moving to their financial

SaaS. Accenture [1] report on financial technology trends and high performance

computing predicts:

• Leveraging technology to address new & change in regulations

• Reliable and globally harmonised financial systems

• Add value through strategic applications

• Harvest benefits from technology

Accenture [1] report also claims SaaS to be a simple, efficient, engaging, accessible,

clear structure, intuitive, and supportive. With keeping this set of requirements as

design criteria, this paper has designed a SaaS component model and a service archi-

tecture supporting required flexibility, scalability, and allowing change in environ-

ment. This paper has proposed an integrated service-oriented architecture and SaaS

component model for financial domains which provides required scalability, flexibil-

ity and customisation that are at the heart of a financial SaaS.

We demonstrate the system design and the implementations. Examples include the

results of running software that can compute call and put prices. Results of simula-

Ramachandran M. and Chang V..

Modelling Financial SaaS as Service Components.

DOI: 10.5220/0004979000130020

In Proceedings of the International Workshop on Emerging Software as a Service and Analytics (ESaaSA-2014), pages 13-20

ISBN: 978-989-758-026-0

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

tions also support the fact that all computations can be completed within seconds. To

illustrate our key messages, the breakdown of this paper is as follows. Section 2 pre-

sents the overall view about SOA approach an FSaaS application. Section 3 discusses

the service component model. Section 4 shows the results of running FSaaS and

large-scaled simulations in seconds. Section 5 sums up issues covered and provides

conclusion.

2 SOA Approach for FSaaS Applications

FSaaS applications require open, flexible, interoperable, collaborative and integrated

architecture to provide services to integrate various stakeholders such as citizens and

financial services (e-shares, e-stockbrokerage, e-fund-management, QoS, FSaaS

cloud simulation services, e-health, e-tax, e-national security, e-pension, e-payment,

e-education and training, e-work and employment, e-funding, etc), business organisa-

tions and vendors (e-procurement), and government agencies (both inter and intra

governments). Therefore, designing architecture for FSaaS applications pose a design

challenge. Software architectural design needs to be verified, assessed and evaluated

for its quality before its development. There are well known generic design criteria

such as flexibility, maintainability, testability, reusability, etc. The key to achieving

good architectural quality for the system being developed is to extract key character-

istics of this system from various sources such as non-functional requirements, cus-

tomer requirements, existing systems, experts, research literatures [2-3 & 6-16] and

so on. This paper identifies such characteristics from various perspectives supporting

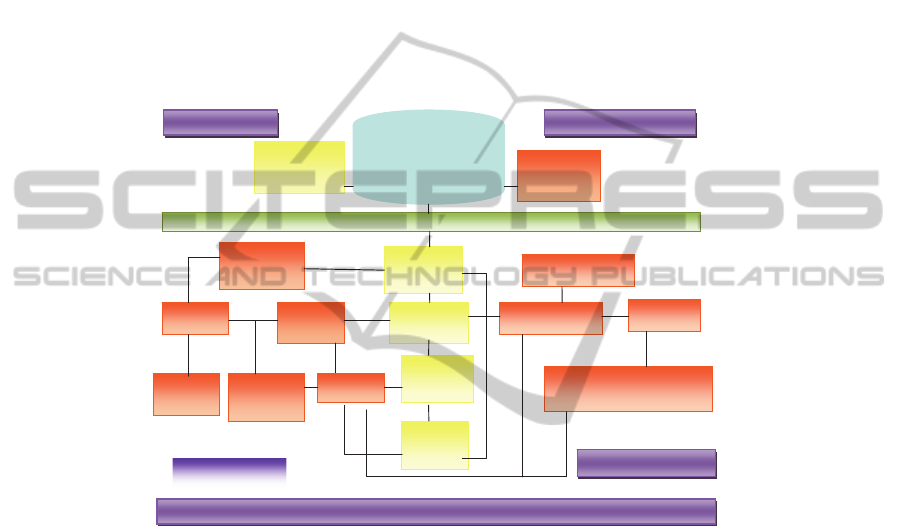

emerging technologies which are shown in Figure 1. These FSaaS application charac-

teristics are the backbone for developing service-oriented architecture and compo-

nents.

Fig. 1. Characteristics of FSaaS Applications.

To further expand on concepts in Figure 1, FSaaS applications need to work and

interface with multi-platform and multi-vendor applications and therefore this needs

14

to be designed for interoperability. Multi-channel delivery of services has been rec-

ommended to deliver FSaaS services through various and emerging communication

channels such as mobile phones, digital TV, cloud services, call centres, kiosks,

emails, PCs, teleconferencing, e-gov apps, web, and webinars - some of these are not

been used by any government at present. Each characteristic shown in Figure 1 repre-

sents not only the application attribute but it also provides a set of key design criteria

and quality attributes for developing architecture that support emerging technologies

for FSaaS. For example, the design criteria interoperability is paramount for FSaaS

applications as they are multi-platform and multi-channel based. Interoperability is

supported in the service-oriented architecture design for FSaaS applications by means

of a service bus and loose coupling of the other components which is shown in Figure

2.

Finance &

Budget

Integration

Systems

Integration

Manager

Investments Portfolio

Management

Tax &

Accounting

Security &

Portal Mgnt

Financial

Projects

Integratio

n

Stakeholders

Financial

Modelling

FSA Policy

Regulations

Service

Integration

Management

Government

Investments

Government

Projects

Integration

E-Financial Services

(e-invest, e-buy, e-sell, e-balance-

sheet, e-financial models, etc)

Investment

Companies

Integration

Integration Layer

Registration,

Authentication &

Security Control

Service

Communication

Channels

Secured FSaaS Service Bus

Integrated Financial

Institutions & Investments

Business La

y

e

r

Orchestration Layer

FSaaSServicesLayer

Infrastructure Laye

r

Fig. 2. Service-Oriented Architecture for FSaaS.

These services can be made available as stand alone, integrated, componentised,

web based service component, composite service (a set of interconnected services),

virtualised services (cloud based), and dynamically re-configurable services. The

architecture presented in this paper is then based after a critical review and analysis of

a number of existing architectures for FSaaS applications. As mentioned before, the

SOA based architecture consists of four distinct levels of abstraction layers which are

connected and communicated by messages through a core communication channel

known as a service bus or a central bus. These layers are: 1) a business layer with a

dedicated set of services, 2) an orchestration layer with a set of services where new

services can be composed, 3) an FSaaS layer that supports integration of services,

government departments and local governments, and 4) an e-business layer that sup-

ports new businesses and integration of data. The SOA based architecture for FSaaS

services then ensures that it achieves the expected service-oriented design factors

such as customisation, cost-effectiveness, availability, etc.

15

Referring to Figure 2, at the business and orchestration layers provide high level

service composition based on new business perspective and policies (both political

and economical factors). Mostly, the customisation and the new business needs arise

from these two key variables. The sub-systems such as registration control, security

control, integrated services for FSaaS applications control, and communications

channels help to achieve customisation at a higher level of abstraction without affect-

ing underlying business logic services. These are communicated and connected to

layers below using a concept of service bus known as FSaaS secured service bus. The

layer below the business layer provides services from various FSaaS departments, and

external suppliers (e-Business layer).

3 Service Component Model for FSaaS Applications

This section proposes an approach to developing FSaaS applications which is based

on developing a financial service component which has provides required customiza-

tion extensibility. As stated before, e-government applications require open, flexible,

interoperable, collaborative and integrated architecture to provide services. These

services can be made available as stand alone, integrated, componentised, web based

service component, composite service (a set of interconnected services), virtualised

services (cloud based), and dynamically re-configurable services. This vision is simi-

lar to the Open Group’s Service Integration Maturity Model (OSIMM) [13]. The

OSIMM provides:

• A process roadmap for attaining key practices with metrics

• Seven levels of maturity to improve

• A quantitative model for assessing current practices and to improve with recom-

mended practices

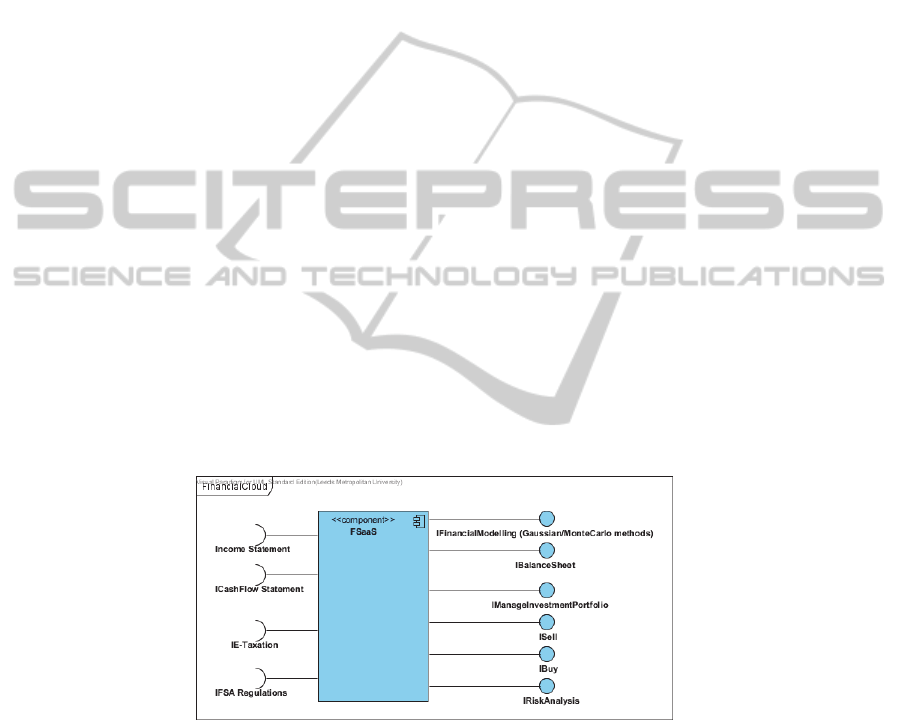

Fig. 3. FSaaS Service Component Model.

Figure 3 shows a design of software as a service component model for financial

applications (FSaaS) where it shows two types of services such as provide (lollypop

notation) and require services (arc notation and the naming convention starts with I).

For example, FSaaS services include Income statement, ICashFlow statement, Ie-

taxation, IFSA regulations). IFSA refers to providing interface service integration for

Financial Authority regulations which any investment service providers should ad-

16

here to and is flexible for change in their regular change thus providing required

scalability and flexibility of FSaaS characteristics discussed earlier.

Similarly, providers service interfaces are Ifinancial modelling, IBalancesheet as a

service which is automatically produced from income and cashflow statements. The

other provider interfaces include ImanageInvestment Portfolio, Isell, IBuy, and

IRiskAnalysis services. In order to achieve the recommended process and key prac-

tices, we need to have interoperability, reconciliations and resiliency between sys-

tems, where interface linkages are appropriate to other services such as those of

emerging technologies interfaces (e.g. Ie-taxation linked to E-Gov applications, and

IFSA regulation service linked to FSA). Similarly, such reconciliations services must

be automated for the sake of cost-efficiency. To develop an integrated FSaaS service-

oriented architecture system, it is critical that service analysts and software engineers

identify and address the key challenges when implementing e-government services.

Some of relevant questions are listed below:

How to adopt a new process and to identify the scope of the business services to

be developed and supported?

How data integrity will be achieved and secured?

How data will be protected when needed to support management decisions?

How systems will fit together to support service choreography and orchestration

layers?

How systems will fit together to support the enabling emerging technologies (sys-

tem architecture needs to be service-oriented thereby any new emerging technolo-

gies in the future should easily be integrated more cost-effectively than with tradi-

tional system architectures)?

How data and services will be safeguarded and secured to ensure the integrity and

re-configurability of service operations and personal data (information assur-

ance)?

How new services can be composed and re-configured at run-time?

This paper has address some of these issues such as achieving business process using

BPMN for identifying FSaaS component services, management decision are intergrt-

ed with service component interfaces as governance, SOA architecture model has

been designed to illustrate other issues. Currently, we are working on developing a

WSDL to link to relevant MATLB code or any other simulation services as shown in

Table 1 (discussed in the following section).

4 Demonstrations and Simulations for FSaaS

This section demonstrates how FSaaS can be used and explains the code and results

during and after using FSaaS services. This mainly involves Monte Carlo Methods

(MCM) and Black Scholes Model (BSM). Chang et al., [4] describe how to use MCM

and BSM for financial computation. They demonstrate the use of risk analysis and

financial modelling on Clouds based on MATLAB and Mathematica, which offer

benefits such as performance, accuracy and integration with security. This includes

the selection of Linear Square Method (LSM) that can compute 100,000 simulations

17

in one go, which takes between 4 to 25 seconds depending on the number of time

steps. It can also work with IBM Fined-Grained Security Model, and it can provide a

safer environment for FSaaS on Clouds.

Mathematical models such as MCM are used in Risk Management area, where

they are used to simulate the risk of exposures to various types of operational risks.

Monte Carlo Simulations (MCS) in Commonwealth Bank Australia are written in

Fortran and C#. Running such simulations may take several hours or over a day [4,

5]. The results may be needed by the bank for the quarterly reporting period. MCM is

suitable to calculate best prices for buy and sell, and provides data for investors’ deci-

sion-making [4, 5]. MATLAB is used due to its ease of use with relatively good

speed. While the volatility is known and provided, prices for buy and sale can be

calculated. Part of the code (fareastmc.m) to is used to present formulas in MCM and

demonstrate coding algorithm presented in Table 1.Variables are explained in [4].

Table 1. Coding algorithm in Monte Carlo in MATLAB for best buy/sell prices.

The following demonstrates running the code and the calculated prices. Call pric-

es are to buy and put prices are for sale. The program calculates the lower limit, the

MCPrice value and the upper limit for each buy and sale category.

> fareastmc (this is the name of the MATLAB file)

[LowerLimit MCPrice UpperLimit]

Call Prices: [4.196694 4.248468 4.300242]

Put Prices: [7.610519 7.666090 7.721662]

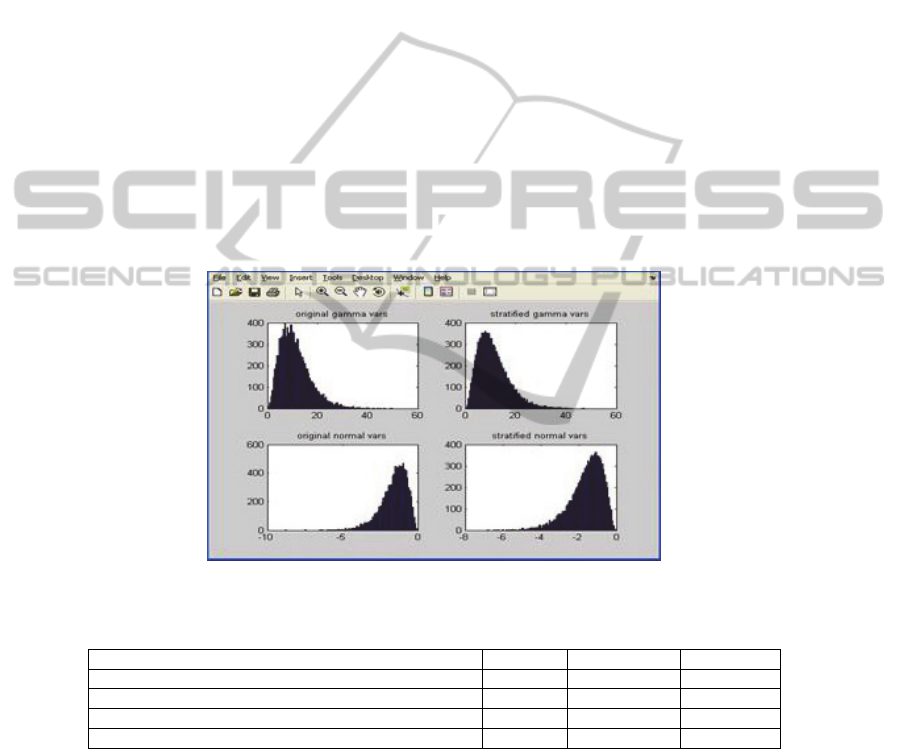

Outliers are common while during computation and they do not fall into the expected

results. To achieve a high level of accuracy, outliers need to be removed. Figure 4 is a

good example. Two screenshots on the left half with “original gamma variables”

show that financial indexes have outliers. In other words, they are not smooth and

outliers need to be filtered out. The other two screenshots on the right half with “strat-

ified gamma variables” means that all outliers are removed and the results are smooth

and usable for predictive modelling or other financial computation. Removal of outli-

ers can ensure a high quality of data analysis can be offered to investors. How remov-

al of outliers relates to the architecture is as follows. It ensures numerical computa-

tions are as accurate as possible and do not provide results that may make investments

or decisions that incur in the loss of money and reputation.

We then perform large-scale simulations to show that all computations can be

achieved within seconds. The hardware infrastructure is as follows. The desktop has

dt=T/(NSteps-1);

vsqrdt=sigma*dt^0.5;

drift=(r-(sigma^2)/2)*dt;

x=randn(NSimulations,NSteps);

Smat=zeros(NSimulations,NSteps);

Smat(:,1)=S;

for i=2:NSteps,

Smat(:,i)=Smat(:,i-1).*exp(drift+vsqrdt*x(:,i));

end

18

2.67 GHz Intel Xeon Quad Core and 4 GB of memory (800 MHz) with installed. Two

Amazon EC2 public clouds are used. The first virtual server is a 64-bit Ubuntu 8.04

with large resource instance of dual core CPU, with 2.33 GHz speed and 7.5GB of

memory. The second virtual server is Ubuntu 7.04 with small resource of 1 CPU with

2.33 GHz speed and 1.5 GB of memory. There are two private clouds set up. The first

private cloud is hosted on a Windows virtual server, which is created by a VMware

Server on top of a rack server, and its network is in a network translated and secure

domain. The virtual server has 2 cores of 2.67 GHz and 4GB of memory at 800 MHz.

The second private cloud is a 64-bit Windows server installed on a rack, with 2.8GHz

Quad Core Xeon, 16 GB of memory. Our FSaaS can work on both Octave or

MATLAB. The experiment began for running the Octave 3.2.4 on desktop, private

cloud and public cloud and started one at a time due to the licensing issue. Table 1

summarises the benchmark for the execution time, which involves running FSaaS

simulations in five different platforms. It took longer time to run simulations in the

public cloud with small instances, which is not recorded in Table 2. This is due to

their low CPU and memory requirements resulting in longer completion time. The

key advantage of designing FSaaS as a service component is any change in the finan-

cial models which can be changed without any ripple effect to the entire FSaaS archi-

tecture.

Fig. 4. Removal of outliers.

Table 2. Timing benchmark to run FSaaS code on Octave 3.2.4.

Number of simulations and time taken (sec) 5,000 10,000 15,000

Desktop 11.08 11.92 12.71

Public cloud (large instance) 11.95 12.30 13.15

Private cloud (default VMs) 11.31 12.13 12.90

Private cloud (large VMs) 9.63 10.51 11.48

5 Conclusion

Financial applications demand better performance and accuracy in a cloud than the

traditional computing platforms. Therefore designing financial software as a service

19

(FSaaS) requirerss engineering and systematic approach. This paper has demonstrated

a systematic approach to developing large scaled financial applications with current

technology such as SOA which supports SaaS features to be integrated with cloud

solutions. This paper has also demonstrated the design and customisation of service

component interfaces to the financial simulation so that it provides automatic predic-

tion models for investors to know accurate results in buy and sale prices. Therefore,

large-scaled simulations can be achieved within a matter of seconds (13.15 seconds).

References

1. Accenture (2011) http://www.slideshare.net/fullscreen/ramblingman/accenture-financial-

saa-s-external-presentation-final/3

2. Baresi, L., Di Nitto, E., and Ghezzi, C (2006) Towards open-world software: issues and

challenges, Computer, Special Issue on Software Engineering: the past and the future, Oc-

tober 2006.

3. Cartwright I and Doernenburg E (2006) Time to jump on the SOA bandwagon, IT Now,

British Computer Society, May 2006

4. Chang, V., Li, C.S, De Roure, D., Wills, G., Walters, R.J., Chee, C.: The Financial Clouds

Review, International Journal of Cloud Applications and Computing, 1 (2), (2011) 46-63.

5. Chang, V., Business Intelligence as Service in the Cloud, Future Generation Computer

Systems, (2014).

6. Erl, T (2005) Core principles for service-oriented architectures, August 2005, Retrieved

Oct 2013, from www.Looselycoupled.com/opinion/2005/erl-core-infr0815.html

7. Groves, D (2005) Successfully planning for SOA, BEA Systems Worldwide, 11 Sept 2005

8. Helbig, J (2007) Creating business value through flexible IT architecture, Special Issue on

Service-oriented Computing, IEEE Computer, V.40, No.11, November 2007.

9. Hohpe, G (2002) Stairway to Heaven, Software Development, May 2002

10. Nano, O. and Zisman, A. (2007) Realizing service-centric software systems, Special issue

on SoC, IEEE Software, November/December 2007.

11. NetSuite (2014) http://www.netsuite.co.uk/portal/uk/seo-landing-page/accounting-

2/main.shtml?gclid=CLK9k5q-37sCFTHLtAodikoAzw, accessed 2014

12. Open Group (2009) OSIMM, Retrieved Oct 2013, from

https://www2.opengroup.org/ogsys/jsp/publications/PublicationDetails.jsp?publicationid=1

2450

13. Ramachandran, M (2012) Software Security Engineering: Design and Applications, Nova

Science Publishers, New York, USA, 2012. ISBN: 978-1-61470-128-6,

https://www.novapublishers.com/catalog/product_info.php?products_id=26331

14. Ramachandran, M (2013) Business Requirements Engineering for Developing Cloud Com-

puting Services, Springer, Software Engineering Frameworks for Cloud Computing Para-

digm, Mahmmood, Z and Saeed, S (eds.), http://www.springer.com/computer/

communication+networks/book/978-1-4471-5030-5

15. Sellami, M. and Jmaiel, M (2013) A Secured Service-Oriented Architecture for FSaaS in

Tunisia, www.redcad.org/PDFs/C33.pdf, accessed on 15th September.

16. Wauters, P., Declercq, K., van der Peijl, S., and Davies, P (2011) Study on cloud and ser-

vice-oriented architectures for FSaaS, FP7 report ref. Ares(2012)149022 - 09/02/2012,

Deloitte.

20